false

0001487197

0001487197

2024-08-14

2024-08-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 14, 2024

BARFRESH

FOOD GROUP INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-41228 |

|

27-1994406 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

3600

Wilshire Boulevard Suite 1720, Los Angeles, California 90010

(Address

of principal executive offices)

Registrant’s

telephone number, including area code: (310) 598-7113

N/A

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

| Common

Stock, $0.000001 par value |

|

BRFH |

|

The

Nasdaq Stock Market LLC |

Securities

registered pursuant to Section 12(g) of the Act: None

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02. Results of Operations and Financial Condition.

On

August 14, 2024, Barfresh Food Group, Inc., a Delaware corporation (the “Company”) issued an update on recent business developments

in conjunction with the filing of its form 10-Q for the quarter ended June 30, 2024.

The

conference call discussing these results took place on Wednesday, August 14, 2024, at 1:30 pm Pacific Time (4:30 pm Eastern Time). A

telephonic playback will be available through Wednesday, August 28, 2024.

Use

of Non-GAAP Measures

Barfresh

Food Group, Inc. prepares its consolidated financial statements in accordance with accounting principles generally accepted in the United

States (“GAAP”). In order to aid in the understanding of the Company’s business performance, the Company has also presented

certain non-GAAP measures, including EBITDA and Adjusted EBITDA, which are reconciled to net (loss) in the schedules to the press release

furnished with this Current Report on Form 8-K as Exhibit 99.1. The reconciling items are non-operational or non-cash costs, including

stock compensation, and other non-recurring costs such as those associated with the dispute regarding the product withdrawal and manufacturing

relocation costs.

Management

believes that Adjusted EBITDA provides useful information to the investor because it is directly reflective of the period-to-period performance

of the Company’s core business. In addition, Adjusted EBITDA is used in developing the Company’s internal budgets, forecasts

and strategic plan; in analyzing the effectiveness of its business strategies; and in making compensation decisions and in communications

with its board of directors concerning its financial performance.

Adjusted

EBITDA should not be considered as an alternative to net loss as a measure of operating results. It may not be comparable to similarly

titled measures used by other companies and exclude financial information that some may consider important in evaluating the Company’s

performance.

Forward

Looking Statements

Except

for historical information herein, matters set forth in this press release are forward-looking, including statements about the Company’s

commercial progress and future financial performance. These forward-looking statements are identified by the use of words such as “grow”,

“expand”, “anticipate”, “intend”, “estimate”, “believe”, “expect”,

“plan”, “should”, “hypothetical”, “potential”, “forecast” and “project”,

among others. All statements, other than statements of historical fact, included in the press release that address activities, events

or developments that the Company believes or anticipates will or may occur in the future are forward-looking statements. These statements

are based on certain assumptions made based on experience, expected future developments and other factors the Company believes are appropriate

under the circumstances. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the

control of the Company and may not materialize. Investors are cautioned that any such statements are not guarantees of future performance.

The contents of this release should be considered in conjunction with the warnings, risk factors and cautionary statements contained

in the Company’s recent filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K and Quarterly

Reports on Form 10-Q. Furthermore, the Company does not intend, and is not obligated, to update publicly any forward-looking statements,

except as required by law.

Item

7.01. Regulation FD Disclosures.

The

disclosures set forth in Item 2.02 are incorporated herein by reference.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

The

following exhibit relating to Items 2.02 and 7.01 shall be deemed to be furnished, and not filed:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned duly authorized.

| |

Barfresh

Food Group Inc.,

a

Delaware corporation

(Registrant) |

| |

|

|

| Date:

August 14, 2024 |

|

/s/

Riccardo Delle Coste |

| |

By: |

Riccardo

Delle Coste |

| |

Its: |

CEO |

Exhibit

99.1

Barfresh

Provides Second Quarter 2024 Results and Business Update

Revenue

of $1.5 Million and Gross Margins of 35% for Second Quarter 2024

Third

Quarter 2024 Revenue and Orders Already at Over $2.2 Million, Up 40% Year-over-Year, with Company on Track for Record Quarterly Revenue

and Positive Adjusted EBITDA

Company

Has Recently Secured Three New Co-Manufacturing Locations, Boosting Production Capacity to Over 120 Million Units Annually, a 400% Increase

