Codexis Reports Second Quarter 2024 Financial Results

August 08 2024 - 3:05PM

Codexis, Inc. (NASDAQ: CDXS), a leading enzyme engineering company,

today announced financial results for the second quarter ended June

30, 2024, and provided a business update.

“We’re pleased that our second quarter revenues

are exactly in-line with our expectations. As a result, we are

reiterating our 2024 financial guidance and look forward to a

strong second half of the year, including fulfilling the first

order for our double-stranded RNA ligase. We are confident that we

remain on track to deliver double-digit year-over-year revenue

growth,” said Stephen Dilly, MBBS, PhD, Chief Executive Officer at

Codexis. “Additionally, our technical progress has been faster than

expected. Our groundbreaking TIDES USA presentation demonstrating

the enzymatic synthesis of a full-length siRNA oligonucleotide is

unprecedented. Finally, discussions with multiple potential

partners are active and proceeding well and we anticipate entering

our first technical collaboration for the ECO Synthesis™

manufacturing platform before year-end.”

Second Quarter and Recent Business

Highlights

- At the TIDES USA

annual meeting in May 2024, Codexis presented groundbreaking

enzymatic synthesis data from its ECO Synthesis™ technology

platform to support RNA-based therapeutics manufacturing. During a

Spotlight Presentation, the Company announced it had synthesized

the full-length, sense strand oligonucleotide of the siRNA

therapeutic lumasiran via its enzymatic route. In the manufacturing

of this commercially available oligonucleotide—as well as shorter

sense strand fragments of a second siRNA therapeutic asset,

givosiran—Codexis consistently achieved coupling efficiency greater

than 98%, which is equivalent to what is seen with phosphoramidite

chemistry; executed the enzymatic addition of a conjugation moiety

to the lumasiran strand; and confirmed the lack of notable

impurities typically observed in oligonucleotide synthesis via

phosphoramidite chemistry. A recording of the presentation, along

with slides and the data press release, can be found on the Codexis

corporate website.

- Also at the 2024

TIDES USA annual meeting, Codexis launched its double-stranded RNA

(dsRNA) ligase screening and optimization services. The dsRNA

ligase program is designed to augment and improve traditional

phosphoramidite chemistry by stitching together small, manufactured

strands of RNA. In addition to enabling the more efficient use of

existing chemical synthesis with the potential to reduce overall

costs, the dsRNA ligase provides an opportunity to educate

potential customers on the benefits of incorporating enzymatic

solutions as a complement to their current manufacturing processes.

The Company has already received a low-to-mid-single-digit

million-dollar order for its dsRNA ligase from a large

pharmaceutical customer.

- In July 2024,

the Company further strengthened its commercial leadership with the

appointment of Britton Jimenez to Senior Vice President, Commercial

Operations, reporting to Kevin Norrett, Chief Operating Officer.

Mr. Jimenez brings more than 20 years’ experience with Contract

Development and Manufacturing Organizations to Codexis, which will

provide valuable insights as we position Codexis for our next phase

of growth.

- Codexis

announced in July 2024 that the Company had finalized a purchase

agreement with Crosswalk Therapeutics for two gene therapy assets.

Under the terms of the agreement, Crosswalk acquired the Company’s

investigational Fabry and Pompe disease compounds, and Codexis is

eligible to receive future development and commercial milestone

payments in addition to a low-to-mid single-digit percentage net

sales-based royalty. Both programs were previously part of Codexis’

collaboration agreement with Takeda. In April 2023, Takeda

discontinued its efforts in adeno-associated virus (AAV) gene

therapy, which included these development programs.

Upcoming Milestones for Second Half

2024

- Codexis

continues to expect to enter its first technical collaboration with

the ECO Synthesis™ manufacturing platform by the end of 2024.

- The Company

expects to complete the build-out of its ECO Synthesis™ Innovation

Lab around the end of 2024.

2024 Financial Guidance

Reiterated

Codexis reiterated its full-year 2024 financial

guidance originally issued on February 28, 2024, as follows:

- Product revenues

are expected to be in the range of $38 million to $42 million,

excluding revenue related to PAXLOVID™.

- R&D revenues

are expected to be in the range of $18 million to $22 million.

- Gross margin on

product revenue is expected to be in the range of 58% to 63%,

excluding revenue related to PAXLOVID™.

Second Quarter

2024 Financial Highlights

- As of June 30,

2024, the Company had $73.2 million in cash, cash equivalents and

short-term investments, which is expected to fund planned

operations through positive cash flow, anticipated around the end

of 2026.

