As

filed with the Securities and Exchange Commission on January 6, 2025

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

S-8

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

APPLIED

DIGITAL CORPORATION

(Exact

name of registrant as specified in its charter)

| Nevada |

|

95-4863690 |

(State

or other jurisdiction of

incorporation or organization) |

|

(I.R.S.

Employer

Identification No.) |

3811

Turtle Creek Boulevard, Suite 2100

Dallas,

TX |

|

75219 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Non-Plan

Restricted Stock Unit Awards

(Full title of the plan)

Wesley

Cummins

Chief

Executive Officer

Applied

Digital Corporation

3811

Turtle Creek Boulevard, Suite 2100

Dallas,

Texas 75219

(Name

and address of agent for service)

Tel:

214-427-1704

(Telephone

number, including area code, of agent for service)

With

a copy to:

Steven

E. Siesser, Esq.

Lowenstein

Sandler LLP

1251

Avenue of the Americas

New

York, New York 10020

Tel:

(212) 204-8688

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

|

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

|

Smaller

reporting company |

☒ |

| |

|

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

INTRODUCTION

This

Registration Statement on Form S-8 (this “Registration Statement”) is filed by Applied Digital Corporation, a Nevada corporation

(the “Company”), to register 600,000 shares of the Company’s common stock, par value $0.001 per share (the “Common

Stock”), that may be issued upon the vesting of time-based restricted stock units that will vest in accordance with the terms of

a Restricted Stock Unit Award Agreement by and between the Company and Laura Laltrello, as an inducement for her accepting employment

with the Company (the “Inducement Award”).

The

Inducement Award will be issued outside of the Company’s 2024 Omnibus Equity Incentive Plan, approved by the Company’s board

of directors and issued pursuant to the “inducement” grant exception under 5635(c)(4) of the Marketplace Rules of the Nasdaq

Stock Market LLC, as inducements that are material to employees’ entering into employment with the Company.

PART

I

INFORMATION

REQUIRED IN THE SECTION 10(a) PROSPECTUS

The

information specified in Part I of Form S-8 is omitted from this Registration Statement and will be sent or given to employees in accordance

with the provisions of Rule 428(b)(1) of the Securities Act of 1933, as amended (the “Securities Act”).

PART

II

INFORMATION

REQUIRED IN REGISTRATION STATEMENT

Item

3. Incorporation of Documents by Reference.

The

following documents, filed by the Company with the Securities and Exchange Commission (the “Commission”) pursuant to the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), are incorporated herein by reference and deemed to be a

part hereof:

| (a) | The

Company’s Annual Report on Form 10-K for the fiscal year ended May 31, 2024, filed

with the Commission on August 30, 2024; |

| | | |

| (b) | The

Company’s Quarterly Report on Form 10-Q for the fiscal quarter ended August 31, 2024,

filed with the Commission on October 9, 2024; |

| | | |

| (c) | The

Company’s Current Reports on Form 8-K filed with the SEC on June 5, 2024, June 7, 2024,

June 11, 2024, June 17, 2024, July 2, 2024, July 9, 2024, July 29, 2024, August 14, 2024,

August 30, 2024, September 10, 2024, September 27, 2024, October 15, 2024, October 24, 2024,

October 30, 2024, October 31, 2024, November 5, 2024, November 14, 2024, November 21, 2024,

December 2, 2024 and December 4, 2024 and our Current Reports on Form 8-K/A filed with the

SEC on June 6, 2024, June 10, 2024 and September 4, 2024 (other than any portions thereof

deemed furnished and not filed); |

| | | |

| (d) | The

Company’s Definitive Proxy Statement on Schedule 14A, filed with the Commission on

October 23, 2024, as supplemented by the Definitive Additional Materials filed with the SEC

on November 15, 2024; and |

| | | |

| (e) | The

description of our common stock, par value $0.001 per share, in our Registration Statement

on Form 8-A, filed with the Commission on April 11, 2022, including any amendment or reports

filed for the purpose of updating such description, including the Description of Capital

Stock filed as Exhibit 4.8 to our Annual Report on Form 10-K for the year ended May 31, 2024,

as filed with the Commission on August 30, 2024. |

All

documents, reports and definitive proxy or information statements filed by the Company pursuant to Sections 13(a), 13(c), 14 and 15(d)

of the Exchange Act (other than Current Reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits furnished on such form

that relate to such items) on or after the date of this Registration Statement and prior to the filing of a post-effective amendment

to this Registration Statement that indicates that all securities offered hereby have been sold or that deregisters all securities then

remaining unsold shall be deemed to be incorporated by reference in this Registration Statement and to be part hereof from the date of

filing of such documents. Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be

deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in

any subsequently filed document that also is deemed to be incorporated by reference herein modifies or supersedes such statement. Any

such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration

Statement.

Item

4. Description of Securities.

Not

applicable.

Item

5. Interests of Named Experts and Counsel.

Not

applicable.

