UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6 - K

Report of Foreign Private Issuer

Pursuant to Rule 13a - 16 or 15d -16

Under the Securities Exchange Act of 1934

For the Month of October 2024

Commission file number 001-14184

B.O.S. Better Online Solutions Ltd.

(Translation of Registrant's Name into English)

20 Freiman Street, Rishon LeZion, 7535825,

Israel

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

B.O.S. Better Online Solutions Ltd.

Attached hereto are the following exhibits:

Signature

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

B.O.S. Better Online Solutions Ltd. |

| |

(Registrant) |

| |

|

|

| |

By: |

/s/ Moshe Zeltzer |

| |

|

Moshe Zeltzer |

| |

|

Chief Financial Officer |

Dated: October 15, 2024

EXHIBIT INDEX

- 3 -

Exhibit 99.1

B.O.S. Better Online Solutions Ltd.

20 Freiman Street

Rishon LeZion 7535825

Israel

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

To Be Held on December 5, 2024

To our Shareholders:

You are invited to attend

an Annual Meeting of Shareholders of B.O.S. Better Online Solutions Ltd. (the “Company”) to be held at the Company’s

offices, at 20 Freiman Street, Rishon LeZion, Israel on December 5, 2024 at 4:00 P.M. local time, and thereafter

as it may be adjourned from time to time (the “Meeting”) for the following purposes:

| 1. | To elect the following person to serve as a director on the

Company’s Board of Directors (the “Board”) for such term as set forth below, and until her successor has been

duly elected and qualified: |

Osnat Gur – for a term of 3 years.

| 2. | To approve an amendment to the Company’s Articles of

Association, as provided in this Proxy Statement, to conform to amendments to the Israeli Companies Regulations. |

| 3. | To approve an increase to the CEO’s salary. |

| 4. | To approve a bonus to the CEO. |

| 5. | To approve the grant of 15,000 options to purchase Ordinary

Shares to newly elected and re-elected directors. |

| 6. | To appoint Fahn Kanne & Co. Grant Thornton Israel, as

the Company’s Independent Auditors for the year ending December 31, 2024, and for such additional period until the next annual

general meeting of shareholders. |

| 7. | To review the Auditor’s Report and the Company’s

Consolidated Financial Statements for the fiscal year ended December 31, 2023. |

The Board has fixed the close

of business on October 21, 2024, as the date for determining the holders of record of Ordinary Shares entitled to notice of and to vote

at the Meeting and any adjournments thereof.

Proposals 1, 2, 5 and 6 are

ordinary resolutions, which require the affirmative vote of a majority of the Ordinary Shares of the Company voted in person or by proxy

at the Meeting on the matter presented for passage. The votes of all shareholders voting on the matter will be counted.

Proposals 3 and 4 are special

resolutions, which require the affirmative vote of a majority of the shares present, in person or by proxy, and voting on the matter,

provided that either: (i) at least a majority of the voted shares of shareholders who are not Controlling shareholders and who do not

have a personal interest in the resolution are voted in favor of the resolution, disregarding abstentions; or (ii) the total number of

shares of shareholders, who are not Controlling shareholders and who do not have a personal interest in the resolution, voted against

the resolution does not exceed two percent (2%) of the outstanding voting power in the Company.

“Controlling”

for the purpose of the preceding paragraph means the ability to direct the acts of the Company. Any person holding twenty five

percent (25%) or more of the voting power of the Company or the right to appoint directors or the Chief Executive Officer is presumed

to have control of such company.

A “personal interest”

is defined as a shareholder’s personal interest in the approval of an act or a transaction of the Company, including (i) the personal

interest of his or her relative (which includes any members of his/her (or his/her spouse’s) immediate family or the spouses of

any such members of his or her (or his/her spouse’s) immediate family); and (ii) a personal interest of a body corporate in which

a shareholder or any of his/her aforementioned relatives serves as a director or the chief executive officer, owns at least 5% of its

issued share capital or its voting rights or has the right to appoint a director or chief executive officer, but excluding a personal

interest arising solely from holding of shares in the Company.

Each shareholder voting

at the Meeting or prior thereto by means of the accompanying proxy card is requested to indicate if he, she or it has a personal interest

in connection with a certain proposal. If any shareholder casting a vote does not explicitly indicate that he, she or it has a personal

interest with respect to a certain proposal and such indication is required, then the vote on the applicable item shall not be counted.

The review of our audited

Consolidated Financial Statements for the fiscal year ended December 31, 2023, described in proposal 7 does not involve a vote of our

shareholders.

Further details of these matters

to be considered at the Meeting are contained in the attached Proxy Statement. Copies of the resolutions to be adopted at the Meeting

will be available to any shareholder entitled to vote at the meeting for review at the Company’s offices during regular business

hours.

The Board believes that the

shareholders of the Company should be represented as fully as possible at the Meeting and encourages your vote. Whether or not you plan

to be present, kindly complete, date and sign the enclosed proxy card exactly as your name appears on the envelope containing this Notice

of Annual General Meeting and mail it promptly so that your votes can be recorded. No postage is required if mailed in the United States.

Return of your proxy does not deprive you of your right to attend the Meeting, to revoke the proxy or to vote your shares in person. All

proxy instruments and powers of attorney must be delivered to the Company no later than 48 hours prior to the Meeting. The Company’s

Proxy Statement is furnished herewith. The presence, in person or by proxy, of at least two shareholders holding at least 33⅓%

of the voting rights, will constitute a quorum at the Meeting.

Joint holders of Ordinary

Shares should take note that, pursuant to Article 14.13 of the Articles of Association of the Company, the vote of the senior of joint

holders of any share who tenders a vote, whether in person or by proxy, will be accepted to the exclusion of the vote(s) of the other

joint holder(s) of the share, and for this purpose seniority will be determined by the order in which the names stand in the shareholders’

register.

By Order of the Board of Directors,

Ziv Dekel, Chairman of the Board of Directors

October 2024

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU

EXPECT TO ATTEND THE MEETING, PLEASE DATE AND SIGN THE PROXY CARD AND RETURN IT PROMPTLY IN THE ENCLOSED ENVELOPE FOR WHICH NO POSTAGE

IS REQUIRED IF MAILED IN THE UNITED STATES. YOU CAN LATER REVOKE YOUR PROXY, ATTEND THE MEETING AND VOTE YOUR SHARES IN PERSON. ALL PROXY

INSTRUMENTS AND POWERS OF ATTORNEY MUST BE DELIVERED TO THE COMPANY NO LATER THAN 48 HOURS PRIOR TO THE MEETING.

B.O.S. Better Online Solutions Ltd.

20 Freiman Street

Rishon LeZion 7535825

Israel

ANNUAL GENERAL MEETING OF SHAREHOLDERS

To Be Held on December 5, 2024

PROXY STATEMENT

This Proxy Statement is furnished

to the holders of ordinary shares, of no nominal value (the “Ordinary Shares”), of B.O.S. Better Online Solutions Ltd.

(“BOS” or the “Company”) in connection with the solicitation of proxies to be voted at the Annual

General Meeting of Shareholders of the Company (the “Meeting”) to be held in Israel at the Company’s offices

at 20 Freiman Street, Rishon LeZion, Israel on December 5, 2024 at 4:00 P.M. local time, and thereafter as it may

be adjourned from time to time.

