UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED

IN STATEMENTS FILED PURSUANT

TO § 240.13d-1(a)

AND AMENDMENTS THERETO FILED PURSUANT TO

§ 240.13d-2(a)

(Amendment No. 54)1

CRACKER BARREL OLD COUNTRY STORE, INC.

(Name

of Issuer)

Common Stock, par value $0.01 per share

(Title of Class of Securities)

22410J106

(CUSIP Number)

Sardar Biglari

Biglari Capital Corp.

19100 Ridgewood Pkwy, Suite 1200

San Antonio, Texas 78259

(210) 344-3400

with copies to:

Steve Wolosky, Esq.

Olshan Frome Wolosky LLP

1325 Avenue of the Americas

New

York, New York 10019

(212)

451-2300

(Name, Address and Telephone Number of Person

Authorized to Receive Notices

and Communications)

August 16, 2024

(Date of Event Which Requires

Filing of This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following

box ¨.

Note: Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

§ 240.13d-7 for other parties to whom copies are to be sent.

1

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided

in a prior cover page.

The information required

on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject

to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

The Lion Fund II, L.P. |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

AF |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Delaware |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

2,000,000 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

-0- |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

2,000,000 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

-0- |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

2,000,000 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

9.0% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

PN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Biglari Capital Corp. |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

AF |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Texas |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

2,000,000 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

-0- |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

2,000,000 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

-0- |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

2,000,000 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

9.0% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

First Guard Insurance Company |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

WC |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Arizona |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

62,300 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

-0- |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

62,300 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

-0- |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

62,300 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

Less than 1% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Southern Pioneer Property and Casualty Insurance Company |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

WC |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Arkansas |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

6,841 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

-0- |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

6,841 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

-0- |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

6,841 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

Less than 1% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Biglari Reinsurance Ltd. |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Bermuda |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

69,141 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

-0- |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

69,141 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

-0- |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

69,141 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

Less than 1% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

CO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Biglari Insurance Group Inc. |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Delaware |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

69,141 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

-0- |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

69,141 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

-0- |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

69,141 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

Less than 1% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

CO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Biglari Holdings Inc. |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Indiana |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

69,141 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

-0- |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

69,141 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

-0- |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

69,141 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

Less than 1% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

CO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Sardar Biglari |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

AF |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

USA |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

2,069,141 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

-0- |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

2,069,141 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

-0- |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

2,069,141 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

9.3% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IN |

|

The following constitutes

Amendment No. 54 to the Schedule 13D filed by the undersigned (“Amendment No. 54”). This Amendment No. 54 amends the Schedule

13D as specifically set forth herein.

| Item 2. | Identity and Background. |

Item 2 is hereby amended

and restated to read as follows:

(a) This

statement is filed by The Lion Fund II, L.P., a Delaware limited partnership (“The Lion Fund II”), Biglari Capital Corp.,

a Texas limited liability company (“BCC”), First Guard Insurance Company, an Arizona corporation (“First Guard”),

Southern Pioneer Property and Casualty Insurance Company, an Arkansas corporation (“Southern Pioneer”), Biglari Reinsurance

Ltd., a Bermuda corporation (“Biglari Reinsurance”), Biglari Insurance Group Inc., a Delaware corporation (“Biglari

Insurance”), Biglari Holdings Inc., an Indiana corporation (“Biglari Holdings”), and Sardar Biglari. Each of the foregoing

is referred to as a “Reporting Person” and collectively as the “Reporting Persons.” Each of the Reporting Persons

is party to that certain Joint Filing and Solicitation Agreement as further described in Item 6. Accordingly, the Reporting Persons are

hereby filing a joint Schedule 13D.

BCC is the general partner

of The Lion Fund II. Sardar Biglari is the Chairman and Chief Executive Officer of BCC and has investment discretion over the securities

owned by The Lion Fund II. By virtue of these relationships, BCC and Sardar Biglari may be deemed to beneficially own the Shares owned

directly by The Lion Fund II.

Biglari Reinsurance is the

direct parent company of each of First Guard and Southern Pioneer. Biglari Insurance is the direct parent company of Biglari Reinsurance.

Biglari Holdings is the direct parent company of Biglari Insurance. Sardar Biglari is the Chairman and Chief Executive Officer of Biglari

Holdings and has investment discretion over the securities owned by each of First Guard and Southern Pioneer. By virtue of these relationships,

Biglari Reinsurance, Biglari Insurance, Biglari Holdings and Sardar Biglari may be deemed to beneficially own the Shares owned directly

by each of First Guard and Southern Pioneer.

Set forth on Schedule

A annexed hereto (“Schedule A”) is the name and present principal occupation or employment, and the name, principal business

and address of any corporation or other organization in which such employment is conducted, of each of the executive officers and directors

of each of First Guard, Southern Pioneer, Biglari Reinsurance, Biglari Insurance and Biglari Holdings. To the best of the Reporting Persons’

knowledge, except as otherwise set forth herein, other than Mr. Biglari, none of the persons listed on Schedule A or any of the Nominees

(as defined below) beneficially owns any securities of the Issuer or is a party to any contract, agreement or understanding required to

be disclosed herein.

(b) The

principal business address of each of The Lion Fund II, BCC, Biglari Holdings, Biglari Insurance and Sardar Biglari is 19100 Ridgewood

Parkway, Suite 1200, San Antonio, Texas 78259. The principal business address of First Guard is 240 Nokomis Ave S., Venice, Florida 34285.

