Second Quarter 2024 Highlights

- Tangible book value per share(1) of $13.53 for the second

quarter of 2024, an increase of $0.32, or 9.8% annualized, compared

to $13.20 for the first quarter of 2024.

- Net interest income increased $365,000, or 1.5%, from the first

quarter of 2024, the first quarter-over-quarter increase since the

third quarter of 2022.

- Net interest margin (on a fully tax-equivalent basis) of 2.24%

for the second quarter of 2024, in line with the first quarter of

2024.

- Loan-to-deposit ratio of 99.8%, compared to 99.4% at March 31,

2024.

- Gross loans increased $16.2 million, or 1.7% annualized, from

the first quarter of 2024. On a year-to-date basis, gross loans

increased $76.1 million, or 4.1% annualized.

- Deposits increased by $487,000, or 0.1% annualized, from the

first quarter of 2024. On a year-to-date basis, deposits increased

by $97.8 million, or 5.3% annualized, and core deposits(2)

increased by $37.6 million, or 3.0% annualized.

- Efficiency ratio(1) of 58.7%, compared to 58.2% for the first

quarter of 2024.

- A provision for credit losses on loans of $600,000 was recorded

in the second quarter of 2024. The allowance for credit losses on

loans to total loans was 1.37% at June 30, 2024, compared to 1.36%

at March 31, 2024.

- Annualized net loan charge-offs as a percentage of average

loans of 0.00% for the second quarter of 2024, in line with the

first quarter of 2024.

- Nonperforming assets to total assets of 0.01% at both June 30,

2024 and March 31, 2024.

- Repurchased 252,707 shares of common stock at a weighted

average price of $11.48 per share, for a total of $2.9

million.

(1) Represents a non-GAAP financial measure. See "Non-GAAP

Financial Measures" for further details. (2) Core deposits are

defined as total deposits less brokered deposits and certificates

of deposit greater than $250,000.

Bridgewater Bancshares, Inc. (Nasdaq: BWB) (the Company), the

parent company of Bridgewater Bank (the Bank), today announced net

income of $8.1 million for the second quarter of 2024, compared to

$7.8 million for the first quarter of 2024, and $9.8 million for

the second quarter of 2023. Earnings per diluted common share were

$0.26 for the second quarter of 2024, compared to $0.24 for the

first quarter of 2024, and $0.31 for the second quarter of

2023.

“Bridgewater saw positive profitability momentum during the

second quarter as total revenue and net interest income both

increased for the first time since the third quarter of 2022,” said

Chairman and Chief Executive Officer, Jerry Baack. “We were pleased

to see net interest margin hold steady as loan portfolio repricing

increased. Meanwhile, the pace of balance sheet growth year-to-date

remained on track with expectations, despite more moderated growth

in the second quarter.

“Asset quality was superb once again as our Twin Cities-focused

commercial real estate and multifamily portfolios continued to

perform well despite a challenging environment. In addition, our

unique corporate culture and responsive service model continued to

shine as Bridgewater was recognized as a top workplace by the Star

Tribune. Our ongoing focus on executing on our business model,

serving our clients, and driving shareholder value over time, have

now resulted in 30 consecutive quarters of tangible book value per

share growth.”

Key Financial Measures

As of and for the Three Months

Ended

As of and for the Six Months

Ended

June 30,

March 31,

June 30,

June 30,

June 30,

2024

2024

2023

2024

2023

Per Common Share Data

Basic Earnings Per Share

$

0.26

$

0.25

$

0.32

$

0.51

$

0.70

Diluted Earnings Per Share

0.26

0.24

0.31

0.50

0.69

Book Value Per Share

13.63

13.30

12.25

13.63

12.25

Tangible Book Value Per Share (1)

13.53

13.20

12.15

13.53

12.15

Financial Ratios

Return on Average Assets (2)

0.70

%

0.69

%

0.88

%

0.69

%

0.97

%

Pre-Provision Net Revenue Return on

Average Assets (1)(2)

0.94

0.95

1.16

0.95

1.32

Return on Average Shareholders' Equity

(2)

7.49

7.35

9.69

7.42

10.69

Return on Average Tangible Common Equity

(1)(2)

7.80

7.64

10.48

7.72

11.68

Net Interest Margin (3)

2.24

2.24

2.40

2.24

2.55

Core Net Interest Margin (1)(3)

2.17

2.18

2.31

2.18

2.46

Cost of Total Deposits

3.46

3.32

2.66

3.39

2.34

Cost of Funds

3.49

3.34

2.91

3.42

2.66

Efficiency Ratio (1)

58.7

58.2

52.3

58.5

48.9

Noninterest Expense to Average Assets

(2)

1.35

1.33

1.28

1.34

1.29

Tangible Common Equity to Tangible Assets

(1)

7.90

7.72

7.39

7.90

7.39

Common Equity Tier 1 Risk-based Capital

Ratio (Consolidated) (4)

9.41

9.21

8.72

9.41

8.72

Balance Sheet and Asset Quality

(dollars in thousands)

Total Assets

$

4,687,035

$

4,723,109

$

4,603,185

$

4,687,035

$

4,603,185

Total Loans, Gross

3,800,385

3,784,205

3,736,211

3,800,385

3,736,211

Deposits

3,807,712

3,807,225

3,577,932

3,807,712

3,577,932

Loan to Deposit Ratio

99.8

%

99.4

%

104.4

%

99.8

%

104.4

%

Net Loan Charge-Offs (Recoveries) to

Average Loans (2)

0.00

0.00

0.00

0.00

0.00

Nonperforming Assets to Total Assets

(5)

0.01

0.01

0.02

0.01

0.02

Allowance for Credit Losses to Total

Loans

1.37

1.36

1.36

1.37

1.36

____________________________________

(1)

Represents a non-GAAP financial measure.

See "Non-GAAP Financial Measures" for further details.

(2)

Annualized.

(3)

Amounts calculated on a tax-equivalent

basis using the statutory federal tax rate of 21%.

(4)

Preliminary data. Current period subject

to change prior to filings with applicable regulatory agencies.

(5)

Nonperforming assets are defined as

nonaccrual loans plus 90 days past due and still accruing plus

foreclosed assets.

Income Statement

Net Interest Margin and Net Interest

Income

Net interest margin (on a fully tax-equivalent basis) for the

second quarter of 2024 was 2.24%, stable with 2.24% in the first

quarter of 2024, and a 16 basis point decline from 2.40% in the

second quarter of 2023. Core net interest margin (on a fully

tax-equivalent basis), a non-GAAP financial measure which excludes

the impact of loan fees, was 2.17% for the second quarter of 2024,

a one basis point decline from 2.18% in the first quarter of 2024,

and a 14 basis point decline from 2.31% in the second quarter of

2023.

- The linked-quarter margin remained stable.

- The year-over-year decline in the margin was primarily due to

higher funding costs, offset partially by higher earning asset

yields.

Net interest income was $25.0 million for the second quarter of

2024, an increase of $365,000 from $24.6 million in the first

quarter of 2024, and a decrease of $876,000 from $25.9 million in

the second quarter of 2023.

