Arbe Robotics Ltd. (NASDAQ, TASE: ARBE) (“Arbe” or the “Company”),

a global leader in Perception Radar Solutions, today announced the

pricing of a public offering of an aggregate of 8,250,000 ordinary

shares (or pre-funded warrants in lieu thereof) accompanied by

Tranche A Warrants to purchase up to 8,250,000 ordinary shares and

Tranche B Warrants to purchase up to 8,250,000 ordinary shares, at

a combined public offering price of $1.82 per share (or per

pre-funded warrant in lieu thereof) and accompanying Tranche A

Warrant and Tranche B Warrant. The Tranche A Warrants will have an

exercise price of $2.35 per share, will be immediately exercisable

upon issuance and will expire on November 4, 2029. The Tranche B

Warrants will have an exercise price of $1.82 per share, will be

immediately exercisable upon issuance and will expire on the

earlier of (A) twenty (20) trading days after (i) the Company shall

have publicly announced that it has entered into a definitive

supply agreement with a named European automotive original

equipment manufacturer (the “Definitive Agreement Announcement”),

(ii) the VWAP (as defined in the Tranche B Warrant) for each

trading day in any period of ten (10) consecutive trading days

within one calendar year of the date of the Definitive Agreement

Announcement (such ten-day period, the “Measurement Period,” and

such one-year period, the “Definitive Agreement Announcement

Period”) is equal to or exceeds $2.25 (subject to certain

adjustments), (iii) the trading volume of the ordinary shares (as

reported by Bloomberg L.P.) on each trading day of the Measurement

Period is at least 250,000 ordinary shares (subject to certain

adjustments), and (iv) the ordinary shares underlying the Tranche B

Warrants and any ordinary shares issuable upon the exercise of any

pre-funded warrants issued upon the exercise of a Tranche B Warrant

(collectively, the “Saleable Shares”) are then covered by an

effective registration statement and a current prospectus which can

be used for the sale or other disposition of the Saleable Shares

and we have no reason to believe that such registration statement

and prospectus will not continue to be available for the Saleable

Shares for the next thirty (30) trading days ((i) – (iv)

collectively, the “Triggering Event”), and (B) November 4, 2027.

The closing of the offering is expected to occur on or about

November 4, 2024, subject to the satisfaction of customary closing

conditions.

Canaccord Genuity is acting as the sole bookrunner for the

offering. Roth Capital Partners is acting as the co-manager for the

offering.

The aggregate gross proceeds to the Company from

this offering are expected to be approximately $15 million, before

deducting the placement agent’s fees and other offering expenses

payable by the Company. The potential additional gross proceeds to

the Company from the Tranche A Warrants and Tranche B Warrants, if

fully exercised on a cash basis, will be approximately $34.4

million. No assurance can be given that any of the Tranche A

Warrants or Tranche B Warrants will be exercised. The Company

intends to use the net proceeds from this offering for working

capital and general corporate purposes.

The securities described above are being offered

pursuant to a registration statement on Form F-3 (File No.

333-269235), as amended, originally filed on January 13, 2023, with

the Securities and Exchange Commission (the “SEC”) and declared

effective by the SEC on February 24, 2023. The offering is being

made only by means of a prospectus and a prospectus supplement

which forms a part of the effective registration statement relating

to the offering. A preliminary prospectus supplement and

accompanying prospectus relating to the offering has been filed

with the SEC and a final prospectus supplement and prospectus

relating to the offering will be filed with the SEC. Electronic

copies of the final prospectus, when available, may be obtained on

the SEC’s website at http://www.sec.gov and may also be

obtained, when available, by contacting Canaccord Genuity LLC,

Attn: Syndication Department, 1 Post Office Square, 30th Floor,

Boston, MA 02109, or by email at prospectus@cgf.com

This press release shall not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

described herein, nor shall there be any sale of these securities

in any state or other jurisdiction in which such an offer,

solicitation or sale would be unlawful prior to the registration or

qualification under the securities laws of any such state or other

jurisdiction.

About Arbe Robotics, Ltd.