The principal business address of Southern Pioneer is 2816 Longview Drive, Jonesboro, Arkansas 72401. The principal business address of

Biglari Reinsurance is 141 Front St., Hamilton HM 19, Bermuda.

(c) The

principal business of The Lion Fund II is purchasing, holding and selling securities for investment purposes. The principal business of

BCC is serving as the general partner of The Lion Fund II and The Lion Fund, L.P. The principal business of First Guard is serving as

a direct underwriter of commercial truck insurance. The principal business of Southern Pioneer is providing property and casualty insurance.

The principal business of Biglari Reinsurance is serving as the direct parent of each of First Guard and Southern Pioneer. The principal

business of Biglari Insurance is serving as the direct parent of Biglari Reinsurance. The principal business of Biglari Holdings is serving

as a holding company owning subsidiaries engaged in a number of diverse business activities, including property and casualty insurance,

licensing and media, restaurants, and oil and gas. The principal occupation of Sardar Biglari is serving as Chairman and Chief Executive

Officer of Biglari Holdings and BCC.

(d) No

Reporting Person or any person listed on Schedule A has, during the last five years, been convicted in a criminal proceeding (excluding

traffic violations or similar misdemeanors).

(e) No

Reporting Person or any person listed on Schedule A has, during the last five years, been party to a civil proceeding of a judicial or

administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order

enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation

with respect to such laws.

(f) The

Lion Fund II is organized under the laws of the State of Delaware. BCC is organized under the laws of the State of Texas. First Guard

is organized under the laws of the State of Arizona. Southern Pioneer is organized under the laws of the State of Arkansas. Biglari Reinsurance

is organized under the laws of Bermuda. Biglari Insurance is organized under the laws of the State of Delaware. Biglari Holdings is organized

under the laws of the State of Indiana. Mr. Biglari is a citizen of the United States of America. The citizenships of the persons listed

on Schedule A are set forth thereon.

| Item 3. | Source and Amount of Funds or Other Consideration. |

Item 3 is hereby amended and restated to read

as follows:

The aggregate purchase price

of the 2,000,000 Shares owned directly by The Lion Fund II is approximately $101,774,800. The Shares owned directly by The Lion Fund II

were acquired with funds of affiliated entities that initially purchased the Shares prior to their contribution to The Lion Fund II.

The Lion Fund II effects

purchases of securities primarily through margin accounts maintained for it with prime brokers, which may extend margin credit to it as

and when required to open or carry positions in the margin accounts, subject to applicable federal margin regulations, stock exchange

rules and the prime brokers’ credit policies. In such instances, the positions held in the margin accounts are pledged as collateral

security for the repayment of debit balances in the accounts.

The aggregate purchase price

of the 62,300 Shares owned directly by First Guard is approximately $5,065,302. The Shares purchased by First Guard were purchased with

working capital (which may, at any given time, include margin loans made by brokerage firms in the ordinary course of business) in open

market purchases, except as otherwise noted.

The aggregate purchase price

of the 6,841 Shares owned directly by Southern Pioneer is approximately $523,129. The Shares purchased by Southern Pioneer were purchased

with working capital (which may, at any given time, include margin loans made by brokerage firms in the ordinary course of business) in

open market purchases, except as otherwise noted.

| Item 4. | Purpose of Transaction. |

Item 4 is hereby amended

to add the following:

On August 16, 2024, the Reporting

Persons delivered a letter to the Issuer nominating Milena Alberti-Perez, Julie Atkinson, Sardar Biglari and Michael W. Goodwin (collectively,

the “Initial Nominees”) for election to the Board at the 2024 annual meeting of shareholders of the Issuer (the “Annual

Meeting”). On August 18, 2024, the Reporting Persons delivered a supplemental letter to the Issuer nominating Michelle Frymire (together

with the Initial Nominees, each, a “Nominee” and collectively, the “Nominees”) for election to the Board at the

Annual Meeting.

Milena Alberti-Perez has

served on the boards of directors of Digimarc Corp. (NASDAQ: DMRC), a provider of enterprise software and services, since April 2022,

Pitney Bowes Inc. (NYSE: PBI), a shipping and mailing company that provides technology, logistics and financial services, since May 2023

and Allurion Technologies, Inc. (NYSE: ALUR), a company dedicated to ending obesity, since March 2024. Ms. Alberti-Perez was most recently

the Chief Financial Officer at Getty Images Holding, Inc. (NYSE: GETY), a visual media company, from January 2021 to January 2022. Previously,

Ms. Alberti-Perez was Chief Financial Officer at MediaMath, Inc., a demand-side platform for programmatic marketing and advertising, from

January 2020 to December 2020. Prior to this, Ms. Alberti-Perez held various financial and publishing roles at Penguin Random House LLC

(“Penguin Random House”), a multinational publishing company, including Global and U.S. Chief Financial Officer from 2015

to 2017, Senior Vice President of Global Corporate Finance from 2014 to 2015, Senior Vice President of Corporate Development from 2011

to 2014, Vice President of Mergers & Acquisitions from 2010 to 2011, Director of Spanish Language Publishing from 2004 to 2010, and

Director of Corporate Development from 2001 to 2004. Earlier in her career, Ms. Alberti-Perez was an associate in Latin American Equity

Research at Morgan Stanley (NYSE: MS), a multinational investment management and financial services company, from 1997 to 1999, and a

financial analyst at Lehman Brothers Holdings Inc., which was an American global financial services firm, from 1995 to 1997. Ms. Alberti-Perez

has served on the boards of directors of International Literary Properties, a company focused on securing literary intellectual property

rights, where she also serves as a Senior Advisor, since July 2024, Overdrive, Inc., a digital content distributor, since September 2020,

and RBmedia, an audiobook publishing company, since 2018. Ms. Alberti-Perez previously served on the boards of directors of Penguin Random

