UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024

Commission File Number: 001-33765

AIRNET TECHNOLOGY INC.

(Exact name of registrant as specified in its charter)

Suite 301

No. 26 Dongzhimenwai Street

Chaoyang District, Beijing 100027

The People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

x Form 40-F ¨

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

AIRNET TECHNOLOGY INC. |

| |

|

|

| Date: May 8, 2024 |

By: |

/s/ Herman Man Guo |

| |

Name: |

Herman Man Guo |

| |

Title: |

Chairman and Interim Chief Financial Officer |

EXHIBIT INDEX

Exhibit 99.1

AirNet Announces Receipt of Nasdaq’s Determination

to Grant Extension to Regain Compliance

BEIJING, May 8, 2024 (GLOBE NEWSWIRE) -- AirNet Technology

Inc., formerly known as AirMedia Group Inc. (“AirNet” or the “Company”) (Nasdaq: ANTE), today announced that it

received a notification letter dated April 29, 2024 from the Listing Qualifications Department of The Nasdaq Stock Market Inc. (the “Nasdaq”)

notifying that Nasdaq has determined to grant the Company an extension to regain compliance with the Nasdaq Listing Rule 5550(b)(1) for

continued listing (the “Rule”).

As previously reported, on January 5, 2024, the Company received

written notice from Nasdaq notifying the Company that, based on the Company’s stockholders’ equity as reported in the Company’s

Form 6-K dated December 28, 2023, the Company did not meet the minimum stockholders’ equity requirement for continued

listing due to its failure to maintain a minimum of $2.5 million in stockholders’ equity (“Minimum Stockholders’ Equity

Requirement”), or the alternatives of market value of listed securities or net income from continuing operations for continued listing

under the Rule. On February 8, 2024, the Company submitted to Nasdaq its plan to regain compliance with the Minimum Stockholders’

Equity Requirement, as supplemented with additional materials on March 10, 2023 (the “Plan”). Based on the Plan, Nasdaq has

determined to grant the Company an extension to regain compliance with the Rule and provided the Company with two alternatives to evidence

compliance with the Rule. Pursuant to the first alternative, the Company must furnish to the SEC and Nasdaq a publicly available report

including: (1) a disclosure of Nasdaq’s deficiency letter and the specific deficiencies cited, (2) a description of the completed

transaction or event that enabled the Company to satisfy the Minimum Stockholders’ Equity Requirement, (3) an affirmative statement

that, as of the date of such publicly available report, the Company believes it has regained compliance with the Minimum Stockholders’

Equity Requirement based upon the specific transaction or event referenced in (2), and (4) a disclosure stating that Nasdaq will continue

to monitor the Company’s ongoing compliance with the Minimum Stockholders’ Equity Requirement and, if at the time

of its next periodic report the Company does not evidence compliance, that it may be subject to delisting.

As previously disclosed, on February 8, 2024, Wealthy Environment

Limited, a company incorporated in the British Virgin Islands, which is wholly owned by Mr. Herman Man Guo, entered into a share

subscription agreement with the Company, pursuant to which the Company transferred 4,448,847 ordinary shares, par value $0.04 per share

(the “Shares”), that were previously held by and in the Company’s name as treasury shares and issued an additional 2,118,584

Shares to Wealthy Environment Limited on March 6, 2024. The aggregate subscription price for the 6,567,431 Shares was approximately

US$7.6 million in cash. In February 2024, the Company entered into an equity transfer agreement with an

unaffiliated third party, pursuant to which the Company disposed of all the 33.67% of equity interests held by Yuehang Sunshine

Network Technology Group Co., Ltd. in an equity investee for an aggregate consideration of RMB197.0 million. On April 15, 2024, the

Company completed a private placement of 3,372,788 Shares for an aggregate subscription amount of US$5.7 million with certain investors.

As a result of the above three transactions, the Company believes that,

as of the date of this press release, it has regained compliance with the Minimum Stockholders’ Equity Requirement for continued

listing on the Nasdaq Capital Market under the Rule. The Company understands that Nasdaq will continue to monitor the Company’s

ongoing compliance with the Minimum Stockholders’ Equity Requirement and, if at the time of its next periodic report the Company

does not evidence compliance, it may be subject to delisting.

Forward-Looking Statements

This announcement contains forward-looking statements within the meaning

of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified

by terminology such as “will,” “expects,” “is expected to,” “anticipates,” “aim,”

“future,” “intends,” “plans,” “believes,” “are likely to,” “estimates,”

“may,” “should” and similar expressions. The Company may also make written or oral forward-looking statements

in its reports filed with, or furnished to, the U.S. Securities and Exchange Commission, in its annual reports to shareholders, in press

releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Forward-looking

statements are based upon management’s current expectations and current market and operating conditions, and involve inherent risks

and uncertainties, all of which are difficult to predict and many of which are beyond the Company’s control, which may cause its

actual results, performance or achievements to differ materially from those in the forward-looking statements. Further information is

included in the Company’s filings with the U.S. Securities and Exchange Commission. All information provided in this announcement

is as of the date of this announcement, and the Company does not undertake any obligation to update any forward-looking statement as a

result of new information, future events or otherwise, except as required under law.

Contact

Penny Pei

Investor Relations

AirNet Technology Inc.

Tel: +86-10-8460-8678

Email: penny@ihangmei.com

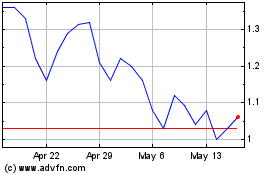

AirNet Technology (NASDAQ:ANTE)

Historical Stock Chart

From Nov 2024 to Dec 2024

AirNet Technology (NASDAQ:ANTE)

Historical Stock Chart

From Dec 2023 to Dec 2024