C.H. Robinson Worldwide, Inc. (“C.H. Robinson”) (Nasdaq: CHRW)

today reported financial results for the quarter ended December 31,

2024.

Fourth Quarter

Highlights:

- Significant year-over-year increase in profitability, driven

by disciplined execution, a focus on quality of volume, and

improvement in gross profit margin, productivity and operating

leverage

- Gross profits increased 10.4% to $672.9 million

- Income from operations increased 71.1% to $183.8 million

- Adjusted operating margin(1) increased 940 basis points to

26.8%

- Adjusted operating margin, excluding restructuring and loss on

divestiture(1), increased 1,020 basis points to 26.9%

- Diluted earnings per share (EPS) increased 369.2% to $1.22

- Adjusted EPS(1) increased 142.0% to $1.21

- Cash generated by operations increased by $220.6 million to

$267.9 million

Full-Year Key Metrics:

- Gross profits increased 5.8% to $2.7 billion

- Income from operations increased 30.0% to $669.1 million

- Adjusted operating margin(1) increased 440 basis points to

24.2%

- Adjusted operating margin, excluding restructuring and loss on

divestiture(1), increased 630 basis points to 27.5%

- Diluted EPS increased 41.9% to $3.86

- Adjusted EPS(1) increased 36.7% to $4.51

- Cash generated by operations decreased by $222.9 million to

$509.1 million, due to an increase in net operating working capital

related to higher ocean rates

(1) Adjusted operating margin, adjusted

operating margin, excluding restructuring and loss on divestiture,

and adjusted EPS are non-GAAP financial measures. The same factors

described in this release that impacted these non-GAAP measures

also impacted the comparable GAAP measures. Refer to pages 12

through 14 for further discussion and GAAP to Non-GAAP

Reconciliations.

"We’ve talked extensively over the past year about our new

Robinson operating model and the disciplined execution that the

model is enabling, as well as how we’re leveraging our industry

leading talent and technology to raise the bar in logistics," said

President and Chief Executive Officer, Dave Bozeman. "The benefits

of these efforts were never more evident than in the significant

year-over-year improvement in our fourth quarter financial

results."

"In what continues to be a historically prolonged freight

recession, with market growth in 2024 that did not materialize as

had been projected, the difference in our execution versus last

year is stark. Our people are embracing the discipline needed to

generate higher highs and higher lows across market cycles,

resulting in a higher quality of volume, greater productivity, and

an expansion of our gross profit and operating profit margins."

"In a trucking environment where the cost of purchased

transportation increased in the fourth quarter due to a decline in

industry capacity, our dynamic costing and pricing tools, our

revenue management practices and our cost of hire advantage enabled

us to provide greater value to our customers, and at the same time,

improve our NAST gross profit margin both year-over-year and

sequentially," said Bozeman.

"In our Global Forwarding business, the team has debunked the

thesis that C.H. Robinson couldn’t continue to improve productivity

when volumes are growing," Bozeman added. "Throughout 2024, I've

been impressed with and highly appreciative of the team, as they

continued to be nimble and highly engaged with our customers to

help them navigate various market disruptions and to provide

differentiated service and solutions. As a result, our ocean and

air shipments grew each quarter on a year-over-year basis, and each

grew more than 5% for the full year. Through improvements in

process standardization and automation and embracing the rigor of

our operating model, the forwarding team decoupled headcount growth

from volume growth, reduced their average headcount for the year

more than 10%, and achieved productivity improvement of greater

than 15% for the full year."

"Over the two-year period of 2023 and 2024, we delivered

compounded productivity growth of 30% or more in both Global

Forwarding and NAST. As we said at our Investor Day in December, we

view our productivity as evergreen improvements that we do not

expect to give back. Enabled by the operating model disciplines and

tools that are being applied across our company, we expect to

further advance our productivity as we grow our businesses,

including both NAST and Global Forwarding. The productivity

improvements have lowered our cost to serve and increased our

operating leverage. Combined with our expanded gross margins, this

resulted in a 79% increase in our fourth quarter adjusted income

from operations."

"As I reflect on the noteworthy progress that we made in 2024,

I’d like to thank the Robinson team for all the work they’ve put in

to get to this point. I don’t take their efforts and dedication for

granted, and I commend them for helping us get more fit, fast and

focused and for embracing the discipline that the new operating

model demands. On my first earnings call in August of 2023, I said

that I looked forward to leading this great company to new heights

and sharing our progress with all of you along our journey. While

there’s still more grass to cut, I believe we’re on the right path,

and I’m pleased with the progress we’ve made on evolving our

strategy and improving our execution by instilling discipline with

our new operating model," Bozeman concluded.

Summary of Fourth Quarter of 2024

Results Compared to the Fourth Quarter of 2023

- Total revenues decreased 0.9% to $4.2 billion, primarily

driven by lower volume and pricing in truckload services, partially

offset by higher pricing in our ocean services.

- Gross profits increased 10.4% to $672.9 million.

Adjusted gross profits increased 10.7% to $684.6 million,

primarily driven by higher adjusted gross profit per transaction in

our truckload and ocean services.

