0000007623

ARTS WAY MANUFACTURING CO INC

false

--11-30

FY

2024

108,636

32,137

0.01

0.01

500,000

500,000

0

0

0

0

0.01

0.01

9,500,000

9,500,000

5,149,173

5,106,922

112,714

94,256

3

2

1

3

40

http://fasb.org/us-gaap/2024#OtherAssetsNoncurrent

http://fasb.org/us-gaap/2024#OtherAssetsNoncurrent

http://fasb.org/us-gaap/2024#AccruedLiabilitiesCurrent

http://fasb.org/us-gaap/2024#AccruedLiabilitiesCurrent

http://fasb.org/us-gaap/2024#OtherAssetsNoncurrent

http://fasb.org/us-gaap/2024#OtherAssetsNoncurrent

2,466,000

4

http://fasb.org/us-gaap/2024#Revenues

1

http://www.artsway-mfg.com/20241130#WallStreetJournalRateMember

150,000

19,648

19,648

7.00

7.00

October 1, 2037

October 1, 2037

2,972

2,972

7.00

7.00

May 15, 2027

May 15, 2027

731

731

3.75

3.75

December 18, 2022

December 18, 2022

June 18, 2050

June 18, 2050

731

731

3.75

3.75

December 18, 2022

December 18, 2022

June 18, 2050

June 18, 2050

731

731

3.75

3.75

December 24, 2022

December 24, 2022

June 24, 2050

June 24, 2050

0

0

0

0

false

false

false

false

FY 2024 capital expenditures include finance leased assets of $39,000 in the Agricultural Products segment.

FY 2022 capital expenditures include $166,000 of finance leased assets.

FY 2023 capital expenditures include finance leased assets of $118,000 in the Agricultural Products segment and $17,000 in the Modular Buildings segment.

00000076232023-12-012024-11-30

iso4217:USD

00000076232024-05-31

xbrli:shares

00000076232025-02-04

thunderdome:item

00000076232024-11-30

00000076232023-11-30

iso4217:USDxbrli:shares

00000076232022-12-012023-11-30

0000007623us-gaap:CommonStockMember2022-11-30

0000007623us-gaap:AdditionalPaidInCapitalMember2022-11-30

0000007623us-gaap:RetainedEarningsMember2022-11-30

0000007623us-gaap:TreasuryStockCommonMember2022-11-30

00000076232022-11-30

0000007623us-gaap:CommonStockMember2022-12-012023-11-30

0000007623us-gaap:AdditionalPaidInCapitalMember2022-12-012023-11-30

0000007623us-gaap:RetainedEarningsMember2022-12-012023-11-30

0000007623us-gaap:TreasuryStockCommonMember2022-12-012023-11-30

0000007623us-gaap:CommonStockMember2023-11-30

0000007623us-gaap:AdditionalPaidInCapitalMember2023-11-30

0000007623us-gaap:RetainedEarningsMember2023-11-30

0000007623us-gaap:TreasuryStockCommonMember2023-11-30

0000007623us-gaap:CommonStockMember2023-12-012024-11-30

0000007623us-gaap:AdditionalPaidInCapitalMember2023-12-012024-11-30

0000007623us-gaap:RetainedEarningsMember2023-12-012024-11-30

0000007623us-gaap:TreasuryStockCommonMember2023-12-012024-11-30

0000007623us-gaap:CommonStockMember2024-11-30

0000007623us-gaap:AdditionalPaidInCapitalMember2024-11-30

0000007623us-gaap:RetainedEarningsMember2024-11-30

0000007623us-gaap:TreasuryStockCommonMember2024-11-30

xbrli:pure

00000076232023-12-012024-08-30

0000007623us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2023-11-012024-11-30

0000007623us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberartw:OneCustomerMember2023-11-012024-11-30

0000007623us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberartw:CustomerTwoMember2023-11-012024-11-30

0000007623us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2022-12-012023-11-30

0000007623us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberartw:OneCustomerMember2022-12-012023-11-30

0000007623artw:AgriculturalProductsFloorplanProgramMember2024-11-30

0000007623artw:AgriculturalProductsFloorplanProgramMember2023-11-30

utr:Y

0000007623srt:MinimumMember2024-11-30

0000007623srt:MaximumMember2024-11-30

utr:M

0000007623us-gaap:ProductMember2023-12-012024-11-30

0000007623us-gaap:ProductMember2022-12-012023-11-30

0000007623artw:FarmEquipmentMemberartw:AgriculturalProductsMember2023-12-012024-11-30

0000007623artw:FarmEquipmentMemberartw:ModularBuildingsMember2023-12-012024-11-30

0000007623artw:FarmEquipmentMember2023-12-012024-11-30

0000007623artw:FarmEquipmentServicePartsMemberartw:AgriculturalProductsMember2023-12-012024-11-30

0000007623artw:FarmEquipmentServicePartsMemberartw:ModularBuildingsMember2023-12-012024-11-30

0000007623artw:FarmEquipmentServicePartsMember2023-12-012024-11-30

0000007623artw:ModularBuildingsMemberartw:AgriculturalProductsMember2023-12-012024-11-30

0000007623artw:ModularBuildingsMemberartw:ModularBuildingsMember2023-12-012024-11-30

0000007623artw:ModularBuildingsMember2023-12-012024-11-30

0000007623artw:ModularBuildingsLeaseIncomeMemberartw:AgriculturalProductsMember2023-12-012024-11-30

0000007623artw:ModularBuildingsLeaseIncomeMemberartw:ModularBuildingsMember2023-12-012024-11-30

0000007623artw:ModularBuildingsLeaseIncomeMember2023-12-012024-11-30

0000007623us-gaap:ProductAndServiceOtherMemberartw:AgriculturalProductsMember2023-12-012024-11-30

0000007623us-gaap:ProductAndServiceOtherMemberartw:ModularBuildingsMember2023-12-012024-11-30

0000007623us-gaap:ProductAndServiceOtherMember2023-12-012024-11-30

0000007623artw:AgriculturalProductsMember2023-12-012024-11-30

0000007623artw:ModularBuildingsMember2023-12-012024-11-30

0000007623artw:FarmEquipmentMemberartw:AgriculturalProductsMember2022-12-012023-11-30

0000007623artw:FarmEquipmentMemberartw:ModularBuildingsMember2022-12-012023-11-30

0000007623artw:FarmEquipmentMember2022-12-012023-11-30

0000007623artw:FarmEquipmentServicePartsMemberartw:AgriculturalProductsMember2022-12-012023-11-30

0000007623artw:FarmEquipmentServicePartsMemberartw:ModularBuildingsMember2022-12-012023-11-30

0000007623artw:FarmEquipmentServicePartsMember2022-12-012023-11-30

0000007623artw:ModularBuildingsMemberartw:AgriculturalProductsMember2022-12-012023-11-30

0000007623artw:ModularBuildingsMemberartw:ModularBuildingsMember2022-12-012023-11-30

0000007623artw:ModularBuildingsMember2022-12-012023-11-30

0000007623artw:ModularBuildingsLeaseIncomeMemberartw:AgriculturalProductsMember2022-12-012023-11-30

0000007623artw:ModularBuildingsLeaseIncomeMemberartw:ModularBuildingsMember2022-12-012023-11-30

0000007623artw:ModularBuildingsLeaseIncomeMember2022-12-012023-11-30

0000007623us-gaap:ProductAndServiceOtherMemberartw:AgriculturalProductsMember2022-12-012023-11-30

0000007623us-gaap:ProductAndServiceOtherMemberartw:ModularBuildingsMember2022-12-012023-11-30

