false

0001798749

0001798749

2025-04-09

2025-04-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date

of earliest event reported): April 9, 2025

AEROVATE

THERAPEUTICS, INC.

(Exact name of Registrant

as Specified in Its Charter)

| Delaware |

|

001-40544 |

|

83-1377888 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 930 Winter

Street, Suite M-500 | | |

| Waltham,

Massachusetts | | 02451 |

| (Address of Principal Executive Offices) | | (Zip

Code) |

Registrant's Telephone Number, Including Area

Code: (617) 443-2400

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.0001 par value per share |

|

AVTE |

|

The

Nasdaq Global Market |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 7.01 Regulation FD Disclosure.

On April 9, 2025, Aerovate Therapeutics, Inc., a Delaware

corporation (“Aerovate”), issued a press release titled “Aerovate Therapeutics Declares Special Cash Dividend in Connection

with the Proposed Merger with Jade Biosciences.” A copy of the press release is being furnished as Exhibit 99.1 to this Current

Report on Form 8-K.

The information under Item 7.01 of this Current Report on Form 8-K

(including Exhibit 99.1) is intended to be furnished and shall not be deemed “filed” for purposes of Section 18

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section,

nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except

as expressly set forth by specific reference in such filing.

Item 8.01 Other Events.

As previously disclosed, on October 30, 2024, Aerovate entered

into an Agreement and Plan of Merger (the “Merger Agreement”) pursuant to which, among other matters, and subject to the satisfaction

or waiver of the conditions set forth in the Merger Agreement, Caribbean Merger Sub I, Inc., a Delaware corporation and wholly owned

subsidiary of Aerovate, will merge with and into Jade Biosciences, Inc. (“Jade”), with Jade continuing as a wholly owned

subsidiary of Aerovate and the surviving corporation of the merger (the “First Merger”), and Jade will merge with and into

Caribbean Merger Sub II, LLC, a Delaware limited liability company and wholly owned subsidiary of Aerovate (“Merger Sub II”

and together with Merger Sub I, “Merger Subs”), with Merger Sub II being the surviving entity of the merger (the “Second

Merger” and, together with the First Merger, the “Merger”).

On April 9, 2025, Aerovate’s board of directors declared

a special cash dividend to its stockholders in connection with the Merger (the “Cash Dividend”). The Cash Dividend will be

an aggregate of $69.6 million, or an estimated $2.40 per share, payable in cash to the stockholders of record as of April 25, 2025.

The estimated per share dividend is based on 28,985,019 shares of Aerovate’s common stock outstanding as of April 9, 2025.

The payment date in respect of the Cash Dividend is scheduled for April 29, 2025.

Aerovate does not have, and does not expect to have, current or accumulated

earnings and profits as described in Section 312 of the Internal Revenue Code of 1986, as amended. Accordingly, the Cash Dividend

is expected to be characterized as a return of capital and reported as a non-dividend distribution.

Payment of the Cash Dividend is conditioned upon the closing of the

Merger. Closing is expected to occur on or about April 28, 2025 assuming that the transaction is approved by Aerovate’s stockholders

and the satisfaction or waiver of all conditions under the Merger Agreement. Aerovate’s stockholders will consider and vote

upon approval of the Merger at the special meeting of Aerovate stockholders scheduled for 9:00 a.m. ET on April 16, 2025.

Forward-Looking Statements

Certain statements in this Current Report on Form 8-K and the

exhibits filed or furnished herewith, other than purely historical information, may constitute “forward-looking statements”

within the meaning of the federal securities laws, including for purposes of the “safe harbor” provisions under the Private

Securities Litigation Reform Act of 1995, concerning Aerovate, Jade, the proposed pre-closing financing and the proposed merger between

Aerovate and Jade (collectively, the “Proposed Transactions”) and other matters. These forward-looking statements include,

but are not limited to: expectations related to Aerovate’s payment of the Cash Dividend in connection with the Proposed Transactions,

including anticipated amount, timing and tax implications; the number of shares of Aerovate common stock that may be outstanding as of

the record date; and expectations related to anticipated timing of the Closing and satisfaction (or waiver) of closing conditions under

the Merger Agreement, including approval of the Merger by Aerovate’s stockholders. In addition, any statements that refer to projections,

forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements.