- The linked-quarter increase in net interest income was

primarily due to growth and higher yields in the loan and

securities portfolios.

- The year-over year decrease in net interest income was

primarily due to higher rates paid on deposits and growth in the

rising interest rate environment, which outpaced the repricing of

the loan and securities portfolios.

Interest income was $60.9 million for the second quarter of

2024, an increase of $2.2 million from $58.7 million in the first

quarter of 2024, and an increase of $5.9 million from $55.0 million

in the second quarter of 2023.

- The yield on interest earning assets (on a fully tax-equivalent

basis) was 5.41% in the second quarter of 2024, compared to 5.28%

in the first quarter of 2024 and 5.06% in the second quarter of

2023.

- The linked-quarter increase in the yield on interest earning

assets was primarily due to growth and repricing of the loan

portfolio at yields accretive to the existing portfolio.

- The year-over-year increase in the yield on interest earning

assets was primarily due to the purchase of higher yielding

securities and the growth and repricing of the loan and securities

portfolios in the rising interest rate environment.

- Loan interest income and loan fees remain the primary

contributing factors to the changes in the yield on interest

earning assets. The aggregate loan yield increased to 5.50% in the

second quarter of 2024, 12 basis points higher than 5.38% in the

first quarter of 2024, and 31 basis points higher than 5.19% in the

second quarter of 2023.

- The core loan yield continues to rise as new loan originations

and the existing portfolio reprice in the higher rate

environment.

A summary of interest and fees recognized on loans for the

periods indicated is as follows:

Three Months Ended

June 30, 2024

March 30, 2024

December 31, 2023

September 30, 2023

June 30, 2023

Interest

5.42

%

5.31

%

5.25

%

5.16

%

5.09

%

Fees

0.08

0.07

0.08

0.10

0.10

Yield on Loans

5.50

%

5.38

%

5.33

%

5.26

%

5.19

%

Interest expense was $35.9 million for the second quarter of

2024, an increase of $1.8 million from $34.0 million in the first

quarter of 2024, and an increase of $6.8 million from $29.1 million

in the second quarter of 2023.

- The cost of interest bearing liabilities was 4.19% in the

second quarter of 2024, compared to 4.03% in the first quarter of

2024 and 3.59% in the second quarter of 2023.

- The linked-quarter increase in the cost of interest bearing

liabilities was primarily due to higher rates paid on deposits and

an increase in the utilization of overnight borrowings.

- The year-over-year increase in the cost of interest bearing

liabilities was primarily due to continued deposit repricing in the

higher rate environment.

Interest expense on deposits was $31.6 million for the second

quarter of 2024, an increase of $1.4 million from $30.2 million in

the first quarter of 2024, and an increase of $8.6 million from

$23.0 million in the second quarter of 2023.

- The cost of total deposits was 3.46% in the second quarter of

2024, compared to 3.32% in the first quarter of 2024 and 2.66% in

the second quarter of 2023.

- The linked-quarter increase in the cost of total deposits was

primarily due to continued client demand for higher interest rates,

increased competition, and changes in the mix of deposits.

- The year-over-year increase in the cost of total deposits was

primarily due to upward repricing of the deposit portfolio in the

higher interest rate environment.

Provision for Credit Losses

The provision for credit losses on loans was $600,000 for the

second quarter of 2024, compared to $850,000 for the first quarter

of 2024 and $550,000 for the second quarter of 2023.

- The provision for credit losses on loans recorded in the second

quarter of 2024 was primarily attributable to changes in the mix of

the loan portfolio.

- The allowance for credit losses on loans to total loans was

1.37% at June 30, 2024, compared to 1.36% at both March 31, 2024

and June 30, 2023.

There was no provision for credit losses for off-balance sheet

credit exposures for the second quarter of 2024, compared to a

negative provision of $100,000 for the first quarter of 2024 and a

negative provision of $500,000 for the second quarter of 2023.

- No provision was recorded during the second quarter of 2024 due

to unfunded commitments remaining stable as the migration to funded

loans was offset by the volume of newly originated loans with

unfunded commitments.

Noninterest Income

Noninterest income was $1.8 million for the second quarter of

2024, an increase of $213,000 from $1.6 million for the first

quarter of 2024 and an increase of $348,000 from $1.4 million for

the second quarter of 2023.

- The linked-quarter increase was primarily due to a net gain on

sale of securities and higher letter of credit fees, offset

partially by a decrease in other income.

- The year-over-year increase was primarily due to a net gain on

sale of securities and an increase in the cash surrender value of

bank-owned life insurance.

Noninterest Expense

Noninterest expense was $15.5 million for the second quarter of

2024, an increase of $350,000 from $15.2 million for the first

quarter of 2024 and an increase of $1.3 million from $14.3 million

for the second quarter of 2023.

- The linked-quarter increase was primarily due to increases in

salaries and employee benefits and other expense, offset partially

by a decrease in the FDIC insurance assessment.

- The year-over-year increase was primarily attributable to

increases in salaries and employee benefits, higher derivative

collateral fees and information technology and telecommunications,

offset partially by a decrease in the FDIC insurance

assessment.

- The efficiency ratio, a non-GAAP financial measure, was 58.7%

for the second quarter of 2024, compared to 58.2% for the first

quarter of 2024, and 52.3% for the second quarter of 2023.

- The Company had 258 full-time equivalent employees at June 30,

2024, compared to 255 employees at March 31, 2024, and 253

employees at June 30, 2023.

Income Taxes

The effective combined federal and state income tax rate for the

second quarter of 2024 was 23.6%, a slight increase from 23.5% for

the first quarter of 2024 and an increase from 24.3% for the second

quarter of 2023.

Balance Sheet

Loans

(dollars in thousands)

June 30, 2024

March 31, 2024

December 31, 2023

September 30, 2023

June 30, 2023

Commercial

$

518,762

$

483,069

$

464,061

$

459,854

$

460,061

Construction and Land Development

134,096

200,970

232,804

294,818

351,069

1 - 4 Family Construction

60,551

65,606

65,087

64,463

69,648

Real Estate Mortgage:

1 - 4 Family Mortgage

416,944

417,773

402,396

404,716

400,708

Multifamily

1,404,835

1,389,345

1,388,541

1,378,669

1,314,524

CRE Owner Occupied

185,988

182,589

175,783

159,485

159,088

CRE Nonowner Occupied

1,070,050

1,035,702

987,306

951,263

971,532

Total Real Estate Mortgage Loans

3,077,817

3,025,409

2,954,026

2,894,133

2,845,852

Consumer and Other

9,159

9,151

8,304

9,003

9,581

Total Loans, Gross

3,800,385

3,784,205

3,724,282

3,722,271

3,736,211

Allowance for Credit Losses on Loans

(51,949

)

(51,347

)

(50,494

)

(50,585

)

(50,701

)

Net Deferred Loan Fees

(6,214

)

(6,356

)

(6,573

)

(7,222

)

(7,718

)

Total Loans, Net

$

3,742,222

$

3,726,502

$

3,667,215

$

3,664,464

$

3,677,792

Total gross loans at June 30, 2024 were $3.80 billion, an

increase of $16.2 million, or 1.7% annualized, over total gross

loans of $3.78 billion at March 31, 2024, and an increase of $64.2

million, or 1.7%, over total gross loans of $3.74 billion at June

30, 2023.