0000007623us-gaap:ProductAndServiceOtherMember2022-12-012023-11-30

0000007623artw:AgriculturalProductsMember2022-12-012023-11-30

0000007623artw:ModularBuildingsMember2022-12-012023-11-30

00000076232022-12-01

0000007623us-gaap:OtherCurrentAssetsMemberartw:InternalUseSoftwareMember2024-11-30

0000007623us-gaap:OtherCurrentAssetsMemberartw:InternalUseSoftwareMember2023-11-30

0000007623artw:InternalUseSoftwareMemberus-gaap:OperatingExpenseMemberartw:NoncapitalizedImplementationCostsMember2023-12-012024-11-30

0000007623artw:InternalUseSoftwareMemberus-gaap:OperatingExpenseMemberartw:NoncapitalizedImplementationCostsMember2022-12-012023-11-30

0000007623us-gaap:SegmentDiscontinuedOperationsMemberartw:ToolsMember2024-10-31

0000007623us-gaap:SegmentDiscontinuedOperationsMemberartw:ToolsMember2024-10-012024-10-31

0000007623us-gaap:SegmentDiscontinuedOperationsMember2023-11-30

0000007623us-gaap:SegmentDiscontinuedOperationsMember2023-12-012024-11-30

0000007623us-gaap:SegmentDiscontinuedOperationsMember2022-12-012023-11-30

0000007623us-gaap:SegmentDiscontinuedOperationsMemberartw:ToolsMember2023-12-012024-11-30

0000007623us-gaap:SegmentDiscontinuedOperationsMemberartw:ToolsMember2022-12-012023-11-30

0000007623us-gaap:SegmentDiscontinuedOperationsMemberartw:ToolsMember2024-11-30

0000007623us-gaap:SegmentDiscontinuedOperationsMemberartw:ToolsMember2023-11-30

0000007623us-gaap:LandMember2024-11-30

0000007623us-gaap:LandMember2023-11-30

0000007623us-gaap:BuildingAndBuildingImprovementsMember2024-11-30

0000007623us-gaap:BuildingAndBuildingImprovementsMember2023-11-30

0000007623us-gaap:ConstructionInProgressMember2024-11-30

0000007623us-gaap:ConstructionInProgressMember2023-11-30

0000007623us-gaap:MachineryAndEquipmentMember2024-11-30

0000007623us-gaap:MachineryAndEquipmentMember2023-11-30

0000007623us-gaap:VehiclesMember2024-11-30

0000007623us-gaap:VehiclesMember2023-11-30

0000007623us-gaap:FurnitureAndFixturesMember2024-11-30

0000007623us-gaap:FurnitureAndFixturesMember2023-11-30

0000007623artw:ModularBuildingsMember2024-11-30

0000007623artw:ModularBuildingsMember2023-11-30

0000007623artw:LeasedBuildingsMemberartw:ModularBuildingsMember2024-11-30

0000007623artw:ModularBuildingsMember2022-12-012023-11-30

0000007623us-gaap:RevolvingCreditFacilityMemberartw:BankMidwestMember2024-11-30

0000007623artw:BankMidwestMember2024-11-30

0000007623us-gaap:RevolvingCreditFacilityMemberartw:BankMidwestMember2023-12-012024-11-30

0000007623artw:TermLoanDueOctober2037Memberartw:BankMidwestMember2024-11-30

0000007623artw:TermLoanDueOctober2037Memberartw:BankMidwestMember2024-11-30

0000007623artw:TermLoanDueOctober2037Memberartw:BankMidwestMember2023-12-012024-11-30

0000007623artw:UnitedStatesDepartmentOfAgricultureMemberartw:TermLoanDueOctober2037Memberartw:BankMidwestMember2023-12-012024-11-30

0000007623artw:JWardMcconnellJrMemberartw:TermLoanDueOctober2037Memberartw:BankMidwestMember2023-12-012024-11-30

0000007623artw:TermLoanDueOctober2037Memberartw:BankMidwestMember2024-10-232024-10-23

0000007623artw:RoofTermLoanMemberartw:BankMidwestMember2022-05-17

0000007623artw:RoofTermLoanMemberartw:BankMidwestMember2024-10-232024-10-23

0000007623artw:BankMidwestMember2017-09-282017-09-28

0000007623artw:BankMidwestMembersrt:MinimumMember2017-09-282017-09-28

0000007623artw:BankMidwestMember2023-12-012024-11-30

0000007623artw:EIDLAssistanceProgramLoanOneMember2020-06-182020-06-18

0000007623artw:EIDLAssistanceProgramLoanThreeMember2020-06-242020-06-24

0000007623artw:EconomicInjuryDistasterLoanAssistanceProgramMember2020-06-24

0000007623artw:EIDLAssistanceProgramLoanTwoMember2020-06-242020-06-24

0000007623artw:EconomicInjuryDistasterLoanAssistanceProgramMember2020-06-242020-06-24

0000007623artw:TermLoanDueOctober2037Member2023-12-012024-11-30

0000007623artw:TermLoanDueOctober2037Member2022-12-012023-11-30

0000007623artw:TermLoanDueOctober2037Member2024-11-30

0000007623artw:TermLoanDueOctober2037Member2023-11-30

0000007623artw:BankMidwestLoan2Member2023-12-012024-11-30

0000007623artw:BankMidwestLoan2Member2022-12-012023-11-30

0000007623artw:BankMidwestLoan2Member2024-11-30

0000007623artw:BankMidwestLoan2Member2023-11-30

0000007623artw:SBALoanOneMember2023-12-012024-11-30

0000007623artw:SBALoanOneMember2022-12-012023-11-30

0000007623artw:SBALoanOneMember2024-11-30

0000007623artw:SBALoanOneMember2023-11-30

0000007623artw:SBALoanTwoMember2023-12-012024-11-30

0000007623artw:SBALoanTwoMember2022-12-012023-11-30

0000007623artw:SBALoanTwoMember2024-11-30

0000007623artw:SBALoanTwoMember2023-11-30

0000007623artw:SBALoanThreeMember2023-12-012024-11-30

0000007623artw:SBALoanThreeMember2022-12-012023-11-30

0000007623artw:SBALoanThreeMember2024-11-30

0000007623artw:SBALoanThreeMember2023-11-30

0000007623us-gaap:RelatedPartyMember2023-12-012024-11-30

0000007623us-gaap:RelatedPartyMember2022-12-012023-11-30

0000007623us-gaap:RelatedPartyMember2024-11-30

0000007623us-gaap:RelatedPartyMember2023-11-30

0000007623artw:The2020PlanMember2020-02-252020-02-25

0000007623artw:The2011PlanMember2020-02-25

0000007623artw:NonQualifiedStockUnitsToNonEmployeeDirectorsAnnuallyOrUponElectionMember2020-02-25

0000007623artw:NonqualifiedStockUnitsToNonemployeeDirectorsQuarterlyMember2020-02-252020-02-25

0000007623srt:DirectorMemberartw:VestingImmediatelyMember2023-12-012024-11-30

0000007623srt:DirectorMemberartw:VestingImmediatelyMember2022-12-012023-11-30

0000007623artw:EmployeesDirectorsAndConsultantsMemberartw:AwardsWithThreeyearVestingMember2023-12-012024-11-30

0000007623artw:EmployeesDirectorsAndConsultantsMemberartw:AwardsWithThreeyearVestingMember2022-12-012023-11-30

00000076232024-09-012024-11-30

0000007623us-gaap:OperatingSegmentsMemberartw:AgriculturalProductsMember2023-12-012024-11-30

