0001554818

false

--12-31

2023

Q2

0001554818

2023-01-01

2023-06-30

0001554818

AUUD:CommonStockParValue0.001PerShareMember

2023-01-01

2023-06-30

0001554818

AUUD:WarrantsEachExercisableForOneShareOfCommonStockMember

2023-01-01

2023-06-30

0001554818

2023-08-11

0001554818

2023-06-30

0001554818

2022-12-31

0001554818

2023-04-01

2023-06-30

0001554818

2022-04-01

2022-06-30

0001554818

2022-01-01

2022-06-30

0001554818

us-gaap:CommonStockMember

2022-12-31

0001554818

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001554818

us-gaap:RetainedEarningsMember

2022-12-31

0001554818

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0001554818

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-03-31

0001554818

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0001554818

2023-01-01

2023-03-31

0001554818

us-gaap:CommonStockMember

2023-03-31

0001554818

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001554818

us-gaap:RetainedEarningsMember

2023-03-31

0001554818

2023-03-31

0001554818

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0001554818

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2023-06-30

0001554818

us-gaap:RetainedEarningsMember

2023-04-01

2023-06-30

0001554818

us-gaap:CommonStockMember

2023-06-30

0001554818

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001554818

us-gaap:RetainedEarningsMember

2023-06-30

0001554818

us-gaap:CommonStockMember

2021-12-31

0001554818

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001554818

us-gaap:RetainedEarningsMember

2021-12-31

0001554818

2021-12-31

0001554818

us-gaap:CommonStockMember

2022-01-01

2022-03-31

0001554818

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-03-31

0001554818

us-gaap:RetainedEarningsMember

2022-01-01

2022-03-31

0001554818

2022-01-01

2022-03-31

0001554818

us-gaap:CommonStockMember

2022-03-31

0001554818

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0001554818

us-gaap:RetainedEarningsMember

2022-03-31

0001554818

2022-03-31

0001554818

us-gaap:CommonStockMember

2022-04-01

2022-06-30

0001554818

us-gaap:AdditionalPaidInCapitalMember

2022-04-01

2022-06-30

0001554818

us-gaap:RetainedEarningsMember

2022-04-01

2022-06-30

0001554818

us-gaap:CommonStockMember

2022-06-30

0001554818

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001554818

us-gaap:RetainedEarningsMember

2022-06-30

0001554818

2022-06-30

0001554818

us-gaap:IPOMember

AUUD:StockAndWarrantUnitsMember

2021-02-15

2021-02-16

0001554818

AUUD:UnderwritersMember

AUUD:SeriesAWarrantsMember

us-gaap:IPOMember

2021-02-15

2021-02-16

0001554818

AUUD:UnderwritersMember

AUUD:RepresentativesWarrantsMember

us-gaap:IPOMember

2021-02-15

2021-02-16

0001554818

us-gaap:ComputerEquipmentMember

2023-06-30

0001554818

us-gaap:ComputerEquipmentMember

2022-12-31

0001554818

us-gaap:FurnitureAndFixturesMember

2023-06-30

0001554818

us-gaap:FurnitureAndFixturesMember

2022-12-31

0001554818

us-gaap:SoftwareDevelopmentMember

2023-06-30

0001554818

us-gaap:SoftwareDevelopmentMember

2022-12-31

0001554818

AUUD:PriorNoteMember

2022-11-30

0001554818

AUUD:PriorNoteMember

2022-11-29

2022-11-30

0001554818

AUUD:PriorNoteMember

AUUD:AdditionalWarrantsMember

2023-05-01

2023-05-31

0001554818

AUUD:PriorNoteMember

AUUD:OriginalIssuedWarrantsMember

2023-04-01

2023-04-30

0001554818

AUUD:PriorNoteMember

AUUD:NewCommonStockWarrantsMember

2023-04-01

2023-04-30

0001554818

AUUD:PriorNoteMember

AUUD:NewCommonStockWarrantsMember

2023-04-30

0001554818

AUUD:PriorNoteMember

AUUD:NewCommonStockWarrantsMember

2023-05-31

0001554818

AUUD:PriorNoteMember

AUUD:NewNoteMember

2023-04-30

0001554818

AUUD:PriorNoteMember

AUUD:NewNoteMember

2023-04-29

2023-04-30

0001554818

AUUD:PriorNoteMember

AUUD:AdditonalWarrantsMember

2023-04-29

2023-04-30

0001554818

AUUD:PriorNoteMember

AUUD:NewNoteMember

2023-06-30

0001554818

AUUD:PriorNoteMember

AUUD:NewNoteMember

2023-01-01

2023-06-30

0001554818

AUUD:PriorNoteMember

AUUD:NewNoteMember

2023-04-01

2023-06-30

0001554818

us-gaap:StockOptionMember

2022-12-31

0001554818

us-gaap:StockOptionMember

2023-01-01

2023-06-30

0001554818

us-gaap:StockOptionMember

2023-06-30

0001554818

us-gaap:StockOptionMember

AUUD:ExercisePrice1Member

2023-06-30

0001554818

us-gaap:StockOptionMember

AUUD:ExercisePrice1Member

2023-01-01

2023-06-30

0001554818

us-gaap:StockOptionMember

AUUD:ExercisePrice2Member

2023-06-30

0001554818

us-gaap:StockOptionMember

AUUD:ExercisePrice2Member

2023-01-01

2023-06-30

0001554818

us-gaap:StockOptionMember

AUUD:ExercisePrice3Member

2023-06-30

0001554818

us-gaap:StockOptionMember

AUUD:ExercisePrice3Member

2023-01-01

2023-06-30

0001554818

us-gaap:StockOptionMember

AUUD:ExercisePrice4Member

2023-06-30

0001554818

us-gaap:StockOptionMember

AUUD:ExercisePrice4Member

2023-01-01

2023-06-30

0001554818

us-gaap:StockOptionMember

AUUD:ExercisePrice5Member

2023-06-30

0001554818

us-gaap:StockOptionMember

AUUD:ExercisePrice5Member

2023-01-01

2023-06-30

0001554818

us-gaap:StockOptionMember

AUUD:ExercisePrice6Member

2023-06-30

0001554818

us-gaap:StockOptionMember

AUUD:ExercisePrice6Member

2023-01-01

2023-06-30

0001554818

us-gaap:StockOptionMember

AUUD:ExercisePrice7Member

2023-06-30

0001554818

us-gaap:StockOptionMember

AUUD:ExercisePrice7Member

2023-01-01

2023-06-30

0001554818

us-gaap:RestrictedStockUnitsRSUMember

2023-01-01

2023-06-30

0001554818

us-gaap:WarrantMember

2023-01-01

2023-06-30

0001554818

us-gaap:RestrictedStockUnitsRSUMember

2022-12-31

0001554818

us-gaap:RestrictedStockUnitsRSUMember

2023-06-30

0001554818

us-gaap:WarrantMember

2022-12-31

0001554818

us-gaap:WarrantMember

2023-06-30

0001554818

AUUD:WhiteLionPurchaseAgreementMember

us-gaap:CommonStockMember

2023-04-01

2023-04-30

0001554818

AUUD:WhiteLionPurchaseAgreementMember

us-gaap:CommonStockMember

2023-06-01

2023-06-30

0001554818

AUUD:WhiteLionPurchaseAgreementMember

us-gaap:CommonStockMember

2023-06-30

0001554818

AUUD:S3OfferingMember

2023-01-01

2023-06-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| ☒ |

Quarterly REPORT pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| |

| For the quarterly period ended June 30, 2023 |

| |

| Or |

| |

| ☐ |

Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| |

| For the transition period from _____________ to _____________ |

Commission File No. 001-40071

AUDDIA INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware |

|

45-4257218 |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

| |

|

|

|

2100 Central Ave., Suite 200

Boulder, Colorado |

|

80301 |

| Address of Principal Executive Offices |

|

Zip Code |

(303) 219-9771

(Registrant’s telephone

number, including area code)

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| |

|

|

|

|

| Common Stock, par value $0.001 per share |

|

AUUD |

|

The Nasdaq Stock Market |

| |

|

|

|

|

| Warrants, each exercisable for one share of Common Stock |

|

AUUDW |

|

The Nasdaq Stock Market |

Indicate by check mark whether the registrant: (1)

filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or

for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has

submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of

this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer,

an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large

accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company”

in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer ☐ |

Accelerated Filer ☐ |

| Non-accelerated Filer ☒ |

Smaller Reporting Company ☒ |

| |

Emerging Growth Company ☒ |

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined

in Rule 12(b)-2 of the Exchange Act). Yes ☐ No ☒

As of August 11, 2023, there were 19,947,223

shares of the registrant’s common stock, $0.001 par value per share, outstanding.

