Backblaze, Inc. (Nasdaq: BLZE), the cloud storage innovator

delivering a modern alternative to traditional cloud providers,

today announced results for its second quarter ended June 30,

2024.

“Q2 marked another strong growth quarter for

Backblaze, along with efficient execution driving continued margin

expansion and momentum moving up-market,” said Gleb Budman, CEO of

Backblaze. “We continued our recent string of innovations with the

launch of Backblaze B2 Live Read in June. This transformative,

patent-pending feature enables customers to use their data during

the upload process, which has unique value for live broadcast

workflows.

“Additionally, we are excited to introduce our

new Chief Revenue Officer Jason Wakeam and Chief Financial Officer

Marc Suidan, both accomplished leaders who will help drive our

growth strategy.”

Second Quarter 2024 Financial

Highlights:

- Revenue of $31.3 million, an

increase of 27% year-over-year (YoY).

- B2 Cloud Storage revenue was $15.4

million, an increase of 43% YoY.

- Computer Backup revenue was $15.9

million, an increase of 15% YoY.

- Gross profit of $17.2 million, or

55% of revenue, compared to $12.1 million or 49% of revenue, in Q2

2023.

- Adjusted gross profit of $24.5

million, or 78% of revenue, compared to $18.4 million, or 75% of

revenue, in Q2 2023.

- Net loss was $10.3 million compared

to a net loss of $14.3 million in Q2 2023.

- Net loss per share was $0.25

compared to a net loss per share of $0.41 in Q2 2023.

- Adjusted EBITDA was $2.7 million,

or 9% of revenue, compared to $(1.8) million, or (7%) of revenue,

in Q2 2023.

- Non-GAAP net loss of $4.8 million

compared to non-GAAP net loss of $8.3 million in Q2 2023.

- Non-GAAP net loss per share of

$0.11 compared to a non-GAAP net loss per share of $0.24 in Q2

2023.

- Cash, short-term investments, and

restricted cash, non-current totaled $28.3 million as of

June 30, 2024.

Second Quarter 2024 Operational

Highlights:

- Annual recurring revenue (ARR) was

$126.3 million, an increase of 30% YoY.

- B2 Cloud

Storage ARR was $62.8 million, an increase of 44% YoY.

- Computer

Backup ARR was $63.5 million, an increase of 18% YoY.

- Net revenue retention (NRR) rate

was 114% compared to 110% in Q2 2023.

- B2 Cloud

Storage NRR was 126% compared to 121% in Q2 2023.

- Computer

Backup NRR was 105% compared to 103% in Q2 2023.

- Gross customer retention rate was

90% in Q2 2024 compared to 91% in Q2 2023.

- B2 Cloud

Storage gross customer retention rate was 89% in Q2 2024 compared

to 90% in Q2 2023.

- Computer

Backup gross customer retention rate was 90% in Q2 2024 compared to

91% in Q2 2023.

Recent Business Highlights:

- Launched Backblaze B2 Live

Read: This patent-pending cloud solution enables customers

to access and edit files during the upload process. The initial

focus will be on media and entertainment use cases, which will help

production teams accelerate their speed to market.

-

Continued Up-Market Momentum: Customers

contributing over $50,000 in ARR grew more than 55% year over

year.

-

Introduced Internet2 Peering: The integration of

Internet2’s network provides the world's largest research and

educational institutions fast access to and easier adoption of B2

Cloud Storage.

-

Announced Marc Suidan to Join as Chief Financial

Officer: Marc brings over 20 years experience as a public

company CFO, strategic advisor and management consultant. As a

senior partner at PricewaterhouseCoopers, Marc advised the largest

global technology companies. Marc is expected to join Backblaze as

CFO on August 16, 2024.

- Hired

Jason Wakeam as Chief Revenue Officer: Jason adds decades

of experience in building high impact sales, channel, and partner

teams and driving competitive market share growth at

Hewlett-Packard, Microsoft, Cloudera and SnapLogic.

-

Selected for the Russell 2000 Index: The widely

used benchmark brings added investor awareness to Backblaze.

Financial Outlook:

Based on information available as of the date of this press

release,

For the third quarter of 2024 we expect:

- Revenue between $32.4 million to

$32.8 million

- Adjusted EBITDA margin between 9%

to 11%

- Basic shares outstanding of 43.0

million to 43.5 million shares

For full-year 2024 we expect:

- Revenue between $126.5 million to

$128.5 million

- Adjusted EBITDA margin between 9%

to 11%

Conference Call Information:

Backblaze will host a conference call today,

August 8, 2024 at 1:30 p.m. PT (4:30 p.m. ET) to review its

financial results.