The words “opportunity,” “potential,” “milestones,” “pipeline,” “can,” “goal,”

“strategy,” “target,” “anticipate,” “achieve,” “believe,” “contemplate,”

“continue,” “could,” “estimate,” “expect,” “intends,” “may,” “plan,”

“possible,” “project,” “should,” “will,” “would” and similar expressions (including

the negatives of these terms or variations of them) may identify forward-looking statements, but the absence of these words does not mean

that a statement is not forward-looking. These forward-looking statements are based on current expectations and beliefs concerning future

developments and their potential effects. There can be no assurance that future developments affecting Aerovate, Jade or the Proposed

Transactions or the Cash Dividend will be those that have been anticipated. These forward-looking statements involve a number of risks,

uncertainties (some of which are beyond Aerovate’s control) or other assumptions that may cause actual results, the Cash Dividend

or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties

include, but are not limited to, the risk that the conditions to the closing or consummation of the Proposed Transactions are not satisfied,

including Aerovate’s failure to obtain stockholder approval for the proposed merger; the risk that the proposed pre-closing financing

is not completed in a timely manner or at all; uncertainties as to the timing of the consummation of the Proposed Transactions and the

ability of each of Aerovate and Jade to consummate the transactions contemplated by the Proposed Transactions; risks related to Aerovate’s

continued listing on Nasdaq until closing of the Proposed Transactions and the combined company’s ability to remain listed following

the Proposed Transactions; risks related to Aerovate’s and Jade’s ability to correctly estimate their respective operating

expenses and expenses associated with the Proposed Transactions, as applicable, as well as uncertainties regarding the impact any delay

in the closing of any of the Proposed Transactions would have on the anticipated cash resources of the resulting combined company upon

closing and other events and unanticipated spending and costs that could reduce the combined company’s cash resources; the failure

or delay in obtaining required approvals from any governmental or quasi-governmental entity necessary to consummate the Proposed Transactions;

the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the business combination

between Aerovate and Jade; costs related to the merger; as a result of adjustments to the exchange ratio, Jade stockholders and Aerovate

stockholders could own more or less of the combined company than is currently anticipated; the outcome of any legal proceedings that may

be instituted against Aerovate, Jade or any of their respective directors or officers related to the Merger Agreement or the transactions

contemplated thereby; unexpected costs, charges or expenses resulting from the Proposed Transactions; potential adverse reactions or changes

to business relationships resulting from the announcement or completion of the Proposed Transactions; the risk that Aerovate stockholders

receive more or less of the cash dividend than is currently anticipated; and those uncertainties and factors more fully described in filings

with the Securities and Exchange Commission (the “SEC”),including reports filed on Form 10-K, 10-Q and 8-K, in other

filings that Aerovate makes and will make with the SEC in connection with the proposed Merger, including the proxy statement/prospectus

described below under “Important Additional Information About the Proposed Transaction Filed with the SEC,” as well as discussions

of potential risks, uncertainties, and other important factors included in other filings by Aerovate from time to time, any risk factors

related to Aerovate or Jade made available to you in connection with the Proposed Transactions, as well as risk factors associated with

companies, such as Jade, that operate in the biopharma industry. Should one or more of these risks or uncertainties materialize, or should

any of Aerovate’s or Jade’s assumptions prove incorrect, actual results may vary in material respects from those projected

in these forward-looking statements. Nothing in this Current Report on Form 8-K and the exhibits filed or furnished herewith should

be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the

contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements

in this Current Report on Form 8-K and the exhibits filed or furnished herewith, which speak only as of the date they are made and

are qualified in their entirety by reference to the cautionary statements herein. Neither Aerovate nor Jade undertakes or accepts any

duty to release publicly any updates or revisions to any forward-looking statements. This Current Report on Form 8-K and the exhibits

filed or furnished herewith do not purport to summarize all of the conditions, risks and other attributes of an investment in Aerovate

or Jade.

No Offer or Solicitation

This Current Report on Form 8-K and the exhibits filed or furnished

herewith is not intended to and does not constitute (i) a solicitation of a proxy, consent or approval with respect to any securities

or in respect of the Proposed Transactions between Aerovate and Jade or (ii) an offer to sell or the solicitation of an offer to

subscribe for or buy or an invitation to purchase or subscribe for any securities pursuant to the Proposed Transactions or otherwise,

nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities

shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended, or an exemption therefrom.

Subject to certain exceptions to be approved by the relevant regulators or certain facts to be ascertained, the public offer will not

be made directly or indirectly, in or into any jurisdiction where to do so would constitute a violation of the laws of such jurisdiction,

or by use of the mails or by any means or instrumentality (including without limitation, facsimile transmission, telephone and the internet)

of interstate or foreign commerce, or any facility of a national securities exchange, of any such jurisdiction.

NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR

DISAPPROVED OF THE SECURITIES OR DETERMINED IF THIS CURRENT REPORT ON FORM 8-K IS TRUTHFUL OR COMPLETE.