At the Meeting, shareholders of the Company

will be asked to vote upon the following matters:

| 1. | To elect the following person to serve as a director on the

Company’s Board of Directors (the “Board”) for such terms as set forth below, and until her successor has been

duly elected and qualified: |

Osnat Gur – for a term of 3 years.

| 2. | To approve an amendment to the Company’s Articles of

Association, as provided in this Proxy Statement, to conform to amendments to the Israeli Companies Regulations. |

| 3. | To approve an increase to the CEO’s salary. |

| 4. | To approve a bonus to the CEO. |

| 5. | To approve the grant of 15,000 options to purchase Ordinary

Shares to re-elected and newly elected directors. |

| 6. | To appoint Fahn Kanne & Co. Grant Thornton Israel, as

the Company’s Independent Auditors for the year ending December 31, 2024, and for such additional period until the next annual

general meeting of shareholders. |

| 7. | To review the Auditor’s Report and the Company’s

Consolidated Financial Statements for the fiscal year ended December 31, 2023. |

A proxy card for use

at the Meeting and a return envelope for the proxy card are enclosed. By signing the proxy card, shareholders may vote their shares at

the Meeting whether or not they attend. Upon the receipt of a properly signed and dated proxy card in the form enclosed, the shares represented

thereby shall be voted in accordance with the instructions of the shareholder indicated thereon, or, if no direction is indicated, then

in accordance with the recommendations of the Board of Directors. Your voting through the use of a proxy card will constitute a declaration

that you do not have a personal interest in the relevant proposal. If you have a personal interest in the approval of one of more proposals,

please notify the Company accordingly. The Company knows of no other matters to be submitted at the Meeting other than as specified in

the Notice of the Annual General Meeting of Shareholders enclosed with this Proxy Statement. Shares represented by executed and unrevoked

proxies will be voted. On all matters considered at the Meeting, abstentions and broker non-votes will not be treated as either a vote

“for” or “against” the matter, although they will be counted to determine if a quorum is present.

The proxy solicited hereby

may be revoked at any time prior to its exercise, by the substitution with a new proxy bearing a later date or by a request for the return

of the proxy at the Meeting. All proxy instruments and powers of attorney must be delivered to the Company no later than 48 hours prior

to the Meeting.

The Company expects to mail

this Proxy Statement and the enclosed form of proxy card to shareholders on or about October 22, 2024. All expenses of this solicitation

will be borne by the Company. In addition to the solicitation of proxies by mail, directors, officers and employees of the Company, without

receiving additional compensation therefore, may solicit proxies by telephone, facsimile, electronic mail, in person or by other means.

Brokerage firms, nominees, fiduciaries and other custodians have been requested to forward proxy solicitation materials to the beneficial

owners of shares of the Company held of record by such persons, and the Company will reimburse such brokerage firms, nominees, fiduciaries

and other custodians for reasonable out-of-pocket expenses incurred by them in connection therewith.

Shareholders Entitled to

Vote. Only holders of record of Ordinary Shares at the close of business on October 21, 2024, are entitled to notice of and to vote

at the Meeting. The Company had 5,761,448 Ordinary Shares issued and outstanding on September 30, 2024. Each Ordinary Share is entitled

to one vote on each matter to be voted on at the Meeting. The Articles of Association of the Company do not provide for cumulative voting

for the election of the directors or for any other purpose. The presence, in person or by proxy, of at least two shareholders holding

at least 33⅓% of the voting rights, will constitute a quorum at the Meeting.

Votes Required.

Proposals 1, 2, 5 and 6 are

ordinary resolutions, which require the affirmative vote of a majority of the Ordinary Shares of the Company voted in person or by proxy

at the Meeting on the matter presented for passage. The votes of all shareholders voting on the matter will be counted.

Proposal 3 and 4 are special

resolutions, which require the affirmative vote of a majority of the shares present, in person or by proxy, and voting on the matter,

provided that either: (i) at least a majority of the voted shares of shareholders who are not Controlling shareholders and who do not

have a personal interest in the resolution are voted in favor of the resolution, disregarding abstentions; or (ii) the total number of

shares of shareholders, who are not Controlling shareholders and who do not have a personal interest in the resolution, voted against

the resolution does not exceed two percent (2%) of the outstanding voting power in the Company.

“Controlling”

for the purpose of the preceding paragraph means the ability to direct the acts of the Company. Any person holding twenty five

percent (25%) or more of the voting power of the Company or the right to appoint directors or the Chief Executive Officer is presumed

to have control of the Company.

A “personal interest”

is defined as a shareholder’s personal interest in the approval of an act or a transaction of the Company, including (i) the personal

interest of his or her relative (which includes any members of his/her (or his/her spouse’s) immediate family or the spouses of

any such members of his or her (or his/her spouse’s) immediate family); and (ii) a personal interest of a body corporate in which

a shareholder or any of his/her aforementioned relatives serves as a director or the chief executive officer, owns at least 5% of its

issued share capital or its voting rights or has the right to appoint a director or chief executive officer, but excluding a personal

interest arising solely from holding of shares in such company.

The proxy card will indicate

that the voting shareholder does not have a personal interest in the applicable proposal.

If you are a shareholder who

has a personal interest in the resolution, please notify Mr. Eyal Cohen, our Chief Executive Officer, at 20 Freiman Street, Rishon

LeZion, Israel; telephone: +972-3-9542000, or by email: eyalc@boscom.com. If your shares are held in “street name” by your

broker, bank or other nominee and you are a shareholder who has a personal interest in the resolution, you should notify the Company as

outlined above, and, in addition, you should advise your broker, bank or other nominee of that status, and they in turn should notify

the Company as described in the preceding sentence.

The review of our audited

Consolidated Financial Statements for the fiscal year ended December 31, 2023, described in proposal 7 does not involve a vote of our

shareholders.

Further details of these matters

to be considered at the Meeting are contained in the attached Proxy Statement. Copies of the resolutions to be adopted at the Meeting

will be available to any shareholder entitled to vote at the meeting for review at the Company’s offices during regular business

hours.

The Board believes that the

shareholders of the Company should be represented as fully as possible at the Meeting and encourages your vote. Whether or not you plan

to be present kindly complete, date and sign the enclosed proxy card exactly as your name appears on the envelope containing this Notice

of Annual General Meeting and mail it promptly so that your votes can be recorded. No postage is required if mailed in the United States.

Return of your proxy does not deprive you of your right to attend the Meeting, to revoke the proxy or to vote your shares in person. All

proxy instruments and powers of attorney must be delivered to the Company no later than 48 hours prior to the Meeting. The Company’s

Proxy Statement is furnished herewith.

Joint holders of Ordinary

Shares should take note that, pursuant to Article 14.13 of the Articles of Association of the Company, the vote of the senior of joint

holders of any share who tenders a vote, whether in person or by proxy, will be accepted to the exclusion of the vote(s) of the other

joint holder(s) of the share, and for this purpose seniority will be determined by the order in which the names stand in the shareholders’

register.

By Order of the Board of Directors,

Ziv Dekel, Chairman of the Board of Directors

October, 2024

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU

EXPECT TO ATTEND THE MEETING, PLEASE DATE AND SIGN THE PROXY CARD AND RETURN IT PROMPTLY IN THE ENCLOSED ENVELOPE FOR WHICH NO POSTAGE

IS REQUIRED IF MAILED IN THE UNITED STATES. YOU CAN LATER REVOKE YOUR PROXY, ATTEND THE MEETING AND VOTE YOUR SHARES IN PERSON. ALL PROXY

INSTRUMENTS AND POWERS OF ATTORNEY MUST BE DELIVERED TO THE COMPANY NO LATER THAN 48 HOURS PRIOR TO THE MEETING.

| I. | PRINCIPAL SHAREHOLDERS; EXECUTIVE COMPENSATION |

The following table sets forth, as of September

30, 2024, to the Company’s knowledge, information as to each person known to the Company to be the beneficial owner of more than

five percent (5%) of the Company’s outstanding Ordinary Shares. To the Company’s knowledge, based on information provided

by the owners, the beneficial owners of the shares listed below have sole investment and voting power with respect to those shares.

Applicable percentage ownership in the following

table is based on 5,761,448 shares outstanding as of September 30, 2024.

