UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2024

Commission File Number: 001-42308

Click Holdings Limited

Unit 709, 7/F., Ocean Centre

5 Canton Road

Tsim Sha Tsui, Kowloon

Hong Kong

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

INFORMATION CONTAINED IN THIS REPORT ON FORM

6-K

Interim Results for The Six Months Ended June 30, 2024

The unaudited financial results for the six

months ended June 30, 2024 (“Interim Results”) of Click Holdings Limited (“Click Holdings”) and its

subsidiaries (collectively, the “Company”) is furnished as Exhibit 99.1 to this Form 6-K.

Management’s Discussion and Analysis of Financial Condition

and Results of Operations

The management’s discussion and

analysis of financial condition and results of operations for the Company’s Interim Results is furnished as Exhibit

99.2 to this Form 6-K.

Press Release

On November 22, 2024, the Company issued a press

release (the “Press Release”) reporting the Company’s Interim Results.

A copy of the Press Release announcing the Interim

Results is included as Exhibit 99.3 to this Form 6-K.

Safe Harbor Statements

This filing contains forward-looking

statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation

Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,”

“expects,” “anticipates,” “aims,” “future,” “intends,”

“plans,” “believes,” “estimates,” “confident,” “potential,”

“continue” or other similar expressions. Among other things, the quotations from management in this announcement, as

well as Click Holding’s strategic and operational plans, contain forward-looking statements. Click Holdings may also make

written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission (the

“SEC”), in its annual report to shareholders, in press releases and/or other written materials and/or in oral statements

made by its officers, directors or employees to third parties. Statements that are not historical facts, including but not limited

to statements about Click Holding’s beliefs and expectations, are forward-looking statements. Although the Company believes

that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will

turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results

and encourages investors to review other factors that may affect its future results in the Company’s registration statement

and other filings with the SEC, which are available for review at www.sec.gov. All information provided in this report and in the

attachments is as of the date of this report, and Click Holding undertakes no obligation to update any forward-looking statement,

except as required under applicable law.

Exhibit Index

SIGNATURES

Pursuant to the requirements of the Securities

and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

CLICK HOLDINGS LIMITED |

| |

|

|

| |

By: |

/s/ Chan Chun Sing |

| |

Name: |

Chan Chun Sing |

| |

Title: |

Chief Executive Officer, Chairman and

Director |

Date: November 22, 2024

3

Exhibit 99.1

CLICK HOLDINGS LIMITED AND SUBSIDIARIES

INDEX TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

CLICK HOLDINGS LIMITED AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Expressed in U.S. dollars)

| | |

June 30,

2024 | | |

December 31,

2023 | |

| | |

(Unaudited) | | |

(Audited) | |

| Assets: | |

| | |

| |

| Current assets | |

| | |

| |

| Cash and cash equivalents | |

$ | 221,047 | | |

$ | 482,588 | |

| Accounts receivable, net | |

| 1,082,297 | | |

| 850,193 | |

| Prepaid expenses and other current assets | |

| 59,372 | | |

| 57,190 | |

| Total current assets | |

| 1,362,716 | | |

| 1,389,971 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 73,641 | | |

| 85,436 | |

| Right-of-use assets, net | |

| 113,697 | | |

| 170,545 | |

| Deferred offering costs | |

| 728,725 | | |

| — | |

| Total non-current assets | |

| 916,063 | | |

| 255,981 | |

| | |

| | | |

| | |

| Total assets | |

$ | 2,278,779 | | |

$ | 1,645,952 | |

| | |

| | | |

| | |

| Liabilities and Shareholders’ Equity: | |

| | | |

| | |

| Liabilities: | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 111,778 | | |

$ | 68,177 | |

| Accrued expenses and other current liabilities | |

| 75,897 | | |

| 123,182 | |

| Advance from customers | |

| — | | |

| 123,077 | |

| Short-term bank loans | |

| 448,718 | | |

| 461,538 | |

| Short-term lease liabilities | |

| 114,842 | | |

| 110,544 | |

| Due to related parties | |

| — | | |

| 203,559 | |

| Income tax payable | |

| 144,983 | | |

| 94,568 | |

| Total current liabilities | |

| 896,218 | | |

| 1,184,645 | |

| | |

| | | |

| | |

| Long-term lease liabilities | |

| — | | |

| 58,001 | |

| Total liabilities | |

| 896,218 | | |

| 1,242,646 | |

| | |

| | | |

| | |

| Commitment and contingencies | |

| — | | |

| — | |

| | |

| | | |

| | |

| Shareholders’ Equity: | |

| | | |

| | |

| Ordinary shares, $0.0001 par value, 500,000,000 shares authorized, 13,500,000 shares and 13,100,000 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively* | |

| 1,350 | | |

| 1,310 | |

| Additional paid-in capital | |

| 897,405 | | |

| 384,587 | |

| Accumulated other comprehensive income | |

| 613 | | |

| 2,051 | |

| Retained earnings | |

| 483,193 | | |

| 15,358 | |

| | |

| | | |

| | |

| Total shareholders’ equity | |

| 1,382,561 | | |

| 403,306 | |

| | |

| | | |

| | |

| Total liabilities and shareholders’ equity | |

$ | 2,278,779 | | |

$ | 1,645,952 | |

| * | Gives retroactive effect to reflect the reorganization in August

2024. |

The accompanying notes are an integral part

of these unaudited condensed consolidated financial statements.

