AquaBounty Technologies, Inc. (Nasdaq: AQB) (“AquaBounty” or the

“Company”), a land-based aquaculture company utilizing technology

to enhance productivity and sustainability, today provided a

corporate update on the progress of its planned large-scale salmon

farm in Pioneer, Ohio.

“We have made solid progress towards finalizing site engineering

designs and permitting since our site announcement in July,” said

Sylvia Wulf, Chief Executive Officer of AquaBounty. “With hydrology

studies complete, confirming that the quantity and quality of water

available meets our needs as well as the needs of the local

community, key water and environmental permits are currently

underway. We remain on track with our preliminary timing estimates

to commence construction by year-end, with commercial stocking of

salmon estimated to occur in 2023. We are working closely with the

Village of Pioneer, Williams County, the State of Ohio, JobsOhio

and the Regional Growth Partnership – whose ongoing support has

been invaluable in our progress.

“As we’ve progressed on the final design for our 10,000 metric

ton Ohio farm, we have been able to further refine our expected

project cost, which we estimate to be in the range of $290 million

to $320 million, including a reserve for potential contingencies of

$30 million. The increase from our previous estimates is

attributable to several factors, including the cost of building

materials and the Recirculating Aquaculture System technology,

along with the inclusion of an on-site processing plant and water

treatment facility.

“As we’ve stated before, our capitalization plan for financing

the farm project includes leveraging our equity contribution with

debt. To that point, we have begun the process for the placement of

a mix of tax-exempt and taxable bonds through the Toledo-Lucas

County Port Authority, whose board has approved the issuance of up

to $300 million in bonds to support the financing of the project.

We have also engaged Wells Fargo Corporate and Investment Banking

to underwrite and market the bond placement, which we expect to

complete in Q1 2022. Though there is still work to be done to close

this transaction, we believe that this financing will be a major

milestone for the Company.

“To support the egg requirements of the Ohio farm, and future

farms, we made the decision to transition our Prince Edward Island,

Canada grow-out farm operation to the production of traditional

salmon broodstock, eggs and fry, in addition to our genetically

engineered salmon eggs. This transition is expected to occur over

the next two years and increase our egg production capacity from 8

million to 30 million eggs annually. There is an increasing demand

for traditional salmon eggs in North America and so our increased

egg production capacity is expected to supply both our own needs

and create an additional revenue stream from traditional salmon

eggs.

“We believe our 25 years of experience and learning from our

current operations continues to position us to achieve our goal of

profitably producing commodity-priced salmon safely, securely and

sustainably. We look forward to finalizing the plans and

construction timeline for our next-generation farm, that will

ensure the safety of our fish from hatch to harvest, while

maximizing long-term value creation for our shareholders,”

concluded Wulf.

About AquaBounty

AquaBounty Technologies, Inc. (NASDAQ: AQB) is a leader in the

field of land-based aquaculture and the use of technology for

improving its productivity and sustainability. The Company’s

objective is to help ensure the availability of high-quality

seafood to meet global consumer demand, while addressing critical

production constraints in the most popular farmed

species.

The Company’s genetically engineered salmon program is based

upon a single, specific molecular modification in salmon that

results in more rapid growth in early development. With aquaculture

farms located in Prince Edward Island, Canada, and Indiana, United

States, AquaBounty is raising salmon that is free of antibiotics

and other contaminants, in land-based Recirculating Aquaculture

Systems (“RAS”) which are designed to prevent disease and to

include multiple levels of fish containment to protect wild fish

populations. AquaBounty’s solution offers a reduced carbon

footprint and no risk of pollution of marine ecosystems, as

compared to traditional sea-cage farming. For more information,

please visit www.aquabounty.com.

Forward-Looking Statements

This press release contains “forward-looking statements” as

defined in the Private Securities Litigation Reform Act of 1995, as

amended, including regarding the Company’s commencement,

completion, timing, terms, size, and use of proceeds of the

proposed bond financing with the Toledo-Lucas County Port

Authority, job creation plans, anticipated size of its facility in

Ohio, production capacity, timing of construction, permits, or

commercial stocking, cost of construction and startup costs, amount

to be invested in the project, availability and mix of debt and

equity financing, ability and approvals to convert operations on

PEI to broodstock, and ability to produce eggs, fry, and

broodstock, and future revenue streams, pricing and profitability.

There is no guarantee that AquaBounty will be successful in raising

the capital required for this project through the issuance of the

bonds discussed herein. The forward-looking statements in this

press release are neither promises nor guarantees, and you should

not place undue reliance on these statements because they involve

significant risks and uncertainties about AquaBounty. AquaBounty

may use words such as “expect,” “anticipate,” “project,” “intend,”

“slated to,” “plan,” “aim,” “believe,” “seek,” “estimate,” “can,”

“focus,” “will,” and “may” and similar expressions to identify such

forward-looking statements. Among the important factors that could

cause actual results to differ materially from those indicated by

such forward-looking statements are risks relating to, among other

things, whether AquaBounty and its partners will commence or

consummate the proposed bond financing, the final terms of the

proposed bond financing, market and other conditions for such

offering, the satisfaction of related closing conditions, the

impact of the bond offering on AquaBounty’s financial condition,

credit rating and stock price, whether or not AquaBounty will need

to and be able to raise additional equity capital, whether

AquaBounty will be able to service the bond commitments,

AquaBounty’s business and financial condition, AquaBounty’s ability

to secure required regulatory approvals and permits, AquaBounty’s

ability to profitably construct and operate the farm, and the

impact of general economic, public health, industry or political

conditions in the United States or internationally. For additional

disclosure regarding these and other risks faced by AquaBounty, see

disclosures contained in AquaBounty’s public filings with the SEC,

including the “Risk Factors” in the company’s Annual Report on Form

10-K and Quarterly Reports on Form 10-Q. You should consider these

factors in evaluating the forward-looking statements included in

this press release and not place undue reliance on such statements.

The forward-looking statements reflect AquaBounty’s current views

about its plans, intentions, expectations, strategies and

prospects, which are based on the information currently available

to AquaBounty and on assumptions AquaBounty has made as of the date

hereof. AquaBounty undertakes no obligation to update such

statements as a result of new information, future events or

otherwise, except as required by law.

This press release does not constitute an offer to sell or a

solicitation of an offer to buy the bonds described herein, nor

shall there be any sale of these bonds in any state or jurisdiction

in which such offer, solicitation or sale would be unlawful.

Company Contact:AquaBounty TechnologiesDave

ConleyCorporate Communications(613) 294-3078

Investor Relations:Greg Falesnik or Luke

ZimmermanMZ Group - MZ North America(949)

259-4987AQB@mzgroup.us

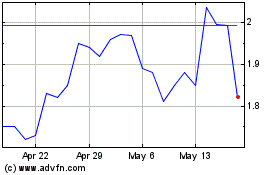

AquaBounty Technologies (NASDAQ:AQB)

Historical Stock Chart

From Jan 2025 to Feb 2025

AquaBounty Technologies (NASDAQ:AQB)

Historical Stock Chart

From Feb 2024 to Feb 2025