Form 8-K - Current report

February 12 2025 - 6:22AM

Edgar (US Regulatory)

0001398733false00013987332025-02-122025-02-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 12, 2025

Aquestive Therapeutics, Inc.

(Exact name of Registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-38599 | 82-3827296 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

30 Technology Drive

Warren, NJ 07059

(908) 941-1900

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Not Applicable

(Former name or former address, if changed since last report)

________________________________________________________________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which

registered |

| Common Stock, par value $0.001 per share | AQST | Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On February 12, 2025, Aquestive Therapeutics, Inc. (the “Company”) issued a press release announcing that multiple presentations highlighting the results from the investigational use of Anaphylm™, its epinephrine sublingual film product candidate or the treatment of severe allergic reaction, including anaphylaxis, will be featured at the 2025 American Academy of Allergy, Asthma and Immunology (AAAAI) Annual Meeting which is being held from February 28 - March 3, 2025, in San Diego, California. The abstracts are available online at https://annualmeeting.aaaai.org/ as well as on the Company's website on the Scientific Events page of the investor section. The press release is filed as Exhibit 99.1 hereto and incorporated herein by reference.

| | | | | |

Item 9.01 | Financial Statements and Exhibits. |

(d)Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| | Aquestive Therapeutics, Inc. Press Release, dated February 12, 2025 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

Dated: February 12, 2025 | Aquestive Therapeutics, Inc. |

| | | |

| | By: | /s/ A. Ernest Toth, Jr |

| | | Name: A. Ernest Toth, Jr. |

| | | Title: Chief Financial Officer |

Aquestive Therapeutics to Present New Findings on Anaphylm™ (Epinephrine Sublingual Film) at the 2025 AAAAI Annual Meeting • Data show Anaphylm maintains consistent stability and potency under extreme temperature and real-world conditions, including heat, freezing, and water submersion • New findings demonstrate dosing of Anaphylm results in consistent epinephrine absorption without impacting safety or pharmacodynamic (PD) parameters • Anaphylm pharmacokinetic (PK) and PD are not impacted by oral swelling • Median symptom resolution time was 12 minutes compared to 74 minutes without treatment; mean angioedema symptom resolution time was within 5 minutes. WARREN, N.J., February 12, 2025 – Aquestive Therapeutics, Inc. (NASDAQ: AQST) (“Aquestive” or the “Company”), a pharmaceutical company advancing medicines to bring meaningful improvement to patients' lives through innovative science and delivery technologies, today announced that multiple presentations highlighting results from the investigational use of Anaphylm epinephrine sublingual film in the treatment of severe allergic reactions, including anaphylaxis, will be featured at the 2025 American Academy of Allergy, Asthma and Immunology (AAAAI) Annual Meeting. The meeting will take place February 28 - March 3, 2025, in San Diego, CA. “These latest results reinforce the strength of our clinical data and the potential of our product candidate Anaphylm as a reliable, portable, and effective treatment for anaphylaxis,” said Daniel Barber, Chief Executive Officer of Aquestive. “Anaphylm was designed to offer patients a more accessible option for emergency epinephrine administration, without the need for an injection or device, if approved by the FDA. These data further demonstrate Anaphylm’s performance under real-world conditions in resolving angioedema symptoms.” In the Phase 2 open-label Oral Anaphylm Symptom Intervention Study (“OASIS”) study, adults with Oral Allergy Syndrome (n=36) received Anaphylm under different conditions, including single and repeat dosing with and without oral allergen challenge (OAC), alongside intramuscular (IM) epinephrine injection as a comparator. The study found that: • Anaphylm matched or exceeded IM epinephrine in all key PK parameters. • No significant differences in drug performance compared to IM epinephrine were observed, regardless of whether patients had an oral allergen challenge or not. • Median symptom resolution time was 12 minutes compared to 74 minutes without treatment; mean angioedema symptom resolution time was within 5 minutes.