House as a non-voting board member and a member of its audit committee from 2015 to 2017, Companhia das Letras, the largest publishing

house in São Paulo, from 2016 to 2017, and FlatWorld (f/k/a Flat World Knowledge), a publisher of college-level textbooks and educational

supplements, as an observer from 2011 to 2016. Ms. Alberti-Perez has also served on the boards of National Public Radio, Inc., a public

broadcasting organization, since May 2023, the Wild Bird Fund, New York City’s only wildlife rehabilitation center, since October

2019, and Jumpstart, a national early education organization, since 2015. Ms. Alberti-Perez is a member of the Latino Corporate Directors

Association, a non-profit organization, since 2018. Ms. Alberti-Perez previously served on the boards of directors of THE CITY, a non-profit

news organization, from June 2019 to January 2021, and the University of Pennsylvania’s Executive Fund, the annual giving fund of

the University of Pennsylvania, from 2015 to April 2021. Ms. Alberti-Perez received an M.B.A. from the Harvard Business School and a B.A.

in Economics from The University of Pennsylvania.

Julie Atkinson has served

on the boards of directors of Bright Horizons Family Solutions Inc. (NYSE: BFAM), an educational support services company, since 2017,

Rewards Network Establishment Services Inc., a fintech company providing marketing for the restaurant industry, since December 2021 and

Inn on Boltwood (f/k/a The Lord Jeffery Inn), a historic hotel, since 2017. Ms. Atkinson served as Chief Marketing Officer of Founders

Table Restaurant Group, LLC, a restaurant company, from October 2019 to January 2023. Prior to that, Ms. Atkinson served as Senior Vice

President, Global Digital of Tory Burch LLC, a luxury lifestyle brand, from 2017 to 2018. Prior to that, Ms. Atkinson held various roles

of increasing responsibility at Starwood Hotels & Resorts Worldwide, Inc. (formerly NYSE: HOT), a hospitality company, including Senior

Vice President, Global Digital from 2014 to 2017, Vice President of Global Online Distribution from 2012 to 2014, and Senior Director

of Online Sales and Distribution from 2008 to 2012. Prior to that, Ms. Atkinson held various roles at Travelocity Global, an online travel

agency, including Director of Marketing, Operations and Revenue from 2007 to 2008, Director of Hotel Product Marketing from 2004 to 2007,

and Product Manager from 2001 to 2003. Additionally, Ms. Atkinson served on the board of directors of Ventoux CCM Acquisition Corp. (formerly

NASDAQ: VTAQ), a special purpose acquisition company, from December 2020 to September 2022 following the completion of a business combination

transaction. Ms. Atkinson received a B.A. in English and Political Science from Amherst College.

Sardar Biglari has served as Chairman

of the Board of Directors and Chief Executive Officer of Biglari Holdings (NYSE: BH, BH-A), a holding company owning subsidiaries engaged

in a number of diverse business activities, since 2008. In his capacity as Chairman and Chief Executive Officer of Biglari Holdings, Mr.

Biglari serves as a director, Chairman and/or Chief Executive Officer of certain of Biglari Holdings’ subsidiaries, including Steak

n Shake Inc., an American brand serving premium burgers and shakes. Mr. Biglari has also served as Chairman and Chief Executive Officer

of BCC, of which he is the sole owner, and which is the general partner of The Lion Fund, L.P. and The Lion Fund II, private investment

partnerships, since its inception in 2000. Mr. Biglari has served on the board of directors of Abraxas Petroleum Corporation (formerly

OTCQX: AXAS), a crude oil and natural gas exploration and production company, since September 2022. Mr. Biglari received a B.S. in Business

Administration from Trinity University.

Michael W. Goodwin has served on

the board of directors of Burlington Stores, Inc. (NYSE: BURL), a department store retailer, since December 2020. Mr. Goodwin most recently

served as Senior Vice President of Information Technology and Chief Technology Information Officer of PetSmart, Inc., a specialty provider

of pet products and services, from 2014 to January 2023. Prior to that, Mr. Goodwin held several positions of increasing responsibility

at Hallmark Cards, Incorporated (“Hallmark”), a manufacturer and publisher of greeting cards and gifts, from 1990 to 2014,

ultimately serving as Senior Vice President and Chief Information Officer and Business Enablement, from 2006 to 2014. Prior to Hallmark,

Mr. Goodwin served as a Field Artillery Officer in the United States Army, from 1982 to 1990. Mr. Goodwin has served on the boards of

directors of Eckerd Connects, a non-profit organization specializing in workforce development for underserved populations, since June

2023, and Telecare Corporation, a provider of mental health services, since August 2023. Mr. Goodwin has also served as a member of the

Strategic Council of Plexus Worldwide, LLC, a science-based health and wellness company, since October 2022. Mr. Goodwin earned an M.B.A.

from the University of Kansas Graduate School of Business and a B.S. in Computer Science from the United States Military Academy at West

Point.

Michelle Frymire has served on the

boards of directors of NCR Atleos Corporation (NYSE: NATL), a financial technology company expanding self-service financial access, since

October 2023 and Sonder Holdings Inc. (NASDAQ: SOND), a hospitality company, since September 2022. Ms. Frymire has also served on the

board of directors of Six Flags Entertainment Corporation (NYSE: FUN), an amusement park corporation, since July 2024, following its merger

with Cedar Fair, L.P., a regional amusement-resort operator, where she served on the board of directors, from October 2022 to July 2024.

