Central Garden & Pet Beats Estimate - Analyst Blog

May 05 2011 - 3:15AM

Zacks

Central Garden & Pet

Company (CENT) recently announced healthy second-quarter

2011 results. The company delivered a quarterly income of 54 cents

a share, beating the Zacks Consensus Estimate and prior-year

quarter’s income of 49 cents.

With respect to earnings surprises,

Central Garden & Pet has missed the Zacks Consensus Estimate in

three of the last four quarters. Compared with the Zacks Consensus

Estimate, the earnings surprise ranges from a negative 114.3% to a

positive 10.2%, the average being negative 43.3%. This signifies

that Central Garden & Pet has underperformed the Zacks

Consensus Estimate by 43.3% on an average in the last four

quarters.

As per Central Garden & Pet,

total revenue for the quarter increased 10.0% to $485.7 million,

reflecting significant sales growth in garden products segment. The

company’s total branded product sales climbed 13.0% to $417.3

million, whereas sales of other manufacturers’ products went down

7.6% to $68.4 million.

The reported net sales also

surpassed the Zacks Consensus Revenue Estimate of $457.0

million.

During the reported quarter, gross

profit inched up 1.3% to $163.3 million, whereas gross margin

contracted 290 basis points to 33.6%. The decline in margin

reflected a 14.9% rise in input costs. Total operating income for

the quarter was $59.6 million, down 1.5% from $60.5 million in the

year-ago quarter, reflecting the company’s increased spending on

brand building coupled with accelerating commodity prices.

Central Garden & Pet, one of

the leading producers and marketers of premium and value-oriented

products, is focused on the lawn & garden and pet supplies

markets in the U.S.

Garden Products segment sales

jumped 19.0% to $260.3 million driven by the growth in its grass

seed business coupled with the sales rise in garden chemicals and

control business. The segment reported an operating income of $46.9

million compared with $36.8 million posted in the previous-year

quarter.

Pet Products segment sales inched

up 1.0% to $225.4 million and the segment’s operating income

plunged 33.0% to $23.3 million, reflecting a continued rise in raw

material costs.

Central Garden & Pet, which

faces stiff competition from The Scotts Miracle-Gro

Company (SMG), ended the quarter with cash and cash

equivalents of $11.2 million, total long-term debt of $517.1

million and shareholders’ equity of $502.9 million, excluding a

non-controlling interest of $0.5 million.

On July 15, 2010, the

company’s board authorized a new $100 million share repurchase

program. During the quarter under review, the company bought back

$39.0 million of its shares.

Followed by a broad evaluation, we

prefer to maintain our long-term ‘Underperform’ recommendation on

the stock. Moreover, Central Garden & Pet holds a Zacks #3

Rank, which translates into a short-term ‘Hold’ rating.

CENTRAL GARDEN (CENT): Free Stock Analysis Report

SCOTTS MIRCL-GR (SMG): Free Stock Analysis Report

Zacks Investment Research

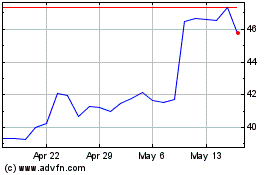

Central Garden and Pet (NASDAQ:CENT)

Historical Stock Chart

From Jun 2024 to Jul 2024

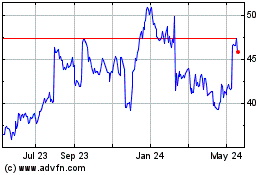

Central Garden and Pet (NASDAQ:CENT)

Historical Stock Chart

From Jul 2023 to Jul 2024