0001752828

false

--12-31

0001752828

2024-02-22

2024-02-22

0001752828

CELU:ClassCommonStock0.0001ParValuePerShareMember

2024-02-22

2024-02-22

0001752828

CELU:WarrantsEachExercisableForOneShareOfClassCommonStockAtExercisePriceOf11.50PerShareMember

2024-02-22

2024-02-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 22, 2024

Celularity

Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-38914 |

|

83-1702591 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

| 170 Park Ave |

|

|

| Florham Park, New Jersey |

|

07932 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (908) 768-2170

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Exchange Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Class

A Common Stock, $0.0001 par value per share |

|

CELU |

|

The

Nasdaq Stock Market LLC |

| Warrants,

each exercisable for one share of Class A Common Stock at an exercise price of $11.50 per share |

|

CELUW |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 3.03 Material Modifications to Rights of Security Holders.

To

the extent required by Item 3.03 of Form 8-K, information regarding the Reverse Stock Split (as defined below) contained in Item 5.03

of this Current Report on Form 8-K is incorporated by reference herein.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

At

the special meeting of stockholders of Celularity Inc., or Celularity, held on February 22, 2024, or the Special Meeting, the stockholders

of Celularity approved an amendment to Celularity’s Second Amended and Restated Certificate of Incorporation, as amended, or the

Charter, to effect a reverse stock split of Celularity’s Class A common stock, par value $0.0001 per share, or the Common Stock,

at a ratio to be determined by Celularity’s Board of Directors, or the Board, within a range of 1-for-10 to 1-for-100 (or any number

in between), to be effected in the sole discretion of the Board without further approval or authorization from Celularity’s stockholders.

Following the Special Meeting, the Board approved the combination of Celularity’s outstanding shares of Common Stock at a ratio

of 1 for 10. Celularity filed a certificate of amendment to the Charter, or the Certificate of Amendment, with the Secretary of State

of the State of Delaware on February 22, 2024, which will take effect at 5:00 p.m. (Eastern Time) on February 28, 2024, and following

which each ten shares of Common Stock issued and outstanding immediately prior thereto will be automatically reclassified, combined,

converted and changed into one share of Common Stock, or the Reverse Stock Split. Immediately following the Reverse Stock Split, Celularity

expects there will be approximately 21,782,861 shares of Common Stock issued and outstanding (without taking into account elimination

of fractions).

Celularity

will not issue any fractional shares as a result of the Reverse Stock Split. Instead, any stockholder who would otherwise have been entitled

to a fractional share as a result of the Reverse Stock Split (after aggregating all fractions of a share to which such stockholder would

otherwise be entitled) will be, in lieu thereof, entitled to receive a cash payment equal to the product of such resulting fractional

interest in one share of Common Stock post-Reverse Stock Split multiplied by the closing trading price of a share of Common Stock on

The Nasdaq Stock Market LLC on February 28, 2024, the last trading day immediately prior to the date on which the effective time of the

Reverse Stock Split will occur, as adjusted by the split ratio. The par value per share of Common Stock and the number of shares of authorized

Common Stock remain unchanged.

The

foregoing description is qualified in its entirety by the Certificate of Amendment, which is attached as Exhibit 3.1 to this Current

Report on Form 8-K and is incorporated herein by reference.

Item 5.07 Submission of Matters to a Vote of Security Holders.

At

the Special Meeting, Celularity’s stockholders voted on three proposals, each of which is described in more detail in its definitive

proxy statement on Schedule 14A filed with the U.S. Securities and Exchange Commission on February 2, 2024. The following is a brief

description of each matter voted upon and the certified results, including the number of votes cast for and against each matter and,

if applicable, the number of abstentions and broker non-votes with respect to each matter.

Proposal

1. Stockholders approved an amendment to Celularity’s Charter to effect a reverse stock split of Celularity’s Common

Stock at a ratio to be determined by Celularity’s Board within a range of 1-for-10 to 1-for-100 (or any number in between), to

be effected in the sole discretion of the Board without further approval or authorization from Celularity’s stockholders The voting

results were as follows:

| Votes For |

|

Votes Against |

|

Abstentions |

|

Broker Non-Votes |

| 132,805,636 |

|

3,544,785 |

|

71,121 |

|

- |

Proposal

2. Stockholders did not approve the issuance or potential issuance of shares of Common Stock issuable upon the exercise of Tranche

