0000796505 False 0000796505 2024-11-01 2024-11-01 iso4217:USD xbrli:shares iso4217:USD xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 1, 2024

_______________________________

CLEARFIELD, INC.

(Exact name of registrant as specified in its charter)

_______________________________

| Minnesota | 000-16106 | 41-1347235 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

7050 Winnetka Avenue North, Suite 100

Brooklyn Park, Minnesota 55428

(Address of Principal Executive Offices) (Zip Code)

(763) 476-6866

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | CLFD | The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 7, 2024, Clearfield, Inc. (the “Company”) issued a press release announcing the results of its fourth quarter and fiscal year ended September 30, 2024. A copy of that press release is furnished hereto as Exhibit 99.1 and is hereby incorporated by reference. The information in this Item 2.02, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be deemed incorporated by reference into any Company filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On November 5, 2024, the Board of Directors (the “Board”) of the Company appointed Ms. Catherine T. Kelly and Mr. Ademir Sarcevic to serve as directors of the Company, effective December 11, 2024. Ms. Kelly has been appointed to serve on the Board’s Audit Committee and Nominating and Corporate Governance Committee, effective December 11, 2024. Mr. Sarcevic has been appointed to serve on the Board’s Audit Committee and Compensation Committee, effective December 11, 2024. In connection with their appointments, Ms. Kelly and Mr. Sarcevic will be receiving the standard director compensation as referenced in the Company’s Proxy Statement for the 2024 Annual Meeting of Shareholders.

On November 1, 2024, the Compensation Committee of the Board approved discretionary cash bonuses to the Company’s named executive officers, who are Cheryl Beranek, President and Chief Executive Officer, Daniel R. Herzog, Chief Financial Officer, and John P. Hill, Chief Operating Officer. The Compensation Committee awarded the bonuses to the named executive officers in recognition of their significant efforts and contributions during fiscal 2024 in: (1) establishing and building the infrastructure necessary to produce the Company’s FieldShield® fiber optic cable in the U.S. to support customers that are, or will be, subject to the Build America, Buy America Act requirements of the Broadband Equity, Access, and Deployment (BEAD) Program over the next several years; and (2) establishing inventory management processes to utilize and significantly reduce the Company’s excess inventory to contribute to positive cashflow from operations and improve liquidity while existing customer excess inventory levels are worked down during the post-pandemic environment. The Compensation Committee believes these efforts and contributions will help position the Company for future growth as the industry recovers. The amounts of the cash bonuses are as follows: Ms. Beranek, $140,250; Mr. Herzog, $112,200; and Mr. Hill, $140,250.

Item 9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | CLEARFIELD, INC. |

| | | |

| | | |

| Date: November 7, 2024 | By: | /s/ Cheryl Beranek |

| | | Cheryl Beranek |

| | | Chief Executive Officer |

| | | |

EXHIBIT 99.1

Clearfield Reports Fiscal Fourth Quarter and Full Year 2024 Results

- Q4 Revenue of $46.8 million and net loss per share of $(0.06) in Q4 exceeded guidance

- Achieved BABA self-certification recognition from the NTIA, the federal government agency administering BEAD

- Revenue guidance of $170 million to $185 million for fiscal year 2025

MINNEAPOLIS, Nov. 07, 2024 (GLOBE NEWSWIRE) -- Clearfield, Inc. (NASDAQ: CLFD), a leader in fiber connectivity, reported results for the fourth quarter and fiscal year 2024.

| Fiscal Q4 2024 Financial Summary | | |

| (in millions except per share data and percentages) | Q4 2024 | vs. Q4 2023 | Change | Change (%) | |

| Net Sales | $ | 46.8 | | $ | 49.7 | | $ | (2.9 | ) | -6 | % | |

| | | | | | |

| Gross Profit ($) | $ | 10.7 | | $ | 12.0 | | $ | (1.3 | ) | -11 | % | |

| Gross Profit (%) | | 22.8 | % | | 24.1 | % | | -1.3 | % | -5 | % | |

| | | | | | |

| (Loss) Income from Operations | $ | (3.0 | ) | $ | 1.7 | | $ | (4.7 | ) | -276 | % | |