- Operating expenses decreased 2.0% to $500.8 million.

Personnel expenses decreased 2.1% to $354.4 million,

primarily due to cost optimization efforts and productivity

improvements, partially offset by higher variable compensation.

Average employee headcount declined 9.5%. Other selling, general

and administrative (“SG&A”) expenses decreased 2.0% to

$146.4 million, primarily due to a $12.6 million favorable

adjustment to the loss on the planned divestiture of our Europe

Surface Transportation business, which was partially offset by

impairments related to reducing our facilities footprint.

- Income from operations totaled $183.8 million, up 71.1%

due to both the increase in adjusted gross profit and decrease in

operating expenses. Adjusted operating margin(1) of 26.8%

increased 940 basis points.

- Interest and other income/expense, net totaled $15.4

million of expense, consisting primarily of $18.8 million of

interest expense, which decreased $2.8 million versus last year due

to a lower average debt balance and lower variable interest rates,

and a $3.3 million net gain from foreign currency revaluation and

realized foreign currency gains and losses.

- The effective tax rate in the quarter was 11.4%,

compared to 55.3% in the fourth quarter of 2023. The lower rate in

the fourth quarter of 2024 was driven by the impact of

non-recurring discrete items, higher U.S. tax credits, and

increased tax benefit related to stock-based compensation,

partially offset by lower foreign tax credits.

- Net income totaled $149.3 million, up 382.1% from a year

ago. Diluted EPS of $1.22 increased 369.2%. Adjusted

EPS(1) of $1.21 increased 142.0%.

(1) Adjusted operating margin and adjusted

EPS are non-GAAP financial measures. The same factors described in

this release that impacted these non-GAAP measures also impacted

the comparable GAAP measures. Refer to pages 12 through 14 for

further discussion and GAAP to Non-GAAP Reconciliations.

Summary of 2024 Year-to-Date Results

Compared to 2023

- Total revenues increased 0.7% to $17.7 billion,

primarily driven by higher pricing and volume in our ocean

services, partially offset by lower pricing and volume in our

truckload services.

- Gross profits increased 5.8% to $2.7 billion.

Adjusted gross profits increased 6.2% to $2.8 billion,

primarily driven by higher adjusted gross profit per transaction in

our truckload and ocean services.

- Operating expenses increased 0.3% to $2.1 billion.

Personnel expenses decreased 0.6% to $1.5 billion, primarily

due to cost optimization efforts and productivity improvements,

partially offset by higher variable compensation and higher

restructuring charges related to workforce reductions. Average

employee headcount declined 10.3%. Other SG&A expenses

increased 2.5% to $639.6 million primarily due to a $44.5 million

loss on the planned divestiture of our Europe Surface

Transportation business. The prior year included $19.6 million of

restructuring expenses, primarily related to the divestiture of our

operations in Argentina. In addition, other SG&A expenses

decreased across several expense categories in 2024.

- Income from operations totaled $669.1 million, up 30.0%

from last year, due to the increase in adjusted gross profits,

partially offset by the increase in operating expenses. Adjusted

operating margin(1) of 24.2% increased 440 basis points.

- Interest and other income/expense, net totaled $89.9

million of expense, primarily consisting of $85.9 million of

interest expense, which decreased $4.3 million versus last year,

due to a lower average debt balance. The year-to-date results also

include a $7.4 million net loss from foreign currency revaluation

and realized foreign currency gains and losses.

- The effective tax rate for the full year ended December

31, 2024 was 19.6% compared to 20.5% in the year-ago period. The

lower rate in 2024 was driven by the impact of non-recurring

discrete items and higher U.S. tax credits, partially offset by

higher pre-tax income and lower foreign tax credits.

- Net income totaled $465.7 million, up 43.2% from a year

ago. Diluted EPS of $3.86 increased 41.9%. Adjusted

EPS(1) of $4.51 increased 36.7%.

(1) Adjusted operating margin and adjusted

EPS are non-GAAP financial measures. The same factors described in

this release that impacted these non-GAAP measures also impacted

the comparable GAAP measures. Refer to pages 12 through 14 for

further discussion and GAAP to Non-GAAP Reconciliations.

North American Surface Transportation

(“NAST”) Results

Summarized financial results of our NAST segment are as follows

(dollars in thousands):

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

% change

2024

2023

% change

Total revenues

$

2,802,700

$

3,000,650

(6.6

)%

$

11,727,539

$

12,471,075

(6.0

)%

Adjusted gross profits(1)

403,764

380,157

6.2

%

1,641,195

1,593,854

3.0

%

Income from operations

132,528

95,958

38.1

%

531,292

459,960

15.5

%

____________________________________________

(1) Adjusted gross profits is a non-GAAP financial measure

explained later in this release. The difference between adjusted

gross profits and gross profits is not material.

