BridgeBio Pharma, Inc. (Nasdaq: BBIO) (the “Company,” “we” or

“BridgeBio”) announced today that it intends to offer, subject to

market conditions and other factors, $500 million aggregate

principal amount of convertible senior notes due 2031 (the “notes”)

in a private offering (the “offering”) to qualified institutional

buyers pursuant to Rule 144A under the Securities Act of 1933, as

amended (the “Securities Act”). In connection with the offering,

the Company expects to grant the initial purchasers an option to

purchase up to an additional $75 million aggregate principal amount

of notes.

The Company intends to use a portion of the net proceeds from

the offering to repay all outstanding borrowings under and

terminate its Financing Agreement, dated as of January 17, 2024,

with the lenders party thereto and Blue Owl Corporation, as

administrative agent, as amended (the “Financing Agreement”), and

pay any fees related thereto. The termination of the Financing

Agreement, which accounted for approximately $51.5 million of cash

paid for interest in 2024 and contains various restrictive

covenants, will provide the Company with reduced pro forma interest

expense and greater operational flexibility. The Company intends to

use up to $50 million of any remaining net proceeds from the

offering to repurchase shares of its common stock from certain

purchasers of the notes in privately negotiated transactions

effected through one or more of the initial purchasers or an

affiliate thereof concurrently with the pricing of the notes (such

transactions, the “share repurchases”), together, if necessary,

with cash on hand. The Company expects to use any remaining net

proceeds from the offering for general corporate purposes.

The Company expects the purchase price per share of its common

stock in the share repurchases to equal the last reported sale

price per share of its common stock on the Nasdaq Global Select

Market as of the date of the pricing of the notes. The share

repurchases could increase (or reduce the size of any decrease in)

the market price of the Company’s common stock prior to,

concurrently with or shortly after the pricing of the notes, and

could result in a higher effective conversion price for the notes.

The Company cannot predict the magnitude of such market activity or

the overall effect it will have on the market price of the notes

and/or the market price of the Company’s common stock.

The final terms of the notes, including the initial conversion

rate, interest rate and certain other terms, will be determined at

the time of pricing. The notes will bear interest semi-annually and

will mature on March 1, 2031, unless earlier converted, redeemed or

repurchased. Prior to December 2, 2030, the notes will be

convertible only upon satisfaction of certain conditions and during

certain periods. Thereafter, the notes will be convertible at any

time until the close of business on the second scheduled trading

day immediately preceding the maturity date. The notes will be

convertible at the option of the holders, subject to certain

conditions and during certain periods, into cash, shares of the

Company’s common stock or a combination of cash and shares of the

Company’s common stock, with the form of consideration determined

at the Company’s election.

The Company may not redeem the notes prior to March 6, 2028. On

or after March 6, 2028 and on or before the 41st scheduled trading

day immediately before the maturity date of the notes, the Company

may redeem for cash all or any portion of the notes, at its option

at any time, and from time to time, if the last reported sale price

per share of the Company’s common stock exceeds 130% of the

conversion price for a specified period of time and certain other

conditions are satisfied. The redemption price will be equal to

100% of the principal amount of the notes being redeemed, plus

accrued and unpaid interest to, but excluding, the redemption date.

Holders of the notes will have the right to require the Company to

repurchase all or a portion of their notes at 100% of their

principal amount, plus any accrued and unpaid interest, upon the

occurrence of certain events.

When issued, the notes will be the Company’s senior unsecured

obligations and will rank senior in right of payment to any of the

Company’s unsecured indebtedness that is expressly subordinated in

right of payment to the notes; equal in right of payment to any of

the Company’s unsecured indebtedness that is not so subordinated;

effectively junior in right of payment to any of the Company’s

secured indebtedness and obligations, to the extent of the value of

the assets securing such indebtedness; and structurally junior to

all indebtedness and other liabilities (including trade payables)

of the Company’s subsidiaries.

The notes and the shares of common stock issuable upon

conversion of the notes, if any, are not being registered under the

Securities Act, or the securities laws of any other jurisdiction.

The notes and the shares of common stock issuable upon conversion

of the notes, if any, may not be offered or sold in the United

States except in transactions exempt from, or not subject to, the

registration requirements of the Securities Act and any applicable

state securities laws.

This press release does not constitute an offer to sell or a

solicitation of an offer to buy the securities described herein,

nor shall there be any sale of these securities in any state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of such jurisdiction.

About BridgeBio

BridgeBio is a new type of biopharmaceutical company founded to

discover, create, test, and deliver transformative medicines to

treat patients who suffer from genetic diseases. BridgeBio’s

pipeline of development programs ranges from early science to

advanced clinical trials. BridgeBio was founded in 2015 and its

team of experienced drug discoverers, developers and innovators are

committed to applying advances in genetic medicine to help patients

as quickly as possible.

Forward-Looking Statements

This press release contains forward-looking statements.

Statements in this press release may include statements that are

not historical facts and are considered forward-looking within the

meaning of Section 27A of the Securities Act and Section 21E of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”),

which are usually identified by the use of words such as

“anticipates,” “believes,” “continues,” “estimates,” “expects,”

“hopes,” “intends,” “may,” “plans,” “projects,” “remains,” “seeks,”

“should,” “will,” and variations of such words or similar

expressions. We intend these forward-looking statements to be

covered by the safe harbor provisions for forward-looking

statements contained in Section 27A of the Securities Act and

Section 21E of the Exchange Act. These forward-looking statements,

including statements relating to whether we will offer and issue

the notes, the terms of the notes, the anticipated use of the net

proceeds from the offering and the expectations regarding the

effect of the share repurchases, reflect our current views about

our plans, intentions, expectations and strategies, which are based

on the information currently available to us and on assumptions we

have made.

Although we believe that our plans, intentions, expectations and

strategies as reflected in or suggested by those forward-looking

statements are reasonable, we can give no assurance that the plans,

intentions, expectations or strategies will be attained or

achieved. Furthermore, actual results may differ materially from

those described in the forward-looking statements and will be

affected by a number of risks, uncertainties and assumptions,

including, but not limited to, those risks set forth in the Risk

Factors section of our Annual Report on Form 10-K for the year

ended December 31, 2024 and our other filings with the U.S.

Securities and Exchange Commission. Moreover, we operate in a very

competitive and rapidly changing environment in which new risks

emerge from time to time. These forward-looking statements are

based upon the current expectations and beliefs of our management

as of the date of this press release, and are subject to certain

risks and uncertainties that could cause actual results to differ

materially from those described in the forward-looking statements.

Except as required by applicable law, we assume no obligation to

update publicly any forward-looking statements, whether as a result

of new information, future events or otherwise.

Contact:

Bubba Murarka, EVP

Communicationscontact@bridgebio.com(650)-789-8220Source: BridgeBio

Pharma, Inc.

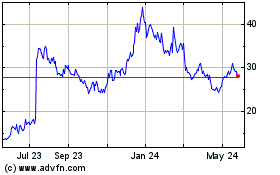

BridgeBio Pharma (NASDAQ:BBIO)

Historical Stock Chart

From Jan 2025 to Feb 2025

BridgeBio Pharma (NASDAQ:BBIO)

Historical Stock Chart

From Feb 2024 to Feb 2025