Expanded

Product Portfolio with Recent Launch of 100% Juice Freeze Pops in Education Channel, Poised to Significantly Increase Channel Revenue

Company

Expects to Achieve Record Annual Revenue in Fiscal Year 2024 and Year-over-Year Margin Improvement, Propelled by Increased Production

Capacity and Accelerated Customer Wins

LOS

ANGELES, August 14, 2024 (GLOBE NEWSWIRE) – Barfresh Food Group Inc. (the “Company” or “Barfresh”) (Nasdaq:

BRFH), a provider of frozen, ready-to-blend and ready-to-drink beverages, is providing a business update for the second quarter ended

June 30, 2024.

Management

Comments

Riccardo

Delle Coste, the Company’s Chief Executive Officer, stated, “During the first six months of this year we have made tremendous

improvements in all areas of our business. Our recent infrastructure investments have us well positioned to achieve record quarterly

revenue results in our third quarter and record annual revenue results while also driving margin improvement. The recent investments

include expanding our co-manufacturing capacity by 400%, expanding our product line with a new offering that has the potential to be

as big as of all of our other products combined, significantly increasing the number of school customers, and extending our sales reach

to cover over 95% of the country – all while bringing on top talent to our leadership team. These investments are not just about

this year’s results; they are about building a company that is primed for sustained, long-term growth. The infrastructure we’ve

put in place thus far is the launchpad for our next phase of growth. As we look ahead, I’m energized by the opportunities before

us and confident in our ability to deliver substantial value to our customers and shareholders alike.”

Second

Quarter of 2024 Financial Results

Revenue

for the second quarter of 2024 was $1.46 million, compared to $1.51 million in the second quarter of 2023. Revenue in 2024 benefitted

from increased capacity in carton production and improvements in bulk sales. Revenue in 2023 was positively impacted by adjustments to

estimated credits related to our legal dispute. Excluding such adjustments, revenue increased by 6% year-over-year. Gross margins for

the second quarter of 2024 were 34.8%, compared to 31.4% for the second quarter of 2023. The improvement in gross margins is a result

of favorable product mix, pricing actions, and a slight improvement in the cost of supply chain components.

Selling,

marketing and distribution expenses for the second quarter of 2024 decreased 7% to $583,000, or 40% of revenue, compared to $625,000,

or 41% of revenue, for the second quarter of 2023. G&A expenses in the second quarter of 2024 were $871,000 compared to $493,000

in the second quarter of 2023. The increase in G&A was due to a number of factors including recruiting fees to broaden the capabilities

of the Company’s management team, a non-cash shift to stock-based compensation and the non-recurrence of recognizing Employee Retention

Tax Credit benefits in 2023.

Net

loss in the second quarter of 2024 was $1.0 million, as compared to a loss of $742,000 in the second quarter of 2023. The increase is

a result of a shift to stock-based compensation, recruiting expense, and the non-recurrence of tax benefits in 2023.

Non-GAAP

Financial Measures

The

above information is presented in conformity with accounting principles generally accepted in the United States. In order to aid in the

understanding of the Company’s business performance, the Company has also presented below certain non-GAAP measures, including

EBITDA and Adjusted EBITDA, which are reconciled in the table below to comparable GAAP measures. Management believes that Adjusted EBITDA

provides useful information to the investor because it is directly reflective of the performance of the Company. The exclusion of certain

items including stock compensation, and other non-recurring costs such as those associated with the product withdrawal, the related dispute,

and certain manufacturing relocation costs in calculating Adjusted EBITDA can provide a useful measure for period-to-period comparisons

of the Company’s core business performance. Adjusted EBITDA is not a recognized measurement under GAAP and should not be considered

as an alternative to net income, income from operations or any other performance measure derived in accordance with GAAP.

