ANI Pharmaceuticals, Inc. (Nasdaq: ANIP) (ANI or the Company) today

affirmed its prior net revenues, adjusted non-GAAP EBITDA, and

adjusted non-GAAP diluted EPS guidance for 2024 and provided its

preliminary financial outlook for 2025. Nikhil Lalwani, ANI’s

President and Chief Executive Officer, will discuss these updates

as part of a presentation at the 43rd Annual J.P. Morgan Healthcare

Conference on Tuesday, January 14, 2025, at 2:15 PST/5:15 EST.

“We are delighted to share that we had a strong close to 2024,

which was a year of significant momentum for our business as we

continued to execute on our strategic priorities while adding two

important assets to our Rare Disease portfolio through the

acquisition of Alimera,” said Mr. Lalwani. “We’re pleased to report

that the integration is on track and that our overall Rare Disease

business performed in line with our expectations during the fourth

quarter. Looking ahead to 2025, we expect another year of robust

growth led by our Rare Disease franchise, which is reflected by our

preliminary financial targets. We remain dedicated to our purpose

of ‘Serving Patients, Improving Lives.’”

Preliminary Fourth Quarter and Full Year 2024 Financial

Results

Based on preliminary, unaudited results, ANI expects Purified

Cortrophin Gel net revenues of $59.2 million to $59.8 million for

the fourth quarter of 2024 and $197.8 million to $198.4 million for

the full year 2024. In addition, the company expects combined

ILUVIEN and YUTIQ net revenues of $26.6 million to $27.2 million

for the fourth quarter of 2024 and $30.4 million to $31.0 million

for the post-acquisition period from September 16, 2024 to December

31, 2024.

Additionally, the Company expects full year 2024 total net

revenues, adjusted non-GAAP EBITDA, and adjusted non-GAAP diluted

EPS to be at or above the guidance ranges provided on November 8,

2024.

The information presented above is unaudited and reflects

preliminary estimates subject to the completion of financial

closing procedures and any adjustments that may result from the

finalization of the quarterly and annual review of the Company’s

consolidated financial statements. ANI will report its full year

2024 results during its fourth quarter 2024 earnings conference

call in late February.

Preliminary Full Year 2025 Outlook

For full year 2025, ANI expects total net revenues of between

$739 million and $759 million, representing growth of 24% to 27% as

compared to the midpoint of 2024 guidance, and adjusted non-GAAP

EBITDA of between $182 million and $192 million.

ANI will provide its full 2025 financial guidance during its

fourth quarter 2024 earnings conference call in late February.

Presentation

This financial information was announced in advance of the

Company's presentation at the 43rd Annual J.P. Morgan Healthcare

Conference on Tuesday, January 14, 2025, at 2:15pm PST/5:15pm EST,

in San Francisco. The live and archived webcast will be accessible

from the Company’s website at www.anipharmaceuticals.com, under the

Investors section under Events and Presentations. The replay of the

webcast will be accessible for 90 days.

Non-GAAP Financial Measures

Adjusted non-GAAP EBITDA

ANI’s management considers adjusted non-GAAP EBITDA to be an

important financial indicator of ANI’s operating performance,

providing investors and analysts with a useful measure of operating

results unaffected by non-cash stock-based compensation and

differences in capital structures, tax structures, capital

investment cycles, ages of related assets, and compensation

structures among otherwise comparable companies. Management uses

adjusted non-GAAP EBITDA when analyzing Company performance.

Adjusted non-GAAP EBITDA is defined as net (loss) income,

excluding tax provision or benefit, interest expense, net, other

expense, net, loss on extinguishment of debt, depreciation and

amortization expense, non-cash stock-based compensation expense,

M&A transaction and integration expenses, contingent

consideration fair value adjustments, unrealized gain on our

investment in equity securities, gain on sale of the former

Oakville, Ontario manufacturing site, litigation expenses related

to certain matters, amortization of certain purchase price

adjustments, severance expense, and certain other items that vary

in frequency and impact on ANI’s results of operations. Adjusted

non-GAAP EBITDA should be considered in addition to, but not in

lieu of, net income or loss reported under GAAP.

ANI is not providing a reconciliation for the forward-looking

full year 2024 and 2025 adjusted EBITDA guidance because it does

not currently have sufficient information to accurately estimate

all of the variables and individual adjustments for such

reconciliation, including “with” and “without” tax provision

information. As such, ANI’s management cannot estimate on a

forward-looking basis without unreasonable effort the impact these

variables and individual adjustments will have on its reported

results.

Adjusted non-GAAP Diluted Earnings per

Share

ANI’s management considers adjusted non-GAAP diluted earnings

per share to be an important financial indicator of ANI’s operating

performance, providing investors and analysts with a useful measure

of operating results unaffected by the non-cash stock-based

compensation, non-cash interest expense, depreciation and

amortization, M&A transaction and integration expenses,

contingent consideration fair value adjustment, unrealized gain on

our investment in equity securities, gain on sale of the former

Oakville, Ontario manufacturing site, litigation expenses related

to certain matters, loss on extinguishment of debt, amortization of

certain purchase price adjustments, severance expense, and certain

other items that vary in frequency and impact on ANI’s results of

operations. Management uses adjusted non-GAAP diluted earnings per

share when analyzing Company performance.

Adjusted non-GAAP diluted earnings per share is defined as

adjusted non-GAAP net income, as defined above, divided by the

diluted weighted average shares outstanding during the period.

