false

0001094831

0001094831

2024-12-06

2024-12-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 6, 2024

BGC Group,

Inc.

(Exact name of Registrant as specified in

its charter)

| Delaware |

|

001-35591 |

|

86-3748217 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

499 Park Avenue, New York, NY 10022

(Address of principal executive offices)

Registrant’s telephone number, including

area code: (212) 610-2200

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Class A Common Stock, $0.01 par value |

|

BGC |

|

The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

☐

Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not

to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section

13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

The information set forth in Item 8.01 of this Current Report on Form

8-K is incorporated herein by reference.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation

under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth in Item 8.01 of this Current Report on Form

8-K is incorporated herein by reference.

Item 8.01. Other Events.

On December 6, 2024, BGC Group, Inc. (“BGC” or the “Company”)

entered into the First Amendment (“First Amendment”), which amends that certain Second Amended and Restated Credit Agreement

dated as of April 26, 2024 (as amended, restated, supplemented or otherwise modified prior to the date hereof, the “Existing Credit

Agreement”), by and among the Company, the several financial institutions from time to time party thereto, as Lenders, and Bank

of America, N.A., as Administrative Agent, pursuant to which the Lenders provided the Company with an increase to the Aggregate Revolving

Commitments, resulting in total Aggregate Revolving Commitments equal to $700,000,000 (the “Revolving Credit Facility”). The

Existing Agreement as amended by the First Amendment shall be referred to as the “Credit Agreement”. Terms used herein without

definition have the meanings provided in the Credit Agreement. The borrowing rates and financial covenants under the Existing Credit Agreement

have not been changed by the First Amendment.

The Company expects to use funds borrowed under the Credit Agreement

for general corporate purposes.

The foregoing description of the First Amendment does not purport to

be complete and is qualified in its entirety by reference to the actual terms of the First Amendment, a copy of which is attached hereto

as Exhibit 10.1, and is incorporated herein by reference.

Discussion of Forward-Looking Statements about BGC

Statements in this document regarding BGC that are not historical facts

are “forward-looking statements” that involve risks and uncertainties, which could cause actual results to differ from those

contained in the forward-looking statements. These include statements about BGC’s business, results, financial position, liquidity

and outlook, which may constitute forward-looking statements and are subject to the risk that the actual impact may differ, possibly materially,

from what is currently expected. Except as required by law, BGC undertakes no obligation to update any forward-looking statements. For

a discussion of additional risks and uncertainties, which could cause actual results to differ from those contained in the forward-looking

statements, see BGC’s Securities and Exchange Commission filings, including, but not limited to, the risk factors and Special Note

on Forward-Looking Information set forth in these filings and any updates to such risk factors and Special Note on Forward-Looking Information

contained in subsequent reports on Form 10-K, Form 10-Q or Form 8-K.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

The exhibit index set forth below is incorporated by reference in response

to this Item 9.01.

EXHIBIT INDEX

| Exhibit Number |

|

Description |

| 10.1. |

|

First Amendment to Second Amended and Restated Credit Agreement, dated as of December 6, 2024, by and among BGC Group, Inc., as the Borrower, the several financial institutions from time to time as parties thereto, as Lenders, and Bank of America, N.A., as Administrative Agent |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report on Form 8-K to be signed on its behalf by the undersigned hereunto duly authorized.

| |

BGC Group, Inc. |

| |

|

| Date: December 6, 2024 |

By: |

/s/ Howard W. Lutnick |

| |

Name: |

Howard W. Lutnick |

| |

Title: |

Chairman of the Board and Chief Executive Officer |

[Signature Page to Form

8-K, dated December 6, 2024, regarding BGC Group, Inc.’s First Amendment to Second A&R Credit Agreement]

