CEA Industries Inc. Negotiating to Acquire a Leading Specialty Retailer

December 03 2024 - 8:20AM

CEA Industries Inc. (NASDAQ: CEAD, CEADW) (“CEA Industries” or the

“Company”), today announced that it is under a non-binding Letter

of Intent (“LOI”)”) to acquire a leading specialty retailer and

manufacturer (the “Target”), which would be paid for with a

combination of cash, CEA Industries common shares, and debt.

“This proposed transaction offers an exciting

opportunity for our shareholders to benefit from a growing and

profitable business operating in a high-demand industry,” said Tony

McDonald, Chairman and CEO of CEA Industries. “The Target has a

demonstrated track record of double-digit revenue growth,

consistent profitability, and positive cash flow. Building on the

Target’s solid foundation in a fragmented industry, we plan to

utilize our strong balance sheet to scale an even larger specialty

retail footprint and drive further growth and enhanced levels of

profitability. We are excited about the opportunities this

acquisition brings to deliver long-term value to our

shareholders.”

The Target has more than 30 retail locations

over a broad geography, with a deep portfolio of trademarks and

intellectual property. The Company intends to utilize its strong

balance sheet to further expand the Target’s retail footprint

through the acquisition of additional stores as well as opening de

novo stores, enabling broader market reach and customer

accessibility. Additionally, CEA Industries plans to grow the

Target’s manufacturing business that supplies house brand and

white-label products to other retailers. These strategic

initiatives will enable the Company to build on the target’s solid

foundation, accelerate growth, and enhance profitability and

operational excellence.

The Company expects to sign a definitive

agreement to acquire the Target before year end, with a closing of

the transaction targeted for the first quarter of 2025, pending

customary closing conditions. Mr. McDonald added “we look forward

to sharing more about this very exciting development in the near

future.”

Acquisition Disclaimers

Signing the definitive documentation for the

acquisition is subject to the continued evaluation of the Target,

including:

- Continued

business, financial and legal due diligence and regulatory review

and compliance;

- The preparation

of audited financial statements of the Target prior to

signing;

- Negotiating the

definitive acquisition documentation, including indemnification and

hold back terms; and

- Negotiating

various ancillary agreements such as employment agreements with key

operating persons and vendor and other financing arrangements.

The completion of the acquisition, after signing

the acquisition and ancillary agreements, will be subject to

various closing conditions precedent, which may be modified or

waived, as relevant, by mutual agreement of the parties or one of

the parties, including:

- Completion of

all required due diligence and final assessment of the Target and

its operations;

- Delivery and

review of the audited financial statements;

- Obtaining

landlord consents and estoppel agreements and all other third party

consents;

- Obtaining

government approval for the transfer of certain operating

licenses;

- Raising required

acquisition funds, if any, and entry into vendor financing;

- Execution of the

ancillary documents, including employment, non-competition and

escrow arrangements; and

- The continued

correctness of the representations and warranties and fulfillment

of the pre-closing covenants by each of the parties to the

acquisition agreement, and the target not having had any material

adverse changes in its business and having the continued prospects

of the business as then currently conducted.

There can be no assurance that any definitive

agreement documents will be fully and finally negotiated or that

they will be signed by all the necessary parties, which requires

both CEA and the several selling persons to agree and execute the

purchase agreement and various other parties to agree to the

ancillary agreements. Even if the definitive agreements are signed,

there are various covenants that must be fulfilled by certain dates

after signing and prior to closing that must be fulfilled, of which

there can be no assurance given that they will be completed to the

satisfaction of the relevant party or parties. And, finally, there

can be no assurance that the acquisition will be completed, as such

an acquisition is a complicated undertaking with may requirements

that may not be completed on a timely basis or to the satisfaction

of the parties. Therefore, investors in the Company should

carefully consider whether or not an acquisition of this nature

will be completed and when it might be completed, before they make

any assessment of their investment in the Company.

About CEA Industries Inc.

CEA Industries Inc. (www.ceaindustries.com)

provides a suite of complementary and adjacent offerings to the

controlled environment agriculture industry. The Company’s

comprehensive solutions, when aligned with industry operators’

product and sales initiatives, support the development of the

global ecosystem for indoor cultivation.

Forward Looking Statements

This press release may contain statements of a

forward-looking nature relating to future events. These

forward-looking statements are subject to the inherent

uncertainties in predicting future results and conditions. These

statements reflect our current beliefs, and a number of important

factors could cause actual results to differ materially from those

expressed in this press release, including the factors set forth in

“Risk Factors” set forth in our annual and quarterly reports filed

with the Securities and Exchange Commission (“SEC”), and subsequent

filings with the SEC. Please refer to our SEC filings for a more

detailed discussion of the risks and uncertainties associated with

our business, including but not limited to the risks and

uncertainties associated with our business prospects and the

prospects of our existing and prospective customers; the inherent

uncertainty of product development; regulatory, legislative and

judicial developments, especially those related to changes in, and

the enforcement of, cannabis laws; increasing competitive pressures

in our industry; and relationships with our customers and

suppliers. Except as required by the federal securities laws, we

undertake no obligation to revise or update any forward-looking

statements, whether as a result of new information, future events

or otherwise. The reference to CEA’s website has been provided as a

convenience, and the information contained on such website is not

incorporated by reference into this press release.

Investor Contact:

Sean Mansouri, CFAElevate IRinfo@ceaindustries.com(720)

330-2829

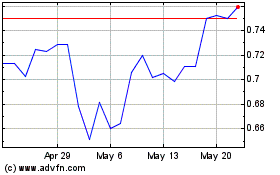

CEA Industries (NASDAQ:CEAD)

Historical Stock Chart

From Nov 2024 to Dec 2024

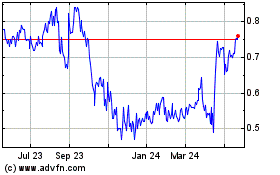

CEA Industries (NASDAQ:CEAD)

Historical Stock Chart

From Dec 2023 to Dec 2024