Bragg Gaming Group (NASDAQ: BRAG, TSX: BRAG) ("Bragg" or the

"Company"), a global B2B content-driven iGaming technology

provider, today reported record revenue for the second quarter of

2024.

Summary of 2Q24 Financial and

Operational Highlights

Euros (millions)(1)

2Q24

2Q23

Change

Revenue

€

24.9

€

24.7

0.5

%

Gross profit

€

12.4

€

13.8

(10.3)

%

Gross profit margin

49.9

%

55.9

%

(600)

bps

Adjusted EBITDA(2)

€

3.6

€

4.7

(23.8)

%

Adjusted EBITDA margin

14.5

%

19.2

%

(470)

bps

Operating Income (Loss)

€

(1.2)

€

1.3

(195.6)

%

(1)

Bragg’s reporting currency is Euros. The

exchange rate provided is EUR 1.00 = USD 1.07. Due to fluctuating

currency exchange rates, this reference rate is provided for

convenience only.

(2)

“Adjusted EBITDA” is a non-IFRS measure.

For important information on the Company’s non-IFRS measures, see

“Non-IFRS Financial Measures” below.

Chief Executive Officer Commentary

Matevž Mazij, Chief Executive Officer for Bragg, commented: "In

the second quarter, we delivered revenues of EUR 24.9 million (USD

26.6 million), a new quarterly record and increase of 0.5% year

over year, reflecting a robust business performance diversified

over several growing iGaming markets and in-demand product

verticals. As expected, gross profit and adjusted EBITDA were down

10.3% and 23.8% year over year respectively, as our product mix has

changed. However, I am encouraged by recent momentum for our higher

margin products including for our proprietary iGaming content in

North America, and from launches of new customers powered by

Bragg’s Player Account Management (“PAM”) and turnkey solutions. I

am also pleased with sequential growth in revenue (+4.4%), gross

profit (+4.4%) and Adjusted EBITDA (+6.0%) compared to the first

quarter of the year, a timeframe during which our product mix has

remained consistent, and I am confident that we have the products,

the strategy and the expertise in place to be able to continue to

grow our revenues and profit margins in the second half of the year

and into 2025.

“We have taken decisive steps to bolster our leadership team,

expand our presence in key markets worldwide, and make significant

inroads in the U.S. market. With Bragg’s overall share of the U.S.

iGaming content supplier market still estimated at below 1%, our

expanding distribution in the United States along with our

extensive distribution reach in regulated markets globally,

represents a huge upside opportunity for the Company, which is now

licensed, certified or otherwise compliant with relevant local

regulations in more than 30 jurisdictions. In the U.S. we are

pleased to be on track to more than double our wagering volume this

year compared to 2023, and we look forward to continuing the trend

into future years. Looking ahead, I am confident that the seeds we

are planting today - in the U.S., in content, and in our technology

platform - will yield a robust harvest in the future. We are

building a stronger, more agile Bragg that, along with our U.S.

distribution and global reach, is poised to capitalize on the

immense opportunities that lie ahead in the worldwide iGaming

market."

Recent Business Highlights

- Appointed Robbie Bressler as interim Chief Financial Officer,

Neill Whyte as Chief Commercial Officer and Tommaso Di Chio as

Chief Legal & Compliance Officer

- Launched 17 new titles globally in the second quarter of 2024,

including a record 12 new games launches from our proprietary

studio brands

- Continued global expansion, striking deal to power Kingsbet.cz

launch with an end-to-end iGaming solution that will increase reach

in Czech Republic with a second PAM and full turnkey solution

client. This achievement aligns with Bragg’s strategic objective of

growing higher margin, proprietary solutions which include PAM and

turnkey services, as a proportion of product mix

- Continued U.S. Expansion with BetMGM Pennsylvania content

launch, extending content reach with U.S. online casino heavyweight

to third state following similar launches in Michigan and New

Jersey

- Launched content with Pennsylvania market leader FanDuel, as

well as a successful launch with Golden Nugget in New Jersey, a

success which keeps the Company on track to cover approximately 90%

of the U.S. total addressable market (TAM) with its newest iGaming

content and technology by the end of the year

- Launched full turnkey solution to power the Hard Rock Casino

brand in the Netherlands, securing sixth PAM customer as part of

Bragg’s strategic goal of being the leading technology and content

supplier to the Dutch market

- Launched third-party sportsbooks with Betnation.nl (Metric),

ComeOn.nl (Metric) and 711.nl (Kambi) in the Netherlands,

leveraging relationships with sports betting technology partners,

underscoring Bragg’s continued commitment to be the preferred

iGaming technology and content supplier in the Dutch market.

