UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of

1934

Date of Report (Date of earliest event reported): June 11, 2024

ARYA SCIENCES ACQUISITION CORP IV

(Exact name of registrant as specified in its charter)

Cayman Islands

|

001-40122

|

98-1574672

|

|

(State or other jurisdiction of

incorporation)

|

(Commission File Number) |

(I.R.S. Employer

Identification No.)

|

|

51 Astor Place, 10th Floor

New York, NY

|

10003

|

| (Address of principal executive offices) |

(Zip Code) |

(212) 284-2300

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

☒ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading

Symbol(s)

|

Name of each exchange

on which registered

|

Class A Ordinary Shares, par value $0.0001 per share

|

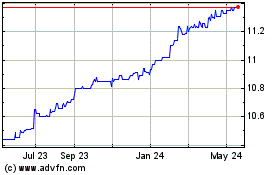

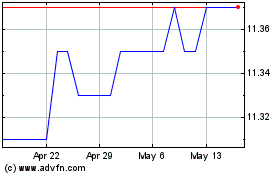

ARYD

|

The Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01. |

Regulation FD Disclosure. |

As previously announced, on February 13, 2024,

ARYA Sciences Acquisition Corp IV, a Cayman Islands exempted company (“ARYA”), Aja Holdco, Inc., a Delaware corporation and wholly-owned subsidiary of ARYA (“ListCo”), Aja Merger Sub 1, a Cayman Islands exempted company and wholly-owned subsidiary

of ListCo (“ARYA Merger Sub”), Aja Merger Sub 2, Inc., a Delaware corporation and wholly-owned subsidiary of ListCo (“Company Merger Sub”) and Adagio Medical, Inc., a Delaware corporation (“Adagio”), entered into a Business Combination Agreement

(as it may be amended, supplemented or otherwise modified from time to time, the “Business Combination Agreement”). Furnished herewith as Exhibit 99.1 and incorporated into this Item 7.01 by reference is an updated investor presentation, dated as

of June 11, 2024, that ARYA, Adagio and ListCo have prepared for use in connection with the Business Combination and various meetings with investors.

The foregoing (including Exhibit 99.1) is being

furnished pursuant to Item 7.01 and will not be deemed to be filed for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to the liabilities of that section, nor will it be

deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act.

Forward-Looking Statements

Certain statements in this Current Report may be

considered “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or ARYA’s, Adagio’s or

New Adagio’s future financial or operating performance. For example, any statements that refer to expectations, projections or other characterizations of future events or circumstances, including post-Business Combination fully diluted equity

value, the anticipated enterprise value of New Adagio, expected ownership in New Adagio, projections of market opportunity and market share, the capability of Adagio’s or New Adagio’s business plans including its plans to expand, the sources and

uses of cash from the Business Combination, any benefits of Adagio’s partnerships, strategies or plans as they relate to the Business Combination, anticipated benefits of the Business Combination and expectations related to the terms and timing of

the Business Combination, Adagio’s expected pro forma cash, Adagio’s or New Adagio’s expected cash runway through 2025 or statements related to Adagio’s or New Adagio’s funding gap, funded business plan or use of proceeds, or other metrics or

statements derived therefrom, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “future,” “intend,”

“may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “propose,” “seek,” “should,” “strive,” “will,” or “would” or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are

subject to risks, uncertainties, and other factors which may be beyond the control of ARYA, Adagio or New Adagio and could cause actual results to differ materially from those expressed or implied by such forward-looking statements. These

forward-looking statements are based upon estimates and assumptions that, while considered reasonable by ARYA and its management, Adagio and its management and New Adagio and its management, as the case may be, are inherently uncertain. Each of

ARYA, Adagio and New Adagio caution you that these statements are based on a combination of facts and factors currently known and projections of the future, which are inherently uncertain. There will be risks and uncertainties described in the

proxy statement/prospectus included in the Registration Statement relating to the Business Combination, which has been filed by ListCo with the SEC, and described in other documents filed by ARYA or New Adagio from time to time with the SEC. These

filings may identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Neither ARYA nor Adagio can assure you that the

forward-looking statements in this Current Report will prove to be accurate.

In addition, new risks and uncertainties may

emerge from time to time, and it may not be possible to identify and accurately predict the potential impacts of any such risks and uncertainties that may arise in the future. Factors that may cause actual results to differ materially from current

expectations include, but are not limited to: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of negotiations and any subsequent definitive agreements with respect to the Business Combination;

(2) the outcome of any potential litigation, government or regulatory proceedings that may be instituted against ARYA, Adagio, New Adagio or others; (3) the inability to complete the Business Combination due to the failure to obtain approval of the

shareholders of ARYA, to obtain financing to complete the Business Combination or to satisfy other conditions to closing; (4) the amount of redemption requests made by ARYA’s public shareholders; (5) changes to the proposed structure of the

Business Combination that may be required or appropriate as a result of applicable laws or regulations or as a condition to obtaining regulatory approval of the Business Combination; (6) delays in obtaining, adverse conditions in, or the inability

to obtain regulatory approvals, or delays in completing regulatory reviews, required to complete the Business Combination; (7) the ability to meet stock exchange listing standards prior to or following the consummation of the Business Combination;

(8) the risk that the Business Combination disrupts current plans and operations of Adagio or New Adagio as a result of the announcement and consummation of the Business Combination; (9) Adagio’s ability to remain compliant with the covenants of

its existing debt, including any convertible or bridge financing notes; (10) New Adagio’s ability to remain compliant with the covenants of, and other obligations under, the senior secured convertible notes that will be issued in connection with

the closing of the Business Combination; (11) the ability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition, the ability of New Adagio to grow and manage growth profitably,

maintain relationships with customers and suppliers and retain its management and key employees; (12) costs related to the Business Combination; (13) risks associated with changes in applicable laws or regulations and Adagio’s or New Adagio’s

international operations and operations in a regulated industry; (14) the possibility that Adagio or New Adagio may be adversely affected by other economic, business, and/or competitive factors; (15) Adagio’s or New Adagio’s use of proceeds,

post-Business Combination fully diluted equity value or fully diluted enterprise value, expected pro forma cash, expected cash runway or funding gap, estimates of expenses and profitability; and (16) the other risks and uncertainties set forth in

the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in ARYA’s Annual Report on Form 10-K for the year ended December 31, 2023, its Quarterly Reports on Form 10-Q, and other documents filed, or to be

filed, with the SEC by ARYA or New Adagio. There may be additional risks that ARYA, Adagio or New Adagio do not presently know or that ARYA, Adagio or New Adagio currently believe are immaterial that could also cause actual results to differ from

those contained in the forward-looking statements. Actual events and circumstances are difficult or impossible to predict and may materially differ from assumptions. Many actual events and circumstances are beyond the control of ARYA, Adagio and

New Adagio.

Nothing in this Current Report should be

regarded as a representation or warranty by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved, in any specified time frame,

or at all. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made in this Current Report. Subsequent events and developments may cause those views to change. Neither ARYA, Adagio nor New

Adagio undertakes any duty to update these forward-looking statements.

Additional Information

In connection with the Business Combination,

ListCo has filed with the SEC a Registration Statement on Form S-4 containing a preliminary proxy statement of ARYA and a preliminary prospectus of ListCo, and after the Registration Statement is declared effective, ARYA expects to mail a

definitive proxy statement/prospectus related to the Business Combination to its shareholders. The proxy statement/prospectus contains important information about the Business Combination and the other matters to be voted upon at ARYA’s shareholder

meeting to be held to approve the Business Combination. ARYA and ListCo may also file other documents with the SEC regarding the Business Combination. This Current Report does not contain all the information that should be considered concerning the

Business Combination and is not intended to form the basis of any investment decision or any other decision in respect of the Business Combination. Before making any voting or other investment decisions, shareholders of ARYA and other interested

persons are advised to read, the preliminary proxy statement/prospectus and any amendments thereto, the definitive proxy statement/prospectus and other documents filed in connection with the Business Combination, as these materials contain

important information about ARYA, Adagio and the Business Combination. After the Registration Statement becomes effective, the definitive proxy statement/prospectus and other relevant materials for the Business Combination will be mailed to

shareholders of ARYA as of a record date to be established for voting on the Business Combination. Shareholders will also be able to obtain copies of the definitive proxy statement/prospectus and other documents filed with the SEC, without charge,

once available, at the SEC’s website at www.sec.gov, or by directing a request to: ARYA Sciences Acquisition Corp IV, 51 Astor Place, 10th Floor, New York, New York, 10003, Attention: Secretary, ARYA4@perceptivelife.com.

INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN

APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A

CRIMINAL OFFENSE.

Participants in the Solicitation

ARYA and its respective directors and executive

officers may be deemed to be participants in the solicitation of proxies from ARYA’s shareholders with respect to the Business Combination. A list of the names of ARYA’s directors and executive officers and a description of their interests in ARYA

is contained in ARYA’s Annual Report on Form 10-K, which was filed with the SEC and is available free of charge at the SEC’s web site at www.sec.gov, or by directing a request to ARYA Sciences Acquisition Corp IV, 51 Astor Place, 10th Floor, New

York, New York, 10003, Attention: Secretary, ARYA4@perceptivelife.com. Additional information regarding the interests of such participants is contained in the proxy statement/prospectus for the Business Combination. Investors, security holders and

other interested persons of ARYA, Adagio and New Adagio are urged to carefully read in their entirety the proxy statement/prospectus and other relevant documents that that have been filed or will be filed with the SEC because they contain important

information about the Business Combination. Also see above under the heading “Additional Information.”

Adagio and New Adagio, and its directors and

executive officers may also be deemed to be participants in the solicitation of proxies from the shareholders of ARYA in connection with the Business Combination. A list of the names of such directors and executive officers and information

regarding their interests in the Business Combination is included in the proxy statement/prospectus for the Business Combination.

No Offer and Non-Solicitation

This Current Report does not constitute (i) a

solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Business Combination or (ii) an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any securities of ARYA, Adagio

or New Adagio, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such state or

jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act, or an exemption therefrom.

| Item 9.01. |

Financial Statements and Exhibits. |

|

Exhibit

Number

|

Description |

| |

|

| 99.1 |

Investor Presentation, dated as of June 2024. |

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: June 11, 2024 |

|

|

| |

|

|

| |

ARYA Sciences Acquisition Corp IV |

|

| |

|

|

| |

By: |

/s/ Adam Stone |

|

| |

Name: |

Adam Stone |

|

| |

Title: |

Chief Executive Officer |

|

Exhibit 99.1

ADAGIO MEDICAL Investor Presentation | June 2024 1

DISCLAIMER This investor presentation (together with the oral statements made in connection herewith, this “Presentation”) is for informational purposes only to assist

interested parties in making their own evaluation with respect to the proposed business combination and any related transaction, including with the PIPE financing described herein (collectively, the “Business Combination”), by and among ARYA Sciences

Acquisition Corp IV (NASDAQ: ARYD) (“ARYA”), Adagio Medical, Inc. (the “Company”) and Aja Holdco, Inc., of which the Company will become a subsidiary following the consummation of the Business Combination (“ListCo”), and for no other purpose. The

information contained herein is subject to change, and any such change could be material, and does not purport to be all-inclusive and none of ARYA, the Company, ListCo, Jefferies LLC (“Jefferies”) or Chardan Capital Markets, LLC (“Chardan”) or any of

their respective affiliates (including, without limitation, control persons, directors, officers, employees, shareholders, representatives, legal counsel or advisors) makes any representation or warranty, express or implied, as to the accuracy,

completeness or reliability of the information contained in this Presentation or any other written or oral communication communicated to the recipient in the course of the recipient’s evaluation of ARYA, the Company and ListCo. Please refer to the

definitive merger agreement and other related transaction documents for the full terms of the Business Combination. This Presentation does not constitute (i) a solicitation of a proxy, consent or authorization with respect to any securities or in

respect of the Business Combination or (ii) an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any security of ARYA, the Company, ListCo or any of their respective affiliates. You should not construe the contents of

this Presentation as legal, tax, accounting or investment advice or a recommendation. You should consult your own counsel and tax and financial advisors as to legal and related matters concerning the matters described herein, and, by accepting this

Presentation, you confirm that you are not relying upon the information contained herein to make any investment decision. The reader shall not rely upon any statement, representation or warranty made by any other person, firm or corporation (including,

without limitation, Jefferies, Chardan and any of their affiliates or control persons, officers, directors and employees) in making its investment or decision to invest in ARYA, the Company or ListCo. To the fullest extent permitted by law, none of

ARYA, the Company, ListCo, Jefferies and Chardan nor any of their respective affiliates nor any of its or their control persons, officers, directors, employees or representatives, shall be responsible or liable to the reader for any information set

forth herein or any action taken or not taken by any reader, including any investment in ARYA, the Company or ListCo. The distribution of this Presentation may also be restricted by law and persons into whose possession this Presentation comes should

inform themselves about and observe any such restrictions. The recipient acknowledges that it is (a) aware that the United States securities laws prohibit any person who has material, non-public information concerning a company from purchasing or

selling securities of such company or from communicating such information to any other person under circumstances in which it is reasonably foreseeable that such person is likely to purchase or sell such securities, and (b) familiar with the Securities

Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder (collectively, the “Exchange Act”), and that the recipient will neither use, nor cause any third party to use, this Presentation or any information contained herein

in contravention of the Exchange Act, including, without limitation, Rule 10b-5 thereunder. This Presentation and information contained herein constitutes confidential information and is provided to you on the condition that you agree that you will

hold it in strict confidence and not use, discuss, reproduce, disclose, forward or distribute it in whole or in part without the prior written consent of ARYA, the Company and ListCo and is intended for the recipient hereof only. No securities

commission or securities regulatory authority in the United States or any other jurisdiction has in any way passed upon the merits of the Business Combination or the accuracy or adequacy of this Presentation. Certain monetary amounts, percentages and

other figures included in this Presentation have been subject to rounding adjustments. Certain amounts that appear in this Presentation may not sum due to rounding. Management's Estimates The Company has based its estimates of the total addressable

market and growth forecasts on a number of internal and third-party estimates and resources, including, without limitation, third party reports and the experience of the management team across the industries. While the Company believes its assumptions

and the data underlying its estimates are reasonable, these assumptions and estimates may not be correct and the conditions supporting such assumptions or estimates may change at any time, thereby reducing the predictive accuracy of these underlying

factors. In addition, the novelty of the markets for the Company’s products may make its assumptions and estimates more uncertain. As a result, the Company's estimates of the total addressable market and growth forecasts for its products are subject to

significant uncertainty and may prove to be incorrect. If third-party or internally generated data prove to be inaccurate or the Company makes errors in its assumptions based on that data, the total addressable market for the Company's products may be

smaller than it has estimated, its future growth opportunities and sales growth may be impaired, any of which could have a material adverse effect on the Company's business, financial condition and results of operations. Forward-Looking Statements

Certain statements in this Presentation may be considered “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate

to future events or ARYA’s, the Company’s or ListCo’s future financial or operating performance. For example, any statements that refer to expectations, projections or other characterizations of future events or circumstances, including post-Business

Combination fully diluted equity value, the anticipated enterprise value of ListCo, expected ownership in ListCo, projections of market opportunity and market share, the capability of the Company’s or ListCo’s business plans including its plans to

expand, the sources and uses of cash from the Business Combination, any benefits of the Company’s partnerships, strategies or plans as they relate to the Business Combination, anticipated benefits of the Business Combination and expectations related to

the terms and timing of the Business Combination, the Company’s expected pro forma cash, the Company’s or ListCo’s expected cash runway through 2025 or statements related to the Company’s or ListCo’s funding gap, funded business plan or use of

proceeds, or other metrics or statements derived therefrom, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,”

“forecast,” “future,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “propose,” “seek,” “should,” “strive,” “will,” or “would” or the negatives of these terms or variations of them or similar terminology. Such

forward-looking statements are subject to risks, uncertainties, and other factors which may be beyond the control of ARYA, the Company or ListCo and could cause actual results to differ materially from those expressed or implied by such forward-looking

statements. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by ARYA and its management, the Company and its management and ListCo and its management, as the case may be, are inherently

uncertain. Each of ARYA, the Company and ListCo caution you that these statements are based on a combination of facts and factors currently known and projections of the future, which are inherently uncertain. There will be risks and uncertainties

described in the proxy statement/prospectus included in the registration statement on Form S-4 (the “Registration Statement”) relating to the Business Combination, which is expected to be filed by ListCo with the U.S. Securities and Exchange Commission