The shareholders’ holdings reflect their

voting rights. The Company’s major shareholders do not have different voting rights than other shareholders, with respect to their

shares.

| | |

Shares Beneficially Owned | |

| Name and Address | |

Outstanding Shares | | |

Warrant Shares | | |

Total Shares | | |

Percentage | |

Todd M. Felte 8655

East Via De Ventura

Suite G-175

Scottsdale, AZ

85258(1) | |

| 556,390 | | |

| 165,100 | | |

| 721,490 | | |

| 12.2 | % |

| Janney Montgomery Scott LLC(2) | |

| 524,481 | | |

| | | |

| 524,481 | | |

| 9.1 | % |

| (1) | According

to a 13G report dated January 30, 2024. |

| (2) | According

to a 13G report dated October 8, 2021, which contained information with respect to Janney Montgomery Scott’s ownership as of October

8, 2021. |

Summary Compensation Table

The following table outlines

the compensation granted to our most highly compensated office holders and employees during or with respect to the year ended December

31, 2023.

For purposes of the table

and the summary below, “compensation” includes base salary, discretionary and non-equity incentive bonuses, equity-based compensation,

payments accrued or paid in connection with retirement or termination of employment, and personal benefits and perquisites such as car

and social benefits paid to or earned by each listed executive during the year ended on December 31, 2023.

| Name | |

Position | |

Salary Cost | | |

Non-Equity Incentive Bonuses | | |

Equity-Based Compensation | | |

Car

Expenses | | |

Total | |

| Eyal Cohen | |

CEO | |

$ | 245,000 | | |

| - | | |

$ | 61,000 | | |

$ | 18,000 | | |

$ | 324,000 | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Avidan Zelicovsky | |

President and Head of the Supply Chain division | |

$ | 255,000 | | |

$ | 68,000 | | |

| - | | |

$ | 36,000 | | |

$ | 359,000 | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Moshe Zeltzer | |

CFO | |

$ | 126,000 | | |

| - | | |

$ | 8,000 | | |

$ | 17,000 | | |

$ | 151,000 | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Hagit Eliyahu | |

VP, Supply Chain division | |

$ | 143,000 | | |

$ | 369,000 | | |

| - | | |

$ | 19,000 | | |

$ | 531,000 | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Uzi Parizat | |

VP Sales & Marketing, RFID division | |

$ | 172,000 | | |

$ | 42,000 | | |

| - | | |

$ | 18,000 | | |

$ | 232,000 | |

At the Meeting, the shareholders are requested

to elect the following person, for such term as set forth below and until her successor has been duly elected and qualified:

Osnat Gur – for a term of 3 years.

The Company’s Articles of Association currently

provide that the number of directors in the Company shall be determined from time to time by the annual general meeting, provided that

it shall neither be less than four (4) nor more than seven (7).

Following the reelection of Ms. Osnat Gur, the

Company’s Board shall comprise of 4 members.

Regulation 5D of the Israeli Companies Regulations

(Reliefs for Public Companies whose Shares are Listed on a Stock Exchange Outside of Israel), 2000 provides that a public company with

securities listed on the Nasdaq Capital Market that has no controlling shareholder, may elect to be exempt from the requirements under

the Companies Law, 5759-1999 (the “Companies Law”), to appoint external directors. The Company has adopted this exemption

and consequently the Company’s Board of Directors does not include external directors, as defined under the Companies Law.

The Companies Law provides that a nominee for

a position of a director shall have declared to the Company that he or she complies with the qualifications prescribed by the Companies

Law for appointment as a director. The proposed nominee has declared to the Company that she complies with such qualifications.

The nominee named in this proposal 1, if elected,

shall hold office for the term noted above, and until her successor has been duly elected and qualified, unless any office is vacated

earlier. The Company is unaware of any reason why the nominee, if elected, should be unable to serve as a director. The nominee has advised

the Board that she intends to serve as a director if elected.

Nominee for the Board of Directors

Set forth below is information about the nominee,

including age, position(s) held with the Company, principal occupation, business history and other directorships held.

| Name |

|

Age |

|

Position |

| Ms. Osnat Gur (1) |

|

53 |

|

Director |

| (1) | Ms.

Osnat Gur holds options to purchase 7,500 Ordinary Shares, which she received upon her appointment as a director, in accordance with

the Shareholders resolution on October 31, 2019. In addition, subject to approval of resolution No. 4 in this Proxy Statement, Ms. Gur

shall receive additional options to purchase 15,000 Ordinary Shares, in connection with her re-appointment as a director. |

Ms. Osnat Gur joined

our Board of Directors in October 2021. Ms. Gur brings extensive experience in the management of companies. Currently, Ms. Gur serves

as the CEO of Oz Global B2B, a full-service global B2B marketing agency. She has served as the CEO of TAT, a technology company from 2014

through 2019 and as a director in the public company Maabarot Products Ltd during 2004-2015. From 2013 to 2015, Ms. Gur served as the

CEO of Anlit Ltd a company that develops and produces high-quality children’s dietary supplements and from 2012-2014 she served

as the deputy to the CEO of Altman Health, a provider of dietary supplements. Ms. Gur holds an MA in Organizational Sociology from the

Tel Aviv University, and a BA in Behavioral Sciences from Bar Ilan University.

Compensation of Directors and Officers

The following table presents

the total compensation (in thousands) paid to or accrued on behalf of all of our directors and officers as a group for the year ended

December 31, 2023 (6 persons):

| | |

Year ended December 31,

2023 | |

| Salaries, Directors’ fees, Service fees, Commissions and Bonuses(1) | |

$ | 744 | |

| Pension, Retirement and Similar benefits | |

$ | 105 | |

| (1) | Does not include amounts expended by the Company, including car expenses, business association dues, expense

reimbursements and other fringe benefits commonly reimbursed or paid for by companies. |

At the Meeting, the Board of Directors proposes

that the following resolution be adopted:

“RESOLVED, to

elect the following person to the Board, for such term as set forth below and until her successor has been duly elected and qualified:

Osnat Gur – for a term of 3 years.”

Vote Required

The affirmative vote of the

holders of a majority of the voting power represented at the Meeting in person or by proxy is necessary for the approval of the foregoing

resolution.

2. AMENDMENT TO THE COMPANY’S ARTICLES OF ASSOCIATION

Under the Company’s Articles of Association,

as amended, (the “Articles”), the Board must convene a Special Meeting (as defined therein) if it receives a written

requisition from a shareholder or shareholders of the Company holding at least 5% of the issued capital and at least 1% of the voting

rights in the Company. In addition, a shareholder holding at least 1% of the voting rights in the Company has the right to nominate a

board member.

In March 2024, Israeli Companies Regulations were

amended to increase the thresholds required (a) for a shareholder to convene a meeting from 5% to 10% and (b) for a shareholder to nominate

a Board member or to propose a removal of an incumbent director from 1% to 5%.

Accordingly, on August 22, 2024, the Board of

Directors approved an amendment to the Company’s Articles of Association, to conform the Articles to the amendments to the Israeli

Companies Regulations.

The Board of Directors believes that the amendments

to the Articles are in the best interests of the shareholders.

The complete text of the Articles, as amended,

is attached to this Proxy Statement as Exhibit A.

At the Meeting, the Board of Directors will propose

that the following resolution be adopted:

“RESOLVED, to approve an amendment

to the Company’s Articles of Association as detailed in the Proxy Statement.”

Vote Required

The affirmative vote of the

holders of a majority of the voting power represented at the Meeting in person or by proxy is necessary for the approval of the foregoing

resolution.