| Income Tax (Benefit) Expense | $ | (0.5 | ) | $ | 0.6 | | $ | (1.1 | ) | -187 | % | |

| | | | | | |

| Net (Loss) Income | $ | (0.8 | ) | $ | 2.7 | | $ | (3.5 | ) | -131 | % | |

| Net (Loss) Income per Diluted Share | $ | (0.06 | ) | $ | 0.17 | | $ | (0.23 | ) | -135 | % | |

| | | | | | |

| Fiscal YTD 2024 Financial Summary | | |

| (in millions except per share data and percentages) | 2024 YTD | vs. 2023 YTD | Change | Change (%) | |

| Net Sales | $ | 166.7 | | $ | 268.7 | | $ | (102.0 | ) | -38 | % | |

| | | | | | |

| Gross Profit ($) | $ | 28.9 | | $ | 85.3 | | $ | (56.4 | ) | -66 | % | |

| Gross Profit (%) | | 17.3 | % | | 31.7 | % | | -14.4 | % | -45 | % | |

| | | | | | |

| (Loss) Income from Operations | $ | (23.2 | ) | $ | 37.3 | | $ | (60.5 | ) | -162 | % | |

| Income Tax (Benefit) Expense | $ | (3.8 | ) | $ | 9.1 | | $ | (12.9 | ) | -142 | % | |

| | | | | | |

| Net (Loss) Income | $ | (12.5 | ) | $ | 32.5 | | $ | (45.0 | ) | -138 | % | |

| Net (Loss) Income per Diluted Share | $ | (0.85 | ) | $ | 2.17 | | $ | (3.02 | ) | -139 | % | |

| | | | | | |

Management Commentary

"As we close out the fiscal year, we are proud of how well-positioned Clearfield is to capitalize on the significant opportunities ahead. Our quarterly outperformance was driven by stronger-than-expected sales in the MSO and Large Regional service provider markets," said Company President and Chief Executive Officer, Cheri Beranek. "Our revenue from products for homes connected continues to grow and we are encouraged by the positive response to our active cabinet solutions. Looking forward, we are excited about the opportunities from both public and private funding for rural broadband expansion. Our recent NTIA recognition for self-certification to the Build America Buy America (“BABA”) requirements further prepares us for the significant Broadband Equity, Access, and Deployment (“BEAD”) Program opportunity ahead, with initial revenue expected in late 2025," said Beranek.

“We are pleased to report positive cash flow from operations of approximately $22.2 million for the full year, reflecting our commitment to strategically investing in the organization, while maintaining a prudent and disciplined approach to our cost controls. We’ve made significant progress in reducing our inventory levels, and we will continue to prioritize this effort to further enhance cash flow from operations,” said Chief Financial Officer Dan Herzog. “Pockets of inventory remain at some customer sites, however, the successful transition of Clearfield becoming a full portfolio supplier of products for both passing and connecting homes has positioned the company for growth consistent with the general industry outlook. As a result, we are guiding to revenues of $170 million to $185 million in fiscal year 2025, with revenue growth expected to be primarily driven by the U.S. market as we concentrate on gross profit improvements in our international markets.

Financial Results for the Three Months Ended September 30, 2024

Net sales for the fourth quarter of fiscal 2024 decreased 5.9% to $46.8 million from $49.7 million in the same year-ago quarter.

As of September 30, 2024, order backlog (defined as purchase orders received but not yet fulfilled) was $25.1 million, a decrease of $7.5 million, or 23%, compared to $32.6 million as of June 30, 2024, and a decrease of $32.2 million, or 56.1%, from September 30, 2023.

Gross margin for the fourth quarter of fiscal 2024 was 22.8%, compared to 24.1% in the fourth quarter of fiscal 2023. While gross margin was down from the year ago quarter, it was slightly improved from the previous quarter gross margin of 21.9% due to lower excess inventory charges as a result of better utilization in the quarter.

Operating expenses for the fourth quarter of fiscal 2024 increased 33.1% to $13.7 million, or 29.3% of net sales, from $10.3 million, or 20.7% of net sales, mainly due to higher variable compensation and professional fees than in the same year-ago quarter.