Item

6. Indemnification of Directors and Officers.

Section

78.138 of the Nevada Revised Statutes, or NRS, provides that, unless the corporation’s articles of incorporation provide otherwise,

a director or officer will not be individually liable unless the presumption that it is acting in good faith and on an informed basis

with a view to the interests of the corporation has been rebutted, and it is proven that (i) the director’s or officer’s

acts or omissions constituted a breach of his or her fiduciary duties, and (ii) such breach involved intentional misconduct, fraud, or

a knowing violation of the law. Our Second Amended and Restated Articles of Incorporation, as amended, provide that no director or officer

shall have any personal liability to the Company or its stockholders for damages for breach of fiduciary duty as a director or officer,

except for (i) acts that involve intentional misconduct, fraud, or a knowing violation of the law or (ii) the payment of dividends in

violation of Nevada corporate law.

Section

78.7502(1) of the NRS provides that a corporation may indemnify, pursuant to that statutory provision, any person who was or is a party

or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative

or investigative (other than an action by or in the right of the corporation) by reason of the fact that he is or was a director, officer,

employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent

of another corporation or other enterprise or as a manager of a limited liability company, against expenses (including attorneys’

fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by him or her in connection with such action,

suit or proceeding if he is not liable pursuant to NRS 78.138 or if he acted in good faith and in a manner he reasonably believed to

be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable

cause to believe his or her conduct was unlawful.

NRS

78.7502(2) permits a corporation to indemnify, pursuant to that statutory provision, any person who was or is a party or is threatened

to be made a party to any threatened, pending or completed action or suit by or in the right of the corporation to procure a judgment

in its favor by reason of the fact that such person acted in any of the capacities set forth above against expenses, including amounts

paid in settlement and attorneys’ fees actually and reasonably incurred by him or her in connection with the defense or settlement

of such action or suit if he acted under similar standards, except that no indemnification pursuant to NRS 78.7502 may be made in respect

of any claim, issue or matter as to which such person shall have been adjudged by a court of competent jurisdiction, after any appeals

taken therefrom, to be liable to the corporation or for amounts paid in settlement to the corporation, unless and only to the extent

that the court in which such action or suit was brought or other court of competent jurisdiction determines that, in view of all the

circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expenses as the court deems proper. NRS

78.751(1) provides that a corporation shall indemnify any person who is a director, officer, employee or agent of the corporation, against

expenses actually and reasonably incurred by the person in connection with defending an action (including, without limitation, attorney’s

fees), to the extent that the person is successful on the merits or otherwise in defense of any threatened, pending or completed action,

suit or proceeding, whether civil, criminal, administrative or investigative, including, without limitation, an action by or in the right

of the corporation, by reason of the fact that the person is or was a director, officer, employee or agent of the corporation, or is

or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint

venture, trust or other enterprise or as a manager of a limited liability company, or any claim, issue or matter in such action.

NRS

78.751 provides that the indemnification pursuant to NRS 78.7502 shall not be deemed exclusive or exclude any other rights to which the

indemnified party may be entitled (except that indemnification may not be made to or on behalf of any director or officer finally adjudged

by a court of competent jurisdiction, after exhaustion of any appeals taken therefrom, to be liable for intentional misconduct, fraud

or a knowing violation of the law and such intentional misconduct, fraud or a knowing violation of the law was material to the cause

of action) and that the indemnification shall continue as to directors, officers, employees or agents who have ceased to hold such positions,

and to their heirs, executors and administrators. NRS 78.752 permits a corporation to purchase and maintain insurance on behalf of a

director, officer, employee or agent of the corporation against any liability asserted against him or her or incurred by him or her in

any such capacity or arising out of his or her status as such whether or not the corporation would have the power to indemnify him or

her against such liabilities.

Section

78.752 of the NRS provides that a Nevada company may purchase and maintain insurance or make other financial arrangements on behalf of

any person who is or was a director, officer, employee, or agent of the company, or is or was serving at the request of the company as

a director, officer, employee, or agent of another company, partnership, joint venture, trust, or other enterprise, for any liability

asserted against him and liability and expenses incurred by him in his capacity as a director, officer, employee, or agent, or arising

out of his status as such, whether or not the company has the authority to indemnify him against such liability and expenses.

Our

Third Amended and Restated Bylaws, as amended (the “Bylaws”), provide that the Corporation shall, to the fullest extent not

prohibited by applicable law, pay the expenses (including attorneys’ fees) incurred by an indemnitee in defending or otherwise

participating in any proceeding in advance of its final disposition.

In

addition, we have entered into indemnification agreements with each of our directors and executive officers. These agreements, among

other things, require us to indemnify our directors and executive officers for certain expenses, including attorneys’ fees, judgments

and fines incurred by a director or executive officer in any action or proceeding arising out of their services as one of our directors

or executive officers or any other company or enterprise to which the person provides services at our request.

We

maintain a directors’ and officers’ insurance policy pursuant to which our directors and officers are insured against liability

for actions taken in their capacities as directors and officers. We believe these provisions in the Bylaws and these indemnification

agreements are necessary to attract and retain qualified persons as directors and officers.

Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers, or control persons, in the

opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

Item

7. Exemption from Registration Claimed.

Not

applicable.