CLICK HOLDINGS LIMITED AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS

OF OPERATIONS

AND COMPREHENSIVE INCOME

(Expressed in U.S. dollars)

| | |

Six Months Ended

June 30, | |

| | |

2024 | | |

2023 | |

| Revenue | |

$ | 3,181,992 | | |

$ | 2,788,050 | |

| Cost of revenue | |

| 2,225,962 | | |

| 2,012,659 | |

| Gross profit | |

| 956,030 | | |

| 775,391 | |

| | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | |

| General and administrative | |

| 412,837 | | |

| 355,410 | |

| Selling and marketing | |

| 13,218 | | |

| 11,698 | |

| Total operating expenses | |

| 426,055 | | |

| 367,108 | |

| | |

| | | |

| | |

| Income from operations | |

| 529,975 | | |

| 408,283 | |

| | |

| | | |

| | |

| Other (expense) income: | |

| | | |

| | |

| Government subsidies | |

| — | | |

| 8,536 | |

| Interest income | |

| 1,719 | | |

| 135 | |

| Interest expense | |

| (17,421 | ) | |

| (13,026 | ) |

| Other miscellaneous income | |

| 3,977 | | |

| — | |

| Total other (expense), net | |

| (11,725 | ) | |

| (4,355 | ) |

| | |

| | | |

| | |

| Income before provision for income taxes | |

| 518,250 | | |

| 403,928 | |

| Income tax expense | |

| (50,415 | ) | |

| (18,055 | ) |

| Net income | |

| 467,835 | | |

| 385,873 | |

| | |

| | | |

| | |

| Other comprehensive loss | |

| | | |

| | |

| Foreign currency translation adjustment | |

| (1,438 | ) | |

| (496 | ) |

| Total comprehensive income | |

$ | 466,397 | | |

$ | 385,377 | |

| | |

| | | |

| | |

| Basic and diluted earnings per ordinary share* | |

$ | 0.03 | | |

$ | 0.03 | |

| | |

| | | |

| | |

| Weighted average number of ordinary shares outstanding – basic and diluted* | |

| 13,418,681 | | |

| 13,100,000 | |

| * | Gives retroactive effect to reflect the reorganization in August

2024. |

The accompanying notes are an integral part

of these unaudited condensed consolidated financial statements.

CLICK HOLDINGS LIMITED AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS

OF

CHANGES IN SHAREHOLDERS’ EQUITY (DEFICIT)

(Expressed in U.S. dollars)

| | |

Ordinary

Shares

number* | | |

Ordinary

Shares

amount | | |

Additional

paid-in

capital | | |

Accumulated

other

comprehensive

income | | |

Accumulated

deficit | | |

Total

shareholders’

equity

(deficit) | |

| Balance as of December 31, 2022 | |

| 13,100,000 | | |

$ | 1,310 | | |

$ | 384,587 | | |

$ | 805 | | |

$ | (466,776 | ) | |

$ | (80,074 | ) |

| Net income | |

| — | | |

| — | | |

| — | | |

| — | | |

| 385,873 | | |

| 385,873 | |

| Foreign currency translation adjustment | |

| — | | |

| — | | |

| — | | |

| (496 | ) | |

| — | | |

| (496 | ) |

| Balance as of June 30, 2023 (Unaudited) | |

| 13,100,000 | | |

$ | 1,310 | | |

$ | 384,587 | | |

$ | 309 | | |

$ | (80,903 | ) | |

$ | 305,303 | |

| | |

Ordinary

Shares

number* | | |

Ordinary

Shares

amount | | |

Additional

paid-in

capital | | |

Accumulated

other

comprehensive

income | | |

Retained

earnings | | |

Total

shareholders’

equity | |

| Balance as of December 31, 2023 | |

| 13,100,000 | | |

$ | 1,310 | | |

$ | 384,587 | | |

$ | 2,051 | | |

$ | 15,358 | | |

$ | 403,306 | |

| Issuance of ordinary shares | |

| 400,000 | | |

| 40 | | |

| 512,818 | | |

| — | | |

| — | | |

| 512,858 | |

| Net income | |

| — | | |

| — | | |

| — | | |

| — | | |

| 467,835 | | |

| 467,835 | |

| Foreign currency translation adjustment | |

| — | | |

| — | | |

| — | | |

| (1,438 | ) | |

| — | | |

| (1,438 | ) |

| Balance as of June 30, 2024 (Unaudited) | |

| 13,500,000 | | |

$ | 1,350 | | |

$ | 897,405 | | |

$ | 613 | | |

$ | 483,193 | | |

$ | 1,382,561 | |

| * | Gives retroactive effect to reflect the reorganization in August

2024. |

The accompanying notes are an integral part

of these unaudited condensed consolidated financial statements.

