Creative Medical Technology Holdings Announces Agreements for Exercise of Warrants for $3.7 Million Gross Proceeds

March 06 2025 - 7:10AM

Creative Medical Technology Holdings, Inc.,

(Nasdaq: CELZ) (the “Company”), a leading biotechnology innovator

in regenerative medicine, today announced it has entered into

agreements with certain holders of its existing warrants for the

immediate exercise of certain outstanding warrants to purchase up

to an aggregate of 837,104 shares of common stock of the Company

originally issued in October 2024 at their current exercise price

of $4.42 per share. The shares of common stock issuable upon

exercise of the existing warrants are registered pursuant to an

effective registration statement on Form S-1 (File No. 333-283091).

The aggregate gross proceeds from the exercise of the existing

warrants is expected to total approximately $3.7 million, before

deducting financial advisory fees.

Roth Capital Partners is acting as the Company’s

financial advisor for this transaction.

In consideration for the immediate exercise of

the existing warrants for cash, the Company will issue new

unregistered warrants to purchase shares of common stock. The new

warrants will be exercisable for an aggregate of up to 1,674,208

shares of common stock, at an exercise price of $3.75 per share and

will be exercisable for a period of five years following

shareholder approval of the exercise of the warrants.

The transaction is expected to close on or about

March 6, 2025, subject to satisfaction of customary closing

conditions. The Company intends to use the net proceeds from the

offering for working capital and general corporate purposes.

The new warrants described above were offered in

a private placement pursuant to an applicable exemption from the

registration requirements of the Securities Act of 1933, as amended

(the “1933 Act”) and, along with the shares of common stock

issuable upon their exercise, have not been registered under the

1933 Act, and may not be offered or sold in the United States

absent registration with the Securities and Exchange Commission

(“SEC”) or an applicable exemption from such registration

requirements. The Company has agreed to file a registration

statement with the SEC covering the resale of the shares of common

stock issuable upon exercise of the new warrants.

This press release shall not constitute an offer

to sell or a solicitation of an offer to buy nor shall there be any

sale of these securities in any state or jurisdiction in which such

offer, solicitation or sale would be unlawful prior to the

registration or qualification under the securities laws of any such

state or jurisdiction.

About Creative Medical Technology

Holdings, Inc.

Creative Medical Technology Holdings, Inc. is a

biotechnology company dedicated to the advancement of identifying

and translating novel biological therapeutics in the fields of

immunotherapy, endocrinology, urology, gynecology, and orthopedics

and is traded on NASDAQ under the ticker symbol CELZ. For further

information about the Company, please visit

www.creativemedicaltechnology.com.

Forward-Looking Statements

This news release may contain forward-looking

statements, including but not limited to comments regarding the

timing and content of upcoming clinical trials and laboratory

results, marketing efforts, funding, etc. Forward-looking

statements address future events and conditions, which may involve

inherent risks and uncertainties. Actual results may differ

materially from those currently anticipated in such statements. See

the periodic and other reports filed by Creative Medical Technology

Holdings, Inc. with the Securities and Exchange Commission and

available on the Commission's website at www.sec.gov.

Contact:

Creative Medical Technology Holdings,

Inc.IR@CreativeMedicalTechnology.com

Investor Relations:Devin Sullivan, Managing DirectorThe Equity

Group Inc.dsullivan@equityny.com

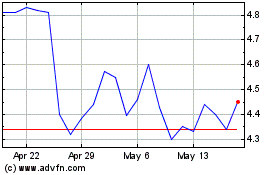

Creative Medical Technol... (NASDAQ:CELZ)

Historical Stock Chart

From Feb 2025 to Mar 2025

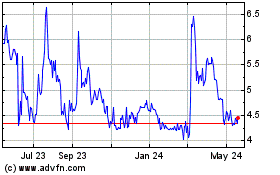

Creative Medical Technol... (NASDAQ:CELZ)

Historical Stock Chart

From Mar 2024 to Mar 2025