(the “SEC”), and described in other documents filed by ARYA or ListCo from time to time with the SEC. These filings may identify and address other important risks and uncertainties that could cause actual events and results to differ materially from

those contained in the forward-looking statements. Neither ARYA nor the Company can assure you that the forward-looking statements in this presentation will prove to be accurate. In addition, new risks and uncertainties may emerge from time to time,

and it may not be possible to identify and accurately predict the potential impacts of any such risks and uncertainties that may arise in the future. Factors that may cause actual results to differ materially from current expectations include, but are

not limited to: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of negotiations and any subsequent definitive agreements with respect to the Business Combination; (2) the outcome of any potential

litigation, government or regulatory proceedings that may be instituted against ARYA, the Company, ListCo or others; (3) the inability to complete the Business Combination due to the failure to obtain approval of the shareholders of ARYA, to obtain

financing to complete the Business Combination or to satisfy other conditions to closing; (4) the amount of redemption requests made by ARYA’s public shareholders; (5) changes to the proposed structure of the Business Combination that may be required

or appropriate as a result of applicable laws or regulations or as a condition to obtaining regulatory approval of the Business 2 PRIVATE AND CONFIDENTIAL

DISCLAIMER (CONT.) Combination; (6) delays in obtaining, adverse conditions in, or the inability to obtain regulatory approvals, or delays in completing regulatory reviews,

required to complete the Business Combination; (7) the ability to meet stock exchange listing standards prior to or following the consummation of the Business Combination; (8) the risk that the Business Combination disrupts current plans and operations

of the Company or ListCo as a result of the announcement and consummation of the Business Combination; (9) Adagio’s ability to remain compliant with the covenants of its existing debt, including any convertible or bridge financing notes; (10) ListCo’s

ability to remain compliant with the covenants of the senior secured convertible notes that will be issued in connection with the closing of the Business Combination; (11) the ability to recognize the anticipated benefits of the Business Combination,

which may be affected by, among other things, competition, the ability of ListCo to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees; (12) costs related to the Business

Combination; (13) risks associated with changes in applicable laws or regulations and the Company’s or ListCo’s international operations and operations in a regulated industry; (14) the possibility that the Company or ListCo may be adversely affected

by other economic, business, and/or competitive factors; (15) the Company’s or ListCo’s use of proceeds, post-Business Combination fully diluted equity value or fully diluted enterprise value, expected pro forma cash, expected cash runway or funding

gap, estimates of expenses and profitability; and (16) the risks described in the “Risk Factor Summary” included in this Presentation, and other risks and uncertainties set forth in the section entitled “Risk Factors” and “Cautionary Note Regarding

Forward-Looking Statements” in ARYA’s Annual Report on Form 10-K for the year ended December 31, 2023, its Quarterly Reports on Form 10-Q, and other documents filed, or to be filed, with the SEC. There may be additional risks that ARYA, the Company or

ListCo do not presently know or that ARYA, the Company or ListCo currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. Actual events and circumstances are difficult or

impossible to predict and may materially differ from assumptions. Many actual events and circumstances are beyond the control of ARYA, the Company and ListCo. Nothing in this Presentation should be regarded as a representation or warranty by any person

that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward- looking statements will be achieved in any specified time frame or at all. You should not place undue reliance on

forward-looking statements, which speak only as of the date they are made in this Presentation. Subsequent events and developments may cause those views to change. Neither ARYA, the Company nor ListCo undertakes any duty to update these forward-looking

statements. Use of Projections This Presentation contains forecasts with respect to the Company’s minimum total pro forma cash after expenses at announcement of the Business Combination and ListCo’s expected cash runway through 2025, based on current

plans and estimates of the Company. Neither ARYA’s, the Company’s nor ListCo’s independent auditors have audited, reviewed, compiled or performed any procedures with respect to such projected or forecasted information included in this Presentation and,

accordingly, they did not express an opinion or provide any other form of assurance with respect thereto for the purpose of this Presentation. The inclusion of the forecasted information should not be relied upon as being necessarily indicative of

future results and should not be regarded as an indication that ARYA, the Company, ListCo or any other person considered, or now considers, the projections to be a reliable prediction of future events, and does not constitute an admission or

representation by any person that the expectations, beliefs, opinions, and assumptions that underlie such forecasts remain the same following the date of this Presentation, and readers are cautioned not to place undue reliance on any prospective

information. The assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual

cash or cash needs to differ materially from those contained in the prospective financial information. Accordingly, there can be no assurance that the prospective cash or cash needs are indicative of the future performance of the Company or ListCo or

that actual cash or cash needs will not differ materially from those presented in the prospective financial information. ARYA, the Company and ListCo do not assume any obligation to update the projected information or any other information in this

Presentation, and do not expect to continue to disclose detailed prospective financial information going forward. Actual cash or cash needs may differ as a result of the completion of the Company’s or ListCo’s applicable financial reporting period

closing procedures, review adjustments and other developments that may arise between now and the time such financial information for the presented or projected periods is finalized. As a result, these estimates are preliminary, may change and

constitute forward-looking information, and are subject to significant risks and uncertainties. See “Forward-Looking Statements” above. Any such forecasted information presented herein was not prepared with a view towards compliance with the published

guidelines of the SEC, Regulation S-X promulgated under the Securities Act of 1933, as amended (the “Securities Act”) or any guidelines established by the American Institute of Certified Public Accountants for the presentation and preparation of

“prospective financial information.” Accordingly, the information and data presented in this Presentation may not be included, may be adjusted, or may be presented differently, in any proxy statement or registration statement that may be filed in

connection with a Business Combination. Industry and Market Data; Trademarks Certain information contained in the Presentation relates to or is based on studies, publications, statistics and surveys from third-party sources, and on ARYA’s and the

Company’s own internal estimates and research. In addition, all of the market data included in this Presentation involves a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions.

While ARYA and the Company believe that the third-party sources and ARYA’s and the Company’s internal research are reliable, such sources and research have not been verified by any independent source. Any data on past performance or modeling contained

herein is not an indication as to future performance. This information involves many assumptions and limitations, and you are cautioned not to give undue weight to such industry and market data. The information contained in the third party citations

referenced in this presentation is not incorporated by reference into this presentation. This Presentation may include trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners. The

inclusion of particular trademarks, service marks, trade names and copyrights of other companies is not intended to, and does not, imply a relationship with ARYA, the Company or ListCo or an endorsement or sponsorship by or of ARYA, the Company or

ListCo. ARYA, the Company and ListCo own or have rights to various trademarks, service marks, trade names and copyrights in connection with the operation of their respective businesses which are also included in this Presentation. Solely for

convenience, some of the trademarks, service marks, trade names and copyrights referred to in this Presentation may be listed without the , ℠, ©, or ® symbols, but the Company, ARYA and ListCo will assert, to the fullest extent under applicable law,

the right of the applicable owners, if any, to these trademarks, service marks, trade names and copyrights. Additional Information In connection with the Business Combination, ListCo filed with the SEC a registration statement on Form S-4 containing a

preliminary proxy statement of ARYA and a preliminary prospectus of ListCo, and after the Registration Statement is declared effective, ARYA expects to mail a definitive proxy statement/prospectus related to the Business Combination to its

shareholders. The proxy statement/prospectus contains important information about the Business Combination and the other matters to be voted upon at ARYA’s shareholder meeting to be held to approve the Business Combination. ARYA and ListCo may also

file other documents with the SEC regarding the Business Combination. This Presentation does not contain all the information that should be considered concerning the Business Combination and is not intended to form the basis of any investment decision

or any other decision in respect of the Business Combination. Before making any voting or other investment decisions, shareholders of ARYA and other interested persons are advised to read the preliminary proxy statement/prospectus and any amendments

thereto, the definitive proxy statement/prospectus and other documents filed in connection with the Business Combination, as these materials contain important information about ARYA, the Company and the Business Combination. After the Registration

Statement becomes effective, the definitive proxy statement/prospectus and other relevant materials for the Business Combination will be mailed to shareholders of ARYA as of a record date to be established for voting on the Business Combination.

