Net Sales of $314M and GAAP Net Income of

$29M

Adj. EBITDA of $46M with 15% Margin and

2,130 Buses Sold

FY2025 Adj. EBITDA Reaffirmed at $200M or

14% of Revenue

Blue Bird Corporation (“Blue Bird”) (Nasdaq: BLBD), the leader

in electric and low-emission school buses, announced today its

fiscal 2025 first quarter results.

Highlights

(in millions except Unit Sales and EPS

data)

Three Months Ended December

28, 2024

B/(W) Prior Year

Unit Sales

2,130

1

GAAP Measures:

Revenue

$

313.9

$

(3.8

)

Net Income

$

28.7

$

2.6

Diluted EPS

$

0.86

$

0.05

Non-GAAP Measures1:

Adjusted EBITDA

$

45.8

$

(1.9

)

Adjusted Net Income

$

30.6

$

0.9

Adjusted Diluted EPS

$

0.92

$

0.01

1 Reconciliation to relevant GAAP metrics

shown below

“I am incredibly proud of our team’s achievements in delivering

another outstanding result and near record profit in the first

quarter,” said Phil Horlock, President & CEO of Blue Bird

Corporation. “The Blue Bird team continued to exceed expectations,

improving operations, driving new orders, and expanding our

leadership in alternative-powered buses. Market demand remains very

strong with nearly 4,400 units in our order backlog at the end of

the first quarter. Unit sales were about the same as last year,

with revenue down by $3.8M, driven by product mix, and we delivered

an exceptional 14.6% Adj. EBITDA margin. With 94% of our first

quarter unit sales mix comprised of internal combustion engine

(ICE) buses, this result demonstrates the very strong earnings

power of our base business.

“In our push to expand our leadership in alternative-powered

school buses, we delivered over 130 electric-powered buses this

quarter, ahead of the plan we communicated in November. We also saw

strong growth in EV orders from both the EPA’s Clean School Bus

Program and state/local level programs. As of today, we have

approximately 1,000 EV buses either sold or in our firm order

backlog, which supports our EV sales target for 2025.

“Based on our strong Q1 performance, we’ve reaffirmed our

full-year financial guidance for Adjusted EBITDA at $200 million,

with a 14% margin. This will be an all-time full-year record for

Blue Bird, and we look forward to sustained profitable growth in

the coming years.”

FY2025 Guidance and Long-Term Outlook

Reaffirmed

“We are very pleased with the first quarter results, with the

second highest ever Q1 Adj. EBITDA” said Razvan Radulescu, CFO of

Blue Bird Corporation. “Our business is in a very strong position

and we continue to deliver ahead of the plan we have been

messaging. We are reaffirming our full-year 2025 guidance for Net

Revenue to $1.4-1.5 Billion, Adj. EBITDA to $185-215 million and

Adj. Free Cash Flow to $40-60 million. Additionally, we are

confirming our long-term profit outlook towards an Adjusted EBITDA

margin of 15%+ on ~$2 billion in revenues.”

Fiscal 2025 First Quarter Results

Net Sales

Net sales were $313.9 million for the first quarter of fiscal

2025, a decrease of $3.8 million, or 1.2%, from the first quarter

of last year. Bus sales decreased $5.3 million, reflecting a 1.9%

decrease in average sales price per unit, primarily due to customer

and product mix changes (lower EV volumes). In the first quarter of

fiscal 2025, 2,130 units were booked compared with 2,129 units

booked for the same period in fiscal 2024. Additionally, Parts

sales increased $1.5 million, or 6.2%, for the first quarter of

fiscal 2025 compared with the first quarter of fiscal 2024. This

increase is primarily attributed to price increases, driven by

ongoing inflationary pressures, as well as higher fulfillment

volumes and slight variations due to product and channel mix.

Gross Profit

First quarter gross profit of $60.3 million represented a

decrease of $3.2 million from the first quarter of last year. The

decrease was primarily driven by the $3.8 million decrease in net

sales, discussed above, and partially offset by a corresponding

decrease of $0.5 million in cost of goods sold.

Net Income

Net income was $28.7 million for the first quarter of fiscal

2025, which was a $2.6 million increase from the first quarter of

last year. The increase was primarily driven by $2.6 million in

emission credits that the Company sold in the first quarter of

fiscal 2025, recorded in other income (expense), net, with no

similar income in the first quarter of fiscal 2024.

Adjusted Net Income

Adjusted net income was $30.6 million, largely consistent with

the $29.7 million from the same period last year.