- Global content distribution agreement announced with Light

& Wonder, unlocking new content distribution opportunities

- Continued to gain traction in the key European market of Italy,

where Bragg has partnered with Sisal

- Remaining outstanding Lind convertible debt of USD 1 million

settled in full, in cash, post quarter end

Additional June 30, 2024 Key Financial Metrics

- For the six-month period ended June 30, 2024, Cash flow

generated from operations was EUR 2.1 million (USD 2.2 million),

compared to EUR 5.2 million (USD 5.5million) for the first six

months of 2023

- Cash and cash equivalents as of June 30, 2024 was EUR 10.9

million (USD 11.6 million) and net working capital, excluding

deferred consideration, loans payable, and convertible debt, was

EUR 10.5 million (USD 11.3 million)

- Secured a EUR 6.5 million (USD 7.0 million) investment through

a promissory note, enhancing balance sheet flexibility to execute

on strategy.

Reiterates Full Year 2024 Guidance

Bragg reiterates its 2024 full year revenue guidance range of

EUR 102.0-109.0 million (USD 109.1-116.6 million) and its full year

Adjusted EBITDA range of EUR 15.2-18.5 million (USD 16.3-19.8

million), noting that the Company is currently tracking to the

lower end of guidance.

Strategic Review Process

In March 2024, Bragg announced that it was undertaking a review

of strategic alternatives for maximizing shareholder value. The

Company continues to be pleased with the progress made to date but

will not be providing specific comments on the status of the

process until circumstances warrant.

Investor Conference Call

The Company will host a conference call today, August 8, 2024,

at 8:30 a.m. Eastern Time, to discuss its second quarter 2024

results. During the call, management will review a presentation

that will be made available to download at

https://investors.bragg.group/financials/quarterly-results/default.aspx.

To join the call, please use the below dial-in information:

Participant Toll-Free Dial-In Number (US and Canada): 1 (800)

715-9871 Participant Toll Dial-In Number (International): 1 (646)

307-1963 UK Toll Free: +44 800 358 0970 Conference ID: 3347914

A webcast of the call and presentation may also be viewed at:

https://investors.bragg.group/events-and-presentations/events/default.aspx

A replay of the call will be available until August 15, 2024,

following the conclusion of the live call. To access the replay,

dial + 1 (609) 800-9099 or +1 (800) 770-2030 (toll-free) or +44 20

3433 3849 (UK) and use the passcode 3347914.

Cautionary Statement Regarding Forward-Looking

Information

This news release contains forward-looking statements or

“forward-looking information” within the meaning of applicable

Canadian securities laws (“forward-looking statements”), including,

without limitation, statements with respect to the following: the

Company’s strategic growth initiatives and corporate vision and

strategy; financial guidance for 2024, expected performance of the

Company’s business; expansion into new markets, our strategy for

customer retention, growth, product development, and market

position; expected future growth and expansion opportunities;

expected benefits of transactions; expected future actions and

decisions of regulators and the timing and impact thereof.

Forward-looking statements are provided for the purpose of

presenting information about management’s current expectations and

plans relating to the future and allowing readers to get a better

understanding of the Company’s anticipated financial position,

results of operations, and operating environment. Often, but not

always, forward-looking statements can be identified by the use of

words such as “plans”, “expects” or “does not expect”, “is

expected”, “budget”, “scheduled”, “estimates”, “forecasts”,

“intends”, “anticipates” or “does not anticipate”, or “believes”,

or describes a “goal”, or variation of such words and phrases or

state that certain actions, events or results “may”, “could”,

“would”, “might” or “will” be taken, occur or be achieved.

All forward-looking statements contained in this news release or

the conference call reflect the Company’s beliefs and assumptions

based on information available at the time the statements were

made. Actual results or events may differ from those predicted in

these forward-looking statements. All of the Company’s

forward-looking statements are qualified by the assumptions that

are stated or inherent in such forward-looking statements,

including the assumptions listed below. Although the Company

believes that these assumptions are reasonable, this list is not

exhaustive of factors that may affect any of the forward-looking

statements. The key assumptions that have been made in connection

with the forward-looking statements include the regulatory regime

governing the business of the Company; the operations of the

Company; the products and services of the Company; the Company’s

customers; the growth of Company’s business, meeting minimum

listing requirements of the stock exchanges on which the Company’s

shares trade; the integration of technology; and the anticipated

size and/or revenue associated with the gaming market globally.