AUDDIA INC.

2023 QUARTERLY REPORT ON

FORM 10-Q

TABLE OF CONTENTS

Unless we state otherwise or the context otherwise

requires, the terms “Auddia,” “we,” “us,” “our” and the “Company” refer to

Auddia Inc., a Delaware corporation.

SPECIAL NOTE REGARDING

FORWARD-LOOKING STATEMENTS

This Quarterly Report on

Form 10-Q, or Quarterly Report, contains forward-looking statements that involve risks and uncertainties. We make such forward-looking

statements pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities

laws. All statements other than statements of historical facts contained in this Quarterly Report are forward-looking statements. In some

cases, you can identify forward-looking statements by terminology such as “may”, “will”, “should”,

“expects”, “intends”, “plans”, “anticipates”, “believes”, “estimates”,

“predicts”, “potential”, “continue” or the negative of these terms or other comparable terminology.

Forward-looking statements

are neither historical facts nor assurances of future performance, and are based only on our current beliefs, expectations and assumptions

regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future

conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in

circumstances that are difficult to predict and many of which are outside of our control. Therefore, you should not rely on any of these

forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those

indicated in the forward-looking statements include, among others, the following:

| |

· |

the ultimate impact of the ongoing coronavirus (COVID-19) pandemic, or any other health epidemic, on our business, results of operations, cash flows, financial condition and liquidity, and the global economy as a whole; |

| |

· |

the sufficiency of our existing cash to meet our working capital and capital expenditure needs over the next 12 months and our need to raise additional capital; |

| |

· |

our ability to generate revenue from new software services; |

| |

· |

our limited operating history; |

| |

· |

our ability to maintain proper and effective internal financial controls; |

| |

· |

our ability to continue to operate as a going concern; |

| |

· |

changes in laws, government regulations and policies and interpretations thereof; |

| |

· |

our ability to obtain and maintain protection for our intellectual property; |

| |

· |

the risk of errors, failures or bugs in our platform or products; |

| |

· |

our ability to attract and retain qualified employees and key personnel; |

| |

· |

our ability to manage our rapid growth and organizational change effectively; |

| |

· |

the possibility of security vulnerabilities, cyberattacks and network disruptions, including breaches of data security and privacy leaks, data loss, and business interruptions; |

| |

· |

our compliance with data privacy laws and regulations; |

| |

· |

our ability to develop and maintain our brand cost-effectively; and |

| |

· |

the other factors set forth elsewhere in this Quarterly Report and in Part

I, Item 1A, “Risk Factors” of our Annual Report on Form 10-K for the year ended December 31, 2022.

|

These forward-looking statements

speak only as of the date of this Form 10-Q and are subject to business and economic risks. We do not undertake any obligation to update

or revise the forward-looking statements to reflect events that occur or circumstances that exist after the date on which such statements

were made, except to the extent required by law.

PART I – FINANCIAL INFORMATION

| Item

1. |

Financial Statements |

Auddia Inc.

Condensed Balance Sheets

| | |

| | | |

| | |

| | |

June 30,

2023

Unaudited | | |

December 31,

2022

Audited | |

| ASSETS | |

| | |

| |

| Current assets: | |

| | | |

| | |

| Cash | |

$ | 3,605,144 | | |

$ | 1,661,434 | |

| Accounts receivable, net | |

| 371 | | |

| 137 | |

| Prepaid insurance | |

| 53,777 | | |

| – | |

| Total current assets | |

| 3,659,292 | | |

| 1,661,571 | |

| | |

| | | |

| | |

| Non-current assets: | |

| | | |

| | |

| Property and equipment, net of accumulated depreciation | |

| 28,277 | | |

| 41,080 | |

| Software development costs, net of accumulated amortization | |

| 3,790,878 | | |

| 4,134,225 | |

| Deferred offering costs | |

| 170,259 | | |

| 222,896 | |

| Prepaids and other non-current assets | |

| 63,263 | | |

| 51,754 | |

| Total non-current assets | |

| 4,052,676 | | |

| 4,449,955 | |

| Total assets | |

$ | 7,711,968 | | |

$ | 6,111,526 | |

| | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable and accrued liabilities | |

$ | 511,202 | | |

$ | 324,138 | |

| Notes payable to related party, net of debt issuance costs | |

| 2,838,898 | | |

| 1,775,956 | |

| Stock awards liability | |

| 30,090 | | |

| 161,349 | |

| Total current liabilities | |

| 3,380,190 | | |

| 2,261,443 | |

| Total liabilities | |

| 3,380,190 | | |

| 2,261,443 | |

| | |

| | | |

| | |

| Commitments and contingencies (Note 5) | |

| – | | |

| – | |

| | |

| | | |

| | |

| Shareholders' equity: | |

| | | |

| | |

| Preferred stock - $0.001 par value, 10,000,000 authorized and 0 shares issued and outstanding | |

| – | | |

| – | |

| Common stock - $0.001 par value, 100,000,000 authorized and 19,947,223 and 12,654,949 shares issued and outstanding June 30, 2023 and December 31, 2022 | |

| 19,947 | | |

| 12,654 | |

| Additional paid-in capital | |

| 80,525,840 | | |

| 75,573,263 | |

| Accumulated deficit | |

| (76,214,008 | ) | |

| (71,735,834 | ) |

| Total shareholders' equity | |

| 4,331,778 | | |

| 3,850,083 | |

| Total liabilities and shareholders' equity | |

$ | 7,711,968 | | |

$ | 6,111,526 | |

The accompanying notes are an integral part of these

unaudited condensed financial statements.

Auddia Inc.

