UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE

ISSUER

PURSUANT TO RULE 13a-16

OR 15d-16 UNDER

THE SECURITIES EXCHANGE

ACT OF 1934

For the month of December

2023

Commission File Number:

001-40540

Atour Lifestyle Holdings

Limited

(Exact name of registrant

as specified in its charter)

18th floor, Wuzhong Building,

618 Wuzhong Road, Minhang

District,

Shanghai, People’s

Republic of China

(+86) 021-64059928

(Address of principal

executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F:

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

Atour Lifestyle Holdings Limited |

| |

|

| |

By: |

/s/ HAIJUN WANG |

| |

|

Name: |

Haijun Wang |

| |

|

Title: |

Chairman of the Board of Director and Chief Executive Officer |

| |

|

| Date: December 6, 2023 |

Exhibit

99.1

Atour Lifestyle Holdings

Limited Announces Pricing of Upsized Registered Secondary

Offering of

American Depositary

Shares by Legend Capital

SHANGHAI, China, December 6, 2023 /GlobeNewswire/

— Atour Lifestyle Holdings Limited (“Atour” or the “Company”) (NASDAQ: ATAT), a leading hospitality

and lifestyle company in China, today announced the pricing of an upsized registered secondary underwritten offering by entities affiliated

with Legend Capital (“Legend Capital”) of an aggregate of 9,600,000 American depositary shares (the “ADSs”

and such offering, the “Secondary Offering”), each ADS representing three Class A ordinary shares of par value US$0.0001

each of the Company, at an offering price of US$15.80 per ADS. The Secondary Offering was upsized from 8,000,000 ADSs, as previously disclosed,

to 9,600,000 ADSs. The underwriters in the Secondary Offering will have a 30-day option to purchase up to 1,440,000 additional ADSs from

Legend Capital.

The Company will not receive any proceeds

from the sale of the ADSs by Legend Capital. The gross proceeds of the Secondary Offering to Legend Capital amounts to approximately US$151.7

million, without deducting underwriting discounts and commissions and offering expenses payable by Legend Capital and assuming the underwriters

do not exercise the option to purchase additional ADSs. The closing of the Secondary Offering will be subject to customary closing conditions.

BofA

Securities, Inc., CMB International Capital Limited and Citigroup Global Markets Inc. act as the joint bookrunners for the Secondary

Offering.

This

Secondary Offering is made pursuant to an effective shelf registration statement on Form F-3 filed with the U.S. Securities and Exchange

Commission (the “SEC”), which is available on the SEC’s website at www.sec.gov. This Secondary Offering

is being made by means of a prospectus supplement and an accompanying prospectus included in the Form F-3. The Form F-3 and the prospectus

supplement are available on the SEC’s website at www.sec.gov. Copies of the prospectus supplement and the accompanying prospectus

related to this Secondary Offering may be obtained by contacting BofA Securities, Inc., One Bryant Park, New York, NY 10036, United States

of America, Attention: Prospectus Department, telephone: +1-800-294-1322, email: dg.prospectus_requests@bofa.com; CMB International Capital

Limited, 45F, Champion Tower, 3 Garden Road, Central, Hong Kong, Attention: CMBI ECM, telephone: +852-3761-8990, email: ECMs@cmbi.com.hk;

Citigroup Global Markets Inc., c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, New York 11717, or by telephone

at +1-800-831-9146, or by emailing prospectus@citi.com.

This

press release shall not constitute an offer to sell, or a solicitation of an offer to buy, the securities described herein, nor shall

there be any offer, solicitation or sale of these securities in any state or jurisdiction in which such an offer, solicitation or sale

would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About

Atour Lifestyle Holdings Limited

Atour

Lifestyle Holdings Limited (NASDAQ: ATAT) is a leading hospitality and lifestyle company in China, with a distinct portfolio of lifestyle

hotel brands. Atour is the leading upper midscale hotel chain in China and is the first Chinese hotel chain to develop a scenario-based

retail business. Atour is committed to bringing innovations to China’s hospitality industry and building new lifestyle brands around

hotel offerings. For more information, please visit https://ir.yaduo.com.

Safe

Harbor Statement

This

press release contains forward-looking statements. These statements are made under the "safe harbor" provisions of the U.S.

Private Securities Litigation Reform Act of 1995. Statements that are not historical facts, including statements about the Company's

beliefs and expectations, are forward-looking statements. In some cases, forward-looking statements can be identified by words or phrases

such as "may," "will," "expect," "anticipate," "target," "aim," "estimate,"

"intend," "plan," "believe," "potential," "continue," "is/are likely to,"

or other similar expressions. Forward-looking statements involve inherent risks and uncertainties, and a number of factors could cause

actual results to differ materially from those contained in any forward-looking statement. Further information regarding these and other

risks, uncertainties or factors is included in the Company's filings with the SEC. All information provided in this press release is

as of the date of this press release, and the Company does not undertake any duty to update such information, except as required under

applicable law.

Investor

Relations Contact

Atour

Lifestyle Holdings Limited

Email:

ir@yaduo.com

Piacente

Financial Communications

Email:

Atour@tpg-ir.com

Tel:

+86-10-6508-0677

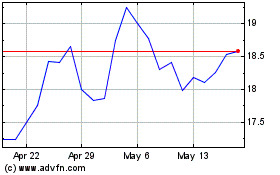

Atour Lifestyle (NASDAQ:ATAT)

Historical Stock Chart

From Nov 2024 to Dec 2024

Atour Lifestyle (NASDAQ:ATAT)

Historical Stock Chart

From Dec 2023 to Dec 2024