SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrant x |

| Filed

by a Party other than the Registrant ¨ |

| Check the appropriate box: |

| ¨ |

Preliminary Proxy Statement |

| ¨ |

Definitive Proxy Statement |

| x |

Definitive Additional Materials |

| ¨ |

Soliciting Material Pursuant to § 240.14a-12 |

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| |

| CENTURY ALUMINUM COMPANY |

|

(Name of Registrant as Specified in its Charter)

|

|

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

|

| Payment of Filing Fee (Check the appropriate box): |

| x |

No fee required. |

| ¨ |

Fee paid previously with preliminary materials. |

| ¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

May 28, 2024

| RE: | Century Aluminum Company (“Century” or the “Company”) |

| | 2024 Annual Meeting of Stockholders – June 3,

2024 |

| | Proposal 3 – Advisory Vote to Approve the Compensation

of Our Named Executive Officers |

Dear Fellow Stockholders:

We

are providing this supplement to ask that, in accordance with the recommendations of our Board of Directors, you vote “FOR”

Item 3 – Advisory Vote to Approve the Compensation of Our Named Executive Officers (referred to as the “Say-on-Pay Proposal”)

as set out in our 2024 Proxy Statement.

The

proxy advisory firm Glass Lewis recommended that its clients vote “FOR” the Say-on-Pay Proposal and noted that

Century’s overall NEO compensation measured below the median of our peers on a three-year weighted average basis. Glass Lewis also

observed that the below-target payouts for the most recently completed performance share unit (“PSU”) cycle indicates that

the NEOs are being held accountable for long-term Company performance, and that this is further supported by the alignment of CEO realized

pay and TSR performance on a five-year average basis.

Institutional Shareholder Services (“ISS”) recommended

that its clients vote against our Say-on-Pay Proposal. However, their recommendation appears to be based largely on (i) a significant

change in ISS’ peer group that lowered their assessment of median CEO pay by over 17% from their assessment last year and (ii) incorrect

interpretations of elements of our compensation program that were present in previous years and received strong stockholder support. ISS

made their recommendation despite noting that Century’s (i) annual incentive awards are based on pre-set quantitative metrics,

(ii) long-term incentive (“LTI”) awards remain at least half performance-based for all NEOs, and (iii) recently

completed PSUs for the 2021-2023 performance period vested below target in line with performance. We respond to ISS’ concerns at

the end of this letter.

For

the reasons described below and in the Compensation Discussion and Analysis of the Proxy Statement, Century’s Board

of Directors unanimously recommends that you vote “FOR” the Say-on-Pay Proposal.

2023 Financial and Operational Performance was Strong

Century delivered strong financial and operational results in 2023,

and compensation decisions and incentive program outcomes for 2023 were directly linked to that performance. Key performance highlights

for 2023 noted in our 2024 Proxy Statement include:

| · | Reduced workplace injuries by 20% compared to prior year levels. |

| · | Realized $59.3 million improvement to operating results due to Section 45X Advanced Manufacturing Credit. |

| · | Reduced total debt by $49 million. |

| · | Completed the strategic acquisition of a 55% stake in the Jamalco alumina refinery. |

| · | Reached agreement on a new, three-year power contract for our Mt. Holly smelter. |

| · | Agreed to a new, five-year collective bargaining agreement with the United Steelworkers. |

| · | Continued progress on our low-carbon billet casthouse at Grundartangi, which began production in 2024. |

Realized Pay Demonstrates Alignment of Pay with Performance

The executive compensation program at Century is structured to align

the interests of executives and stockholders. Our strong pay-for-performance alignment is illustrated by the graph below, which compares

the CEO’s total realized compensation for fiscal years 2019 – 2023 with Century’s TSR as measured on the last day of

each fiscal year. Total realized compensation includes (i) base salary paid during the fiscal year, (ii) annual cash incentive

award amounts earned for the fiscal year, (iii) other cash bonus compensation (other than CEO Promotion Bonus), and (iv) the

value of long-term incentive awards vested during the fiscal year, measured as of the end of the fiscal year.

The Compensation Committee annually reviews the Company’s incentive

program design and compensation outcomes to ensure they align the interests of our NEOs with the long-term interests of our stockholders.

The Committee is committed to continually improving the Company’s compensation program to drive increased alignment between pay

and performance over time.

Sincerely,

Jarl Berntzen

Chair of the Compensation Committee

ISS’

“High Concern” on its Quantitative CEO Pay-for-Performance Test was driven by two factors that we do

not believe warrant a vote against the Say-on-Pay Proposal.

First, the ISS peer group was updated this year with three changes

that had the impact of reducing the market median for Century’s CEO from $7.0M last year to $5.7M this year, a 17.4% decrease. This

change is disconnected from typical market movements for senior executive pay and highlights a degree of exogenous volatility in ISS’

assessment data that, at a minimum, requires a meaningful level of judgment when applying it to Century’s compensation program.

Second, Mr. Gary received promotion-based awards in connection

with his election as CEO in July 2021. The cash portions of this award are reported in the Summary Compensation Table in the year

paid, and the award was fully described in the Company’s Form 8-K dated May 17, 2021, and in subsequent proxy statements.

