false

0000007623

0000007623

2025-02-11

2025-02-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

Current Report Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 11, 2025

ART’S-WAY MANUFACTURING CO., INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

(State or other jurisdiction of incorporation)

|

|

000-05131

|

42-0920725

|

|

(Commission File Number)

|

(IRS Employer

|

| |

Identification No.)

|

|

5556 Highway 9

Armstrong, Iowa 50514

|

|

(Address of principal executive offices) (Zip Code)

|

| |

|

(712) 208-8467

|

|

(Registrant’s telephone number, including area code)

|

| |

|

Not Applicable

|

|

(Former name or former address, if changed since last report.)

|

| |

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, $0.01 par value per share

|

ARTW

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 11, 2025, Art’s-Way Manufacturing Co., Inc. (the “Company”) issued a press release announcing its financial results for the twelve months ended November 30, 2024. A copy of the press release is attached as Exhibit 99.1 hereto and incorporated by reference herein.

The information contained in this report (including Exhibit 99.1) shall not be deemed “filed” for purposes of section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

|

Exhibit No.

|

|

Description of Exhibit

|

| |

|

|

|

99.1

|

|

|

| |

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ART’S-WAY MANUFACTURING CO., INC.

|

| |

|

| |

|

|

Dated: February 11, 2025

|

By:

|

/s/ Michael W. Woods

|

| |

|

Michael W. Woods

|

| |

|

Chief Financial Officer

|

Exhibit 99.1

FOR IMMEDIATE RELEASE

February 11, 2025

ART’S WAY ANNOUNCES FISCAL 2024 RESULTS, LED BY STRONG YEAR FROM MODULAR BUILDING SEGMENT AND IMPROVED LIQUIDITY DESPITE DIFFICULT AG CONDITIONS

ARMSTRONG, IOWA, February 11, 2025 – Art’s-Way Manufacturing Co., Inc. (Nasdaq: ARTW) (the “Company”), a diversified, international manufacturer and distributor of equipment serving agricultural and research needs, announces its financial results for fiscal 2024.

| |

|

For the Twelve Months Ended

|

|

| |

|

(Consolidated Continuing Operations)

|

|

| |

|

November 30, 2024

|

|

|

November 30, 2023

|

|

|

Net Sales

|

|

$ |

24,499,000 |

|

|

$ |

30,281,000 |

|

|

Operating Income

|

|

$ |

461,000 |

|

|

$ |

1,531,000 |

|

|

Income (loss) from Continuing Operations

|

|

$ |

(94,000 |

) |

|

$ |

763,000 |

|

|

EPS – Continuing Ops – Basic

|

|

$ |

(0.02 |

) |

|

$ |

0.15 |

|

|

EPS – Continuing Ops – Diluted

|

|

$ |

(0.02 |

) |

|

$ |

0.15 |

|

| |

|

|

|

|

|

|

|

|

|

Weighted Average Shares Outstanding:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

5,052,167 |

|

|

|

5,002,238 |

|

|

Diluted

|

|

|

5,052,167 |

|

|

|

5,002,238 |

|

Agricultural Products: Our Agricultural Products segment’s net sales for the 2024 fiscal year were $14,663,000 compared to $22,467,000 during the 2023 fiscal year, a decrease of $7,804,000, or 34.7%. Commodity prices in the agricultural market dropped below five-year averages in fiscal 2024, which lead to a meaningful decrease in demand for our agricultural products. This demand decrease was not isolated to our company, instigating mass layoffs and major production cuts in fiscal 2024 for many in our industry. Another factor in the sales decrease we experienced was the amount of inventory on dealer lots at the end of fiscal 2023. Many dealers were oversaturated with inventory related to excess demand in 2023 from high commodity prices and supply chains' inability to keep up. This turned drastically in the first quarter of fiscal 2024, as increasing interest rates and declining commodity prices decreased expected net farm income. Gross profit percentage in the Agricultural Products segment for the 2024 fiscal year was 28.3% compared to 29.3% for the 2023 fiscal year. We continued to see inflationary pressure in fiscal 2024. Steel prices rose through the summer of fiscal 2024 but leveled off and dropped near the end of the year. We continued to see price increases from insurance groups and other manufacturing expense companies, which led to an increase in our overhead costs. These factors and the overall sales decrease contributed to the drop in gross profit percentage. We put a focus on cost reductions on two of our highest volume products in fiscal 2024, which we expect to bear fruit in fiscal 2025.