Shareholders will also be able to obtain copies of the definitive proxy statement/prospectus and other documents filed with the SEC, without charge, once available, at the SEC’s website at www.sec.gov, or by directing a request to: ARYA Sciences

Acquisition Corp IV, 51 Astor Place, 10th Floor, New York, New York, Attention: Secretary, ARYA4@perceptivelife.com. INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS

ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. 3 PRIVATE AND CONFIDENTIAL

DISCLAIMER (CONT.) Participants in the Solicitation ARYA, the Company, ListCo and their respective directors and executive officers may be deemed to be participants in the

solicitation of proxies from ARYA’s shareholders with respect to the Business Combination. A list of the names of ARYA’s directors and executive officers and a description of their interests in ARYA is contained in ARYA’s Annual Report on Form 10-K,

which was filed with the SEC and is available free of charge at the SEC’s web site at www.sec.gov, or by directing a request to ARYA Sciences Acquisition Corp IV, 51 Astor Place, 10th Floor, New York, New York, Attention: Secretary,

ARYA4@perceptivelife.com. Additional information regarding the interests of such participants is contained in the proxy statement/prospectus for the Business Combination. Investors, security holders and other interested persons of ARYA, the Company and

ListCo are urged to carefully read in their entirety the proxy statement/prospectus and other relevant documents that have been filed or will be filed with the SEC because they contain important information about the Business Combination. Also see

above under the heading “Additional Information.” The Company and ListCo, and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from the shareholders of ARYA in connection with the proposed

Business Combination. A list of the names of such directors and executive officers and information regarding their interests in the proposed Business Combination is included in the proxy statement/prospectus for the proposed Business Combination. No

Offer and Non-Solicitation This Presentation does not constitute (i) a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Business Combination or (ii) an offer to sell, a solicitation of an offer to

buy, or a recommendation to purchase any security of ARYA, the Company, ListCo or any of their respective affiliates. No such offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities

Act, or an exemption therefrom. The offering and resale of the securities issuable in connection with the PIPE financing described herein has not been and will not be registered under the Securities Act or any applicable state securities laws. If the

proposed Business Combination is entered into, the PIPE financing will be offered and sold only to “qualified institutional buyers” (as defined in Rule 144A under the Securities Act) and institutional “accredited investors” (as defined in Rule

501(a)(1), (2), (3) or (7) promulgated under the Securities Act) upon the consummation of the proposed Business Combination. Notice to investors in the European Economic Area / Prohibition of sales to EEA retail investors In member states of the

European Economic Area (the “EEA”), this Presentation and any offer if made subsequently is directed exclusively at persons who are “qualified investors” within the meaning of Article 2(e) of Regulation (EU) 2017/1129 (the “Prospectus Regulation”). The

securities are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the EEA. For these purposes, a retail investor means a person who is one (or more) of:

(i) a retail client as defined in point (11) of Article 4(1) of Directive 2014/65/EU (as amended, “MiFID II”); (ii) a customer within the meaning of Directive 2002/92/EC (as amended, the “Insurance Mediation Directive”), where that customer would not

qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II; or (iii) not a qualified investor as defined in the Prospectus Regulation. Consequently, no key information document required by Regulation (EU) No 1286/2014 (as

amended the “PRIIPs Regulation”) for offering or selling the securities or otherwise making them available to retail investors in the EEA has been prepared and therefore offering or selling the securities or otherwise making them available to any

retail investor in the EEA may be unlawful under the PRIIPs Regulation. Notice to investors in the UK / Prohibition of sales to UK retail investors In the United Kingdom (“UK”), any offer of the securities will be made pursuant to an exemption under

Regulation (EU) 2017/1129 as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018 (the “EUWA”) (the “UK Prospectus Regulation”) from a requirement to publish a prospectus for offers of securities. This Presentation is for

distribution in the UK only to (i) investment professionals falling within article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”); or (ii) high net worth entities and other persons to whom it may

lawfully be communicated, falling within article 49(2)(a) to (d) of the Order; and (iii) “qualified investors” within the meaning of article 2(e) of the UK Prospectus Regulation. The securities are not intended to be offered, sold or otherwise made

available to and should not be offered, sold or otherwise made available to any retail investor in the UK. For these purposes, a “retail investor” means a person who is one (or more) of: (i) a retail client, as defined in Directive (EU) 2014/65/EU on

markets in financial instruments (as amended) and implemented in the UK as it forms part of the domestic law of the United Kingdom by virtue of the EUWA (“UK MIFID II”); (ii) a customer within the meaning of Directive (EU) 2016/97 (as amended) as it

forms part of the domestic law of the UK by virtue of the EUWA, where that customer would not qualify as a professional client as defined in UK MIFID II; or (iii) not a “qualified investor” as defined in Article 2(e) of the UK Prospectus Regulation.

Consequently, no key information document required by Regulation (EU) No 1286/2014 as it forms part of the domestic law of the UK by virtue of the EUWA (the “UK PRIIPs Regulation”) for offering or selling the securities or otherwise making them

available to retail investors in the UK has been prepared and, therefore, offering or selling the securities or otherwise making them available to any retail investor in the UK may be unlawful under the UK PRIIPs Regulation. 4 PRIVATE AND CONFIDENTIAL

TODAY’S PRESENTERS Olav Bergheim CEO & President 30+ years of experience in life sciences Adagio at a Glance… ~90 Employees Founded in 2011 Headquartered in Laguna Hills,

California Founder of Innovative cardiac ablation medical technology company John Dahldorf Chief Financial Officer 20+ years of corporate finance experience Focused on large, underserved market – cardiac arrythmia addressing atrial fibrillation and

ventricular tachycardia Unique portfolio that works – supported by compelling clinical data Poised to disrupt the market with unique technologies with commercial approvals in progress and pivotal data readouts Note: Olav Bergheim serves as the CEO of

the Company pursuant to the terms of a Facilities and Shared Services Agreement between the Company and Fjord Ventures, LLC. Based on such agreement, Mr. Bergheim is compensated for serving in such position by Fjord Ventures, LLC. Two funds managed by

Mr. Bergheim, one of which is affiliated with Fjord Ventures, LLC, have invested an aggregate of approximately $10M among the approximately $100M investment in aggregate that the Company has received so far. 5 PRIVATE AND CONFIDENTIAL

WHY INVEST: ADAGIO MEDICAL OPPORTUNITY IN A NUTSHELL Currently ~$3 billion catheter market; advanced catheter revenue (75% of total) experienced historical double-digit

growth1 Unique near-term opportunity in ~ $300M VT ablation market with potential 2-3x segment growth on improved safety, effectiveness and usability Outcomes-based differentiation in $0.8B with 14% Y/Y growth persistent AF segment: opportunity for

substantial share gain in top tier VT-AF accounts2 Value inflection expected from catalysts through the next 18 months Leading inside investors include Perceptive Advisors and RA Capital Note: Management's analysis and estimates which are subject to

significant uncertainty and may prove to be incorrect. Please see Disclaimer - Management's Estimates on slide 2. 1) The historical market growth is based on management's analysis and calculations using internal and third-party estimates and resources,

subject to certain assumptions and limitations. Please see Slides 64-69 which are part of Appendix II - Market Sources & Analysis for further details. 2) The combined growth potential is based on management's analysis and projections using internal

and third-party estimates and resources, subject to certain assumptions and limitations. Please see Slides 64-69 which are part of Appendix II - Market Sources & Analysis for further details. 6 PRIVATE AND CONFIDENTIAL

ADAGIO SOLUTION: DURABLE, CONTIGUOUS, TRANSMURAL LESIONS …anywhere in the heart ULTC/PFCA for ventricular arrhythmias vCLAS ULTC for atrial arrhythmias iCLAS PRIVATE AND

CONFIDENTIAL PFCA for atrial arrhythmias Cryopulse

ULTC TEMPERATURES AND LESIONS

https://vimeo.com/936025754/f221e1388a?share=copy 8 PRIVATE AND CONFIDENTIAL

INVASIVE TREATMENTS OF CARDIAC ARRHYTHMIAS Treatment Options Original Surgical “Cut and Sew” Technique Cardiac Conditions Normal Electrical Conduction Atrial Fibrillation