3. APPROVAL OF A SALARY INCREASE TO THE CEO

Mr. Eyal Cohen, the

CEO has made significant and invaluable contributions to the Company’s success. Under his leadership, the Company has secured important

achievements, including:

| 1. | Financial Growth: Revenues increased from $33.8 million in

2019 to $44.2 million in 2023. A net loss of $913,000 in 2019 turned into a net income of $2.0 million in 2023. Shareholder equity increased

from $12.6 million as of December 31, 2019, to $18.8 million as of December 31, 2023. |

| 2. | Strategic Development: The Company has successfully launched

several initiatives that have significantly broadened the Company’s offerings and bolstered its market position in Supply Chain technologies. |

In view of the above and

considering that CEO’s last salary increase was in January 2018 (when he served as co-CEO) our Compensation Committee and Board of Directors

have approved an increase of the monthly base salary of the CEO. The increase shall be from NIS 51,196 (approximately $13,725) to NIS

65,000 (approximately $17,426), linked to increases in the Israeli Consumer Price index (provided, however, that the base salary shall

not be reduced as a result of a CPI decrease).

This adjustment aligns the

CEO’s compensation with that of CEOs of peer companies in the Company’s industry, and intends to maintain his motivation and

commitment to the Company. The increase shall take effect after approval by the shareholders.

The salary increase for

the Chief Executive Officer complies with the Company’s Compensation Policy.

At

the Meeting, the Board of Directors will propose that the following resolution be adopted:

“RESOLVED,

to approve an increase to the CEO’s salary.”

Vote Required

Under the Companies Law, the

approval of this resolution requires the affirmative vote of a majority of the shares present, in person or by proxy, and voting on the

matter, provided that either: (i) at least a majority of the voted shares of shareholders who are not Controlling shareholders and who

do not have a personal interest in the resolution are voted in favor of the resolution, disregarding abstentions; or (ii) the total number

of shares of shareholders, who are not Controlling shareholders and who do not have a personal interest in the resolution, voted against

the resolution does not exceed two percent (2%) of the outstanding voting power in the Company.

4. APPROVAL OF A BONUS TO THE CEO

Our Compensation Committee

and Board of Directors have approved a bonus payment to the Company’s CEO, of US$ 68,625, which is equal to five months’ salaries.

This amount is aligned with industry benchmarks and is based on the CEO’s outstanding performance and leadership throughout 2023. Under

the CEO’s guidance, the Company exceeded its financial outlook of $1.5 million net income for 2023 and ended the year with a net

income of $2 million.

The Board of Directors has

set the bonus amount in view of the CEO’s significant achievements in year 2023 and the fact that he did not receive a bonus for

the Company’s progress in year 2022 (Year 2022 revenues grew by 23% to $44 million from $33.6 million in year 2021 and net income

increased by 183% to $1.3 million from $0.45 million in year 2021).

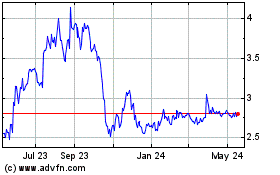

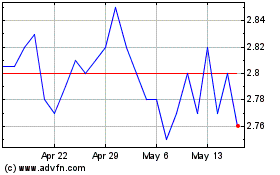

The bonus payment will be

payable in Ordinary Shares, which shall be issued on the date of approval by the shareholders. The number of shares shall be calculated

based on a price per share equal to the weighted average closing price of the Company’s Ordinary Shares on NASDAQ during the 20 trading

days preceding the date of the approval of the bonus by the Board. The bonus shall be subject to a clawback in accordance with the Company’s

Compensation Policy.

The proposed bonus for the

Chief Executive Officer complies with the Company’s Compensation Policy.

At

the Meeting, the Board of Directors will propose that the following resolution be adopted:

“RESOLVED,

to approve the bonus to the CEO.”

Vote Required

Under the Companies Law, the

approval of this resolution requires the affirmative vote of a majority of the shares present, in person or by proxy, and voting on the

matter, provided that either: (i) at least a majority of the voted shares of shareholders who are not Controlling shareholders and who

do not have a personal interest in the resolution are voted in favor of the resolution, disregarding abstentions; or (ii) the total number

of shares of shareholders, who are not Controlling shareholders and who do not have a personal interest in the resolution, voted against

the resolution does not exceed two percent (2%) of the outstanding voting power in the Company.

5. APPROVAL

OF THE GRANT OF 15,000 OPTIONS TO PURCHASE ORDINARY SHARES TO RE-ELECTED AND NEWLY ELECTED DIRECTORS

The shareholders are asked to approve the grant

of 15,000 options to purchase Ordinary Shares (the “Options”) to those directors elected or re-elected by the shareholders,

provided that three years have lapsed since the Company’s previous grant of options to such director, and to future directors to

be elected for the first time to the Board.

The grant date will be the date of approval of

appointment or reappointment of the director at the shareholders meeting (the “Grant Date”). This grant replaces the

previously approved grant of 7,500 options to directors, once every three years.

For the avoidance of doubt, a grant of options

to a director may occur in the middle of the term of such director.

The Options shall

be granted pursuant to the Company’s 2003 Share Option Plan and have the following terms:

| ● | Exercise price: the weighted average closing price of

the Ordinary Shares on the NASDAQ during the 20 trading days preceding the Grant Date. |

| ● | Vesting schedule: the Options will vest and become exercisable

over a period of three years, in three equal parts, such that one third of the Options shall vest on each of the first, second and third

anniversary of the Grant Date, provided that the director is still serving on the Company’s Board of Directors at the applicable

vesting date. |

| ● | Unless previously exercised, the Options shall expire on

the fifth anniversary of the Grant Date. |

| ● | Payment of the exercise price must be made in full upon exercise

of the Options, by cash or check or cash equivalent, or by the assignment of the proceeds of a sale of some or all of the Ordinary Shares

being acquired upon exercise of options, or by any combination of the foregoing. |

| ● | The Options are exercisable only by the director, and may

not be assigned or transferred except following approval of the Company’s Audit Committee or Compensation Committee, as applicable,

by will or by the laws of descent and distribution. The Options shall be exercisable during the term the director holds office (up to

five years) or within 60 days following termination of this position, with certain exceptions in the case of the death or disability. |

The Company’s Compensation

Policy provides that equity awarded to directors shall have a fair market value (as shall be determined by the Board of Directors) not

to exceed US$ 5,000 per year of vesting, on a linear basis, with respect to each director.

The fair market value of the

Options to be granted to a director is approximately $13,050 ($0.87 per option and $4,350 per year of vesting) and therefore the grant

is in compliance with the Company’s Compensation Policy.

At

the Meeting, the Board of Directors will propose that the following resolution be adopted:

“RESOLVED,

to approve the grant of options to newly elected and re-elected directors as detailed in the Proxy Statement.”

Vote Required

The affirmative vote of the

holders of a majority of the voting power represented at the Meeting in person or by proxy is necessary for the approval of the foregoing

resolution.

6. APPOINTMENT OF

INDEPENDENT AUDITORS

The Board of Directors recommends

that the shareholders appoint Fahn Kanne & Co. Grant Thornton Israel (“Fahn Kanne”), as the independent auditors

of the Company for the year ending December 31, 2024, and for such additional period, until the next annual general meeting of shareholders.

Fahn Kanne have served as the Company’s independent auditors since 2017.

Pursuant to Section 24.2 to

the Company’s Articles of Association, the auditor fees are set by the Company’s Board.

The table below summarizes

the audit and other fees paid and accrued by the Company and its consolidated subsidiaries to Fahn Kanne during 2022 and 2023.

| | |

Year Ended

December 31, 2023 | | |

Year Ended

December 31, 2022 | |

| | |

Amount | | |

Percentage | | |

Amount | | |

Percentage | |

| Audit Fees – Grant Thornton (1) | |

$ | 81,000 | | |

| 100 | % | |

$ | 95,000 | | |

| 100 | % |

| Other Fees – Grant Thornton (2) | |

| - | | |

| - | | |

| - | | |

| - | |

| Total | |

$ | 81,000 | | |

| 100 | % | |

$ | 95,000 | | |

| 100 | % |

| (1) | Audit

fees are fees for audit services for each of the years shown in this table, including fees associated with the annual audit and audit

services provided in connection with other statutory or regulatory filings. |

| (2) | Other

fees are fees for professional services other than audit fees. |

Audit Committee’s

pre-approval policies and procedures:

The Audit Committee is responsible

for the oversight of the independent auditors’ work, including the approval of services provided by the independent auditors. These

services may include audit, audit-related, tax or other services, as described above. On an annual basis, the audit committee may pre-approve

audit and non-audit services to be provided to the Company by its auditors, and set a budget for such services. Additional services not

covered by the annual pre-approval may be approved by the Audit Committee on a case-by-case basis as the need for such services arises.