Arbe (Nasdaq: ARBE), a global leader in

Perception Radar solutions, is spearheading a radar revolution,

enabling safe driver-assist systems today while paving the way to

full autonomous-driving. Arbe's radar technology is 100 times more

detailed than any other radar on the market and is a critical

sensor for L2+ and higher autonomy. The company is empowering

automakers, Tier 1 suppliers, autonomous ground vehicles,

commercial and industrial vehicles, and a wide array of safety

applications with advanced sensing and paradigm changing

perception. Arbe is based in Tel Aviv, Israel, and has offices in

China, Germany, and the United States.

Forward-Looking Statements

This press release contains "forward-looking

statements" within the meaning of the Securities Act of 1933 and

the Securities Exchange Act of 1934, both as amended by the Private

Securities Litigation Reform Act of 1995. contains "forward-looking

statements" within the meaning of the Securities Act of 1933 and

the Securities Exchange Act of 1934, both as amended by the Private

Securities Litigation Reform Act of 1995. The words "expect,"

"believe," "estimate," "intend," "plan," "anticipate," "may,"

"should," "strategy," "future," "will," "project," "potential" and

similar expressions indicate forward-looking statements.

Forward-looking statements are predictions, projections and other

statements about future events that are based on current

expectations and assumptions and, as a result, are subject to risks

and uncertainties, and include, but are not limited to, statements

or expectations regarding the timing and completion of the

offering, anticipated gross proceeds from the offering, the

anticipated use of net proceeds from the offering, the ability of

the Company to achieve certain milestone events, the exercise of

the Tranche A Warrants and Tranche B Warrants upon the achievement

of such milestone events or otherwise prior to their expiration,

and the total number of securities to be issued in the offering.

Actual events or results could differ materially from those

discussed in the forward-looking statements as a result of various

factors, including, but not limited to the effect on the Israeli

economy generally and on the Company's business resulting from the

terrorism and the hostilities in Israel and with its neighboring

countries including the effects of the continuing war with Hamas

and any further intensification of hostilities with others,

including Iran and Hezbollah, and the effect of the call-up of a

significant portion of its working population, including the

Company's employees; the effect of any potential boycott both of

Israeli products and business and of stocks in Israeli companies;

the effect of any downgrading of the Israeli economy and the effect

of changes in the exchange rate between the US dollar and the

Israeli shekel; the Company's ability to meet the conditions to the

release from escrow of the proceeds from its recent sale of

convertible debentures; the Company's ability to generate

additional OEM selections and substantial orders and the risk and

uncertainties described in "Cautionary Note Regarding

Forward-Looking Statements," "Item 3. Key Information – D. Risk

Factors" and "Item 5. Operating and Financial Review and Prospects"

and in the Company's Annual Report on Form 20-F for the year ended

December 31, 2023, which was filed with the Securities and Exchange

Commission (the "SEC") on March 28, 2024, as well as other

documents filed by the Company with the SEC. Accordingly, you are

cautioned not to place undue reliance on these forward-looking

statements. Forward-looking statements relate only to the date they

were made, and the Company does not undertake any obligation to

update forward-looking statements to reflect events or

circumstances after the date they were made except as required by

law or applicable regulation.

Information contained on, or that can be accessed through, the

Company's website or any other website or any social media is

expressly not incorporated by reference into and is not a part of

this press release.

CONTACT:

Miri Segal-Scharia

msegal@ms-ir.com

917-607-8654

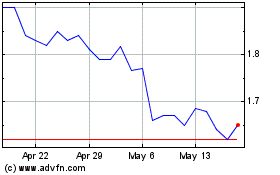

Arbe Robotics (NASDAQ:ARBE)

Historical Stock Chart

From Jan 2025 to Feb 2025

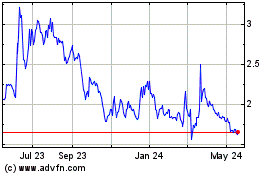

Arbe Robotics (NASDAQ:ARBE)

Historical Stock Chart

From Feb 2024 to Feb 2025