Additionally, new findings indicate that Anaphylm maintains prior reported top line data in support of stability and potency despite exposure to extreme temperatures and environmental conditions, underscoring its performance in real-world settings where patients may need it most. Poster presentation details are as follows: Poster Title: Durability of Anaphylm (Epinephrine Sublingual Film) under Real-World Use Poster Number: 304 Lead Author: Steve Wargacki, PhD Presentation Time: Saturday, Mar. 1, 9:45 am – 10:45 am PT Poster Title: Stability Results of Anaphylm (Epinephrine Sublingual Film) Under Extreme Temperature Conditions Poster Number: 305 Lead Author: Steve Wargacki, PhD Presentation Time: Saturday, Mar. 1, 9:45 am – 10:45 am PT Poster Title: Epinephrine Delivered via Sublingual Film (Anaphylm): Pharmacokinetic and Pharmacodynamic Responses Poster Number: 312 Lead Author: Carl N. Kraus, MD Presentation Time: Saturday, Mar. 1, 9:45 am – 10:45 am PT Poster Title: Oral Anaphylm Symptom Intervention Study (OASIS): Pharmacokinetics, Pharmacodynamics, and Symptom Resolution in Allergy Patients Poster Number: L18 Lead Author: Carl N. Kraus, MD Presentation Time: Saturday, Mar. 1, 9:45 am – 10:45 am PT The abstracts are available online at annualmeeting.aaaai.org, as well as on the Company’s website on the Scientific events page of the of the Investor section. About Anaphylm™ (epinephrine) Sublingual Film Anaphylm™ (epinephrine) Sublingual Film is a polymer matrix-based epinephrine prodrug product candidate. Anaphylm is similar in size to a postage stamp, weighs less than an ounce, and begins to dissolve on contact. No water or swallowing is required for administration. The packaging for Anaphylm is thinner and smaller than an average credit card, can be carried in a pocket, and is designed to withstand weather excursions such as exposure to rain and/or sunlight. The Anaphylm trade name for AQST-109 has been conditionally approved by the U.S. Food and Drug Administration (FDA). Final approval of the Anaphylm proprietary name is conditioned on FDA approval of the product candidate.

About Aquestive Therapeutics Aquestive is a pharmaceutical company advancing medicines to bring meaningful improvement to patients' lives through innovative science and delivery technologies. We are developing orally administered products to deliver complex molecules, providing novel alternatives to invasive and inconvenient standard of care therapies. Aquestive has five commercialized products marketed by the Company and its licensees in the U.S. and around the world, and is the exclusive manufacturer of these licensed products. The Company also collaborates with pharmaceutical companies to bring new molecules to market using proprietary, best-in-class technologies, like PharmFilm®, and has proven drug development and commercialization capabilities. Aquestive is advancing a late-stage proprietary product candidate for the treatment of severe allergic reactions, including anaphylaxis, and an earlier stage epinephrine prodrug topical gel product candidate for possible various dermatology conditions. For more information, visit Aquestive.com and follow us on LinkedIn. Forward-Looking Statement Certain statements in this press release include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “believe,” “anticipate,” “plan,” “expect,” “estimate,” “intend,” “may,” “will,” or the negative of those terms, and similar expressions, are intended to identify forward-looking statements. These forward-looking statements include, but are not limited to, statements regarding the advancement and related timing of our product candidate Anaphylm™ (epinephrine) Sublingual Film through clinical development and approval by the FDA, including filing the NDA for Anaphylm with the FDA and the following launch of Anaphylm, if approved by the FDA; that the results of the Company’s clinical studies for Anaphylm are sufficient to support submission of the NDA for approval of Anaphylm by the FDA; the advancement of the Company’s product candidate AQST-108 through clinical development and approval by the FDA for possible various dermatology conditions; the potential benefits our products and product candidates could bring to patients; and business strategies, market opportunities, and other statements that are not historical facts. These forward-looking statements are based on our current expectations and beliefs and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Such risks and uncertainties include, but are not limited to, risks associated with our development work, including any delays or changes to the timing, cost and success of our product development activities and clinical trials and plans, including those relating to Anaphylm (including for pediatric patients) and AQST-108; risk of delays in advancement of the regulatory approval process through the FDA of our product candidates, including the filing of the respective NDAs, including for Anaphylm and AQST-108, or the failure to receive FDA approval at all of any of these product candidates; risk of the Company’s ability to generate sufficient clinical data for approval of our product candidates, including with respect to our pharmacokinetic and pharmacodynamic comparability submission for FDA approval of Anaphylm; risk of the Company’s ability to address the FDA’s comments on