As noted above, Glass Lewis did not raise any concerns about Mr. Gary’s

promotion bonus and noted that “the CEO’s 2023 compensation would also measure below the Glass Lewis peer group median when

removing the 2023 payout of the 2021 CEO transition award.” ISS recommended in favor of “Say-on-Pay” in 2022 and 2023

and has previously noted no concerns about the arrangement. Absent these awards, we believe that Century would have been rated a “Low

Concern” in the ISS model.

Our CEO’s initial target for total compensation (excluding one-time

promotion awards) of $4.2M for 2021 was well below the market median based on both our peer group and general industry survey data reviewed

by our Compensation Committee. In 2023, his target total compensation was increased to $4.8M (after 18 months in the role) which remained

well below the ISS median for Century of $7.0M in its 2023 report and remains below the ISS median of $5.7M in its 2024 report.

Annual incentive program targets for 2023 were MORE rigorous

than 2022 targets.

In its report, ISS raised a concern that certain of our 2023 STI

targets were less rigorous than prior years. Although no reference was made to a specific element of our STI program, we believe that

ISS likely incorrectly interpreted the target for Shipment Volume in our 2023 annual incentive plan. While the Shipment Volume target

was nominally lower in 2023 than 2022, the lower 2023 Shipment Volume target is solely attributable to the Company’s Hawesville

plant being idled in June 2022. Other than this change in the Company’s operational footprint, there were no other changes

to the Company’s target setting methodology for this metric and the 2023 volume target was actually more rigorous than

the 2022 target for our operating plants, reflecting the strong operations performance and continuous improvement the Compensation

Committee expects of the management team.

The 2023 discretionary bonuses were linked to material impact

of the IRA 45X tax credits.

As disclosed on page 41 of the Company’s 2024 Proxy Statement,

the issuance of proposed regulations in connection with Section 45X of the Inflation Reduction Act of 2022 (“IRA”) had

a materially positive impact of approximately $59.3 million on Century’s financial performance and results of operations and is

expected to have similar impact in future years. The Compensation Committee recognized that the management team made a significant,

multi-year effort to ensure that aluminum was covered by the regulation and that Century’s business would benefit. Although the

Compensation Committee has no historical practice of regularly using discretionary bonuses, it believed that such recognition was appropriate

in light of the significant and sustained benefit to the Company and its stockholders. Additionally, Glass Lewis noted that the special

cash bonuses were modest in size and “[a]s such, the special cash bonuses are not particularly problematic in our view.”

Our LTI program aligns management’s interests with those

of our stockholders by focusing on long-term value creation throughout the economic cycle.

ISS commented negatively on the design of our LTI program because (1) PSU

performance is measured over 2- and 3-year periods and (2) the presence of a strategic modifier. However, we believe each of these

design features is aligned with market practice and reflective of Century’s commodity-based business.

Century’s LTI program is comprised of 60% performance units for

our CEO and 50% for our other NEOs, which links a majority of long-term compensation directly to the performance of our share price. In

fact, relative total stockholder return (“TSR”) is the sole quantitative performance metric used in the program, directly

aligning executive compensation with stockholder returns.

2- and 3-Year Performance Period Rationale

As a producer of primary aluminum, Century’s performance is highly

exposed to commodity price cycles and numerous other macro-economic factors that are outside of management’s control. Specifically,

the Company’s financial results are materially linked to price of aluminum which is set on international commodity markets. As a

result, the Company’s stock price directly reflects fluctuations in commodity and energy markets and can be highly volatile.

Using a 2- and 3-year performance period (where the overall payout

is the average of the two periods) smooths volatility in results, while keeping the performance period measured over multiple years to

ensure a sufficient long-term orientation. This provision has been in place and disclosed for several years and ISS and our stockholders

have supported the annual Say-on-Pay vote, with no concerns noted on this provision, since its inception. Additionally, all PSUs cliff

vest after three years, ensuring executives are held accountable for stock price performance during the full 3-year performance period

(i.e., no vesting occurs until the end of year three).

Strategic Modifier

The strategic modifier was added to the program in 2020 to provide

balance to the program. This is particularly necessary given that our financial and stock price performance are so heavily dependent on

global commodity pricing and ensures that management stays focused on driving long-term performance that is controllable, even in challenging

aluminum pricing conditions. While the use of this modifier is discretionary, the strategic objectives underlying it are not. These strategic

objectives are established at the outset of each performance period and prioritized to inform the Committee’s overall determination

of performance and use of the corresponding modifier. Importantly, we note that the Strategic Modifier was NOT exercised in 2023 and

overall payouts were substantially below Target, reflecting the Company’s TSR performance during the period. As noted above,

this provision has been disclosed since the 2021 proxy statement and ISS has supported the annual Say-on-Pay vote, until now.

We

appreciate your historical support of our executive compensation program and ask that you vote “FOR” the Say on Pay Proposal.

Our Proxy Statement, which was filed on April 18, 2024, is available on Century’s website and on the SEC’s

website.

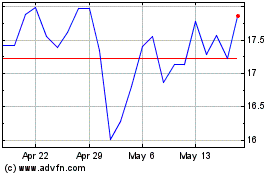

Century Aluminum (NASDAQ:CENX)

Historical Stock Chart

From May 2024 to Jun 2024

Century Aluminum (NASDAQ:CENX)

Historical Stock Chart

From Jun 2023 to Jun 2024