Previously, Ms. Frymire held several positions of increasing responsibility at CWT (f/k/a Carlson Wagonlit Travel), a leader in travel

management technology, including Chief Executive Officer, from May 2021 to May 2022. Ms. Frymire was responsible for leading the company

through and beyond the impact of the COVID-19 pandemic, driving the company’s global strategy and overseeing significant investment

in the company’s product and technology platforms. Prior to serving as Chief Executive Officer of CWT, Ms. Frymire served as President,

Strategy and Transformation and Chief Financial Officer, from September 2020 to May 2021, Executive Vice President, Chief Finance and

Strategy Officer, from May 2020 to September 2020, and Executive Vice President and Chief Financial Officer, from January 2019 to April

2020. Prior to joining CWT, Ms. Frymire served as Chief Financial Officer of U.S. Risk Insurance Group, LLC, a specialty lines underwriting

manager and wholesale broker, from 2017 to January 2019. Prior to that, Ms. Frymire served as Chief Financial Officer of Service King

Collision Repair Centers (n/k/a Crash Champions), an auto body collision repair company, from 2015 to 2017. Prior to that, Ms. Frymire

held various roles at The Service Master Companies, Inc., a residential and commercial services company, including Vice President, FP&A

and Strategy, from 2014 to 2015, and Chief Financial Officer of TruGreen Lawncare, from 2009 to 2013. From 2005 to 2009, Ms. Frymire served

as Chief Financial Officer of Vacation Ownership at Starwood Hotels & Resorts Worldwide, Inc., a hospitality company. Prior to that,

Ms. Frymire held various positions at Delta Air Lines, Inc. (NYSE: DAL), a global airline carrier, including Vice President, Finance,

Marketing, International, Network and Technology, from 1998 to 2005. Ms. Frymire previously served on the board of directors of Spirit

Realty Capital, Inc. (formerly NYSE: SRC), a triple net lease real estate investment trust, from May 2021 to January 2024. Ms. Frymire

also served as a member of the United States Travel and Tourism Advisory Board, from March 2022 to November 2022. Ms. Frymire received

an M.B.A. from the University of Texas McCombs School of Business and a B.A. in Economics from Austin College.

| Item 5. | Interest in Securities of the Issuer. |

Item 5 is hereby amended

and restated to read as follows:

(a – e) The aggregate

percentage of Shares reported owned by the Reporting Persons is based upon 22,202,296 Shares outstanding as of May 23, 2024, which is

the total number of Shares outstanding as reported in the Issuer’s Quarterly Report on Form 10-Q filed with the Securities and Exchange

Commission on May 30, 2024.

As of the close of business

on August 20, 2024, The Lion Fund II owned directly 2,000,000 Shares, constituting approximately 9.0% of the Shares outstanding. By virtue

of their relationships with The Lion Fund II, each of BCC and Sardar Biglari may be deemed to beneficially own the Shares owned by The

Lion Fund II.

As of the close of business

on August 20, 2024, First Guard owned directly 62,300 Shares, constituting less than 1% of the Shares outstanding. By virtue of their

relationships with First Guard, each of Biglari Reinsurance, Biglari Insurance, Biglari Holdings and Sardar Biglari may be deemed to beneficially

own the Shares owned directly by First Guard.

As of the close of business

on August 20, 2024, Southern Pioneer owned directly 6,841 Shares, constituting less than 1% of the Shares outstanding. By virtue of their

relationships with Southern Pioneer, each of Biglari Reinsurance, Biglari Insurance, Biglari Holdings and Sardar Biglari may be deemed

to beneficially own the Shares owned directly by Southern Pioneer.

An aggregate of 2,069,141

Shares, constituting approximately 9.3% of the Shares outstanding, are reported by the Reporting Persons in this statement.

None of the Nominees or any

person set forth on Schedule A, other than Mr. Biglari, beneficially owns any Shares as of the date hereof.

By virtue of his relationships

with the other Reporting Persons, Sardar Biglari may be deemed to have the sole power to vote and dispose of the Shares owned directly

by The Lion Fund II, First Guard and Southern Pioneer.

There have been no transactions

in securities of the Issuer by the Reporting Persons during the past sixty days.

No person other than the

Reporting Persons is known to have the right to receive, or the power to direct the receipt of dividends from, or proceeds from the sale

of, the Shares.

The

filing of this Schedule 13D shall not be deemed an admission that any of the Reporting Persons is, for purposes of Section 13(d) of the

Securities Exchange Act of 1934, as amended, the beneficial owner of any Shares he or it does not directly own. Each of the Reporting

Persons specifically disclaims beneficial ownership of the Shares reported herein that he or it does not directly own.

| Item 6. | Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer. |

Item 6 is hereby amended

to add the following:

On

August 16, 2024, the Reporting Persons and the Initial Nominees entered into a Joint Filing and Solicitation Agreement (the “Joint

Filing and Solicitation Agreement”) in which, among other things, (i) the Reporting Persons and the Initial Nominees agreed to jointly

file a statement on Schedule 13D, and any amendments thereto, with respect to securities of the Company to the extent required by applicable

law, (ii) the Reporting Persons and the Initial Nominees agreed to solicit proxies for the election of certain persons nominated for election

to the Board at the Annual Meeting (including those nominated by or on behalf of the Reporting Persons), (iii) the Reporting Persons and

the Initial Nominees agreed to take all other action necessary to achieve the foregoing, and (iv) the Reporting Persons agreed to bear

all expenses incurred in connection with the Reporting Persons’ and the Initial Nominees’ activities, including approved expenses

incurred by any of the parties in connection with the solicitation, subject to certain limitations. The Joint Filing and Solicitation

Agreement is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

On

August 18, 2024, the Reporting Persons and the Nominees entered into a Joinder Agreement

(the “Joinder Agreement”) to the Joint Filing and Solicitation Agreement, pursuant to which Ms.