(AF) Ventricular Tachycardia (VT) AFib is an irregular and often very rapid heart rhythm that can lead to blood clots, stroke, heart failure and other heart- related complications. VT is a heart rhythm problem (arrhythmia) caused by irregular

electrical signals in the lower chambers of the heart (ventricles). Catheter Ablation Using surgical cuts or catheter-created lesions to cut and isolate aberrant electrical circuits in the heart Blue images: adopted from: Mayo Clinic,

https://www.mayoclinic.org/ Surgical technique, adopted from: Ruaensgri S, Schill MR, Khiabani MJ, et al. The Cox-maze IV procedure in its second decade: still the gold standard? European Journal of Cardio-Thoracic Surgery 53 (2018) i19–i25 9 PRIVATE

AND CONFIDENTIAL

VENTRICULAR TACHYCARDIA ABLATIONS MARKET: OPPORTUNITY, DRIVERS AND INHIBITORS

VT MARKET: CURRENT SIZE AND GROWTH OPPORTUNITY VT Ablations, by Indication1 HF/Cardiomyopathy/ICDs Idiopathic VT Estimated US Market For VT Ablations2 2-3x3 market growth

opportunity with improved ablation effectiveness and reduced risk profile within EP practice ~ 3.5M ~$107M Ischemic ~$126M Cases (thousands) 200 150 2% CAGR 100 7% CAGR 50 Non-Ischemic ~$67M 0 Annual VT Ablations Annual Incidence of "Trigger" VTs HF /

Cardiomyopathy / ICDs Disease Prevalence Idiopathic VTs 1) The estimate VT ablation market size breakdown by etiology is based on management analysis of the reported epidemiologic information in various clinical settings and trials and disregards a

contribution of the ablations of VF or polymorphic VTs, and is subject to certain assumptions and limitations. See slides 54-65 of Appendix II – Market Sources and analysis for further detail. 2) The annual VT ablations, annual incidence of "trigger"

VTs, disease prevalence and market growth are based on management's analysis and projections using internal and third-party estimates and resources, subject to certain assumptions and limitations. Please see Slides 54-65 which are part of Appendix II -

Market Sources & Analysis for further details. 3) Refer to slide 69 for more information on market growth opportunity. 11 PRIVATE AND CONFIDENTIAL

VT MARKET: CURRENT RISK-BENEFIT LIMITS ABLATION THERAPY PENETRATION Use and Potential Benefits of VT Ablations1-5,7 • • • Management of VT emergencies (VT storms) Reduction

of recurring symptomatic arrhythmic events and ICD shocks Discontinuation or reduction of harmful AADs VS. Technical Challenges of the Procedure7,8 Procedural Risks and Complications6 Death Perforations/tamponade Major Bleeding Vascular Stroke

Unspecified Any Complication 2.7% 2.0% 5.6% 1.7% 0.4% 1.8% 11.5% • • • • Intraprocedural management of patient hemodynamics, particularly in patients with depressed ventricular function Maintaining catheter stability and myocardial contact Ablations

near coronary arteries Ablation of deep substrate, particularly in patients with non- ischemic cardiomyopathy Most are addressable or partially addressable by better ablation catheter technology 1) 2) 3) 4) 5) 6) 7) 8) PRIVATE AND CONFIDENTIAL Muser D,

Liang JJ, Pathak RK, et al. Long-Term Outcomes of Catheter Ablation of Electrical Storm in Nonischemic Dilated Cardiomyopathy Compared With Ischemic Cardiomyopathy. J Am Coll Cardiol EP 2017;3:767–78. Da Silva GL, Nunnes-Ferreira A, Cortez-Diaz N, et

al. Radiofrequency catheter ablation of ventricular tachycardia in ischemic heart disease in light of current practice: a systematic review and meta-analysis of randomized controlled trials. J Interv Card Electrophysiol. 2020 Dec;59(3):603-616 Sapp JL,

Wells GA, Parkash R, et al. Ventricular Tachycardia Ablation versus Escalation of Antiarrhythmic Drugs. N Engl J Med 2016;375:111-21 Liang JJ, Yang W, Santangeli P, et al. Amiodarone Discontinuation or Dose Reduction Following Catheter Ablation for

Ventricular Tachycardia in Structural Heart Disease. J Am Coll Cardiol EP 2017;3:503–11 Arenal A, Avila P, Jimenez-Candil J, et al. Substrate Ablation vs Antiarrhythmic Drug Therapy for Symptomatic Ventricular Tachycardia. J Am Coll Cardiol

2022;79:1441–1453 Cheung JW, Yeo I, Ip JE, et al. Outcomes, Costs, and 30-Day Readmissions After Catheter Ablation of Myocardial Infarct–Associated Ventricular Tachycardia in the Real World. Circ Arrhythm Electrophysiol. 2018;11:e006754. Cronin EM,

Bogun FM, Maury P, et al. 2019 HRS/EHRA/APHRS/LAHRS expert consensus statement on catheter ablation of ventricular arrhythmias. Heart Rhythm 2020; 17:e3-e154 Sultan A, Futyma P, Metzner A, et al. Management of ventricular tachycardias:insights on

centre settings, procedural workflow, endpoints, and implementation of guidelines—results from an EHRA survey. Europace 2024;26:1-10

ROLE OF ULTC LESION DEPTH IN ABLATION OF SCAR-MEDIATED VTs VENTRICULAR LESION DEPTH FROM DIFFERENT ENERGY SOURCES7,8 ISCHEMIC SCAR1,2 < 10% require additional epicardial

ablations3 18 16 critical sites of re-entrant VT circuits 14 Lesion Depth FOR ILLUSTRATION PURPOSES ONLY Endocardium Epicardium with coronary vessels NON-ISCHEMIC SCAR2,4,5 10 2.1x 8 2.6x 6 4 Endocardium critical sites of re-entrant VT circuits 12 >

30% require epicardial or endo- epicardial ablations3,6 2 0 RF 7 Healthy Tissue ULTC Scar Epicardium with coronary vessels 1) 2) 3) 4) 5) 6) 7) 8) 13 Bourantas CV, Nikitin NP, Loh HP, et al. Prevalence of scarred and dysfunctional myocardium in

patients with heart failure of ischaemic origin: A cardiovascular magnetic resonance study. Journal of Cardiovascular Magnetic Resonance 2011, 13:53 Piers SRD, Tao Q, de Riva Silva M, et al. CMR–Based Identification of Critical Isthmus Sites of

Ischemic and Nonischemic Ventricular Tachycardia. J Am Coll Cardiol Img 2014;7:774–84 Dinov B, Fielder L, Schonbauer R, et al. Outcomes in Catheter Ablation of Ventricular Tachycardia in Dilated Nonischemic Cardiomyopathy Compared With Ischemic

Cardiomyopathy. Circulation. 2014;129:728-736. Kanagasundram A, John RM, Stevenson WG. Sustained Monomorphic Ventricular Tachycardia in Nonischemic Heart Disease: Arrhythmia-Substrate Correlations That Inform the Approach to Ablation. Circ Arrhythm

Electrophysiol. 2019;12:e007312 Betensky BP, Kapa S, Desjardins B, et al. Characterization of Trans-septal Activation During Septal Pacing Criteria for Identification of Intramural Ventricular Tachycardia Substrate in Nonischemic Cardiomyopathy. Circ

Arrhythm Electrophysiol. 2013;6:1123-11306 Vaseghi M, Hy TY, Tung R, et al. Outcomes of Catheter Ablation of Ventricular Tachycardia Based on Etiology in Nonischemic Heart Disease. J Am Coll Cardiol EP 2018;4:1141–50 Im SI, Higuchi S, Lee A, et al.