3

Exhibit 10.1

EXECUTION VERSION

FIRST AMENDMENT TO SECOND AMENDED AND RESTATED

CREDIT AGREEMENT

Dated as of December 6, 2024

among

BGC GROUP, INC.,

as the Borrower,

THE LENDERS PARTY HERETO,

BANK OF AMERICA, N.A.,

as Administrative Agent and L/C Issuer,

CAPITAL ONE, NATIONAL ASSOCIATION,

CITIZENS BANK, N.A.,

FIFTH THIRD BANK, NATIONAL ASSOCIATION,

INDUSTRIAL AND COMMERCIAL BANK OF CHINA LIMITED,

NEW YORK BRANCH,

M&T BANK,

PNC BANK, NATIONAL ASSOCIATION,

REGIONS BANK,

SANTANDER BANK, N.A.,

SYNOVUS BANK,

THE HUNTINGTON NATIONAL BANK,

and

WELLS FARGO BANK, NATIONAL ASSOCIATION,

as Co-Syndication Agents,

ASSOCIATED BANK, N.A.,

KEYBANK NATIONAL ASSOCIATION,

COMERICA BANK,

and

GOLDMAN SACHS BANK USA,

as Co-Documentation Agents,

Arranged By:

BOFA SECURITIES, INC.,

CAPITAL ONE, NATIONAL ASSOCIATION,

CITIZENS BANK, N.A.,

FIFTH THIRD BANK, NATIONAL ASSOCIATION,

INDUSTRIAL AND COMMERCIAL BANK OF CHINA LIMITED,

NEW YORK BRANCH,

M&T BANK,

PNC CAPITAL MARKETS, LLC,

REGIONS CAPITAL MARKETS, a division of Regions

Bank,

SANTANDER BANK, N.A.,

SYNOVUS BANK,

THE HUNTINGTON NATIONAL BANK,

and

WELLS FARGO SECURITIES, LLC,

as Joint Lead Arrangers and Joint Bookrunners

FIRST AMENDMENT TO SECOND AMENDED AND RESTATED

CREDIT AGREEMENT

This FIRST AMENDMENT TO SECOND

AMENDED AND RESTATED CREDIT AGREEMENT (this “Agreement”) is entered into as of December 6, 2024 (the “Effective

Date”), among BGC GROUP, INC., a Delaware corporation (the “Borrower”), the Lenders party hereto, and BANK

OF AMERICA, N.A., as Administrative Agent and L/C Issuer. Capitalized terms used herein and not otherwise defined herein shall have the

meanings ascribed thereto in the Existing Credit Agreement (defined herein) or the Amended Credit Agreement (defined herein), as applicable.

RECITALS

WHEREAS, the Borrower, the Guarantors

from time to time party thereto, the Lenders from time to time party thereto and Bank of America, N.A., as Administrative Agent and L/C

Issuer, are parties to that certain Second Amended and Restated Credit Agreement dated as of April 26, 2024 (as amended, restated, amended

and restated, extended, supplemented or otherwise modified from time to time prior to the date hereof, the “Existing Credit Agreement”;

the Existing Credit Agreement, as amended by this Agreement, the “Amended Credit Agreement”);

WHEREAS, the Borrower has requested

that (a) the Lenders provide an increase to the Aggregate Revolving Commitments in an aggregate principal amount equal to $325,000,000

(the “First Amendment Incremental Increase”; such increased commitments, the “Incremental Commitments”;

and the Lenders providing the Incremental Commitments, the “Incremental Lenders”) and (b) the Lenders amend certain

provisions of the Existing Credit Agreement; and

WHEREAS, the Incremental Lenders

party hereto are willing to provide the First Amendment Incremental Increase and the Lenders party hereto are willing to make such amendments,

in each case, in accordance with and subject to the terms and conditions set forth herein.

NOW, THEREFORE, in consideration

of the agreements hereinafter set forth, and for other good and valuable consideration, the receipt and adequacy of which are hereby acknowledged,

the parties hereto agree as follows:

1. First

Amendment Incremental Increase; Reallocation. Upon giving effect to this Agreement, (i) the Incremental Commitment of each Incremental

Lender shall be as set forth opposite its name on Schedule 1 attached hereto, (ii) the Revolving Commitment and the Applicable

Percentage of each Lender shall be as set forth opposite its name on Schedule 2.01 attached hereto, (iii) the Aggregate Revolving

Commitments shall equal $700,000,000, and (iv) if any Revolving Loans are outstanding, the Administrative Agent, the Borrower, and the

Lenders shall effect such reallocations as the Administrative Agent determines are necessary to ensure that all outstanding Revolving

Loans on the Effective Date are held ratably by the Lenders based on their revised Applicable Percentages arising from the First Amendment

Incremental Increase

2. Amendments

to Existing Credit Agreement.