- Product and

R&D revenues for the second quarter 2024 were in-line with

guidance provided during the Company’s Q1 2024 financial results

call. Total revenues were $8.0 million for second quarter 2024

compared to $21.3 million in second quarter 2023. Product revenues

were $6.3 million for second quarter 2024 compared to $11.0 million

in second quarter 2023, driven by timing of customer orders.

R&D revenues for second quarter 2024 were $1.7 million compared

to $10.3 million in second quarter 2023; the decrease was primarily

due to lower non-recurring items, including for Biotherapeutics

programs that the Company previously discontinued and a one-time,

non-cash license fee.

- Product gross

margin was 45% for second quarter 2024 compared to 71% in second

quarter 2023. The decline in gross margin was largely due to

variability in the product mix.

- R&D expenses

for second quarter 2024 were $11.4 million compared to $17.3

million in second quarter 2023; the decrease was primarily driven

by a decrease in costs associated with lower headcount, lower use

of outside services related to Chemistry, Manufacturing and

Controls and lower regulatory expenses, a decrease in lease and

facilities costs due to the assignment of the Company’s San Carlos

facility lease during the fourth quarter of 2023, and lower

stock-based compensation costs.

- Selling, General

& Administrative expenses for second quarter 2024 were $15.7

million compared to $13.4 million in second quarter 2023; the

increase was primarily due to higher stock-based compensation

expense, including a one-time, non-cash modification expense of $2

million, and an increase in facilities associated costs, partially

offset by a decrease in costs associated with lower headcount.

- The net loss for

second quarter 2024 was $22.8 million, or $0.32 per share, compared

to a net loss of $11.5 million, or $0.17 per share, for second

quarter 2023.

Conference Call and Webcast

Codexis will hold a conference call and webcast

today beginning at 4:30 pm ET. A live webcast and slide

presentation to accompany the conference call will be

available on the Investors section of the Company website

at www.codexis.com/investors. The conference call dial-in

numbers are 877-705-2976 for domestic callers and 201-689-8798 for

international callers.

A telephone recording of the call will be

available for 48 hours beginning approximately two hours after the

completion of the call by dialing 877-660-6853 for domestic callers

or 201-612-7415 for international callers. Please use the passcode

13726635 to access the recording. A webcast replay will be

available on the Investors section of the Company

website for at least 90 days, beginning approximately two

hours after the completion of the call.

About Codexis

Codexis is a leading enzyme engineering company

leveraging its proprietary CodeEvolver® technology platform to

discover, develop and enhance novel, high-performance enzymes and

other classes of proteins. Codexis enzymes solve for real-world

challenges associated with small molecule pharmaceuticals

manufacturing and nucleic acid synthesis. The Company is currently

developing its proprietary ECO Synthesis™ manufacturing platform to

enable the scaled manufacture of RNAi therapeutics through an

enzymatic route. Codexis’ unique enzymes can drive improvements

such as higher yields, reduced energy usage and waste generation,

improved efficiency in manufacturing and greater sensitivity in

genomic and diagnostic applications. For more information,

visit https://www.codexis.com.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. In some cases, you can identify

forward-looking statements by terminology such as “aim,”

“anticipate,” “assume,” “believe,” “contemplate,” “continue,”

“could,” “design,” “due,” “estimate,” “expect,” “goal,” “intend,”

“may,” “objective,” “plan,” “positioned,” “potential,” “predict,”

“seek,” “should,” “suggest,” “target,” “on track,” “will,” “would”

and other similar expressions that are predictions of or indicate

future events and future trends, or the negative of these terms or

other comparable terminology. To the extent that statements

contained in this press release are not descriptions of historical

facts, they are forward-looking statements reflecting the current

beliefs and expectations of management, including but not limited

to statements regarding anticipated milestones, including product

launches, technical milestones, data releases and public

announcements related thereto; whether Codexis will be able to, and

the timing of it entering its first technical collaboration with

its ECO Synthesis™ manufacturing platform in 2024; whether Codexis

will be able to, and the timing of it substantially completing, the

build-out of its planned ECO Synthesis™ Innovation Lab around the

end of 2024; Codexis’ expectations regarding 2024 product revenues,

R&D revenues and gross margin on product revenue, as well as

its ability to fund planned operations through the end of 2026;