Pulsed Field Ablation of Left Ventricular Myocardium in a Swine Infarct Model. J Am Coll Cardiol EP 2022;8:722-731 Dewland TA, Higuchi S, Venkateswaran R, Lee C, Gerstenfeld EP. AB-452672-2 Ultra-low Temperature Cryoablation Versus Ultra-low

Temperature Cryoablation Combined With Pulsed Field Ablation In A Swine Ventricular Infarct Model. Heart Rhythm 2023;20:S92-S93. doi: doi.org/10.1016/j.hrthm.2023.03.395 . Reference slide #87 for further detail. PRIVATE AND CONFIDENTIAL 8

ADAGIO MEDICAL VT CRYOABLATION SYSTEM A New Benchmark in VT Ablations Differentiated and Highly Desirable Functional Performance • Titratable lesion depth and size • Catheter

stability during ablation • Ability to ablate deep intramural scar • No need to irrigate (simplifies hemodynamic management in HF patients) INDICATIONS FOR USE1: The Adagio Medical Inc. VT Cryoablation System (Catheter and Console) is indicated for the

treatment of monomorphic ventricular tachycardia by ablation of arrhythmogenic tissue that drives and maintains these arrhythmias. 1) vCLAS Cryoablation Catheter Instructions for Use. P/N 108-0118-001. 14 PRIVATE AND CONFIDENTIAL Common Cryoablation

Console

CRYOCURE-VT STUDY (NCT # 04893317) Patients 64 patients, Rx-refractory persistent recurring monomorphic VT of both ischemic and non-ischemic etiology Endpoints Procedural

safety, acute and chronic effectiveness Sites 9 centers Data Readout Late-Breaking Clinical Trial Presentation at EHRA 2024 CE-Mark Received on March 15, 2024 Next Steps Commercial launch in Q1 2024 / Results to be presented at EHRA 2024 / Initiation

of post-market studies Initial Results First-in-human experience with ultra-low temperature cryoablation for monomorphic ventricular tachycardia1 Note: Expectations are preliminary and subject to change. Please see Disclaimer Forward Looking Statements

on slide 2. (1) De Potter T, Balt J, Boersma L, et al. First-in-Human Experience With Ultra-Low Temperature Cryoablation for Monomorphic Ventricular Tachycardia Open Access. J Am Coll Cardiol EP. 2023 May, 9 (5) 686–691 15 PRIVATE AND CONFIDENTIAL

vCLAS CRYOCURE-VT CLINICAL TRIAL: REDEFINING RISK/BENEFIT IN VT ABLATIONS Exceptional Acute Effectiveness and Safety Excellent Procedural Profile CRYOCURE-VT RF-based

Reference 185 min 225-273 min 9 24 - 34 Procedure Time # of lesions 94% x 0% x FREEDOM FROM CLINICAL VTs* MAEs * patients with inducible clinical VTs pre-ablation and which were non-inducible post-ablation Adagio Medical, Inc. CryoCure-VT Interim

Clinical Investigation Report. CS-191. Data on File. 16 PRIVATE AND CONFIDENTIAL

FULCRUM-VT PIVOTAL STUDY (NCT # 05675865) Patients 206 patients, inclusive of patients enrolled in Early Feasibility Study, Rx-refractory persistent recurring monomorphic VT

of both ischemic and non-ischemic etiology Endpoints Procedural safety, acute and chronic effectiveness Sites Up to 20 centers Data Readout Expected in Q3 2025 https://clinicaltrials.gov/study/NCT05675865 FULCRUM-VT Early Feasibility IDE Study

Vanderbilt University Medical Center Banner University Health Center Mount Sinai Hospital UC San Francisco 17 PRIVATE AND CONFIDENTIAL • 20 patients enrolled • On April 26, 2024 US FDA approved FULCRUM-VT Pivotal IDE Supplement, increasing the number

of study sites to 20 and number of subjects to 206.

HIGHLY CONCENTRATED MARKET DRIVES COMMERCIAL STRATEGY Estimated Annual VT Ablations Volumes in 20222 Estimated VT Ablations Penetration in Europe (2016)1 and US (2023)2

35,000 US 98 - 124 30,000 25,000 20,000 15,000 10,000 5,000 - US GERMANY • 2024 Adagio’s commercial focus: UK and Germany, large volume / key opinion leader accounts • Key performance metric: share uptake, translated (mid-to-long term) in increased

therapy penetration • Clinical development through post-market studies, scientific publications and peer-group networks 1) Ratikainen MJP, Arnar DO, Merkely B, et al. A Decade of Information on the Use of Cardiac Implantable Electronic Devices and

Interventional Electrophysiological Procedures in the European Society of Cardiology Countries: 2017 Report from the European Heart Rhythm Association. Europace (2017) 19, ii1–ii90 2) Country-level volume of VT ablations is based on management's

analysis and projections using internal and third-party information, subject to certain assumptions and limitations. Please see slide 57 (analysis of the current VT ablations volume in the USA), 71 and 72 which are part of Appendix II - Market Sources

& Analysis for further details. 18 PRIVATE AND CONFIDENTIAL UK SPAIN

US MARKET US VT Market Structure1 100.0% Cumulative Number of Cases, % 90.0% 80.0% 70.0% 60.0% 50.0% 40.0% Top 150 sites perform ~ 50% of VT procedures 30.0% 20.0% 10.0% 0.0%

# of sites, in rank order of VT volumes 1) Based on management's analysis of Medicare FFS data, subject to certain assumptions and limitations. Please see Slide #71 which is part of Appendix II - Market Sources & Analysis for further details. 19

PRIVATE AND CONFIDENTIAL

NEAR-TERM VT VALUATION -DRIVING MILESTONES 2024 2026 2025 Cryocure-VT Primary Endpoints (EHRA 2024) Q1 vCLAS CE-Mark and EU launch Q2 Q2 FULCRUM-VT Pivotal IDE Start Note:

Milestones are preliminary and subject to change. Please see Disclaimer – Forward-Looking Statements on slide 2. 20 PRIVATE AND CONFIDENTIAL Q3 FULCRUM-VT Pivotal Primary Endpoints Q1 vCLAS PMA and US launch

ATRIAL FIBRILLATION MARKET: OPPORTUNITY, DRIVERS AND INHIBITORS

AF MARKET: FULL UPSIDE REQUIRES IMPROVEMENT IN LONG-TERM OUTCOMES Current AF Ablation Market By Clinical Diagnosis1 Paroxysmal AF (PAF) • • • US AF Disease2 and Treatment

Statistics3,4 4% CAGR Persistent AF (PsAF) 9 Relatively worse outcomes Weaker indications More “PVI+”* ablations 8 Cases (millions) 7 ~0.8B 6-8x upside in ablations if Class I indication as 1st line therapy – not achievable at current rates of

recurrence, re-ablations and associated morbidity 6 5 8.6 4 4% CAGR 3 ~$1.2B 2 • • • Relatively better outcomes Stronger indications Mostly “PVI only”* ablations 1 14% CAGR 0.23 1.9 0 Annual AF Ablations Annual AF Incidence * “PVI only” ablations refer

to the strategy of pulmonary vein (PV) isolation without any ablations of non-PV targets. “PVI+” refers to procedures combining PV isolation with ablations of non-PV targets. 1) Management market size estimates and characterization, subject to certain

assumptions and limitations. Refer to slides 50 and 65-69 in Appendix II - Market Sources &Analysis for further details on the market and subsequent slides on the discussion of outcomes. 2) C. Tsao, et al. Heart Disease and Stroke Statistics-2022

Update: A Report From the American Heart Association. Circulation 2022;145:e153-e169 3) Adagio Medical Analysis of Medicare FFS and Commercial Claims 4) The annual AF ablations, annual AF incidence, AF prevalence and market growth are based on

management's analysis and projections using internal and third-party estimates and resources, subject to certain assumptions and limitations. Please see Slides 47-52 which are part of Appendix II - Market Sources & Analysis for further details. 22

PRIVATE AND CONFIDENTIAL AF Prevalence

AF ABLATION MODALITIES: EQUIVALENT SAFETY AND EFFICACY OUTCOMES Freedom From AF/AT After Single Procedure In Paroxysmal AF Patients CIRCA-DOSE TRIAL (2019)1 ADVENT TRIAL

(2023)2 - 73.1% • 55% RF • 45% Cryoballoon . 1) 2) 23 Andrade JG, et al. Cryoballoon or radiofrequency ablation for atrial fibrillation assessed by continuous monitoring: A randomized clinical trial. Circulation 2019;140:1779–1788 Reddy VY, Gerstenfeld

W, Natale A, et al. Pulsed Field or Conventional Thermal Ablation for Paroxysmal Atrial Fibrillation. N Engl J Med 2023; 389:1660-1671 PRIVATE AND CONFIDENTIAL - 71.3%