Important Additional Information about the Proposed Transaction

Filed with the SEC

This Current Report on Form 8-K and the exhibits filed or furnished

herewith are not substitutes for the registration statement on Form S-4 or for any other document that Aerovate has filed or may

file with the SEC in connection with the Proposed Transactions. In connection with the Proposed Transactions, Aerovate has filed with

the SEC a registration statement on Form S-4, which contains a proxy statement/prospectus of Aerovate. AEROVATE URGES INVESTORS AND

STOCKHOLDERS TO READ THE REGISTRATION STATEMENT ON FORM S-4, PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT ARE

OR MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE

THEY DO AND WILL CONTAIN IMPORTANT INFORMATION ABOUT AEROVATE, JADE, THE PROPOSED TRANSACTIONS AND RELATED MATTERS. Investors and stockholders

can obtain free copies of the proxy statement/prospectus and other documents filed by Aerovate with the SEC through the website maintained

by the SEC at www.sec.gov. Stockholders are urged to read the proxy statement/prospectus and the other relevant materials filed with the

SEC before making any voting or investment decision with respect to the Proposed Transactions. In addition, investors and stockholders

should note that Aerovate communicates with investors and the public using its website (https://ir.aerovatetx.com/).

Participants in the Solicitation

Aerovate, Jade and their respective directors and executive officers

may be deemed to be participants in the solicitation of proxies from stockholders in connection with the Proposed Transactions. Information

about Aerovate’s directors and executive officers, including a description of their interests in Aerovate, is included in the proxy

statement/prospectus relating to the Proposed Transactions and Aerovate’s most recent Annual Report on Form 10-K, including

any information incorporated therein by reference, each as filed with the SEC. Information about Aerovate’s and Jade’s respective

directors and executive officers and their interests in the Proposed Transactions is included in the proxy statement/prospectus relating

to the Proposed Transactions filed with the SEC. These documents can be obtained free of charge from the sources indicated above.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

Aerovate Therapeutics, Inc.

(Registrant) |

| |

|

|

|

| Date: |

April 9, 2025 |

By: |

/s/ George A. Eldridge |

| |

|

Name:

Title: |

George A. Eldridge

Chief Financial Officer |

Exhibit 99.1

Aerovate Therapeutics Declares Special Cash

Dividend in Connection with the Proposed Merger with Jade Biosciences

Aggregate cash dividend of $69.6 million, or

an estimated $2.40 per share

Waltham, MA, April 9, 2025 – Aerovate Therapeutics, Inc.

(Nasdaq: AVTE) (“Aerovate”) today announced that its Board of Directors has declared a special cash dividend (the “Cash

Dividend”) in connection with the previously announced merger (the “Merger”) with Jade Biosciences, Inc. (“Jade”)

pursuant to the Agreement and Plan of Merger, dated October 30, 2024 (the “Merger Agreement”). The Cash Dividend will

be an aggregate of $69.6 million, or an estimated $2.40 per share, payable in cash to the stockholders of record as of April 25,

2025. The estimated per share dividend is based on 28,985,019 shares of Aerovate’s common stock outstanding as of April 9,

2025. The payment date in respect of the Cash Dividend is scheduled for April 29, 2025.

Aerovate does not have, and does not expect to have, current or accumulated

earnings and profits as described in Section 312 of the Internal Revenue Code of 1986, as amended. Accordingly, the Cash Dividend

is expected to be characterized as a return of capital and reported as a non-dividend distribution.

Payment of the Cash Dividend is conditioned upon the closing of the

Merger. Closing is expected to occur on or about April 28, 2025 assuming that the transaction is approved by Aerovate’s stockholders

and the satisfaction or waiver of all conditions under the Merger Agreement. Aerovate’s stockholders will consider and vote upon

approval of the Merger at the special meeting of Aerovate stockholders scheduled for 9:00 a.m. ET on April 16, 2025.

If you need assistance in voting your shares or have questions regarding

the special meeting of Aerovate’s stockholders, please contact Aerovate’s proxy solicitor, Innisfree M&A Incorporated

at (877) 750-8310 (toll-free) or (212) 750-5833.

About Aerovate Therapeutics, Inc.

Aerovate Therapeutics is a biotechnology company

that was focused on improving the lives of patients with rare cardiopulmonary disease. For more information, please visit www.aerovatetx.com.