Item

8. Exhibits.

| Exhibit

No. |

|

Description |

| 4.1 |

|

Second Amended and Restated Articles of Incorporation, as amended from time to time. (Incorporated by reference to Exhibit 3.1 to the Company’s Annual Report on Form 10-K filed with the SEC on August 2, 2023). |

| 4.2 |

|

Certificate of Amendment to the Certificate of Designations for the Series E Redeemable Preferred Stock. (Incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K filed with the SEC on May 16, 2024). |

| 4.3 |

|

Certificate of Amendment, dated June 11, 2024, to Second Amended and Restated Articles of Incorporation, as amended (Incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K, filed with the SEC on June 11, 2024). |

| 4.4 |

|

Certificate of the Designations, Powers, Preferences and Rights of Series F Preferred Stock (Incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K, filed with the SEC on August 30, 2024). |

| 4.5 |

|

Third Amended and Restated Bylaws of the Company (Incorporated by reference to Exhibit 3.1 of the Company’s Current Report on Form 8-K filed with the SEC on April 29, 2024). |

| 4.6 |

|

Certificate, Amendment or Withdrawal of Designation, relating to the Series A Preferred Stock, filed with the Secretary of State of Nevada on October 21, 2024 (Incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K, filed with the SEC on October 24, 2024). |

| 4.7 |

|

Certificate, Amendment or Withdrawal of Designation, relating to the Series B Preferred Stock, filed with the Secretary of State of Nevada on October 21, 2024 (Incorporated by reference to Exhibit 3.2 to the Company’s Current Report on Form 8-K, filed with the SEC on October 24, 2024). |

| 4.8 |

|

Certificate, Amendment or Withdrawal of Designation, relating to the Series D Preferred Stock, filed with the Secretary of State of Nevada on October 21, 2024 (Incorporated by reference to Exhibit 3.3 to the Company’s Current Report on Form 8-K, filed with the SEC on October 24, 2024). |

| 4.9 |

|

Certificate of Designations of the Powers, Preferences and Relative, Participating, Optional and Other Restrictions of Series E-1 Preferred Stock filed with the Secretary of State of the State of Nevada on November 8, 2024. (Incorporated by reference to Exhibit 3.1 of the Company’s Current Report on Form 8-K filed with the SEC on November 14, 2024). |

| 4.10 |

|

Certificate of Amendment, dated November 20, 2024, to Second Amended and Restated Articles of Incorporation, as amended (Incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K, filed with the SEC on November 21, 2024). |

| 4.11* |

|

Form of Restricted Stock Unit Award Agreement, by and between the Company and Laura Laltrello. |

| 5.1* |

|

Opinion of Snell & Wilmer L.L.P. |

| 23.1* |

|

Consent of Independent Registered Public Accounting Firm (Marcum LLP). |

| 23.2* |

|

Consent of Snell & Wilmer L.L.P. (included in Exhibit 5.1). |

| 24.1* |

|

Power of Attorney (included on signature page). |

| 107* |

|

Filing Fee Table. |

Item

9. Undertakings.

(a)

The undersigned registrant hereby undertakes:

(1)

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i)

To include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii)

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration

statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range

may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume

and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration

Fee” table in the effective registration statement; and

(iii)

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or

any material change to such information in the registration statement;

Provided,

however, that paragraphs (a)(1)(i) and (a)(1)(ii) do not apply if the information required to be included in a post-effective amendment

by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to section 13 or section

15(d) of the Exchange Act that are incorporated by reference in the registration statement.

(2)

That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be

a new registration statement relating to the securities offered herein, and the offering of such securities at that time shall be deemed

to be the initial bona fide offering thereof.

(3)

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering.

(b)

The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of

the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing

of an employee benefit plan’s annual report pursuant to section 15(d) of the Exchange Act) that is incorporated by reference in

the Registration Statement shall be deemed to be a new registration statement relating to the securities offered herein, and the offering

of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c)

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons

of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities

and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred

or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is

asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless

in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the

question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final

adjudication of such issue.

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all

of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned,

thereunto duly authorized, in the City of Dallas, Texas, on the day of January 6, 2025.

| |

APPLIED

DIGITAL CORPORATION |

| |

|

|

| |

By: |

/s/

Wes Cummins |

| |

Name: |

Wes

Cummins |

| |

Title: |

Chief

Executive Officer and Chairman |

POWER

OF ATTORNEY

KNOW

ALL PERSONS BY THESE PRESENTS, that each of Applied Digital Corporation, a Nevada corporation (the “Company”), and the undersigned

Directors and Officers of the Company hereby constitute and appoint Wes Cummins and Saidal Mohmand as the Company’s or such Director’s

or Officer’s true and lawful attorneys-in-fact and agents, for the Company or such Director or Officer and in the Company’s

or such Director’s or Officer’s name, place and stead, in any and all capacities, with full power to act alone, to sign any

and all amendments to this Registration Statement, and to file each such amendment to this Registration Statement, with all exhibits

thereto, and any and all documents in connection therewith, with the Securities and Exchange Commission, hereby granting unto said attorneys-in-fact

and agents, and each of them, full power and authority to do and perform any and all acts and things requisite and necessary to be done

in connection therewith, as fully to all intents and purposes as the Company or such Director or Officer might or could do in person,

hereby ratifying and confirming all that said attorneys-in-fact and agents, or any of them may lawfully do or cause to be done by virtue

hereof.