Any services pre-approved by the Audit Committee must be permitted by applicable law.

At the Meeting, the Board

of Directors will propose that the following resolution be adopted:

“RESOLVED, that

Fahn Kanne be, and they hereby are, appointed as independent auditors of the Company for the year ending December 31, 2024, and for such

additional period until the next annual general meeting of shareholders.”

Vote Required

The affirmative vote of the

holders of a majority of the voting power represented at the Meeting in person or by proxy is necessary for the approval of the foregoing

resolution.

7. REVIEW

OF AUDITOR’S REPORT AND FINANCIAL STATEMENTS

At the Meeting, the Auditor’s

Report and the Consolidated Financial Statements of the Company for the fiscal year ended December 31, 2023, will be presented for review.

The Company’s Audited Consolidated Financial Statements were filed by the Company with the U.S. Securities and Exchange Commission

on Form 20-F on April 1, 2024, and appear on its website: www.sec.gov as well as on the Company’s website: www.boscom.com.

These financial statements are not a part of this Proxy Statement. This item will not involve a vote of the shareholders.

OTHER BUSINESS

The Meeting is called for

the purposes set forth in the Notice accompanying this Proxy Statement. As of the date of the Notice, the Board of Directors knows of

no business which will be presented for consideration at the Meeting other than the foregoing matters. However, if any other business

properly comes before the Meeting, the persons named in the enclosed proxy will vote upon such matters in accordance with their best judgment.

Shareholder Proposals

for the Annual Meeting

Any shareholder of the Company

who intends to present a proposal at the Meeting must satisfy the requirements of the Companies Law. For a shareholder proposal to be

considered for inclusion in the Meeting, we must receive the written proposal in English at the Company’s offices no later than

October 22, 2024.

Exhibit A

Articles

B.O.S BETTER ON-LINE SOLUTIONS LTD.

ARTICLES OF ASSOCIATION

IN ACCORDANCE WITH THE COMPANIES LAW, 5759-1999

| |

The Company’s name is “B.O.S Better On-Line Solutions Ltd”. |

| |

The Company’s object is to engage in any legal business. |

| |

3.1 |

Everything mentioned in the singular shall include the plural and vice versa, and everything mentioned in the masculine shall include the feminine and vice versa. |

| |

3.2 |

Unless these articles include special definitions for certain terms, every word and expression herein shall bear the meaning attributed thereto in the Companies Law, 5759-1999 (hereinafter referred to as the “Companies Law”), unless the context otherwise admits. |

| |

3.3 |

For the avoidance of doubt, it is expressed that in respect of matters regulated in the Companies Law such that it is possible to qualify the arrangements in respect thereof in articles, and these articles do not include in respect thereof provisions different from those of the Companies Law - the provisions of the Companies Law shall apply in respect thereof. |

| 4. |

The Company’s Share Capital and the Rights Attached to Shares |

| |

4.1 |

The Company’s authorized capital is divided into 11,000,000 ordinary shares of no nominal value each. (amended May 2003, May 2006, December 2009, December 2012, January 2015, July 2018, December 2020 and December 2022). |

| |

4.2 |

The ordinary shares shall vest the holders thereof with - |

| |

4.2.1 |

an equal right to participate in and vote at the Company’s general meetings, whether an Annual Meeting or a Special Meeting, and each of the shares in the Company shall entitle its holder, present at the general meeting and participating in the vote, himself, by proxy or through a voting instrument, to one vote; (amended October 2019) |

| |

4.2.2 |

an equal right to participate in a distribution of dividends, whether in cash or by way of bonus shares, in a distribution of assets or in any other distribution, pro rata to the nominal value of the shares held by them; |

| |

4.2.3 |

an equal right to participate in a distribution of the Company’s surplus assets on winding up pro rata to the nominal value of the shares held by them. |

| |

4.3 |

The board of directors may issue shares and other securities which are convertible or exercisable into shares up to the limit of the Company’s authorized share capital. With regard to computing the limit of the authorized capital, securities convertible or exercisable into shares shall be deemed to have been converted or exercised on the date of their issue. The board of directors may delegate such authority as permitted by law. (amended May 2006) |

| |

The shareholders’ liability for the Company’s debts shall be limited to the full amount (nominal value plus premium) they are required to pay the Company for the shares and not yet paid by them. |

| 6. |

Joint Shareholders and Share Certificates |

| |

6.1 |

Where two or more persons are listed in the shareholders’ register as the joint holders of a share, each of them may give binding receipts for any dividend or other monies in connection with such share. |

| |

6.2 |

A shareholder who is listed in the shareholders’ register may receive from the Company, without payment, within three months of the allotment or registration of the transfer, one share certificate bearing a seal in respect of all the shares registered in his name, which shall specify the number of shares. In the case of a jointly held share, the Company shall issue one share certificate to all the joint shareholders, and the delivery of such a certificate to one of the joint shareholders shall be deemed delivery to all of them. |

| |

|

Each share certificate shall bear the signature of at least one director together with the Company’s stamp or its printed name. |

| |

6.3 |

A share certificate which has been defaced, destroyed or lost may be renewed in reliance upon proof and guarantees as required by the Company from time to time. |

| 7. |

The Company’s Reliefs in relation to Shares Not Paid in Full |

| |

7.1 |

If the consideration which the shareholder undertook to pay the Company for his shares or any part thereof is not paid at the time and on the terms prescribed in the shares’ allotment terms and/or in the payment call mentioned in paragraph 7.2 below, the Company may, pursuant to the board of directors’ resolution, forfeit the shares whose consideration has not been paid in full. The shares shall be forfeited, provided that the Company has sent the shareholder written warning of its intention to forfeit his shares, at least seven days from the date of receiving the warning if the payment is not effected during the period specified in the warning letter. |

| |

|

The board of directors may, at any time prior to the date on which a share forfeited is sold, re-allotted or otherwise transferred, cancel the forfeiture on such terms as it deems fit. |

| |

|

The shares forfeited shall be held by the Company as dormant shares or shall be sold to another. |

| |

7.2 |

If pursuant to the issue terms of shares there is no fixed date for payment of any part of the price payable therefor, the board of directors may from time to time make calls for payment on the shareholders in respect of the monies not yet paid for the shares held by them, and every shareholder shall be liable to pay the Company the amount of the call made on him on the date specified as aforesaid, provided that he receives 14 days’ notice of the date and place for payment (hereinafter referred to as “call”). The notice shall state that non-payment on the date specified or prior thereto at the place specified might result in the forfeiture of the shares in relation to which the call was made. A call may be cancelled or postponed to another date, as resolved by the board of directors. |

| |

7.3 |

In the absence of another provision in the shares’ allotment terms, a shareholder shall not be entitled to receive dividend or to exercise any right as a shareholder in respect of shares not yet paid up in full. |

| |

7.4 |

Persons who are joint holders of a share shall be jointly and severally liable for payment of the amounts due to the Company in respect of the share. |

| |

7.5 |

The provisions of this paragraph are not such as to derogate from any other relief available to the Company vis-a-vis a shareholder who has not paid his debt to the Company in respect of his shares. |

| |

8.1 |

The Company’s shares may be transferred. |

| |

8.2 |

A share transfer shall be effected in writing and shall not be registered unless - |

