false

0001173489

0001173489

2025-01-24

2025-01-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): January 24, 2025

CEVA, INC.

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

|

000-49842

|

|

77-0556376

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

15245 Shady Grove Road, Suite 400, Rockville, MD 20850

(Address of Principal Executive Offices, and Zip Code)

(240) 308-8328

Registrant’s Telephone Number, Including Area Code

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which

registered

|

|

Common Stock, $0.001 par value

|

|

CEVA

|

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(d)

Effective January 24, 2025, the Board of Directors (the “Board”) of Ceva, Inc. (the “Company”), upon the recommendation of the Nominations and Corporate Governance Committee of the Board, approved an increase to the number of members of the Board from seven (7) to eight (8) and elected Amir Faintuch to serve as an independent member of the Board. Pursuant to his appointment, Mr. Faintuch will serve as a director until the Company’s annual meeting of stockholders in 2025, at which time he is expected to stand for election.

Mr. Faintuch, 56, is currently and has served as the Chief Executive Officer of Volumez, a pioneering leader in the Data Infrastructure as a Service (DIaaS) sector, since December 2022. Previously, Mr. Faintuch held senior executive management positions spanning technical and business responsibilities at leading technology companies including: GlobalFoundries, where he was Senior Vice President and General Manager of the Computing, Wired Infrastructure and Storage business; Intel Corporation where he served as Senior Vice President and General Manager of Platform Engineering; and Qualcomm, where his roles included President of Qualcomm Atheros. Mr. Faintuch started his corporate career at Texas Instruments where he was responsible for establishing the company’s technical and market leadership in mobile connectivity technologies such as Bluetooth, Wi-Fi, GPS and NFC. Mr. Faintuch holds a bachelor’s degree in economics and business administration from Haifa University in Israel and a dual MBA degree in high technology management from the Kellogg School of Management at Northwestern University and the Recanati Business School at Tel Aviv University.

There are no arrangements or understandings between Mr. Faintuch and any other persons, in each case, pursuant to which Mr. Faintuch was appointed to serve on the Board. There are no family relationships between Mr. Faintuch and any other director or executive officer of the Company, nor is he a participant in any related party transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

In accordance with the Company’s non-employee director compensation policy, Mr. Faintuch will be entitled to receive an annual cash retainer of $40,000, which would be pro-rated based on Mr. Faintuch’s date of appointment, and an annual director restricted stock unit grant of $124,670 under the Company’s Amended and Restated 2011 Stock Incentive Plan. The restricted stock units vest over a two-year period, with the first 50% vesting after the first anniversary of the grant date and the remainder vesting on the second anniversary of the grant date. A form of the director restricted stock unit agreement was filed as Exhibit 10.22 to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the U.S. Securities and Exchange Commission on March 7, 2024 (the “2024 10-K”) and is incorporated herein by reference.

The Company also intends to enter into its standard director indemnification agreement with Mr. Faintuch, the form of which was filed as Exhibit 10.4 to the 2024 10-K and is incorporated herein by reference.

A copy of the press release, dated January 29, 2025, announcing Mr. Faintuch’s appointment is attached and filed herewith as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

|

Exhibit

Number

|

|

Description

|

| |

|

|

|

99.1

|

|

|

|

|

104

|

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CEVA, INC.

|

| |

|

|

Date: January 29, 2025

|

By:

|

/s/ Yaniv Arieli

|

| |

Name:

|

Yaniv Arieli

|

| |

Title:

|

Chief Financial Officer

|

Exhibit 99.1

Ceva, Inc. Appoints Amir Faintuch to its Board of Directors

ROCKVILLE, MD., January 29, 2025 - Ceva, Inc. (NASDAQ: CEVA), the leading licensor of silicon and software IP that enables Smart Edge devices to connect, sense and infer data more reliably and efficiently, today announced the appointment of Amir Faintuch, a seasoned technology executive, to its Board of Directors as an independent director, effective January 24, 2025. This election expands Board membership to eight members, seven of whom are independent.

“We welcome Amir to the Ceva Board,” said Peter McManamon, Chairman of the Board of Ceva. “His extensive experience and deep expertise as a business and technology executive at some of the world’s leading semiconductor companies will provide the Ceva board and management team with valuable insights in leadership and strategy as we embark on our next phase of growth and expansion in the smart edge AI era.”