(a) The

definition of “Aggregate Revolving Commitments” in Section 1.01 of the Existing Credit Agreement is amended in its entirety

to read as follows:

“Aggregate

Revolving Commitments” means the Revolving Commitments of all the Lenders. The amount of the Aggregate Revolving Commitments

in effect on the First Amendment Effective Date is $700,000,000.

(b) Section

1.01 of the Existing Credit Agreement is amended to insert the following definition in the appropriate alphabetical order:

“First Amendment

Effective Date” means December 6, 2024.

(c) Section

2.01(b)(i) of the Existing Credit Agreement is amended in its entirety to read as follows:

(i) after

giving effect to such Incremental Increase, the Aggregate Revolving Commitments shall not exceed $700,000,000;

(d) Schedule

2.01 to the Existing Credit Agreement is hereby amended in its entirety to read in the form attached hereto as Schedule 2.01.

All other Schedules and Exhibits to the Existing Credit Agreement shall not be modified or otherwise affected hereby.

3. Joinder

of New Lenders.

(a) Each

Person that signs this Agreement as a Lender and that was not a Lender party to the Existing Credit Agreement (each a “New Lender”)

(i) represents and warrants that (A) it has full power and authority, and has taken all action necessary, to execute and deliver

this Agreement and to consummate the transactions contemplated hereby and to become a Lender under the Amended Credit Agreement; (B) it

meets all the requirements to be an assignee under Sections 11.06(b)(iii) and (v) of the Amended Credit Agreement (subject to such consents,

if any, as may be required under Section 11.06(b)(iii) of the Amended Credit Agreement); (C) from and after the Effective Date, it shall

be bound by the provisions of the Amended Credit Agreement as a Lender thereunder and shall have the obligations of a Lender thereunder;

(D) it has received a copy of the Existing Credit Agreement, and has received or has been accorded the opportunity to receive copies of

the most recent financial statements delivered pursuant to Section 6.01 thereof, as applicable, and such other documents and information

as it deems appropriate to make its own credit analysis and decision to enter into this Agreement; (E) it has, independently and without

reliance upon the Administrative Agent or any other Lender and based on such documents and information as it has deemed appropriate, made

its own credit analysis and decision to enter into this Agreement; and (F) if it is a Foreign Lender, any documentation required to be

delivered by it pursuant to the terms of the Amended Credit Agreement, duly completed and executed by the New Lender (as applicable),

has been delivered to the Administrative Agent; and (ii) agrees that (A) it will, independently and without reliance upon the Administrative

Agent or any other Lender, and based on such documents and information as it shall deem appropriate at the time, continue to make its

own credit decisions in taking or not taking action under the Loan Documents; and (B) it will perform in accordance with their terms all

of the obligations which by the terms of the Loan Documents are required to be performed by it as a Lender.

(b) Each

of the Borrower and the Administrative Agent agree that, as of the Effective Date, each New Lender shall (i) be a party to the

Amended Credit Agreement and the other Loan Documents, (ii) be a “Lender” for all purposes of the Amended Credit Agreement

and the other Loan Documents, and (iii) have the rights and obligations of a Lender under the Amended Credit Agreement and the other

Loan Documents.

(c) The

address, facsimile number, electronic mail address and telephone number of each New Lender for purposes of Section 11.02 of the

Amended Credit Agreement are as set forth in such New Lender’s Administrative Questionnaire delivered by such New Lender to the

Administrative Agent on or before the Effective Date or to such other address, facsimile number, electronic mail address and telephone

number as shall be designated by such New Lender in a notice to the Administrative Agent.