| |

8.2.1 |

a due share transfer instrument is furnished to the Company at its registered office together with the certificates relating to the shares to be transferred, if issued. The transfer instrument shall be signed by the transferor and a witness verifying the transferor’s signature. In the case of a transfer of shares which are not fully paid up on the date of the transfer, the transfer instrument shall also be signed by the transferee and a witness verifying the transferee’s signature; or |

| |

8.2.2 |

the Company is given a court order to amend the registration; or |

| |

8.2.3 |

it is proved to the Company that the legal conditions for transmission of the right to the share have been fulfilled. |

| |

8.3 |

A transfer of shares which are not fully paid up requires the approval of the board of directors, which may refuse to grant its approval in its absolute discretion and without giving grounds therefor. |

| |

8.4 |

The transferee shall be deemed the shareholder in relation to the shares being transferred from the moment his name is listed in the shareholders’ register. |

| |

9.1 |

The general meeting may increase the Company’s authorized share capital by creating new shares of an existing class or of a new class, as determined in the general meeting’s resolution. |

| |

9.2 |

The general meeting may cancel authorized share capital which has not yet been allotted, provided that the Company has not undertaken, including conditionally, to allot the shares. |

| |

9.3 |

The general meeting may, subject to the provisions of any law: |

| |

9.3.1 |

consolidate and re-divide its share capital, or any part thereof, into shares of a nominal value greater than that of the existing shares; |

| |

9.3.2 |

sub-divide its existing shares, or any of them, or its share capital, or any part thereof, into shares of a nominal value smaller than that of the existing shares; |

| |

9.3.3 |

reduce its share capital and any capital redemption reserve fund in such manner and on such terms and conditions and with the receipt of such approval as the Companies Law requires. |

| 10. |

Alteration of the Rights Attached to Classes of Shares |

| |

10.1 |

So long as not otherwise provided in the shares’ issue terms and subject to the provisions of any law, the rights attached to a particular class of shares may be altered, after a resolution is passed by the Company and with the approval of a resolution passed at a general meeting of the holders of the shares of such class or the written agreement of all the class holders. |

| |

|

The provisions of the Company’s articles regarding general meetings shall apply, mutatis mutandis, to a general meeting of the holders of a particular class of shares. |

| |

10.2 |

The rights vested in the holders of shares of a particular class that were issued with special rights shall not be deemed to have been altered by the creation or issue of further shares ranking equally with them, unless otherwise provided in such shares’ issue terms. |

| |

11.1 |

The Company’s resolutions on the following matters shall be passed at the general meeting - |

| |

11.1.1 |

alterations to the articles; |

| |

11.1.2 |

the exercise of the board of directors’ powers when the board of directors is unable to function; |

| |

11.1.3 |

the appointment and dismissal of the Company’s auditor; |

| |

11.1.4 |

the appointment and removal of directors, including independent and external directors, provided however, that appointment or removal of directors shall only be made by the Annual Meeting; (amended October 2019) |

| |

11.1.5 |

the approval of acts and transactions requiring the general meeting’s approval pursuant to the provisions of the Companies Law and any other law; |

| |

11.1.6 |

increasing and reducing the authorized share capital; |

| |

11.1.7 |

a merger as defined in the Companies Law. |

| 12. |

Convening General Meetings (amended October 2019; December 2024) |

| |

12.1 |

An Annual Meeting shall be convened at once a year at such place and time as determined by the board of directors but no later than 15 months from the last Annual meeting The Company’s other shareholder meetings shall be referred to as “Special Meetings”. |

| |

12.2 |

The Annual Meeting’s agenda shall include a discussion of the board of directors’ reports and the financial statements as required by the Companies Law. The Annual Meeting shall appoint an auditor, appoint the directors pursuant to these articles and discuss all the other matters which must be discussed at the Company’s Annual Meeting, pursuant to these articles or the Companies Law, as well as any other matter determined by the board of directors. One or more shareholders holding the required percentage under the Companies Law may request that the board of directors include a proposal in the agenda of an Annual Meeting or a Special Meeting, provided that such shareholder(s) gives timely notice in writing to the Company and the request complies with all requirements of these articles, applicable law and the stock exchange laws. |

| |

12.3 |

The board of directors may convene a Special Meeting pursuant to its resolution and it must convene a Special Meeting if it receives a written requisition from two directors or one quarter of the directors holding office and/or one or more shareholders of the Company holding the required percentage under the Companies Law, and subject to the terms and conditions of these articles and applicable laws and stock exchange rules (a “Requisition”). |

| |

12.4 |

A Requisition must detail the objects for which the Special Meeting must be convened and shall be signed by the persons requisitioning it and sent to the Company’s registered office. The Requisition may be made up of a number of documents in an identical form of wording, each of which shall be signed by one or more of the persons requisitioning the Special Meeting. |

| |

12.5 |

Where the board of directors is required to convene a Special Meeting, it shall do so within 21 days of the Requisition being submitted to it, for a date that shall be specified in the invitation pursuant to paragraph 12.6 below and subject to the law. |

| |

12.6 |

Notice to the Company’s members regarding the convening of an Annual Meeting or a Special Meeting shall be sent to all the shareholders listed in the Company’s shareholders’ register at least 21 days prior to the general meeting and shall be published in other ways insofar as required by the Companies Law. The notice shall include the agenda, proposed resolutions and arrangements with regard to a written vote. |

| |

|

The accidental omission to give notice of a general meeting to any member, or the non-receipt of notice sent to such member, shall not invalidate the proceedings at such general meeting. |

| 13. |

The Discussion at the General Meetings |

| |

13.1 |

No discussions may be commenced at the general meeting unless a quorum is present at the time of the discussion’s commencement. A quorum is the presence of at least two shareholders holding at least 33⅓% of the voting rights (including presence through a proxy or a voting instrument), within half an hour of the time fixed for the meeting’s commencement. (amended August 2004) |

| |

13.2 |

If no quorum is present at a general meeting within half an hour of the time fixed for the commencement thereof, the meeting shall be adjourned for one week, to the same day, time and place, or to a later time if stated in the invitation to the meeting or in the notice of the meeting (hereinafter referred to as “the adjourned meeting”). |

| |

13.3 |

The quorum for the commencement of the adjourned meeting shall be any number of participants. |

| |

13.4 |

The board of directors’ chairman shall serve as the general meeting’s chairman. If the board of directors’ chairman is not present at the meeting within 15 minutes of the time fixed therefor or if he refuses to chair the meeting, the chairman shall be elected by the general meeting. |

| |

13.5 |

A general meeting at which a quorum is present may resolve to adjourn the meeting to another place and time determined by it, and in such case notices and invitations in respect of the adjourned meeting shall be given as provided in paragraph 12.6 above. The agenda of an adjourned Meeting shall include only the matters that were on the agenda of the meeting when it first convened. |

| 14. |

Voting at the General Meeting (amended October 2019) |

| |

14.1 |

A shareholder of the Company may vote at the general meetings himself or through a proxy or a voting instrument. |

| |

|

The shareholders entitled to participate in and vote at the general meeting are the shareholders on the date specified by the board of directors in the resolution to convene the general meeting, and subject to the law. |

| |

14.2 |

In every vote each shareholder shall have a number of votes according with the number of shares held by him. |

| |

14.3 |

A resolution at the general meeting shall be passed by an ordinary majority unless another majority is specified in the Companies Law or these articles. |

| |

14.4 |

The declaration of the general meeting’s chairman that a resolution has been passed unanimously or by a particular majority, or that it has been defeated or not passed by a particular majority, shall constitute prima facie proof of that stated therein. |

| |

14.5 |

If the votes at a general meeting are tied, the chairman of the general meeting shall not have an additional or deciding vote, and the resolution that was put to the vote shall be defeated. |