Pursuant

to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities

and on the date indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

Wes Cummins |

|

Chief

Executive Officer and Chairman |

|

January

6, 2025 |

| Wes

Cummins |

|

(Principal

Executive Officer) |

|

|

| |

|

|

|

|

| /s/

Saidal Mohmand |

|

Chief

Financial Officer |

|

January

6, 2025 |

| Saidal

L. Mohmand |

|

(Principal

Financial Officer and Principal Accounting Officer) |

|

|

| |

|

|

|

|

| /s/

Chuck Hastings |

|

Director |

|

January

6, 2025 |

| Chuck

Hastings |

|

|

|

|

| |

|

|

|

|

| /s/

Douglas Miller |

|

Director |

|

January

6, 2025 |

| Douglas

Miller |

|

|

|

|

| |

|

|

|

|

| /s/

Richard Nottenburg |

|

Director |

|

January

6, 2025 |

| Richard

Nottenburg |

|

|

|

|

| |

|

|

|

|

| /s/

Rachel Lee |

|

Director |

|

January

6, 2025 |

| Rachel

Lee |

|

|

|

|

| |

|

|

|

|

| /s/

Ella Benson |

|

Director |

|

January

6, 2025 |

| Ella

Benson |

|

|

|

|

Exhibit

4.11

RESTRICTED

STOCK UNIT INDUCEMENT AWARD AGREEMENT

APPLIED

DIGITAL CORPORATION

This

Restricted Stock Unit Inducement Award Agreement (the “Agreement” or “Award Agreement”), dated

as of the “Award Date” set forth in the attached Exhibit A, is entered into between Applied Digital Corporation, a

Nevada corporation (the “Company”), and the individual named in Exhibit A hereto (the “Participant”).

WHEREAS,

the Company desires to provide the Participant with an opportunity to acquire the Company’s common shares, par value $0.001 per

share (the “Common Stock”), and thereby provide additional incentive for the Participant to promote and participate

in the progress and success of the business of the Company; and

WHEREAS,

to give effect to the foregoing intention, the Company desires to award the Participant Restricted Stock Units outside the terms of the

Applied Digital Corporation 2024 Omnibus Equity Incentive Plan (as amended, restated or otherwise modified from time to time, the “Plan”)

as an “employment inducement award” within the meaning of Nasdaq Listing Rule 5635(c), provided that the Participant commences

employment with the Company no later than January 6, 2025 (the “Start Date”);

NOW,

THEREFORE, the following provisions apply to this Award:

1.

Award. The Company hereby awards the Participant the number of Restricted Stock Units (each an “RSU” and collectively

the “RSUs”) set forth in Exhibit A, outside of the Plan as an “employment inducement award” within

the meaning of Nasdaq Listing Rule 5635(c), provided that the Participant commences employment with the Company no later than the Start

Date. In the event the Participant fails to commence employment with the Company by the Start Date, this Award shall be null and void

ab initio. Such RSUs shall be subject to the terms and conditions set forth in this Agreement. Although the RSUs have not been granted

pursuant to the Plan except as expressly stated herein the RSUs will be governed by the terms and conditions set forth in the Plan as

if the RSUs had been granted under the Plan. The provisions of the Plan are incorporated herein by reference. Capitalized terms used

but not otherwise defined herein shall have the meanings as set forth in the Plan.

2.

Vesting and settlement.

(a)

Vesting. Except as otherwise provided in this Agreement, the RSUs shall vest in accordance with the vesting schedule set forth

in Exhibit A, provided that the Participant remains in Continuous Service through each applicable vesting date.

(b)

Settlement. For each RSU that becomes vested in accordance with this Agreement, the Company shall issue and deliver to Participant

one share of Common Stock. Such shares shall be issued and delivered as soon as administratively practicable following the vesting date

of each such RSU, but in no event later than March 15 of the year following the year in which such vesting date occurs. Except as provided

above, in the event that the Participant ceases to be in Continuous Service, any RSUs that have not vested as of the date of such cessation

of service shall be forfeited. If requested by the Participant, delivery of shares may be effected by book-entry credit to the Participant’s

brokerage account.

3.

No Rights as Stockholder. The Participant shall not be entitled to any of the rights of a stockholder with respect to any share

of Common Stock that may be acquired following vesting of an RSU unless and until such share of Common Stock is issued and delivered

to the Participant. Without limitation of the foregoing, the Participant shall not have the right to vote any share of Common Stock to

which an RSU relates and shall not be entitled to receive any dividend attributable to such share of Common Stock for any period prior

to the issuance and delivery of such share to Participant.

4.

Covenants Agreement. The RSUs shall be subject to forfeiture at the election of the Company, without payment of consideration,

in the event that the Participant breaches the Employee Non-Disclosure, Invention Assignment and Restrictive Covenants Agreement by and

between the Participant and the Company, dated November 27, 2024 (as amended, restated or otherwise modified from time to time), or any

other agreement between the Participant and the Company with respect to noncompetition, nonsolicitation, nondisparagement, assignment

of inventions and contributions and/or nondisclosure obligations of the Participant.