Condensed Statements of Operations (Unaudited)

| | |

| | | |

| | |

|

|

|

|

|

|

| | |

Three Months Ended | |

|

Six Months Ended |

|

| | |

6/30/2023 | | |

6/30/2022 | |

|

6/30/23 |

|

|

6/30/22 |

|

| Revenue | |

$ | – | | |

$ | – | |

|

$ |

– |

|

|

$ |

– |

|

| | |

| | | |

| | |

|

|

|

|

|

|

|

|

| Operating expenses: | |

| | | |

| | |

|

|

|

|

|

|

|

|

| Direct cost of services | |

| 45,038 | | |

| 43,532 | |

|

|

87,339 |

|

|

|

96,093 |

|

| Sales and marketing | |

| 223,760 | | |

| 740,019 | |

|

|

448,879 |

|

|

|

1,097,086 |

|

| Research and development | |

| 180,363 | | |

| 151,251 | |

|

|

390,489 |

|

|

|

300,015 |

|

| General and administrative | |

| 892,510 | | |

| 842,555 | |

|

|

1,819,336 |

|

|

|

1,860,283 |

|

| Depreciation and amortization | |

| 442,618 | | |

| 271,005 | |

|

|

885,653 |

|

|

|

447,132 |

|

| Total operating expenses | |

| 1,784,290 | | |

| 2,048,362 | |

|

|

3,631,696 |

|

|

|

3,800,609 |

|

| Loss from operations | |

| (1,784,290 | ) | |

| (2,048,362 | ) |

|

|

(3,631,696 |

) |

|

|

(3,800,609 |

) |

| | |

| | | |

| | |

|

|

|

|

|

|

|

|

| Other (expense) income: | |

| | | |

| | |

|

|

|

|

|

|

|

|

| Interest expense | |

| (538,572 | ) | |

| (2,023 | ) |

|

|

(846,478 |

) |

|

|

(3,035 |

) |

| Total other expense | |

| (538,572 | ) | |

| (2,023 | ) |

|

|

(846,478 |

) |

|

|

(3,035 |

) |

| Provision for income taxes | |

| – | | |

| – | |

|

|

– |

|

|

|

– |

|

| Net loss | |

$ | (2,322,862 | ) | |

$ | (2,050,385 | ) |

|

$ |

(4,478,174 |

) |

|

$ |

(3,803,644 |

) |

| | |

| | | |

| | |

|

|

|

|

|

|

|

|

| Net loss per share attributable to common stockholders | |

| | | |

| | |

|

|

|

|

|

|

|

|

| Basic and diluted | |

$ | (0.15 | ) | |

$ | (0.16 | ) |

|

$ |

(0.32 |

) |

|

$ |

(0.30 |

) |

| | |

| | | |

| | |

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding | |

| | | |

| | |

|

|

|

|

|

|

|

|

| Basic and diluted | |

| 15,352,297 | | |

| 12,514,763 | |

|

|

14,058,662 |

|

|

|

12,489,790 |

|

The accompanying notes are an integral part of these

unaudited condensed financial statements.

Auddia Inc.

Condensed Statements of Changes in Shareholders’

Equity (Unaudited)

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

For The Three and Six Months Ended June 30, 2023 | |

| | |

Common Stock | | |

| | |

| | |

| |

| | |

Number of

Shares | | |

Par Value | | |

Additional

Paid-In-Capital | | |

Accumulated

Deficit | | |

Total | |

| Balance, January 1, 2023 | |

| 12,654,949 | | |

$ | 12,654 | | |

$ | 75,573,262 | | |

$ | (71,735,834 | ) | |

$ | 3,850,083 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Exercise of Restricted Stock Units | |

| 195,760 | | |

| 196 | | |

| 42,601 | | |

| – | | |

| 42,797 | |

| Share-based compensation | |

| – | | |

| – | | |

| 357,680 | | |

| – | | |

| 357,680 | |

| Net loss | |

| – | | |

| – | | |

| – | | |

| (2,155,312 | ) | |

| (2,155,312 | ) |

| Balance, March 31, 2023 | |

| 12,850,709 | | |

$ | 12,850 | | |

$ | 75,973,543 | | |

$ | (73,891,146 | ) | |

$ | 2,095,247 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of common shares, net of costs | |

| 7,096,514 | | |

| 7,097 | | |

| 3,956,787 | | |

| – | | |

| 3,963,884 | |

| Issuance of warrants | |

| – | | |

| – | | |

| 383,004 | | |

| – | | |

| 383,004 | |

| Share-based compensation | |

| – | | |

| – | | |

| 224,856 | | |

| – | | |

| 224,856 | |

| Reclassification of share-based compensation liability | |

| – | | |

| – | | |

| (12,352 | ) | |

| – | | |

| (12,352 | ) |

| Net loss | |

| – | | |

| – | | |

| – | | |

| (2,322,862 | ) | |

| (2,322,862 | ) |

| Balance, June 30, 2023 | |

| 19,947,223 | | |

$ | 19,947 | | |

$ | 80,525,838 | | |

$ | (76,214,008 | ) | |

$ | 4,331,778 | |

| | |

For The Three and Six Months Ended June 30, 2022 | |

| | |

Common Stock | | |

| | |

| | |

| |

| | |

Number of

Shares | | |

Par Value | | |

Additional

Paid-In-Capital | | |

Accumulated

Deficit | | |

Total | |

| Balance, January 1, 2022 | |

| 12,416,408 | | |

$ | 12,416 | | |

$ | 74,236,910 | | |

$ | (64,838,389 | ) | |

$ | 9,410,937 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Exercise of restricted stock units | |

| 98,355 | | |

| 98 | | |

| (98 | ) | |

| – | | |

| – | |

| Share-based compensation | |

| – | | |

| – | | |

| 385,908 | | |

| – | | |

| 385,908 | |

| Reclassification of share-based compensation liability | |

| – | | |

| – | | |

| (128,534 | ) | |

| – | | |

| (128,534 | ) |

| Net loss | |

| – | | |

| – | | |

| – | | |

| (1,753,258 | ) | |

| (1,753,258 | ) |

| Balance, March 31, 2022 | |

| 12,514,763 | | |

$ | 12,514 | | |

$ | 74,494,186 | | |

$ | (66,591,647 | ) | |

$ | 7,915,053 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share-based compensation | |

| – | | |

| – | | |

| 285,921 | | |

| – | | |

| 285,921 | |

| Reclassification of share-based compensation liability | |

| – | | |

| – | | |

| (7,262 | ) | |

| – | | |

| (7,262 | ) |

| Net loss | |

| – | | |

| – | | |

| – | | |

| (2,050,385 | ) | |

| (2,050,385 | ) |

| Balance, June 30, 2022 | |

| 12,514,763 | | |

$ | 12,514 | | |

$ | 74,772,845 | | |

$ | (68,642,033 | ) | |

$ | 6,143,327 | |

The accompanying notes are an integral part of these

unaudited condensed financial statements.

Auddia Inc.

Condensed Statements of Cash Flows (Unaudited)

| | |

| | | |

| | |

| | |

Six Months Ended June 30, | |

| | |

2023 | | |

2022 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net loss | |

$ | (4,478,174 | ) | |

$ | (3,803,644 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Finance Charge associated with debt issuance cost | |

| 695,947 | | |

| – | |

| Depreciation and amortization | |

| 885,653 | | |

| 447,132 | |

| Change in assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| (234 | ) | |

| 36 | |

| Prepaid insurance | |

| (53,777 | ) | |

| – | |

| Prepaids and other non-current assets | |

| (11,509 | ) | |

| (4,312 | ) |

| Accounts payable and accrued liabilities | |

| 164,829 | | |

| 56,113 | |

| Net cash used in operating activities | |

| (2,214,729 | ) | |

| (2,632,846 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Software capitalization | |

| (529,503 | ) | |

| (1,278,625 | ) |

| Purchase of property and equipment | |

| – | | |

| (3,808 | ) |

| Net cash used in investing activities | |

| (529,503 | ) | |

| (1,282,433 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Net settlement of share-based compensation liability | |

| (78,580 | ) | |

| (88,723 | ) |

| Proceeds from related party debt, net of original issue discount | |

| 750,000 | | |

| – | |

| Proceeds from issuance of common shares, net of issuance costs | |

| 4,016,521 | | |

| – | |

| Net cash provided by (used in) financing activities | |

| 4,687,941 | | |

| (88,723 | ) |

| | |

| | | |

| | |

| Net increase (decrease) in cash | |

| 1,943,710 | | |

| (4,004,002 | ) |

| | |

| | | |

| | |

| Cash, beginning of period | |

| 1,661,434 | | |

| 6,345,291 | |

| | |

| | | |

| | |

| Cash, end of period | |

$ | 3,605,144 | | |

$ | 2,341,289 | |

| | |

| | | |

| | |

| Supplemental disclosures of cash flow information: | |

| | | |

| | |

| Cash paid for Interest | |

$ | 4,460 | | |

$ | 3,035 | |

| | |

| | | |

| | |

| Supplemental disclosures of non-cash activity: | |

| | | |

| | |

| Reclassification of deferred offering cost | |

$ | 52,637 | | |

$ | – | |

| Original issue discount and issuance of warrants on related party debt | |

$ | 458,004 | | |

$ | – | |

The accompanying notes are an integral part of these

unaudited condensed financial statements.