4. Representations

and Warranties. The Borrower hereby represents and warrants to the Administrative Agent and the Lenders that:

(a) The

execution, delivery and performance by the Borrower of this Agreement has been duly authorized by all necessary corporate or other organizational

action.

(b) The

execution, delivery and performance by the Borrower of this Agreement does not (i) contravene the terms of any of the Borrower’s

Organization Documents, (ii) conflict with or result in any breach or contravention of, or the creation of any Lien under, or require

any payment to be made under (A) any Contractual Obligation to which the Borrower is a party or affecting the Borrower or the properties

of the Borrower or any of its Subsidiaries or (B) any order, injunction, writ or decree of any Governmental Authority or any arbitral

award to which the Borrower or its property is subject, or (iii) violate any Law.

(c) This

Agreement has been duly executed and delivered by the Borrower and constitutes the Borrower’s legal, valid and binding obligation,

enforceable against the Borrower in accordance with its terms, subject to applicable bankruptcy, insolvency, reorganization, moratorium

or other laws affecting creditors’ rights generally and subject to general principles of equity, regardless of whether considered

in a proceeding in equity or at law.

(d) No

approval, consent, exemption, authorization, or other action by, or notice to, or filing with, any Governmental Authority or any other

Person is necessary or required in connection with the execution, delivery or performance by, or enforcement against, the Borrower of

this Agreement or any other Loan Document, other than those that have already been obtained and are in full force and effect.

(e) After

giving effect to this Agreement, the representations and warranties of the Borrower contained in Article V of the Amended Credit

Agreement or any other Loan Document, or which are contained in any document furnished at any time under or in connection therewith, are

true and correct in all material respects (other than those representations and warranties qualified by materiality or Material Adverse

Effect, in which case they are true and correct in all respects) on and as of the Effective Date, except to the extent that such representation

and warranties specifically refer to an earlier date, in which case they were true and correct in all material respects (other than those

representations and warranties qualified by materiality or Material Adverse Effect, in which case they were true and correct in all respects)

as of such earlier date.

(f) After

giving effect to this Agreement, no event has occurred and is continuing which constitutes a Default.

(g) Except

as specifically provided in this Agreement, the Obligations are not reduced or modified by this Agreement and are not subject to any offsets,

defenses or counterclaims.

5. Effective

Date Conditions. This Agreement shall become effective on the Effective Date upon satisfaction of the following conditions precedent:

(a) The

Administrative Agent shall have received a copy of this Agreement duly executed by the Borrower, Lenders constituting the Required Lenders,

each Incremental Lender, the L/C Issuer, and the Administrative Agent.

(b) The

Administrative Agent shall have received a Note executed by a Responsible Officer of the Borrower in favor of each Lender requesting a

Note (to the extent that such Lender has not previously been issued a Note under the Existing Credit Agreement).

(c) The

Administrative Agent shall have received a certificate signed by a Responsible Officer of the Borrower certifying and attaching the resolutions

adopted by the board of directors of the Borrower approving or consenting to the First Amendment Incremental Increase.

(d) The

Administrative Agent shall have received evidence that the Borrower is duly organized or formed, and is validly existing, in good

standing and qualified to engage in business in its state of organization or formation.

(e) The

Administrative Agent shall have received a certificate signed by a Responsible Officer of the Borrower certifying (i) as to the

conditions specified in Sections 4(e) and 4(f) and (ii) that after giving effect to the First Amendment Incremental Increase

and any Borrowings on the Effective Date, the Borrower will be in compliance on a Pro Forma Basis with all of the covenants in Section

7.11 of the Amended Credit Agreement.

(f) The

Administrative Agent shall have received favorable opinions of legal counsel to the Borrower, addressed to the Administrative Agent,

each Lender, and the L/C Issuer, dated as of the Effective Date.

(g) (i)

Upon the reasonable request of any Lender, the Borrower shall have provided to such Lender, and such Lender shall be reasonably satisfied

with, any documentation and other information so requested in connection with applicable “know your customer” and anti-money-laundering

rules and regulations (including the Act) and (ii) if the Borrower qualifies as a “legal entity customer” under the Beneficial

Ownership Regulation, the Borrower shall have delivered, to each Lender that so requests, a Beneficial Ownership Certification in relation

to the Borrower.