0000007623us-gaap:OperatingSegmentsMemberartw:ModularBuildingsMember2023-12-012024-11-30

0000007623us-gaap:OperatingSegmentsMember2023-12-012024-11-30

0000007623us-gaap:OperatingSegmentsMemberartw:AgriculturalProductsMember2024-11-30

0000007623us-gaap:OperatingSegmentsMemberartw:ModularBuildingsMember2024-11-30

0000007623us-gaap:OperatingSegmentsMember2024-11-30

0000007623us-gaap:OperatingSegmentsMemberartw:AgriculturalProductsMember2022-12-012023-11-30

0000007623us-gaap:OperatingSegmentsMemberartw:ModularBuildingsMember2022-12-012023-11-30

0000007623us-gaap:OperatingSegmentsMember2022-12-012023-11-30

0000007623us-gaap:OperatingSegmentsMemberartw:AgriculturalProductsMember2023-11-30

0000007623us-gaap:OperatingSegmentsMemberartw:ModularBuildingsMember2023-11-30

0000007623us-gaap:OperatingSegmentsMember2023-11-30

0000007623us-gaap:OperatingSegmentsMemberartw:ToolsMember2023-11-30

FORM 10-K

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended November 30, 2024

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to ____________

Commission file number 000-5131

ART’S-WAY MANUFACTURING CO., INC.

(Exact name of registrant as specified in its charter)

| Delaware | | 42-0920725 |

| (State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer Identification No.) |

P.O. Box 288

5556 Highway 9

Armstrong, Iowa 50514

(Address of principal executive offices, including zip code)

(712) 864-3131

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

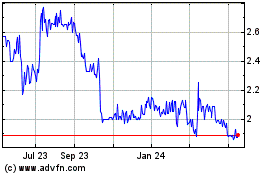

| Common stock $.01 par value | ARTW | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☒ | Smaller reporting company ☒ |

| | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicated by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

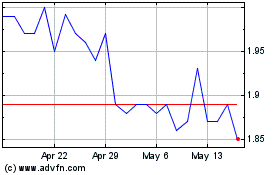

The aggregate market value of the voting and non-voting common equity held by non-affiliates as of the last business day of the registrant’s most recently completed second fiscal quarter, based on the closing sale price on May 31, 2024 as reported on the Nasdaq Stock Market LLC ($1.74 per share), was approximately $4,154,977.

As of February 4, 2025 there were 5,082,459 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement for the registrant’s 2025 Annual Meeting of Stockholders to be filed within 120 days of November 30, 2024 are incorporated by reference into Part III of this Annual Report on Form 10-K.

Art’s-Way Manufacturing Co., Inc.

Index to Annual Report on Form 10-K

FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K (this “report”) may contain forward-looking statements that reflect future events, future business, industry and other conditions, our future performance, and our plans and expectations for future operations and actions. In some cases forward-looking statements may be identified by the use of words such as “may,” “should,” “anticipate,” “believe,” “expect,” “plan,” “future,” “intend,” “could,” “estimate,” “predict,” “hope,” “potential,” “continue", "foresee,"” or the negative of these terms or other similar expressions. Forward-looking statements in this report generally relate to: our business condition and results of operations; our expectations regarding our warranty costs and order backlog; our beliefs regarding the sufficiency of working capital and cash flows; our expectations regarding our continued ability to renew or obtain financing on reasonable terms when necessary as well as our continued positive relationship with our creditors and lenders; the impact of recently issued accounting pronouncements; our intentions and beliefs relating to our costs, product developments and business strategies; our expectations concerning our continued expansion into international markets; our expectations with respect to government spending and programs that may directly or indirectly be used to purchase our products; our beliefs concerning our ability to attract and maintain an adequate workforce in a competitive labor market; our expected operating and financial results; our expectations on expense savings due to recent layoffs, strategic terminations, and our early retirement program; our beliefs concerning the effects of, and costs of compliance with government regulations; our expectations concerning our primary capital and cash flow needs; our expectations of, and the timing for, receipt of any proceeds from our Employee Retention Credit ("ERC"); our beliefs regarding competitive factors and our competitive strengths; our expectations regarding our capabilities and demand for our products; our predictions regarding the impact of seasonality; our beliefs regarding the impact of the farming industry on our business; our beliefs regarding our internal controls over financial reporting; and our intentions for paying dividends. Many of these forward-looking statements are located in this report under “Item 1. BUSINESS” and “Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS,” but they may appear in other sections as well.

You should read this report thoroughly with the understanding that our actual results may differ materially from those set forth in the forward-looking statements for many reasons, including events beyond our control and assumptions that prove to be inaccurate or unfounded. We cannot provide any assurance with respect to our future performance or results. Our actual results or actions could and likely will differ materially from those anticipated in the forward-looking statements for many reasons, including, but not limited to, the impact of changes in credit markets on our ability to continue to obtain financing on reasonable terms; our ability to repay current debt, continue to meet debt obligations and comply with financial covenants; obstacles related to liquidation of product lines; the effect of inflation, interest rate fluctuations and general economic conditions, including consumer and governmental spending, on the demand for our products and the cost of our supplies and materials; fluctuations in seasonal demand and our production cycle; the ability of our suppliers to meet our demands for raw materials and component parts; our original equipment manufacturer customers’ decisions regarding supply chain structure, inventory levels, and overall business conditions; fluctuations in the price of raw materials, especially steel; our ability to predict and meet the demands of each market in which our segments operate; a decrease in demand for our products in international markets; the existence and outcome of product liability claims and other ordinary course litigation; changes in environmental, health and safety regulations and employment laws; our ability to fill open positions within the Company and retain our key employees; the cost of complying with laws, regulations, and standards relating to corporate governance and public disclosure, and the demand such compliance places on management’s time; and other factors described in this report and from time to time in our other reports filed with the Securities and Exchange Commission. We do not intend to update the forward-looking statements contained in this report other than as required by law. We caution investors not to put undue reliance on any forward-looking statements, which speak only as of the date of this report. This report and the documents that we reference in this report and have filed as exhibits should be read completely and with the understanding that our actual future results may be materially different from what we currently expect. We qualify all of our forward-looking statements by these cautionary statements.

PART I

Item 1. BUSINESS.

General

Art’s-Way Manufacturing Co., Inc., a Delaware corporation (“we,” “us,” “our,” and the “Company”), began operations as a farm equipment manufacturer in 1956. Since that time, we have become a worldwide manufacturer of agricultural equipment and specialized modular science and agricultural buildings. Our principal manufacturing plant and corporate headquarters is located in Armstrong, Iowa.

We have organized our business into two operating segments. Management separately evaluates the financial results of each segment because each is a strategic business unit offering different products and requiring different technology and marketing strategies. Our Agricultural Products segment manufactures and distributes farm equipment under the Art’s-Way name. Our Modular Buildings segment manufactures modular buildings for various uses, commonly animal containment and research laboratories, through our wholly owned subsidiary, Art’s-Way Scientific, Inc., an Iowa corporation. During the third quarter of fiscal 2023, the Company ceased operations of its Tools business, which was reported in discontinued operations for the twelve months ended November 30, 2023. The remaining components of the Tools segment were prior to the twelve months ended November 30, 2024. For detailed financial information relating to segment reporting, see Note 18 “Segment Information” to our financial statements in “Item 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA” of this report.

Corporate information about Art’s-Way can be found on our website, http://www.artsway-mfg.com/, while information on our agriculture products can be found on http://www.artsway.com/. The information contained on our website or available by hyperlink from our website is not a part of this report and is not incorporated into this report or any other documents we file with, or furnish to, the Securities and Exchange Commission (the "SEC").