- The increase in the loan portfolio during the second quarter of

2024 was due to increased loan originations, partially offset by

elevated loan payoffs. The loan portfolio composition remained

relatively stable during the quarter with the exception of the

construction and land development portfolio which decreased.

Deposits

(dollars in thousands)

June 30, 2024

March 31, 2024

December 31, 2023

September 30, 2023

June 30, 2023

Noninterest Bearing Transaction

Deposits

$

705,175

$

698,432

$

756,964

$

754,297

$

751,217

Interest Bearing Transaction Deposits

752,568

783,736

692,801

780,863

719,488

Savings and Money Market Deposits

943,994

979,773

935,091

872,534

860,613

Time Deposits

373,713

352,510

300,651

265,737

271,783

Brokered Deposits

1,032,262

992,774

1,024,441

1,002,078

974,831

Total Deposits

$

3,807,712

$

3,807,225

$

3,709,948

$

3,675,509

$

3,577,932

Total deposits at June 30, 2024 were $3.81 billion, an increase

of $487,000, over total deposits of $3.81 billion at March 31,

2024, and an increase of $229.8 million, or 6.4%, over total

deposits of $3.58 billion at June 30, 2023.

- Core deposits, defined as total deposits excluding brokered

deposits and time deposits greater than $250,000, decreased $52.7

million from the first quarter of 2024. Growth in core deposits can

fluctuate from quarter to quarter, as deposit growth is not always

linear. On a year-to-date basis, core deposits increased by $37.6

million, or 3.0% annualized.

- Brokered deposits continue to be used as a supplemental funding

source, as needed.

- Uninsured deposits were 23% of total deposits as of June 30,

2024, compared to 26% of total deposits as of March 31, 2024.

Liquidity

Total on- and off-balance sheet liquidity was $2.22 billion as

of June 30, 2024, compared to $2.25 billion at March 31, 2024 and

$1.96 billion at June 30, 2023.

Primary Liquidity—On-Balance

Sheet

June 30, 2024

March 31, 2024

December 31, 2023

September 30, 2023

June 30, 2023

(dollars in thousands)

Cash and Cash Equivalents

$

97,237

$

105,784

$

96,594

$

77,617

$

138,618

Securities Available for Sale

601,057

633,282

604,104

553,076

538,220

Less: Pledged Securities

(169,095

)

(169,479

)

(170,727

)

(164,277

)

(236,206

)

Total Primary Liquidity

$

529,199

$

569,587

$

529,971

$

466,416

$

440,632

Ratio of Primary Liquidity to Total

Deposits

13.9

%

15.0

%

14.3

%

12.7

%

12.3

%

Secondary Liquidity—Off-Balance Sheet

Borrowing Capacity

Net Secured Borrowing Capacity with the

FHLB

$

451,171

$

446,801

$

498,736

$

516,501

$

400,792

Net Secured Borrowing Capacity with the

Federal Reserve Bank

1,015,873

1,006,010

979,448

1,022,128

986,644

Unsecured Borrowing Capacity with

Correspondent Lenders

200,000

200,000

200,000

150,000

108,000

Secured Borrowing Capacity with

Correspondent Lender

26,250

26,250

26,250

26,250

26,250

Total Secondary Liquidity

$

1,693,294

$

1,679,061

$

1,704,434

$

1,714,879

$

1,521,686

Total Primary and Secondary Liquidity

$

2,222,493

$

2,248,648

$

2,234,405

$

2,181,295

$

1,962,318

Ratio of Primary and Secondary Liquidity

to Total Deposits

58.4

%

59.1

%

60.2

%

59.3

%

54.8

%

Asset Quality

Overall asset quality remained superb due to the Company’s

measured risk selection, consistent underwriting standards, active

credit oversight, and experienced lending and credit teams.

- Annualized net charge-offs as a percentage of average loans

were 0.00% for each of the second quarter of 2024, the first

quarter of 2024 and the second quarter of 2023.

- At June 30, 2024, the Company’s nonperforming assets, which

include nonaccrual loans, loans past due 90 days and still

accruing, and foreclosed assets, were $678,000, or 0.01% of total

assets, compared to $269,000, or 0.01%, of total assets at March

31, 2024, and $778,000, or 0.02%, of total assets at June 30,

2023.

- Loans with potential weaknesses that warranted a watchlist risk

rating at June 30, 2024 totaled $30.4 million, compared to $21.6

million at March 31, 2024, and $27.2 million at June 30, 2023.

- Loans that warranted a substandard risk rating at June 30, 2024

totaled $33.9 million, compared to $33.8 million at March 31, 2024,

and $33.8 million at June 30, 2023.

Capital

Total shareholders’ equity at June 30, 2024 was $439.2 million,

an increase of $5.6 million, or 1.3%, compared to total

shareholders’ equity of $433.6 million at March 31, 2024, and an

increase of $30.1 million, or 7.4%, over total shareholders’ equity

of $409.1 million at June 30, 2023.

- The linked-quarter increase was primarily due to net income

retained, offset partially by preferred stock dividends and stock

repurchases.

- The year-over-year increase was due to net income retained and

a decrease in unrealized losses in the securities portfolio, offset

partially by a decrease in unrealized gains in the derivatives

portfolio, preferred stock dividends, and stock repurchases.

- The Common Equity Tier 1 Risk-Based Capital Ratio was 9.41% at

June 30, 2024, compared to 9.21% at March 31, 2024 and 8.72% at

June 30, 2023.

- Tangible common equity as a percentage of tangible assets, a

non-GAAP financial measure, was 7.90% at June 30, 2024, compared to

7.72% at March 31, 2024, and 7.39% at June 30, 2023.

Tangible book value per share, a non-GAAP financial measure, was

$13.53 as of June 30, 2024, an increase of 2.4% from $13.20 as of

March 31, 2024, and an increase of 11.4% from $12.15 as of June 30,

2023.

- The Company has increased tangible book value per share each of

the past 30 quarters.

During the second quarter of 2024, the Company repurchased

252,707 shares of its common stock. Shares were repurchased at a

weighted average price of $11.48 per share, for a total of $2.9

million.

- The Company has $15.3 million remaining under its current share

repurchase authorization.

- On July 23, 2024, the Board of Directors extended

the expiration date of the current share repurchase authorization

from August 16, 2024 to August 20, 2025.

Today, the Company also announced that its Board of Directors

has declared a quarterly cash dividend on its 5.875% Non-Cumulative

Perpetual Preferred Stock, Series A (Series A Preferred Stock). The

quarterly cash dividend of $36.72 per share, equivalent to $0.3672

per depositary share, each representing a 1/100th interest in a

share of the Series A Preferred Stock (Nasdaq: BWBBP), is payable

on September 3, 2024 to shareholders of record of the Series A

Preferred Stock at the close of business on August 15, 2024.