5.

Transfer Restrictions. Neither this Agreement nor the RSUs may be sold, assigned, pledged or otherwise transferred or encumbered

without the prior written consent of the Committee and any purported sale, assignment, pledge, transfer or encumberance shall be null

and void ab initio.

6.

Acceptance. To accept the RSUs, please execute and return this Agreement where indicated (including acceptance via an electronic

platform maintained by the Company or a third party administrator engaged by the Company) no later than the day prior to the Start Date

(the “Acceptance Deadline”). By executing this Agreement and accepting your RSUs, you will have agreed to all the

terms and conditions set forth in this Agreement. The grant of the RSUs will be considered null and void, and acceptance of the RSUs

will be of no effect, if you do not execute and return this Agreement by the Acceptance Deadline.

7.

Government Regulations. Notwithstanding anything contained herein to the contrary, the Company’s obligation hereunder to

issue or deliver certificates evidencing shares of Common Stock shall be subject to the terms of all Applicable Laws.

8.

Withholding Taxes. The Participant shall pay in cash to the Company, or make provision satisfactory to the Company for payment

of, the minimum statutory amount required to satisfy all federal, state and local income tax withholding requirements and the Participant’s

share of applicable employment withholding taxes in connection with the issuance and deliverance of shares of Common Stock following

vesting of RSUs, in any manner permitted by the Plan. If permissible under Applicable Law, the minimum federal, state, and local and

foreign income, payroll, employment and any other applicable taxes which the Company determines must be withheld with respect to the

RSUs (“Tax Withholding Obligation”) may be satisfied by shares of Common Stock being sold on the Participant’s

behalf at the prevailing market price pursuant to such procedures as the Company may specify from time to time, including through a broker-assisted

arrangement (it being understood that the shares of Common Stock to be sold must have vested pursuant to the terms of this Agreement).

In addition to shares of Common Stock sold to satisfy the Tax Withholding Obligation, additional shares of Common Stock may be sold to

satisfy any associated broker or other fees. The proceeds from any sale will be used to satisfy the Participant’s Tax Withholding

Obligation arising with respect to the RSUs and any associated broker or other fees. Only whole shares of Common Stock will be sold.

Any proceeds from the sale of shares of Common Stock in excess of the Tax Withholding Obligation and any associated broker or other fees

will be paid to the Participant in accordance with procedures the Company may specify from time to time.

The

Committee may also permit the Participant to satisfy the Participant’s Tax Withholding Obligation by (i) delivering to the Company

shares of Common Stock that the Participant owns and that have vested with a fair market value equal to the amount required to be withheld,

(ii) having the Company withhold otherwise deliverable shares of Common Stock having a value equal to the minimum amount statutorily

required to be withheld, (iii) payment by Participant in cash, or (iv) such other means as the Committee deems appropriate.

No

shares of Common Stock shall be issued with respect to RSUs unless and until satisfactory arrangements acceptable to the Company have

been made by the Participant with respect to the payment of any income and other taxes which the Company determines must be withheld

or collected with respect to the RSUs.

9.

Investment Purpose. Any and all shares of Common Stock acquired by the Participant under this Agreement will be acquired for investment

for the Participant’s own account and not with a view to, for resale in connection with, or with an intent of participating directly

or indirectly in, any distribution of such shares of Common Stock within the meaning of the Securities Act of 1933, as amended (the “Securities

Act”). The Participant shall not sell, transfer or otherwise dispose of such shares unless they are either (1) registered under

the Securties Act and all applicable state securities laws, or (2) exempt from such registration in the opinion of Company counsel.

10.

Securities Law Restrictions. Regardless of whether the offering and sale of shares of Common Stock issuable to Participant pursuant

to this Agreement have been registered under the Securities Act, or have been registered or qualified under the securities laws of any

state, the Company at its sole and absolute discretion may impose restrictions upon the sale, pledge or other transfer of such shares

of Common Stock (including the placement of appropriate legends on stock certificates or the imposition of stop-transfer instructions)

if, in the judgment of the Company, such restrictions are necessary in order to achieve compliance with Applicable Laws.

11.

Lock-Up Agreement. The Participant, in the event that any shares of Common Stock which become deliverable to Participant with

respect to RSUs at a time during which any directors or officers of the Company have agreed with one or more underwriters not to sell

securities of the Company, shall enter into an agreement, in form and substance satisfactory to the Company, pursuant to which the Participant

shall agree to restrictions on transferability of the shares of such Common Stock comparable to the restrictions agreed upon by such

directors or officers of the Company.

12.

Participant Obligations. The Participant should review this Agreement with his or her own tax advisors to understand the federal,

state, local and foreign tax consequences of the transactions contemplated by this Agreement. The Participant is relying solely on such

advisors and not on any statements or representations of the Company or any of its agents, if any, made to the Participant. The Participant

(and not the Company) shall be responsible for the Participant’s own tax liability arising as a result of the transactions contemplated

by this Agreement.

13.

No Guarantee of Continued Service. Nothing in this Agreement confers on the Participant any right to remain in Continuous Service,

nor shall it affect in any way any right of the Participant or the Company to terminate the Participant’s service relationship.