Auddia Inc.

Notes to Condensed Financial Statements (Unaudited)

Note 1 - Description of Business, Basis of Presentation and Summary

of Significant Accounting Policies

Description of Business

Auddia Inc., formerly Clip Interactive, LLC, (the

“Company”, “Auddia”, “we”, “our”) is a technology company that is reinventing how consumers

engage with audio through the development of a proprietary AI platform for audio and innovative technologies for podcasts. Clip Interactive,

LLC was initially formed as a Colorado limited liability company on January 14, 2012, and on November 25, 2019, changed its trade name

to Auddia.

On February 16, 2021, the Company completed an initial

public offering (the “IPO”) of 3,991,818 units, at $4.125 per unit, consisting of one share of common stock and one Series

A warrant to purchase one share of common stock at an exercise price of $4.54 per share. In addition, the underwriters exercised their

option to purchase 598,772 Series A warrants to cover over-allotments and were issued 319,346 in representative warrants at an exercise

price of $5.15625 per share. After deducting underwriters’ commissions and expenses, the Company received net proceeds of approximately

$15.1 million and its common stock commenced trading on Nasdaq under the ticker symbol “AUUD”. Concurrently with the IPO,

holders of the Company’s promissory notes, convertible notes, and related party notes, along with accrued interest, were converted

into 6,814,570 shares of the Company’s common stock.

Concurrently with the IPO the Company converted from

a Colorado limited liability company to a Delaware corporation.

Basis of Presentation

The accompanying financial statements have been prepared

in accordance with generally accepted accounting principles in the United States of America (“GAAP”).

Unaudited interim financial information

The condensed financial statements of the

Company included herein have been prepared, without audit, pursuant to the rules and regulations of the Securities and Exchange Commission

(the “SEC”). Certain information and footnote disclosures normally included in financial statements prepared in accordance

with GAAP have been condensed or omitted from this Quarterly Report, as is permitted by such rules and regulations. The condensed balance sheet as of December 31, 2022 has been derived

from the financial statements included in the Company’s annual report on Form 10-K. Accordingly, these

condensed financial statements should be read in conjunction with the financial statements and notes thereto included in the Company’s

Annual Report on Form 10-K. The results for any interim period are not necessarily indicative of results for any future period. The Company

recorded all adjustments necessary for a fair statement of the results for the interim period and all such adjustments are of a normal

recurring nature.

Use of Estimates

The preparation of financial statements in conformity

with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures

of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during

the reporting period. Actual results could differ from those estimates.

The condensed financial statements include some amounts

that are based on management's best estimates and judgments. The most significant estimates relate to valuation of capital stock, warrants

and options to purchase shares of the Company's common stock, and the estimated recoverability and amortization period for capitalized

software development costs. These estimates may be adjusted as more current information becomes available, and any adjustment could be

significant.

Risks and Uncertainties

The Company is subject to various risks and uncertainties

frequently encountered by companies in the early stages of development. Such risks and uncertainties include, but are not limited to,

its limited operating history, competition from other companies, limited access to additional funds, dependence on key personnel, and

management of potential rapid growth. To address these risks, the Company must, among other things, develop its customer base; implement

and successfully execute its business and marketing strategy; develop follow-on products; provide superior customer service; and attract,

retain, and motivate qualified personnel. There can be no guarantee that the Company will be successful in addressing these or other such

risks.

Emerging Growth Company Status

The Company is an emerging growth company, as

defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). Under the JOBS Act, emerging growth companies

can delay adopting new or revised accounting standards issued subsequent to the enactment of the JOBS Act until such time as those standards

apply to private companies. The Company has elected to use this extended transition period to comply with certain new or revised accounting

standards that have different effective dates for public and private companies.

Going Concern

The Company had cash of $3,605,144

as of June 30, 2023. We will need additional funding to complete the development of our full product line and scale products with a demonstrated

market fit. Management has plans to secure such additional funding. If we are unable to raise capital when needed or on acceptable terms,

we would be forced to delay, reduce, or eliminate our technology development and commercialization efforts.

As a result of the Company’s recurring losses

from operations, and the need for additional financing to fund its operating and capital requirements, there is uncertainty regarding

the Company’s ability to maintain liquidity sufficient to operate its business effectively, which raises substantial doubt as to

the Company’s ability to continue as a going concern within one year after the date the financial statements are issued. Management

has plans to mitigate the conditions or events that raise substantial doubt about the entity’s ability to continue as a going concern,

such as the White Lion equity line of credit (refer to Note 8) and additional future financing agreements. However, management cannot

provide any assurances that the Company will be successful in accomplishing any of its plans. These financial statements do not include

any adjustments related to the recoverability and classification of assets or the amounts and classification of liabilities that might

be necessary should the Company be unable to continue as a going concern. The Company’s current

level of cash are not sufficient to execute our business plan. For the foreseeable future, we will incur significant operating expenses,

capital expenditures and working capital funding that will deplete our cash on hand by November 2023.

Cash

The Company considers all highly liquid instruments

purchased with an original maturity of three months or less to be cash equivalents. The Company had no cash equivalents as of June 30,

2023 or December 31, 2022.

The Company maintains cash deposits at several

financial institutions, which are insured by the Federal Deposit Insurance Corporation up to $250,000. The Company’s cash

balance may at times exceed these limits. At June 30, 2023, the Company had approximately $3.4

million in excess of federally insured limits. As at December 31, 2022, the Company had approximately $1.4

million in excess of federally insured limits. The Company continually monitors its positions with, and the credit quality

of, the financial institutions with which it invests.

Software Development Costs

The Company accounts for costs incurred in the development

of computer software as software research and development costs until the preliminary project stage is completed, management has committed

to funding the project, and completion and use of the software for its intended purpose is probable.

The Company ceases capitalization of development costs

once the software has been substantially completed and is available for its intended use. Software development costs are amortized over

a useful life estimated by the Company’s management of three years. Costs associated with significant upgrades and enhancements

that result in additional functionality are capitalized. Capitalized costs are subject to an ongoing assessment of recoverability based

on anticipated future revenues and changes in software technologies.

Unamortized capitalized software development

costs determined to be in excess of anticipated future net revenues are considered impaired and expensed during the period of such

determination. We determined that no such impairments were required during the three months and six month period ended June 30,

2023. Software development costs of $258,929

and $617,411

were capitalized for the three months ended June 30, 2023, and 2022, respectively and $529,503

and $1,278,625

were capitalized for the six months ended June 30, 2023 and 2022, respectively. Amortization of capitalized software development

costs were $436,425

and $262,703

for the three months ended June 30, 2023, and 2022, respectively and $872,850

and $430,739

for the six months ended June 30, 2023 and 2022, respectively and are included in depreciation and amortization expense in the

Company’s condensed statement of operations.