Net loss for the fourth quarter of fiscal 2024 totaled $0.8 million, or ($0.06) per diluted share, compared to net income of $2.7 million, or $0.17 per diluted share, in the same year-ago quarter.

Outlook

At this time and after considering the expected impacts of seasonality and the current state of the industry, the Company expects net sales for the first quarter of fiscal 2025 to be in the range of $33 million to $38 million and net loss per share to be in the range of $0.28 to $0.35. This loss per share range is based on the number of shares outstanding at the end of the fourth quarter and does not reflect potential share repurchases completed in the first quarter of fiscal 2025. Additionally, the Company expects net sales in fiscal year 2025 to be in the range of $170 million to $185 million.

Conference Call

Management will hold a conference call today, November 7, 2024, at 5:00 p.m. Eastern Time (4:00 p.m. Central Time) to discuss these results and provide an update on business conditions.

U.S. dial-in: 1-833-816-1424

International dial-in: 1-412-317-0517

Conference ID: 10192600

The live webcast of the call can be accessed at the Clearfield Investor Relations website along with the company's earnings press release and presentation.

A replay of the call will be available after 8:00 p.m. Eastern Time on the same day through November 21, 2024, while an archived version of the webcast will be available on the Investor Relations website for 90 days.

U.S. replay dial-in: 1-844-512-2921

International replay dial-in: 1-412-317-6671

Replay ID: 10192600

About Clearfield, Inc.

Clearfield, Inc. (NASDAQ: CLFD) designs, manufactures, and distributes fiber optic management, protection, and delivery products for communications networks. Our “fiber to anywhere” platform serves the unique requirements of leading incumbent local exchange carriers (traditional carriers), competitive local exchange carriers (alternative carriers), and MSO/cable TV companies, while also catering to the broadband needs of the utility/municipality, enterprise, and data center markets. Headquartered in Minneapolis, MN, Clearfield deploys more than a million fiber ports each year. For more information, visit www.SeeClearfield.com.

Cautionary Statement Regarding Forward-Looking Information

Forward-looking statements contained herein and in any related presentation or in the related Earnings Presentation are made pursuant to the safe harbor provisions of the Private Litigation Reform Act of 1995. Words such as “may,” “plan,” “expect,” “aim,” “believe,” “project,” “target,” “anticipate,” “intend,” “estimate,” “will,” “should,” “could,” “outlook,” or “continue” or comparable terminology are intended to identify forward-looking statements. Such forward looking statements include, for example, statements about the Company’s future revenue and operating performance, expected customer ordering patterns and future supply agreements with customers, anticipated shipping on backlog and future lead times, future availability of components and materials from the Company’s supply chain, compliance with Build America Buy America (“BABA”) Act requirements, future availability of labor impacting our customers’ network builds, the impact of the Broadband Equity, Access, and Deployment (BEAD) Program, Rural Digital Opportunity Fund (RDOF) or other government programs on the demand for the Company’s products or timing of customer orders, the Company’s ability to match capacity to meet demand, expansion into new markets and trends in and growth of the FTTx markets, market segments or customer purchases and other statements that are not historical facts. These statements are based upon the Company's current expectations and judgments about future developments in the Company's business. Certain important factors could have a material impact on the Company's performance, including, without limitation: inflationary price pressures and uncertain availability of components, raw materials, labor and logistics used by us and our suppliers could negatively impact our profitability; we rely on single-source suppliers, which could cause delays, increase costs or prevent us from completing customer orders; we depend on the availability of sufficient supply of certain materials and global disruptions in the supply chain for these materials could prevent us from meeting customer demand for our products; a significant percentage of our sales in the last three fiscal years have been made to a small number of customers, and the loss of these major customers could adversely affect us; further consolidation among our customers may result in the loss of some customers and may reduce sales during the pendency of business combinations and related integration activities; we may be subject to risks associated with acquisitions, and the risks could adversely affect future operating results; we have exposure to movements in foreign currency exchange rates; adverse global economic conditions and geopolitical issues could have a negative effect on our business, and results of operations and financial condition; growth may strain our business infrastructure, which could adversely affect our operations and financial condition; product defects or the failure of our products to meet specifications could cause us to lose customers and sales or to incur unexpected expenses; we are dependent on key personnel; cyber-security incidents, including ransomware, data breaches or computer viruses, could disrupt our business operations, damage our reputation, result in increased expense, and potentially lead to legal proceedings; our business is dependent on interdependent management information systems; natural disasters, extreme weather conditions or other catastrophic events could negatively affect our business, financial condition, and operating results; pandemics and other health crises, including COVID-19, could have a material adverse effect on our business, financial condition, and operating results; to compete effectively, we must continually improve existing products and introduce new products that achieve market acceptance; if the telecommunications market does not continue to expand, our business may not grow as fast as we expect, which could adversely impact our business, financial condition and operating results; changes in U.S. government funding programs may cause our customers and prospective customers to delay, reduce, or accelerate purchases, leading to unpredictable and irregular purchase cycles; intense competition in our industry may result in price reductions, lower gross profits and loss of market share; our success depends upon adequate protection of our patent and intellectual property rights; we face risks associated with expanding our sales outside of the United States; expectations relating to environmental, social and governance matters may increase our cost of doing business and expose us to reputational harm and potential liability; our operating results may fluctuate significantly from quarter to quarter, which may make budgeting for expenses difficult and may negatively affect the market price of our common stock; our stock price has been volatile historically and may continue to be volatile - the price of our common stock may fluctuate significantly; anti-takeover provisions in our organizational documents, Minnesota law and other agreements could prevent or delay a change in control of our Company; and other factors set forth in Part I, Item IA. Risk Factors of Clearfield's Annual Report on Form 10-K for the year ended September 30, 2023 as well as other filings with the Securities and Exchange Commission. The Company undertakes no obligation to update these statements to reflect actual events unless required by law.