(h) The

Administrative Agent shall have received any fees and expenses required to be paid to the Administrative Agent, the Lenders, and

the Arrangers on or before the Effective Date.

(i) The

Borrower shall have paid all reasonable fees, charges and disbursements of counsel to the Administrative Agent (directly to such counsel

if requested by the Administrative Agent) to the extent invoiced prior to or on the Effective Date, plus such additional amounts of such

fees, charges and disbursements as shall constitute its reasonable estimate of such fees, charges and disbursements incurred or to be

incurred by it through the closing proceedings (provided that such estimate shall not thereafter preclude a final settling of accounts

between the Borrower and the Administrative Agent).

Without limiting the generality of the provisions

of the last paragraph of Section 9.03 of the Existing Credit Agreement, for purposes of determining compliance with the conditions specified

in this Section 5, each Lender that has signed this Agreement shall be deemed to have consented to, approved or accepted or to

be satisfied with, each document or other matter required thereunder to be consented to or approved by or acceptable or satisfactory to

a Lender unless the Administrative Agent shall have received notice from such Lender prior to the proposed Effective Date specifying its

objection thereto.

6. Miscellaneous.

(a) Amended

Terms. On and after the Effective Date, all references to the Existing Credit Agreement in each of the Loan Documents shall hereafter

mean the Amended Credit Agreement. (i) Except as specifically amended hereby or otherwise agreed, the Existing Credit Agreement is hereby

ratified and confirmed and shall remain in full force and effect according to its terms and (ii) the execution, delivery and effectiveness

of this Agreement shall not, except as expressly provided herein, operate as a waiver of any right, power or remedy of any Lender or the

Administrative Agent under any of the Loan Documents, nor constitute a waiver of any provision of any of the Loan Documents.

(b) Loan

Document; Entirety; Further Assurances. This Agreement shall constitute a Loan Document under the terms of the Amended Credit Agreement.

This Agreement and the other Loan Documents embody the entire agreement among the parties hereto and supersede all prior agreements and

understandings, oral or written, if any, relating to the subject matter hereof. The Borrower agrees to promptly take such action, upon

the request of the Administrative Agent, as is necessary to carry out the intent of this Agreement.

(c) Electronic

Execution; Counterparts. Subject to Section 11.17 of the Amended Credit Agreement, this Agreement may be in the form of an Electronic

Record and may be executed using Electronic Signatures (including facsimile and .pdf) and shall be considered an original, and shall have

the same legal effect, validity and enforceability as a paper record. This Agreement may be executed in as many counterparts as necessary

or convenient, including both paper and electronic counterparts, but all such counterparts are one and the same Agreement. The authorization

under this Section 6(c) may include use or acceptance by the Administrative Agent, the L/C Issuer, and the Lenders of a manually

signed paper copy of this Agreement which has been converted into electronic form (such as scanned into .pdf format), or an electronically

signed copy of this Agreement converted into another format, for transmission, delivery and/or retention.

(d) Severability.

If any provision of this Agreement is held to be illegal, invalid or unenforceable, (i) the legality, validity and enforceability of the

remaining provisions of this Agreement shall not be affected or impaired thereby and (ii) the parties shall endeavor in good faith negotiations

to replace the illegal, invalid or unenforceable provisions with valid provisions the economic effect of which comes as close as possible

to that of the illegal, invalid or unenforceable provisions. The invalidity of a provision in a particular jurisdiction shall not invalidate

or render unenforceable such provision in any other jurisdiction.

(e) GOVERNING

LAW; Submission to Jurisdiction; Waiver of Jury Trial; Etc. THIS AGREEMENT AND ANY CLAIMS, CONTROVERSY, DISPUTE OR CAUSE OF ACTION

(WHETHER IN CONTRACT OR TORT OR OTHERWISE) BASED UPON, ARISING OUT OF OR RELATING TO THIS AGREEMENT AND THE TRANSACTIONS CONTEMPLATED

HEREBY SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH THE LAW OF THE STATE OF NEW YORK. The submission to jurisdiction, service

of process, waiver of venue and waiver of jury trial provisions of Sections 11.14 and 11.15 of the Amended Credit Agreement are hereby

incorporated by reference, mutatis mutandis.