Codexis’ ability to achieve positive cash flow around the end of

2026; the potential of such dsRNA ligase to, among other things,

augment and improve traditional phosphoramidite chemistry, enable

more efficient use of existing manufacturing infrastructure and

reduce overall costs; potential receipt by Codexis of certain

milestone and royalty payments pursuant to its recent asset

purchase agreement with Crosswalk Therapeutics; the potential of

the ECO Synthesis™ manufacturing platform, including its ability to

be broadly utilized and to enable commercial-scale manufacture of

RNAi therapeutics through an enzymatic route; and expectations

regarding future demand for dsRNA. You should not place undue

reliance on these forward-looking statements because they involve

known and unknown risks, uncertainties and other factors that are,

in some cases, beyond Codexis’ control and that could materially

affect actual results. Factors that could materially affect actual

results include, among others: Codexis’ dependence on its licensees

and collaborators; if any of its collaborators terminate their

development programs under their respective license agreements with

Codexis; Codexis may need additional capital in the future in order

to expand its business; if Codexis is unable to successfully

develop new technology such as its ECO Synthesis™ manufacturing

platform and dsRNA ligase; Codexis’ dependence on a limited number

of products and customers, and potential adverse effects to

Codexis’ business if its customers’ products are not received well

in the markets; if Codexis is unable to develop and commercialize

new products for its target markets; if competitors and potential

competitors who have greater resources and experience than Codexis

develop products and technologies that make Codexis’ products and

technologies obsolete; Codexis’ ability to comply with debt

covenants under its loan facility; if Codexis is unable to

accurately forecast financial and operational performance; and

market and economic conditions may negatively impact Codexis

business, financial condition and share price. Additional

information about factors that could materially affect actual

results can be found in Codexis’ Annual Report on Form 10-K filed

with the Securities and Exchange Commission (SEC) on February 28,

2024 and in Codexis’ Quarterly Report on Form 10-Q filed with the

SEC on or about the date hereof, including under the caption “Risk

Factors,” and in Codexis’ other periodic reports filed with the

SEC. Codexis expressly disclaims any intent or obligation to update

these forward-looking statements, except as required by law.

Codexis’ results for the quarter ended June 30, 2024, are not

necessarily indicative of our operating results for any future

periods.