We are subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Exchange Act requires us to file periodic reports, proxy statements and other information with the “SEC”. The SEC maintains a website that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. These materials may be obtained electronically by accessing the SEC’s website at http://www.sec.gov.

Business of Our Segments

Agricultural Products

Our Agricultural Products segment, which accounted for 59.9% of our net revenue in the 2024 fiscal year and 74.2% of our net revenue in the 2023 fiscal year, is located primarily in Armstrong, Iowa. This segment manufactures a variety of specialized farm machinery under our own label, including portable and stationary animal feed processing equipment and related attachments used to mill and mix feed grains into custom animal feed rations; a line of forage equipment consisting of forage boxes, bale processors, running gear, and dump boxes; a line of manure spreaders; sugar beet harvesting equipment; and a line of dirt work equipment. We sell our labeled products through independent farm equipment dealers throughout the United States, Australia, Canada, Japan and the United Kingdom. We also provide after-market service parts that are available to keep our branded equipment operating to the satisfaction of the end user of our products.

Modular Buildings

Our Modular Buildings segment, which accounted for 40.1% of our net revenue in the 2024 fiscal year and 25.8% of our net revenue in the 2023 fiscal year, is located in Monona, Iowa. This segment produces, sells and leases modular buildings, which are custom-designed to meet the specific research needs of our customers. The buildings we commonly produce range from basic swine buildings to complex containment research laboratories. Our focus is providing research facilities for academic research institutions, government research and diagnostic centers, public health institutions and private research and pharmaceutical companies, as those are our primary market sectors. We provide services from start to finish by designing, manufacturing, delivering and installing these facilities to meet customers’ critical requirements. In addition to selling these facilities, we also offer a lease option to customers in need of temporary facilities.

Our Principal Agricultural Products

Arthur Luscombe built the first power take-off powered grinder mixer on his farm near Dolliver, Iowa. The product’s ability to tackle even the most demanding workload made it an overwhelming success – and secured Luscombe’s reputation as a farmer, entrepreneur and independent thinker who did things his way. Over the years our Agricultural Products segment has grown through developing several new products and with acquisitions. We take pride in our manure spreaders, forage equipment, bale processors, dirt work equipment, sugar beet harvesting equipment and feed mills. We provide limited original equipment manufacturer, or OEM, parts to some of the industry’s leading manufacturers.

Feed mills. There’s no one better than Art’s Way when it comes to processing feed. Stationary mills for livestock feeding or breweries, portable units for small operations and large grinder mixers for the modern feeding operation have our customers’ backs day in and day out. Hammer mills provide faster processing and easily changing micron size or roller mills offer more consistency. We offer the most complete lineup of equipment in feed processing.

Manure spreaders. The X Series spreaders have a unique vertical beater placement combined with guillotine slop gate controls to create the best spread pattern in the industry. Flared sides and densilite flooring provide easy loading and material movement. Backed by our limited lifetime warranty on the apron chain, customers can depend on this rugged machine. The upgraded rate control option powered by Raven is the only unit in the industry to have completely automatic spreading capabilities with apron speed and slop gate control.

Forage. The 2100 series are user-friendly forage boxes in different lengths and unload configurations. It is the only box in its class to offer 100% in-cab controls. Tube side stakes and corrugated sides give users confidence when side-by-side with competitor models. The 9016-HD High Dump cart boasts the largest capacity in the industry at 40,000 pounds.

Bale processors. Spread large round or square bales in the same machine attached to a skid steer, telehandler, or tractor with the patented TOP-SPREAD loader mounted spreader. The compact size fits into barns and alleyways and is easy to maneuver. On a construction site, cover roadsides or fresh seeding quickly from the seat of a skid steer.

Dirt work equipment. Level out and shape fields with the single blade or folding land planes featuring our patented floating hitch design. Reduce erosion by eliminating water pockets, furrows, and implement scars in the field. Shape yards or work sites with standard or rear steer graders that follow closely behind the tractor for leveling in smaller spaces.

Sugar beet harvesting equipment. We are proud to offer the best sugar beet cleaning in the industry during muddy harvest conditions with our patented grab roll bed. Our 12-row harvester has been improved with an automatic leveling system add-on for consistent digging across the field. The defoliator cleanly removes the leaves off the beets prior to digging them up for harvest. The leaves are incorporated back into the soil to provide nutrients for next year’s crop.

Product Distribution and Markets

We distribute goods for our Agricultural Products segment primarily through a network of approximately 500 U.S. and Canadian independent dealers, as well as overseas dealers in Australia, Japan and the United Kingdom, whose customers require specialized agricultural machinery. We have sales representation in 48 states and seven Canadian provinces. Our dealers sell our products to various agricultural and commercial customers. We also maintain a local sales force in our Armstrong, Iowa facility to provide oversight services for our distribution network, communicate with end users, and recruit and train dealers on the uses of our products. Our local service parts staff is available to help customers and dealers with their service parts needs. Our Modular Buildings segment typically sells products customized to the end-users' requirements directly to the end-user.

We currently export products to nine foreign countries. We have been shipping grinder mixers abroad since 2006 and have exported portable rollermills as well. We continue to strengthen these relationships and intend to develop new international markets. Our international sales accounted for 3.3% of consolidated sales during the 2024 fiscal year compared to 3.1% in the 2023 fiscal year.

Backlog. The Company’s backlog of orders varies on a daily basis. The Company’s Agricultural Products segment had a net backlog of approximately $3,486,000 as of February 4, 2025 compared to $4,364,000 on February 4, 2024. The overall agriculture economy remained stagnant for our fall early order program after three years of increased demand. High interest rates and low commodity prices are still affecting demand as we roll into fiscal 2025, however, we have seen better than expected demand for our grinder mixers. The Company’s Modular Buildings segment had approximately $2,393,000 of backlog as of February 4, 2025, compared to $6,170,000 on that date in 2024. The Modular Buildings segment has strong leads in the engineering phase that we expect to go under contract and become part of our project backlog, which could drive similar revenue results to fiscal 2024. The Company expects that its order backlogs will continue to fluctuate as orders are received, filled, or canceled, and, due to dealer discount arrangements it may enter into from time to time. Accordingly, these figures are not necessarily indicative of future revenue.

Recent Product Developments

In 2024, we focused on cost reductions to improve pricing competitiveness of our manure spreader product line and to boost margin of our highest demanded grinder mixer products. We finished the development of a chicken litter variation for our manure spreaders and a sonar leveling system for our defoliators. We expect continued focus on increasing margins on our current product lines and new developments that make our products more useful for our customers.

Our Modular Buildings segment completed projects based on customer specifications and did not engage in specific product development during the 2024 fiscal year.

Competition

Each of our segments have competitive strengths described below. In addition to individual competitive strengths, the barrier to entry for competitors in our industries is high.

Agricultural Products

Our Agricultural Products segment competes in a highly competitive agricultural equipment industry. We compete with larger manufacturers and suppliers that have broader product offerings and significant resources at their disposal; however, we believe that our competitive strengths allow us to compete effectively in our market.

Management believes that grain and livestock producers, as well as those who provide services to grain and livestock operations, are the primary purchasers of agricultural equipment. Many factors influence a buyer’s choice for agricultural equipment. Any one or all factors may be determinative, but they include brand loyalty, the relationship with dealers, product quality and performance, product innovation, product availability, parts and warranty programs, price, and customer service.