[NO FURTHER TEXT ON THIS PAGE]

IN WITNESS WHEREOF, the parties

hereto have caused this Agreement to be duly executed and delivered as of the date first above written.

| BORROWER: |

BGC GROUP, INC., |

| |

a Delaware corporation |

| |

|

|

| |

By: |

/s/ Jason Hauf |

| |

Name: |

Jason Hauf |

| |

Title: |

Chief Financial Officer |

BGC GROUP, INC.

FIRST AMENDMENT

| ADMINISTRATIVE AGENT: |

BANK OF AMERICA, N.A., |

| |

as the Administrative Agent |

| |

|

|

| |

By: |

/s/ Sherman Wong |

| |

Name: |

Sherman Wong |

| |

Title: |

Director |

BGC GROUP, INC.

FIRST AMENDMENT

| LENDERS: |

BANK OF AMERICA, N.A., |

| |

as a Lender and the L/C Issuer |

| |

|

|

| |

By: |

/s/ Sherman Wong |

| |

Name: |

Sherman Wong |

| |

Title: |

Director |

BGC GROUP, INC.

FIRST AMENDMENT

| |

CAPITAL ONE,

NATIONAL ASSOCIATION, |

| |

as a Lender |

| |

|

|

| |

By: |

/s/ Jerry Huang |

| |

Name: |

Jerry Huang |

| |

Title: |

Duly Authorized Signatory |

BGC GROUP, INC.

FIRST AMENDMENT

| |

CITIZENS BANK,

N.A., |

| |

as a Lender |

| |

|

|

| |

By: |

/s/ Douglas Kennedy |

| |

Name: |

Douglas Kennedy |

| |

Title: |

Senior Vice President |

BGC GROUP, INC.

FIRST AMENDMENT

| |

FIFTH THIRD

BANK, NATIONAL ASSOCIATION, |

| |

as a Lender |

| |

|

|

| |

By: |

/s/

Christine Reyling |

| |

Name: |

Christine Reyling |

| |

Title: |

SVP, Managing Director |

BGC GROUP, INC.

FIRST AMENDMENT

| |

INDUSTRIAL

AND COMMERCIAL BANK OF CHINA LIMITED, NEW YORK BRANCH, |

| |

as a Lender |

| |

|

|

| |

By: |

/s/ Xioxing Huang |

| |

Name: |

Xioxing Huang |

| |

Title: |

Vice President |

| |

|

|

| |

By: |

/s/ Robert O’Brien |

| |

Name: |

Robert O’Brien |

| |

Title: |

Executive Director |

BGC GROUP, INC.

FIRST AMENDMENT

| |

M&T BANK, |

| |

as a Lender |

| |

|

|

| |

By: |

/s/ Brooks Thropp |

| |

Name: |

Brooks Thropp |

| |

Title: |

Director |

BGC GROUP, INC.

FIRST AMENDMENT

| |

PNC BANK, NATIONAL

ASSOCIATION, |

| |

as a Lender |

| |

|

|

| |

By: |

/s/ Brendan Saldana |

| |

Name: |

Brendan Saldana |

| |

Title: |

Vice President |

BGC GROUP, INC.

FIRST AMENDMENT

| |

REGIONS BANK, |

| |

as a Lender |

| |

|

|

| |

By: |

/s/ William Soo |

| |

Name: |

William Soo |

| |

Title: |

Managing Director |

BGC GROUP, INC.

FIRST AMENDMENT

| |

SANTANDER BANK,

N.A., |

| |

as a Lender |

| |

|

|

| |

By: |

/s/ Joseph Kim |

| |

Name: |

Joseph Kim |

| |

Title: |

Senior Vice President |

BGC GROUP, INC.