Adjusted EBITDA

Adjusted EBITDA was $45.8 million, which was a decrease of $1.9

million compared with the first quarter of fiscal 2024. This

decrease results primarily from the lower gross profit, partially

offset by improvements in other income(expense), net, as described

above..

Conference Call Details

Blue Bird will discuss its first quarter 2025 results in a

conference call at 4:30 PM ET today. Participants may listen to the

audio portion of the conference call either through a live audio

webcast on the Company's website or by telephone. The slide

presentation and webcast can be accessed via the Investor Relations

portion of Blue Bird's website at www.blue-bird.com.

- Webcast participants should log on and register at least 15

minutes prior to the start time on the Investor Relations homepage

of Blue Bird’s website at http://investors.blue-bird.com. Click the

link in the events box on the Investor Relations landing page.

- Participants desiring audio only should dial 404-975-4839 or

833-470-1428. The access code is 393430.

A replay of the webcast will be available approximately two

hours after the call concludes via the same link on Blue Bird’s

website.

About Blue Bird

Corporation

Blue Bird (NASDAQ: BLBD) is recognized as a technology leader

and innovator of school buses since its founding in 1927. Our

dedicated team members design, engineer and manufacture school

buses with a singular focus on safety, reliability, and durability.

School buses carry the most precious cargo in the world – 25

million children twice a day – making them the most trusted mode of

student transportation. The company is the proven leader in low-

and zero-emission school buses with more than 20,000 propane,

natural gas, and electric powered buses in operation today. Blue

Bird is transforming the student transportation industry through

cleaner energy solutions. For more information on Blue Bird's

complete product and service portfolio, visit

www.blue-bird.com.

Key Non-GAAP Financial Measures We Use

to Evaluate Our Performance

This press release includes the following non-GAAP financial

measures “Adjusted EBITDA,” "Adjusted EBITDA Margin," "Adjusted Net

Income," "Adjusted Diluted Earnings per Share," “Free Cash Flow”

and “Adjusted Free Cash Flow”. Adjusted EBITDA and Free Cash Flow

are financial metrics that are utilized by management and the board

of directors, as and when applicable, to determine (a) the annual

cash bonus payouts, if any, to be made to certain employees based

upon the terms of the Company’s Management Incentive Plan, and (b)

whether the performance criteria have been met for the vesting of

certain equity awards granted annually to certain members of

management based upon the terms of the Company’s Omnibus Equity

Incentive Plan. Additionally, consolidated EBITDA, which is an

adjusted EBITDA metric defined by our Amended Credit Agreement that

could differ from Adjusted EBITDA discussed above as the

adjustments to the calculations are not uniform, is used to

determine the Company's ongoing compliance with several financial

covenant requirements, including being utilized in the denominator

of the calculation of the Total Net Leverage Ratio. Accordingly,

management views these non-GAAP financial metrics as key for the

above purposes and as a useful way to evaluate the performance of

our operations as discussed further below.

Adjusted EBITDA is defined as net income or loss prior to

interest income; interest expense including the component of

operating lease expense (which is presented as a single operating

expense in selling, general and administrative expenses in our U.S.

GAAP financial statements) that represents interest expense on

lease liabilities; income taxes; and depreciation and amortization

including the component of operating lease expense (which is

presented as a single operating expense in selling, general and

administrative expenses in our U.S. GAAP financial statements) that

represents amortization charges on right-of-use lease assets; as

adjusted for certain non-cash charges or credits that we may record

on a recurring basis such as share-based compensation expense and

unrealized gains or losses on certain derivative financial

instruments; net gains or losses on the disposal of assets as well

as certain charges such as (i) significant product design changes;

(ii) transaction related costs; or (iii) discrete expenses related

to major cost cutting and/or operational transformation

initiatives. While certain of the charges that are added back in

the Adjusted EBITDA calculation, such as transaction related costs

and operational transformation and major product redesign

initiatives, represent operating expenses that may be recorded in

more than one annual period, the significant project or transaction

giving rise to such expenses is not considered to be indicative of

the Company’s normal operations. Accordingly, we believe that

these, as well as the other credits and charges that comprise the

amounts utilized in the determination of Adjusted EBITDA described

above, should not be used in evaluating the Company’s ongoing

annual operating performance.

We define Adjusted EBITDA Margin as Adjusted EBITDA as a

percentage of net sales. Adjusted EBITDA and Adjusted EBITDA Margin

are not measures of performance defined in accordance with U.S.