For More InformationInvestor ContactCarrie

McKim(336) 608-9706ir@codexis.com

Media ContactLauren Musto(650) 421-8205media@codexis.com

| |

|

Codexis, Inc.Condensed Consolidated

Statements of

Operations(Unaudited)(In

Thousands, Except Per Share Amounts) |

| |

|

|

|

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Revenues: |

|

|

|

|

|

|

|

|

Product revenue |

$ |

6,259 |

|

|

$ |

11,048 |

|

|

$ |

15,810 |

|

|

$ |

19,412 |

|

|

Research and development revenue |

|

1,720 |

|

|

|

10,275 |

|

|

|

9,242 |

|

|

|

14,893 |

|

| Total revenues |

|

7,979 |

|

|

|

21,323 |

|

|

|

25,052 |

|

|

|

34,305 |

|

| Costs and operating

expenses: |

|

|

|

|

|

|

|

|

Cost of product revenue |

|

3,462 |

|

|

|

3,178 |

|

|

|

8,317 |

|

|

|

7,698 |

|

|

Research and development |

|

11,413 |

|

|

|

17,334 |

|

|

|

22,659 |

|

|

|

33,988 |

|

|

Selling, general and administrative |

|

15,671 |

|

|

|

13,365 |

|

|

|

28,531 |

|

|

|

28,765 |

|

|

Restructuring charges |

|

— |

|

|

|

72 |

|

|

|

— |

|

|

|

145 |

|

|

Asset impairment and other charges |

|

165 |

|

|

|

— |

|

|

|

165 |

|

|

|

— |

|

| Total costs and operating

expenses |

|

30,711 |

|

|

|

33,949 |

|

|

|

59,672 |

|

|

|

70,596 |

|

| Loss from operations |

|

(22,732 |

) |

|

|

(12,626 |

) |

|

|

(34,620 |

) |

|

|

(36,291 |

) |

| Interest income |

|

972 |

|

|

|

1,121 |

|

|

|

1,881 |

|

|

|

2,209 |

|

| Interest and other expense,

net |

|

(985 |

) |

|

|

(9 |

) |

|

|

(1,500 |

) |

|

|

(33 |

) |

| Loss before income taxes |

|

(22,745 |

) |

|

|

(11,514 |

) |

|

|

(34,239 |

) |

|

|

(34,115 |

) |

| Provision for income

taxes |

|

10 |

|

|

|

9 |

|

|

|

21 |

|

|

|

25 |

|

| Net loss |

$ |

(22,755 |

) |

|

$ |

(11,523 |

) |

|

$ |

(34,260 |

) |

|

$ |

(34,140 |

) |

| |

|

|

|

|

|

|

|

| Net loss per share, basic and

diluted |

$ |

(0.32 |

) |

|

$ |

(0.17 |

) |

|

$ |

(0.49 |

) |

|

$ |

(0.51 |

) |

| Weighted average common stock

shares used in computing net loss per share, basic and diluted |

|

70,376 |

|

|

|

67,573 |

|

|

|

70,115 |

|

|

|

66,756 |

|

| |

|

|

|

|

|

|

|

| |

|

Codexis, Inc.Condensed Consolidated

Statements of Comprehensive

Loss(Unaudited)(In

Thousands) |

| |

|

|

|

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Net loss |

$ |

(22,755 |

) |

|

$ |

(11,523 |

) |

|

$ |

(34,260 |

) |

|

$ |

(34,140 |

) |

|

Other comprehensive loss: |

|

|

|

|

|

|

|

|

Unrealized loss on available-for-sale short-term investments, net

of tax |

|

(7 |

) |

|

|

— |

|

|

|

(23 |

) |

|

|

— |

|

| Comprehensive loss |

$ |

(22,762 |

) |

|

$ |

(11,523 |

) |

|

$ |

(34,283 |

) |

|

$ |

(34,140 |

) |

| |

|

|

|

|

|

|

|

| |

|

Codexis, Inc.Condensed Consolidated

Balance Sheets(Unaudited)(In

Thousands) |

| |

|

|

|

| |

June 30, 2024 |

|

December 31, 2023 |

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

18,595 |

|

|

$ |

65,116 |

|

|

Restricted cash, current |

|

517 |

|

|

|

519 |

|

|

Short-term investments |

|

54,604 |

|

|

|

— |

|

|

Financial assets: |

|

|

|

|

Accounts receivable |

|

4,860 |

|

|

|

10,036 |

|

|

Contract assets |

|

3,213 |

|

|

|

815 |

|

|

Unbilled receivables |

|

4,380 |

|

|

|

9,142 |

|

|

Total financial assets |

|

12,453 |

|

|

|

19,993 |

|

|

Less: allowances |

|

(65 |

) |

|

|

(65 |

) |

|

Total financial assets, net |

|

12,388 |

|

|

|

19,928 |

|

|

Inventories |

|

2,232 |

|

|

|

2,685 |

|

|

Prepaid expenses and other current assets |

|

3,062 |

|

|

|

5,218 |

|

|

Total current assets |

|

91,398 |

|

|

|

93,466 |

|

| Restricted cash |

|

1,062 |

|

|

|

1,062 |

|

| Investment in non-marketable

equity securities |

|

9,700 |

|

|

|

9,700 |

|

| Right-of-use assets -

Operating leases, net |

|

11,576 |

|

|

|

13,137 |

|

| Property and equipment,

net |

|

13,966 |

|

|

|

15,487 |

|

| Goodwill |

|

2,463 |

|

|

|

2,463 |

|

| Other non-current assets |

|

1,841 |

|

|

|

1,246 |

|

|

Total assets |

$ |

132,006 |

|

|

$ |

136,561 |

|

| |

|

|

|

| Liabilities and

Stockholders' Equity |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

3,685 |

|

|

$ |

5,947 |

|

|

Accrued compensation |

|

7,658 |

|

|

|

11,246 |

|

|

Other accrued liabilities |

|

5,417 |

|

|

|

4,735 |

|

|

Current portion of lease obligations - Operating leases |

|

3,979 |

|

|

|

3,781 |

|

|

Deferred revenue |

|

9,800 |

|

|

|

10,121 |

|

|

Total current liabilities |

|

30,539 |

|

|

|

35,830 |

|

| Deferred revenue, net of

current portion |

|

200 |

|

|

|

640 |

|

| Long-term lease obligations -

Operating leases |

|

10,191 |

|

|

|

12,243 |

|

| Long-term debt |

|

28,365 |

|

|

|

— |

|

| Other long-term

liabilities |

|

1,264 |

|

|

|

1,233 |

|

|

Total liabilities |

|

70,559 |

|

|

|

49,946 |

|

| |

|

|

|

| Stockholders' equity: |

|

|

|

|

Common stock |

|

7 |

|

|

|

7 |

|

|

Additional paid-in capital |

|

593,253 |

|

|

|

584,138 |

|

|

Accumulated other comprehensive income |

|

(23 |

) |

|

|

— |

|

|

Accumulated deficit |

|

(531,790 |

) |

|

|

(497,530 |

) |

|

Total stockholders' equity |

|

61,447 |

|

|

|

86,615 |

|

|

Total liabilities and stockholders' equity |

$ |

132,006 |

|

|

$ |

136,561 |

|

|

|

|

|

|

|

|

|

|

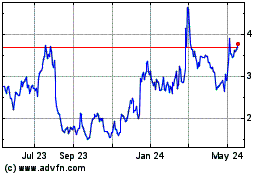

Codexis (NASDAQ:CDXS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Codexis (NASDAQ:CDXS)

Historical Stock Chart

From Dec 2023 to Dec 2024