Forward-looking statements involve known and unknown risks,

future events, conditions, uncertainties and other factors that may

cause actual results, performance or achievements to be materially

different from any future results, prediction, projection,

forecast, performance or achievements expressed or implied by the

forward-looking statements. Such factors include, among others, the

following: risks related to the Company’s business and financial

position; that the Company may not be able to accurately predict

its rate of growth and profitability; risks associated with general

economic conditions; adverse industry events; future legislative

and regulatory developments; the inability to access sufficient

capital from internal and external sources; the inability to access

sufficient capital on favourable terms; realization of growth

estimates, income tax and regulatory matters; the ability of the

Company to implement its business strategies; competition; economic

and financial conditions, including volatility in interest and

exchange rates, commodity and equity prices; changes in customer

demand; disruptions to our technology network including computer

systems and software; natural events such as severe weather, fires,

floods and earthquakes; any disruptions to operations as a result

of the strategic alternatives review process; and risks related to

health pandemics and the outbreak of communicable diseases.

Although the Company has attempted to identify important factors

that could cause actual actions, events or results to differ

materially from those described in forward-looking statements,

there may be other factors that cause actions, events or results

not to be as anticipated, estimated or intended. There can be no

assurance that forward-looking statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking

statements.

The Company disclaims any intention or obligation to update or

revise any forward-looking statements whether as a result of new

information, future events, or otherwise, except in accordance with

applicable securities laws.

Non-IFRS Financial Measures

Statements in this news release make reference to “Adjusted

EBITDA”, which is a non-IFRS (as defined herein) financial measure

that the Company believes is appropriate to provide meaningful

comparison with, and to enhance an overall understanding of, the

Company’s past financial performance and prospects for the future.

The Company believes that “Adjusted EBITDA” provides useful

information to both management and investors by excluding specific

expenses and items that management believe are not indicative of

the Company’s core operating results. “Adjusted EBITDA” is a

financial measure that does not have a standardized meaning under

International Financial Reporting Standards (“IFRS”). As there is

no standardized method of calculating “Adjusted EBITDA”, it may not

be directly comparable with similarly titled measures used by other

companies. The Company considers “Adjusted EBITDA” to be a relevant

indicator for measuring trends in performance and its ability to

generate funds to service its debt and to meet its future working

capital and capital expenditure requirements. “Adjusted EBITDA” is

not a generally accepted earnings measure and should not be

considered in isolation or as an alternative to net income (loss),

cash flows or other measures of performance prepared in accordance

with IFRS. Adjusted EBITDA is more fully defined and discussed, and

reconciliation to IFRS financial measures is provided, in Company’s

Management’s Discussion and Analysis (“MD&A”) for the

three-month and six-month period ended June 30, 2024.

About Bragg Gaming Group

Bragg Gaming Group (NASDAQ: BRAG, TSX: BRAG) is an iGaming

content and turnkey technology solutions provider serving online

and land-based gaming operators with its proprietary and exclusive

content, and cutting-edge technology. Bragg Studios offer

high-performing and passionately crafted casino game titles using

the latest in data-driven insights from in-house brands including

Wild Streak Gaming, Atomic Slot Lab and Indigo Magic. Its

proprietary content portfolio is complemented by a cross section of

exclusive titles from carefully selected studio partners under the

Powered By Bragg program. Games built on Bragg’s remote games

server (Bragg RGS) technology are distributed via the Bragg Hub

content delivery platform and are available exclusively to Bragg

customers. Bragg’s flexible, modern, omnichannel Player Account

Management (PAM) platform powers multiple leading iCasino and

sportsbook brands and at all points is supported by expert in-house

managed, operational, and marketing services. Content delivered via

the Bragg Hub either exclusively or from the Bragg aggregated games

portfolio is managed from a single back-office which is supported

by powerful data analytics tools, and Bragg’s award-winning Fuze™

player engagement toolset. Bragg is licensed, certified, approved

and operational in many regulated iCasino markets globally,

including the U.S, Canada, United Kingdom, Italy, the Netherlands,

Germany, Sweden, Spain, Malta and Colombia.