| |

14.6 |

The Company’s shareholders may, in respect of any matter on the general meeting’s agenda, vote at a general meeting (including a class meeting) through a voting instrument, provided that the board of directors does not, subject to any law, rule out the possibility of voting through a proxy instrument on such matter in its resolution to convene the general meeting. |

| |

|

If the board of directors prohibits voting through a voting instrument, the fact that the possibility of voting through a voting instrument has been ruled out shall be stated in the notice of the general meeting pursuant to paragraph 12.6 above. |

| |

14.7 |

A shareholder may state the way in which he is voting in the voting instrument and send it to the Company’s registered office at least 48 hours prior to the general meeting’s commencement. A voting instrument in which a shareholder states the way in which he is voting, which reaches the Company’s registered office at least 48 hours prior to the general meeting (including the adjourned meeting), shall be deemed presence at the general meeting for the purpose of constituting the quorum as provided in paragraph 13.1 above. (amended May 2003) |

| |

14.8 |

A proxy shall be appointed in a written instrument signed by the appointor. A corporation shall vote through its representatives who shall be appointed by a document duly signed by the corporation. |

| |

14.9 |

Voting in accordance with the terms and conditions of a proxy instrument shall be legal even if prior thereto the appointor dies or becomes legally incapacitated, is wound up, becomes bankrupt, cancels the proxy instrument or transfers the share in relation to which it was given, unless written notice is received at the office prior to the general meeting that the shareholder has died, become legally incapacitated, been wound up, become bankrupt, cancelled the appointment instrument or transferred the share as aforesaid. |

| |

14.10 |

The proxy instrument and the power of attorney or a copy certified by an attorney shall be deposited at the Company’s registered office at least 48 hours prior to the time fixed for the general meeting or the adjourned meeting at which the person mentioned in the document intends voting pursuant thereto. |

| |

14.11 |

A shareholder of the Company shall be entitled to vote at general meetings of the Company through a number of proxies appointed by him, provided that each proxy is appointed in respect of different parts of the shares held by the shareholder. There shall not be any impediment to any proxy as aforesaid voting differently at general meetings of the Company. |

| |

14.12 |

If a shareholder is legally incapacitated, he may vote by his board of trustees, receiver, natural guardian or other legal guardian, and they may vote themselves or by proxy or through a voting instrument. |

| |

14.13 |

Where two or more persons are the joint holders of a share, in a vote on any matter the vote of the person whose name appears first in the shareholders’ register as the holder of such share shall be accepted, himself or by proxy, and he is entitled to give the Company voting instruments. |

| 15. |

The Board of Directors |

| |

The board of directors shall delineate the Company’s policy and supervise the performance of the Managing Director’s duties and actions. Any power of the Company which has not been vested in another organ pursuant to the Companies Law or the articles may be exercised by the board of directors. |

| 16. |

Appointment and Dismissal of Directors (amended May 2003, May 2006 and October 2019) |

| |

16.1 |

The number of directors in the Company (including, if required by law external directors) shall be determined from time to time by the Annual Meeting, provided that it shall not be less than four nor more than seven. |

| |

16.2 |

Subject to the provisions of section 16.3 below, the Company’s directors shall be elected only at the Annual Meeting, and shall hold office until the end of the next Annual Meeting or until they cease to hold office pursuant to the provisions of the articles. If at an Annual Meeting of the Company new directors in the minimum amount specified pursuant to the articles are not elected, the directors who held office until such time shall continue to hold office, until they are replaced by the Company’s Annual Meeting. |

| |

16.3 |

The board of directors shall be divided into three

classes, such that each class of directors consists, as nearly as possible, of one-third of the total number of directors constituting

the entire board of directors.

At the first election of directors implementing

the classified board structure, the term of the directors included in the class A shall be one year, the term of the directors included

in class B shall be two years, and the term of the directors included in class C shall be three years. |

At each Annual Meeting the election or re-election of directors following the expiration of the term of office of the directors of that class of directors, will be for a term of office that expires on the third Annual Meeting following such election or re-election, so that each year the term of office of only one class of directors will expire. Each director will hold office until the Annual Meeting for the year in which his or her term expires, unless they are removed pursuant to section 16.7 below.

In addition to the provisions of paragraph 16.2 above, the board of directors may by unanimous vote appoint a director instead of a director whose office has been vacated and/or one additional director, subject to the maximum number of directors on the board of directors as provided in paragraph 16.1 above. The appointment of a director by the board of directors shall be valid until the next Annual Meeting or until he ceases to hold office pursuant to the provisions of the articles.

| |

16.4 |

A director whose term of office has come to an end may be re-elected only by the Annual Meeting. |

| |

16.5 |

The office of a director shall commence on the date of his appointment by the Annual Meeting and/or the board of directors or on a later date if specified in the appointment resolution of the Annual Meeting and/or board of directors. |

| |

16.6 |

The board of directors shall elect a board of directors’ chairman from amongst its members. If a chairman is not elected or if the chairman is not present at the end of 15 minutes from the time fixed for the Annual Meeting, the directors present shall elect one of their number to chair such meeting, and the person chosen shall conduct the meeting and sign the discussion minutes. |

| |

|

The board of directors’ chairman shall not be the Company’s CEO save on fulfillment of the conditions mentioned in section 121(c) of the Companies Law. |

| |

16.7 |

The Annual Meeting, by a vote of 60% of the shares

voted (excluding abstentions) may remove any director from his office before the end of his term of office, whether the director was appointed

by it by virtue of paragraph 16.2 above or by the board of directors by virtue of paragraph 16.3 above, provided that the director is

given a reasonable opportunity to state his case before the Annual Meeting.

|

| |

16.8 |

Where the office of a director is vacated, the remaining directors may continue to act so long as their number has not fallen below the minimum specified in the articles. Where the number of directors has fallen below the aforementioned minimum, the remaining directors may only act in order to fill the place of the director which has been vacated as mentioned in paragraph 16.3 above or in order to convene an Annual Meeting of the Company, and until the Annual Meeting is convened as aforesaid they may act to manage the Company’s business only in respect of matters that cannot bear delay. The initial term of the director elected by the shareholders as a replacement for a vacated director shall correspond to the balance of the term of such vacated director. |

| |

16.9 |

Every board of directors’ member may appoint an alternate for himself, provided that such an appointment shall not be for a period exceeding one month, and that someone who was appointed as an alternate for another director and/or who is already serving as a director of the Company may not be appointed as an alternate, except as provided in section 237(d) of the Companies Law. |

| |

|

The appointment or termination of the office of an alternate shall be effected in a written document signed by the director who appointed him; however, in any event, the office of an alternate shall terminate if one of the events specified in paragraph 16.10 below befalls the alternate or if the office of the board of directors’ member for whom he is acting as alternate is vacated for whatsoever reason. |

| |

|

An alternate shall be treated as a director and all the provisions of the law and these articles shall apply to him, save for the provisions regarding the appointment and/or dismissal of a director specified herein. |

| |

16.10 |

The office of a director shall be vacated in any one of the following cases: |

| |

16.10.1 |

he resigns from his office by a letter signed him and submitted to the Company which specifies the reasons for his resignation; |

| |

16.10.2 |

he is removed from his office by the Annual Meeting in accordance with the provisions of these articles; |

| |

16.10.3 |

he is convicted of an offence as provided in section 232 of the Companies Law; |

| |

16.10.4 |

pursuant to a court decision, as provided in section 233 of the Companies Law; |

| |

16.10.5 |

he is declared legally incapacitated; |

| |

16.10.6 |

he is declared bankrupt, and in the case of a corporation - it is resolved to wind it up voluntarily or a winding up order is given in respect thereof. |

| |

16.11 |

The terms of compensation of the board of directors' members shall be approved by the compensation committee, the board of directors and the general meeting, in this chronological order. |

| |

|

|

| |

16.12 |

It is clarified that this Section 16, including any of its subsections, may be amended only by vote of 60% of the shares voted (excluding abstentions) at an Annual Meeting. |