Revenue Recognition

Revenue will be measured according to Accounting

Standards Codification (“ASC”) 606, Revenue – Revenue from Contracts with Customers, and will be recognized based

on consideration specified in a contract with a customer, and excludes any sales incentives and amounts collected on behalf of third

parties. We will recognize revenue when we satisfy a performance obligation by transferring control over a service or product to a

customer. We will report revenues net of any tax assessed by a governmental authority that is both imposed on, and concurrent with,

a specific revenue-producing transaction between a seller and a customer in our condensed statements of operations. Collected taxes

will be recorded within Other current liabilities until remitted to the relevant taxing authority.

Subscriber revenue will consist primarily of subscription

fees and other ancillary subscription-based revenues. Revenue will be recognized on a straight-line basis when the performance obligations

to provide each service for the period are satisfied, which is over time as our subscription services are continuously available and can

be consumed by customers at any time. There is no revenue recognized for unpaid trial subscriptions.

Customers may pay for the services in advance of the

performance obligation and therefore these prepayments are recorded as deferred revenue. The deferred revenue will be recognized as revenue

in our statement of operations as the services are provided.

Share-Based Compensation

The Company accounts for share-based compensation

arrangements with employees, directors, and consultants and recognizes the compensation expense for share-based awards based on the estimated

fair value of the awards on the date of grant in accordance with ASC 718.

Compensation expense for all share-based awards is

based on the estimated grant-date fair value and recognized in earnings over the requisite service period (generally the vesting period).

The Company records share-based compensation expense related to non-employees over the related service periods.

Certain share-based compensation awards include a

net-share settlement feature that provides the grantee an option to withhold shares to satisfy tax withholding requirements and are classified

as a share-based compensation liability. Cash paid to satisfy tax withholdings is classified as financing activities in the condensed

statements of cash flows.

Recently Adopted ASUs

ASU 2016-13-Financial Instruments-Credit Losses-

The new guidance makes significant changes to the accounting for credit losses on financial instruments and disclosures about them. Specifically,

the new CECL impairment model requires an estimate of expected credit losses, measured over the contractual life of an instrument, that

considers forecasts of future economic conditions in addition to information about past events and current conditions. The Company adopted

the new standard beginning January 1, 2023. The adoption of the new standard did not have a material impact to the Company’s financial statements.

Note 2 – Property & Equipment and

Software Development Costs

Property and equipment and software development costs

consisted of the following as of:

| Schedule of property, equipment and software development costs | |

| | |

| |

| | |

June 30,

2023 | | |

December 31,

2022 | |

| Computers and equipment | |

$ | 99,939 | | |

$ | 99,939 | |

| Furniture | |

| 7,262 | | |

| 7,262 | |

| Accumulated depreciation | |

| (78,924 | ) | |

| (66,121 | ) |

| Total property and equipment, net | |

$ | 28,277 | | |

$ | 41,080 | |

| | |

| | | |

| | |

| Software development costs | |

$ | 7,155,552 | | |

$ | 6,626,049 | |

| Accumulated amortization | |

| (3,364,674 | ) | |

| (2,491,824 | ) |

| Total software development costs, net | |

$ | 3,790,878 | | |

$ | 4,134,225 | |

The Company recognized depreciation expense of

$6,193 and $8,302 for the three months ended June 30, 2023, and 2022, respectively related to property and equipment and

amortization expense of $436,425 and $262,703 for the three months ended June 30, 2023, and 2022, respectively related to software

development costs. The Company recognized depreciation expense of $12,803

and $16,393 for the six

months ended June 30, 2023, and 2022, respectively related to property and equipment and amortization expense of $872,850

and $430,739

for the six months ended June 30, 2023, and 2022, respectively related to software development costs.

Note 3 – Accounts Payable and Accrued

Liabilities

Accounts payable and accrued liabilities consist

of the following:

| Schedule of accounts payable and accrued liabilities | |

| | |

| |

| | |

June 30,

2023 | | |

December 31,

2022 | |

| | |

| | |

| |

| Accounts payable and accrued liabilities | |

$ | 316,511 | | |

$ | 289,955 | |

| Credit cards payable | |

| 21,520 | | |

| 6,072 | |

| Accrued interest | |

| 173,170 | | |

| 28,111 | |

| Accounts payable and accrued liabilities | |

$ | 511,202 | | |

$ | 324,138 | |

Note 4 – Notes Payable to Related Party,

net of debt issuance costs

In November 2022, the Company entered into a Secured

Bridge Note (the “Prior Note”) financing with an existing shareholder of the Company. The principal amount of the Prior Note

was $2,200,000 including an original issue discount of $200,000. The Prior Note bears interest at a stated rate of 10% and had an original

maturity date of May of 2023. The Prior Note is secured by a lien on substantially all of the Company’s assets. At maturity, the

lender had the option to convert any original issue discount and accrued but unpaid interest into shares of the Company’s common

stock at a fixed conversion price of $1.23 per share. The conversion right is available to the lender at the earlier of (i) maturity,

or (ii) payback of all the principal. In connection with the Prior Note financing, the Company issued 300,000 common stock warrants with

a five-year term and an exercise price of $2.10 per share. The warrants were valued at $361,878, which was recorded as an additional debt

discount. During May of 2023, the Company extended the maturity date by six months to November 2023 at an increased annual interest rate

of 20% and the issuance of an additional 300,000 warrants. The additional warrants were valued at $94,083, which was also recorded as

an additional debt discount. The embedded conversion option was not accounted for separately as, in accordance with the guidance outlined

in ASC 815-40, it was considered indexed to the Company’s shares. Similarly, the issued warrants were classified in equity as they

were also considered indexed to the Company’s shares in accordance with ASC 815-40.

In connection with an additional financing with the

same related party during April of 2023, the Company cancelled the original 300,000 warrants issued with the Prior Note and issued 600,000

new common stock warrants with a five-year term and an exercise price of $0.61

per share. The Company recognized the modification in accordance with ASC 815-40-35, which resulted in the recognition of additional

debt discount in the amount of $35,981.

Upon issue of the new common stock warrants, 300,000 were fully vested and immediately exercisable upon issue. The remaining 300,000

warrants were unvested.

During May of 2023, the Company extended the maturity

date of the Prior Notes by six months to November 2023 at an increased annual interest rate of 20%. In connection with this extension,

the 300,000 outstanding unvested warrants became vested and exercisable.

As of June 30, 2023, and December 31, 2022, the

balance of the Prior Note, net of debt issuance costs, was $2,121,341

and $1,775,956,

respectively. Interest expense related to the Prior Note for the three and six months ended June 30, 2023, was $261,861 and $567,802.

As noted above, the Company entered into an additional

Secured Bridge Note (“New Note”) financing with the same accredited investor and significant existing shareholder during

April of 2023. In addition, the Company also amended the terms of the Prior Note. The principal amount of the New Note is $825,000

including an original issue discount of $75,000.

The New Note bears interest at an annual stated rate of 10%

and matures in July 2023. The New Note is secured by a lien on substantially all of the Company’s assets. At maturity the lender

has the option to convert any original issue discount and accrued but unpaid interest into shares of the Company’s common stock

at a fixed conversion price of $0.61

per share. The conversion right is available to the lender at the earlier of (i) maturity, or (ii) payback of all the principal.

In connection with the New Note financing, the Company issued 325,000

common stock warrants with a

five-year term and an exercise price of $0.61

per share and an additional 325,000

common stock warrants with a five-year term and an exercise price of $0.61

per share that are exercisable in the event that the loan term is extended. The warrants were valued at $252,940,

which was recorded as additional debt discount. Similar to the accounting for the Prior Note, the embedded conversion option was not

accounted for separately as, in accordance with the guidance outlined in ASC 815-40, it was considered indexed to the Company’s

shares. In addition, the issued warrants were classified in equity as they were also considered indexed to the Company’s shares

in accordance with ASC 815-40.