While our larger competitors may have resources greater than ours, we believe we compete effectively in the farm equipment industry by serving smaller markets in specific product areas rather than directly competing with larger competitors across an extensive range of products. Our Agricultural Products segment caters to niche markets in the agricultural industry. We do not have a direct competitor that has the same product offerings that we do. Instead, each of our product lines competes with similar products of many other manufacturers. Some of our product lines face greater competition than others, but we believe that our products are competitively priced with greater diversity than most competitor product lines. Other companies produce feed processing equipment, sugar beet harvesting and defoliating equipment, grinders, and other products similar to ours; therefore, we focus on providing the best product available at a reasonable price. Overall, we believe our products are competitively priced with above average quality and performance, in a market where price, product performance, and quality are principal elements.

In addition, in order to capitalize on brand recognition for our Agricultural Products segment, we have numerous product lines produced under our own label. We also provide aftermarket service parts which are available to keep our branded and OEM-produced equipment operating to the satisfaction of the customer. We sell products to customers in the United States and nine foreign countries through a network of approximately 500 independent dealers in the United States and Canada, as well as overseas dealers in Australia, Japan and the United Kingdom.

We believe that our competitive pricing, product quality and performance, network of worldwide and domestic distributors, and strong market share for many of our products allow us to compete effectively in the agricultural products market.

Modular Buildings

We expect continued competition from our Modular Buildings segment’s existing competitors, which include conventional design/build firms, as well as competition from new entrants into the modular building market. To some extent, we believe barriers to entry in the modular building industry limit the competition we face in the industry. Barriers to entry in the market consist primarily of access to capital, access to a qualified labor pool, and the bidding process that accompanies many jobs in the health and education markets. Despite these barriers, manufacturers who have a skilled work force and adequate production facilities could adapt their manufacturing facilities to produce modular structures.

We believe the competitive strength of our Modular Buildings segment is our ability to design and produce high-tech modular buildings more quickly than conventional design/build firms. Conventional design/build construction may take two to five years, while our modular laboratories can be delivered in as little as six months. As one of the few companies in the industry to supply turnkey modular buildings and laboratories, we believe we provide high-quality buildings at reasonable prices that meet our customers’ time, flexibility, and security expectations.

Raw Materials, Principal Suppliers, and Customers

Raw materials for our various segments are acquired from domestic and foreign sources and normally are readily available. We rely on foreign suppliers and foreign markets for materials and components for some of our products. However, these suppliers are not principal suppliers, and there are alternative sources for these materials.

We do not typically rely on sales to one customer or a small group of customers. During the 2024 fiscal year, one customer accounted for just more than 17% consolidated net revenues from continuing operations and another approximately 15% of consolidated revenues.

Intellectual Property

We maintain manufacturing rights on several products, which cover unique aspects of design. We also have trademarks covering product identification. We believe our trademarks and licenses help us to retain existing business and secure new relationships with customers. The duration of these rights ranges from 5 to 10 years, with options for renewal. We currently have no pending applications for intellectual property rights.

We have a licensing and royalty agreement with Spreader, LLC to produce a loader mounted spreader in exchange for royalty payments until December 2026.

Government Relationships and Regulations; Environmental Compliance

Our Modular Buildings segment must design, manufacture, and install its modular buildings in accordance with state building codes, and we have been able to achieve the code standards in all instances. In addition, we are subject to various federal, state, and local laws and regulations pertaining to environmental protection and the discharge of materials into the environment. We do not expect that the cost of complying with these regulations will have a material impact on our consolidated results of operations, financial position, or cash flows.

Employees

As of November 30, 2024, we employed 68 employees in our Agricultural Products segment including one on a part-time basis, and 22 employees in our Modular Buildings segment, two on a part-time basis. These numbers do not necessarily represent peak employment during the 2024 fiscal year.

Item 1A. RISK FACTORS.

As a smaller reporting company, we are not required to provide disclosure pursuant to this Item.

Item 1B. UNRESOLVED STAFF COMMENTS.

As a smaller reporting company, we are not required to provide disclosure pursuant to this Item.

Item 1C. CYBERSECURITY.

We have a multi-layered approach to assess, identify and manage material risks from cybersecurity threats. This approach includes a wide variety of mechanisms, controls, technologies, methods, systems, and other processes that are designed to prevent, detect, or mitigate data loss, theft, misuse, unauthorized access, or other cybersecurity incidents or vulnerabilities affecting the data.

The data includes confidential, proprietary, and business and personal information that we collect, process, store, and transmit as part of our business, including on behalf of third parties. We also use systems and processes designed to reduce the impact of a cybersecurity incident at a third-party vendor or customer. Additionally, we use processes to oversee and identify material risks from cybersecurity threats associated with our use of third-party technology and systems, including technology and systems we use for encryption and authentication; employee email; content delivery to customers; back-office support; and other functions.

As part of our risk management process, we conduct regular application security assessments to identify vulnerabilities within our IT infrastructure. These assessments include both automated scans and manual reviews by our cybersecurity team. Threat intelligence feeds and security reports are continuously monitored, with the goal of staying ahead of emerging threats. In the event of a cybersecurity incident, we maintain incident response plans that are utilized when incidents are detected. We require employees with access to information systems, including all corporate employees, to undertake data protection and cybersecurity training and compliance programs annually along with random internal phishing campaigns.

We are led by our Director of IT, who is responsible for implementing and maintaining centralized cybersecurity and data protection practices in close coordination with our senior leadership team. We also engage assessors, consultants, or other third parties to assist with assessing, identifying, and managing cybersecurity risks. Our cybersecurity risks and associated mitigations are evaluated by senior leadership and routinely by our Board of Directors.

Our Director of IT, who has extensive cybersecurity knowledge and skills gained from over 10 years of work experience in various information technology roles, heads the team responsible for implementing and maintaining cybersecurity and data protection practices and reports directly to the Chief Financial Officer.

As of the date of this report, we have not encountered any risks from cybersecurity threats that have materially affected or are reasonably likely to materially affect the Company, including its business strategy, results of operations, or financial condition. Cybersecurity threats are continually evolving, and no assurances can be given that our risk management systems and processes will fully mitigate all cybersecurity threats and risks.

Item 2. PROPERTIES.

Our executive offices, as well as the primary production and warehousing facilities for our Agricultural Products segment, are located in Armstrong, Iowa. These facilities were constructed after 1965 and remain in fair condition. The facilities in Armstrong contain approximately 249,000 square feet of usable space. We have engaged in several building improvement projects during the last several years including most recently updating our office spaces and employee break room in 2021, new shop and office boilers and roofing improvements in 2022 and remodeling our production facility bathrooms in fiscal 2023. In addition, we own approximately 30 acres of land west of Armstrong, on which the factory and inventory storage space is situated for our Agricultural Products segment.

Our facility in Monona, Iowa was constructed by us in 2007, and houses the manufacturing for our Modular Buildings segment. The facility was custom-designed to meet our production needs. It has approximately 50,000 square feet of usable space and accommodates a sprinkler system and crane. We own a second building to the east with approximately 12,000 square feet of space, which is used as our weld shop for building frames.

All of our owned real property is subject to mortgages granted to Bank Midwest as security for our long-term debt and our line of credit. See “Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS – Liquidity and Capital Resources” for more information.

Item 3. LEGAL PROCEEDINGS.

From time to time in the ordinary course of business, we may be named as a defendant in legal proceedings incidental to the business, including without limitation, workers’ compensation claims, tort claims, or contractual disputes. We are not currently involved in any material legal proceedings, directly or indirectly, and we are not aware of any claims pending or threatened against us or any of the directors that could result in the commencement of material legal proceedings.