Adjusted

EBITDA was approximately a loss of $682,000 for the second quarter of 2024, compared to a loss of approximately $617,000 for the second

quarter of 2023. A reconciliation of net loss to Adjusted EBITDA is provided below.

| | |

For the three months ended June 30, | | |

For the six months ended June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Net loss | |

$ | (1,011,000 | ) | |

$ | (742,000 | ) | |

$ | (1,460,000 | ) | |

$ | (1,647,000 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Depreciation and amortization | |

| 72,000 | | |

| 102,000 | | |

| 146,000 | | |

| 205,000 | |

| Interest expense | |

| 6,000 | | |

| - | | |

| 10,000 | | |

| - | |

| EBITDA | |

| (933,000 | ) | |

| (640,000 | ) | |

| (1,304,000 | ) | |

| (1,442,000 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Stock based compensation, employees and board of directors | |

| 214,000 | | |

| (17,000 | ) | |

| 517,000 | | |

| 190,000 | |

| Operating expense related to withdrawn product and related dispute (1) | |

| 32,000 | | |

| 40,000 | | |

| 108,000 | | |

| 92,000 | |

| Manufacturing relocation (2) | |

| 5,000 | | |

| - | | |

| 50,000 | | |

| - | |

| Adjusted EBITDA | |

$ | (682,000 | ) | |

$ | (617,000 | ) | |

$ | (629,000 | ) | |

$ | (1,160,000 | ) |

(1)

Barfresh experienced a quality issue with product manufactured by one of its contract manufacturers, which is the subject of a legal

dispute as to the source of complaints received. Operating expense in 2023 and 2024 primarily includes legal expense incurred with respect

to the dispute.

(2)

Represents costs incurred to relocate single-serve ready-to-blend beverage pack production lines owned by Barfresh at the conclusion

of a multi-year manufacturing agreement.

Balance

Sheet

As

of June 30, 2024, the Company had approximately $383,000 of cash, and approximately $1.5 million of inventory on its balance sheet. In

the first half of the year, the Company deployed a significant amount of cash to build up inventory in preparation for its seasonally

high third quarter. This decision was made as the Company continued to work to secure additional production capacity to meet anticipated

demand. Given that this additional capacity has been secured and production is set to commence, the Company expects its cash burn to

normalize in the second half of the year. In August 2024, the Company secured a $1.5 million receivables financing facility with a one-year

term that renews annually and is secured by accounts receivable and inventory. This provides the Company with extra coverage to fund

inventory should it need to flex up production further. This proactive approach ensures the Company has the flexibility to respond quickly

to market demands while maintaining a strong financial position. In addition, the Company also received non-recourse litigation financing

to allow vigorous pursuit of its legal complaint without further expense to the company.

Commentary

and Outlook for 2024

The

Company continues to expect to achieve record fiscal year revenue for fiscal year 2024.

The

Company continues to expect to achieve higher gross profit in 2024 compared to 2023 with gross profit margins for 2024 expected to be

in the high 30’s.

The

Company expects positive adjusted EBITDA in the second half of fiscal year 2024.

Supplier

Dispute

During

the third quarter of 2022, Barfresh received customer complaints related to the textural consistency of some of the Company’s Twist

& Go™ bottle product, which was isolated to one manufacturer. The product was found to be safe for consumption but did not

meet the textural standards as outlined in the supply agreement with the manufacturer. In response, Barfresh withdrew product from the

market and destroyed on-hand inventory. Barfresh attempted to resolve the issues by informal negotiation, as contractually required prior

to filing suit; however, such negotiations were unsuccessful. Barfresh filed a complaint on November 10, 2022, in the Federal District

Court in Los Angeles against the manufacturer. In response, the manufacturer terminated the supply agreement. On January 20, 2023, Barfresh

filed a voluntary dismissal of the complaint which allows the parties to reach a potential resolution outside of the court system. However,

as the parties were once again unable to come to an agreement, Barfresh re-filed the complaint in California State Court in August 2023

and the case continues to progress through the court system. Due to the uncertainties surrounding the claim, Barfresh is not able to

predict either the outcome or a range of reasonably possible recoveries that could result from its actions against the manufacturer,

and no gain contingencies have been recorded. The total impact of the product withdrawal and loss of a manufacturer of Twist & Go™

bottle product may be subject to change.