Frymire agreed to be bound by the terms of the Joint Filing and Solicitation Agreement. The Joinder Agreement is attached hereto

as Exhibit 99.2 and is incorporated herein by reference.

| Item 7. | Material to be Filed as Exhibits. |

Item 7 is hereby amended

to add the following exhibits:

| 99.1 | Joint Filing and Solicitation Agreement, dated August 16, 2024. |

| 99.2 | Joinder Agreement, dated August 18, 2024. |

SIGNATURE

After reasonable inquiry

and to the best of his knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true,

complete and correct.

| |

THE LION FUND II, L.P. |

| |

|

| |

By: |

BIGLARI CAPITAL CORP., its General Partner |

| |

|

|

| |

By: |

/s/ Sardar Biglari |

| |

|

Name: |

Sardar Biglari |

| |

|

Title: |

Chairman and Chief Executive Officer |

| |

BIGLARI CAPITAL CORP. |

| |

|

| |

By: |

/s/ Sardar Biglari |

| |

|

Name: |

Sardar Biglari |

| |

|

Title: |

Chairman and Chief Executive Officer |

| |

FIRST GUARD INSURANCE COMPANY |

| |

|

| |

By: |

/s/ Sardar Biglari |

| |

|

Name: |

Sardar Biglari |

| |

|

Title: |

Authorized Signatory |

| |

SOUTHERN PIONEER PROPERTY AND CASUALTY INSURANCE COMPANY |

| |

|

| |

By: |

/s/ Sardar Biglari |

| |

|

Name: |

Sardar Biglari |

| |

|

Title: |

Authorized Signatory |

| |

BIGLARI REINSURANCE LTD. |

| |

|

| |

By: |

/s/ Sardar Biglari |

| |

|

Name: |

Sardar Biglari |

| |

|

Title: |

Authorized Signatory |

| |

BIGLARI INSURANCE GROUP INC. |

| |

|

| |

By: |

/s/ Sardar Biglari |

| |

|

Name: |

Sardar Biglari |

| |

|

Title: |

Authorized Signatory |

| |

BIGLARI HOLDINGS INC. |

| |

|

| |

By: |

/s/ Sardar Biglari |

| |

|

Name: |

Sardar Biglari |

| |

|

Title: |

Chairman and Chief Executive Officer |

| |

/s/ Sardar Biglari |

| |

SARDAR BIGLARI |

SCHEDULE A

Directors and Executive Officers of First

Guard

NAME AND

POSITION WITH

FIRST GUARD |

PRESENT PRINCIPAL

OCCUPATION |

BUSINESS ADDRESS |

CITIZENSHIP |

|

Edmund B. Campbell, III,

Executive Chairman |

Executive Chairman of First Guard |

240 Nokomis Ave.

S.

Venice, FL

34285 |

U.S.A. |

|

Sardar Biglari,

Director

|

See Item 2 |

See Item 2 |

See Item 2 |

|

Philip L. Cooley,

Director |

Vice Chairman of Biglari Holdings |

19100 Ridgewood Pkwy, Suite 1200

San Antonio, Texas 78259

|

U.S.A. |

|

Anddrew S. Toepfer,

President,

Chief Executive Officer, Treasurer and Director |

President and Chief Executive Officer of First Guard |

240 Nokomis Ave.

S.

Venice, FL

34285 |

U.S.A. |

|

Edmund B. Campbell, Jr.,

Director |

Retired; former Executive at First Guard |

240 Nokomis Ave.

S.

Venice, FL

34285 |

U.S.A. |

|

Courtney Wilson,

Vice President and Secretary

|

Vice President and Secretary at First Guard |

240 Nokomis Ave.

S.

