Aurora Announces Proposed Public Offering of Class A Common Stock

July 31 2024 - 3:19PM

Business Wire

Aurora Innovation, Inc. (Nasdaq: AUR) today announced that it

has commenced an underwritten public offering of up to $350 million

of its Class A common stock. Aurora intends to grant the

underwriters a 30-day option to purchase up to an additional 15% of

the shares to be sold in the proposed public offering. All of the

shares of Class A common stock in this offering will be sold by

Aurora. The proposed offering is subject to market and other

conditions, and there can be no assurance as to whether or when the

offering may be completed, or as to the actual size or terms of the

offering.

The shares of Class A common stock in the proposed underwritten

public offering are being offered by Aurora pursuant to a

Registration Statement on Form S-3 previously filed and declared

effective by the U.S. Securities and Exchange Commission (the

“SEC”), and Aurora has filed a preliminary prospectus supplement

and accompanying prospectus relating to and describing the terms of

the proposed underwritten public offering, copies of which can be

accessed for free through the SEC’s website at www.sec.gov. When

available, copies of the preliminary prospectus supplement and the

accompanying prospectus relating to the underwritten public

offering may also be obtained from: Goldman Sachs & Co. LLC,

Attention: Prospectus Department, 200 West Street, New York, New

York 10282-2198; Allen & Company LLC, Attention: Prospectus

Department, 711 Fifth Avenue New York, New York 10022; or Morgan

Stanley & Co. LLC, Attention: Prospectus Department, 180 Varick

Street, 2nd Floor, New York, NY 10014.

This press release does not constitute an offer to sell or a

solicitation of an offer to buy, nor will there be any sale of the

shares of Class A common stock in any state or other jurisdiction

in which such offer, solicitation, or sale would be unlawful before

registration or qualification under the securities laws of any such

state or jurisdiction.

Forward-Looking Statements

This press release contains forward-looking statements as that

term is defined in Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. Such statements

include, but are not limited to the timing, pricing and size of the

public offering. These forward-looking statements are neither

promises nor guarantees and are subject to a variety of risks and

uncertainties, including but not limited to: whether or not Aurora

will be able to raise capital through the sale of Class A common

stock or consummate the proposed offering; the final terms of the

offering; and its expectations with respect to granting the

underwriters a 30-day option to purchase additional shares of Class

A common stock; the satisfaction of closing conditions; and other

risks. Information regarding the foregoing and additional risks are

described in the Risk Factors sections of the preliminary

prospectus supplement for the underwritten public offering filed

with the SEC, and the documents incorporated by reference therein,

including without limitation those risks and uncertainties

identified in the “Risk Factors” section of Aurora’s Registration

Statement on Form S-3 declared effective by the SEC on January 8,

2024, the accompanying prospectus, Aurora’s Annual Report on Form

10-K filed with the SEC on February 15, 2024, as amended by

Aurora’s Form 10-K/A filed with the SEC on May 24, 2024, and other

filings that Aurora makes with the SEC from time to time. All

forward-looking statements reflect Aurora’s beliefs and assumptions

only as of the date of this press release. Aurora undertakes no

obligation to update forward-looking statements to reflect future

events or circumstances.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240731927571/en/

Investor Relations: Stacy Feit ir@aurora.tech

Media: press@aurora.tech

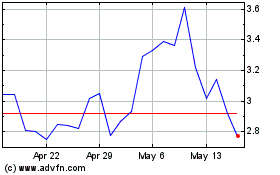

Aurora Innovations (NASDAQ:AUR)

Historical Stock Chart

From Oct 2024 to Nov 2024

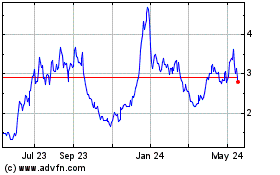

Aurora Innovations (NASDAQ:AUR)

Historical Stock Chart

From Nov 2023 to Nov 2024