Atara received FDA Complete Response Letter

(CRL) solely related to inspection findings at third-party

manufacturer

CRL did not identify deficiencies related to

clinical efficacy or safety data in the Biologics License

Application (BLA), and the FDA did not request any new clinical

studies to support approval

Atara remains committed to working with the

FDA, Pierre Fabre Laboratories, and the third-party manufacturer to

bring EBVALLO to patients in the U.S.

Atara has engaged a well-known financial

advisor to support exploration of all strategic options

Atara remains focused on preserving future

EBVALLO financial value for the benefit of all stockholders

Atara has entered into a non-binding term sheet

with Redmile Group to provide up to $15 million in funding, which

Atara believes is sufficient to fund the ongoing activities

required to achieve BLA approval

Atara Biotherapeutics, Inc. (Nasdaq: ATRA), a leader in T-cell

immunotherapy, leveraging its novel allogeneic Epstein-Barr virus

(EBV) T-cell platform to develop transformative therapies for

patients with cancer and autoimmune diseases, today announced it

received a Complete Response Letter (CRL) from the U.S. Food and

Drug Administration (FDA) for the EBVALLOTM (tabelecleucel)

Biologics License Application (BLA) as monotherapy treatment for

adult and pediatric patients two years of age and older with

Epstein-Barr virus positive post-transplant lymphoproliferative

disease (EBV+ PTLD), who have received at least one prior therapy

including an anti-CD20 containing regimen.

The CRL was solely related to observations as part of a standard

pre-license inspection of a third-party manufacturing facility for

EBVALLO. The CRL did not identify any deficiencies related to the

manufacturing process, the clinical efficacy, or clinical safety

data in the BLA, and the FDA did not request any new clinical

trials to support the approval of EBVALLO.

“We are working closely with our partner Pierre Fabre

Laboratories, the FDA, and the third-party manufacturer to address

the feedback to support marketing approval for EBVALLO,” said Cokey

Nguyen, Ph.D., President and Chief Executive Officer of Atara.

“Once the third-party manufacturer GMP compliance issues have been

adequately addressed, we will file for a resubmission, which we

would expect to be potentially approved within six months of

resubmission. Atara and its partner Pierre Fabre remain confident

in the potential of EBVALLO and are committed to bringing this

potential first-in-class medicine to U.S. patients with EBV+ PTLD

who have limited treatment options and significant unmet need.”

“We are disappointed by the delay and are willing to work with

Atara on appropriate next steps to bring EBVALLO to U.S. patients

that suffer from this deadly rare disease with no approved

therapies,” said Eric Ducournau, CEO of Pierre Fabre

Laboratories.

EBVALLO, which was granted marketing authorization by the

European Commission in December of 2022, is an allogeneic,

EBV-specific T-cell immunotherapy designed to target and eliminate

EBV-infected cells. The BLA in the U.S. is based on results from

the pivotal ALLELE study demonstrating a statistically significant

50% Objective Response Rate (ORR) and a favorable safety

profile.

A second third-party manufacturer, FUJIFILM Diosynth

Biotechnologies (FDB) manufacturing facility in Thousand Oaks, CA,

has recently been approved to manufacture EBVALLO by the EMA,

making it a critical component of the planned long-term global

manufacturing strategy for EBVALLO.

Corporate Updates

Review of Strategic Alternatives: The Board regularly

reviews Atara’s strategic plan, priorities, and opportunities as

part of its commitment to act in the best interest of Atara and its

stockholders. Atara had previously engaged a well-known financial

advisor to support the assessment of opportunities to advance and

realize value from Atara’s CAR-T assets. The advisor’s scope has

recently expanded to include a wider range of additional strategic

alternatives which may include, but are not limited to, an

acquisition, merger, reverse merger, other business combinations,

sale of assets, or other strategic transactions. Through this

process, Atara is already in active discussions with several

potential parties. However, there can be no assurance regarding the

results or outcome of this process. It is possible that Atara may

not pursue a strategic alternative or transaction or that any

strategic alternative or transaction, if pursued, will be completed

on attractive terms, or that a strategic alternative or transaction

may not ultimately be consummated.

Preservation of Future EBVALLO Milestone and Royalty Income

Value to Shareholders: Atara remains eligible to receive a $60

million milestone payment from Pierre Fabre upon FDA approval of

the EBVALLO BLA, as well as significant double-digit tiered

royalties as a percentage of net sales, and milestones related to

commercial sales of EBVALLO. Atara remains committed to preserving

this potential future value for all stockholders.

If a strategic resolution is not reached to provide funding for

its CAR-T development programs in Q1 2025, Atara intends to suspend

all CAR-T activities, and significantly reduce company expenses and

activities to only those that support the approval of EBVALLO,

including through a near-term progressive transfer of all

operational activities related to EBVALLO to Pierre Fabre.

Atara has entered into a non-binding term sheet with Redmile

Group to provide up to $15 million in funding through an equity

line of credit, which Atara believes is sufficient to fund the

ongoing activities required to achieve BLA approval. Atara is also

exploring alternative financing options, including non-dilutive

sources of capital.

“We are pleased to have the strong confidence from a key

stockholder in the future of EBVALLO and access to the capital to

support the transfer of EBVALLO activities to Pierre Fabre,

creating opportunities for value creation through the anticipated

U.S. approval and launch,” said Cokey Nguyen, Ph.D., President and

Chief Executive Officer of Atara.