14.

Notices. Notices or communications to be made hereunder shall be in writing and shall be delivered in person, by registered mail,

by confirmed facsimile or by a reputable overnight courier service to the Company at its principal office or to the Participant at his

or her address contained in the records of the Company. Alternatively, notices and other communications may be provided in the form and

manner of such electronic means as the Company may permit.

15.

Entire Agreement; Governing Law. This Award Agreement constitutes the entire Agreement with respect to the subject matter hereof

and supersedes in its entirety all prior undertakings and agreements of the Company and the Participant with respect to the subject matter

hereof, and except as provided in the Plan, as incorporated herein by reference, may not be modified in a manner material and adverse

to the Participant’s interest except by means of a writing signed by the Company and the Participant. In the event of any conflict

between this Award Agreement and the Plan, as incorporated by reference, the terms of the Plan, shall be controlling. This Award Agreement

shall be construed under the laws of the State of Texas, without regard to conflict of laws principles.

16.

Opportunity for Review. Participant and the Company agree that this Award is governed by the terms and conditions of this Award

Agreement and the Plan, as incorporated herein by reference. The Participant has reviewed this Award Agreement in its entirety, has had

an opportunity to obtain the advice of counsel prior to accepting this Award Agreement and fully understands all provisions of this Award

Agreement. The Participant hereby agrees to accept as binding, conclusive and final all decisions or interpretations of the Committee

upon any questions relating to this Award Agreement. The Participant further agrees to promptly notify the Company upon any change in

Participant’s residence address.

17.

Binding Effect. This Agreement shall be binding upon and inure to the benefit of the Company and the Participant and their respective

permitted successors, assigns, heirs, beneficiaries and representatives.

18.

Section 409A Compliance. To the extent that this Agreement and the award of RSUs hereunder are or become subject to the provisions

of Section 409A of the Code, the Company and the Participant agree that this Agreement may be amended or modified by the Company, in

its sole and absolute discretion and without the Participant’s consent, as appropriate to maintain compliance with the provisions

of Section 409A of the Code.

19.

Recoupment. Notwithstanding anything to the contrary contained herein, any amounts paid hereunder shall be subject to recoupment

in accordance with The Dodd–Frank Wall Street Reform and Consumer Protection Act and any implementing regulations thereunder, any

clawback policy adopted by the Company, as in effect from time to time, or as is otherwise required by Applicable Law.

[Signature

Page Follows]

IN

WITNESS WHEREOF, the parties hereto have executed this Agreement as of the date set forth in Exhibit A.

| |

APPLIED DIGITAL CORPORATION |

| |

|

|

| |

By: |

|

| |

Name: |

|

| |

Title: |

|

| |

|

|

| |

PARTICIPANT |

| |

|

|

| |

Name: |

|

| |

|

|

EXHIBIT

A

APPLIED

DIGITAL CORPORATION

RESTRICTED

STOCK UNIT INDUCEMENT AWARD AGREEMENT

(a).

Participant’s Name: Laura Laltrello

(b).

Award Date: January 6, 2025

(c).

Number of Restricted Stock Units (“RSUs”) Granted: 600,000

(d).

Vesting Schedule: The RSUs shall vest as follows: (i) one-third (1/3rd) of the RSUs shall vest on the one (1)-year anniversary

of the Start Date (the “Cliff Date”); and (ii) one-sixth (1/6th) of the RSUs shall vest on each six (6) month anniversary

of the Cliff Date thereafter (such that the RSUs shall be fully vested on the third anniversary of the Cliff Date), in each case, subject

to the Participant’s Continuous Service with the Company through the applicable vesting date.

Additionally,

in the event that the Participant’s employment with the Company is terminated by the Company without Cause, as defined in that

certain Offer of Employment from the Company to Participant’s, dated November 26, 2024 (as amended, restated or otherwise modified

from time to time), within one (1) year following consummation of a Change of Control, fifty percent (50%) of the then-unvested RSUs

shall accelerate and vest upon such termination.

Exhibit

5.1

Snell

& Wilmer L.L.P.

Hughes

Center

3883

Howard Hughes Parkway, Suite 1100

Las

Vegas, NV 89169-5958

TELEPHONE:

702.784.5200

FACSIMILE:

702.784.5252

January

6, 2025

Applied

Digital Corporation

3811

Turtle Creek Blvd., Suite 2100

Dallas,

Texas 75219

Re:

Registration Statement on Form S-8

Ladies

and Gentlemen:

We

have served as special Nevada counsel to Applied Digital Corporation, a Nevada corporation (the “Company”), in connection

with the registration of 600,000 shares (the “Shares”) of common stock, $0.001 par value per share, of the Company (the “Common

Stock”), issuable outside of the Company’s 2024 Omnibus Equity Incentive Plan, approved by the Company’s board of directors

and issued pursuant to the “inducement” grant exception under 5635(c)(4) of the Marketplace Rules of the Nasdaq Stock Market

LLC, upon the vesting of time-based restricted stock units that will vest in accordance with the terms of a Restricted Stock Unit Award

Agreement by and between the Company and Laura Laltrello, as an inducement for her accepting employment with the Company (the “Inducement

Award”), covered by the above-referenced Registration Statement on Form S-8 (the “Registration Statement”) filed by

the Company with the United States Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933,

as amended (the “1933 Act”), on or about the date hereof.