Fourth quarter total revenues for the NAST segment totaled $2.8

billion, a decrease of 6.6% over the prior year, primarily driven

by lower truckload volume and pricing, reflecting an oversupply of

truckload capacity compared to freight demand. NAST adjusted gross

profits increased 6.2% in the quarter to $403.8 million. Adjusted

gross profits in truckload increased 9.5% due to a 17.0% increase

in adjusted gross profit per shipment, partially offset by a 6.5%

decrease in truckload shipments. Our average truckload linehaul

rate per mile charged to our customers, which excludes fuel

surcharges, increased approximately 6.0% in the quarter compared to

the prior year, while truckload linehaul cost per mile, excluding

fuel surcharges, increased 4.0%, resulting in an 18.0% increase in

truckload adjusted gross profit per mile. LTL adjusted gross

profits increased 4.5% versus the year-ago period, driven by a 2.5%

increase in LTL volume and a 2.0% increase in adjusted gross profit

per order. NAST overall volume decreased approximately 1.0% for the

quarter. Operating expenses decreased 4.6%, primarily due to cost

optimization efforts, productivity improvements and lower claims,

which were partially offset by higher variable compensation. Fourth

quarter average employee headcount was down 12.4% year-over-year.

Income from operations increased 38.1% to $132.5 million, and

adjusted operating margin expanded 760 basis points to 32.8%.

Global Forwarding

Results

Summarized financial results of our Global Forwarding segment

are as follows (dollars in thousands):

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

% change

2024

2023

% change

Total revenues

$

883,968

$

708,814

24.7

%

$

3,805,018

$

2,997,704

26.9

%

Adjusted gross profits(1)

203,801

162,322

25.6

%

802,549

689,365

16.4

%

Income from operations

51,827

22,576

129.6

%

212,476

85,830

147.6

%

____________________________________________

(1) Adjusted gross profits is a non-GAAP

financial measure explained later in this release. The difference

between adjusted gross profits and gross profits is not

material.

Fourth quarter total revenues for the Global Forwarding segment

increased 24.7% to $884.0 million, primarily driven by higher

pricing in our ocean services. Adjusted gross profits increased

25.6% in the quarter to $203.8 million. Ocean adjusted gross

profits increased 27.7%, driven by a 23.5% increase in adjusted

gross profit per shipment and a 3.5% increase in shipments. Air

adjusted gross profits increased 45.4%, driven by a 26.0% increase

in adjusted gross profit per metric ton shipped and a 15.5%

increase in metric tons shipped. Customs adjusted gross profits

increased 11.6%, driven by a 14.5% increase in adjusted gross

profit per transaction, partially offset by a 2.5% reduction in

transaction volume. Operating expenses increased 8.8%, primarily

due to higher variable compensation, which was partially offset by

cost optimization efforts and productivity improvements. Fourth

quarter average employee headcount decreased 9.5% year-over-year.

Income from operations increased 129.6% to $51.8 million, and

adjusted operating margin expanded 1,150 basis points to 25.4% in

the quarter.

All Other and Corporate

Results

Total revenues and adjusted gross profits for Robinson Fresh,

Managed Solutions and Other Surface Transportation are summarized

as follows (dollars in thousands):

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

% change

2024

2023

% change

Total revenues

$

497,988

$

512,423

(2.8

)%

$

2,192,399

$

2,127,664

3.0

%

Adjusted gross profits(1):

Robinson Fresh

$

35,983

$

31,093

15.7

%

$

146,310

$

131,216

11.5

%

Managed Solutions

28,133

28,846

(2.5

)%

113,770

116,196

(2.1

)%

Other Surface Transportation

12,942

16,205

(20.1

)%

61,190

73,977

(17.3

)%

____________________________________________

(1) Adjusted gross profits is a non-GAAP

financial measure explained later in this release. The difference

between adjusted gross profits and gross profits is not

material.

Fourth quarter Robinson Fresh adjusted gross profits increased

15.7% to $36.0 million due to an increase in integrated supply

chain solutions for retail and foodservice customers. Managed

Solutions adjusted gross profits decreased 2.5% due to lower

transaction volume. Other Surface Transportation adjusted gross

profits decreased 20.1% to $12.9 million, primarily due to a 19.4%

decrease in Europe truckload adjusted gross profits.

Other Income Statement

Items

Interest and other income/expense, net totaled $15.4 million of

expense, consisting primarily of $18.8 million of interest expense,

which decreased $2.8 million versus the fourth quarter of 2023 due

to a lower average debt balance and lower variable interest rates,

and a $3.3 million net gain from foreign currency revaluation and

realized foreign currency gains and losses.

The fourth quarter effective tax rate was 11.4%, down from 55.3%

in the fourth quarter of 2023. The lower rate in the fourth quarter

of 2024 was also driven by the impact of non-recurring discrete

items, higher U.S. tax credits, and increased tax benefit related

to stock-based compensation, partially offset by lower foreign tax

credits. For 2025, we expect our full-year effective tax rate to be

18% to 20%.

Diluted weighted average shares outstanding in the quarter were

up 2.2% year-over-year.