Conference Call and Webcast

The Company will host a conference call to discuss its second

quarter 2024 financial results on Thursday, July 25, 2024 at 8:00

a.m. Central Time. The conference call can be accessed by dialing

844-481-2913 and requesting to join the Bridgewater Bancshares

earnings call. To listen to a replay of the conference call via

phone, please dial 877-344-7529 and enter access code 3041856. The

replay will be available through August 1, 2024. The conference

call will also be available via a live webcast on the Investor

Relations section of the Company’s website,

investors.bridgewaterbankmn.com, and archived for replay.

About the Company

Bridgewater Bancshares, Inc. (Nasdaq: BWB) is a St. Louis Park,

Minnesota-based financial holding company. Bridgewater's banking

subsidiary, Bridgewater Bank, is a premier, full-service Twin

Cities bank dedicated to serving the diverse needs of commercial

real estate investors, entrepreneurs, business clients and

successful individuals. By pairing a range of deposit, lending, and

treasury management solutions with a responsive service model,

Bridgewater has seen continuous growth and profitability. With

total assets of $4.7 billion and seven branches as of June 30,

2024, Bridgewater is considered one of the largest locally led

banks in the State of Minnesota, and has received numerous awards

for its growth, banking services, and esteemed corporate

culture.

Use of Non-GAAP financial measures

In addition to the results presented in accordance with U.S.

Generally Accepted Accounting Principles (GAAP), the Company

routinely supplements its evaluation with an analysis of certain

non-GAAP financial measures. The Company believes these non-GAAP

financial measures, in addition to the related GAAP measures,

provide meaningful information to investors to help them understand

the Company’s operating performance and trends, and to facilitate

comparisons with the performance of peers. These disclosures should

not be viewed as a substitute for operating results determined in

accordance with GAAP, nor are they necessarily comparable to

non-GAAP performance measures that may be presented by other

companies. Reconciliations of non-GAAP disclosures used in this

earnings release to the comparable GAAP measures are provided in

the accompanying tables.

Forward-Looking Statements

This earnings release contains “forward-looking statements”

within the meaning of the safe harbor provisions of the U.S.

Private Securities Litigation Reform Act of 1995. Forward-looking

statements include, without limitation, statements concerning

plans, estimates, calculations, forecasts and projections with

respect to the anticipated future performance of the Company. These

statements are often, but not always, identified by words such as

“may”, “might”, “should”, “could”, “predict”, “potential”,

“believe”, “expect”, “continue”, “will”, “anticipate”, “seek”,

“estimate”, “intend”, “plan”, “projection”, “would”, “annualized”,

“target” and “outlook”, or the negative version of those words or

other comparable words of a future or forward-looking nature.

Forward-looking statements are neither historical facts nor

assurances of future performance. Instead, they are based only on

our current beliefs, expectations and assumptions regarding our

business, future plans and strategies, projections, anticipated

events and trends, the economy and other future conditions. Because

forward-looking statements relate to the future, they are subject

to inherent uncertainties, risks and changes in circumstances that

are difficult to predict and many of which are outside of our

control. Our actual results and financial condition may differ

materially from those indicated in the forward-looking statements.

Therefore, you should not rely on any of these forward-looking

statements. Important factors that could cause our actual results

and financial condition to differ materially from those indicated

in the forward-looking statements include, among others, the

following: interest rate risk, including the effects of sustained

high interest rates; fluctuations in the values of the securities

held in our securities portfolio, including as the result of

changes in interest rates; business and economic conditions

generally and in the financial services industry, nationally and

within our market area, including high rates of inflation and

possible recession; the effects of developments and events in the

financial services industry, including the large-scale deposit

withdrawals over a short period of time that resulted in recent

bank failures; loan concentrations in our portfolio; the overall

health of the local and national real estate market; our ability to

successfully manage credit risk; our ability to maintain an

adequate level of allowance for credit losses on loans; new or

revised accounting standards; the concentration of large loans to

certain borrowers; the concentration of large deposits from certain

clients, who have balances above current FDIC insurance limits; our

ability to successfully manage liquidity risk, which may increase

our dependence on non-core funding sources such as brokered

deposits, and negatively impact our cost of funds; our ability to

raise additional capital to implement our business plan; our

ability to implement our growth strategy and manage costs

effectively; the composition of our senior leadership team and our

ability to attract and retain key personnel; talent and labor

shortages and high rates of employee turnover; the occurrence of

fraudulent activity, breaches or failures of our or our third-party

vendors’ information security controls or cybersecurity-related

incidents, including as a result of sophisticated attacks using

artificial intelligence and similar tools; interruptions involving

our information technology and telecommunications systems or

third-party servicers; competition in the financial services

industry, including from nonbank competitors such as credit unions

and “fintech” companies; the effectiveness of our risk management

framework; the commencement and outcome of litigation and other

legal proceedings and regulatory actions against us; the impact of

recent and future legislative and regulatory changes, including in

response to the recent bank failures; risks related to climate

change and the negative impact it may have on our customers and

their businesses; the imposition of other governmental policies

impacting the value of products produced by our commercial

borrowers; severe weather, natural disasters, wide spread disease

or pandemics, acts of war or terrorism or other adverse external

events, including the ongoing Israeli-Palestinian conflict and the

Russian invasion of Ukraine; potential impairment to the goodwill

the Company recorded in connection with our past acquisition;

changes to U.S. or state tax laws, regulations and guidance;

potential changes in federal policy and at regulatory agencies as a

result of the upcoming 2024 presidential election; and any other

risks described in the “Risk Factors” sections of reports filed by

the Company with the Securities and Exchange Commission.

Any forward-looking statement made by us in this press release

is based only on information currently available to us and speaks

only as of the date on which it is made. The Company undertakes no

obligation to publicly update any forward-looking statement,

whether written or oral, that may be made from time to time,

whether as a result of new information, future developments or

otherwise.

Bridgewater Bancshares, Inc. and

Subsidiaries

Financial Highlights

(dollars in thousands, except share

data)

As of and for the Three Months

Ended

June 30,

March 30,

December 31,

September 30,

June 30,

(dollars in thousands)

2024

2024

2023

2023

2023

Income Statement

Net Interest Income

$

24,996

$

24,631

$

25,314

$

25,421

$

25,872

Provision for (Recovery of) Credit

Losses

600

750

(250

)

(600

)

50

Noninterest Income

1,763

1,550

1,409

1,726

1,415

Noninterest Expense

15,539

15,189

15,740

15,237

14,274

Net Income

8,115

7,831

8,873

9,629

9,816

Net Income Available to Common

Shareholders

7,101

6,818

7,859

8,616

8,802

Per Common Share Data

Basic Earnings Per Share

$

0.26

$

0.25

$

0.28

$

0.31

$

0.32

Diluted Earnings Per Share

0.26

0.24

0.28

0.30

0.31

Book Value Per Share

13.63

13.30

12.94

12.47

12.25

Tangible Book Value Per Share (1)

13.53

13.20

12.84

12.37

12.15

Basic Weighted Average Shares

Outstanding

27,386,713

27,691,401

27,870,430

27,943,409

27,886,425

Diluted Weighted Average Shares

Outstanding

27,748,184

28,089,805

28,238,056

28,311,778

28,198,739

Shares Outstanding at Period End

27,348,049

27,589,827

27,748,965

28,015,505

27,973,995

Financial Ratios

Return on Average Assets (2)