Investor Relations Contact:

Greg McNiff

The Blueshirt Group

773-485-7191

clearfield@blueshirtgroup.com

| | CLEARFIELD, INC. | | | | | | |

| | CONSOLIDATED BALANCE SHEETS | | | | | | |

| | (IN THOUSANDS, EXCEPT SHARE DATA) | | | | | | |

| | | | | | | | |

| | | | September 30, | | | September 30, | | |

| | | | 2024 | | | 2023 | | |

| | Assets | | | | | | |

| | Current Assets | | | | | | |

| | Cash and cash equivalents | $ | 16,167 | | $ | 37,827 | | |

| | Short-term investments | | 114,825 | | | 130,286 | | |

| | Accounts receivable, net | | 21,309 | | | 28,392 | | |

| | Inventories, net | | 66,766 | | | 98,055 | | |

| | Other current assets | | 10,528 | | | 1,695 | | |

| | Total current assets | | 229,595 | | | 296,255 | | |

| | | | | | | | |

| | Property, plant and equipment, net | | 23,953 | | | 21,527 | | |

| | | | | | | | |

| | Other Assets | | | | | | |

| | Long-term investments | | 24,505 | | | 6,343 | | |

| | Goodwill | | 6,627 | | | 6,528 | | |

| | Intangible assets, net | | 6,343 | | | 6,092 | | |

| | Right of use lease assets | | 15,797 | | | 13,861 | | |

| | Deferred tax asset | | 6,135 | | | 3,039 | | |

| | Other | | 2,320 | | | 1,872 | | |

| | Total other assets | | 61,727 | | | 37,735 | | |

| | Total Assets | $ | 315,275 | | $ | 355,517 | | |

| | | | | | | | |

| | Liabilities and Shareholders' Equity | | | | | | |

| | Current Liabilities | | | | | | |

| | Current portion of lease liability | $ | 3,357 | | $ | 3,737 | | |

| | Current maturities of long-term debt | | - | | | 2,112 | | |

| | Accounts payable | | 6,720 | | | 8,891 | | |

| | Accrued compensation | | 6,977 | | | 5,571 | | |

| | Accrued expenses | | 4,378 | | | 2,404 | | |

| | Factoring liability | | 2,920 | | | 6,289 | | |

| | Total current liabilities | | 24,352 | | | 29,004 | | |

| | | | | | | | |

| | Other Liabilities | | | | | | |

| | Long-term debt, net of current maturities | | 2,228 | | | - | | |

| | Long-term portion of lease liability | | 12,771 | | | 10,629 | | |

| | Deferred tax liability | | 161 | | | 721 | | |

| | Total Liabilities | | 39,512 | | | 40,354 | | |

| | | | | | | | |

| | Shareholders' Equity | | | | | | |

| | Common stock | | 140 | | | 153 | | |

| | Additional paid-in capital | | 159,582 | | | 188,218 | | |

| | Accumulated other comprehensive income (loss) | | 1,079 | | | (544 | ) | |

| | Retained earnings | | 114,962 | | | 127,336 | | |

| | Total Shareholders' Equity | | 275,763 | | | 315,163 | | |

| | Total Liabilities and Shareholders' Equity | $ | 315,275 | | $ | 355,517 | | |