Cash Flow Generation and Capital

Distribution

Cash generated from operations totaled $267.9 million in the

fourth quarter, compared to $47.3 million of cash generated from

operations in the fourth quarter of 2023. The $220.6 million

increase in cash flow from operations was primarily related to a

$118.3 million increase in net income and an $81.3 million increase

in cash provided by changes in net operating working capital, due

to a $90.8 million sequential decrease in net operating working

capital in the fourth quarter of 2024 compared to a $9.5 million

sequential decrease in the fourth quarter of 2023.

In the fourth quarter of 2024, cash returned to shareholders

totaled $82.8 million, with $74.5 million in cash dividends and

$8.3 million in repurchases of common stock.

Capital expenditures totaled $15.2 million in the quarter and

$74.3 million for the year. Capital expenditures for 2025 are

expected to be $75 million to $85 million.

About C.H. Robinson

C.H. Robinson delivers logistics like no one else™. Companies

around the world look to us to reimagine supply chains, advance

freight technology, and solve logistics challenges—from the simple

to the most complex. 83,000 customers and 450,000 contract carriers

in our network trust us to manage 37 million shipments and $23

billion in freight annually. Through our unmatched expertise,

unrivaled scale, and tailored solutions, we ensure the seamless

delivery of goods across industries and continents via truckload,

less-than-truckload, ocean, air, and beyond. As a responsible

global citizen, we make supply chains more sustainable and proudly

contribute millions to the causes that matter most to our

employees. For more information, visit us at chrobinson.com

(Nasdaq: CHRW).

Except for the historical information contained herein, the

matters set forth in this release are forward-looking statements

that represent our expectations, beliefs, intentions or strategies

concerning future events. These forward-looking statements are

subject to certain risks and uncertainties that could cause actual

results to differ materially from our historical experience or our

present expectations, including, but not limited to, factors such

as changes in economic conditions, including uncertain consumer

demand; changes in market demand and pressures on the pricing for

our services; fuel price increases or decreases, or fuel shortages;

competition and growth rates within the global logistics industry

that could adversely impact our profitability and achieving our

long-term growth targets; freight levels and increasing costs and

availability of truck capacity or alternative means of transporting

freight; risks associated with seasonal changes or significant

disruptions in the transportation industry; risks associated with

identifying and completing suitable acquisitions; our dependence on

and changes in relationships with existing contracted truck, rail,

ocean, and air carriers; risks associated with the loss of

significant customers; risks associated with reliance on technology

to operate our business; cyber-security related risks; our ability

to staff and retain employees; risks associated with operations

outside of the U.S.; our ability to successfully integrate the

operations of acquired companies with our historic operations or

efficiently managing divestitures; climate change related risks;

risks associated with our indebtedness; risks associated with

interest rates; risks associated with litigation, including

contingent auto liability and insurance coverage; risks associated

with the potential impact of changes in government regulations

including environmental-related regulations; risks associated with

the changes to income tax regulations; risks associated with the

produce industry, including food safety and contamination issues;

the impact of changes in political and governmental conditions;

changes to our capital structure; changes due to catastrophic

events; risks associated with the usage of artificial intelligence

technologies; risks associated with cybersecurity events; and other

risks and uncertainties detailed in our Annual and Quarterly

Reports.

Any forward-looking statement speaks only as of the date on

which such statement is made, and we undertake no obligation to

update such statement to reflect events or circumstances arising

after such date. All remarks made during our financial results

conference call will be current at the time of the call, and we

undertake no obligation to update the replay.

Conference Call Information: C.H.

Robinson Worldwide Fourth Quarter 2024 Earnings Conference Call

Wednesday, January 29, 2025; 5:00 p.m. Eastern Time Presentation

slides and a simultaneous live audio webcast of the conference call

may be accessed through the Investor Relations link on C.H.

Robinson’s website at chrobinson.com. To participate in the

conference call by telephone, please call ten minutes early by

dialing: 877-269-7756

Adjusted Gross Profit by Service Line

(in thousands)

This table of summary results presents our service line adjusted

gross profits on an enterprise basis. The service line adjusted

gross profits in the table differ from the service line adjusted

gross profits discussed within the segments as our segments may

have revenues from multiple service lines.

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

% change

2024

2023

% change

Adjusted gross profits(1):

Transportation

Truckload

$

261,527

$

243,839

7.3

%

$

1,072,691

$

1,039,079

3.2

%

LTL

141,982

136,602

3.9

%

572,169

550,373

4.0

%

Ocean

127,139

99,191

28.2

%

519,970

420,883

23.5

%

Air

40,856

28,224

44.8

%

135,901

123,470

10.1

%

Customs

26,467

23,730

11.5

%

107,480

97,096

10.7

%

Other logistics services

54,383

59,402

(8.4

)%

225,599

255,735

(11.8

)%

Total transportation

652,354

590,988

10.4

%

2,633,810

2,486,636

5.9

%

Sourcing

32,269

27,635

16.8

%

131,204

117,972

11.2

%

Total adjusted gross profits

$

684,623

$

618,623

10.7

%

$

2,765,014

$

2,604,608

6.2

%

____________________________________________

(1) Adjusted gross profits is a non-GAAP

financial measure explained later in this release. The difference

between adjusted gross profits and gross profits is not

material.