0.70

%

0.69

%

0.77

%

0.85

%

0.88

%

Pre-Provision Net Revenue Return on

Average Assets (1)(2)

0.94

0.95

0.96

1.01

1.16

Return on Average Shareholders' Equity

(2)

7.49

7.35

8.43

9.23

9.69

Return on Average Tangible Common Equity

(1)(2)

7.80

7.64

8.95

9.92

10.48

Net Interest Margin (3)

2.24

2.24

2.27

2.32

2.40

Core Net Interest Margin (1)(3)

2.17

2.18

2.21

2.24

2.31

Cost of Total Deposits

3.46

3.32

3.19

2.99

2.66

Cost of Funds

3.49

3.34

3.23

3.10

2.91

Efficiency Ratio (1)

58.7

58.2

58.8

56.1

52.3

Noninterest Expense to Average Assets

(2)

1.35

1.33

1.37

1.34

1.28

Balance Sheet

Total Assets

$

4,687,035

$

4,723,109

$

4,611,990

$

4,557,070

$

4,603,185

Total Loans, Gross

3,800,385

3,784,205

3,724,282

3,722,271

3,736,211

Deposits

3,807,712

3,807,225

3,709,948

3,675,509

3,577,932

Total Shareholders' Equity

439,241

433,611

425,515

415,960

409,126

Loan to Deposit Ratio

99.8

%

99.4

%

100.4

%

101.3

%

104.4

%

Core Deposits to Total Deposits (4)

67.9

69.3

68.7

70.3

70.3

Uninsured Deposits to Total Deposits

22.5

26.0

24.3

22.2

22.1

Asset Quality

Net Loan Charge-Offs to Average Loans

(2)

0.00

%

0.00

%

0.01

%

0.01

%

0.00

%

Nonperforming Assets to Total Assets

(5)

0.01

0.01

0.02

0.02

0.02

Allowance for Credit Losses to Total

Loans

1.37

1.36

1.36

1.36

1.36

Capital Ratios (Consolidated)

(6)

Tier 1 Leverage Ratio

9.66

%

9.66

%

9.57

%

9.62

%

9.47

%

Common Equity Tier 1 Risk-based Capital

Ratio

9.41

9.21

9.16

9.07

8.72

Tier 1 Risk-based Capital Ratio

11.03

10.83

10.79

10.69

10.33

Total Risk-based Capital Ratio

14.16

14.00

13.97

13.88

13.50

Tangible Common Equity to Tangible Assets

(1)

7.90

7.72

7.73

7.61

7.39

____________________________________

(1)

Represents a non-GAAP financial measure.

See "Non-GAAP Financial Measures" for further details.

(2)

Annualized.

(3)

Amounts calculated on a tax-equivalent

basis using the statutory federal tax rate of 21%.

(4)

Core deposits are defined as total

deposits less brokered deposits and certificates of deposit greater

than $250,000.

(5)

Nonperforming assets are defined as

nonaccrual loans plus 90 days past due and still accruing plus

foreclosed assets.

(6)

Preliminary data. Current period subject

to change prior to filings with applicable regulatory agencies.

Bridgewater Bancshares, Inc. and

Subsidiaries

Consolidated Balance Sheets

(dollars in thousands, except share

data)

June 30,

March 31,

December 31,

September 30,

June 30,

2024

2024

2023

2023

2023

(Unaudited)

(Unaudited)

(Unaudited)

(Unaudited)

Assets

Cash and Cash Equivalents

$

134,093

$

143,355

$

128,562

$

124,358

$

177,101

Bank-Owned Certificates of Deposit

—

—

—

1,225

1,225

Securities Available for Sale, at Fair

Value

601,057

633,282

604,104

553,076

538,220

Loans, Net of Allowance for Credit

Losses

3,742,222

3,726,502

3,667,215

3,664,464

3,677,792

Federal Home Loan Bank (FHLB) Stock, at

Cost

15,844

17,195

17,097

17,056

21,557

Premises and Equipment, Net

47,902

48,299

48,886

49,331

49,710

Accrued Interest

16,944

16,696

16,697

15,182

13,822

Goodwill

2,626

2,626

2,626

2,626

2,626

Other Intangible Assets, Net

171

180

188

197

206

Bank-Owned Life Insurance

35,090

34,778

34,477

34,209

33,958

Other Assets

91,086

100,196

92,138

95,346

86,968

Total Assets

$

4,687,035

$

4,723,109

$

4,611,990

$

4,557,070

$

4,603,185

Liabilities and Equity

Liabilities

Deposits:

Noninterest Bearing

$

705,175

$

698,432

$

756,964

$

754,297

$

751,217

Interest Bearing

3,102,537

3,108,793

2,952,984

2,921,212

2,826,715

Total Deposits

3,807,712

3,807,225

3,709,948

3,675,509

3,577,932

Federal Funds Purchased

—

—

—

—

195,000

Notes Payable

13,750

13,750

13,750

13,750

13,750

FHLB Advances

287,000

317,000

319,500

294,500

262,000

Subordinated Debentures, Net of Issuance

Costs

79,479

79,383

79,288

79,192

79,096

Accrued Interest Payable

3,999

4,405

5,282

3,816

2,974

Other Liabilities

55,854

67,735

58,707

74,343

63,307

Total Liabilities

4,247,794

4,289,498

4,186,475

4,141,110

4,194,059

Shareholders' Equity

Preferred Stock- $0.01 par value;

Authorized 10,000,000

Preferred Stock - Issued and Outstanding

27,600 Series A shares ($2,500 liquidation preference) at June 30,

2024 (unaudited), March 31, 2024 (unaudited), December 31, 2023,

September 30, 2023 (unaudited), and June 30, 2023 (unaudited)

66,514

66,514

66,514

66,514

66,514

Common Stock- $0.01 par value; Authorized

75,000,000

Common Stock - Issued and Outstanding

27,348,049 at June 30, 2024 (unaudited), 27,589,827 at March 31,

2024 (unaudited), 27,748,965 at December 31, 2023, 28,015,505 at

September 30, 2023 (unaudited), and 27,973,995 at June 30, 2023

(unaudited)

273

276

277

280

280

Additional Paid-In Capital

93,205

95,069

96,320

100,120

99,044

Retained Earnings

294,569

287,468

280,650

272,812

264,196

Accumulated Other Comprehensive Loss

(15,320

)

(15,716

)

(18,246

)

(23,766

)

(20,908

)

Total Shareholders' Equity

439,241

433,611

425,515

415,960

409,126

Total Liabilities and Equity

$

4,687,035

$

4,723,109

$

4,611,990

$

4,557,070

$

4,603,185

Bridgewater Bancshares, Inc. and

Subsidiaries

Consolidated Statements of

Income

(dollars in thousands, except per share

data)

(Unaudited)

Three Months Ended

Six Months Ended

June 30,

March 31,

December 31,

September 30,

June 30,

June 30,

June 30,

(dollars in thousands)

