BTCS Inc. (Nasdaq: BTCS) (“BTCS” or the “Company”), a leader in

blockchain infrastructure and technology, issued a letter to its

shareholders describing the Company’s recent achievements and goals

for 2025, including surpassing its predefined revenue performance

target of $3,712,500. Further, the Company unveiled its refreshed

investor presentation and a revamped website, accessible

at www.btcs.com. These developments align with the Company’s

strategy to effectively communicate its business model and growth

opportunities.

The letter from Charles Allen, CEO of BTCS, is

reprinted below in its entirety.

Dear Shareholders,

As we move forward into 2025, I am excited to

reflect on the significant progress BTCS has made and to share our

vision for the future. The past year has been a pivotal one for us.

We have been diligently heads down focused on building the

business, expanding our team with talented new employees, and

navigating through rigorous inquiries from the SEC—challenges that

now seem to be behind us.

Reflecting on our journey, it’s essential to

recall our early recognition of the crypto market’s potential. In

2014, I identified growth opportunities in Bitcoin mining, and by

year-end, BTCS became the first public company to mine Bitcoin.

However, being ahead of the curve came with its challenges. In

2015, a steep 72% drop in Bitcoin’s price tested our resilience,

and our operations could not withstand the downturn. By 2017, early

investors in BTCS backed what would become major players in the

market, specifically Riot Platforms and Marathon Holdings. Notably,

I played a significant role in Marathon’s early days, when they had

a mere $10 million market capitalization, providing them with a

turnkey business model in connection with a merger that didn’t come

to fruition. We were also the first public company to offer a

digital asset treasury in 2017, three years before the likes of

MicroStrategy entered the crypto market; though we were too early

and too small to get noticed. However, our crypto treasury strategy

laid the foundation for our current operations. For over a decade,

I have sought the next regulatory-compliant, transformative

opportunity in the crypto market that aligns with public market

standards. This quest has finally culminated in the launch of our

block-building operations in early 2024. I firmly believe that

Ethereum infrastructure—focused on block-building and

validation—presents the most compelling growth opportunity I’ve

ever witnessed in the crypto space, surpassing even the early days

of Bitcoin mining in 2017. Unlike traditional bitcoin mining

operations that require substantial capital investments in hardware

with depreciating value, our approach to vertically integrated

Ethereum block-building and validation offers exceptional revenue

growth potential without high capital constraints. We effectively

offer the best of both worlds: direct Ethereum exposure, akin to

MicroStrategy, and the growth potential of a 2017-era Bitcoin

miner—all without the burden of intensive capital expenditures.

Going forward we aim to be the leading Ethereum blockchain

infrastructure company and are currently the only pure-play,

publicly traded company focused on this strategy.

These are not pie-in-the-sky over-optimistic

comments that many are accustomed to hearing from CEOs; they are

backed by numbers. While I’ll need to wait for the audit completion

to disclose our full-year 2024 revenue, I am proud to share that

our unaudited revenue for 2024 surpassed the predefined performance

milestone of $3,712,500 over a 177% gain from 2023. This

achievement was a key factor in determining 2024 executive

performance-based bonuses. Our executive compensation program for

2025 is once again fully performance-based, focusing on measurable

outcomes to align leadership incentives with long-term shareholder

value. For 2025, the compensation committee has yet again set

ambitious targets with a clear progression: a revenue threshold of

$4 million, a target of $8 million, and a cutoff of $20 million.

You can read more details in the 8-K filed on January 2, 2025.

While we cannot provide assurances or guarantees of future

performance, our team’s goal is to exceed the $20 million cutoff,

striving for the benefit of our shareholders and to further align

with the company’s broader strategic objectives of driving

sustainable growth and value creation.