GAAP to Non-GAAP Reconciliation

(unaudited, in thousands)

Our adjusted gross profit is a non-GAAP financial measure.

Adjusted gross profit is calculated as gross profit excluding

amortization of internally developed software utilized to directly

serve our customers and contracted carriers. We believe adjusted

gross profit is a useful measure of our ability to source, add

value, and sell services and products that are provided by third

parties, and we consider adjusted gross profit to be a primary

performance measurement. Accordingly, the discussion of our results

of operations often focuses on the changes in our adjusted gross

profit. The reconciliation of gross profit to adjusted gross profit

is presented below (in thousands):

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

% change

2024

2023

% change

Revenues:

Transportation

$

3,870,927

$

3,930,461

(1.5

)%

$

16,353,745

$

16,372,660

(0.1

)%

Sourcing

313,729

291,426

7.7

%

1,371,211

1,223,783

12.0

%

Total revenues

4,184,656

4,221,887

(0.9

)%

17,724,956

17,596,443

0.7

%

Costs and expenses:

Purchased transportation and related

services

3,218,573

3,339,473

(3.6

)%

13,719,935

13,886,024

(1.2

)%

Purchased products sourced for resale

281,460

263,791

6.7

%

1,240,007

1,105,811

12.1

%

Direct internally developed software

amortization

11,762

9,320

26.2

%

44,308

33,620

31.8

%

Total direct expenses

3,511,795

3,612,584

(2.8

)%

15,004,250

15,025,455

(0.1

)%

Gross profit

$

672,861

$

609,303

10.4

%

$

2,720,706

$

2,570,988

5.8

%

Plus: Direct internally developed software

amortization

11,762

9,320

26.2

%

44,308

33,620

31.8

%

Adjusted gross profit

$

684,623

$

618,623

10.7

%

$

2,765,014

$

2,604,608

6.2

%

Our adjusted operating margin is a non-GAAP financial measure

calculated as operating income divided by adjusted gross profit.

Our adjusted operating margin - excluding restructuring and loss on

divestiture is a similar non-GAAP financial measure as adjusted

operating margin, but also excludes the impact of restructuring and

loss on divestiture. We believe adjusted operating margin and

adjusted operating margin - excluding restructuring and loss on

divestiture are useful measures of our profitability in comparison

to our adjusted gross profit, which we consider a primary

performance metric as discussed above. The comparisons of operating

margin to adjusted operating margin and adjusted operating margin -

excluding restructuring and loss on divestiture are presented

below:

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

% change

2024

2023

% change

Total revenues

$

4,184,656

$

4,221,887

(0.9

%)

$

17,724,956

$

17,596,443

0.7

%

Income from operations

183,799

107,429

71.1

%

669,141

514,607

30.0

%

Operating margin

4.4

%

2.5

%

190 bps

3.8

%

2.9

%

90 bps

Adjusted gross profit

$

684,623

$

618,623

10.7

%

$

2,765,014

$

2,604,608

6.2

%

Income from operations

183,799

107,429

71.1

%

669,141

514,607

30.0

%

Adjusted operating margin

26.8

%

17.4

%

940 bps

24.2

%

19.8

%

440 bps

Adjusted gross profit

$

684,623

$

618,623

10.7

%

$

2,765,014

$

2,604,608

6.2

%

Adjusted income from operations

184,408

103,153

78.8

%

759,349

552,648

37.4

%

Adjusted operating margin - excluding

restructuring and loss on divestiture

26.9

%

16.7

%

1,020 bps

27.5

%

21.2

%

630 bps

GAAP to Non-GAAP Reconciliation

(unaudited, in thousands)

Our adjusted income (loss) from operations, adjusted operating

margin - excluding restructuring and loss on divestiture, adjusted

net income and adjusted net income per share (diluted) are non-GAAP

financial measures. These non-GAAP measures are calculated

excluding the impact of restructuring, losses from divestitures,

foreign currency losses from our Argentina operations, and the

impact of an income tax settlement in the prior year. We believe

that these measures provide useful information to investors and

include them within our internal reporting to our chief operating

decision maker. Accordingly, the discussion of our results of

operations includes discussion on the changes in our adjusted

income (loss) from operations, adjusted operating margin -

excluding restructuring and loss on divestiture, adjusted net

income and adjusted net income per share (diluted). The

reconciliation of these non-GAAP measures are presented below (in

thousands except per share data):

NAST

Global Forwarding

All Other and Corporate

Consolidated

Three Months Ended December 31, 2024

Non-GAAP

Reconciliation:

Income (loss) from operations

$

132,528

$

51,827

$

(556

)

$

183,799

Severance and other personnel expenses

1,154

1,017

1,574

3,745

Other selling, general, and administrative

expenses

671

2,281

(6,088

)

(3,136

)

Total adjustments to income (loss) from

operations(1)

1,825

3,298

(4,514

)

609

Adjusted income (loss) from operations

$

134,353

$

55,125

$

(5,070

)