GAAP. The measures are used as a supplement to U.S. GAAP results in

evaluating certain aspects of our business, as described below.

We believe that Adjusted EBITDA, Adjusted EBITDA margin,

Adjusted Net Income, and Adjusted Diluted Earnings per Share are

useful to investors in evaluating our performance because the

measures consider the performance of our ongoing operations,

excluding decisions made with respect to capital investment,

financing, and certain other significant initiatives or

transactions as outlined in the preceding paragraph. We believe the

non-GAAP measures offer additional financial metrics that, when

coupled with the GAAP results and the reconciliation to GAAP

results, provide a more complete understanding of our results of

operations and the factors and trends affecting our business.

Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Net Income and

Adjusted Diluted Earnings per Share should not be considered as

alternatives to net income or GAAP earnings per share as an

indicator of our performance or as alternatives to any other

measure prescribed by GAAP as there are limitations to using such

non-GAAP measures. Although we believe the non-GAAP measures may

enhance an evaluation of our operating performance based on recent

revenue generation and product/overhead cost control because they

exclude the impact of prior decisions made about capital

investment, financing, and other expenses, (i) other companies in

Blue Bird’s industry may define Adjusted EBITDA, Adjusted EBITDA

margin, Adjusted Net Income, and Adjusted Diluted Earnings per

Share differently than we do and, as a result, they may not be

comparable to similarly titled measures used by other companies in

Blue Bird’s industry, and (ii) Adjusted EBITDA, Adjusted EBITDA

margin, Adjusted Net Income, and Adjusted Diluted Earnings per

Share exclude certain financial information that some may consider

important in evaluating our performance.

We compensate for these limitations by providing disclosure of

the differences between Adjusted EBITDA, Adjusted EBITDA margin,

Adjusted Net Income, and Adjusted Diluted Earnings per Share and

GAAP results, including providing a reconciliation to GAAP results,

to enable investors to perform their own analysis of our operating

results.

Our measures of “Free Cash Flow” and "Adjusted Free Cash Flow"

are used in addition to and in conjunction with results presented

in accordance with GAAP and free cash flow and adjusted free cash

flow should not be relied upon to the exclusion of GAAP financial

measures. Free cash flow and adjusted free cash flow reflect an

additional way of viewing our liquidity that, when viewed with our

GAAP results, provides a more complete understanding of factors and

trends affecting our cash flows. We strongly encourage investors to

review our financial statements and publicly-filed reports in their

entirety and not to rely on any single financial measure.

We define Free Cash Flow as total cash provided by/used in

operating activities as adjusted for net cash paid for the

acquisition of fixed assets and intangible assets. We use Free Cash

Flow, and ratios based on Free Cash Flow, to conduct and evaluate

our business because, although it is similar to cash flow from

operations, we believe it is a more conservative measure of cash

flow since purchases of fixed assets and intangible assets are a

necessary component of ongoing operations.

Forward Looking

Statements

This press release includes forward-looking statements within

the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements relate to expectations for future financial performance,

business strategies or expectations for our business. Specifically,

forward-looking statements include statements in this press release

regarding guidance, seasonality, product mix and gross profits and

may include statements relating to:

- Inherent limitations of internal controls impacting financial

statements

- Growth opportunities

- Future profitability

- Ability to expand market share

- Customer demand for certain products

- Economic conditions (including tariffs) that could affect fuel

costs, commodity costs, industry size and financial conditions of

our dealers and suppliers

- Labor or other constraints on the Company’s ability to maintain

a competitive cost structure

- Volatility in the tax base and other funding sources that

support the purchase of buses by our end customers

- Lower or higher than anticipated market acceptance for our

products

- Other statements preceded by, followed by or that include the

words “estimate,” “plan,” “project,” “forecast,” “intend,”

“expect,” “anticipate,” “believe,” “seek,” “target” or similar

expressions

These forward-looking statements are based on information

available as of the date of this press release, and current

expectations, forecasts and assumptions, and involve a number of

judgments, risks and uncertainties. Accordingly, forward-looking

statements should not be relied upon as representing our views as

of any subsequent date, and we do not undertake any obligation to

update forward-looking statements to reflect events or

circumstances after the date they were made, whether as a result of

new information, future events or otherwise, except as may be

required under applicable securities laws. The factors described

above, as well as risk factors described in reports filed with the

SEC by us (available at www.sec.gov), could cause our actual

results to differ materially from estimates or expectations

reflected in such forward-looking statements.