PERSISTENTLY WORSE OUTCOMES IN PERSISTENT AF PATIENTS Reported Results of Catheter Ablation in Persistent AF Patients Across Multiple Technologies 75 69% 58% 50 51% n=339 71%

n=196 68% 65% 61% n=101 n=102 55% n=153 n=3,133 n=150 n=7,502 25 Catheter Ablation RF1 w/o AAD w/ or w/o AAD Minimally Invasive Surgical Ablation1 w/o AAD w/ or w/o AAD Cryoballoon2 Hybrid CONVERGE3 PULSED AF4 2023 MANIFEST5 2023 PFA (1) Berger WR, et

al. Persistent atrial fibrillation: A systematic review and meta-analysis of invasive strategies, International Journal of Cardiology 2019;278:137–143 (2) Boveda S, Metzner A, Nguyen D, et al. Single-procedure Outcomes and QOL Improvement 12 Months

Post-Cryoballoon Ablation in Persistent AF. JACC EP 2018; 4:1440-1447 (3) DeLurgio DB, et al. Hybrid convergent procedure for the treatment of persistent and long-standing persistent atrial fibrillation. Circ Arrhythm Electrophysiol. 2020;13:e009288

(4) Verma A, Haines DE, Boersma LV, et al. Pulsed Field Ablation for the Treatment of Atrial Fibrillation: PULSED AF Pivotal Trial. Circulation. 2023;147, in press (5) Turagam MK, Neuzil P, Schmidt B, et al. Safety and Effectiveness of Pulsed Field

Ablation to Treat Atrial Fibrillation: One-Year Outcomes from the MANIFEST-PF Registry. Circulation. 2023;148:35–46 (6) Kisler PM, Chieng D, Sugumar H, et al. Effect of Catheter Ablation Using Pulmonary Vein Isolation With vs Without Posterior Left

AtrialWall Isolation on Atrial Arrhythmia Recurrence in Patients With Persistent Atria Fibrillation: The CAPLA Randomized Clinical Trial. JAMA. 2023;329(2):127-135 24 54% 52% n=168 n=170 PVI PVI+PWI registry Freedom from AF of AT/AF at 12 months (%)

100 Directional comparison only. The data presented below is not based on head-to-head clinical trials, as such data may not be directly comparable due to differences in study protocols, conditions, patient populations and reporting standards, and

should not be relied upon to predict the relative efficacy or other benefits of the associated products and technologies PRIVATE AND CONFIDENTIAL CAPLA6 w/o AAD 2023 Modern RF

DURABLE, CONTIGUOUS, TRANSMURAL LESIONS FOR TREATMENT OF AFIB iCLAS Cryoablation Catheter Esophageal Warming Balloon Shaped Stylets iCLAS Cryoablation System is CE-Mark

approved for the treatment of drug refractory, recurrent, symptomatic, Paroxysmal Atrial Fibrillation (PAF), Persistent Atrial Fibrillation (PsAF), and Atrial Flutter (AFL). In the U.S.A., iCLAS system is an investigational device, limited by Federal

law to investigational use (IDE # G180263). 25 PRIVATE AND CONFIDENTIAL • • • Same ULTC platform (as vCLAS) Same scientific principles of lesion formation (as vCLAS) Catheter implementation for patient-tailored atrial ablations

CRYOCURE-2 CLINICAL TRIAL Effectiveness Kaplan-Meier Estimates Freedom from AF (%) 100% 85.9% 80% : 82.6% 60% All AF, n=65 Persistent AF, n=44 40% CRYOCURE-2 20% 0% 0 3 6 9

Months from Index Procedure NCT #02839304 12 Safety Cryomapping Cohort (n=65) Phrenic nerve palsy Resolved during procedure Resolved during follow-up Unresolved Total device-related events 1 1 1 0 1.5% Cryocure-2 (NCT #02839304) data have been used to

obtain CE-mark approval for iCLAS Cryoablation System No esophageal fistula, pericarditis, heart block T. De Potter, et al. Ultralow Temperature Cryoablation For Atrial Fibrillation, Primary Outcome Results On Efficacy and Safety. The Cryocure-2 Study.

JACC Clinical Electrophysiology 2022; Aug;8(8):1034-1039 26 PRIVATE AND CONFIDENTIAL

LEVERAGING VT PENETRATION INTO AF MARKET SHARE US Ablation Market Structure1 Cumulative Number of Cases, % 100% 90% 80% 70% 60% 50% 40% Top 150 sites perform ~ 50% of VT

procedures Top 150 sites perform ~ 40% of AF procedures 30% 20% 10% 0% # sites, in rank order of VT volumes VT Volumes AF Volumes • AF market is slightly less concentrated compared to VT • Access to 50% of VT volumes creates potential pull-through in ~

40% of AF volumes 1) Based on management's analysis of Medicare FFS data, subject to certain assumptions and limitations. Please see Slides 48-, 50, 71 and 73 which are part of Appendix II - Market Sources & Analysis for further details. 27 PRIVATE

AND CONFIDENTIAL

WHAT IS PULSED FIELD CRYOABLATION?

PFCA: MODULATING TISSUE IMPEDANCE TO OPTIMIZE PFA ENERGY DELIVERY Impedance of bovine myocardial tissue as a function of temperature1 Ohm’s Law 103 V=RxI Normalized Impedance

|Z| (Ohm) Representative curve, f=20kHz Electric Field Strength 102 -15 -10 -5 Temperature • Increased impedance of frozen tissue leads to reduced electric current for the same magnitude of electric field or and increased magnitude of electric field

for the same magnitude of electric current as compared to normal temperature tissue • Opportunity to modulate pulsed field strength and penetration depth (as well as associated currents) by pre-treatment with ultra-low temperature cryoablation2 •

Electric field exclusion from low Z (warm) tissues – enhancing selectivity of ablation2 0 5 10 15 (0C) 1) Fischer G et al. Impedance and conductivity of bovine myocardium during freezing and thawing at slow rates – implications for cardiac

cryoablation. Medical Engineering and Physics 2019; 74: 89-98 2) Daniels CS, Rubinsky B. Temperature Modulation of Electric Fields in Biological Matter. PLoS ONE 2011; 6:e20877. doi:10.1371/journal.pone.0020877 29 Current density Impedance 101 100 -20

E=z xJ PRIVATE AND CONFIDENTIAL

PFCA: COMBINING THE BENEFITS OF ULTC AND MINIMIZING THE LIMITATIONS OF PFA Single catheter with ablation element capable of both ultra-low temperature cryoablation and PFA

PFA Console Cryoablation Console 30 PRIVATE AND CONFIDENTIAL Connected to standalone or integrated cryoablation and PFA consoles 1 2 Lesion Formation: Short duration ultra-low temperature cryoablation Immediately followed by PFA

PFCA: COMBINING THE BENEFITS OF ULTC AND MINIMIZING THE LIMITATIONS OF PFA PFCA vs ULTC: up to 85% shorter ablation cycle for the same lesion depth1 For illustration purposes

only. Adopted from (5). Note: Management's estimates which are subject to significant uncertainty and may prove to be incorrect. Please see Disclaimer - Management's Estimates on slide 2. 1) 2) 3) 4) 5) 31 PFCA vs PFA2,3: • Potentially deeper lesions •

Consistent tissue contact • Contiguity “by design” • No phrenic nerve capture • No skeletal muscle activation • No or minimized microbubbles • No or minimized coronary spasm4 Assuming 3 min ablation cycle (freeze-thaw-freeze) for ULTC vs 30 seconds

freeze for PFCA. Adagio iCLAS Cryoablation Catheter IFU 108-0064-001 and Adagio Cryopulse Catheter IFU 108-0138-001 Verma A, Feld GK, Cox JL, et al. Combined pulsed field ablation with ultra-low temperature cryoablation: A preclinical experience. J

Cardiovasc Electrophysiol. 2022;1–10 Boston Scientific issued an Urgent Field Safety Notice regarding its PFA products dated September 15, 2022, which, among others, warned about the injuries that might potentially caused by the use of PFA:

http://www.bostonscientific.com/content/dam/bostonscientific/quality/documents/Recent%20Product%20Advisories/September%202022%20FARAPULSE%20PFA%20Physician%20Letter%20-%20EU%20English.pdf Preliminary data, courtesy Dr. E. Gerstenfeld (UCSF). AF