Conference

Call

The

conference call to discuss these results is scheduled for today, Wednesday, August 14, 2024, at 1:30 pm Pacific Time (4:30 pm Eastern

Time). Listeners can dial (877) 407-4018 in North America, and international listeners can dial (201) 689-8471. A telephonic playback

will be available approximately two hours after the call concludes and will be available through Wednesday, August 28, 2024. Listeners

in North America can dial (844) 512-2921, and international listeners can dial (412) 317-6671. Passcode is 13747368. Interested parties

may also listen to a simultaneous webcast of the conference call by clicking here or logging

onto the Company’s website at www.barfresh.com in the Investors-Presentations section.

About

Barfresh Food Group

Barfresh

Food Group Inc. (Nasdaq: BRFH) is a developer, manufacturer and distributor of ready-to-blend and ready-to-drink beverages, including

smoothies, shakes and frappes, primarily for the education market, foodservice industry and restaurant chains, delivered as fully prepared

individual portions or single serving and bulk formats for on-site preparation. The Company’s single serving, on-site prepared

product utilizes a proprietary, patented system that uses portion-controlled pre-packaged beverage ingredients, delivering a freshly

made frozen beverage that is quick, cost efficient, better for you and without waste. For more information, please visit www.barfresh.com.

Forward

Looking Statements

Except

for historical information herein, matters set forth in this press release are forward-looking, including statements about the Company’s

commercial progress, success of its strategic relationship(s), and projections of future financial performance. These forward-looking

statements are identified by the use of words such as “grow”, “expand”, “anticipate”, “intend”,

“estimate”, “believe”, “expect”, “plan”, “should”, “hypothetical”,

“potential”, “forecast” and “project”, “continue,” “could,” “may,”

“predict,” and “will” and variations of such words and similar expressions are intended to identify such forward-looking

statements. All statements, other than statements of historical fact, included in the press release that address activities, events or

developments that the Company believes or anticipates will or may occur in the future are forward-looking statements. These statements

are based on certain assumptions made based on experience, expected future developments and other factors the Company believes are appropriate

under the circumstances. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the

control of the Company. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect,

actual results may vary materially from those indicated or anticipated by such forward-looking statements. Accordingly, you are cautioned

not to place undue reliance on these forward-looking statements, which speak only as of the date they are made. The contents of this

release should be considered in conjunction with the Company’s recent filings with the Securities and Exchange Commission, including

its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, including any warnings, risk factors

and cautionary statements contained therein. Furthermore, the Company expressly disclaims any current intention to update publicly any

forward-looking statements after the distribution of this release, whether as a result of new information, future events, changes in

assumptions or otherwise.

Investor

Relations

John

Mills

ICR

646-277-1254

John.Mills@icrinc.com

Deirdre

Thomson

ICR

646-277-1283

Deirdre.Thomson@icrinc.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

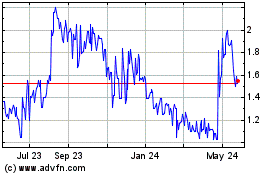

Barfresh Food (NASDAQ:BRFH)

Historical Stock Chart

From Feb 2025 to Mar 2025

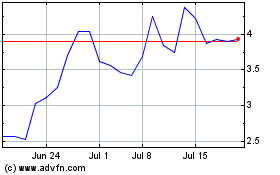

Barfresh Food (NASDAQ:BRFH)

Historical Stock Chart

From Mar 2024 to Mar 2025