FIRST AMENDMENT

| |

SYNOVUS BANK, |

| |

as a Lender |

| |

|

|

| |

By: |

/s/ Andrew May |

| |

Name: |

Andrew May |

| |

Title: |

Director |

BGC GROUP, INC.

FIRST AMENDMENT

| |

THE HUNTINGTON

NATIONAL BANK, |

| |

as a Lender |

| |

|

|

| |

By: |

/s/ Scott Lyman |

| |

Name: |

Scott Lyman |

| |

Title: |

Assistant Vice President |

BGC GROUP, INC.

FIRST AMENDMENT

| |

WELLS FARGO

BANK, NATIONAL ASSOCIATION, |

| |

as a Lender |

| |

|

|

| |

By: |

/s/ Nick Brokke |

| |

Name: |

Nick Brokke |

| |

Title: |

Executive Director |

BGC GROUP, INC.

FIRST AMENDMENT

| |

ASSOCIATED

BANK, N.A., |

| |

as a Lender |

| |

|

|

| |

By: |

/s/ Daniel R. Raynor |

| |

Name: |

Daniel R. Raynor |

| |

Title: |

Senior Vice President |

BGC GROUP, INC.

FIRST AMENDMENT

| |

KEYBANK NATIONAL

ASSOCIATION, |

| |

as a Lender |

| |

|

|

| |

By: |

/s/ Marc Evans |

| |

Name: |

Marc Evans |

| |

Title: |

Senior Vice President |

BGC GROUP, INC.

FIRST AMENDMENT

| |

COMERICA BANK, |

| |

as a Lender |

| |

|

|

| |

By: |

/s/

Robert Wilson |

| |

Name: |

Robert Wilson |

| |

Title: |

Senior Vice President |

BGC GROUP, INC.

FIRST AMENDMENT

| |

GOLDMAN SACHS

BANK USA, |

| |

as a Lender |

| |

|

|

| |

By: |

/s/

Priyankush Goswami |

| |

Name: |

Priyankush Goswami |

| |

Title: |

Authorized Signatory |

BGC GROUP, INC.

FIRST AMENDMENT

| |

CIBC BANK USA, |

| |

as a Lender |

| |

|

|

| |

By: |

/s/ Morgan Donovan |

| |

Name: |

Morgan Donovan |

| |

Title: |

Managing Director |

BGC GROUP, INC.

FIRST AMENDMENT

| |

U.S. BANK NATIONAL

ASSOCIATION, |

| |

as a Lender |

| |

|

|

| |

By: |

/s/ William R. Mandaro |

| |

Name: |

William R. Mandaro |

| |

Title: |

SVP |

BGC GROUP, INC.

FIRST AMENDMENT

| |

BMO BANK, N.A., |

| |

as a Lender |

| |

|

|

| |

By: |

/s/ Adam Tarr |

| |

Name: |

Adam Tarr |

| |

Title: |

Managing Director |

BGC GROUP, INC.

FIRST AMENDMENT

| |

OLD NATIONAL

BANK, |

| |

as a Lender |

| |

|

|

| |

By: |

/s/ Michael King |

| |

Name: |

Michael King |

| |

Title: |

Senior Vice President, Financial Institutions Group |

BGC GROUP, INC.

FIRST AMENDMENT

| |

TRISTATE CAPITAL

BANK, |

| |

as a Lender |

| |

|

|

| |

By: |

/s/ Ellen Frank |

| |

Name: |

Ellen Frank |

| |

Title: |

Senior Vice President |

BGC GROUP, INC.