Attend the webcast here:

https://edge.media-server.com/mmc/p/47dcvumdRegister to listen by

phone here: https://dpregister.com/sreg/10190613/fcff4b25e9

Phone registrants will receive dial-in

information via email.

An archive of the webcast will be available

shortly after its completion on the Investor Relations section of

the Backblaze website at https://ir.backblaze.com.

About Backblaze

Backblaze is the cloud storage innovator

delivering a modern alternative to traditional cloud providers. We

offer high-performance, secure cloud object storage that customers

use to develop applications, manage media, secure backups, build AI

workflows, protect from ransomware, and more. Backblaze helps

businesses break free from the walled gardens that traditional

providers lock customers into, enabling customers to use their data

in open cloud workflows with the providers they prefer at a

fraction of the cost. Headquartered in San Mateo, CA, Backblaze

(Nasdaq: BLZE) was founded in 2007 and serves over 500,000

customers in 175 countries around the world. For more information,

please go to www.backblaze.com.

Cautionary Note Regarding Forward-looking

Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, which involve risks and uncertainties. These

forward-looking statements are frequently identified by the use of

forward-looking terminology, including the terms “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,” “intend,”

“likely,” “may,” “plan,” “possible,” “potential,” “predict,”

“project,” “should,” “target,” “will,” “would,” or other similar

terms or expressions that relate to our future performance,

expectations, strategy, plans or intentions, and include statements

in the section titled “Financial Outlook” and statements regarding

the use and impact of our IPO proceeds.

Our actual results could differ materially from those stated in

or implied by the forward-looking statements in this press release

due to a number of factors, including but not limited to: market

competition, including competitors that may have greater size,

offerings and resources; effectively managing growth; ability to

offer new features and other offerings on a timely basis and

achieve desired market adoption; disruption in our service or loss

of availability of customers’ data; cyberattacks; ability to

attract and retain customers, including increasingly larger

customers and the continued growth of data stored by our customers;

continued growth consistent with historical levels; ability to

offer new features and other offerings on a timely basis and the

impact of pricing and other product offering changes; material

defects or errors in our software; supply chain disruption; ability

to maintain existing relationships with partners and to enter into

new partnerships; ability to remediate and prevent material

weaknesses in our internal controls over financial reporting;

hiring and retention of key employees; the impact of a pandemic,

war or hostilities, including the Israel-Hamas conflict, and other

significant world or regional events on our business and the

business of our customers, vendors, supply chain and partners;

litigation and other disputes; and general market, political,

economic, and business conditions. Further information on these and

additional risks, uncertainties, assumptions, and other factors

that could cause actual results or outcomes to differ materially

from those included in or implied by the forward-looking statements

contained in this release are included under the caption “Risk

Factors” and elsewhere in our Annual Report on Form 10-K for the

year ended December 31, 2023 and other filings and reports we make

with the SEC from time to time.

The forward-looking statements made in this

release reflect our views as of the date of this press release. We

undertake no obligation to update any forward-looking statements in

this press release, whether as a result of new information, future

events or otherwise.

Non-GAAP Financial Measures

To supplement the financial measures prepared in

accordance with generally accepted accounting principles (GAAP), we

use non-GAAP adjusted gross margin and adjusted EBITDA margin.

These non-GAAP financial measures exclude certain items and are not

prepared in accordance with GAAP; therefore, the information is not

necessarily comparable to other companies and should be considered

as a supplement to, not a substitute for, or superior to, the

corresponding measures calculated in accordance with GAAP. We

present these non-GAAP measures because management believes they

are a useful measure of the company’s performance and provide an

additional basis for assessing our operating results. Please see

the appendix attached to this press release for a reconciliation of

non-GAAP adjusted gross margin and adjusted EBITDA margin to the

most directly comparable GAAP financial measures.

A reconciliation of non-GAAP guidance measures

to corresponding GAAP measures is not available on a

forward-looking basis without unreasonable effort due to the

uncertainty regarding, and the potential variability of, expenses

and other factors in the future. For example, stock-based

compensation expense-related charges are impacted by the timing of

employee stock transactions, the future fair market value of our

common stock, and our future hiring and retention needs, all of

which are difficult to predict with reasonable accuracy and subject

to constant change.