Mr. Faintuch has served as the Chief Executive Officer of Volumez, a pioneering leader in Data Infrastructure as a Service (DIaaS), since December 2022. Previously, Mr. Faintuch held senior executive management positions spanning technical and business responsibilities at leading technology companies including: GlobalFoundries, where he was Senior Vice President and General Manager of the Computing, Wired Infrastructure and Storage business; Intel Corporation where he served as Senior Vice President and General Manager of Platform Engineering; and Qualcomm, where his roles included President of Qualcomm Atheros. Mr. Faintuch started his corporate career at Texas Instruments where he was responsible for establishing the company’s technical and market leadership in mobile connectivity technologies such as Bluetooth, Wi-Fi, GPS and NFC. Mr. Faintuch holds a bachelor’s degree in economics and business administration from Haifa University in Israel and a dual MBA degree in high technology management from the Kellogg School of Management at Northwestern University and the Recanati Business School at Tel Aviv University.

###

About Ceva, Inc.

At Ceva, we are passionate about bringing new levels of innovation to the smart edge. Our wireless communications, sensing and Edge AI technologies are at the heart of some of today’s most advanced smart edge products. From wireless connectivity IPs (Bluetooth, Wi-Fi, UWB and 5G platform IP), to scalable Edge AI NPU IPs and sensor fusion solutions, we have the broadest portfolio of IP to connect, sense and infer data more reliably and efficiently. We deliver differentiated solutions that combine outstanding performance at ultra-low power within a very small silicon footprint. Our goal is simple – to deliver the silicon and software IP to enable a smarter, safer, and more interconnected world. This philosophy is in practice today, with Ceva powering more than 18 billion of the world’s most innovative smart edge products from AI-infused smartwatches, IoT devices and wearables to autonomous vehicles and 5G mobile networks.

Our headquarters are in Rockville, Maryland with a global customer base supported by operations worldwide. Our employees are among the leading experts in their areas of specialty, consistently solving the most complex design challenges, enabling our customers to bring innovative smart edge products to market.

Ceva is a sustainability- and environmentally-conscious company, adhering to our Code of Business Conduct and Ethics. As such, we emphasize and focus on environmental preservation, recycling, the welfare of our employees and privacy – which we promote on a corporate level. At Ceva, we are committed to social responsibility, values of preservation and consciousness towards these purposes.

Ceva: Powering the Smart Edge™

Visit us at www.ceva-ip.com and follow us on LinkedIn, X, YouTube, Facebook, and Instagram.

Forward Looking Statements

This press release contains forward-looking statements that involve risks and uncertainties, as well as assumptions that if they materialize or prove incorrect, could cause the results of Ceva to differ materially from those expressed or implied by such forward-looking statements and assumptions. Forward-looking statements include Mr. McManamon’s statements regarding Mr. Faintuch’s contribution to the Board as Ceva embarks on its next phase of growth and expansion in the smart edge AI era. The risks, uncertainties and assumptions that could cause differing Ceva results include: the effect of intense industry competition; the ability of Ceva’s technologies and products incorporating Ceva’s technologies to achieve market acceptance; Ceva’s ability to meet changing needs of end-users and evolving market demands; the cyclical nature of and general economic conditions in the semiconductor industry; Ceva’s ability to diversify its royalty streams and license revenues; Ceva’s ability to continue to generate significant revenues from the handset baseband market and to penetrate new markets; and general market conditions and other risks relating to Ceva’s business, including, but not limited to, those that are described from time to time in our SEC filings. Ceva assumes no obligation to update any forward-looking statements or information, which speak as of their respective dates.

For more information, contact:

|

Yaniv Arieli

Ceva, Inc.

CFO

+972.9.961.3770

yaniv.arieli@ceva-ip.com

|

Richard Kingston

Ceva, Inc.

VP Market Intelligence, Investor & Public Relations

+1.650.220.1948

richard.kingston@ceva-ip.com

|

v3.24.4

Document And Entity Information

|

Jan. 24, 2025 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

CEVA, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jan. 24, 2025

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

000-49842

|

| Entity, Tax Identification Number |

77-0556376

|

| Entity, Address, Address Line One |

15245 Shady Grove Road, Suite 400

|

| Entity, Address, City or Town |

Rockville

|

| Entity, Address, State or Province |

MD

|

| Entity, Address, Postal Zip Code |

20850

|

| City Area Code |

240

|

| Local Phone Number |

308-8328

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

CEVA

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001173489

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

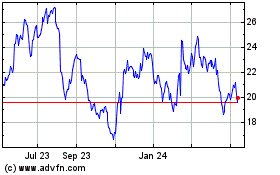

CEVA (NASDAQ:CEVA)

Historical Stock Chart

From Dec 2024 to Jan 2025

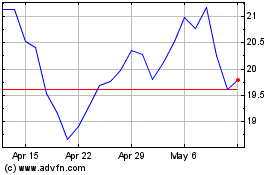

CEVA (NASDAQ:CEVA)

Historical Stock Chart

From Jan 2024 to Jan 2025