Venice, FL 34285 |

U.S.A. |

|

Daniel Ribar,

Vice President

|

Vice President at First Guard |

240 Nokomis Ave. S.

Venice, FL 34285 |

U.S.A. |

Directors and Executive Officers of Southern

Pioneer

NAME AND

POSITION WITH

SOUTHERN PIONEER |

PRESENT PRINCIPAL

OCCUPATION |

BUSINESS ADDRESS |

CITIZENSHIP |

|

Hal Hyneman,

President and Director |

President of Southern Pioneer |

2816 Longview Drive, Jonesboro, AR 72401 |

U.S.A. |

|

Ben Hyneman,

Chairman of the Board |

Chairman of Hyneman & Associates, Inc. |

2816 Longview Drive, Jonesboro, AR 72401 |

U.S.A. |

|

Sardar Biglari,

Director

|

See Item 2 |

See Item 2 |

See Item 2 |

|

Philip L. Cooley,

Director |

Vice Chairman of Biglari Holdings |

19100 Ridgewood Parkway,

Suite 1200

San Antonio,

TX 78259 |

U.S.A. |

|

Hunter Hyneman,

Vice

President |

Vice President of Southern Pioneer |

2816 Longview Drive, Jonesboro, AR 72401 |

U.S.A. |

|

Brian Hyneman,

Secretary,

Treasurer and Director |

Secretary and Treasurer of Southern Pioneer |

2816 Longview Drive, Jonesboro, AR 72401 |

U.S.A. |

|

Matt Hyneman,

Director

|

Vice President of Hyneman & Associates, Inc. |

2816 Longview Drive, Jonesboro, AR 72401 |

U.S.A. |

|

Anthony Grant,

Director and Vice President

|

Vice President of Southern Pioneer |

2816 Longview Drive, Jonesboro, AR 72401 |

U.S.A. |

|

Rob Shaughnessy,

Vice President

|

Vice President of Southern Pioneer |

2816 Longview Drive, Jonesboro, AR 72401 |

U.S.A. |

|

David O’Quinn,

Vice President

|

Vice President of Southern Pioneer |

2816 Longview Drive, Jonesboro, AR 72401 |

U.S.A. |

Directors and Executive Officers of Biglari

Reinsurance

NAME AND

POSITION WITH

BIGLARI HOLDINGS |

PRESENT PRINCIPAL

OCCUPATION |

BUSINESS ADDRESS |

CITIZENSHIP |

|

Sardar Biglari,

Chairman of the Board and

Chief Executive Officer

|

See Item 2 |

See Item 2 |

See Item 2 |

|

Robert T. Chapman,

Executive Vice President, Chief Operating Officer and Chief

Financial Officer

|

Executive Vice President, Chief Operating Officer and Chief Financial Officer of Biglari Reinsurance and Chief Operating Officer and Secretary of Biglari Insurance |

19100 Ridgewood Parkway,

Suite 1200

San Antonio,

TX 78259 |

U.S.A. |

|

Appleby Global Corporate Services (Bermuda) Ltd.,

Secretary

|

Corporate services provider |

Canon’s Court

22 Victoria Street

Hamilton HM12

Bermuda |

Bermuda |

Directors and Executive Officers of Biglari

Insurance

NAME AND

POSITION WITH

BIGLARI HOLDINGS |

PRESENT PRINCIPAL

OCCUPATION |

BUSINESS ADDRESS |

CITIZENSHIP |

|

Sardar Biglari,

Director and Chairman of the Board

|

See Item 2 |

See Item 2 |

See Item 2 |

|

Robert T. Chapman,

Chief Operating Officer and Secretary |

Executive Vice President, Chief Operating Officer and Chief Financial Officer of Biglari Reinsurance and Chief Operating Officer and Secretary of Biglari Insurance |

19100 Ridgewood Parkway,

Suite 1200

San Antonio,

TX 78259 |

U.S.A. |

Directors and Executive Officers of Biglari

Holdings

NAME AND

POSITION WITH

BIGLARI HOLDINGS |

PRESENT PRINCIPAL

OCCUPATION |

BUSINESS ADDRESS |

CITIZENSHIP |

|

Sardar Biglari,

Chairman of the Board and Chief Executive Officer

|

See Item 2 |

See Item 2 |

See Item 2 |

|

Philip L. Cooley,

Vice Chairman of the Board |

Vice Chairman of the Board of Biglari Holdings |

19100 Ridgewood Parkway,

Suite 1200

San Antonio,

TX 78259 |

U.S.A. |

|

Ruth J. Person,

Director

|

Retired; former professor of Management, University of Michigan-Flint |

19100 Ridgewood Parkway,

Suite 1200

San Antonio,

TX 78259 |

U.S.A. |

|

Kenneth R. Cooper,

Director

|

Attorney |

19100 Ridgewood Parkway,

Suite 1200

San Antonio,

TX 78259 |

U.S.A. |

|

John Garrett Cardwell,

Director

|

Retired; former executive with Johnson Controls, Inc. |

19100 Ridgewood Parkway,

Suite 1200

San Antonio,

TX 78259 |

U.S.A. |

|

Bruce Lewis,

Controller

|

Controller of Biglari Holdings |

19100 Ridgewood Parkway,

Suite 1200

San Antonio,

TX 78259 |

U.S.A. |

Exhibit 99.1

JOINT FILING AND SOLICITATION AGREEMENT

WHEREAS, certain of the

undersigned are shareholders, direct or beneficial, of Cracker Barrel Old Country Store, Inc., a Tennessee corporation (the “Company”);

and

WHEREAS, The Lion Fund

II, L.P., a Delaware limited partnership, Biglari Capital Corp., a Texas limited liability company, First Guard Insurance Company, an

Arizona corporation, Southern Pioneer Property and Casualty Insurance Company, an Arkansas corporation, Biglari Reinsurance Ltd., a Bermuda

corporation, Biglari Insurance Group Inc., a Delaware Corporation, Biglari Holdings Inc., an Indiana corporation and Sardar Biglari (collectively,

“Biglari”), and Michael W. Goodwin, Milena Alberti-Perez and Julie Atkinson (collectively, the “Outside Nominees”)

wish to form a group for the purpose of (i) seeking representation on the Board of Directors of the Company (the “Board”)

at the 2024 annual meeting of shareholders of the Company (including any other meeting of shareholders held in lieu thereof, and any adjournments,

postponements, reschedulings or continuations thereof, the “Annual Meeting”), (ii) soliciting proxies for the election

of certain persons nominated for election to the Board at the Annual Meeting (including those nominated by or on behalf of Biglari), (iii)

taking all other action necessary to achieve the foregoing and (iv) taking any other actions the Group (as defined below) determines to

undertake in connection with their respective investment in the Company (collectively, the “Purposes”).

NOW, IT IS AGREED, this

16th day of August 2024 by the parties hereto:

1.In

accordance with Rule 13d-1(k)(1)(iii) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), each

of the undersigned (collectively, the “Group”) agrees to the joint filing on behalf of each of them of statements on

Schedule 13D, and any amendments thereto, with respect to the securities of the Company to the extent required by applicable law. Each

member of the Group shall be responsible for the accuracy and completeness of his, her or its own disclosure therein, and is not responsible

for the accuracy and completeness of the information concerning the other members, unless such member knows or has reason to know that

such information is inaccurate.