As of June 30, 2023, the balance of the New Note

issued in April 2023, net of debt issuance costs, was $717,557.

Interest expense related to the New Note for the three and six months ended June 30, 2023 was $273,204,

respectively.

On July 31, 2023, the Company extended the maturity

date of the New Note to November 30, 2023. In connection with such extension, 325,000 outstanding unvested warrants became vested and

exercisable.

Note 5 – Commitments and Contingencies

Operating Lease

In April 2021, the Company entered into a lease agreement

for office space in Boulder, Colorado comprising 8,639 square feet. The lease commenced on May 15, 2021, and terminated after 12 months.

The Company subsequently extended the lease through November 2022. In November 2022, the Company amended the lease, reducing the square

footage rented to 2,160 with a base rent of $4,018 per month. The amended lease terminates after 13 months. Rent expense, as part of general and administrative expenses as included in the

Condensed Statement of Operations, was $25,385 and

$21,733 for the three months ended June 30, 2023, and 2022, respectively and $37,438 and $43,182 for the six months ended June 30, 2023,

and 2022, respectively.

Litigation

In the normal course of business, the Company is party

to litigation from time to time. The Company maintains insurance to cover certain actions and believes that resolution of such litigation

will not have a material adverse effect on the Company. There are no active litigations as of the date the financial statements were issued.

However, a pre-IPO investor has contacted the Company claiming damages caused by alleged acts and

omissions arising from a private financing by the Company. No complaint has been filed by the investor. The alleged damages asserted by

the investor are less than approximately $300,000. The outcome of the complaint was neither probable or estimable as of the date the financial

statements were issued.

NASDAQ deficiency

On May 23, 2023, we received a letter (the “Notice”)

from the Listing Qualifications Staff of the Nasdaq Stock Market, LLC (“Nasdaq”) indicating that, based upon the Company’s

reported stockholder’s equity of $2,095,247 at the end of March 31, 2023, we are not in compliance with the requirement to maintain

a minimum stockholder’s equity of $2,500,000 for continued listing on the Nasdaq Capital Market, as set forth in Nasdaq Listing

Rule 5550(b)(1) the “Stockholder’s Equity”). We were provided a compliance period of 45 calendar days from the date

of the Notice, or until July 7, 2023, to submit a plan to regain compliance with the Stockholder’s Equity Requirement, pursuant

to Nasdaq Listing Rule 5810(c)(2)(A).

On July 10, 2023, the Company received a letter

from Nasdaq advising that the Company had been granted an extension to file a Form 10-Q for the quarter-ended June 30, 2023 evidencing

compliance with Stockholder’s Equity requirement. If we do not regain compliance within the allotted compliance period, Nasdaq will

provide notice that the Company’s Common Stock will be subject to delisting. The Company would then be entitled to appeal that determination

to a Nasdaq hearings panel.

As disclosed elsewhere in the Quarterly Report,

the Company’s stockholder’s equity as of June 30, 2023 is $4,331,778, which is $1,831,778 over the $2.5 million Nasdaq continued

listing requirement.

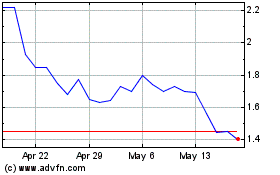

Separately, on April

24, 2023 we received a letter from Nasdaq indicating that the Company is not in compliance with the $1.00 Minimum Bid Price requirement

set forth in Nasdaq Listing Rule 5550(a)(2) for continued listing on the Nasdaq Capital Market (the “Bid Price Requirement”).

The letter indicated

that the Company will be provided 180 calendar days (or until October 23, 2023) in which to regain compliance. If at any time during this

180 calendar day period the bid price of the Company’s common stock closes at or above $1.00 per share for a minimum of ten consecutive

business days, Nasdaq will provide the Company with a written confirmation of compliance and the matter will be closed.

Alternatively, if the

Company fails to regain compliance with Rule 5550(a)(2) prior to the expiration of the initial 180 calendar day period, the Company may

be eligible for an additional 180 calendar day compliance period, provided (i) it meets the continued listing requirement for market value

of publicly held shares and all other applicable requirements for initial listing on the Nasdaq Capital Market (except for the Bid Price

Requirement) and (ii) it provides written notice to Nasdaq of its intention to cure this deficiency during the second compliance period

by effecting a reverse stock split, if necessary. In the event the Company does not regain compliance with Rule 5550(a)(2) prior to the

expiration of the initial 180 calendar day period, and if it appears to the Staff that the Company will not be able to cure the deficiency,

or if the Company is not otherwise eligible, the Staff will provide the Company with written notification that its securities are subject

to delisting from The Nasdaq Capital Market. At that time, the Company may appeal the delisting determination to a Hearings Panel.

The Company intends to

consider all options to regain compliance with all Nasdaq continued listing requirements.

The Company’s receipt

of these Nasdaq letters does not affect the Company’s business, operations or reporting requirements with the Securities and Exchange

Commission.

Note 6 - Share-based Issuances

Stock Options

The following table presents the activity for stock

options outstanding:

| Schedule of stock option activity | |

| | | |

| | |

| | |

Options | | |

Weighted Average Exercise Price | |

| Outstanding - December 31, 2022 | |

| 1,663,173 | | |

$ | 2.45 | |

| Granted | |

| 200,200 | | |

$ | 0.94 | |

| Forfeited/canceled | |

| (198,954 | ) | |

$ | 1.50 | |

| Exercised | |

| – | | |

$ | – | |

| Outstanding - June 30, 2023 | |

| 1,664,419 | | |

$ | 2.38 | |

The following table presents the composition of options

outstanding and exercisable:

| Options outstanding and exercisable | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Options Outstanding | | |

Options Exercisable | |

| Exercise Prices | |

Number | | |

Price | | |

Life* | | |

Number | | |

Price* | |

| $2.70 | |

| 22,264 | | |

$ | 2.70 | | |

| 1.00 | | |

| 22,264 | | |

$ | 2.70 | |

| $2.90 | |

| 53,128 | | |

$ | 2.90 | | |

| 4.36 | | |

| 53,128 | | |

$ | 2.90 | |

| $4.26 | |

| 171,197 | | |

$ | 4.26 | | |

| 5.98 | | |

| 169,793 | | |

$ | 4.26 | |

| $2.79 | |

| 772,194 | | |

$ | 2.79 | | |

| 7.48 | | |

| 553,122 | | |

$ | 2.79 | |

| $1.79 | |

| 206,250 | | |

$ | 1.79 | | |

| 8.24 | | |

| 68,437 | | |

$ | 1.79 | |

| $1.21 | |

| 389,386 | | |

$ | 1.21 | | |

| 9.2 | | |

| 258,793 | | |

$ | 1.21 | |

| $0.39 | |

| 50,000 | | |

$ | 0.39 | | |

| 10 | | |

| – | | |

$ | 0.39 | |

| Total - June 30, 2023 | |

| 1,664,419 | | |

$ | 2.38 | | |

| 7.71 | | |

| 1,125,537 | | |

$ | 2.59 | |

________________________

During the six months ended June 30, 2023, the Company

granted 200,200 stock options. Under the terms of the option agreements, the options are subject to certain vesting requirements. The

fair value of each award is determined using the Black-Scholes option-pricing model which values options based on the stock price at the

grant date, the expected life of the option, the estimated volatility of the stock, and the risk-free interest rate over the expected

life of the option. The expected volatility was determined considering comparable companies historical stock prices as a peer group for

the fiscal year the grant occurred and prior fiscal years for a period equal to the expected life of the option. The risk-free interest

rate was the rate available from the St. Louis Federal Reserve Bank with a term equal to the expected life of the option. The expected

life of the option was estimated based on a mid-point method calculation.