Symposium 2023. https://vimeo.com/798627743/00bc646d3b Essebag V, Boersma L, Petry J, et al. Acute Procedural Characteristics and Safety of Pulsed Field Cryoablation for Persistent AF: Multicenter Results from the First in Human PARALELL Trial. EHRA

2024 PRIVATE AND CONFIDENTIAL

PRE-CLINICAL EVIDENCE1: SHORTER ABLATIONS, DEEPER LESIONS, ENHANCED SELECTIVITY PFCA LESION IN ~ 6mm THICK CTI Lesion depth of 30 seconds, single freeze ULTC Lesion depth

enhancement due to pulsed field Blood vessel and surrounding muscle bundle preservation, suggestive of PFA exclusion from the unfrozen tissue POTENTIAL MECHANISM OF AVOIDING CORONARY VASOSPASMS REPORTED IN ENDOCARDIAL2,3 AND EPICARDIAL4 PFA 1) 2) 3) 4)

32 Verma A, Feld GK, Cox JL, et al. Combined pulsed field ablation with ultra-low temperature cryoablation: A preclinical experience. J Cardiovasc Electrophysiol. 2022;1–10 Reddy VY, Petru J, Funasako M, et al. Coronary Arterial Spasm During Pulsed

Field Ablation to Treat Atrial Fibrillation. Circulation. 2022;146:1808–1819 Gunaverdene MA, Schaeffer BN, Jularic M, et al. Coronary Spasm During Pulsed Field Ablation of the Mitral Isthmus Line. JACC: Clinical Electrophysiology 2021; 7:1618-1620

Higuchi S, Im SI, Stillson C, et al. Effect of Epicardial Pulsed Field Ablation Directly on Coronary Arteries. J Am Coll Cardiol EP 2022;8:1486–1496 PRIVATE AND CONFIDENTIAL

EU PARALELL TRIAL (NCT #05408754): Pulsed Field Ablation and Pulsed Field Cryoablation for Persistent Atrial Fibrillation Patients Projecting 90 PsAF patients (60 PFCA and 30

PFA) Endpoints Procedural safety, acute and chronic effectiveness Sites 7 sites in Canada, the Netherlands, Ireland, Belgium, UK, Czech Republic and Poland and 1 additional site expected in Canada1 Data Readout Expected in Q4 2025 CE-Mark Expected in

Q1 2026 Next Steps • Estimated study enrollment completion = Q4 2024 followed by 12-months follow-up • CE-mark application/submission expected to start Q2 2025 PFA 1) 33 Expectations are preliminary and subject to change. Please see Disclaimer --

Forward-Looking Statements on slide 2. PRIVATE AND CONFIDENTIAL PFCA

NEAR-TERM AF VALUATION-DRIVING MILESTONES 2024 iCLAS PMA Approval Q3 iCLAS IDE Primary Endpoints Note: Milestones are preliminary and subject to change. Please see Disclaimer

– Forward-Looking Statements on slide 2. 34 PRIVATE AND CONFIDENTIAL 2026 2025 Q1 PARALELL Primary Endpoints Q4 Cryopulse CE-Mark Q1

THE COOLEST CATHETER ABLATION TECHNOLOGY THANK YOU 35 © COPYRIGHT 2023 ADAGIO MEDICAL, INC. COMPANY CONFIDENTIAL

APPENDIX I 36

HIGHLY ACCOMPLISHED EXECUTIVE TEAM Olav Bergheim CEO & President 30+ years of experience in life sciences Hakon Bergheim Chief Operating Officer 10+ years of experience

in medical devices John Dahldorf Chief Financial Officer Nabil Jubran Chief Compliance Officer 20+ years of corporate finance experience 20+ years of medical device experience Tim Glynn VP of Global Sales Ilya Grigorov Vice President, Global Marketing

and Product Management 25+ years of medical experience 1 Founder of 3F Therapeutics Prelude Corporation 1 20+ years of medical device experience 1 Note: Olav Bergheim serves as the CEO of the Company pursuant to the terms of a Facilities and Shared

Services Agreement between the Company and Fjord Ventures, LLC. Based on such agreement, Mr. Bergheim is compensated for serving in such position by Fjord Ventures, LLC. Two funds managed by Mr. Bergheim, one of which is affiliated with Fjord Ventures,

LLC, have invested an aggregate of approximately $10M among the approximately $100M investment in aggregate that the Company has received so far. 1) Volcano Corporation was acquired by Royal Philips in 2015. 37 Doug Kurschinski Vice President of

Clinical Affairs 30+ years of medical device experience

SELECTED RISK FACTORS No representation or warranty (whether express or implied) has been made by ARYA, the Company, ListCo or any of their respective directors, officers,

employees, affiliates, agents, advisors or representatives with respect to the proposed PIPE financing or Business Combination or the manner in which the proposed PIPE financing or Business Combination is conducted, and the recipient hereby disclaims

any such representation or warranty. The recipient of this Presentation acknowledges that ARYA, the Company, ListCo and their respective directors, officers, employees, affiliates, agents, advisors or representatives are under no obligation to accept

any offer or proposal by any person or entity regarding the PIPE financing and the Business Combination. None of ARYA, the Company, ListCo or any of their respective directors, officers, employees, affiliates, agents, advisors or representatives has

any legal, fiduciary or other duty to any recipient of this Presentation with respect to the manner in which the proposed PIPE financing or Business Combination is conducted. Unless the context otherwise requires, all reference in this subsection to

the “Company,” “Adagio,” “we,” “us” or “our” refer to Adagio Medical, Inc. and its subsidiaries, prior to, or following, the consummation of the Business Combination, as the context requires. The risks presented below are some of the general risks to

the business and operations of Adagio, ARYA Sciences Acquisition Corp IV (“ARYA”) and Aja Holdco, Inc., of which Adagio will become a subsidiary following the consummation of the Business Combination (the “Post-Combination Company”), and such risks are

not exhaustive. The list below is qualified in its entirety by disclosures that will be contained in the future filings by ARYA and the Post-Combination Company, or of each of their respective affiliates or by third parties with the U.S. Securities and

Exchange Commission (the “SEC”), including any documents filed in connection with the proposed transaction. The risks presented in such filings may differ significantly from and may be more extensive than those presented below. The list below is not

exhaustive, and you are encouraged to perform your own investigation with respect to the business, financial condition and prospects of Adagio or the Post-Combination Company. You should carefully consider the following risk factors in addition to the

information included in this presentation. Adagio or the Post-Combination Company may face additional risks and uncertainties that are not presently known to it or that it currently deems immaterial, which may also impair Adagio’s or the

Post-Combination Company’s business or its financial condition. These risks speak only as of the date of this presentation, and neither the Company, ARYA nor the Post-Combination Company undertake any obligation to update the disclosure contained

herein. In making any investment decision, you should rely solely upon independent investigation made by you. You acknowledge that you are not relying upon, and have not relied upon, any of the summary of risks or any other statement, representation or

warranty made by any person or entity other than the statements, representations and warranties of the Company, ARYA or the Post-Combination Company explicitly contained in any definitive agreement you enter into. You acknowledge that you have such

knowledge and experience in financial and business matters as to be capable of evaluating the merits and risks of an investment in the Company or the Post-Combination Company and you have sought such accounting, legal and tax advice from your own

advisors as you have considered necessary to make an informed decision. 38 PRIVATE AND CONFIDENTIAL

SELECTED RISK FACTORS (CONT.) 39 The consummation of the Business Combination is subject to a number of conditions, and if those conditions are

not satisfied or waived, the Business Combination may not be completed; Some of ARYA’s, the Company’s or the Post-Combination Company’s officers and directors may have conflicts of interest that may influence them to approve the Business Combination

without regard to your interests; ARYA’s directors and officers may have interests in the Business Combination different from the interests of ARYA, the Company, the Post-Combination Company or their respective shareholders; If ARYA is unable to close

certain financing transactions and sufficient shareholders exercise their redemption rights in connection with the Business Combination such that there is less than $60 million of cash proceeds available from ARYA’s trust account and the financing

transactions, then ARYA may lack sufficient funds to consummate the Business Combination; A portion of the total outstanding shares of the Post-Business Combination Company is expected to be restricted from immediate resale but may be sold into the