Adjusted Gross Profit (and

Margin)

We believe adjusted gross profit (and margin),

when taken together with our GAAP financial results, provides a

meaningful assessment of our performance and is useful to us for

evaluating our ongoing operations and for internal planning and

forecasting purposes.

We define adjusted gross margin as gross profit,

exclusive of stock-based compensation expense, depreciation expense

of our property and equipment, and amortization expense of

capitalized internal-use software included within cost of revenue,

as a percentage of adjusted gross profit to revenue. We exclude

stock-based compensation, which is a non-cash item, because we do

not consider it indicative of our core operating performance. We

exclude depreciation expense of our property and equipment and

amortization expense of capitalized internal-use software, because

these may not reflect current or future cash spending levels to

support our business. We believe adjusted gross margin provides

consistency and comparability with our past financial performance

and facilitates period-to-period comparisons of operations, as this

metric eliminates the effects of depreciation and amortization.

Adjusted

EBITDA

We define adjusted EBITDA as net loss adjusted

to exclude depreciation and amortization, stock-based compensation,

interest expense, investment income, income tax provision,

workforce reduction and related severance charges, and other

non-recurring charges. We use adjusted EBITDA to evaluate our

ongoing operations and for internal planning and forecasting

purposes. We believe that adjusted EBITDA, when taken together with

our GAAP financial results, provides meaningful supplemental

information regarding our operating performance by excluding

certain items that may not be indicative of our business, results

of operations, or outlook. We consider adjusted EBITDA to be an

important measure because it helps illustrate underlying trends in

our business and our historical operating performance on a more

consistent basis.

Non-GAAP Net Income (Loss)

We define non-GAAP net income (loss) as net

income adjusted to exclude stock-based compensation and other items

we deem non-recurring. We believe that non-GAAP net income (loss),

when taken together with our GAAP financial results, provides

meaningful supplemental information regarding our operating

performance by excluding certain items that may not be indicative

of our business, results of operations, or outlook.

Key Business Metrics:

Annual Recurring Revenue

(ARR)

We define annual recurring revenue (ARR) as the

annualized value of all Backblaze B2 and Computer Backup

arrangements as of the end of a period. Given the renewable nature

of our business, we view ARR as an important indicator of our

financial performance and operating results, and we believe it is a

useful metric for internal planning and analysis. ARR is calculated

based on multiplying the monthly revenue from all Backblaze B2 and

Computer Backup arrangements, which represent greater than 98% of

our revenue for the periods presented (and excludes Physical Media

revenue), for the last month of a period by 12. Our annual

recurring revenue for Computer Backup and B2 Cloud Storage is

calculated in the same manner as our overall annual recurring

revenue based on the revenue from our Computer Backup and B2 Cloud

Storage solutions, respectively.

Net Revenue Retention Rate

(NRR)

Our overall net revenue retention rate (NRR) is

a trailing four-quarter average of the recurring revenue from a

cohort of customers in a quarter as compared to the same quarter in

the prior year. We calculate our overall net revenue retention rate

for a quarter by dividing (i) recurring revenue in the current

quarter from any accounts that were active at the end of the same

quarter of the prior year by (ii) recurring revenue in the current

corresponding quarter from those same accounts. Our overall net

revenue retention rate includes any expansion of revenue from

existing customers and is net of revenue contraction and customer

attrition, and excludes revenue from new customers in the current

period. Our net revenue retention rate for Computer Backup and B2

Cloud Storage is calculated in the same manner as our overall net

revenue retention rate based on the revenue from our Computer

Backup and B2 Cloud Storage solutions, respectively.

Gross Customer Retention

Rate

We use gross customer retention rate to measure

our ability to retain our customers. Our gross customer retention

rate reflects only customer losses and does not reflect the

expansion or contraction of revenue we earn from our existing

customers. We believe our high gross customer retention rates

demonstrate that we serve a vital service to our customers, as the

vast majority of our customers tend to continue to use our platform

from one period to the next. To calculate our gross customer

retention rate, we take the trailing four-quarter average of the

percentage of cohort of customers who were active at the end of the

quarter in the prior year that are still active at the end of the

current quarter. We calculate our gross customer retention rate for

a quarter by dividing (i) the number of accounts that generated

revenue in the last month of the current quarter that also

generated recurring revenue during the last month of the

corresponding quarter in the prior year, by (ii) the number of

accounts that generated recurring revenue during the last month of

the corresponding quarter in the prior year.