Item 4. MINE SAFETY DISCLOSURES.

Not applicable.

PART II

Item 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.’

Market Information

Our common stock trades on the Nasdaq Stock Market LLC under the symbol “ARTW.”

Stockholders

We have two classes of stock, undesignated preferred stock and $0.01 par value common stock. No shares of preferred stock have been issued or are outstanding. As of January 16, 2025 we had 70 common stock stockholders of record, which number does not include stockholders who hold our common stock in street name.

Dividends

We did not pay a dividend during the 2024 or 2023 fiscal years. We expect that the payment of and the amount of any future dividends will depend on our financial condition at that time.

Unregistered Sales of Equity Securities

None.

Purchases of Equity Securities by the Company

There were no purchases of common stock by the Company made in the fourth quarter of fiscal 2024.

Equity Compensation Plans

For information on our equity compensation plans, refer to Item 12, “SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS.”

Item 6. {RESERVED}

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

The following discussion, which focuses on our results of operations, contains forward-looking information and statements. Actual events or results may differ materially from those indicated or anticipated, as discussed in the section entitled “Forward Looking Statements.” The following discussion of our financial condition and results of operations should also be read in conjunction with our financial statements and notes to financial statements contained in “Item 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA” of this report.

Financial Condition

Our Agricultural Products segment saw a 34.7% decline in revenue in fiscal 2024 due to suppressed commodity prices, high borrowing rates and saturated inventory levels. Our Modular Buildings segment increased revenues by 25.9% and recorded strong profitability. Our consolidated revenues from continued operations decreased 19.1% year on year, and we had $461,000 of operating income from continuing operations for the fiscal year ended November 30, 2024.

We finished the year ended November 30, 2024 with approximately $94,000 of consolidated net loss from continued operations, $307,000 of net income and saw our working capital increase by approximately $802,000.

We expect to have access to capital as needed throughout fiscal 2025 from the collection of receivables, sale of inventory and the expected receipt of approximately $1.2 million of gross proceeds from a filed Employee Retention Credit or ERC. Due to the timing of filing an ERC claim after the IRS announced a moratorium on processing applications, and uncertainty surrounding the nature and timing of the claim approval and subsequent payment process, recognition of the claim is deferred until payment is received. Accordingly, the claim has not been recorded in receivables, assets, or income. On November 30, 2024 we had $3,571,563 available on our line of credit and $930,036 of excess collateral towards our borrowing base. Our working capital remained strong at approximately $6,492,000 in fiscal 2024 with a current ratio of 1.98. Our banking relationship remains positive, and we expect it to only strengthen as our balance sheet continues to improve through the retirement of debt. We believe that our current cash and financing arrangements will provide sufficient cash to finance operations for the next 12 months. We expect to continue to rely on cash from financing activities to supplement our cash flows from operations in order to meet our liquidity and capital expenditure needs in the near future.

Critical Accounting Policies

Our significant accounting policies are described in Note 1 “Summary of Significant Accounting Policies” to our financial statements in “Item 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA” of this report. Critical accounting policies are those that we believe are both important to the portrayal of our financial condition and results of operations and require our most difficult, subjective or complex judgments, often as a result of the need to make estimates about the effect of matters that are inherently uncertain.

We believe that the following represents the most critical accounting policies and estimates used in the preparation of our consolidated financial statements.

Inventories

Inventories are stated at the lower of cost or net realizable value, and cost is determined using the standard costing method, which approximates costs determined on the first-in, first-out basis. Management monitors the carrying value of inventories using inventory control and review processes that include, but are not limited to, sales forecast review, inventory status reports, and inventory reduction programs. We record inventory write downs to net realizable value based on expected usage information for raw materials and historical selling trends for finished goods. If the assumptions made by management do not occur, we may need to record additional write downs.

Revenue Recognition

In accordance with Accounting Standards Codification, or ASC, 606, revenue is measured based on consideration specified in a contract with a customer and recognized when we satisfy the performance obligation specified in each contract.

Our revenues primarily result from contracts with customers. The major sources of revenue for the Agricultural Products segment are farm equipment and service parts related to farm equipment. The Agricultural Products segment generally executes short-term contracts that contain a single performance obligation – the delivery of product to the common carrier. We recognize revenue for the production and sale of farm equipment and service parts upon shipment of the goods. Shipment of the goods is the point in time when risk of ownership and title pass to the customer. All sales are made to authorized dealers whose application for dealer status has been approved and who have been informed of general sales policies. Any changes in our terms are documented in the most recently published price lists. Pricing is fixed and determinable according to our published equipment and parts price lists. Title to all equipment and parts sold pass to the customer upon delivery to the carrier and is not subject to a customer acceptance provision. Proof of the passing of title is documented by the signing of the delivery receipt by a representative of the carrier. Post shipment obligations are limited to any claim with respect to the condition of the equipment or parts. The Agricultural Products segments typically require payment in full 30 days after the ship date. To take advantage of program discounts, some customers pay deposits up front. Any deposits received are considered unearned revenue and increase contract liabilities.

In certain circumstances, upon the customer’s written request, we may recognize revenue when production is complete, and the goods are ready for shipment. At the customer’s request, we will bill the customer upon completing all performance obligations, but before shipment. The customer dictates that we ship the goods per its direction from our manufacturing facility, as is customary with this type of agreement, in order to minimize shipping costs. The written agreement with the customer specifies that the goods will be delivered on a schedule to be determined by the customer, with a final specified delivery date, and that we will segregate the goods from our inventory, such that they are not available to fill other orders. This agreement also specifies that the customer is required to purchase all goods manufactured under this agreement. Title of the goods will pass to the customer when the goods are complete and ready for shipment, per the customer agreement. At the transfer of title, all risks of ownership have passed to the customer, and the customer agrees to maintain insurance on the manufactured items that have not yet been shipped. We have operated using bill and hold agreements with certain customers for many years, with consistent satisfactory results for both the customers and us. The credit terms on this agreement are consistent with the credit terms on other sales. All risks of loss are shouldered by the customer, and there are no exceptions to the customer’s commitment to accept and pay for these manufactured goods. Revenues recognized when goods were ready for shipment in fiscal 2024 were approximately $1,073,000 compared to $3,110,000 in fiscal 2023.

The Modular Buildings segment is in the construction industry with its major source of revenue arising from modular building sales. Sales of modular buildings are generally recognized using input methods to measure progress towards the satisfaction of a performance obligation using the percentage of completion method. Revenue and gross profit are recognized as work is performed based on the relationship between actual costs incurred and total estimated costs at completion. Contract costs consist of direct costs on contracts, including labor, materials, and amounts payable to subcontractors and those indirect costs related to contract performance, such as equipment costs, insurance and employee benefits. Contract cost is recorded as incurred, and revisions in contract revenues and cost estimates are reflected in the accounting period when known. Provisions for estimated losses on uncompleted contracts are made in the period in which such losses are determined. Contract losses are recognized when current estimates of total contract revenue and contract cost indicate a loss. Estimated contract costs include any and all costs appropriately allocable to the contract. The provision for these contract losses will be the excess of estimated contract costs over estimated contract revenues. Changes in job performance, job conditions and estimated profitability, including those changes arising from contract change orders, penalty provisions and final contract settlements may result in revisions to costs and income and are recognized in the period in which the revisions are determined. We use significant judgements in determining estimated contract costs and completion percentages throughout the life of the project. Stock modular building sales also occur and are recognized at a point in time when the performance obligation is fulfilled through substantial completion. Substantial completion is achieved through customer acceptance of the completed building. The Modular Buildings segment executes contracts with customers that can be short- or long-term in nature. These contracts can have multiple performance obligations and revenue from these can be recognized over time or at a point in time depending on the nature of the contracts. Payment terms for the Modular Buildings segment vary by contract, but typically utilize money down and progress payments throughout the life of the contract. The payment terms of the Modular Buildings segment have the most impact on our contract receivables, contract assets and contract liabilities. Project invoicing from the Modular Buildings segment increases contract receivables and has an effect on contract liabilities through billings in excess of costs, estimated gross profit and customer deposits. The balance of contract assets is typically made up of the balance of costs and estimated gross profit in excess of billings. Costs and profit in excess of amounts billed are classified as current assets and billings in excess of cost and profit are classified as current liabilities.