| | | | | | | | |

| | | | | | | | | | | | | |

| CLEARFIELD, INC. | | | | | | | | | | | | |

| CONSOLIDATED STATEMENTS OF OPERATIONS | | | | | | | | | | |

| (IN THOUSANDS, EXCEPT SHARE DATA) | | | | | | | | | | |

| | (Unaudited) | | | | | | | |

| | Three Months Ended | | Year Ended | |

| | September 30, | | September 30, | |

| | | 2024 | | | | 2023 | | | | 2024 | | | | 2023 | | |

| | | | | | | | | | | | | |

| Net sales | $ | 46,772 | | | $ | 49,685 | | | $ | 166,705 | | | $ | 268,720 | | |

| | | | | | | | | | | | | |

| Cost of sales | | 36,104 | | | | 37,692 | | | | 137,816 | | | | 183,441 | | |

| | | | | | | | | | | | | |

| Gross profit | | 10,668 | | | | 11,993 | | | | 28,889 | | | | 85,279 | | |

| | | | | | | | | | | | | |

| Operating expenses | | | | | | | | | | | | |

| Selling, general and | | | | | | | | | | | | |

| administrative | | 13,681 | | | | 10,277 | | | | 52,111 | | | | 47,992 | | |

| (Loss) Income from operations | | (3,013 | ) | | | 1,716 | | | | (23,222 | ) | | | 37,287 | | |

| | | | | | | | | | | | | |

| Net investment income | | 1,819 | | | | 1,878 | | | | 7,472 | | | | 5,206 | | |

| Interest expense | | (124 | ) | | | (330 | ) | | | (506 | ) | | | (881 | ) | |

| (Loss) Income before income taxes | | (1,318 | ) | | | 3,264 | | | | (16,256 | ) | | | 41,612 | | |

| | | | | | | | | | | | | |

| Income tax (benefit) expense | | (492 | ) | | | 568 | | | | (3,803 | ) | | | 9,079 | | |

| | | | | | | | | | | | | |

| Net (loss) income | $ | (827 | ) | | $ | 2,696 | | | $ | (12,453 | ) | | $ | 32,533 | | |

| | | | | | | | | | | | | |

| Net (loss) income per share: | | | | | | | | | | | | |

| Basic | $ | (0.06 | ) | | $ | 0.16 | | | $ | (0.85 | ) | | $ | 2.17 | | |

| Diluted | $ | (0.06 | ) | | $ | 0.17 | | | $ | (0.85 | ) | | $ | 2.17 | | |

| | | | | | | | | | | | | |

| Weighted average shares outstanding: | | | | | | | | | | |

| Basic | | 14,234,506 | | | | 15,258,782 | | | | 14,582,450 | | | | 14,975,972 | | |

| Diluted | | 14,234,506 | | | | 15,258,782 | | | | 14,582,450 | | | | 15,012,527 | | |

| | | | | | | | | | | | | |

| Clearfield, Inc. | | | | | | | |

| Consolidated Statement of Cashflows | | | | | | | |

| (In Thousands) | | | | | | | |

| | | | | | Year Ended | | | Year Ended |

| | | | | | September 30, | | | September 30, |

| | | | | | 2024 | | | | 2023 | |

| | Cash flows from operating activities | | | | | | | |

| | Net (loss) income | | | $ | (12,453 | ) | | $ | 32,533 | |

| | Adjustments to reconcile net income to cash provided by operating activities: | | | | | | | |