Investors ContactMimi KongSenior Director,

Investor Relations and Corporate Developmentir@backblaze.com

Press ContactJeanette FosterCommunications

Managerpress@backblaze.com

|

BACKBLAZE, INC.CONDENSED CONSOLIDATED

BALANCE SHEETS(in thousands, except share and per

share data) |

| |

|

|

|

| |

June 30, |

|

December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| |

(unaudited) |

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

9,273 |

|

|

$ |

12,502 |

|

|

Short-term investments, net |

|

14,373 |

|

|

|

16,799 |

|

|

Accounts receivable, net |

|

1,814 |

|

|

|

800 |

|

|

Prepaid expenses and other current assets |

|

8,252 |

|

|

|

8,413 |

|

|

Total current assets |

|

33,712 |

|

|

|

38,514 |

|

| Restricted cash,

non-current |

|

4,682 |

|

|

|

4,128 |

|

| Property and equipment,

net |

|

41,037 |

|

|

|

45,600 |

|

| Operating lease right-of-use

assets, net |

|

8,962 |

|

|

|

9,980 |

|

| Capitalized internal-use

software, net |

|

38,335 |

|

|

|

32,521 |

|

| Other assets |

|

1,048 |

|

|

|

944 |

|

|

Total assets |

$ |

127,776 |

|

|

$ |

131,687 |

|

| Liabilities and

Stockholders’ Equity |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

1,147 |

|

|

$ |

1,973 |

|

|

Accrued expenses and other current liabilities(1) |

|

5,854 |

|

|

|

8,768 |

|

|

Finance lease liabilities and lease financing obligations,

current |

|

16,951 |

|

|

|

18,492 |

|

|

Operating lease liabilities, current |

|

1,668 |

|

|

|

1,878 |

|

|

Deferred revenue, current |

|

29,438 |

|

|

|

25,976 |

|

|

Total current liabilities |

|

55,058 |

|

|

|

57,087 |

|

| Debt facility,

non-current |

|

4,682 |

|

|

|

4,128 |

|

| Deferred

revenue, non-current |

|

4,605 |

|

|

|

4,073 |

|

| Finance lease liabilities and

lease financing obligations, non-current |

|

10,763 |

|

|

|

13,310 |

|

| Operating lease liabilities,

non-current |

|

7,570 |

|

|

|

8,151 |

|

|

Total liabilities |

$ |

82,678 |

|

|

$ |

86,749 |

|

| Commitments and

contingencies |

|

|

|

| Stockholders’

Equity |

|

|

|

| Class A common stock, $0.0001

par value; 113,000,000 shares authorized as of June 30, 2024

and December 31, 2023; 42,886,281 and 39,150,610 shares issued

and outstanding as of June 30, 2024 and December 31,

2023, respectively. |

|

4 |

|

|

|

4 |

|

|

Additional paid-in capital |

|

213,949 |

|

|

|

192,388 |

|

| Accumulated deficit |

|

(168,855 |

) |

|

|

(147,454 |

) |

|

Total stockholders’ equity |

|

45,098 |

|

|

|

44,938 |

|

|

Total liabilities and stockholders’ equity |

$ |

127,776 |

|

|

$ |

131,687 |

|

(1) As of June 30, 2024, the company

reclassified certain current liabilities from accounts payable to

accrued expenses and other current liabilities. The prior period

amount of $0.3 million as of December 31, 2023 has been

reclassified to conform with current presentation.

|

BACKBLAZE, INC.CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS(in thousands, except

share and per share data) |

| |

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

(unaudited) |

| Revenue |

$ |

31,285 |

|

|

$ |

24,589 |

|

|

$ |

61,253 |

|

|

$ |

47,983 |

|

| Cost of revenue |

|

14,056 |

|

|

|

12,538 |

|

|

|

28,213 |

|

|

|

24,963 |

|

| Gross profit |

|

17,229 |

|

|

|

12,051 |

|

|

|

33,040 |

|

|

|

23,020 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Research and development |