Modular Buildings: Our Modular Buildings segment’s net sales for the 2024 fiscal year were $9,836,000 compared to $7,814,000 for the 2023 fiscal year, an increase of $2,022,000, or 25.9%. While our agricultural products building sales suffered under the same adverse market conditions of our Agricultural Products segment, we saw increased demand in the research markets for our modular products, which led to a 124% increase in research sales. Our Modular Building segment's gross profit percentage for the 2024 fiscal year was 32.1% compared to 25.6% during the 2023 fiscal year. Our project performance in fiscal 2024 exceeded expectations as our workforce was consistently under budget on production disciplines. We are also historically more efficient when our shop is busy and perform better on research projects as we often have more contingency built in than traditional ag modulars. Our project management team continued to build on fiscal 2023 strides to increase profitability on projects and to provide better service to our customers. This focus translated to some of the best results we have seen in this operating segment, and we believe our sales funnel leading into fiscal 2025 can deliver similar performance.

Discontinued Operations: On June 7, 2023 we announced we would be discontinuing our Tools segment with the last day of normal operations occurring on July 14, 2023. Just over a year later, on October 21, 2024, we completed the sale of the remaining real estate associated with our Tools segment for $1,800,000. The Company’s assets and liabilities from this segment were gone prior to November 30, 2024 and will no longer report discontinued operations in our current year financials moving forward. Our discontinued operations generated approximately $1,271,000 from operating, investing and financing activities mainly related to closing activities and the sale of the real estate. Our Tools segment reported net income of $402,000 for the twelve months ending November 30, 2024 compared to net loss of $496,000 in the same period of fiscal 2023.

Operating income (continuing operations): Our consolidated operating income from continuing operations for the 2024 fiscal year was $461,000 compared to operating income of $1,531,000 for the 2023 fiscal year. Our Agricultural Products segment had an operating loss of $1,510,000, and our Modular Buildings segment had operating income of $1,971,000.

Net income (loss) per share (continuing operations): Loss per basic and diluted share from continuing operations for the 2024 fiscal year was $(0.02), compared to net income of $0.15 per share for the 2023 fiscal year.

Consolidated net income (continuing and discontinued operations): Consolidated net income for the 2024 fiscal year was $307,000 compared to net income of $267,000 in the 2023 fiscal year.

Backlog: The Company’s backlog of orders varies on a daily basis. The Company’s Agricultural Products segment had a net backlog of approximately $3,486,000 as of February 4, 2025 compared to $4,364,000 on February 4, 2024. The overall agriculture economy remained stagnant for our fall early order program after three years of increased demand. High interest rates and low commodity prices are still affecting demand as we roll into fiscal 2025, however, we have seen better than expected demand for our grinder mixers. The Company’s Modular Buildings segment had approximately $2,393,000 backlog as of February 4, 2025, compared to $6,170,000 on that date in 2024. The Modular Buildings segment has strong leads in the engineering phase that we expect to reach contract phase, which could bring us to similar revenue results as were achieved during fiscal 2024. The Company expects that its order backlogs will continue to fluctuate as orders are received, filled, or canceled, and, due to dealer discount arrangements it may enter into from time to time. Accordingly, these figures are not necessarily indicative of future revenue.

Marc McConnell, Chairman, President and CEO of Art’s Way states, “Fiscal 2024 was a year of considerable challenges and transition at Art’s Way, yet one that demonstrated the benefits of our diversification strategy. Amid a significant down cycle in the farm equipment industry, we experienced a reduction in demand along with our industry peers. Meanwhile we benefited greatly from the tremendous growth and operational performance in our Modular Buildings segment. We responded to challenges in our Agricultural Products segment by focusing closely on cost reductions, reducing debt, and improving cashflow while maintaining our emphasis on quality, innovation, and customer experience. We are confident these measures position the company for improving markets in the future and are pleased to report that our current debt level represents a historical low.

Going forward we have meaningful reason for optimism in both business segments for 2025 and beyond. There are positive indications in the dairy and livestock markets that could drive demand for our products serving those markets. We also carry positive momentum into the new year in our Modular Buildings segment that we believe we can sustain. On a consolidated basis we anticipate that solid demand, reduced overhead expenses, improved liquidity and reduced interest expense from debt reduction will result in improved profitability and cashflow in fiscal 2025.”