2 Warrants to purchase shares of Common Stock issued to Resorts World Inc Pte Ltd, or RWI, on January 16, 2024, with an exercise price

that may be equal to or less than $0.24898 per share, which was the “Minimum Price” pursuant to Nasdaq Rule 5635(d) on the

date of agreement to issue the Tranche 2 Warrants. The proposal failed to receive the affirmative vote of the holders of a majority of

the voting power of the stock of the shares present at the Special Meeting and entitled to vote thereon. Dragasac Limited, an affiliate

of the parent company to RWI, abstained from voting on the matter. The voting results were as follows:

| Votes

For |

|

Votes

Against |

|

Abstentions |

|

Broker

Non-Votes |

| 66,443,495 |

|

956,202 |

|

51,559,153 |

|

17,462,692 |

Proposal

3. Stockholders approved the adjournment or postponement of the Special Meeting, if necessary, to continue to solicit votes for the

above proposals. The voting results were as follows:

| Votes

For |

|

Votes

Against |

|

Abstentions |

|

Broker

Non-Votes |

| 134,165,134 |

|

2,054,505 |

|

201,903 |

|

- |

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

|

|

CELULARITY

INC. |

| |

|

|

|

| Date: |

February

26, 2024 |

By:

|

/s/

Robert J. Hariri |

| |

|

|

Robert

J. Hariri, M.D., Ph.D.

Chairman

and CEO |

Exhibit

3.1

CERTIFICATE

OF AMENDMENT

OF

SECOND

AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

OF

CELULARITY

INC.

Celularity

Inc. (the “Corporation”), a corporation organized and existing under the laws of the State of Delaware, hereby

certifies as follows:

1.

This Certificate of Amendment (the “Certificate of Amendment”) amends the provisions of the Corporation’s

Second Amended and Restated Certificate of Incorporation, as amended (the “Certificate of Incorporation”).

2.

The terms and provisions of this Certificate of Amendment have been duly adopted in accordance with Section 242 of the General Corporation

Law of the State of Delaware.

3.

That Article IV of the Certificate of Incorporation be, and hereby is, amended by adding the following new paragraph at the end of such

article:

“E.

Effective at 5:00 p.m. (Eastern Time) on February 28, 2024 (such time, the “Effective Time”), every ten (10) shares of

Class A Common Stock outstanding immediately prior to the Effective Time (such shares, the “Old Common Stock”) shall automatically

without further action on the part of the Company be combined into one (1) fully paid and nonassessable share of Class A Common Stock

(the “New Common Stock”), subject to the treatment of fractional shares described below. From and after the Effective Time,

certificates representing the Old Common Stock shall, without the necessity of presenting the same for exchange, represent the number

of shares of New Common Stock into which such Old Common Stock shall have been converted pursuant to this Certificate of Amendment. There

shall be no fractional shares issued. Stockholders who otherwise would be entitled to receive fractional shares because they hold a number

of shares of Common Stock not evenly divisible by ten (10), will be entitled to receive cash in lieu of fractional shares at the value

thereof on the date of the Effective Time as determined by the Board of Directors; provided that, whether or not fractional shares would

be issuable as a result of the share combination shall be determined on the basis of (i) the total number of shares of Old Common Stock

that were issued and outstanding immediately prior to the Effective Time formerly that the holder is at the time surrendering and (ii)

the aggregate number of shares of New Common Stock after the Effective Time into which the shares of Old Common Stock shall have been

reclassified; and (b) with respect to holders of shares of Old Common Stock in book-entry form in the records of the Corporation’s

transfer agent that were issued and outstanding immediately prior to the Effective Time, any holder who would otherwise be entitled to

a fractional share of New Common Stock as a result of the share combination (after aggregating all fractional shares), following the

Effective Time, shall be entitled to receive the fractional share payment automatically and without any action by the holder.”

4.

All other provisions of the Certificate of Incorporation shall remain in full force and effect.

IN

WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to be executed by its duly authorized officer on this 22nd

day of February, 2024.

| |

CELULARITY

INC. |

| |

|

|

| |

By: |

/s/

Robert Hariri |

| |

Name: |

Robert

J. Hariri, M.D., Ph.D. |

| |

Title: |

Chief

Executive Officer |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CELU_ClassCommonStock0.0001ParValuePerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CELU_WarrantsEachExercisableForOneShareOfClassCommonStockAtExercisePriceOf11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

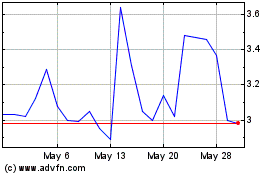

Celularity (NASDAQ:CELU)

Historical Stock Chart

From Jan 2025 to Feb 2025

Celularity (NASDAQ:CELU)

Historical Stock Chart

From Feb 2024 to Feb 2025