| 17. |

Board of Directors’ Meetings (amended December 2011; October 2019) |

| |

17.1 |

The board of directors shall convene in accordance with the Company’s requirements and at least once every three months. |

| |

17.2 |

The board of directors’ chairman may convene the board of directors at any time. In addition, the board of directors shall hold a meeting, on a matter that shall be detailed, in the following cases: |

| |

17.2.1 |

on the demand of two directors; however, if at such time the board of directors consists of five directors or less - on the demand of one director; |

| |

17.2.2 |

on the demand of one director if he states in his demand to convene the board of directors that he has learned of a matter involving the Company in which a prima facie contravention of the Law or an infringement of proper business procedure has been discovered; |

| |

17.2.3 |

a notice or report of the CEO obliges action by the board of directors; |

| |

17.2.4 |

the auditor has notified the board of directors’ chairman of materials deficiencies in the audit of the Company’s accounts. |

| |

17.3 |

Notice of a board of directors’ meeting shall be sent to all its members at least three days prior to the date of the meeting. The notice shall be sent to the address of the director which was furnished to the Company in advance, and shall state the date, time and place of the meeting, and reasonable details of all the matters on the agenda. |

| |

|

Notwithstanding the aforegoing, in urgent circumstances, the board of directors may convene a meeting without notice, with a majority of the directors’ agreement. (amended December 2011) |

| |

17.4 |

The quorum for the commencement of a board of directors’ meeting shall be a majority of the members of the board of directors. If no quorum is present at the board of directors’ meeting within half an hour of the time fixed for the meeting’s commencement, the meeting shall be adjourned to another date decided upon by the board of directors’ chairman, or in his absence by the directors present at the meeting, provided that three days’ notice shall be given to all the directors of the date of the adjourned meeting. The quorum for the commencement of an adjourned meeting shall be any number of participants. Notwithstanding the aforegoing, the quorum for discussions and resolutions at the board of directors on the auditor’s dismissal or suspension shall be a majority of the board of directors’ members. |

| |

17.5 |

The board of directors may hold meetings using any communications means, provided that all the directors participating may hear each other simultaneously. |

| |

17.6 |

The board of directors may also pass resolutions without actually convening, provided that all the directors entitled to participate in the discussion and vote on a matter that is brought for resolution agree not to convene for discussion of the matter. In such a case, minutes of the resolutions (including the decision not to convene) shall be signed by the chairman of the board of directors, or alternatively, signatures of the directors shall be attached to the minutes. Instead of a director’s signature, the chairman of the board or the corporate secretary may attach a signed memo regarding the oral vote of a director. Resolutions passed without convening, as aforementioned, shall be passed by an ordinary majority and shall have the same effect as resolutions passed at a duly convened meeting. (amended May 2006) |

| 18. |

Voting at the Board of Directors |

| |

18.1 |

In a vote at the board of directors, each director shall have one vote. |

| |

18.2 |

The board of directors’ resolutions shall be passed on a majority. The board of directors’ chairman shall not have an additional or deciding vote and where the votes are tied, the resolution that was put to the vote shall be defeated. |

| 19. |

Board of Directors’ Committees |

| |

19.1 |

The board of directors may establish committees and appoint members from the board of directors thereto (hereinafter referred to as “board of directors’ committee”), and it may from time to time revoke such delegation or alter the composition of such committee. If board of directors’ committees are established, the board of directors shall determine in their terms of authority whether certain powers of the board of directors will be delegated to the board of directors’ committee such that a resolution of the board of directors’ committee shall be deemed a resolution of the board of directors or whether a resolution of the board of directors’ committee shall merely amount to a recommendation which is subject to the board of directors’ approval, provided that powers to resolve on the matters specified in section 112 of the Companies Law shall not be delegated to a committee. If a committee merely has a recommendation role, the board of directors may also appoint to the committee members who are not directors. (amended May 2006) |

| |

19.2 |

The meetings and discussions of any board of directors’ committee composed of two or more members shall be governed by the provisions of these articles regarding board of directors’ meetings and the voting thereat, mutatis mutandis, so far as not superseded by the Companies Law, and subject to the board of directors’ resolutions regarding arrangements for the committee’s meetings (if any). (amended December 2011) |

| |

20.1 |

The Company’s board of directors shall appoint an audit committee from amongst its members. The number of members on the audit committee shall not be less than three and all the external directors shall be members thereof. The board of directors’ chairman and any director employed by the Company or providing services to it on a permanent basis and/or a control owner or his relative shall not be appointed as members of the committee. |

| |

20.2 |

The duties of the audit committee shall be - |

| |

20.2.1 |

to detect deficiencies in the Company’s business management, inter alia through consultation with the Company’s internal auditor or with the auditor, and to propose to the board of directors ways of rectifying them; |

| |

20.2.2 |

to resolve whether to approve acts and transactions requiring the audit committee’s approval pursuant to the Companies Law. |

| 21. |

Chief Executive Officer (amended October 2019) |

| |

The Company’s board of directors shall appoint a Chief Executive Officer (“CEO”) and may appoint more than one CEO. The CEO shall be responsible for the routine management of the Company’s affairs within the framework of the policy determined by the board of directors and subject to its guidelines. |

| 22. |

Exemption, Insurance and Indemnity (amended May 2006 and December 2011) |

| |

22.1 |

The Company may exempt an Office Holder therein in advance for his liability, or any part thereof, for damage in consequence of a breach of the duty of care vis-a-vis it, except with respect to Distribution (as defined in the Companies Law). |

| |

22.2 |

The Company may indemnify an Office Holder retroactively for an obligation or expense as specified in sub-paragraphs 22.2.1 22.2.2 and 22.2.3 below, imposed on him in consequence of an act or omission done in his capacity as an officer in the Company. |

| |

22.2.1 |

a monetary obligation imposed on him in favor of another person pursuant to a judgment, including a judgment given in settlement or an arbitrator’s award that has been approved by a court; |

| |

22.2.2 |

reasonable litigation expenses, including advocates’ professional fees, incurred by the Office Holder pursuant to an investigation or a proceeding commenced against him by a competent authority and that was terminated without an indictment and without having a monetary charge imposed on him in exchange for a criminal procedure (as such terms are defined in the Companies Law), or that was terminated without an indictment but with a monetary charge imposed on him in exchange for a criminal procedure in a crime that does not require proof of criminal intent or in connection with a financial sanction; |

| |

22.2.3 |

reasonable litigation expenses, including advocates’ professional fees, incurred by the Office Holder or which he is ordered to pay by a court, in proceedings filed against him by the company or on its behalf or by another person, or in a criminal indictment in which he is acquitted, or in a criminal indictment in which he is convicted of an offence that does not require proof of criminal intent; |

| |

22.2.4 |

expenses, including reasonable litigation expenses and legal fees, incurred by an Office Holder as a result of a proceeding instituted against such Office Holder in relation to (A) infringements that may result in imposition of financial sanction pursuant to the provisions of Chapter H’3 under the Securities Law or (B) administrative infringements pursuant to the provisions of Chapter H’4 under the Securities Law or (C) infringements pursuant to the provisions of Chapter I’1 under the Securities Law; and |

| |

22.2.5 |

payments to an injured party of infringement under Section 52ND(a)(1)(a) of the Securities Law. |

| |

22.3 |

The Company may give an advance undertaking vis-a-vis an Office Holder to indemnify him in respect of an obligation or expense as specified in paragraph 22.2 above, provided that the undertaking specified in paragraph 22.2.1 is limited to types of events which in the board of directors’ opinion may be anticipated, in light of the Company’s activities, at the time of giving the indemnity undertaking, and to an amount or criteria which the board of directors determines is reasonable in the circumstances of the case, both to be specified in the Company’s undertaking. |

| |

22.4 |