This

opinion is being furnished in accordance with the requirements of Item 601(b)(5) of Regulation S-K under the Securities Act in connection

with the filing of the Registration Statement. All capitalized terms used herein and not otherwise defined shall have the respective

meanings given to them in the Registration Statement.

In

connection with our representation of the Company, and as a basis for the opinion hereinafter set forth, we have relied upon and examined

matters of fact, questions of law and documents as we have deemed necessary to render this opinion, including the originals, or copies

certified or otherwise identified to our satisfaction, of the following documents (hereinafter collectively referred to as the “Documents”):

1.

The Registration Statement and exhibits hereto;

2.

The Second Amended and Restated Articles of Incorporation of the Company filed with the Secretary of State of the State of Nevada, as

amended though the date hereof, certified as of the date hereof by an officer of the Company;

3.

The Third Amended and Restated Bylaws of the Company, as amended though the date hereof, certified as of the date hereof by an officer

of the Company;

4.

Certificate of Existence with Status in Good Standing, certified by the Secretary of State of the State of Nevada, dated as of January

3, 2025;

5.

The resolutions adopted by the Board of Directors of the Company relating to the approval of the Inducement Award, the authorization

of the issuance of the Shares issuable upon the vesting of time-based restricted stock units pursuant to the terms of the Inducement

Award and the preparation and filing of the Registration Statement (collectively, the “Resolutions”), certified as of the

date hereof by an officer of the Company;

6.

A copy of the Inducement Award;

7.

A certificate executed by an officer of the Company, dated as of the date hereof, as to certain factual matters; and

Applied

Digital Corporation

January 6, 2025

Page 2 |

8.

Such other documents and matters as we have deemed necessary or appropriate to express the opinion set forth below, subject to the assumptions,

limitations and qualifications stated herein.

In

expressing the opinion set forth below, we have assumed the following:

A.

Each individual executing any of the Documents, whether on behalf of such individual or any other person, is legally competent to do

so.

B.

All Documents submitted to us as originals are authentic. The form and content of all Documents submitted to us as unexecuted drafts

do not differ in any respect relevant to this opinion from the form and content of such Documents as executed and delivered. All Documents

submitted to us as certified or photostatic copies conform to the original documents. All signatures on all such Documents are genuine.

All public records reviewed or relied upon by us or on our behalf are true and complete. All representations, warranties, statements

and information contained in the Documents are true and complete. There has been no oral or written modification of or amendment to any

of the Documents, and there has been no waiver of any provision of any of the Documents, by action or omission of the parties or otherwise.

For the purpose of the opinion rendered below, we have assumed that, upon each issuance of Shares, the Company will receive or has received

the consideration for such Shares required by the Resolutions.

Based

upon the foregoing, and subject to the assumptions, limitations and qualifications stated herein, it is our opinion that the issuance

of the Shares has been duly authorized and, when issued and delivered by the Company pursuant to the Resolutions, the terms of the Inducement

Award and otherwise in accordance with the Registration Statement, and upon delivery of the Shares subject to issuance by the Company,

the Shares will be validly issued, fully paid and nonassessable.

We

render this opinion only with respect to the general corporate law of the State of Nevada as set forth in Chapter 78 of the Nevada Revised

Statutes. We neither express nor imply any obligation with respect to any other laws or the laws of any other jurisdiction or of the

United States. For purposes of this opinion, we assume that the Shares will be issued in compliance with all applicable state securities

or blue sky laws.

The

opinion expressed herein is limited to the matters specifically set forth herein and no other opinion shall be inferred beyond the matters

expressly stated. We assume no obligation to supplement this opinion if any applicable law changes after the date hereof or if we become

aware of any fact that might change the opinion expressed herein after the date hereof. Without limiting the generality of the foregoing,

we neither express nor imply any opinion regarding the contents of the Registration Statement, other than as expressly stated herein

with respect to the Shares.

We

hereby consent to the filing of this opinion as an exhibit to the Registration Statement and to the use of the name of our firm therein.

In giving this consent, we do not admit that we are within the category of persons whose consent is required by Section 7 of the 1933

Act or the rules and regulations of the Commission promulgated thereunder.

| |

Very

truly yours, |

| |

|

| |

/s/ Snell

& Wilmer L.L.P. |

| |

|

| |

Snell & Wilmer L.L.P. |

Exhibit

23.1

INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM’S CONSENT

We

consent to the incorporation by reference in this Registration Statement of Applied Digital Corporation on Form S-8 of our report dated

August 30, 2024, with respect to our audits of the consolidated financial statements of Applied Digital Corporation as of May 31, 2024

and 2023 and for each of the two years in the period ended May 31, 2024 appearing in the Annual Report on Form 10-K of Applied Digital

Corporation for the year ended May 31, 2024.