2.So

long as this agreement is in effect, each of the Outside Nominees shall provide written notice to Olshan Frome Wolosky LLP (“Olshan”)

of (i) any of his or her purchases or sales of securities of the Company; or (ii) any securities of the Company over which he or she acquires

or disposes of beneficial ownership. Notice shall be given no later than 24 hours after each such transaction.

3.So

long as this agreement is in effect, each of the Outside Nominees agrees to provide Biglari advance written notice prior to effecting

any purchase, sale, acquisition or disposition of any securities of the Company which he or she has, or would have, direct or indirect

beneficial ownership so that Biglari has an opportunity to review the potential implications of any such transaction in the securities

of the Company and pre-clear any such potential transaction in the securities of the Company by any of the Outside Nominees. Each of the

Outside Nominees agrees that he or she shall not undertake or effect any purchase, sale, acquisition or disposition of any securities

of the Company without the prior written consent of Biglari. For purposes of this agreement, the term “beneficial ownership”

shall have the meaning of such term set forth in Rule 13d-3 under the Exchange Act.

4.Each

of the undersigned agrees to form the Group for the Purposes as set forth above.

5.Biglari

shall have the right to pre-approve all expenses incurred in connection with the Group’s activities and agrees to pay directly all

such pre-approved expenses.

6.Each

of the undersigned agrees that any SEC filing, press release or shareholder communication proposed to be made or issued by the Group or

any member of the Group in connection with the Group’s activities set forth in Section 4 shall be first approved by Biglari.

7.The

relationship of the parties hereto shall be limited to carrying on the business of the Group in accordance with the terms of this agreement.

Such relationship shall be construed and deemed to be for the sole and limited purpose of carrying on such business as described herein.

Nothing herein shall be construed to authorize any party to act as an agent for any other party, or to create a joint venture or partnership,

or to constitute an indemnification. Except as otherwise provided herein, nothing herein shall restrict any party’s right to purchase

or sell securities of the Company, as he, she or it deems appropriate, in his, her or its sole discretion, provided that all such purchases

and sales are made in compliance with all applicable securities laws and the provisions of this agreement.

8.This

agreement may be executed in counterparts, each of which shall be deemed an original and all of which, taken together, shall constitute

but one and the same instrument, which may be sufficiently evidenced by one counterpart.

9.This

agreement is governed by and will be construed in accordance with the laws of the State of New York. In the event of any dispute arising

out of the provisions of this agreement or their investment in the Company, the parties hereto consent and submit to the exclusive jurisdiction

of the United States District Court for the Southern District of New York located in the Borough of Manhattan or the courts of the State

of New York located in the County of New York.

10. The

parties’ rights and obligations under this agreement (other than the rights and obligations set forth in Section 5 and Section 9,

which shall survive any termination of this agreement) shall terminate upon the earlier to occur of (i) the certification of the results

of the Annual Meeting or (ii) Biglari providing written notice of termination to the other parties.

11. Each

party hereby waives the application of any law, regulation, holding, or rule of construction providing that ambiguities in an agreement

or other document will be construed against the party drafting such agreement or document.

12.Each

party acknowledges that Olshan shall act as counsel for both the Group and Biglari and its affiliates relating to their investment in

the Company.

13.Each

of the undersigned parties hereby agrees that this agreement shall be filed as an exhibit to a Schedule 13D pursuant to Rule 13d-1(k)(1)(iii)

under the Exchange Act.

IN WITNESS WHEREOF, the

parties hereto have caused this agreement to be executed as of the day and year first above written.

| |

THE LION FUND II, L.P. |

| |

|

| |

By: |

BIGLARI CAPITAL CORP., its General Partner |

| |

|

|

| |

By: |

/s/ Sardar Biglari |

| |

|

Name: |

Sardar Biglari |

| |

|

Title: |

Chairman and Chief Executive Officer |

| |

BIGLARI CAPITAL CORP. |

| |

|

| |

By: |

/s/ Sardar Biglari |

| |

|

Name: |

Sardar Biglari |

| |

|

Title: |

Chairman and Chief Executive Officer |

| |

FIRST GUARD INSURANCE COMPANY |

| |

|

| |

By: |

/s/ Sardar Biglari |

| |

|

Name: |

Sardar Biglari |

| |

|

Title: |

Authorized Signatory |

| |

SOUTHERN PIONEER PROPERTY AND CASUALTY INSURANCE COMPANY |

| |

|

| |

By: |

/s/ Sardar Biglari |

| |

|

Name: |

Sardar Biglari |

| |

|

Title: |

Authorized Signatory |

| |

BIGLARI REINSURANCE LTD. |

| |

|

| |

By: |

/s/ Sardar Biglari |

| |

|

Name: |

Sardar Biglari |

| |

|

Title: |

Authorized Signatory |

| |

BIGLARI INSURANCE GROUP INC. |

| |

|

| |

By: |

/s/ Sardar Biglari |

| |

|

Name: |

Sardar Biglari |

| |

|

Title: |

Authorized Signatory |

| |

BIGLARI HOLDINGS INC. |

| |

|

| |

By: |

/s/ Sardar Biglari |

| |

|

Name: |

Sardar Biglari |

| |

|

Title: |

Chairman and Chief Executive Officer |

| |

/s/ Sardar Biglari |

| |

SARDAR BIGLARI |

| |

/s/ Michael W. Goodwin |

| |

MICHAEL W. GOODWIN |

| |

/s/ Milena Alberti-Perez |

| |

MILENA ALBERTI-PEREZ |

| |

/s/ Julie Atkinson |

| |

JULIE ATKINSON |

Exhibit 99.2

JOINDER AGREEMENT

This JOINDER AGREEMENT

(the “Joinder”) is dated as of August 18, 2024 by and among The Lion Fund II, L.P., a Delaware limited partnership, Biglari