Financial Update

- Cash, cash equivalents and short-term investments as of

year-end 2024 totaled approximately $43 million

- Entered into non-binding term sheet with Redmile Group to

provide up to $15 million in available capital through an equity

line of credit

- Several additional options are under consideration as part of

the exploration of financial and strategic alternatives

This estimate of our cash, cash equivalents and short-term

investments as of December 31, 2024 is preliminary, has not been

audited and is subject to change upon completion of our financial

statement closing procedures. Our independent registered public

accounting firm has not audited or performed any procedures with

respect to this estimate. Additional information and disclosure

would be required for a more complete understanding of our

financial position and results of operations as of December 31,

2024.

About Atara Biotherapeutics, Inc.

Atara is harnessing the natural power of the immune system to

develop off-the-shelf cell therapies for difficult-to-treat cancers

and autoimmune conditions that can be rapidly delivered to patients

from inventory. With cutting-edge science and differentiated

approach, Atara is the first company in the world to receive

regulatory approval of an allogeneic T-cell immunotherapy. Our

advanced and versatile T-cell platform does not require T-cell

receptor or HLA gene editing and forms the basis of a diverse

portfolio of investigational therapies that target EBV, the root

cause of certain diseases, in addition to next-generation

AlloCAR-Ts designed for best-in-class opportunities across a broad

range of hematological malignancies and B-cell driven autoimmune

diseases. Atara is headquartered in Southern California. For more

information, visit atarabio.com and follow @Atarabio on X and

LinkedIn.

Forward-Looking Statements

This press release contains or may imply "forward-looking

statements" within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934. For

example, forward-looking statements include statements regarding:

(1) the development, timing and progress of tab-cel, including the

BLA and potential indications, the timing for FDA review of any

resubmission of the BLA, the potential characteristics and benefits

of tab-cel, and the results of, and prospects for, the global

partnership with Pierre Fabre Laboratories involving tab-cel, and

the potential financial benefits to Atara as a result of the global

partnership with Pierre Fabre, including the receipt, timing and

amount of any payments to be received by Atara thereunder; (2) the

development, timing and progress of Atara’s AlloCAR-T programs

(including ATA3219 and ATA3431), including potentially suspending

such programs; (3) Atara’s cash, cash equivalents and short-term

investments as of December 31, 2024, as well as Atara’s cash

runway, the timing and receipt of potential milestone and other

payments, and operating expenses; (4) Atara’s fundraising needs and

the sufficiency of additional funding to support operations, and

the availability of such funding, including the non-binding term

sheet and Atara’s ability to enter into definitive documentation

for such funding; (5) Atara’s planned transition of substantially

all activities relating to EBVALLO to Pierre Fabre and the timing

thereof; (6) Atara’s planned cost reduction strategies; and (7)

Atara’s exploration of strategic alternatives and ability to

consummate one or more strategic transactions. Because such

statements deal with future events and are based on Atara’s current

expectations, they are subject to various risks and uncertainties

and actual results, performance or achievements of Atara could

differ materially from those described in or implied by the

statements in this press release. These forward-looking statements

are subject to risks and uncertainties, including, without

limitation, risks and uncertainties associated with the costly and

time-consuming pharmaceutical product development process and the

uncertainty of clinical success; risks related to FDA feedback and

the ability of Atara and its third-party manufacturer to address

the issues identified in the CRL; our ability to access capital;

the sufficiency of Atara’s cash resources and need for and ability

to obtain additional capital on favorable terms or at all; risks

and uncertainties related to Atara’s financial close and audit

procedures; the timing of the strategic review process; whether

Atara will pursue any strategic alternatives; in the event Atara

pursues a strategic alternative, that the strategic alternative may

not be attractive or ultimately consummated; whether any strategic

alternative will result in additional value for Atara and its

shareholders; whether the process will have an adverse impact on

Atara; and other risks and uncertainties affecting Atara’s and its

development programs, including those discussed in Atara’s filings

with the Securities and Exchange Commission , including in the

“Risk Factors” and “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” sections of the

Company’s most recently filed periodic reports on Form 10-K and

Form 10-Q and subsequent filings and in the documents incorporated

by reference therein. Except as otherwise required by law, Atara

disclaims any intention or obligation to update or revise any

forward-looking statements, which speak only as of the date hereof,

whether as a result of new information, future events or

circumstances or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250116967931/en/

Investor and Media Relations Jason Awe, Ph.D. Head of

Corporate Communications & Investor Relations (805) 217-2287

jawe@atarabio.com

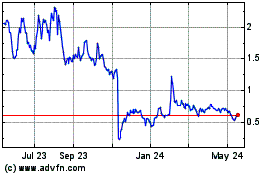

Atara Biotherapeutics (NASDAQ:ATRA)

Historical Stock Chart

From Jan 2025 to Feb 2025

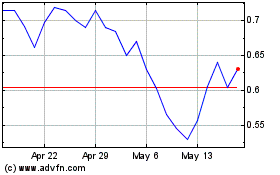

Atara Biotherapeutics (NASDAQ:ATRA)

Historical Stock Chart

From Feb 2024 to Feb 2025