|

9,589 |

|

|

|

9,925 |

|

|

|

19,335 |

|

|

|

20,458 |

|

|

Sales and marketing |

|

10,991 |

|

|

|

9,875 |

|

|

|

21,013 |

|

|

|

20,434 |

|

|

General and administrative |

|

6,458 |

|

|

|

6,165 |

|

|

|

13,011 |

|

|

|

12,842 |

|

|

Total operating expenses |

|

27,038 |

|

|

|

25,965 |

|

|

|

53,359 |

|

|

|

53,734 |

|

| Loss from operations |

|

(9,809 |

) |

|

|

(13,914 |

) |

|

|

(20,319 |

) |

|

|

(30,714 |

) |

| Investment income |

|

362 |

|

|

|

519 |

|

|

|

746 |

|

|

|

1,129 |

|

| Interest expense |

|

(901 |

) |

|

|

(942 |

) |

|

|

(1,822 |

) |

|

|

(1,865 |

) |

| Loss before provision for

income taxes |

|

(10,348 |

) |

|

|

(14,337 |

) |

|

|

(21,395 |

) |

|

|

(31,450 |

) |

| Income tax provision |

|

— |

|

|

|

— |

|

|

|

6 |

|

|

|

— |

|

| Net loss |

$ |

(10,348 |

) |

|

$ |

(14,337 |

) |

|

$ |

(21,401 |

) |

|

$ |

(31,450 |

) |

| Net loss per share, basic and

diluted |

$ |

(0.25 |

) |

|

$ |

(0.41 |

) |

|

$ |

(0.52 |

) |

|

$ |

(0.91 |

) |

|

Weighted average shares used in computing net loss per share

attributable to Class A and Class B common stockholders, basic and

diluted(1) |

|

42,151,850 |

|

|

|

35,149,000 |

|

|

|

41,188,544 |

|

|

|

34,539,229 |

|

(1) On July 6, 2023, all shares of the Company’s

then outstanding Class B common stock were automatically converted

into the same number of Class A common stock, pursuant to the terms

of the Company’s Amended and Restated Certificate of Incorporation.

No additional shares of Class B common stock will be issued

following such conversion.

|

BACKBLAZE, INC.CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS(in

thousands) |

| |

| |

Six Months Ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

| |

(unaudited) |

| CASH FLOWS FROM

OPERATING ACTIVITIES |

|

|

|

| Net loss |

$ |

(21,401 |

) |

|

$ |

(31,450 |

) |

|

Adjustments to reconcile net loss to net cash provided by (used in)

operating activities: |

|

|

|

|

Net accretion of discount on investment securities and net realized

investment gains |

|

31 |

|

|

|

(966 |

) |

|

Noncash lease expense on operating leases |

|

1,018 |

|

|

|

1,293 |

|

|

Depreciation and amortization |

|

13,937 |

|

|

|

11,864 |

|

|

Stock-based compensation |

|

11,057 |

|

|

|

10,712 |

|

|

Gain on disposal of assets and other |

|

(6 |

) |

|

|

(1 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

Accounts receivable |

|

(1,014 |

) |

|

|

30 |

|

|

Prepaid expenses and other current assets |

|

(59 |

) |

|

|

941 |

|

|

Other assets |

|

(104 |

) |

|

|

134 |

|

|

Accounts payable |

|

(745 |

) |

|

|

(245 |

) |

|

Accrued expenses and other current liabilities |

|

(274 |

) |

|

|

(1,600 |

) |

|

Deferred revenue |

|

3,994 |

|

|

|

259 |

|

|

Operating lease liabilities |

|

(791 |

) |

|

|

(1,399 |

) |

| Net cash provided by (used in)