2024

2024

2023

2023

2023

2024

2023

Interest Income

Loans, Including Fees

$

51,385

$

49,581

$

49,727

$

48,999

$

47,721

$

100,966

$

92,676

Investment Securities

8,177

7,916

7,283

6,507

6,237

16,093

12,455

Other

1,316

1,172

1,543

1,303

1,043

2,488

1,862

Total Interest Income

60,878

58,669

58,553

56,809

55,001

119,547

106,993

Interest Expense

Deposits

31,618

30,190

29,448

27,225

22,998

61,808

39,372

Federal Funds Purchased

853

304

268

548

2,761

1,157

7,705

Notes Payable

296

295

299

296

285

591

548

FHLB Advances

2,125

2,258

2,220

2,316

2,092

4,383

2,953

Subordinated Debentures

990

991

1,004

1,003

993

1,981

1,976

Total Interest Expense

35,882

34,038

33,239

31,388

29,129

69,920

52,554

Net Interest Income

24,996

24,631

25,314

25,421

25,872

49,627

54,439

Provision for (Recovery of) Credit

Losses

600

750

(250

)

(600

)

50

1,350

675

Net Interest Income After Provision for

Credit Losses

24,396

23,881

25,564

26,021

25,822

48,277

53,764

Noninterest Income

Customer Service Fees

366

342

359

379

368

708

717

Net Gain (Loss) on Sales of Securities

320

93

(27

)

—

50

413

(6

)

Letter of Credit Fees

387

316

418

315

379

703

1,013

Debit Card Interchange Fees

155

141

152

150

155

296

293

Bank-Owned Life Insurance

312

301

268

252

238

613

472

FHLB Prepayment Income

—

—

—

493

—

—

299

Other Income

223

357

239

137

225

580

570

Total Noninterest Income

1,763

1,550

1,409

1,726

1,415

3,313

3,358

Noninterest Expense

Salaries and Employee Benefits

9,675

9,433

9,615

9,519

8,589

19,108

17,404

Occupancy and Equipment

1,092

1,057

1,062

1,101

1,075

2,149

2,284

FDIC Insurance Assessment

725

875

1,050

1,075

900

1,600

1,565

Data Processing

472

412

424

392

401

884

758

Professional and Consulting Fees

852

889

782

715

829

1,741

1,584

Derivative Collateral Fees

528

486

573

543

404

1,014

784

Information Technology and

Telecommunications

812

796

812

683

711

1,608

1,394

Marketing and Advertising

317

322

324

222

321

639

583

Intangible Asset Amortization

8

9

9

9

34

17

82

Other Expense

1,058

910

1,089

978

1,010

1,968

1,905

Total Noninterest Expense

15,539

15,189

15,740

15,237

14,274

30,728

28,343

Income Before Income Taxes

10,620

10,242

11,233

12,510

12,963

20,862

28,779

Provision for Income Taxes

2,505

2,411

2,360

2,881

3,147

4,916

7,321

Net Income

8,115

7,831

8,873

9,629

9,816

15,946

21,458

Preferred Stock Dividends

(1,014

)

(1,013

)

(1,014

)

(1,013

)

(1,014

)

(2,027

)

(2,027

)

Net Income Available to Common

Shareholders

$

7,101

$

6,818

$

7,859

$

8,616

$

8,802

$

13,919

$

19,431

Earnings Per Share

Basic

$

0.26

$

0.25

$

0.28

$

0.31

$

0.32

$

0.51

$

0.70

Diluted

0.26

0.24

0.28

0.30

0.31

0.50

0.69

Bridgewater Bancshares, Inc. and

Subsidiaries

Analysis of Average Balances, Yields

and Rates

(dollars in thousands, except per share

data)

(Unaudited)

For the Three Months

Ended

June 30, 2024

March 31, 2024

June 30, 2023

Average

Interest

Yield/

Average

Interest

Yield/

Average

Interest

Yield/

(dollars in thousands)

Balance

& Fees

Rate

Balance

& Fees

Rate

Balance

& Fees

Rate

Interest Earning Assets:

Cash Investments

$

81,672

$

922

4.54

%

$

75,089

$

829

4.44

%

$

59,963

$

587

3.93

%

Investment Securities:

Taxable Investment Securities

641,469

7,861

4.93

638,509

7,600

4.79

568,143

6,000

4.24

Tax-Exempt Investment Securities (1)

31,550

401

5.11

31,745

400

5.07

27,081

300

4.44

Total Investment Securities

673,019

8,262

4.94

670,254

8,000

4.80

595,224

6,300

4.24

Loans (1)(2)

3,771,768

51,592

5.50

3,729,355

49,858

5.38

3,716,534

48,066

5.19

Federal Home Loan Bank Stock

19,461

394

8.15

18,058

343

7.64

23,330

456

7.84

Total Interest Earning Assets

4,545,920

61,170

5.41

%

4,492,756

59,030

5.28

%

4,395,051

55,409

5.06

%

Noninterest Earning Assets

100,597

100,082

88,611

Total Assets

$

4,646,517

$

4,592,838

$

4,483,662

Interest Bearing Liabilities:

Deposits:

Interest Bearing Transaction Deposits

$

732,923

$

8,270

4.54

%

$

732,186

$

7,693

4.23

%

$

683,034

$

5,918

3.48

%

Savings and Money Market Deposits

914,397

9,459

4.16

896,844

8,781

3.94

861,947

7,048

3.28

Time Deposits

360,691

3,850

4.30

317,595

3,167

4.01

269,439

1,702

2.53

Brokered Deposits

976,467

10,039

4.13

1,014,197

10,549

4.18

896,989

8,330

3.72

Total Interest Bearing Deposits

2,984,478

31,618

4.26

2,960,822

30,190

4.10

2,711,409

22,998

3.40

Federal Funds Purchased

61,151

853

5.61

21,824

304

5.60

210,677

2,761

5.26

Notes Payable

13,750

296

8.64

13,750

295

8.64

13,750

285

8.33

FHLB Advances

306,396

2,125

2.79

318,648

2,258

2.85

242,714

2,092

3.46

Subordinated Debentures

79,424

990

5.02

79,328

991

5.02

79,041

993

5.04

Total Interest Bearing Liabilities

3,445,199

35,882

4.19

%

3,394,372

34,038

4.03

%

3,257,591

29,129

3.59

%

Noninterest Bearing

Liabilities:

Noninterest Bearing Transaction

Deposits

691,891

701,175

755,040

Other Noninterest Bearing Liabilities

73,842

69,043

64,684

Total Noninterest Bearing Liabilities

765,733

770,218

819,724

Shareholders' Equity

435,585

428,248

406,347

Total Liabilities and Shareholders'

Equity

$

4,646,517

$

4,592,838

$

4,483,662

Net Interest Income / Interest Rate

Spread

25,288

1.22

%

24,992

1.25

%

26,280

1.47

%

Net Interest Margin (3)

2.24

%

2.24

%

2.40

%

Taxable Equivalent Adjustment:

Tax-Exempt Investment Securities and

Loans

(292

)

(361

)

(408

)

Net Interest Income

$

24,996

$

24,631

$

25,872

____________________________________

(1)

Interest income and average rates for

tax-exempt investment securities and loans are presented on a

tax-equivalent basis, assuming a statutory federal income tax rate

of 21%.