$

184,408

Adjusted gross profit

$

403,764

$

203,801

$

77,058

$

684,623

Adjusted income (loss) from operations

134,353

55,125

(5,070

)

184,408

Adjusted operating margin - excluding

restructuring and loss on divestiture

33.3

%

27.0

%

N/M

26.9

%

NAST

Global Forwarding

All Other and Corporate

Consolidated

Twelve Months Ended December 31, 2024

Income (loss) from operations

$

531,292

$

212,476

$

(74,627

)

$

669,141

Severance and other personnel expenses

10,176

6,872

7,004

24,052

Other selling, general, and administrative

expenses

6,885

4,729

54,542

66,156

Total adjustments to income (loss) from

operations(2)

17,061

11,601

61,546

90,208

Adjusted income (loss) from operations

$

548,353

$

224,077

$

(13,081

)

$

759,349

Adjusted gross profit

$

1,641,195

$

802,549

$

321,270

$

2,765,014

Adjusted income (loss) from operations

548,353

224,077

(13,081

)

759,349

Adjusted operating margin - excluding

restructuring and loss on divestiture

33.4

%

27.9

%

N/M

27.5

%

Three Months Ended December 31,

2024

Twelve Months Ended December 31,

2024

$ in 000's

per share

$ in 000's

per share

Net income and per share (diluted)

$

149,306

$

1.22

$

465,690

$

3.86

Restructuring and related costs,

pre-tax

13,183

0.11

45,746

0.38

Loss (gain) on divestiture, pre-tax

(12,574

)

(0.10

)

44,462

0.37

Tax effect of adjustments

(1,851

)

(0.02

)

(11,773

)

(0.10

)

Adjusted net income and per share

(diluted)

$

148,064

$

1.21

$

544,125

$

4.51

____________________________________________

(1) The three months ended December 31,

2024 include restructuring expenses of $3.7 million related to

workforce reductions and $3.1 million net gain driven by a $12.6

million favorable adjustment to the loss on the planned divestiture

of our Europe Surface Transportation business, partially offset by

impairments related to reducing our facilities footprint.

(2) The twelve months ended December 31,

2024 include restructuring expenses of $24.1 million related to

workforce reductions and $66.2 million of

other charges, which includes a $44.5

million loss on the planned divestiture of our Europe Surface

Transportation business and impairments related to reducing our

facilities footprint and of internally developed software.

NAST

Global Forwarding

All Other and Corporate

Consolidated

Three Months Ended December 31, 2023

Non-GAAP

Reconciliation:

Income (loss) from operations

$

95,958

$

22,576

$

(11,105

)

$

107,429

Severance and other personnel expenses

—

(925

)

(409

)

(1,334

)

Other selling, general, and administrative

expenses

—

(3,084

)

142

(2,942

)

Total adjustments to income (loss) from

operations(1)

—

(4,009

)

(267

)

(4,276

)

Adjusted income (loss) from operations

$

95,958

$

18,567

$

(11,372

)

$

103,153

Adjusted gross profit

$

380,157

$

162,322

$

76,144

$

618,623

Adjusted income (loss) from operations

95,958

18,567

(11,372

)

103,153

Adjusted operating margin - excluding

restructuring and loss on divestiture

25.2

%

11.4

%

N/M

16.7

%

NAST

Global Forwarding

All Other and Corporate

Consolidated

Twelve Months Ended December 31, 2023

Income (loss) from operations

$

459,960

$

85,830

$

(31,183

)

$

514,607

Severance and other personnel expenses

1,083

3,817

13,509

18,409

Other selling, general, and administrative

expenses

8

18,158

1,466

19,632

Total adjustments to income (loss) from

operations(2)

1,091

21,975

14,975

38,041

Adjusted income (loss) from operations

$

461,051

$

107,805

$

(16,208

)

$

552,648

Adjusted gross profit

$

1,593,854

$

689,365

$

321,389

$

2,604,608

Adjusted income (loss) from operations

461,051

107,805

(16,208

)

552,648

Adjusted operating margin - excluding

restructuring and loss on divestiture

28.9

%

15.6

%

N/M

21.2

%

Three Months Ended December 31,

2023

Twelve Months Ended December 31,

2023

$ in 000's

per share

$ in 000's

per share

Net income and per share (diluted)

$

30,973

$

0.26

$

325,129

$

2.72

Restructuring and related costs,

pre-tax

(239

)

—

17,476

0.14

Loss (gain) on divestiture, pre-tax

(2,617

)

(0.02

)

21,985

0.18

Foreign currency loss on divested

operations, pre-tax

7,454

0.06

16,375

0.14

Income tax settlement and tax effect of

adjustments

23,928

0.20

14,172

0.12

Adjusted net income and per share

(diluted)

$

59,499

$

0.50

$

395,137

$

3.30

____________________________________________

(1) The three months ended December 31,

2023 include a net gain of $4.3 million driven by a favorable

adjustment to the loss on the divestiture of our operations in

Argentina.