operating activities |

|

5,643 |

|

|

|

(10,428 |

) |

| CASH FLOWS FROM

INVESTING ACTIVITIES |

|

|

|

|

Purchases of marketable securities |

|

(24,127 |

) |

|

|

(9,734 |

) |

|

Maturities of marketable securities |

|

26,523 |

|

|

|

38,500 |

|

|

Proceeds from disposal of property and equipment |

|

184 |

|

|

|

78 |

|

|

Purchases of property and equipment |

|

(694 |

) |

|

|

(4,719 |

) |

|

Capitalized internal-use software costs |

|

(6,828 |

) |

|

|

(7,098 |

) |

| Net cash (used in) provided by

investing activities |

|

(4,942 |

) |

|

|

17,027 |

|

| CASH FLOWS FROM

FINANCING ACTIVITIES |

|

|

|

|

Principal payments on finance leases and lease financing

obligations |

|

(9,711 |

) |

|

|

(9,734 |

) |

|

Proceeds from debt facility |

|

554 |

|

|

|

3,529 |

|

|

Principal payments on insurance premium financing |

|

(590 |

) |

|

|

(1,024 |

) |

|

Proceeds from exercises of stock options |

|

5,012 |

|

|

|

2,182 |

|

|

Proceeds from ESPP |

|

1,359 |

|

|

|

1,171 |

|

| Net cash used in financing

activities |

|

(3,376 |

) |

|

|

(3,876 |

) |

| Net (decrease) increase in

cash and restricted cash, non-current |

|

(2,675 |

) |

|

|

2,723 |

|

| Cash, cash equivalents,

restricted cash, current and restricted cash, non-current at

beginning of period |

|

16,630 |

|

|

|

11,165 |

|

| Cash, restricted cash, current

and restricted cash, non-current at end of period |

$ |

13,955 |

|

|

$ |

13,888 |

|

| SUPPLEMENTAL

DISCLOSURE OF CASH FLOW INFORMATION: |

|

|

|

|

Cash paid for interest |

$ |

1,817 |

|

|

$ |

1,816 |

|

|

Cash paid for income taxes |

$ |

42 |

|

|

$ |

58 |

|

|

Cash paid for operating lease liabilities |

$ |

1,328 |

|

|

$ |

1,458 |

|

| SUPPLEMENTAL

DISCLOSURE OF NON-CASH INVESTING AND FINANCING

ACTIVITIES |

|

|

|

|

Stock-based compensation included in capitalized internal-use

software |

$ |

1,965 |

|

|

$ |

2,030 |

|

|

Accrued bonus settled in restricted stock units |

$ |

3,507 |

|

|

$ |

1,848 |

|

|

2023 Bonus Plan expense classified as stock-based compensation |

$ |

473 |

|

|

$ |

929 |

|

|

2024 Bonus Plan accrual classified as stock-based compensation |

$ |

853 |

|

|

$ |

— |

|

|

Equipment acquired through finance lease and lease financing

obligations |

$ |

5,989 |

|

|

$ |

8,705 |

|

|

Accruals related to purchases of property and equipment |

$ |

18 |

|

|

$ |

224 |

|

|

Assets obtained in exchange for operating lease obligations |

$ |

— |

|

|

$ |

268 |

|

|

Receivable recorded due to stock option exercises pending

settlement |

$ |

5 |

|

|

$ |

29 |

|

| RECONCILIATION OF CASH

AND RESTRICTED CASH |

|

|

|

|

Cash and cash equivalents |

$ |

9,273 |

|

|

$ |

5,886 |

|

|

Restricted cash - included in prepaid expenses and other current

assets |

$ |

— |

|

|

$ |

169 |

|

|

Restricted cash, non-current |

$ |

4,682 |

|

|

$ |

7,833 |

|

|

Total cash and restricted cash |

$ |

13,955 |

|

|

$ |

13,888 |

|

BACKBLAZE,

INC.RECONCILIATION OF GAAP TO NON-GAAP

DATA(unaudited)

