BCB Bancorp, Inc. (the “Company”), (NASDAQ: BCBP), the holding

company for BCB Community Bank (the “Bank”), today announced that

it had extended its offer (the "exchange offer") to exchange up to

$40 million aggregate principal amount of its outstanding 9.25%

Fixed-to-Floating Rate Subordinated Notes due 2034 (the "Old

Notes") for an equivalent amount of its 9.25% Fixed-to-Floating

Rate Subordinated Notes due 2034 registered under the Securities

Act of 1933, as amended (the "Exchange Notes"). $40 million

aggregate principal amount of Old Notes were issued and sold by the

Company in August 2024 in a private offering.

The exchange offer, previously scheduled to expire at 5:00 p.m.,

Eastern Time, on Tuesday, December 3, 2024, will now expire at 5:00

p.m., Eastern Time, on Thursday, December 5, 2024, unless further

extended. $39 million in aggregate principal amount, or 97.5%, of

the outstanding Old Notes were tendered in the exchange offer as of

5:00 p.m., Eastern Time, on December 3, 2024.

The terms of the exchange offer are set forth in a prospectus

dated October 31, 2024. Copies of the prospectus and the other

exchange offer documents may be obtained from the exchange

agent:

UMB Bank, N.A. Attn: Corporate Trust

Officer/James Henry 5555 San Felipe, Suite 870 Houston, Texas 77056

Telephone: (512) 582-5851 Email: james.henry@umb.com Facsimile (for

eligible institutions only): (512) 582-5855

This press release is for informational purposes only and is

neither an offer to buy or sell nor a solicitation of an offer to

buy or sell any Old Notes or Exchange Notes. The exchange offer is

being made only pursuant to the exchange offer prospectus, which is

being distributed to holders of the Old Notes and has been filed

with the Securities and Exchange Commission as part of the

Company's Registration Statement on Form S-4 (File No. 333-282784),

which was declared effective on October 30, 2024.

About BCB Bancorp, Inc.

BCB Bancorp, Inc. is a New Jersey corporation established in

2003, and is the holding company parent of BCB Community Bank. The

Company has not engaged in any significant business activity other

than owning all of the outstanding common stock of the Bank.

Established in 2000 and headquartered in Bayonne, N.J., the Bank is

the wholly-owned subsidiary of BCB Bancorp, Inc. (NASDAQ: BCBP).

The Bank has twenty-three branch offices in Bayonne, Edison,

Hoboken, Fairfield, Holmdel, Jersey City, Lyndhurst, Maplewood,

Monroe Township, Newark, Parsippany, Plainsboro, River Edge,

Rutherford, South Orange, Union, and Woodbridge, New Jersey, and

three branch offices in Hicksville and Staten Island, New York. The

Bank provides businesses and individuals a wide range of loans,

deposit products, and retail and commercial banking services. For

more information, please go to www.bcb.bank.

Forward-Looking Statements

This release, like many written and oral communications

presented by BCB Bancorp, Inc., and our authorized officers, may

contain certain forward-looking statements regarding our

prospective performance and strategies within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. We intend

such forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995, and are including this

statement for purposes of said safe harbor provisions.

Forward-looking statements, which are based on certain assumptions

and describe future plans, strategies, and expectations of the

Company, are generally identified by use of words “anticipate,”

“believe,” “estimate,” “expect,” “intend,” “plan,” “project,”

“seek,” “strive,” “try,” or future or conditional verbs such as

“could,” “may,” “should,” “will,” “would,” or similar expressions.

Our ability to predict results or the actual effects of our plans

or strategies is inherently uncertain. Accordingly, actual results

may differ materially from anticipated results.

The most significant factor that could cause future results to

differ materially from those anticipated by our forward-looking

statements include the ongoing impact of higher inflation levels,

higher interest rates and general economic and recessionary

concerns, all of which could impact economic growth and could cause

a reduction in financial transactions and business activities,

including decreased deposits and reduced loan originations, our

ability to manage liquidity and capital in a rapidly changing and

unpredictable market, supply chain disruptions, labor shortages and

additional interest rate increases by the Federal Reserve. Other

factors that could cause future results to vary materially from

current management expectations as reflected in our forward-looking

statements include, but are not limited to: the global impact of

the military conflicts in the Ukraine and the Middle East;

unfavorable economic conditions in the United States generally and

particularly in our primary market area; the Company’s ability to

effectively attract and deploy deposits; the impact of any future

pandemics or other natural disasters; changes in the Company’s

corporate strategies, the composition of its assets, or the way in

which it funds those assets; shifts in investor sentiment or

behavior in the securities, capital, or other financial markets,

including changes in market liquidity or volatility; the effects of

declines in real estate values that may adversely impact the

collateral underlying our loans; increase in unemployment levels

and slowdowns in economic growth; our level of non-performing

assets and the costs associated with resolving any problem loans

including litigation and other costs; the impact of changes in

interest rates and the credit quality and strength of underlying

collateral and the effect of such changes on the market value of

our loan and investment securities portfolios; the credit risk

associated with our loan portfolio; changes in the quality and

composition of the Bank’s loan and investment portfolios; changes

in our ability to access cost-effective funding; deposit flows;

legislative and regulatory changes, including increases in Federal

Deposit Insurance Corporation, or FDIC, insurance rates; monetary

and fiscal policies of the federal and state governments; changes

in tax policies, rates and regulations of federal, state and local

tax authorities; demands for our loan products; demand for

financial services; competition; changes in the securities or

secondary mortgage markets; changes in management’s business

strategies; changes in consumer spending; our ability to retain key

employees; the effects of any reputational, credit, interest rate,

market, operational, legal, liquidity, or regulatory risk;

expanding regulatory requirements which could adversely affect

operating results; civil unrest in the communities that we serve;

and other factors discussed elsewhere in this report, and in other

reports we filed with the SEC, including under “Risk Factors” in

Part I, Item 1A of our Annual Report on Form 10-K, and our other

periodic reports that we file with the SEC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241204876004/en/

Michael Shriner, President & CEO Jawad Chaudhry, EVP &

CFO (201) 823-0700

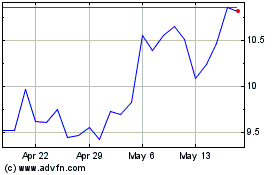

BCB Bancorp (NASDAQ:BCBP)

Historical Stock Chart

From Dec 2024 to Jan 2025

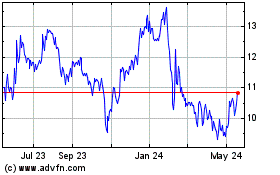

BCB Bancorp (NASDAQ:BCBP)

Historical Stock Chart

From Jan 2024 to Jan 2025