Restricted Stock Units

The following table presents the activity for restricted

stock units outstanding:

| Schedule of restricted stock outstanding | |

| | | |

| | |

| | |

Restricted Stock Units | | |

Weighted Average Grant Date Fair Value | |

| Outstanding - December 31, 2022 | |

| 563,859 | | |

$ | 2.14 | |

| Granted | |

| 37,500 | | |

$ | 1.24 | |

| Forfeited/canceled | |

| (118,346 | ) | |

$ | 1.83 | |

| Vested/issued | |

| (195,759 | ) | |

$ | 1.83 | |

| Outstanding -June 30, 2023 | |

| 287,254 | | |

$ | 2.37 | |

During the six months ended June 30, 2023, the Company

granted 37,500 restricted stock units. Under terms of the restricted stock agreement, the restricted stock units are subject to a certain

vesting schedule.

In 2023, certain restricted stock unit holders elected

a net-share settlement for vested shares to satisfy income tax requirements. The Company applied modification accounting in accordance

with ASC 718 and recorded the expected value of these share-based awards as a liability. The Company recognized a share-based compensation

liability as of June 30, 2023, of $30,090 related to the fair value of vested shares over the service period.

The Company recognized share-based compensation expense

related to stock options and restricted stock units of $582,536 and $671,829 for the six months ended June 30, 2023, and 2022, respectively.

The remaining unvested share-based compensation expense of $1,664,419 is expected to be recognized over the next 93 months.

Warrants

The following table presents the activity for warrants

outstanding:

| Schedule of warrant activity | |

| | | |

| | |

| | |

Warrants | | |

Weighted Average Exercise Price | |

| Outstanding - December 31, 2022 | |

| 4,472,099 | | |

$ | 4.62 | |

| Granted | |

| 950,000 | | |

| 0.61 | |

| Forfeited/canceled | |

| – | | |

| – | |

| Exercised | |

| – | | |

| – | |

| Outstanding - June 30, 2023 | |

| 5,422,099 | | |

$ | 3.84 | |

5,097,099 of the outstanding warrants are currently

exercisable and have a weighted average remaining contractual life of approximately 2.94 years as of June 30, 2023.

Note 7 – Net Loss Per Share

Basic net loss per share is computed by dividing net

loss, which is allocated based upon the proportionate amount of weighted average shares outstanding, to each class of shareholder’s

stock outstanding during the period. For the calculation of diluted net loss per share, net loss per share attributable to common shareholders

for basic net loss per share is adjusted by the effect of dilutive securities, including awards under our equity compensation plans.

As of June 30, 2023, and 2022, 8,505,540 shares and

6,325,245 shares, respectively of potentially dilutive weighted average shares were excluded from the calculation of diluted net loss

per share because their effect would have been anti-dilutive for the periods presented.

Note 8 – Equity Financings

Equity Line Sales of Common

Stock

On November 14, 2022, the

Company entered into a Common Stock Purchase Agreement (the “White Lion Purchase Agreement”) with White Lion Capital, LLC,

a Nevada limited liability company (“White Lion”) for an equity line facility.

In April and June 2023, the

Company closed on three sales of Common Stock under the White Lion Purchase Agreement. As a result, the Company issued an aggregate of

2,361,514 common shares and received aggregate proceeds of approximately $1.3 million.

Any proceeds that the

Company receives under the White Lion Purchase Agreement are expected to be used for working capital and general corporate purposes.

The aggregate number of shares of common stock that

the Company can sell to White Lion under the White Lion Purchase Agreement (including the Commitment Shares) may in no case exceed 2,501,700

shares of the common stock (which is equal to approximately 19.99% of the shares of the common stock outstanding immediately prior to

the execution of the White Lion Purchase Agreement) (the “Exchange Cap”), unless shareholder approval is obtained to issue

purchase shares above the Exchange Cap, in which case the Exchange Cap will no longer apply.

The Company recognized all offering costs related

to the equity line of credit as deferred offering costs in accordance with the guidance in ASC 835-30-S45.

Sale of Common Shares

(S-3 offering)

In June 2023, the Company sold 4,735,000

shares of common stock with net proceeds of $2.7

million.

Note 9 – Subsequent Events

The Company extended the maturity

date of the April 2023 note (described in note 4 to the financial statements) to November 30, 2023. As a result of the extension, the

annual interest rate increased to 20% effective August 1st. Further, the 325,000 contingently exercisable warrants issued with

the loan became immediately exercisable.

Nasdaq Non-Compliance

On August 23, 2023, the Company received a notice from Nasdaq notifying

the Company that because the Company remains delinquent in filing its Form 10-Q, the Company no longer complies with Nasdaq Listing Rule

5250(c)(1), which requires companies with securities listed on Nasdaq to timely file all required periodic reports with the SEC.

The notice received from Nasdaq has no immediate effect on the listing

or trading of the Company’s securities on Nasdaq. However, if the Company would fail to timely regain compliance with Rule 5250(c)(1),

the Company’s securities would be subject to delisting from Nasdaq.

Under the Nasdaq rules, the Company has until October 22, 2023 (60

days after Nasdaq’s notice) to submit a plan to regain compliance with the Rule 5250(c)(1). The Company expects that with the filing

of this Form 10-Q , we have regained compliance with Rule 5250(c)(1).

Item 2. Management’s Discussion and Analysis of Financial

Condition and Results of Operations

The following discussion and analysis should be

read in conjunction with the unaudited condensed financial statements and related notes included elsewhere in this Quarterly Report and

our audited financial statements and related notes thereto included in our Annual Report on Form 10-K for the year ended December 31,

2022, which was filed with the SEC on March 23, 2023. This discussion and analysis and other parts of this Quarterly Report contain forward-looking

statements based upon current beliefs, plans and expectations that involve risks, uncertainties and assumptions, such as statements regarding

our plans, objectives, expectations, intentions and projections. Our actual results and the timing of selected events could differ materially

from those anticipated in these forward-looking statements as a result of several factors, including those set forth under Part II, Item

1A, “Risk Factors” and elsewhere in this Quarterly Report. You should carefully read the “Risk Factors” section

of this Quarterly Report and of our Annual Report on Form 10-K for the year ended December 31, 2022, to gain an understanding of the important

factors that could cause actual results to differ materially from our forward-looking statements. Please also see the section entitled

“Special Note Regarding Forward-Looking Statements.”

Overview

Auddia is a technology company

headquartered in Boulder, CO that is reinventing how consumers engage with audio through the development of a proprietary AI platform

for audio and innovative technologies for podcasts. Auddia is leveraging these technologies within its industry-first audio Superapp,

faidr (previously known as the Auddia App).

faidr gives consumers the

opportunity to listen to any AM/FM radio station with no commercials while personalizing the listening experience through skips and the

insertion of on-demand content, including popular and new music, news, and weather. The faidr app represents the first-time consumers

can combine the local content uniquely provided by AM/FM radio with commercial-free and personalized listening many consumers demand from

digital-media consumption. In addition to commercial-free AM/FM, faidr includes podcasts and exclusive content, branded faidrRadio, which

includes new artist discovery, curated music stations, and Music Casts. Music Casts are unique to faidr. Hosts and DJs can combine on-demand

talk segments with dynamic music streaming, which allows users to hear podcasts with full music track plays embedded in the episodes.

Auddia has also developed

a podcasting platform that provides a unique suite of tools that helps Podcasters create additional digital content for their podcast

episodes as well as plan their episodes, build their brand, and monetize their content with new content distribution channels. This podcast

platform also gives users the ability to go deeper into the stories through supplemental, digital content, and eventually comment and

contribute their own content to episode feeds.