(2) The twelve months ended December 31,

2023 includes restructuring expenses of $18.4 million related to

workforce reductions and $19.6 million of asset impairment and

other charges, primarily related to a loss on the divestiture of

our Argentina operations.

Condensed Consolidated

Statements of Income (unaudited, in thousands, except per share

data)

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

% change

2024

2023

% change

Revenues:

Transportation

$

3,870,927

$

3,930,461

(1.5

)%

$

16,353,745

$

16,372,660

(0.1

)%

Sourcing

313,729

291,426

7.7

%

1,371,211

1,223,783

12.0

%

Total revenues

4,184,656

4,221,887

(0.9

)%

17,724,956

17,596,443

0.7

%

Costs and expenses:

Purchased transportation and related

services

3,218,573

3,339,473

(3.6

)%

13,719,935

13,886,024

(1.2

)%

Purchased products sourced for resale

281,460

263,791

6.7

%

1,240,007

1,105,811

12.1

%

Personnel expenses

354,381

361,820

(2.1

)%

1,456,249

1,465,735

(0.6

)%

Other selling, general, and administrative

expenses

146,443

149,374

(2.0

)%

639,624

624,266

2.5

%

Total costs and expenses

4,000,857

4,114,458

(2.8

)%

17,055,815

17,081,836

(0.2

)%

Income from operations

183,799

107,429

71.1

%

669,141

514,607

30.0

%

Interest and other income/expense, net

(15,350

)

(38,149

)

(59.8

)%

(89,937

)

(105,421

)

(14.7

)%

Income before provision for income

taxes

168,449

69,280

143.1

%

579,204

409,186

41.6

%

Provision for income taxes

19,143

38,307

(50.0

)%

113,514

84,057

35.0

%

Net income

$

149,306

$

30,973

382.1

%

$

465,690

$

325,129

43.2

%

Net income per share (basic)

$

1.24

$

0.26

376.9

%

$

3.89

$

2.74

42.0

%

Net income per share (diluted)

$

1.22

$

0.26

369.2

%

$

3.86

$

2.72

41.9

%

Weighted average shares outstanding

(basic)

120,589

118,605

1.7

%

119,805

118,551

1.1

%

Weighted average shares outstanding

(diluted)

122,291

119,613

2.2

%

120,679

119,677

0.8

%

Business Segment

Information

(unaudited, in thousands, except

average employee headcount)

NAST

Global Forwarding

All Other and Corporate

Consolidated

Three Months Ended December 31, 2024

Total revenues

$

2,802,700

$

883,968

$

497,988

$

4,184,656

Adjusted gross profits(1)

403,764

203,801

77,058

684,623

Income (loss) from operations

132,528

51,827

(556

)

183,799

Depreciation and amortization

4,891

2,357

17,032

24,280

Total assets(2)

2,874,701

1,335,178

1,088,047

5,297,926

Average employee headcount

5,348

4,542

3,979

13,869

NAST

Global Forwarding

All Other and Corporate

Consolidated

Three Months Ended December 31, 2023

Total revenues

$

3,000,650

$

708,814

$

512,423

$

4,221,887

Adjusted gross profits(1)

380,157

162,322

76,144

618,623

Income (loss) from operations

95,958

22,576

(11,105

)

107,429

Depreciation and amortization

5,638

2,915

14,533

23,086

Total assets(2)

3,008,459

1,094,895

1,121,926

5,225,280

Average employee headcount

6,103

5,021

4,195

15,319

____________________________________________

(1) Adjusted gross profits is a non-GAAP

financial measure explained above. The difference between adjusted

gross profits and gross profits is not material.

(2) All cash and cash equivalents are

included in All Other and Corporate.

Business Segment

Information

(unaudited, in thousands, except

average employee headcount)

NAST

Global Forwarding

All Other and Corporate

Consolidated

Twelve Months Ended December 31, 2024

Total revenues

$

11,727,539

$

3,805,018

$

2,192,399

$

17,724,956

Adjusted gross profits(1)

1,641,195

802,549

321,270

2,765,014

Income (loss) from operations

531,292

212,476

(74,627

)

669,141

Depreciation and amortization

20,670

10,602

65,888

97,160

Total assets(2)

2,874,701

1,335,178

1,088,047

5,297,926

Average employee headcount

5,696

4,678

4,012

14,386

NAST

Global Forwarding

All Other and Corporate

Consolidated

Twelve Months Ended December 31, 2023

Total revenues

$

12,471,075

$

2,997,704

$

2,127,664

$

17,596,443

Adjusted gross profits(1)

1,593,854

689,365

321,389

2,604,608

Income (loss) from operations

459,960

85,830

(31,183

)

514,607

Depreciation and amortization

23,027

19,325

56,633

98,985

Total assets(2)

3,008,459

1,094,895

1,121,926

5,225,280

Average employee headcount

6,469

5,222

4,350

16,041

____________________________________________

(1) Adjusted gross profits is a non-GAAP

financial measure explained above. The difference between adjusted

gross profits and gross profits is not material.

(2) All cash and cash equivalents are

included in All Other and Corporate.