Art’s-Way Manufacturing Co., Inc.

Art’s Way Manufacturing is a small, publicly traded company that specializes in equipment manufacturing. For over 65 years, it has been committed to designing and building high-quality machinery for all operations. It has approximately 130 employees across two branch locations: Art’s Way Manufacturing in Armstrong, Iowa and Art’s Way Scientific in Monona, Iowa. Art’s Way manure spreaders, forage boxes, high dump carts, bale processors, graders, land planes, sugar beet harvesters and grinder mixers are designed to optimize production, increase efficiency and meet the growing demands of customers. Art’s Way Manufacturing has two reporting segments: Agricultural Products and Modular Buildings.

For more information, contact: Marc McConnell, Chairman, President and Chief Executive Officer.

712-208-8467

investorrelations@artsway-mfg.com

Or visit our website at www.artsway.com/

Cautionary Note Regarding Forward-Looking Statements

This release includes "forward-looking statements" within the meaning of the federal securities laws. Statements made in this release that are not strictly statements of historical facts are forwarding-looking statements. In some cases, forward-looking statements may be identified by the use of words such as “may,” “should,” “anticipate,” “believe,” “expect,” “plan,” “future,” “intend,” “could,” “estimate,” “predict,” “hope,” “potential,” “continue,” “foresee,” or the negative of these terms or other similar expressions. Forward-looking statements in this release generally relate to our expectations regarding: (i) the Company’s business position; (ii) potential growth in the Company’s business segments and sales, including positive momentum in its Modular Buildings segment; (iii) future results, including but not limited to, expectations regarding demand, the impact of higher interest rates, inventory requirements, revenue and margins; (iv) the Company’s beliefs about indications in the dairy and livestock markets and how such indications may affect future demand for the Company’s products; (v) the Company’s expectations regarding how cost reduction efforts may benefit future performance; (vi) the Company’s beliefs regarding backlog, contracting projects, and completion of projects, including revenues resulting therefrom; and (vii) the benefits of the Company’s business model and strategy. Statements of anticipated future results are based on current expectations and are subject to a number of risks and uncertainties, including, but not limited to: customer demand for the Company’s products; credit-worthiness of its customers; its ability to operate at lower expense levels; its ability to complete projects in a timely and efficient manner in accordance with customer specifications; its ability to renew or obtain financing on reasonable terms; its ability to repay current debt, continue to meet debt obligations and comply with financial covenants; inflation and its effect on our supply chain and demand for its products, domestic and international economic conditions; its ability to attract and maintain an adequate workforce in a competitive labor market; factors affecting the strength of the agricultural sector; the cost of raw materials; unexpected changes to performance by its operating segments; obstacles related to liquidation of product lines and controlling costs; and other factors detailed from time to time in the Company’s Securities and Exchange Commission filings. Actual results may differ markedly from management’s expectations. The Company cautions readers not to place undue reliance upon any such forward-looking statements. The Company does not intend to update forward-looking statements other than as required by law.

v3.25.0.1

Document And Entity Information

|

Feb. 11, 2025 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

ART’S-WAY MANUFACTURING CO., INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Feb. 11, 2025

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

000-05131

|

| Entity, Tax Identification Number |

42-0920725

|

| Entity, Address, Address Line One |

5556 Highway 9

|

| Entity, Address, City or Town |

Armstrong

|

| Entity, Address, State or Province |

IA

|

| Entity, Address, Postal Zip Code |

50514

|

| City Area Code |

712

|

| Local Phone Number |

208-8467

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock

|

| Trading Symbol |

ARTW

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000007623

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

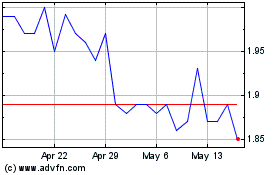

Arts Way Manufacturing (NASDAQ:ARTW)

Historical Stock Chart

From Jan 2025 to Feb 2025

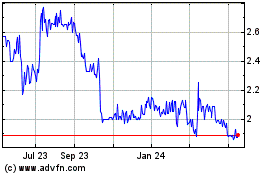

Arts Way Manufacturing (NASDAQ:ARTW)

Historical Stock Chart

From Feb 2024 to Feb 2025