The Agricultural Products segment offers variable consideration in the form of discounts depending on participation in yearly early order programs. This variable consideration is allocated to the transaction price of all products in a sales arrangement and is not contingent on future outcomes. The Agricultural Products segment does not offer rebates or credits. The Modular Buildings segment does not offer discounts, rebates or credits.

Our returns policy allows for new and saleable parts to be returned, subject to inspection and a restocking charge, which is included in net sales. Whole goods are not returnable. Shipping costs charged to customers are included in net sales. Freight costs incurred are included in cost of goods sold. Customer deposits consist of advance payments from customers, in the form of cash, for revenue to be recognized in the following year.

For information on product warranty as it applies to ASC 606, refer to Note 9 “Product Warranty” contained in our financial statements in “Item 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA” of this report.

Results of Operations

Fiscal Year Ended November 30, 2024 Compared to Fiscal Year Ended November 30, 2023

Our consolidated net sales from continuing operations totaled $24,499,000 for the 2024 fiscal year, which represents a 19.1% decrease from our consolidated net sales of $30,281,000 for the 2023 fiscal year. We increased revenue in our Modular Buildings segment while our Agricultural Products segment was met with difficult market conditions in fiscal 2024. Our consolidated gross profit as a percentage of net sales increased to 29.8% in the 2024 fiscal year compared to 28.3% of net sales in the 2023 fiscal year. Our consolidated operating expenses from continuing operations decreased by 2.9%, from $7,053,000 in the 2023 fiscal year to $6,849,000 in the 2024 fiscal year. The majority of our corporate general and administrative expenses are borne by our Agricultural Products segment, including costs associated with being a public company. The Agricultural Products segment represented $5,665,000 of our total consolidated operating expenses, while our Modular Buildings segment represented $1,184,000.

Our consolidated operating income from continuing operations for the 2024 fiscal year was $461,000 compared to operating income of $1,531,000 for the 2023 fiscal year. Our Agricultural Products segment had an operating loss of $1,510,000, and our Modular Buildings segment had operating income of $1,971,000.

Consolidated net income for the 2024 fiscal year was $307,000 compared to net income of $267,000 in the 2023 fiscal year.

Our effective tax rate for the 2024 and 2023 fiscal years was 30.3% and 29.9%, respectively.

Agricultural Products. Our Agricultural Products segment’s net sales for the 2024 fiscal year were $14,663,000 compared to $22,467,000 during the 2023 fiscal year, a decrease of $7,804,000, or 34.7%. Commodity prices in the agricultural market dropped below five-year averages in fiscal 2024, which lead to a strong decrease in demand for our products. This demand decrease was not isolated to our company, instigating mass layoffs and major production cuts in fiscal 2024 for many in our industry. Another factor in the sales decrease was the amount of inventory on dealer lots at the end of fiscal 2023. Many dealers were oversaturated with inventory related to excess demand in 2023 from high commodity prices and supply chains' inability to keep up. This turned drastically in the first quarter of fiscal 2024, as increasing interest rates and declining commodity prices decreased expected net farm income.

Gross profit percentage in the Agricultural Products segment for the 2024 fiscal year was 28.3% compared to 29.3% for the 2023 fiscal year. We continued to see inflationary pressure in fiscal 2024. Steel prices rose through the summer of fiscal 2024 but leveled off and dropped near the end of the year. We continued to see price increases from insurance groups and other manufacturing expense companies, which lead to an increase in our overhead costs. We attribute these factors and overall sales decrease to the drop in gross profit percentage. We put a focus on cost reductions on two of our highest volume products in fiscal 2024, which we expect to bear fruit in fiscal 2025.

Our Agricultural Products segment’s operating expenses for the 2024 fiscal year were $5,665,000 compared to $5,920,000 for the 2023 fiscal year, a decrease of $255,000, or 4.3%. A large share of the operating expense decrease is related to our selling expenses, most notably, commission expense, for which we saw a decrease of $418,000 due to the large sales decrease and the hiring of an inside salesperson. Some of this decrease was offset with added salary for the inside salesperson and travel expense. Our general and administrative expenses increased approximately $333,000 from fiscal 2023. The increase is due to $186,000 of additional salary expense due to wage increases and from the hiring of a HR manager at the end of fiscal 2023 along with a $48,000 increase in computer contract expense related to an enterprise resource planning or ERP conversion that we completed in August of 2023. We also paid out approximately $201,000 in early retirement benefits to employees in the spring of fiscal 2024 in order to drop our headcount to align with our lessened demand. We estimate the early retirement will save us $263,000 in wages and benefits annually moving forward. In addition to early retirement, we also enacted layoffs and strategic terminations that are expected to cut approximately $750,000 of operating expenses annually. Our engineering expenses decreased approximately $166,000 from fiscal 2023 due to a reduction in headcount in our engineering department. We expect the engineering headcount reduction to be temporary, as we recognize the strategic value in new product development and continued product improvement. Total loss from operations for our Agricultural Products segment during the 2024 fiscal year was $1,510,000 compared to operating income of $664,000 for the 2023 fiscal year. The sudden deterioration of the agricultural markets in fiscal 2024 was the primary driver for the decline in operating income from fiscal 2023. We reacted quickly when we identified adverse market conditions early on in fiscal 2024, and began right-sizing operations and overhead expenses to facilitate better performance in fiscal 2025.

Modular Buildings. Our Modular Buildings segment’s net sales for the 2024 fiscal year were $9,836,000 compared to $7,814,000 for the 2023 fiscal year, an increase of $2,022,000, or 25.9%. While our agricultural products building sales suffered under the same adverse market conditions of our Agricultural Products segment, we saw increased demand in the research markets for our modular products, which led to a 124% increase in research sales. Our Modular Building segment's gross profit percentage for the 2024 fiscal year was 32.1% compared to 25.6% during the 2023 fiscal year. Our project performance in fiscal 2024 exceeded expectations as our workforce was consistently under budget on production disciplines. We are also historically more efficient when our shop is busy and perform better on research projects as we often have more contingency built in than traditional ag modulars. Operating expenses for the 2024 fiscal year were $1,184,000 compared to $1,133,000 for the 2023 fiscal year, an increase of $51,000, or 4.5%. This increase is primarily due to increased bonus payout for excellent fiscal 2024 performance. Total income from operations from our Modular Buildings segment during the 2024 fiscal year was $1,971,000 compared to operating income of $867,000 in the 2023 fiscal year. Our project management team continued to build on fiscal 2023 strides to increase profitability on projects and to provide better service to our customers. This focus translated to some of the best results we have seen in this operating segment and we believe our sales funnel leading into fiscal 2025 can deliver similar performance.