| | Depreciation and amortization | | | | 7,411 | | | | 6,054 | |

| | Amortization of discount on investments | | | | (4,406 | ) | | | (3,512 | ) |

| | Deferred income taxes | | | | (4,078 | ) | | | (2,114 | ) |

| | Stock-based compensation expense | | | | 4,641 | | | | 3,578 | |

| | Changes in operating assets and liabilities | | | | | | | |

| | Accounts receivable | | | | 7,799 | | | | 26,277 | |

| | Inventories, net | | | | 31,990 | | | | (15,083 | ) |

| | Other assets | | | | (9,225 | ) | | | (1,466 | ) |

| | Accounts payable and accrued expenses | | | | 544

| | | | (27,843 | ) |

| | Net cash provided by operating activities | | | | 22,223

| | | | 18,424

| |

| | | | | | | | | |

| | Cash flows from investing activities: | | | | | | | |

| | Purchases of property, plant and equipment and intangible assets | | | | (9,567 | ) | | | (8,384 | ) |

| | Purchase of investments | | | | (159,393 | ) | | | (210,923 | ) |

| | Proceeds from sales and maturities of investments | | | | 162,064 | | | | 107,060 | |

| | Net cash used in investing activities | | | | (6,896 | ) | | | (112,247 | ) |

| | | | | | | | | |

| | Cash flows from financing activities: | | | | | | | |

| | Issuance of long-term debt | | | | 2,171 | | | | - | |

| | Repayment of long-term debt | | | | (2,171 | ) | | | (16,700 | ) |

| | Proceeds from issuance of common stock under employee stock purchase plan | | | | 586 | | | | 611 | |

| | Repurchase of shares for payment of withholding taxes for vested restricted stock grants | | | | (493 | ) | | | (1,220 | ) |

| | Tax withholding and proceeds related to exercise of stock options | | | | (9 | ) | | | (491 | ) |

| | Issuance of stock under equity compensation plans | | | | 1 | | | | 954 | |

| | Net borrowings and repayments of factoring liability | | | | (3,617 | ) | | | 1,586 | |

| | Net proceeds from issuance of common stock | | | | - | | | | 130,262 | |

| | Repurchase of common stock | | | | (33,374 | ) | | | - | |

| | Net cash (used in) provided by financing activities | | | | (36,906 | ) | | | 115,002

| |

| | | | | | | | | |

| | Effect of exchange rates on cash | | | | (81 | ) | | | (2 | ) |

| | (Decrease) Increase in cash and cash equivalents | | | | (21,660 | ) | | | 21,177 | |

| | Cash and cash equivalents, beginning of period | | | | 37,827 | | | | 16,650 | |

| | Cash and cash equivalents, end of period | | | $ | 16,167 | | | $ | 37,827 | |

| | | | | | | | | |

| | Supplemental disclosures for cash flow information | | | | | | | |

| | Cash paid during the year for income taxes | | | $ | 159 | | | $ | 12,967 | |

| | Cash paid for interest | | | $ | 394 | | | $ | 463 | |

| | Right of use assets obtained through lease liabilities | | | $ | 4,731 | | | $ | 3,776 | |

| | | | | | | | | |

| | Non-cash financing activities | | | | | | | |

| | Cashless exercise of stock options | | | $ | 19 | | | $ | 566 | |

| | | | | | | | | |

EXHIBIT 99.2

Clearfield Elects Kate Kelly and Ademir Sarcevic to the Board of Directors

MINNEAPOLIS, Nov. 06, 2024 (GLOBE NEWSWIRE) -- Clearfield, Inc. (NASDAQ: CLFD), the leader in community broadband fiber connectivity, today announced the election of Kate Kelly and Ademir Sarcevic to its Board of Directors, effective December 11, 2024.

