Current Report Filing (8-k)

May 27 2021 - 3:18PM

Edgar (US Regulatory)

0001605301FALSE00016053012021-05-242021-05-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 24, 2021

|

|

|

|

|

|

|

|

|

|

|

|

CB FINANCIAL SERVICES, INC.

|

|

|

|

(Exact name of registrant as specified in its charter)

|

|

Commission file number: 001-36706

|

|

|

|

|

|

|

|

|

|

|

Pennsylvania

|

|

51-0534721

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100 N. Market Street,

|

Carmichaels,

|

PA

|

|

|

15320

|

|

|

|

(Address of principal executive offices)

|

|

|

(Zip code)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(724)

|

966-5041

|

|

|

|

|

(Registrant’s telephone number, including area code)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Not Applicable

|

|

|

|

(Former name or former address, if changed since last report)

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock, par value $0.4167 per share

|

|

CBFV

|

|

The Nasdaq Stock Market, LLC

|

|

(Title of each class)

|

|

(Trading symbol)

|

|

(Name of each exchange on which registered)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standard provided pursuant to Section 13(a) of the Exchange

Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

In furtherance of the implementation of strategic initiatives to optimize the operations of Community Bank, the bank subsidiary of CB Financial Services, Inc. (the “Company”), as previously reported in a Current Report on Form 8-K filed on February 23, 2021, Community Bank, on May 24, 2021, entered into two definitive agreements with The Lab Consulting, a workflow optimization consulting firm.

One agreement, referred to therein as the “Improving Financial Services Operations: The Banking Operations Factories (BOF) Initiative” (the “BOF Initiative Agreement”), outlines the services The Lab Consulting will provide to Community Bank to optimize its branch office operations and back office operations. For these services, Community Bank will pay a fee of $1,048,500 to The Lab Consulting, payable in equal consecutive monthly installments of $174,750 over a 6-month period beginning June 2021. Community Bank will also reimburse The Lab Consulting for its reimbursable expenses and any licensing costs. For further information, reference is made to the copy of the BOF Initiative Agreement, which is filed as Exhibit 99.1 hereto and incorporated into this Item 1.01 by reference.

The other agreement, referred to therein as the “Improving Financial Services Operations: The Lending Sales Factories (LSF) Initiative” (the “LSF Initiative Agreement”), outlines the services The Lab Consulting will provide to Community Bank to optimize and enhance the loan origination activities at its branch office. For these services, Community Bank will pay a fee of $751,200 to The Lab Consulting, payable in equal consecutive monthly installments of $150,240 over a 5-month period beginning June 2021. Community Bank will also reimburse The Lab Consulting for its reimbursable expenses and any licensing costs. For further information, reference is made to the copy of the LSF Initiative Agreement, which is filed as Exhibit 99.2 hereto and incorporated into this Item 1.01 by reference.

Item 7.01. Regulation FD Disclosure.

The Company anticipates that it will realize estimated cost savings ranging from approximately $2.5 million to $3.5 million during the year ending December 31, 2022 as a result of the expected operational efficiencies to be realized by Community Bank as a result of the implementation of the optimization initiatives contemplated by the services to be rendered by The Lab Consulting.

Item 9.01. Financial Statements and Exhibits.

(a)Not applicable.

(b)Not applicable.

(c)Not applicable

(d)Exhibits

101 Cover Page Interactive Data File (embedded in Inline XBRL)

Statements contained in this Current Report on Form 8-K that are not historical facts may constitute forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995 and such forward-looking statements are subject to significant risks and uncertainties. The Company intends such forward-looking statements to be covered by the safe harbor provisions contained in the Act. The Company’s ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on the operations and future prospects of the Company and its subsidiaries include, but are not limited to, general and local economic conditions, the scope and duration of economic contraction as a result of the COVID-19 pandemic and its effects on the Company’s business and that of the Company’s customers, changes in market interest rates, deposit flows, demand for loans, real estate values and competition, competitive products and pricing, the ability of the Company’s customers to make scheduled loan payments, loan delinquency rates and trends, the Company’s ability to manage the risks involved in its business, its ability to control costs and expenses, inflation, market and monetary fluctuations, changes in federal and state legislation and regulation applicable to the Company’s business, actions by the Company’s competitors, and other factors that may be disclosed in the Company’s periodic reports as filed with the Securities and Exchange Commission. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. The Company assumes no obligation to update any forward-looking statements except as may be required by applicable law or regulation.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

CB FINANCIAL SERVICES, INC.

|

|

|

|

|

|

|

|

|

|

Date: May 26, 2021

|

By:

|

/s/ John H. Montgomery

|

|

|

|

John H. Montgomery

|

|

|

|

President and Chief Executive Officer

|

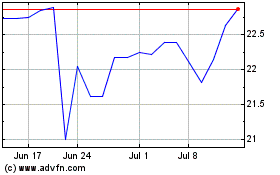

CB Financial Services (NASDAQ:CBFV)

Historical Stock Chart

From Jun 2024 to Jul 2024

CB Financial Services (NASDAQ:CBFV)

Historical Stock Chart

From Jul 2023 to Jul 2024