Current Report Filing (8-k)

October 19 2021 - 8:13AM

Edgar (US Regulatory)

000109166700012718330001271834falsefalsefalse0001091667chtr:CCOHoldingsCapitalCorp.Member2021-10-192021-10-1900010916672021-10-192021-10-190001091667chtr:CCOHoldingsLLCMember2021-10-192021-10-19

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________

FORM 8-K

______________

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 19, 2021

Charter Communications, Inc.

CCO Holdings, LLC

CCO Holdings Capital Corp.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation or organization)

|

|

|

|

|

|

|

|

|

|

|

001-33664

|

|

84-1496755

|

|

001-37789

|

|

86-1067239

|

|

333-112593-01

|

|

20-0257904

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification Number)

|

400 Atlantic Street

Stamford, Connecticut 06901

(Address of principal executive offices including zip code)

(203) 905-7801

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Class A Common Stock, $.001 Par Value

|

CHTR

|

NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 5.02. DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS.

Effective October 19, 2021, Charter Communications, Inc. (“Charter”) appointed John Bickham to the position of Vice Chairman, Chris Winfrey as Chief Operating Officer, and Jessica Fischer as Chief Financial Officer, and expanded the responsibilities of Rich DiGeronimo, Charter’s Chief Product and Technology Officer, to include Network Operations. Mr. Winfrey also entered into an amended and restated employment agreement (the “Amended Agreement”) with a term ending October 19, 2024. Under the Amended Agreement, commencing October 19, 2021, Mr. Winfrey will receive an annual base salary of at least $1,250,000, a target annual cash bonus opportunity of 160% of his annual base salary and will continue to participate in Charter’s employee benefit plans and receive perquisites as generally provided to other senior executives of Charter. Consistent with Mr. Winfrey’s prior employment agreement, Charter will continue to reimburse Mr. Winfrey for all reasonable and necessary expenses incurred in connection with the performance of his duties, and Mr. Winfrey is entitled to use Company aircraft for up to 40 hours of discretionary personal use per calendar year (without carryover).

The Amended Agreement provides that, if Mr. Winfrey’s employment is terminated involuntarily by Charter without cause or by Mr. Winfrey for good reason, Mr. Winfrey would be eligible for (a) a cash severance payment equal to the product of 2.5 multiplied by the sum of his annual base salary and target annual bonus opportunity for the year in which the termination occurs, (b) a prorated annual bonus for the year of termination, determined based on actual performance, (c) a cash payment equal to the cost of COBRA coverage for 30 months, and (d) executive-level outplacement services for up to 12 months following the date of termination. In the event of the termination of Mr. Winfrey’s employment due to death or disability, he would be eligible for a prorated annual bonus for the year of termination, determined based on actual performance.

The termination benefits described above are generally subject to Mr. Winfrey’s execution of a release of claims in favor of Charter and its affiliates. In addition, Mr. Winfrey has agreed to comply with covenants concerning nondisclosure of confidential information, assignment of intellectual property and non-disparagement of Charter and, for two year following termination, a covenant concerning noncompetition as well as for one year following termination a covenant concerning non-solicitation of customers and employees of Charter and its affiliates.

Ms. Fischer will continue her employment under the terms of her employment agreement (the “Employment Agreement”) entered into as of February 5, 2021. The Employment Agreement has an initial term of two years, which is subject to renewal thereafter for one-year periods at Charter’s discretion. In consideration for Ms. Fischer’s services and in connection with her promotion to Chief Financial Officer, the Employment Agreement provides for an annual base salary of $700,000, a target annual bonus opportunity of 150% of annual base salary and participation in employee benefit plans generally on the same terms as our other senior executives.

If the employment of Ms. Fischer is terminated involuntarily by Charter without cause or by her for good reason, she would be entitled to (a) a cash severance payment equal to the product of 2.0 multiplied by the sum of her annual base salary and target annual bonus opportunity for the year in which the termination occurs, (b) a cash payment equal to the cost of COBRA coverage for 24 months following termination and (c) up to 12 months of executive-level outplacement services.

The foregoing severance benefits generally are subject to Ms. Fischer’s execution of a release of claims in favor of Charter and its affiliates. In addition, Ms. Fischer has agreed to comply with noncompetition and customer non-solicitation covenants for two years following termination, a non-solicitation of employees covenant for one year following termination, a perpetual confidentiality covenant and a perpetual non-disparagement covenant.

The foregoing summary of the Amended Agreement and the Employment Agreement does not purport to be complete and is qualified in its entirety by reference to the full text thereof, which are filed herewith as Exhibits 10.1 and 10.2, respectively, and incorporated by reference herein in their entirety.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit

|

|

Description

|

|

|

|

|

|

10.1

|

|

|

|

10.2

|

|

|

|

99.1

|

|

|

|

104

|

|

The cover page from this Current Report on Form 8-K, formatted in Inline XBRL

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, each of Charter Communications, Inc., CCO Holdings, LLC and CCO Holdings Capital Corp. has duly caused this Current Report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CHARTER COMMUNICATIONS, INC.,

|

|

|

Registrant

|

|

|

|

|

|

|

|

By:

|

|

/s/ Kevin D. Howard

|

|

|

|

|

Kevin D. Howard

|

|

Date: October 19, 2021

|

|

|

Executive Vice President, Chief Accounting Officer and Controller

|

|

|

|

|

|

|

|

|

|

|

|

|

CCO Holdings, LLC

|

|

|

Registrant

|

|

|

|

|

|

|

|

By:

|

|

/s/ Kevin D. Howard

|

|

|

|

|

Kevin D. Howard

|

|

Date: October 19, 2021

|

|

|

Executive Vice President, Chief Accounting Officer and Controller

|

|

|

|

|

|

|

|

|

|

|

|

|

CCO Holdings Capital Corp.

|

|

|

Registrant

|

|

|

|

|

|

|

|

By:

|

|

/s/ Kevin D. Howard

|

|

|

|

|

Kevin D. Howard

|

|

Date: October 19, 2021

|

|

|

Executive Vice President, Chief Accounting Officer and Controller

|

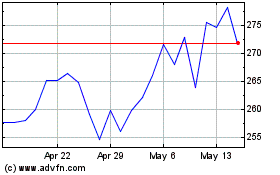

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Jun 2024 to Jul 2024

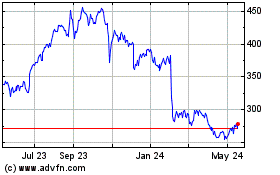

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Jul 2023 to Jul 2024