CLICK HOLDINGS LIMITED AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS

OF CASH FLOWS

(Expressed in U.S. dollars)

| | |

Six Months Ended

June 30, | |

| | |

2024 | | |

2023 | |

| Cash flows from operating activities: | |

| | |

| |

| Net income | |

$ | 467,835 | | |

$ | 385,873 | |

| Adjustment to reconcile net income to net cash provided by (used in) operating activities: | |

| | | |

| | |

| Depreciation | |

| 14,050 | | |

| 13,471 | |

| Non-cash lease expense | |

| 56,848 | | |

| 75,742 | |

| Provision for expected credit losses | |

| 1,800 | | |

| 5,200 | |

| Changes in operating assets and liabilities | |

| | | |

| | |

| Accounts receivable | |

| (233,904 | ) | |

| 231,498 | |

| Prepaid expenses and other current assets | |

| (3,541 | ) | |

| (10,628 | ) |

| Due from related parties | |

| — | | |

| (164,697 | ) |

| Accounts payable | |

| 43,601 | | |

| (40,454 | ) |

| Accrued expenses and other liabilities | |

| (47,285 | ) | |

| 447,301 | |

| Advance from customers | |

| (123,077 | ) | |

| — | |

| Due to a related party | |

| (203,559 | ) | |

| (681,538 | ) |

| Income tax payable | |

| 50,415 | | |

| 18,055 | |

| Lease liabilities | |

| (53,703 | ) | |

| (76,742 | ) |

| Net cash (used in) provided by operating activities | |

| (30,520 | ) | |

| 203,081 | |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Purchase of property and equipment | |

| (2,255 | ) | |

| (1,114 | ) |

| Net cash used in investing activities | |

| (2,255 | ) | |

| (1,114 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Proceeds from short-term bank loans | |

| 743,590 | | |

| 1,025,641 | |

| Repayments of short-term bank loans | |

| (756,410 | ) | |

| (1,282,052 | ) |

| Proceeds from issuance of ordinary shares | |

| 512,858 | | |

| — | |

| Deferred offering costs | |

| (728,725 | ) | |

| — | |

| Net cash used in financing activities | |

| (228,687 | ) | |

| (256,411 | ) |

| | |

| | | |

| | |

| Effect of foreign exchange rate on cash | |

| (79 | ) | |

| (116 | ) |

| | |

| | | |

| | |

| Net decrease in cash and cash equivalents | |

| (261,541 | ) | |

| (54,560 | ) |

| Cash and cash equivalents at beginning of the period | |

| 482,588 | | |

| 237,449 | |

| Cash and cash equivalents at end of the period | |

$ | 221,047 | | |

$ | 182,889 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash flows information: | |

| | | |

| | |

| Cash paid during the period for: | |

| | | |

| | |

| Interest expense | |

$ | 17,421 | | |

$ | 13,026 | |

| Income tax | |

$ | — | | |

$ | — | |

The accompanying notes are an integral part

of these unaudited condensed consolidated financial statements.

CLICK HOLDINGS LIMITED

AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

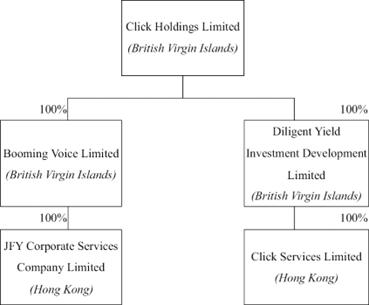

1. ORGANIZATION AND PRINCIPAL BUSINESS

Click Holdings Limited (“Click

Holdings”) was incorporated on January 31, 2024 in the British Virgin Islands (“BVI”). Click Holdings is a holding

company without any operations and owns two companies and their subsidiaries that are incorporated in Hong Kong (collectively, the

“Company”).

On October 9, 2024, the Company

consummated the initial public offering (“IPO”) of 1,400,000 ordinary shares, par value of $0.0001 per share at $4.00 per

share. The ordinary shares of Click Holdings began trading on the Nasdaq Capital Market under the ticker symbol “CLIK”.

The Company is a human resources

solutions provider primarily focused on talent sourcing and the provision of temporary and permanent personnel in: (i) professional, (ii)

nursing, and (iii) logistics and other services.

Business Reorganization

A reorganization of the

Company’s legal entity structure was completed in August 2024. The reorganization involved the incorporation of Click Holdings

in January 2024, and the equity transfer of Booming Voice Limited (“Booming Voice”) and Diligent Yield Investment

Development Limited (“Diligent Yield”) to Click Holdings in February 2024. This transaction was treated as a

reorganization of the companies under common control and the Company’s unaudited condensed consolidated financial statements

(“unaudited condensed CFS”) give retroactive effect to this transaction.

Click Holdings

Click Holdings was incorporated

on January 31, 2024 and owned by Mr. Chan Chun Sing (“Mr. Chan”).