About Jade Biosciences

Jade Biosciences is focused on developing

best-in-class therapies to address critical unmet needs in autoimmune diseases. Its lead asset, JADE-001, targets the cytokine anti-A

PRoliferation-Inducing Ligand (APRIL) for immunoglobulin A (IgA) nephropathy, with Investigational New Drug Application-enabling studies

underway and initiation of a first-in-human trial expected in the second half of 2025. Jade’s pipeline also includes two undisclosed

antibody discovery programs, JADE-002 and JADE-003, currently in preclinical development. Jade was launched based on assets licensed from

Paragon Therapeutics, an antibody discovery engine founded by Fairmount. For more information, visit www.JadeBiosciences.com and follow

the company on LinkedIn.

Forward-Looking Statements

Certain statements in this communication, other than purely historical

information, may constitute “forward-looking statements” within the meaning of the federal securities laws, including for

purposes of the “safe harbor” provisions under the Private Securities Litigation Reform Act of 1995, concerning Aerovate,

Jade, the proposed pre-closing financing and the proposed merger between Aerovate and Jade (collectively, the “Proposed Transactions”)

and other matters. These forward-looking statements include, but are not limited to, expectations related to Aerovate’s payment

of the Cash Dividend in connection with the Proposed Transactions, including anticipated amount, timing and tax implications; the number

of shares of Aerovate common stock that may be outstanding as of the record date; and expectations related to anticipated timing of the

Closing and satisfaction (or waiver) of closing conditions under the Merger Agreement, including approval of the Merger by Aerovate’s

stockholders. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances,

including any underlying assumptions, are forward-looking statements. The words “opportunity,” “potential,” “milestones,”

“pipeline,” “can,” “goal,” “strategy,” “target,” “anticipate,”

“achieve,” “believe,” “contemplate,” “continue,” “could,” “estimate,”

“expect,” “intends,” “may,” “plan,” “possible,” “project,” “should,”

“will,” “would” and similar expressions (including the negatives of these terms or variations of them) may identify

forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking

statements are based on current expectations and beliefs concerning future developments and their potential effects. There can be no assurance

that future developments affecting Aerovate, Jade or the Proposed Transactions or the Cash Dividend will be those that have been anticipated.

These forward-looking statements involve a number of risks, uncertainties (some of which are beyond Aerovate’s control) or other

assumptions that may cause actual results, the Cash Dividend or performance to be materially different from those expressed or implied

by these forward-looking statements. These risks and uncertainties include, but are not limited to, the risk that the conditions to the

closing or consummation of the Proposed Transactions are not satisfied, including Aerovate’s failure to obtain stockholder approval

for the proposed merger; the risk that the proposed pre-closing financing is not completed in a timely manner or at all; uncertainties

as to the timing of the consummation of the Proposed Transactions and the ability of each of Aerovate and Jade to consummate the transactions

contemplated by the Proposed Transactions; risks related to Aerovate’s continued listing on Nasdaq until closing of the Proposed

Transactions and the combined company’s ability to remain listed following the Proposed Transactions; risks related to Aerovate’s

and Jade’s ability to correctly estimate their respective operating expenses and expenses associated with the Proposed Transactions,

as applicable, as well as uncertainties regarding the impact any delay in the closing of any of the Proposed Transactions would have on

the anticipated cash resources of the resulting combined company upon closing and other events and unanticipated spending and costs that

could reduce the combined company’s cash resources; the failure or delay in obtaining required approvals from any governmental or

quasi-governmental entity necessary to consummate the Proposed Transactions; the occurrence of any event, change or other circumstance

or condition that could give rise to the termination of the business combination between Aerovate and Jade; costs related to the merger;

as a result of adjustments to the exchange ratio, Jade stockholders and Aerovate stockholders could own more or less of the combined company

than is currently anticipated; the outcome of any legal proceedings that may be instituted against Aerovate, Jade or any of their respective

directors or officers related to the Merger Agreement or the transactions contemplated thereby; unexpected costs, charges or expenses

resulting from the Proposed Transactions; potential adverse reactions or changes to business relationships resulting from the announcement

or completion of the Proposed Transactions; the risk that Aerovate stockholders receive more or less of the cash dividend than is currently

anticipated; and those uncertainties and factors more fully described in filings with the Securities and Exchange Commission (the “SEC”),

including reports filed on Form 10-K, 10-Q and 8-K, in other filings that Aerovate makes and will make with the SEC in connection

with the proposed Merger, including the proxy statement/prospectus described below under “Important Additional Information About

the Proposed Transaction Filed with the SEC,” as well as discussions of potential risks, uncertainties, and other important factors

included in other filings by Aerovate from time to time, any risk factors related to Aerovate or Jade made available to you in connection

with the Proposed Transactions, as well as risk factors associated with companies, such as Jade, that operate in the biopharma industry.