Just as we led the charge in 2014 by becoming

the first public company to mine Bitcoin, we are now pioneering

Ethereum infrastructure and block-building in the public markets,

making us the first and only public company with this focus. As we

look to 2025 and beyond, our commitment to innovation, strategic

growth, and shareholder value remains unwavering. While we were

heads down and quiet for much of 2023 and 2024, we were laying the

groundwork for the future. We are excited to share more over the

coming weeks and months so stay tuned. Furthermore, the Company and

I plan to be more active on social media, recognizing that most of

our shareholders utilize platforms they’re more accustomed to

instead of our SEC filings. Please follow our official X accounts:

@Charles_BTCS and @Nasdaq_BTCS.

Lastly, a friendly reminder to our February 6,

2023, call to action press release: did you know that in 2023,

Charles Schwab made $419 million loaning retail holders’ shares to

short sellers to bet against them? If you care about our stock

price as I do, please do your part and stop your broker from

lending your shares to short sellers who bet against us. You can do

this by moving your shares to a cash account instead of a margin

account. I wonder what would happen if our 30k+ shareholders all

moved their shares to cash accounts on the same day?

Thank you for your continued support and trust

in BTCS.

Sincerely,

Charles Allen CEO, BTCS Inc.

About BTCS:

BTCS Inc. (Nasdaq: BTCS) is a U.S.-based

blockchain infrastructure technology company currently focused on

driving scalable revenue growth through its blockchain

infrastructure operations. BTCS has honed its expertise in

blockchain network operations, particularly in block building and

validator node management. Its branded block-building operation,

Builder+, leverages advanced algorithms to optimize block

construction for on-chain validation, thus maximizing gas fee

revenues. BTCS also supports other blockchain networks by operating

validator nodes and staking its crypto assets across multiple

proof-of-stake networks, allowing crypto holders to delegate assets

to BTCS-managed nodes. In addition, the Company has developed

ChainQ, an AI-powered blockchain data analytics platform, which

enhances user access and engagement within the blockchain

ecosystem. Committed to innovation and adaptability, BTCS is

strategically positioned to expand its blockchain operations and

infrastructure beyond Ethereum as the ecosystem evolves.

Explore how BTCS is revolutionizing blockchain

infrastructure in the public markets by visiting

www.btcs.com.

Forward-Looking Statements:

Certain statements in this shareholder letter

constitute “forward-looking statements” within the meaning of the

federal securities laws, including statements regarding SEC

inquiries/investigation being behind us, growth opportunities,

belief regarding the Ethereum infrastructure presenting the most

compelling growth opportunity, and exceptional revenue growth

potential. Words such as “may,” “might,” “will,” “should,”

“believe,” “expect,” “anticipate,” “estimate,” “continue,”

“predict,” “forecast,” “project,” “plan,” “intend” or similar

expressions, or statements regarding intent, belief, or current

expectations, are forward-looking statements. While the Company

believes these forward-looking statements are reasonable, undue

reliance should not be placed on any such forward-looking

statements, which are based on information available to us on the

date of this release. These forward-looking statements are based

upon assumptions and are subject to various risks and

uncertainties, including without limitation the SEC seeking further

information about our business, regulatory issues, the new

administration’s failure to favor the crypto landscape as much as

expected, unexpected issues with Builder+, and unexpected issues

with ChainQ, as well as risks set forth in BTCS’ filings with the

Securities and Exchange Commission including its Form 10-K for the

year ended December 31, 2023. Thus, actual results could be

materially different. BTCS expressly disclaims any obligation to

update or alter statements, whether as a result of new information,

future events, or otherwise, except as required by law.

Investor Relations:Charles Allen – CEOX (formerly Twitter):

@Charles_BTCSEmail: ir@btcs.com

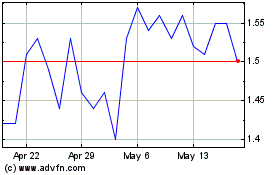

BTCS (NASDAQ:BTCS)

Historical Stock Chart

From Dec 2024 to Jan 2025

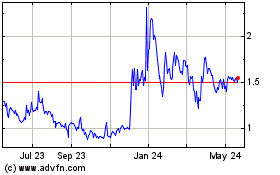

BTCS (NASDAQ:BTCS)

Historical Stock Chart

From Jan 2024 to Jan 2025