On February 4, 2024, Click

Holdings acquired the share capital of Booming Voice from Mr. Chan by allotting shares to Circuit Delight Limited (“Circuit

Delight”) upon the direction Mr. Chan and the consent of Circuit Delight.

On February 5, 2024, Click

Holdings acquired the share capital of Diligent Yield from Ms. Leung Wing Shan (“Ms. Leung”) by allotting shares to Classic

Impact Limited (“Classic Impact”), a wholly owned company of Ms. Leung upon the direction of Ms. Leung and the consent of

Classic Impact.

On February 7, 2024, Circuit

Delight and Tactical Command Limited (“Tactical Command”) entered into an agreement, pursuant to which, Circuit Delight (as

vendor) sold, and Tactical Command (as purchaser) bought the Shares (“Transaction 1”).

On February 7, 2024, Circuit

Delight and Happy Blazing Limited (“Happy Blazing”) entered into an agreement, pursuant to which, Circuit Delight (as vendor)

sold, and Happy Blazing (as purchaser) bought the Shares (“Transaction 2”, together with Transaction 1, the “Transactions”).

On February 7, 2024, each of

Solid Attack Limited (“Solid Attack”), Massive Pride Limited (“Massive Pride”) and Ahead Champion Limited (“Ahead

Champion”) entered into a subscription agreement with Click Holdings, pursuant to which, Click Holdings sold and Solid Attach, Massive

Pride and Ahead Champion bought new 400,000 ordinary Shares (collectively, the “Subscriptions”) for a total consideration of $512,858.

On August 16, 2024, in accordance

with the members’ resolutions of February 4, 2024 and August 16, 2024, the Company completed the filing of amended Memorandum and

Articles of Association with the respective registry that included the share subdivision and the surrender of respective shares (see Note

11).

Upon completion of the Transactions

and the Subscriptions, Click Holdings was owned by Circuit Delight, Classic Impact, Solid Attack, Massive Pride, Ahead Champion, Tactical

Command, and Happy Blazing.

The Company is under common control of same group of shareholders before

and after the reorganization. The unaudited condensed CFS are prepared on the basis as if the reorganization became effective as of the

beginning of the first period presented in the unaudited condensed CFS.

Booming Voice

Booming Voice was incorporated

in the BVI with limited liability on October 25, 2023. After the reorganization, it became a wholly owned subsidiary of Click Holdings.

It holds 100% of JFY Corporate Services Company Limited (“JFY Corporate”), and has no operations since its incorporation.

CLICK HOLDINGS LIMITED AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

1. ORGANIZATION AND PRINCIPAL BUSINESS

(cont.)

Diligent Yield

Diligent Yield was incorporated

in the BVI with limited liability on October 1, 2021. After the reorganization, it became a wholly owned subsidiary of Click Holdings.

It holds 100% of Click Services Limited (“Click Services”), and had no operations since its incorporation.

JFY Corporate

JFY Corporate was incorporated

on May 8, 2017 focusing on providing human resources solution professional services, including accounting and auditing, company secretarial,

and financial and compliance advisory. Upon completion of the reorganization, JFY Corporate became an indirectly wholly-owned subsidiary

of the Company.

Click Services

Click Services was incorporated

on August 28, 2020 focusing on providing human resources solution nursing services and logistic and other services. Upon the completion

of the reorganization, Click Services became an indirectly wholly-owned subsidiary of the Company.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

A. Basis

of presentation and consolidation

The unaudited condensed CFS

and related notes include all the accounts of the Click Holdings and its wholly owned subsidiaries. All intercompany transactions were

eliminated in consolidation. While these unaudited condensed CFS are prepared in accordance with accounting principles generally accepted

in the United States of America (“U.S. GAAP”), they do not include all the information required for annual financial

statements and should be read in conjunction with the audited CFS and accompanying notes for the years December 31, 2023 and 2022, filed

by Click Holdings in its Form 424B5 with the Securities Exchange Commission on October 9, 2024.

CLICK HOLDINGS LIMITED AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(cont.)

B. Use of estimates and assumptions

The preparation of unaudited condensed CFS in conformity with U.S. GAAP

requires management to make certain estimates and assumptions that affect the amounts reported and disclosed in the unaudited condensed

CFS and related notes. Significant accounting estimates include the allowance for expected credit losses on accounts receivable and other

receivables and useful life of property and equipment. Actual amounts could differ from those estimates.

C. Functional currency and foreign

currency translation

The reporting currency of the

Company is the U.S. dollar (“US$”), and the functional currency is the Hong Kong dollar (“HK$”) as Hong Kong

is the primary economic environment in which the Company operates.

The unaudited condensed CFS of the Company are prepared using HK$,

and translated into the Company’s reporting currency, US$. Monetary assets and liabilities denominated in currencies other than

the reporting currency are translated into the reporting currency at the rate of exchange prevailing at the balance sheet date. Revenue

and expenses are translated using the average rates during each reporting period, and shareholders’ equity is translated at historical

exchange rates. Cash flows are also translated at average translation rates for the periods, therefore, amounts reported on the statement

of cash flows will not necessarily agree with changes in the corresponding balances on the consolidated balance sheets. Adjustments resulting

from the translation are recorded as a separate component of accumulated other comprehensive income in shareholders’ equity.