Join Bragg Gaming Group on Social Media

Twitter LinkedIn Facebook Instagram

Financial tables follow:

BRAGG GAMING GROUP

INC.

INTERIM UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF INCOME (LOSS) AND COMPREHENSIVE

LOSS

(In thousands, except per

share amounts)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Revenue

24,861

24,729

48,672

47,588

Cost of revenue

(12,457

)

(10,903

)

(24,391

)

(21,542

)

Gross Profit

12,404

13,826

24,281

26,046

Selling, general and administrative

expenses

(13,702

)

(13,082

)

(26,089

)

(24,988

)

Gain (Loss) on remeasurement of derivative

liability

38

(115

)

(140

)

(179

)

Gain on settlement of convertible debt

—

204

65

204

Gain (Loss) on remeasurement of deferred

consideration

45

438

(600

)

708

Operating Income (Loss)

(1,215

)

1,271

(2,483

)

1,791

Net interest expense and other financing

charges

(930

)

(368

)

(1,522

)

(964

)

Gain (Loss) Before Income Taxes

(2,145

)

903

(4,005

)

827

Income taxes

(255

)

(526

)

(299

)

(926

)

Net Income (Loss)

(2,400

)

377

(4,304

)

(99

)

Items to be reclassified to net income

(loss):

Cumulative translation adjustment

387

(585

)

4

(1,143

)

Net Comprehensive Loss

(2,013

)

(208

)

(4,300

)

(1,242

)

Basic Income (Loss) Per Share

(0.10

)

0.02

(0.18

)

0.00

Diluted Income (Loss) Per Share

(0.10

)

0.02

(0.18

)

0.00

Millions

Millions

Millions

Millions

Weighted average number of shares -

basic

24.0

22.3

23.6

22.0

Weighted average number of shares -

diluted

24.0

23.6

23.6

23.3

BRAGG GAMING GROUP

INC.

INTERIM UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION PRESENTED IN

EUROS (THOUSANDS, EXCEPT PER SHARE AMOUNTS)

As at

As at

June 30,

December 31,

2024

2023

Cash and cash equivalents

10,850

8,796

Trade and other receivables

18,601

18,641

Prepaid expenses and other assets

2,756

1,655

Total Current Assets

32,207

29,092

Property and equipment

1,027

640

Right-of-use assets

3,124

3,233

Intangible assets

36,821

38,133

Goodwill

32,308

31,921

Other assets

358

348

Total Assets

105,845

103,367

Trade payables and other liabilities

20,057

21,846

Income taxes payable

718

917

Lease obligations on right of use

assets

730

709

Deferred consideration

1,797

1,513

Derivative liability

154

471

Convertible debt

463

2,445

Loans payable

6,702

—

Total Current Liabilities

30,621

27,901

Deferred income tax liabilities

699

852

Lease obligations on right of use

assets

2,464

2,568

Deferred consideration

—

1,426

Other non-current liabilities

373

373

Total Liabilities

34,157

33,120

Share capital

131,405

120,015

Shares to be issued

—

3,491

Contributed surplus

17,729

19,887

Accumulated deficit

(80,367

)

(76,063

)

Accumulated other comprehensive income

2,921

2,917

Total Equity

71,688

70,247

Total Liabilities and Equity

105,845

103,367

BRAGG GAMING GROUP

INC.

UNAUDITED SELECTED FINANCIAL

GAAP AND NON-GAAP MEASURES

(in thousands)

Three Months Ended June

30,

Six Months Ended June

30,

EUR 000

2024

2023

2024

2023

Revenue

24,861

24,729

48,672

47,588

Operating income (loss)

(1,215

)

1,271

(2,483

)

1,791

EBITDA

2,779

4,525

5,388

7,754

Adjusted EBITDA

3,615

4,742

7,026

8,636

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240808129267/en/

For media enquiries or interview requests, please contact:

Robert Simmons, Head of Communications at Bragg Gaming Group

press@bragg.group

Investors James Carbonara Hayden IR +1 (646)-755-7412

james@haydenir.com

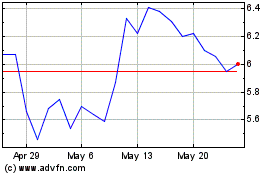

Bragg Gaming (NASDAQ:BRAG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Bragg Gaming (NASDAQ:BRAG)

Historical Stock Chart

From Dec 2023 to Dec 2024