Should one or more of these risks or uncertainties materialize, or should any of Aerovate’s or Jade’s assumptions prove incorrect,

actual results may vary in material respects from those projected in these forward-looking statements. Nothing in this communication should

be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the

contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements

in this communication, which speak only as of the date they are made and are qualified in their entirety by reference to the cautionary

statements herein. Neither Aerovate nor Jade undertakes or accepts any duty to release publicly any updates or revisions to any forward-looking

statements. This communication does not purport to summarize all of the conditions, risks and other attributes of an investment in Aerovate

or Jade.

No Offer or Solicitation

This communication is not intended to and does not constitute (i) a

solicitation of a proxy, consent or approval with respect to any securities or in respect of the Proposed Transactions between Aerovate

and Jade or (ii) an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe

for any securities pursuant to the Proposed Transactions or otherwise, nor shall there be any sale, issuance or transfer of securities

in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the

requirements of the Securities Act of 1933, as amended, or an exemption therefrom. Subject to certain exceptions to be approved by the

relevant regulators or certain facts to be ascertained, the public offer will not be made directly or indirectly, in or into any jurisdiction

where to do so would constitute a violation of the laws of such jurisdiction, or by use of the mails or by any means or instrumentality

(including without limitation, facsimile transmission, telephone and the internet) of interstate or foreign commerce, or any facility

of a national securities exchange, of any such jurisdiction.

NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR

DISAPPROVED OF THE SECURITIES OR DETERMINED IF THIS CURRENT REPORT ON FORM 8-K IS TRUTHFUL OR COMPLETE.

Important Additional Information about the Proposed Transaction

Filed with the SEC

This communication is not a substitute for the Form S-4 or for

any other document that Aerovate has filed or may file with the SEC in connection with the Proposed Transactions. In connection with the

Proposed Transactions, Aerovate has filed with the SEC the Form S-4, which contains a proxy statement/prospectus of Aerovate. AEROVATE

URGES INVESTORS AND STOCKHOLDERS TO READ THE FORM S-4, PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT ARE OR MAY BE

FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY DO AND WILL

CONTAIN IMPORTANT INFORMATION ABOUT AEROVATE, JADE, THE PROPOSED TRANSACTIONS AND RELATED MATTERS. Investors and stockholders can obtain

free copies of the proxy statement/prospectus and other documents filed by Aerovate with the SEC through the website maintained by the

SEC at www.sec.gov. Stockholders are urged to read the proxy statement/prospectus and the other relevant materials filed with the SEC

before making any voting or investment decision with respect to the Proposed Transactions. In addition, investors and stockholders should

note that Aerovate communicates with investors and the public using its website (https://ir.aerovatetx.com/).

Participants in the Solicitation

Aerovate, Jade and their respective directors and executive officers

may be deemed to be participants in the solicitation of proxies from stockholders in connection with the Proposed Transactions. Information

about Aerovate’s directors and executive officers, including a description of their interests in Aerovate, is included in the proxy

statement/prospectus relating to the Proposed Transactions and Aerovate’s most recent Annual Report on Form 10-K, including

any information incorporated therein by reference, each as filed with the SEC. Information about Aerovate’s and Jade’s respective

directors and executive officers and their interests in the Proposed Transactions is included in the proxy statement/prospectus relating

to the Proposed Transactions filed with the SEC. These documents can be obtained free of charge from the sources indicated above.

Jade Biosciences Contact

Media:

Media@JadeBiosciences.com

Investors:

IR@JadeBiosciences.com

Aerovate Therapeutics, Inc. Contact

Investors: IR@Aerovatetx.com

v3.25.1

Cover

|

Apr. 09, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Apr. 09, 2025

|

| Entity File Number |

001-40544

|

| Entity Registrant Name |

AEROVATE

THERAPEUTICS, INC.

|

| Entity Central Index Key |

0001798749

|

| Entity Tax Identification Number |

83-1377888

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

930 Winter

Street,

|

| Entity Address, Address Line Two |

Suite M-500

|

| Entity Address, City or Town |

Waltham

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02451

|

| City Area Code |

617

|

| Local Phone Number |

443-2400

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.0001 par value per share

|

| Trading Symbol |

AVTE

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

true

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

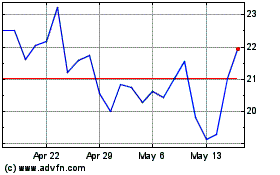

Aerovate Therapeutics (NASDAQ:AVTE)

Historical Stock Chart

From Mar 2025 to Apr 2025

Aerovate Therapeutics (NASDAQ:AVTE)

Historical Stock Chart

From Apr 2024 to Apr 2025