Translation of amounts from

HK$ into US$ has been made at the following exchange rates:

| Balance sheet items, except for equity accounts: | |

|

| As of June 30, 2024 | |

HK$7.81 to US$1 |

| As of December 31, 2023 | |

HK$7.81 to US$1 |

| | |

|

| Statement of operations and cash flow items: | |

|

| Six months ended June 30, 2024 | |

HK$7.82 to US$1 |

| Six months ended June 30, 2023 | |

HK$7.84 to US$1 |

D. Recently

issued accounting pronouncements

In December 2023, the

FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures requiring enhancements and further transparency

to certain income tax disclosures, most notably the tax rate reconciliation and income taxes paid. This ASU is effective for fiscal years

beginning after December 15, 2024 on a prospective basis and retroactive application is permitted. The Company but does not expect

the adoption of this standard to have a material impact on the unaudited condensed CFS.

The Company does not believe

other recently issued but not yet effective accounting standards, if currently adopted, would have a material effect on its unaudited

condensed CFS.

CLICK HOLDINGS LIMITED AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

3. ACCOUNTS RECEIVABLE

The Company expects its accounts

receivable will be substantially settled within 90 days from the invoice date.

Below is an analysis of the

movements in the allowance for expected credit losses:

| | |

Six Months Ended

June 30, | |

| | |

2024 | | |

2023 | |

| Balance at beginning of the period | |

$ | 5,200 | | |

$ | — | |

| Additions | |

| 1,800 | | |

| 5,200 | |

| Balance at end of the period | |

$ | 7,000 | | |

$ | 5,200 | |

As of November 18, 2024, the Company collected approximately $953,000,

or 88.1%, of the accounts receivable as of June 30, 2024. The Company is not aware of any collection risk on the remaining balance.

4. PREPAID EXPENSES AND OTHER CURRENT ASSETS

Prepaid expenses and other

current assets consist of the following:

| | |

As of | |

| | |

June 30,

2024 | | |

December 31,

2023 | |

| | |

| | |

(Audited) | |

| Prepaid expenses | |

$ | 12,100 | | |

$ | 14,718 | |

| Deposits | |

| 47,272 | | |

| 42,472 | |

| Prepaid expenses and other current assets | |

$ | 59,372 | | |

$ | 57,190 | |

5. PROPERTY AND EQUIPMENT, NET

Property and equipment, net,

are as follows:

| | |

As of | |

| | |

June 30,

2024 | | |

December 31,

2023 | |

| | |

| | |

(Audited) | |

| Office equipment and other | |

$ | 49,589 | | |

$ | 47,334 | |

| Leasehold improvement | |

| 92,653 | | |

| 92,653 | |

| Less: accumulated depreciation | |

| (68,601 | ) | |

| (54,551 | ) |

| Property and equipment, net | |

$ | 73,641 | | |

$ | 85,436 | |

During the six months ended

June 30, 2024 and 2023, the Company recorded depreciation expense of $14,050 and $13,471, respectively.

CLICK HOLDINGS LIMITED AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

6. BANK LOANS

The Company’s bank loans

are revolving loans denominated in HK$ from a bank in Hong Kong, and are due and renewable every three months.

As of June 30, 2024 and December 31, 2023 (audited), bank loans

were HK$3,500,000 (US$448,718) and HK$3,600,000 (US$461,538) respectively with interest from 5.47% to 6.11% (2023: 6.37% to 7.15%). The

bank loans are secured by (i) a personal undertaking and guarantee by Ms. Leung (spouse of Mr. Chan, Chairman and CEO of the Company)

and (ii) a security interest in a premise owned by Ms. Leung.

7. RIGHT-OF-USE ASSETS AND LEASE LIABILITIES

Lease

The Company determines if a

contract is a lease at inception. The Company has a lease for office space and facilities. All leases are classified as operating leases.

Supplemental balance sheet

information for the Company’s operating lease as of June 30, 2024 and December 31, 2023 was as follows:

| | |

2024 | | |

2023 | |

| | |

| | |

(Audited) | |

| Right-of-use assets | |

$ | 113,697 | | |

$ | 170,545 | |

| Short-term lease liabilities | |

| 114,842 | | |

| 110,544 | |

| Long-term lease liabilities | |

| — | | |

| 58,001 | |

| Weighted-average remaining lease term | |

| 1.0 year | | |

| 1.5 years | |

| Weighted-average discount rate | |

| 4.125 | % | |

| 4.125 | % |

As of June 30, 2024, the lease

has a remaining term of 1 year. The lease contains renewal options for periods from two to five years. Because the Company is

not reasonably certain to exercise these renewal options, the options are not included in the lease term, and associated potential option

payments are excluded from lease payments.