Discontinued Operations. On June 7, 2023 we announced we would be discontinuing our Tools segment with the last day of normal operations occurring on July 14, 2023. Just over a year later, on October 21, 2024, we completed the sale of the remaining real estate associated with our Tools segment for $1,800,000. The assets and liabilities of this segment were gone prior to November 30, 2024 and will no longer report discontinued operations in our current year financials moving forward. Our discontinued operations generated approximately $1,271,000 from operating, investing and financing activities mainly related to closing activities and the sale of real estate. Our Tools segment reported net income of $402,000 for the twelve months ended November 30, 2024 compared to net loss of $496,000 in the same period of fiscal 2023.

Trends and Uncertainties

We are subject to a number of trends and uncertainties that may affect our short-term or long-term liquidity, sales revenues, and operations. Similar to other farm equipment manufacturers, we are affected by items unique to the farm industry, including fluctuations in farm income resulting from changes in commodity prices, crop damage caused by weather and insects, government farm programs, interest rate fluctuations, and other unpredictable variables. Other uncertainties include our OEM customers and the decisions they make regarding their current supply chain structure, inventory levels, and overall business conditions. Management believes that our business is dependent on the farming industry for the bulk of our sales revenues. As such, our business tends to reap the benefits of increases in farm net income, as farmers tend to purchase equipment in lucrative times and forgo purchases in less profitable years. Direct government payment over the past few years and costs of agricultural production are increasing; further increases in the value of production will benefit our business, while any future decreases in the value of production will decrease farm net income and may negatively affect our financial results.

As with other farm equipment manufacturers, we depend on our network of dealers to influence customers’ decisions, and dealer influence is often more persuasive than a manufacturer’s reputation or the price of the product.

Seasonality

Sales of our agricultural products are seasonal; however, we have tried to decrease the impact of this seasonality through the development of beet harvesting machinery, as the peak periods for these products occur at different times.

Our modular building sales are somewhat seasonal, and we believe that this is due to the budgeting and funding cycles of the universities that commonly purchase our modular buildings. We believe that this cycle can be offset by building backlogs of inventory, by increasing sales to other public and private sectors and by creating repeatable business opportunities.

Liquidity and Capital Resources

Our main source of funds during the 2024 fiscal year was cash generated by operating activities of approximately $2,869,000. We utilized favorable billing schedules in our Modular Buildings segment to generate approximately $1,654,000 in positive cash flow for our fiscal 2024 projects. We also generated approximately $983,000 of cash from the collection of extended term and other outstanding receivables at fiscal 2023 year end, predominately from our Agricultural Products segment. We were also able to reduce our inventory level in fiscal 2024 from higher than normal inventory level at the end of fiscal 2023, to generate approximately $551,000 of positive cash. We expect to be able to continue to decrease inventory in fiscal 2025 to provide positive cash. Our net loss plus noncash adjustment items also provided approximately $1,358,000 in cash in fiscal 2024. Our discontinued operations provided approximately $1,271,000 in positive cash flow primarily from the sale of our remaining real estate. Our largest uses of cash in fiscal 2024 were the payment of accounts payable, purchases of property, plant, and equipment, and retirement of debt, including the payoff of our roof loan and a large decrease in our operating line of credit. We expect our primary capital needs for fiscal 2025 to be operating expenses and continued retirement of debt. We expect our operating expenses to be down significantly in fiscal 2025 as we have right-sized our staff for incoming demand. We expect to use available cash or financing in fiscal 2025 to acquire equipment that we identify as improving efficiency in our manufacturing process. We will be focused on increasing efficiency and margin gains to make the most out of our expected sales in fiscal 2025. We expect to receive approximately $1,200,000 of net proceeds from the Employee Retention Credit in fiscal 2025. Due to the timing of filing an ERC claim after the IRS announced a moratorium on processing applications, and uncertainty surrounding the nature and timing of the claim approval and subsequent payment process, recognition of the claim is deferred until payment is received. Accordingly the claim has not been recorded in receivables, assets, or income.

We have a Bank Midwest credit facility consisting of a $5,500,000 revolving line of credit, pursuant to which we had borrowed $1,928,437, with $3,571,563 remaining, as of November 30, 2024, and one term loan, which had an outstanding principal balance of $1,779,877 as of November 30, 2024. The revolving line of credit is being used for working capital purposes. We also have two Economic Injury Disaster Loans provided by the U.S. Small Business Administration with an aggregate principal balance of $315,089 as of November 30, 2024.

Our loans require us to comply with various covenants, including maintaining certain financial ratios and obtaining prior written consent from Bank Midwest for any investment in, acquisition of, or guaranty relating to another business or entity. We were in compliance with covenants in place under the Bank Midwest loans as of November 30, 2024.

For additional information about our financing activities, please refer to Note 10 “Loan and Credit Agreements” to our financial statements in “Item 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA” of this report.

The following table represents our working capital and current ratio as of the end of the past two fiscal years:

| |

|

November 30, 2024 |

|

|

November 30, 2023 |

|

| Current Assets |

|

$ |

13,124,309 |

|

|

$ |

15,085,494 |

|

| Current Liabilities |

|

|

6,632,493 |

|

|

|

9,395,023 |

|

| Working Capital |

|

$ |

6,491,816 |

|

|

$ |

5,690,471 |

|

| |

|

|

|

|

|

|

|

|

| Current Ratio |

|

|

1.98 |

|

|

|

1.61 |

|

We believe that our current cash and financing arrangements will provide sufficient cash to finance operations for the next 12 months. We expect to continue to rely on cash from financing activities to supplement our cash flows from operations in order to meet our liquidity and capital expenditure needs in the near future. We expect to continue to be able to procure financing upon reasonable terms.

Item 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

As a smaller reporting company, we are not required to provide disclosure pursuant to this Item.

Item 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Stockholders

Art's-Way Manufacturing Co., Inc.

Armstrong, Iowa

Opinion on the Financial Statements

We have audited the accompanying consolidated balance sheets of Art's-Way Manufacturing Co., Inc. and Subsidiaries (the “Company”) as of November 30, 2024 and 2023, and the related consolidated statements of operations, stockholders’ equity, and cash flows, for the years then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of November 30, 2024 and 2023, and the results of its operations and its cash flows for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risk of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Critical Audit Matter

The critical audit matter communicated below is a matter arising from the current period audit of the financial statements that was communicated or required to be communicated to the audit committee and that: (1) relate to accounts or disclosures that are material to the financial statements and (2) involved especially challenging, subjective or complex judgments. The communication of critical audit matters does not alter in any way our opinion on the financial statements, taken as a whole, and we are not, by communicating the critical audit matters below, providing a separate opinion on the critical audit matter or on the accounts or disclosures to which it relates.

Valuation of Inventories

As discussed in Note 4 to the Company’s financial statements, the gross inventories balance was $11,984,915, and the balance net of reserves was $10,327,913 as of November 30, 2024. The Company values its inventories at the lower of cost or net realizable value, with cost being determined using the standard costing method, which approximates first-in, first-out costing method. The Company adjusts the value of inventory for slow-moving and obsolete inventory based on expected future usage of raw materials and finished goods.

We identified the valuation of inventories as a critical audit matter. The principal considerations for our determination that performing procedures relating to valuation of inventories is a critical audit matter are the significant assumptions and complex judgments by management when determining the future salability of the inventory and its net realizable value. These assumptions and judgments include the assessment of the net realizable value by inventory category considering retention periods, future usage, and market demand for products, which in turn led to a high degree of auditor judgment, subjectivity, and effort in performing procedures and evaluating audit evidence related to management’s methods, calculations, and assumptions.

The primary procedures we performed to address this critical audit matter included:

| | ● | Gaining an understanding of management’s processes, controls, and methodology to develop the estimates. |