Capital Corp., a Texas limited liability company, First Guard Insurance Company, an Arizona corporation, Southern Pioneer Property and

Casualty Insurance Company, an Arkansas corporation, Biglari Reinsurance Ltd., a Bermuda corporation, Biglari Insurance Group Inc., a

Delaware Corporation, Biglari Holdings Inc., an Indiana corporation and Sardar Biglari (collectively, “Biglari”), and Michael

W. Goodwin, Milena Alberti-Perez, and Julie Atkinson (collectively, with Biglari, the “Existing Members”) and Michelle McKinney

Frymire (the “New Member”).

WHEREAS, the Existing Members

are parties to that certain Joint Filing and Solicitation Agreement dated as of August 16, 2024 (the “Agreement”), pursuant

to which the Existing Members formed a “group” (as contemplated by Section 13(d) of the Securities Exchange Act of 1934, as

amended) for the purpose of (i) seeking representation on the Board of Directors (the “Board”) of Cracker Barrel Old Country

Store, Inc., a Tennessee corporation (the “Company”) at the 2024 annual meeting of shareholders of the Company (including

any other meeting of shareholders held in lieu thereof, and any adjournments, postponements, reschedulings or continuations thereof, the

“Annual Meeting”), (ii) soliciting proxies for the election of certain persons nominated for election to the Board at the

Annual Meeting (including those nominated by or on behalf of Biglari), (iii) taking all other action necessary to achieve the foregoing

and (iv) taking any other actions the group determines to undertake in connection with their respective investment in the Company.

WHEREAS, the New Member

and Existing Members desire for the New Member to join the group formed by the Existing Members.

NOW, THEREFORE, in consideration

of the promises and of the mutual covenants and agreements of the parties herein contained, the parties hereby agree as follows:

1.

All capitalized terms used, but not defined, herein shall have the meanings ascribed to such terms in the Agreement.

2.

Effective immediately, the New Member is joined as a party to the Agreement.

3.

The New Member agrees to be bound by the terms of the Agreement, including the obligations of a member of the group and the terms

applicable to the Outside Nominees, the terms of which are incorporated herein and made a part hereof.

4.

This Joinder may be executed in counterparts, each of which shall be deemed an original and all of which, taken together, shall

constitute but one and the same instrument, which may be sufficiently evidenced by one counterpart.

[Signatures appear on next

page]

IN WITNESS WHEREOF, the

parties hereto have caused this Joinder Agreement to be executed as of the day and year first above written.

| |

THE LION FUND II, L.P. |

| |

|

| |

By: |

BIGLARI CAPITAL CORP., its General Partner |

| |

|

|

| |

By: |

/s/ Sardar Biglari |

| |

|

Name: |

Sardar Biglari |

| |

|

Title: |

Chairman and Chief Executive Officer |

| |

BIGLARI CAPITAL CORP. |

| |

|

| |

By: |

/s/ Sardar Biglari |

| |

|

Name: |

Sardar Biglari |

| |

|

Title: |

Chairman and Chief Executive Officer |

| |

FIRST GUARD INSURANCE COMPANY |

| |

|

| |

By: |

/s/ Sardar Biglari |

| |

|

Name: |

Sardar Biglari |

| |

|

Title: |

Authorized Signatory |

| |

SOUTHERN PIONEER PROPERTY AND CASUALTY INSURANCE COMPANY |

| |

|

| |

By: |

/s/ Sardar Biglari |

| |

|

Name: |

Sardar Biglari |

| |

|

Title: |

Authorized Signatory |

| |

BIGLARI REINSURANCE LTD. |

| |

|

| |

By: |

/s/ Sardar Biglari |

| |

|

Name: |

Sardar Biglari |

| |

|

Title: |

Authorized Signatory |

| |

BIGLARI INSURANCE GROUP INC. |

| |

|

| |

By: |

/s/ Sardar Biglari |

| |

|

Name: |

Sardar Biglari |

| |

|

Title: |

Authorized Signatory |

| |

BIGLARI HOLDINGS INC. |

| |

|

| |

By: |

/s/ Sardar Biglari |

| |

|

Name: |

Sardar Biglari |

| |

|

Title: |

Chairman and Chief Executive Officer |

| |

/s/ Sardar Biglari |

| |

SARDAR BIGLARI

Individually and as attorney-in-fact for Milena Alberti-Perez, Julie Atkinson,

Michael W. Goodwin and Michelle McKinney Frymire |

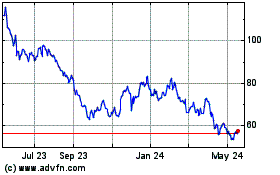

Cracker Barrel Old Count... (NASDAQ:CBRL)

Historical Stock Chart

From Jan 2025 to Feb 2025

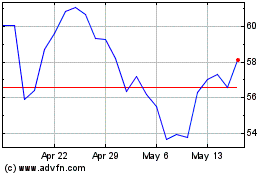

Cracker Barrel Old Count... (NASDAQ:CBRL)

Historical Stock Chart

From Feb 2024 to Feb 2025