Maturities of operating lease

liabilities at June 30, 2024 are:

| 12 months ending June 30, 2024, | |

| |

| June 30, 2025 | |

$ | 117,376 | |

| Less: imputed interest | |

| (2,534 | ) |

| Total lease liabilities | |

$ | 114,842 | |

CLICK HOLDINGS LIMITED AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

8. INCOME TAXES

British Virgin Islands

Under the current laws of the

BVI, the Company is not subject to income tax.

Hong Kong

Under the two-tiered profit

tax rate regime of Hong Kong Profits Tax, the first HK$2,000,000 ($256,410), of profits of the qualifying group entity is taxed at

8.25%, and profits above HK$2,000,000 ($256,410) are taxed at 16.5%.

The income tax provision for

the six months ended June 30, 2024 and 2023 consists of the following:

| | |

2024 | | |

2023 | |

| Current tax | |

$ | 50,415 | | |

$ | 18,055 | |

| Deferred tax | |

| — | | |

| — | |

| Income tax expense | |

$ | 50,415 | | |

$ | 18,055 | |

The following is a reconciliation

of the statutory tax rate to the effective tax rate for the six months ended June 30, 2024 and 2023, respectively.

| | |

2024 | | |

2023 | |

| Hong Kong statutory income tax rate | |

| 16.5 | % | |

| 16.5 | % |

| Effect of Hong Kong graduated rates | |

| (4.1 | )% | |

| (5.2 | )% |

| Effect of non-deductible expense | |

| 0.2 | % | |

| 0.3 | % |

| Effect of non-taxable income | |

| (0.7 | )% | |

| (1.0 | )% |

| Effect of tax losses not recognized | |

| — | | |

| 0.6 | % |

| Effect of utilization of tax losses brought forward | |

| (2.2 | )% | |

| (6.7 | )% |

| Effective tax rate | |

| 9.7 | % | |

| 4.5 | % |

CLICK HOLDINGS LIMITED AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

8. INCOME TAXES (cont.)

The principal components of

deferred tax assets are as follows:

| | |

As of | |

| | |

June 30,

2024 | | |

December 31,

2023 | |

| | |

| | |

(Audited) | |

| Net operating loss carrying forwards | |

$ | 4,327 | | |

$ | 15,869 | |

| Less: valuation allowance | |

| (4,327 | ) | |

| (15,869 | ) |

| Total deferred tax assets | |

$ | — | | |

$ | — | |

As of June 30, 2024 and December 31,

2023 (audited), the Company had net operating loss carrying forwards of US$26,000 and US$96,000, respectively, attributable to the Hong Kong

subsidiaries. The cumulative tax losses for entities in Hong Kong will not expire under the current tax legislation. The Company

evaluates its valuation allowance at the end of each reporting period by reviewing all available evidence, both positive and negative,

and considering whether, based on the weight of that evidence, a valuation allowance is needed. When circumstances cause a change

in management’s judgement about the realizability of deferred tax assets, the impact of the change on the valuation allowance is

generally reflected in income from operations. The future realization of the tax benefit of an existing deductible temporary difference

ultimately depends on the existence of sufficient taxable income of the appropriate character within the carryforward period available

under applicable tax law. As of June 30, 2024 and December 31, 2023 (audited), the Company provided full valuation allowance against

the deferred tax assets because the Company assessed the deferred tax assets would not be realized.

9. REVENUE AND SEGMENT INFORMATION

The Company has three reportable

segments:

| 1. | Professional solution services — delivery of

accounting and auditing, company secretarial, and financial and compliance advisory services; |

| 2. | Nursing solution services — delivery of temporary

healthcare services to institutional clients, including social service organizations and nursing home and individuals; and |

| 3. | Logistics and other solution services — delivery

of logistic and warehouse human resources solution services to corporate customers. |

Corporate and unallocated — included

in Corporate and unallocated are operating expenses that are not directly allocated to the individual business units. These expenses primarily

consist of operating lease cost, certain staff costs, and other various general and administrative expenses.

CLICK HOLDINGS LIMITED AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

9. REVENUE AND SEGMENT INFORMATION (cont.)

Segment information for the six

months ended June 2024 and 2023 is presented below. Management does not manage the assets on a segment basis, therefore segment assets

are not presented below.

| | |

For the six months ended June 30, 2024 | |

| | |

Professional

solution

services | | |

Nursing

solution

services | | |

Logistics

and other

solution

services | | |

Corporate

and

unallocated | | |

Total | |

| Revenue | |

$ | 1,008,729 | | |

$ | 677,640 | | |

$ | 1,495,623 | | |

$ | — | | |

$ | 3,181,992 | |

| Cost of revenue | |

| 382,416 | | |

| 604,520 | | |

| 1,239,026 | | |

| — | | |

| 2,225,962 | |

| Gross profit | |

| 626,313 | | |

| 73,120 | | |

| 256,597 | | |

| — | | |

| 956,030 | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | | |

| | |

| General and administrative | |

| 299,789 | | |

| 31,056 | | |

| 32,279 | | |

| 49,713 | | |

| 412,837 | |

| Selling and marketing | |

| — | | |

| — | | |

| — | | |

| 13,218 | | |

| 13,218 | |

| Total operating expenses | |

| 299,789 | | |

| 31,056 | | |

| 32,279 | | |

| 62,931 | | |

| 426,055 | |

| Income (loss) from operations | |

| 326,524 | | |

| 42,064 | | |

| 224,318 | | |

| (62,931 | ) | |

| 529,975 | |

| Other income (expense) | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 1,450 | | |