the Company’s clinical trials and other concerns identified in the FDA Type C meeting minutes for Anaphylm, including the risk that the FDA may require additional clinical studies for approval of Anaphylm; risk of the success of any competing products; risks and uncertainties inherent in commercializing a new product (including technology risks, financial risks, market risks and implementation risks and regulatory limitations); risk of sufficient capital and cash resources, including sufficient access to available debt and equity financing, including under our ATM facility and the Lincoln Park Purchase Agreement, and revenues from operations, to satisfy all of our short-term and longer-term liquidity and cash requirements and other cash needs, at the times and in the amounts needed, including to fund commercialization activities relating to fund future clinical development and commercial activities for our product candidates, including Anaphylm, should these product candidates be approved by the FDA; risk of eroding market share for Suboxone® and risk as a sunsetting product, which accounts for the substantial part of our current operating revenue; risk of default of our debt instruments; risks related to the outsourcing of certain sales, marketing and other operational and staff functions to third parties; risk of the rate and degree of market acceptance in the U.S. of Anaphylm and our other product candidates, should these product candidates be approved by the FDA, and for our licensed products in the U.S. and abroad; risk of the success of any competing products including generics; risk of the size and growth of our product markets; risk of compliance with all FDA and other governmental and customer requirements for our manufacturing facilities; risks associated with intellectual property rights and infringement claims relating to our products; risk that our patent applications for our product candidates, including for Anaphylm, will not be timely issued, or issued at all, by the PTO; risk of unexpected patent developments; risk of legislation and regulatory actions and changes in laws or regulations affecting our business including relating to our products and products candidates and product pricing, reimbursement or access therefor; risk of loss of significant customers; risks related to claims and legal proceedings against Aquestive including patent infringement, securities, business torts, investigative, product safety or efficacy and antitrust litigation matters; risk of product recalls and withdrawals; risks related to any disruptions in our information technology networks and systems, including the impact of cybersecurity attacks; risk of increased cybersecurity attacks and data accessibility disruptions due to remote working arrangements; risk of adverse developments affecting the financial services industry; risks related to inflation and rising interest rates; risks related to the impact of the COVID-19 global pandemic and other pandemic diseases on our business, including with respect to our clinical trials and the site initiation, patient enrollment and timing and adequacy of those clinical trials, regulatory submissions and regulatory reviews and approvals of our product candidates, availability of pharmaceutical ingredients and other raw materials used in our products and product candidates, supply chain, manufacture and distribution of our products and product candidates; risks and uncertainties related to general economic, political (including the Ukraine and Israel wars and other acts of war and terrorism), business, industry, regulatory, financial and market conditions and other unusual items; and other uncertainties affecting us including those described in the "Risk Factors" section and in other sections included in the Company’s Annual Report on Form 10-K,

Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K filed with the U.S. Securities and Exchange Commission. Given those uncertainties, you should not place undue reliance on these forward-looking statements, which speak only as of the date made. All subsequent forward- looking statements attributable to the Company or any person acting on its behalf are expressly qualified in their entirety by this cautionary statement. The Company assumes no obligation to update forward-looking statements or outlook or guidance after the date of this press release whether as a result of new information, future events or otherwise, except as may be required by applicable law. PharmFilm® and the Aquestive logo are registered trademarks of Aquestive Therapeutics, Inc. All other registered trademarks referenced herein are the property of their respective owners. Investor Contact: Brian Korb astr partners brian.korb@astrpartners.com

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

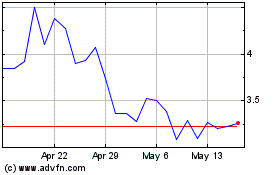

Aquestive Therapeutics (NASDAQ:AQST)

Historical Stock Chart

From Jan 2025 to Feb 2025

Aquestive Therapeutics (NASDAQ:AQST)

Historical Stock Chart

From Feb 2024 to Feb 2025