(2)

Average loan balances include nonaccrual

loans. Interest income on loans includes amortization of deferred

loan fees, net of deferred loan costs.

(3)

Net interest margin includes the tax

equivalent adjustment and represents the annualized results of: (i)

the difference between interest income on interest earning assets

and the interest expense on interest bearing liabilities, divided

by (ii) average interest earning assets for the period.

Bridgewater Bancshares, Inc. and

Subsidiaries

Analysis of Average Balances, Yields

and Rates

(dollars in thousands, except per share

data)

(Unaudited)

For the Six Months

Ended

June 30, 2024

June 30, 2023

Average

Interest

Yield/

Average

Interest

Yield/

(dollars in thousands)

Balance

& Fees

Rate

Balance

& Fees

Rate

Interest Earning Assets:

Cash Investments

$

78,380

$

1,751

4.49

%

$

61,599

$

1,034

3.38

%

Investment Securities:

Taxable Investment Securities

639,989

15,461

4.86

571,176

11,958

4.22

Tax-Exempt Investment Securities (1)

31,648

801

5.09

28,435

629

4.46

Total Investment Securities

671,637

16,262

4.87

599,611

12,587

4.23

Loans (1)(2)

3,750,561

101,450

5.44

3,673,728

93,332

5.12

Federal Home Loan Bank Stock

18,760

737

7.90

24,639

828

6.77

Total Interest Earning Assets

4,519,338

120,200

5.35

%

4,359,577

107,781

4.99

%

Noninterest Earning Assets

100,340

85,087

Total Assets

$

4,619,678

$

4,444,664

Interest Bearing Liabilities:

Deposits:

Interest Bearing Transaction Deposits

$

733,714

$

15,963

4.38

%

$

570,964

$

8,698

3.07

%

Savings and Money Market Deposits

905,620

18,240

4.05

952,865

13,547

2.87

Time Deposits

339,143

7,017

4.16

258,865

2,771

2.16

Brokered Deposits

995,332

20,588

4.16

820,651

14,356

3.53

Total Interest Bearing Deposits

2,973,809

61,808

4.18

2,603,345

39,372

3.05

Federal Funds Purchased

41,487

1,157

5.61

312,329

7,705

4.97

Notes Payable

13,750

591

8.64

13,750

548

8.03

FHLB Advances

312,522

4,383

2.82

185,785

2,953

3.21

Subordinated Debentures

79,376

1,981

5.02

78,994

1,976

5.05

Total Interest Bearing Liabilities

3,420,944

69,920

4.11

%

3,194,203

52,554

3.32

%

Noninterest Bearing

Liabilities:

Noninterest Bearing Transaction

Deposits

695,373

786,009

Other Noninterest Bearing Liabilities

71,445

59,504

Total Noninterest Bearing Liabilities

766,818

845,513

Shareholders' Equity

431,916

404,948

Total Liabilities and Shareholders'

Equity

$

4,619,678

$

4,444,664

Net Interest Income / Interest Rate

Spread

50,280

1.24

%

55,227

1.67

%

Net Interest Margin (3)

2.24

%

2.55

%

Taxable Equivalent Adjustment:

Tax-Exempt Investment Securities and

Loans

(653

)

(788

)

Net Interest Income

$

49,627

$

54,439

Bridgewater Bancshares, Inc. and

Subsidiaries

Asset Quality Summary

(dollars in thousands)

(unaudited)

As of and for the Three Months

Ended

As of and for the Six Months

Ended

June 30,

March 31,

December 31,

September 30,

June 30,

June 30,

June 30,

(dollars in thousands)

2024

2024

2023

2023

2023

2024

2023

Allowance for Credit Losses

Balance at Beginning of Period

$

51,347

$

50,494

$

50,585

$

50,701

$

50,148

$

50,494

$

47,996

Impact of Adopting CECL

—

—

—

—

—

—

650

Provision for Credit Losses

600

850

—

—

550

1,450

2,050

Charge-offs

(10

)

(2

)

(95

)

(122

)

(3

)

(12

)

(7

)

Recoveries

12

5

4

6

6

17

12

Net Charge-offs

$

2

$

3

$

(91

)

$

(116

)

$

3

$

5

$

5

Balance at End of Period

51,949

51,347

50,494

50,585

50,701

51,949

50,701

Allowance for Credit Losses to Total

Loans

1.37

%

1.36

%

1.36

%

1.36

%

1.36

%

1.37

%

1.36

%

As of and for the Three Months

Ended

As of and for the Six Months

Ended

June 30,

March 31,

December 31,

September 30,

June 30,

June 30,

June 30,

(dollars in thousands)

2024

2024

2023

2023

2023

2024

2023

Provision for Credit Losses on Loans

$

600

$

850

$

—

$

—

$

550

$

1,450

$

2,050

Recovery of Credit Losses for Off-Balance

Sheet Credit Exposures

—

(100

)

(250

)

(600

)

(500

)

(100

)

(1,375

)

Provision for (Recovery of) Credit

Losses

$

600

$

750

$

(250

)

$

(600

)

$

50

$

1,350

$

675

As of and for the Three Months

Ended

June 30,

March 31,

December 31,

September 30,

June 30,

(dollars in thousands)

2024

2024

2023

2023

2023

Selected Asset Quality Data

Loans 30-89 Days Past Due

$

502

$

—

$

15,110

$

11

$

—

Loans 30-89 Days Past Due to Total

Loans

0.01

%

0.00

%

0.41

%

0.00

%

0.00

%

Nonperforming Loans

$

678

$

249

$

919

$

749

$

662

Nonperforming Loans to Total Loans

0.02

%

0.01

%

0.02

%

0.02

%

0.02

%

Nonaccrual Loans to Total Loans

0.02

0.01

0.02

0.02

0.02

Nonaccrual Loans and Loans Past Due 90

Days and Still Accruing to Total Loans

0.02

0.01

0.02

0.02

0.02

Foreclosed Assets

$

—

$

20

$

—

$

—

$

116

Nonperforming Assets (1)

678

269

919

749

778

Nonperforming Assets to Total Assets

(1)

0.01

%

0.01

%

0.02

%

0.02

%

0.02

%

Net Loan Charge-Offs (Annualized) to

Average Loans

0.00

0.00

0.01

0.01

0.00

Watchlist Risk Rating Loans

$

30,436

$

21,624

$

26,485

$

26,877

$

27,215

Substandard Risk Rating Loans

33,908

33,829

35,858

35,621

33,821

____________________________________

(1)

Nonperforming assets are defined as

nonaccrual loans plus 90 days past due and still accruing plus

foreclosed assets.