Management will continually analyze this metric and may include

additional adjustments in the calculation in order to provide

further understanding of ANI’s results. Adjusted non-GAAP diluted

earnings per share should be considered in addition to, but not in

lieu of, diluted earnings (loss) per share reported under GAAP.

ANI is not providing a reconciliation for the forward-looking

full year 2024 adjusted diluted earnings per share guidance because

it does not currently have sufficient information to accurately

estimate all of the variables and individual adjustments for such

reconciliation, including “with” and “without” tax provision

information. As such, ANI’s management cannot estimate on a

forward-looking basis without unreasonable effort the impact these

variables and individual adjustments will have on its reported

results.

About ANI

ANI Pharmaceuticals, Inc. (Nasdaq: ANIP) is a diversified

biopharmaceutical company committed to its mission of “Serving

Patients, Improving Lives" by developing, manufacturing, and

commercializing innovative and high-quality therapeutics. The

Company is focused on delivering sustainable growth through its

Rare Disease business, which markets novel products in the areas of

ophthalmology, rheumatology, nephrology, neurology, and

pulmonology; its Generics business, which leverages R&D

expertise, operational excellence, and U.S.-based manufacturing;

and its Established Brands business. For more information, visit

www.anipharmaceuticals.com.

Forward-Looking Statements

To the extent any statements made in this release deal with

information that is not historical, these are forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Such statements include, but are not limited

to, those relating to the commercialization and potential sales of

the product and any additional product launches from the Company’s

generic pipeline, 2024 guidance, 2025 guidance, other statements

that are not historical in nature, particularly those that utilize

terminology such as “anticipates,” “will,” “expects,” “plans,”

“potential,” “future,” “believes,” “intends,” “continue,” other

words of similar meaning, derivations of such words and the use of

future dates.

Uncertainties and risks may cause the Company’s actual results

to be materially different than those expressed in or implied by

such forward-looking statements. Uncertainties and risks include,

but are not limited to: our ability to continue to achieve

commercial success with Cortrophin Gel, our first rare disease

pharmaceutical product, including expanding the market and gaining

market share, our business, financial condition, and results of

operations will be negatively impacted; the ability of our approved

products, including Cortrophin Gel, and products acquired in the

acquisition of Alimera, to achieve commercialization at levels of

market acceptance that will continue to allow us to achieve

profitability; our ability to complete or achieve any, or all of

the intended benefits of acquisitions and investments, including

the acquisition of Alimera, in a timely manner or at all; the risks

that our acquisitions and investments, including the recent

acquisition of Alimera, could disrupt our business and harm our

financial position and operating results; delays in production,

increased costs and potential loss of revenues if we need to change

suppliers due to the limited number of suppliers for our raw

materials, active pharmaceutical ingredients, expedients, and other

materials; our reliance on single source third party contract

manufacturing supply for certain of our key products, including

Cortrophin Gel and products acquired in the acquisition of Alimera;

delays or failure in obtaining and maintaining approvals by the FDA

of the products we sell; changes in policy or actions that may be

taken by the FDA, United States Drug Enforcement Administration and

other regulatory agencies, including among other things, drug

recalls, regulatory approvals, facility inspections and potential

enforcement actions; risks that we may face with respect to

importing raw materials and delays in delivery of raw materials and

other ingredients and supplies necessary for the manufacture of our

products from both domestic and overseas sources due to supply

chain disruptions or for any other reason; the ability of our

manufacturing partners to meet our product demands and timelines;

the impact of changes or fluctuations in exchange rates; our

ability to develop, license or acquire, and commercialize new

products; the level of competition we face and the legal,

regulatory and/or legislative strategies employed by our

competitors to prevent or delay competition from generic

alternatives to branded products; our ability to protect our

intellectual property rights; the impact of legislative or

regulatory reform on the pricing for pharmaceutical products; the

impact of any litigation to which we are, or may become, a party;

our ability, and that of our suppliers, development partners, and

manufacturing partners, to comply with laws, regulations and

standards that govern or affect the pharmaceutical and

biotechnology industries; our ability to maintain the services of

our key executives and other personnel; and general business and

economic conditions, such as inflationary pressures, geopolitical

conditions including but not limited to the conflict between Russia

and the Ukraine, the conflict in the Middle East, conflicts related

to the attacks on cargo ships in the Red Sea, and the effects and

duration of outbreaks of public health emergencies, and other risks

and uncertainties that are described in ANI’s Annual Report on Form

10-K, quarterly reports on Form 10-Q, and other periodic reports

filed with the Securities and Exchange Commission.

More detailed information on these and additional factors that

could affect the Company’s actual results are described in the

Company’s filings with the Securities and Exchange Commission

(SEC), including its most recent annual report on Form 10-K and

quarterly reports on Form 10-Q, as well as other filings with the

SEC. All forward-looking statements in this news release speak only

as of the date of this news release and are based on the Company’s

current beliefs, assumptions, and expectations. The Company

undertakes no obligation to update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise.

Investor Contact Lisa M. Wilson, In-Site Communications,

Inc.

212-452-2793lwilson@insitecony.com

SOURCE: ANI Pharmaceuticals, Inc.

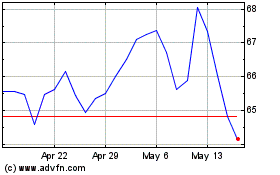

ANI Pharmaceuticals (NASDAQ:ANIP)

Historical Stock Chart

From Jan 2025 to Feb 2025

ANI Pharmaceuticals (NASDAQ:ANIP)

Historical Stock Chart

From Feb 2024 to Feb 2025