Adjusted Gross Profit and Adjusted Gross

Margin

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

(in thousands, except percentages) |

| Gross profit |

$ |

17,229 |

|

|

$ |

12,051 |

|

|

$ |

33,040 |

|

|

$ |

23,020 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

Stock-based compensation |

|

354 |

|

|

|

387 |

|

|

|

740 |

|

|

|

803 |

|

|

Depreciation and amortization |

|

6,879 |

|

|

|

5,985 |

|

|

|

13,653 |

|

|

|

11,555 |

|

|

Adjusted gross profit |

$ |

24,462 |

|

|

$ |

18,423 |

|

|

$ |

47,433 |

|

|

$ |

35,378 |

|

|

Gross margin |

|

55 |

% |

|

|

49 |

% |

|

|

54 |

% |

|

|

48 |

% |

|

Adjusted gross margin |

|

78 |

% |

|

|

75 |

% |

|

|

77 |

% |

|

|

74 |

% |

Adjusted EBITDA

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

(in thousands, except percentages) |

| Net

loss |

$ |

(10,348 |

) |

|

$ |

(14,337 |

) |

|

$ |

(21,401 |

) |

|

$ |

(31,450 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

7,025 |

|

|

|

6,131 |

|

|

|

13,937 |

|

|

|

11,864 |

|

|

Stock-based compensation(1) |

|

5,528 |

|

|

|

4,884 |

|

|

|

11,057 |

|

|

|

10,587 |

|

|

Interest expense and investment income |

|

539 |

|

|

|

423 |

|

|

|

1,076 |

|

|

|

736 |

|

|

Income tax provision |

|

— |

|

|

|

— |

|

|

|

6 |

|

|

|

— |

|

|

Workforce reduction and related severance charges |

|

— |

|

|

|

1,147 |

|

|

|

— |

|

|

|

3,604 |

|

| Adjusted EBITDA |

$ |

2,744 |

|

|

$ |

(1,752 |

) |

|

$ |

4,675 |

|

|

$ |

(4,659 |

) |

|

Adjusted EBITDA margin |

|

9 |

% |

|

|

(7 |

)% |

|

|

8 |

% |

|

|

(10 |

)% |

(1) During the six months ended June 30, 2023,

$125 thousand of stock-based compensation expense is classified as

workforce reduction and related severance charges in the table

above as it was incurred as part of our restructuring program.

Non-GAAP Net Loss

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

(in thousands, except share and per share

data) |

| Net loss |

$ |

(10,348 |

) |

|

$ |

(14,337 |

) |

|

$ |

(21,401 |

) |

|

$ |

(31,450 |

) |

| Adjustments: |

|

|

|

|

|

|

|

|

Stock-based compensation(1) |

|

5,528 |

|

|

|

4,884 |

|

|

|

11,057 |

|

|

|

10,587 |

|

|

Workforce reduction and related severance charges |

|

— |

|

|

|

1,147 |

|

|

|

— |

|

|

|

3,604 |

|

| Non-GAAP net loss |

$ |

(4,820 |

) |

|

$ |

(8,306 |

) |

|

$ |

(10,344 |

) |

|

$ |

(17,259 |

) |

| Non-GAAP net loss per share,

basic and diluted |

$ |

(0.11 |

) |

|

$ |

(0.24 |

) |

|

$ |

(0.25 |

) |

|

$ |

(0.50 |

) |

|

Weighted average shares used in computing net loss per share

attributable to Class A and Class B common stockholders, basic and

diluted(2) |

|

42,151,850 |

|

|

|

35,149,000 |

|

|

|

41,188,544 |

|

|

|

34,539,229 |

|

(1) During the six months ended June 30, 2023,

$125 thousand of stock-based compensation expense is classified as

workforce reduction and related severance charges in the table

above as it was incurred as part of our restructuring program.(2)

On July 6, 2023, all shares of the Company’s then outstanding Class

B common stock were automatically converted into the same number of

Class A common stock, pursuant to the terms of the Company’s

Amended and Restated Certificate of Incorporation. No additional

shares of Class B common stock will be issued following such

conversion.

|

BACKBLAZE, INC.SUPPLEMENTAL FINANCIAL

INFORMATION(unaudited) |

|

Stock-based Compensation |

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

(In thousands, unaudited) |

|

Cost of revenue |

$ |

354 |

|

$ |

387 |

|

$ |

740 |

|

$ |

803 |

| Research

and development |

|

2,250 |

|

|

1,788 |

|

|

4,358 |

|

|

3,921 |

| Sales

and marketing |

|

1,762 |

|

|

1,717 |

|

|

3,584 |

|

|

3,869 |

| General

and administrative |

|

1,162 |

|

|

992 |

|

|

2,375 |

|

|

2,119 |

|

Total stock-based compensation expense |

$ |

5,528 |

|

$ |

4,884 |

|

$ |

11,057 |

|

$ |

10,712 |

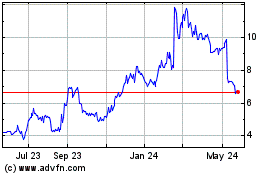

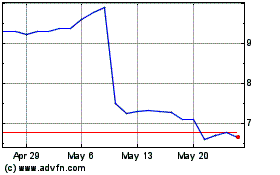

Backblaze (NASDAQ:BLZE)

Historical Stock Chart

From Oct 2024 to Nov 2024

Backblaze (NASDAQ:BLZE)

Historical Stock Chart

From Nov 2023 to Nov 2024