Bridgewater Bancshares, Inc. and

Subsidiaries

Non-GAAP Financial Measures

(dollars in thousands)

(unaudited)

For the Three Months

Ended

For the Six Months

Ended

June 30,

March 31,

December 31,

September 30,

June 30,

June 30,

June 30,

(dollars in thousands)

2024

2024

2023

2023

2023

2024

2023

Pre-Provision Net Revenue

Noninterest Income

$

1,763

$

1,550

$

1,409

$

1,726

$

1,415

$

3,313

$

3,358

Less: (Gain) Loss on Sales of

Securities

(320

)

(93

)

27

—

(50

)

(413

)

6

Less: FHLB Advance Prepayment Income

—

—

—

(493

)

—

—

(299

)

Total Operating Noninterest Income

1,443

1,457

1,436

1,233

1,365

2,900

3,065

Plus: Net Interest Income

24,996

24,631

25,314

25,421

25,872

49,627

54,439

Net Operating Revenue

$

26,439

$

26,088

$

26,750

$

26,654

$

27,237

$

52,527

$

57,504

Noninterest Expense

$

15,539

$

15,189

$

15,740

$

15,237

$

14,274

$

30,728

$

28,343

Total Operating Noninterest Expense

$

15,539

$

15,189

$

15,740

$

15,237

$

14,274

$

30,728

$

28,343

Pre-Provision Net Revenue

$

10,900

$

10,899

$

11,010

$

11,417

$

12,963

$

21,799

$

29,161

Plus:

Non-Operating Revenue Adjustments

320

93

(27

)

493

50

413

293

Less:

Provision (Recovery of) for Credit

Losses

600

750

(250

)

(600

)

50

1,350

675

Provision for Income Taxes

2,505

2,411

2,360

2,881

3,147

4,916

7,321

Net Income

$

8,115

$

7,831

$

8,873

$

9,629

$

9,816

$

15,946

$

21,458

Average Assets

$

4,646,517

$

4,592,838

$

4,567,446

$

4,504,937

$

4,483,662

$

4,619,678

$

4,444,644

Pre-Provision Net Revenue Return on

Average Assets

0.94

%

0.95

%

0.96

%

1.01

%

1.16

%

0.95

%

1.32

%

Core Net Interest Margin

Net Interest Income (Tax-equivalent

Basis)

$

25,288

$

24,992

$

25,683

$

25,822

$

26,280

$

50,280

$

55,227

Less: Loan Fees

(767

)

(608

)

(751

)

(914

)

(941

)

(1,374

)

(1,939

)

Core Net Interest Income

$

24,521

$

24,384

$

24,932

$

24,908

$

25,339

$

48,906

$

53,288

Average Interest Earning Assets

$

4,545,920

$

4,492,756

$

4,480,428

$

4,416,424

$

4,395,050

$

4,519,338

$

4,359,577

Core Net Interest Margin

2.17

%

2.18

%

2.21

%

2.24

%

2.31

%

2.18

%

2.46

%

Efficiency Ratio

Noninterest Expense

$

15,539

$

15,189

$

15,740

$

15,237

$

14,274

$

30,728

$

28,343

Less: Amortization of Intangible

Assets

(8

)

(9

)

(9

)

(9

)

(34

)

(17

)

(82

)

Adjusted Noninterest Expense

$

15,531

$

15,180

$

15,731

$

15,228

$

14,240

$

30,711

$

28,261

Net Interest Income

$

24,996

$

24,631

$

25,314

$

25,421

$

25,872

$

49,627

$

54,439

Noninterest Income

1,763

1,550

1,409

1,726

1,415

3,313

3,358

Less: Gain (Loss) on Sales of

Securities

(320

)

(93

)

27

—

(50

)

(413

)

6

Adjusted Operating Revenue

$

26,439

$

26,088

$

26,750

$

27,147

$

27,237

$

52,527

$

57,803

Efficiency Ratio

58.7

%

58.2

%

58.8

%

56.1

%

52.3

%

58.5

%

48.9

%

Bridgewater Bancshares, Inc. and

Subsidiaries

Non-GAAP Financial Measures

(dollars in thousands)

(unaudited)

For the Three Months

Ended

For the Six Months

Ended

June 30,

March 31,

December 31,

September 30,

June 30,

June 30,

June 30,

(dollars in thousands)

2024

2024

2023

2023

2023

2024

2023

Tangible Common Equity and Tangible

Common Equity/Tangible Assets

Total Shareholders' Equity

$

439,241

$

433,611

$

425,515

$

415,960

$

409,126

Less: Preferred Stock

(66,514

)

(66,514

)

(66,514

)

(66,514

)

(66,514

)

Total Common Shareholders' Equity

372,727

367,097

359,001

349,446

342,612

Less: Intangible Assets

(2,797

)

(2,806

)

(2,814

)

(2,823

)

(2,832

)

Tangible Common Equity

$

369,930

$

364,291

$

356,187

$

346,623

$

339,780

Total Assets

$

4,687,035

$

4,723,109

$

4,611,990

$

4,557,070

$

4,603,185

Less: Intangible Assets

(2,797

)

(2,806

)

(2,814

)

(2,823

)

(2,832

)

Tangible Assets

$

4,684,238

$

4,720,303

$

4,609,176

$

4,554,247

$

4,600,353

Tangible Common Equity/Tangible Assets

7.90

%

7.72

%

7.73

%

7.61

%

7.39

%

Tangible Book Value Per Share

Book Value Per Common Share

$

13.63

$

13.30

$

12.94

$

12.47

$

12.25

Less: Effects of Intangible Assets

(0.10

)

(0.10

)

(0.10

)

(0.10

)

(0.10

)

Tangible Book Value Per Common Share

$

13.53

$

13.20

$

12.84

$

12.37

$

12.15

Return on Average Tangible Common

Equity

Net Income Available to Common

Shareholders

$

7,101

$

6,818

$

7,859

$

8,616

$

8,802

$

13,919

$

19,431

Average Shareholders' Equity

$

435,585

$

428,248

$

417,789

$

414,047

$

406,347

$

431,916

$

404,948

Less: Average Preferred Stock

(66,514

)

(66,514

)

(66,514

)

(66,514

)

(66,514

)

(66,514

)

(66,514

)

Average Common Equity

369,071

361,734

351,275

347,533

339,833

365,402

338,434

Less: Effects of Average Intangible

Assets

(2,802

)

(2,811

)

(2,819

)

(2,828

)

(2,846

)

(2,806

)

(2,870

)

Average Tangible Common Equity

$

366,269

$

358,923

$

348,456

$

344,705

$

336,987

$

362,596

$

335,564

Return on Average Tangible Common

Equity

7.80

%

7.64

%

8.95

%

9.92

%

10.48

%

7.72

%

11.68

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240723536911/en/

Media Contact: Jessica Stejskal | SVP Marketing

Jessica.Stejskal@bwbmn.com | 952.893.6860

Investor Contact: Justin Horstman | VP Investor Relations

Justin.Horstman@bwbmn.com | 952.542.5169

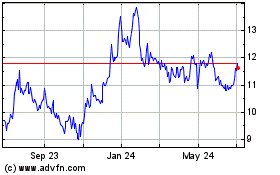

Bridgewater Bancshares (NASDAQ:BWB)

Historical Stock Chart

From Dec 2024 to Jan 2025

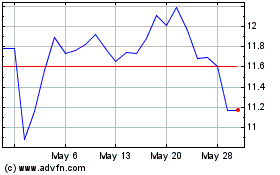

Bridgewater Bancshares (NASDAQ:BWB)

Historical Stock Chart

From Jan 2024 to Jan 2025