FIRST AMENDMENT

Schedule 1

Incremental Commitments

| Incremental Lender | |

Incremental Commitment | |

| Bank of America, N.A. | |

$ | 10,000,000.00 | |

| Capital One, National Association | |

$ | 10,000,000.00 | |

| Citizens Bank, N.A. | |

$ | 40,000,000.00 | |

| Fifth Third Bank, National Association | |

$ | 10,000,000.00 | |

| Industrial and Commercial Bank of China Limited, New York Branch | |

$ | 10,000,000.00 | |

| M&T Bank | |

$ | 10,000,000.00 | |

| PNC Bank, National Association | |

$ | 10,000,000.00 | |

| Regions Bank | |

$ | 10,000,000.00 | |

| Santander Bank, N.A. | |

$ | 12,500,000.00 | |

| Synovus Bank | |

$ | 40,000,000.00 | |

| The Huntington National Bank | |

$ | 40,000,000.00 | |

| Wells Fargo Bank, National Association | |

$ | 10,000,000.00 | |

| Associated Bank, N.A. | |

$ | 10,000,000.00 | |

| KeyBank National Association | |

$ | 10,000,000.00 | |

| Comerica Bank | |

$ | 7,500,000.00 | |

| CIBC Bank USA | |

$ | 25,000,000.00 | |

| U.S. Bank National Association | |

$ | 25,000,000.00 | |

| Old National Bank | |

$ | 20,000,000.00 | |

| Tristate Capital Bank | |

$ | 15,000,000.00 | |

| Total: | |

$ | 325,000,000.00 | |

Schedule 2.01

Commitments and Applicable Percentages

| Lender | |

Revolving

Commitment | | |

Applicable

Percentage of

Aggregate

Revolving

Commitments | |

| Bank of America, N.A. | |

$ | 40,000,000.00 | | |

| 5.714285714 | % |

| Capital One, National Association | |

$ | 40,000,000.00 | | |

| 5.714285714 | % |

| Citizens Bank, N.A. | |

$ | 40,000,000.00 | | |

| 5.714285714 | % |

| Fifth Third Bank, National Association | |

$ | 40,000,000.00 | | |

| 5.714285714 | % |

| Industrial and Commercial Bank of China Limited, New York Branch | |

$ | 40,000,000.00 | | |

| 5.714285714 | % |

| M&T Bank | |

$ | 40,000,000.00 | | |

| 5.714285714 | % |

| PNC Bank, National Association | |

$ | 40,000,000.00 | | |

| 5.714285714 | % |

| Regions Bank | |

$ | 40,000,000.00 | | |

| 5.714285714 | % |

| Santander Bank, N.A. | |

$ | 40,000,000.00 | | |

| 5.714285714 | % |

| Synovus Bank | |

$ | 40,000,000.00 | | |

| 5.714285714 | % |

| The Huntington National Bank | |

$ | 40,000,000.00 | | |

| 5.714285714 | % |

| Wells Fargo Bank, National Association | |

$ | 40,000,000.00 | | |

| 5.714285714 | % |

| Associated Bank, N.A. | |

$ | 30,000,000.00 | | |

| 4.285714286 | % |

| KeyBank National Association | |

$ | 30,000,000.00 | | |

| 4.285714286 | % |

| Comerica Bank | |

$ | 27,500,000.00 | | |

| 3.928571429 | % |

| Goldman Sachs Bank USA | |

$ | 27,500,000.00 | | |

| 3.928571429 | % |

| CIBC Bank USA | |

$ | 25,000,000.00 | | |

| 3.571428571 | % |

| U.S. Bank National Association | |

$ | 25,000,000.00 | | |

| 3.571428571 | % |

| BMO Bank, N.A. | |

$ | 20,000,000.00 | | |

| 2.857142857 | % |

| Old National Bank | |

$ | 20,000,000.00 | | |

| 2.857142857 | % |

| Tristate Capital Bank | |

$ | 15,000,000.00 | | |

| 2.142857146 | % |

| Total: | |

$ | 700,000,000.00 | | |

| 100.000000000 | % |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

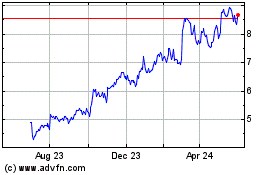

BGC (NASDAQ:BGC)

Historical Stock Chart

From Jan 2025 to Feb 2025

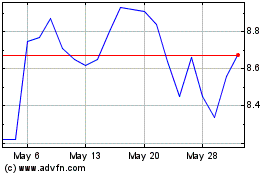

BGC (NASDAQ:BGC)

Historical Stock Chart

From Feb 2024 to Feb 2025