Both of Auddia’s offerings

address large and rapidly growing audiences.

The Company has developed

its AI platform on top of Google’s TensorFlow open-source library that is being “taught” to know the difference between

all types of audio content on the radio. For instance, the platform recognizes the difference between a commercial and a song and is learning

the differences between all other content to include weather reports, traffic, news, sports, DJ conversation, etc. Not only does the technology

learn the differences between the various types of audio segments, but it also identifies the beginning and end of each piece of content.

The Company is leveraging

this technology platform within its premium AM/FM radio listening experience through the faidr App. The faidr App is intended to be downloaded

by consumers who will pay a subscription fee in order to listen to any streaming AM/FM radio station without commercials, podcasts and

the faidrRadio exclusive content offerings. Advanced features will allow consumers to skip any content heard on the station, request audio

content on-demand, and program an audio routine. We believe the faidr App represents a significant differentiated audio streaming product,

or Superapp, that will be the first to come to market since the emergence of popular streaming music apps such as Pandora, Spotify, Apple

Music, Amazon Music, etc. We believe that the most significant point of differentiation is that in addition to ad-free AM/FM streaming,

the faidr App is intended to deliver non-music content that includes local sports, news, weather, traffic and the discovery of new music

alongside exclusive programming and podcasts. No other radio streaming app available today, including category leaders like TuneIn, iHeart,

and Audacy, can compete with faidr’s full product offerings.

We launched an MVP version of faidr through several consumer trials in 2021

to measure consumer interest and engagement with the App. The full app launched on February 15, 2022, and included all major U.S. radio

stations in the US. In February 2023, we added faidrRadio, our exclusive content offerings, to the app. Podcasts were added to the app

for the iOS version before the end of Q1 2023 as planned, and added to the Android app in May of 2023. Podcast functionality will

continue to be enhanced through 2023 and into 2024.

The Company has also developed

its podcasting platform, which leverages technologies and proven product concepts to differentiate its podcasts offering from other competitors

in the radio streaming product category.

With podcasting growing and

predicted to grow at a rapid rate, the Auddia podcast platform was conceptualized to fill a void in the emerging audio media space. The

platform aims to be the preferred podcasting solution for podcasters by enabling them to deliver digital content feeds that match the

audio of their podcast episodes, and by enabling podcasters to make additional revenue from new digital advertising channels; subscription

channels; on-demand fees for exclusive content; and through direct donations from their listeners. Today, podcasters do not have a preference

as to where their listeners access their episodes, as virtually all listening options (mobile apps and web players) deliver only their

podcast audio. By creating a platform on which they can make net new and higher margin revenue, we believe that podcasters will promote

faidr to their listeners, thus creating a powerful, organic marketing dynamic.

One innovative and proprietary

part of the podcast platform is the availability of tools to create and distribute an interactive digital feed which supplements podcast

episode audio with additional digital. These content feeds allow podcasters to tell deeper stories to their listeners while giving podcasters

access to digital revenue for the first time. Podcasters will be able to build these interactive feeds using The Podcast Hub, a content

management system that also serves as a tool to plan and manage podcast episodes. The digital feed activates a new digital ad channel

that turns every audio ad into a direct-response, relevant-to-the-story, digital ad, increasing the effectiveness and value of their established

audio ad model. The feed also presents a richer listening experience, as any element of a podcast episode can be supplemented with images,

videos, text and web links. This feed will appear fully synchronized in the faidr mobile App, and it also can be hosted and accessed independently

(e.g., through any browser), making the content feed universally distributable.

Over time, users will be

able to comment, and podcasters will be able to grant some users publishing rights to add content directly into the feed on their behalf.

This will create another first for podcasting, a dialog between creator and fan, synchronized to the episode content.

The podcast capabilities within faidr will also introduce a unique and

industry first multi-channel, highly flexible set of revenue channels that podcasters can activate in combination to allow listeners to

choose how they want to consume and pay for content. “Flex Revenue” allows podcasters to continue to run their standard audio

ad model and complement those ads with direct response enabled digital ads in each episode content feed, increasing the value of advertising

on any podcast. “Flex Revenue” will also activate subscriptions, on-demand fees for content (e.g., listen without audio ads

for a micro payment fee) and direct donations from listeners. Using these channels in combination, podcasters can maximize revenue generation

and exercise higher margin monetization models, beyond basic audio advertising. Flex Revenue and

the initial inclusion of the new revenue channels that come with it will be added to podcasting in the faidr app, and the first elements

of this new monetization capability is expected to be commercially available before the end of 2023.

The faidr mobile App is available

today through the iOS and Android App stores.

We have funded our operations

with proceeds from the February 2021 IPO, Series A warrants exercised in July 2021 and common share issuance during June of 2023. We also

obtained debt financing through a related party during November 2022 and April 2023. In addition, we sold common shares during April 2023

and June 2023. Since its inception, we have incurred significant operating losses. Since inception we have incurred significant operating

losses. As of June 30, 2023, we had an accumulated deficit of $76.2 million. Our ability to generate product revenue sufficient to achieve

profitability will depend heavily on the successful development and commercialization of one or more of our Apps. We expect that our expenses

and capital requirements will increase substantially in connection with our ongoing activities, particularly if and as we:

| |

· |

nationally launch our faidr App and as we continue training our proprietary AI technology and make product enhancements; |

| |

· |

continue to develop and expand our technology and functionality to advance the faidr app; |

| |

· |

rollout our product on a national basis, which will include increasing our sales and marketing costs related to the promotion of our products. faidr promotion will include a combination of a) purchasing ads directly from broadcasters or b) participating broadcasters to promote without purchasing ads, but sharing a portion of subscription proceeds based on listening activity on those stations; |

| |

· |

hire additional business development, product management, operational and marketing personnel; |

| |

· |

continue market studies of our products; and |

| |

· |

add operational and general administrative personnel which will support our product development programs, commercialization efforts and our transition to operating as a public company. |

As a result, we will need

substantial additional funding to support our continuing operations and pursue our growth strategy. Until such time as we can generate

significant revenue from product sales, if ever, we expect to finance our operations through the sale of equity, debt financings or other

capital sources, which may include collaborations with other companies or other strategic transactions. We may be unable to raise additional

funds or enter into such other agreements or arrangements when needed on favorable terms, or at all. If we fail to raise capital or enter

into such agreements as and when needed, we may have to significantly delay, scale back or discontinue the development and commercialization

of one or more of our product candidates.

Because of the numerous risks

and uncertainties associated with product development, we are unable to predict the timing or amount of increased expenses or when or

if we will be able to achieve or maintain profitability. Even if we are able to generate product sales, we may not become profitable.

If we fail to become profitable or are unable to sustain profitability on a continuing basis, then we may be unable to continue our operations

at planned levels and be forced to reduce or terminate our operations.

As of June 30, 2023, we had

cash of $3,605,144. We will need additional funding to complete the development of our full product line and scale products with a demonstrated

market fit. Management has plans to secure such additional funding. However, if we are unable to raise capital when needed or on acceptable

terms, we would be forced to delay, reduce, or eliminate our technology development and commercialization efforts.

To accelerate

user acquisition, revenue, and cash flow, the Company has explored numerous potential acquisition targets of AM/FM streaming aggregators

over the past year and a half and continues to explore new opportunities. At present, the Company is in advanced active discussions with

two properties and is targeting to execute one or more agreements in the near term. These business development transactions would require

additional funding.

Recent Developments

Nasdaq Deficiency Notice

On May 23, 2023, we received a letter (the “Notice”)