| — | | |

| — | | |

| 269 | | |

| 1,719 | |

| Interest on bank loans | |

| — | | |

| — | | |

| — | | |

| (17,421 | ) | |

| (17,421 | ) |

| Other income | |

| 3,291 | | |

| — | | |

| — | | |

| 686 | | |

| 3,977 | |

| Total other income (expense) | |

| 4,741 | | |

| — | | |

| — | | |

| (16,466 | ) | |

| (11,725 | ) |

| Income (loss) before provision for income taxes | |

$ | 331,265 | | |

$ | 42,064 | | |

$ | 224,318 | | |

$ | (79,397 | ) | |

$ | 518,250 | |

| | |

For the six months ended June 30, 2023 | |

| | |

Professional

solution

services | | |

Nursing

solution

services | | |

Logistics

and other

solution

services | | |

Corporate

and

unallocated | | |

Total | |

| Revenue | |

$ | 967,272 | | |

$ | 954,415 | | |

$ | 866,363 | | |

$ | — | | |

$ | 2,788,050 | |

| Cost of revenue | |

| 449,251 | | |

| 820,749 | | |

| 742,659 | | |

| — | | |

| 2,012,659 | |

| Gross profit | |

| 518,021 | | |

| 133,666 | | |

| 123,704 | | |

| — | | |

| 775,391 | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | | |

| | |

| General and administrative | |

| 242,648 | | |

| 30,872 | | |

| 40,359 | | |

| 41,531 | | |

| 355,410 | |

| Selling and marketing | |

| — | | |

| — | | |

| — | | |

| 11,698 | | |

| 11,698 | |

| Total operating expenses | |

| 242,648 | | |

| 30,872 | | |

| 40,359 | | |

| 53,229 | | |

| 367,108 | |

| Income (loss) from operations | |

| 275,373 | | |

| 102,794 | | |

| 83,345 | | |

| (53,229 | ) | |

| 408,283 | |

| Other income (expense) | |

| | | |

| | | |

| | | |

| | | |

| | |

| Government subsidies | |

| — | | |

| — | | |

| — | | |

| 8,536 | | |

| 8,536 | |

| Interest income | |

| 2 | | |

| — | | |

| — | | |

| 133 | | |

| 135 | |

| Interest on bank loans | |

| — | | |

| — | | |

| — | | |

| (13,026 | ) | |

| (13,026 | ) |

| Total other income (expense) | |

| 2 | | |

| — | | |

| — | | |

| (4,357 | ) | |

| (4,355 | ) |

| Income (loss) before provision for income taxes | |

$ | 275,375 | | |

$ | 102,794 | | |

$ | 83,345 | | |

$ | (57,586 | ) | |

$ | 403,928 | |

The Company’s assets,

including non-current assets are in Hong Kong, are without any specific designation, and are used to generate the Company’s revenue

streams that are all sourced in Hong Kong.

The Company does not have

a concentration of its revenue with specific customers. During the six months ended June 30, 2024 and 2023, there were no customers that

accounted for more than 20% of the Company’s revenue.

CLICK HOLDINGS LIMITED AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

10. RELATED PARTY TRANSACTIONS AND BALANCES

Related parties:

| Name of related parties | |

Relationship with the Company |

| JFY & Co. | |

A customer of the Company controlled by Mr. Chan (Note 1) |

| JFY CPA Limited | |

A customer of the Company controlled by Mr. Chan (Note 1) |

| Note 1: | Mr. Chan is the controlling shareholder of these entities

and Click Holdings. |

Included in the Company’s

revenue for the six months ended June 30, 2024 and 2023 is $nil and $291,494 from related parties, respectively. The details are as follows:

| Name of related parties | |

2024 | | |

2023 | |

| JFY & Co. | |

$ | — | | |

$ | 64,324 | |

| JFY CPA Limited | |

| — | | |

| 227,170 | |

| Total | |

$ | — | | |

$ | 291,494 | |

Included in the Company’s

expenses for the six months ended June 30, 2024 and 2023 are allocated expenses of $nil and $101,451 from related parties, respectively.

The details are as follows:

| Name of related parties | |

2024 | | |

2023 | |

| JFY & Co. | |

$ | — | | |

$ | (14,410 | ) |

| JFY CPA Limited | |

| — | | |

| (87,041 | ) |

| Total | |

$ | — | | |

$ | (101,451 | ) |

Due to related parties

As of June 30, 2024 and December 31,

2023, due to related parties consists of the following:

| | |

As of | |

| Name of related parties | |

June 30,

2024 | | |

December 31,

2023 | |

| | |

| | |

(Audited) | |

| Mr. Chan | |

$ | — | | |

$ | (203,559 | ) |

| Total | |

$ | — | | |

$ | (203,559 | ) |

CLICK HOLDINGS LIMITED AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

10. RELATED PARTY TRANSACTIONS AND BALANCES

(cont.)