/s/

Marcum LLP

Marcum

LLP

New

York, NY

January

3, 2025

S-8

EX-FILING FEES

0001144879

0001144879

1

2025-01-03

2025-01-03

0001144879

2025-01-03

2025-01-03

iso4217:USD

xbrli:pure

xbrli:shares

Ex-Filing Fees

CALCULATION OF FILING FEE TABLES

S-8

Applied Digital Corp.

Table 1: Newly Registered and Carry Forward Securities

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Line Item Type |

|

Security Type |

|

Security Class Title |

|

Notes |

|

Fee Calculation

Rule |

|

Amount Registered |

|

Proposed Maximum Offering

Price Per Unit |

|

Maximum Aggregate Offering Price |

|

Fee Rate |

|

Amount of Registration Fee |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Newly Registered Securities |

| Fees to be Paid |

|

Equity |

|

Common stock, par value $0.001 per share |

|

(1) |

|

Other |

|

600,000 |

|

$ |

7.84 |

|

$ |

4,704,000.00 |

|

0.0001531 |

|

$ |

720.18 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Offering Amounts: |

|

$ |

4,704,000.00 |

|

|

|

|

720.18 |

| Total Fees Previously Paid: |

|

|

|

|

|

|

|

|

| Total Fee Offsets: |

|

|

|

|

|

|

|

0.00 |

| Net Fee Due: |

|

|

|

|

|

|

$ |

720.18 |

__________________________________________

Offering Note(s)

| (1) | |

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), there are also being registered an indeterminable number of additional securities as may be issued

to prevent dilution resulting from stock splits, stock dividends or similar transactions which results in an increase in the number of outstanding shares of the Registrant’s common stock, par

value $0.001 per share (the “Common Stock”).(2) Represents 600,000 shares of Common Stock, that may be issued upon the vesting of time-based restricted stock units that will vest in

accordance with the terms of a Restricted Stock Unit Award Agreement by and between the Company and Laura Laltrello.(3) Calculated in accordance with Rules 457(c) and (h) under the

Securities Act, based on the average of the high and low prices of the Common Stock on the Nasdaq Global Select Market on January 2, 2025, which date is within five business days prior to the

date of filing of this Registration Statement. |

v3.24.4

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_FeeExhibitTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:feeExhibitTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissionLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissnTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.24.4

Offerings - Offering: 1

|

Jan. 03, 2025

USD ($)

shares

|

| Offering: |

|

| Fee Previously Paid |

false

|

| Other Rule |

true

|

| Security Type |

Equity

|

| Security Class Title |

Common stock, par value $0.001 per share

|

| Amount Registered | shares |

600,000

|

| Proposed Maximum Offering Price per Unit |

7.84

|

| Maximum Aggregate Offering Price |

$ 4,704,000.00

|

| Fee Rate |

0.01531%

|

| Amount of Registration Fee |

$ 720.18

|

| Offering Note |

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), there are also being registered an indeterminable number of additional securities as may be issued

to prevent dilution resulting from stock splits, stock dividends or similar transactions which results in an increase in the number of outstanding shares of the Registrant’s common stock, par

value $0.001 per share (the “Common Stock”).(2) Represents 600,000 shares of Common Stock, that may be issued upon the vesting of time-based restricted stock units that will vest in

accordance with the terms of a Restricted Stock Unit Award Agreement by and between the Company and Laura Laltrello.(3) Calculated in accordance with Rules 457(c) and (h) under the

Securities Act, based on the average of the high and low prices of the Common Stock on the Nasdaq Global Select Market on January 2, 2025, which date is within five business days prior to the

date of filing of this Registration Statement.

|

| X |

- DefinitionThe amount of securities being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_AmtSctiesRegd |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTotal amount of registration fee (amount due after offsets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe rate per dollar of fees that public companies and other issuers pay to register their securities with the Commission. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeRate |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:percentItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCheckbox indicating whether filer is using a rule other than 457(a), 457(o), or 457(f) to calculate the registration fee due. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesOthrRuleFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum aggregate offering price for the offering that is being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxAggtOfferingPric |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative100TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum offering price per share/unit being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxOfferingPricPerScty |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal4lItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingNote |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:textBlockItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe title of the class of securities being registered (for each class being registered). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTitl |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionType of securities: "Asset-backed Securities", "ADRs/ADSs", "Debt", "Debt Convertible into Equity", "Equity", "Face Amount Certificates", "Limited Partnership Interests", "Mortgage Backed Securities", "Non-Convertible Debt", "Unallocated (Universal) Shelf", "Exchange Traded Vehicle Securities", "Other" Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_OfferingTable |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_PrevslyPdFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

ffd_OfferingAxis=1 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

v3.24.4

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesSummaryLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_NetFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOfferingAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOffsetAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

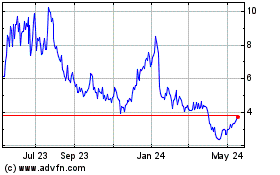

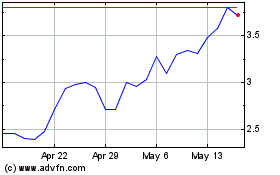

Applied Digital (NASDAQ:APLD)

Historical Stock Chart

From Feb 2025 to Mar 2025

Applied Digital (NASDAQ:APLD)

Historical Stock Chart

From Mar 2024 to Mar 2025