BLUE BIRD CORPORATION AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(in thousands of dollars, except for share

data)

December 28, 2024

September 28, 2024

Assets

Current assets

Cash and cash equivalents

$

136,119

$

127,687

Accounts receivable, net

13,996

59,099

Inventories

163,120

127,798

Other current assets

17,623

8,795

Total current assets

$

330,858

$

323,379

Property, plant and equipment, net

$

98,384

$

97,322

Goodwill

18,825

18,825

Intangible assets, net

43,087

43,554

Equity investment in affiliate

34,393

32,089

Deferred tax assets

2,112

2,399

Finance lease right-of-use assets

156

332

Pension

5,156

4,649

Other assets

2,251

2,345

Total assets

$

535,222

$

524,894

Liabilities and Stockholders'

Equity

Current liabilities

Accounts payable

$

137,757

$

143,156

Warranty

7,059

7,166

Accrued expenses

46,738

55,775

Deferred warranty income

9,907

9,421

Finance lease obligations

436

975

Other current liabilities

22,530

14,480

Current portion of long-term debt

5,000

5,000

Total current liabilities

$

229,427

$

235,973

Long-term liabilities

Revolving credit facility

$

—

$

—

Long-term debt

88,828

89,994

Warranty

9,068

9,013

Deferred warranty income

19,652

18,541

Deferred tax liabilities

368

2,783

Finance lease obligations

6

6

Other liabilities

8,168

9,020

Total long-term liabilities

$

126,090

$

129,357

Guarantees, commitments and

contingencies

Stockholders' equity

Preferred stock, $0.0001 par value,

10,000,000 shares authorized, 0 shares outstanding at December 28,

2024 and September 28, 2024

$

—

$

—

Common stock, $0.0001 par value,

100,000,000 shares authorized, 32,111,078 and 32,268,022 shares

issued and outstanding at December 28, 2024 and September 28, 2024,

respectively

3

3

Additional paid-in capital

187,379

185,977

Retained earnings (accumulated

deficit)

18,686

—

Accumulated other comprehensive loss

(26,363

)

(26,416

)

Total stockholders' equity

$

179,705

$

159,564

Total liabilities and stockholders'

equity

$

535,222

$

524,894

BLUE BIRD CORPORATION AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited)

Three Months Ended

(in thousands of dollars except for share

data)

December 28, 2024

December 30, 2023

Net sales

$

313,872

$

317,660

Cost of goods sold

253,555

254,102

Gross profit

$

60,317

$

63,558

Operating expenses

Selling, general and administrative

expenses

27,275

25,602

Operating profit

$

33,042

$

37,956

Interest expense

(1,915

)

(3,631

)

Interest income

1,568

1,088

Other income (expense), net

2,916

(1,221

)

Loss on debt refinancing

—

(1,558

)

Income before income taxes

$

35,611

$

32,634

Income tax expense

(8,693

)

(8,446

)

Equity in net income of non-consolidated

affiliate

1,804

1,962

Net income

$

28,722

$

26,150

Earnings per share:

Basic weighted average shares

outstanding

32,227,723

32,170,779

Diluted weighted average shares

outstanding

33,360,940

32,429,127

Basic earnings per share

$

0.89

$

0.81

Diluted earnings per share

$

0.86

$

0.81

BLUE BIRD CORPORATION AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited)

Three Months Ended

(in thousands of dollars)

December 28, 2024

December 30, 2023

Cash flows from operating

activities

Net income

$

28,722

$

26,150

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization expense

3,856

3,618

Non-cash interest expense

84

132

Share-based compensation expense

2,506

2,051

Equity in net income of non-consolidated

affiliates

(1,804

)

(1,962

)

Dividend from equity investment in

affiliates

—

2,991

Loss on disposal of fixed assets

20

4

Deferred income tax expense

(2,145

)

1,143

Amortization of deferred actuarial pension

losses

70

172

Loss on debt refinancing

—

1,558

Changes in assets and liabilities:

Accounts receivable

45,103

1,467

Inventories

(35,322

)

(7,171

)

Other assets

(9,241

)

(3,095

)

Accounts payable

(5,473

)

(23,103

)

Accrued expenses, pension and other

liabilities

34

(3,738

)

Total adjustments

$

(2,312

)

$

(25,933

)

Total cash provided by operating

activities

$

26,410

$

217

Cash flows from investing

activities

Cash paid for fixed assets

$

(4,594

)