Kate Kelly

Kate Kelly brings over three decades of experience in the banking industry, having held leadership roles at some of the largest financial institutions in the U.S., including U.S. Bank and PNC. Most recently, as Regional President and Executive Vice President at PNC, she successfully launched and grew PNC’s first expansion market, achieving 24% average annual revenue growth. Prior to PNC, Ms. Kelly was the founding President and CEO of Minnesota Bank & Trust, where she drove 30% annual revenue growth and built the bank’s reputation for high credit quality and customer relationships. She also led Bremer Financial’s Wealth Management division, where she transformed operations and achieved consistent 15% annual growth. Ms. Kelly holds an MBA with a concentration in finance from the University of Minnesota Carlson School of Management and a Bachelor of Arts in Economics and Humanities from St. Catherine University. She is an active board member and a recognized leader in her community, with accolades such as AmeriCorps’ Outstanding Commissioner award and Twin Cities Business’ Hall of Fame award.

Ms. Kelly will serve on the Company’s Audit Committee and its Nominating and Corporate Governance Committee.

Ademir Sarcevic

Ademir Sarcevic brings over two decades of experience driving financial transformation and business growth across a variety of industries. He has a proven track record of improving financial performance, enhancing operational efficiency, and executing strategic M&A initiatives. Mr. Sarcevic currently serves as Vice President, Chief Financial Officer, and Treasurer at Standex International, a leading global industrials company. Under his leadership, Standex has more than doubled its market capitalization and stock price while achieving record operating margins and cash flow. Prior to joining Standex, Mr. Sarcevic held leadership roles at Pentair, where he played a key role in the company’s spin-out and M&A activities, and at Eisai Inc., where he managed financial restructuring efforts. Mr. Sarcevic holds a Master of International Management from Thunderbird School of Global Management and a Bachelor of Science in Finance and International Business from the University of Bridgeport.

Mr. Sarcevic will serve on the Company’s Audit Committee and its Compensation Committee.

“We are pleased to welcome Kate and Ademir to Clearfield’s Board of Directors,” said Ronald G. Roth, Clearfield’s Chairman of the Board. “Both Kate and Ademir are business and financial experts whose unique competencies and perspectives will further strengthen our board, ensuring that our shareholders benefit from a well-rounded and forward-thinking leadership team.”

About Clearfield, Inc.

Clearfield, Inc. (NASDAQ: CLFD) designs, manufactures, and distributes fiber optic management, protection, and delivery products for communications networks. Our “fiber to anywhere” platform serves the unique requirements of leading incumbent local exchange carriers (traditional carriers), competitive local exchange carriers (alternative carriers), and MSO/cable TV companies, while also catering to the broadband needs of the utility/municipality, enterprise, data center, and military markets. Headquartered in Minneapolis, MN, Clearfield deploys more than a million fiber ports each year. For more information, visit www.SeeClearfield.com.

Investor Relations Contact:

Greg McNiff

The Blueshirt Group

773-485-7191

clearfield@blueshirtgroup.com

v3.24.3

Cover

|

Nov. 01, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 01, 2024

|

| Entity File Number |

000-16106

|

| Entity Registrant Name |

CLEARFIELD, INC.

|

| Entity Central Index Key |

0000796505

|

| Entity Tax Identification Number |

41-1347235

|

| Entity Incorporation, State or Country Code |

MN

|

| Entity Address, Address Line One |

7050 Winnetka Avenue North, Suite 100

|

| Entity Address, City or Town |

Brooklyn Park

|

| Entity Address, State or Province |

MN

|

| Entity Address, Postal Zip Code |

55428

|

| City Area Code |

763

|

| Local Phone Number |

476-6866

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

CLFD

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

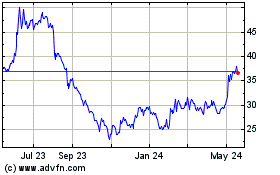

Clearfield (NASDAQ:CLFD)

Historical Stock Chart

From Feb 2025 to Mar 2025

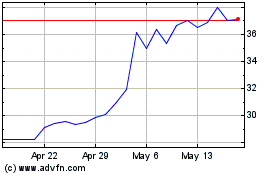

Clearfield (NASDAQ:CLFD)

Historical Stock Chart

From Mar 2024 to Mar 2025