Condensed Consolidated Balance

Sheets

(unaudited, in thousands)

December 31, 2024

December 31, 2023

Assets

Current assets:

Cash and cash equivalents

$

145,762

$

145,524

Receivables, net of allowance for credit

loss

2,383,709

2,381,963

Contract assets, net of allowance for

credit loss

200,332

189,900

Prepaid expenses and other

102,166

163,307

Assets held for sale

137,634

—

Total current assets

2,969,603

2,880,694

Property and equipment, net of accumulated

depreciation and amortization

127,189

144,718

Right-of-use lease assets

334,738

353,890

Intangible and other assets, net of

accumulated amortization

1,866,396

1,845,978

Total assets

$

5,297,926

$

5,225,280

Liabilities and stockholders’

investment

Current liabilities:

Accounts payable and outstanding

checks

$

1,212,132

$

1,370,334

Accrued expenses:

Compensation

180,801

135,104

Transportation expense

153,274

147,921

Income taxes

9,326

4,748

Other accrued liabilities

173,318

159,435

Current lease liabilities

72,842

74,451

Current portion of debt

455,792

160,000

Liabilities held for sale

67,413

—

Total current liabilities

2,324,898

2,051,993

Long-term debt

921,857

1,420,487

Noncurrent lease liabilities

290,641

297,563

Noncurrent income taxes payable

23,472

21,289

Deferred tax liabilities

12,565

13,177

Other long-term liabilities

2,442

2,074

Total liabilities

3,575,875

3,806,583

Total stockholders’ investment

1,722,051

1,418,697

Total liabilities and stockholders’

investment

$

5,297,926

$

5,225,280

Condensed Consolidated

Statements of Cash Flow

(unaudited, in thousands, except

operational data)

Twelve Months Ended December

31,

Operating activities:

2024

2023

Net income

$

465,690

$

325,129

Adjustments to reconcile net income to net

cash (used for) provided by operating activities:

Depreciation and amortization

97,160

98,985

Provision for credit losses

6,688

(6,047

)

Stock-based compensation

84,590

58,169

Deferred income taxes

(80,067

)

(37,746

)

Excess tax benefit on stock-based

compensation

(9,411

)

(11,319

)

Loss on disposal group held for sale

32,794

17,698

Other operating activities

20,682

5,541

Changes in operating elements:

Receivables

(164,255

)

607,259

Contract assets

(11,969

)

68,041

Prepaid expenses and other

60,740

(39,048

)

Right of use asset

(5,937

)

19,255

Accounts payable and outstanding

checks

(79,943

)

(200,843

)

Accrued compensation

49,681

(108,084

)

Accrued transportation expenses

6,756

(51,171

)

Accrued income taxes

15,545

(2,284

)

Other accrued liabilities

12,791

(11,991

)

Lease liability

5,076

(16,500

)

Other assets and liabilities

2,473

16,902

Net cash provided by operating

activities

509,084

731,946

Investing activities:

Purchases of property and equipment

(22,653

)

(29,989

)

Purchases and development of software

(51,635

)

(54,122

)

Proceeds from sale of property and

equipment

—

1,324

Net cash used for investing activities

(74,288

)

(82,787

)

Financing activities:

Proceeds from stock issued for employee

benefit plans

114,890

56,914

Stock tendered for payment of withholding

taxes

(32,217

)

(25,294

)

Repurchase of common stock

—

(63,884

)

Cash dividends

(294,772

)

(291,569

)

Proceeds from long-term borrowings

10,000

—

Payments on long-term borrowings

(10,000

)

—

Proceeds from short-term borrowings

3,192,500

3,893,750

Payments on short-term borrowings

(3,396,500

)

(4,287,750

)

Net cash used for financing activities

(416,099

)

(717,833

)

Effect of exchange rates on cash and cash

equivalents

(8,152

)

(3,284

)

Net change in cash and cash equivalents,

including cash and cash equivalents classified within assets held

for sale

10,545

(71,958

)

Less: net increase in cash and cash

equivalents within assets held for sale

(10,307

)

—

Cash and cash equivalents, beginning of

period

145,524

217,482

Cash and cash equivalents, end of

period

$

145,762

$

145,524

As of December 31,

Operational Data:

2024

2023

Employees

13,781

15,246

CHRW-IR

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250129314724/en/

Chuck Ives, Senior Director of Investor Relations Email:

chuck.ives@chrobinson.com

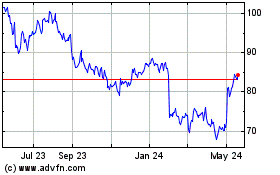

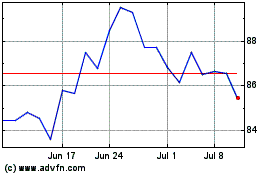

CH Robinson Worldwide (NASDAQ:CHRW)

Historical Stock Chart

From Jan 2025 to Feb 2025

CH Robinson Worldwide (NASDAQ:CHRW)

Historical Stock Chart

From Feb 2024 to Feb 2025