$

(2,904

)

Equity investment in affiliates

(500

)

—

Total cash used in investing

activities

$

(5,094

)

$

(2,904

)

Cash flows from financing

activities

Revolving credit facility borrowings

$

—

$

36,220

Term loan borrowings

—

100,000

Term loan repayments

(1,250

)

(131,800

)

Principal payments on finance leases

(538

)

(145

)

Cash paid for debt costs

—

(3,128

)

Repurchase of common stock in connection

with repurchase program

(10,036

)

—

Repurchase of common stock in connection

with stock award exercises

(1,445

)

(301

)

Cash received from stock option

exercises

385

149

Total cash (used in) provided by

financing activities

$

(12,884

)

$

995

Change in cash and cash

equivalents

8,432

(1,692

)

Cash and cash equivalents at beginning

of period

127,687

78,988

Cash and cash equivalents at end of

period

$

136,119

$

77,296

Reconciliation of Net Income

to Adjusted EBITDA

Three Months Ended

(in thousands of dollars)

December 28, 2024

December 30, 2023

Net income

$

28,722

$

26,150

Adjustments:

Interest expense, net (1)

433

2,655

Income tax expense

8,693

8,446

Depreciation, amortization, and disposals

(2)

4,243

4,210

Share-based compensation expense

2,506

2,051

Stockholder transaction costs

—

1,221

Loss on debt refinancing

—

1,558

Micro Bird Holdings, Inc. total interest

expense, net; income tax expense or benefit; depreciation expense

and amortization expense

1,156

1,395

Other

—

(82

)

Adjusted EBITDA

$

45,753

$

47,604

Adjusted EBITDA margin (percentage of net

sales)

14.6

%

15.0

%

_____________

(1) Includes $0.1 million for both fiscal

periods, representing interest expense on operating lease

liabilities, which are a component of lease expense and presented

as a single operating expense in selling, general and

administrative expenses on our Condensed Consolidated Statements of

Operations.

(2) Includes $0.4 million and $0.6 million

for the three months ended December 28, 2024 and December 30, 2023,

respectively, representing amortization charges on right-of-use

lease assets, which are a component of lease expense and presented

as a single operating expense in selling, general and

administrative expenses on our Condensed Consolidated Statements of

Operations.

Reconciliation of Free Cash

Flow to Adjusted Free Cash Flow

Three Months Ended

(in thousands of dollars)

December 28, 2024

December 30, 2023

Net cash provided by operating

activities

$

26,410

$

217

Cash paid for fixed assets

(4,594

)

(2,904

)

Free cash flow

$

21,816

$

(2,687

)

Cash paid for stockholder transaction

costs

—

1,221

Cash paid for other items

—

(82

)

Adjusted free cash flow

21,816

(1,548

)

Reconciliation of Net Income

to Adjusted Net Income

Three Months Ended

(in thousands of dollars)

December 28, 2024

December 30, 2023

Net income

$

28,722

$

26,150

Adjustments, net of tax benefit or expense

(1)

Share-based compensation expense

1,854

1,518

Stockholder transaction costs

—

904

Loss on debt modification

—

1,153

Other

—

(61

)

Adjusted net income, non-GAAP

$

30,576

$

29,664

___________

(1) Amounts are net of estimated tax rates

of 26%.

Reconciliation of Diluted EPS

to Adjusted Diluted EPS

Three Months Ended

December 28, 2024

December 30, 2023

Diluted earnings per share

$

0.86

$

0.81

One-time charge adjustments, net of tax

benefit or expense

0.06

0.10

Adjusted diluted earnings per share,

non-GAAP

$

0.92

$

0.91

Adjusted weighted average dilutive shares

outstanding

33,360,940

32,429,127

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250205735826/en/

Mark Benfield Investor Relations (478) 822-2315

Mark.Benfield@blue-bird.com

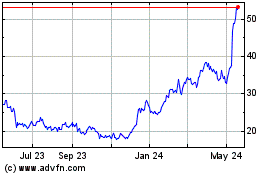

Blue Bird (NASDAQ:BLBD)

Historical Stock Chart

From Jan 2025 to Feb 2025

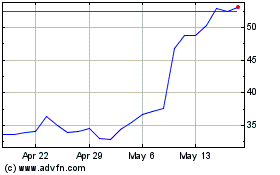

Blue Bird (NASDAQ:BLBD)

Historical Stock Chart

From Feb 2024 to Feb 2025