The amount due to Mr. Chan

as at December 31, 2023 of US$203,559 was non-interest bearing and repayable on demand.

11. SUBSEQUENT EVENTS

In preparing these unaudited condensed CFS, the Company evaluated events

and transactions for potential recognition or disclosure through the date of this report. No other events require adjustment to or disclosure

in the unaudited condensed CFS other than the following:

| ● | In connection with the planned IPO, the Company completed a

reorganization of its corporate structure in August 2024. |

| ● | On August 16, 2024, in accordance with the members’ resolutions

on February 4, 2024 and August 16, 2024, the Company subdivided each issued and unissued share into 10,000 shares and the Company is authorized

to issue 500,000,000 shares of par value US$0.0001 each. |

| ● | On October 9, 2024, the Company consummated the IPO of 1,400,000

ordinary shares at $4.00 per share. The ordinary shares of Click Holdings began trading on the Nasdaq Capital Market under the ticker

symbol “CLIK”. |

F-15

Exhibit 99.2

CLICK HOLDINGS LIMITED

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

for the Six Months Ended June 30, 2024

The following discussion and analysis should be read in conjunction

with our unaudited condensed consolidated financial statements and related notes thereto.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This report contains certain statements that may be deemed “forward-looking

statements” within the meaning of United States of America securities laws. All statements, other than statements of

historical fact, that address activities, events or developments that we intend, expect, project, believe or anticipate and similar expressions

or future conditional verbs such as will, should, would, could or may occur in the future are forward-looking statements. Such statements

are based upon certain assumptions and assessments made by our management in light of their experience and their perception of historical

trends, current conditions, expected future developments and other factors they believe to be appropriate. These statements include, without

limitation, statements about our anticipated expenditures, the potential size of the market for our services, future development

and/or expansion of our services in our markets, our ability to generate revenues. Our actual results will likely differ, perhaps

materially, from those anticipated in these forward-looking statements as a result of macroeconomic factors, The forward-looking statements

included in this report are subject to a number of additional material risks and uncertainties, including but not limited to the risks

described in our filings with the Securities and Exchange Commission.

The following discussion and analysis of our financial condition

and results of operations should be read together with our financial statements and the related notes to those statements included in

this filing. In addition to historical financial information, this discussion may contain forward-looking statements reflecting our current

plans, estimates, beliefs and expectations that involve risks and uncertainties. As a result of many important factors, our actual results

and the timing of events may differ materially from those anticipated in these forward-looking statements.

Results of Operations

Six Months Ended June 30, 2024 Compared to Six Months Ended June

30, 2023

Revenue

Revenue increased by approximately $0.4 million or 14.3% from approximately

$2.8 million for the six months ended June 30, 2023 (“6M2023”) to approximately $3.2 million for the six months ended June

30, 2024 (“6M2024”), mainly because of the increase in revenue from the provision of logistics and other solution services

of approximately $0.6 million partially offset by the decrease in revenue from the provision of nursing solution services of approximately

$0.3 million. The increase in revenue from the provision of logistics and other solution services was mainly attributable to the rapid

expansion of this sector during the 6M2024 in particular the additional demand for placement of works from a major customer starting in

April 2024. Revenue contribution from the provision of logistics and other solution services increased from approximately 31.1% in 6M2023

to 47.0% in 6M2024.

Cost of revenue

Cost of revenue increased by approximately $0.2

million or 10.0% from approximately $2.0 million in 6M2023 to approximately $2.2 million in 6M2024. Such increase was due to the increase

in costs to vendors in relation to the logistics and other solution services.

Gross profit

Gross profit increased by approximately $0.2 million,

or 25.0%, from $0.8 million in 6M2023 to $1.0 million in 6M2024, which was primarily due to (i) an improvement in gross profit margin

for the provision of professional solution services; and (ii) increase in revenue from the provision of logistics and other solution services

in 6M2024. Gross profit margin increased from approximately 27.8% in 6M2023 to 30.0% in 6M2024. The increase in gross profit margin in

6M2024 was mainly attributable to the departure of certain employees resulting in reduction in cost of revenue and increase in gross profit

margin for professional solutions services in 6M2024.

General and administrative expenses

General and administrative expenses were approximately

13.0% and 12.7% of total revenue in 6M2024 and 6M2023, respectively. The increase in general and administrative expenses by approximately

$57,427, or 16.2%, was mainly due to the increase in staff costs of back office for the expansion of operation in 6M2024.

Other expense, net

Other expense, net increased by approximately

169.2% from $4,355 in 6M2023 to $11,725 in 6M2024, which was mainly due to the increase in interest expense on bank loans.

Income tax expense

Income tax expense was $50,415 and $18,055 for

each of the six months ended June 30, 2024 and 2023, respectively. The increase was mainly due to the increase in net income before provision

for income taxes. The income before provision of income tax in 6M2023 was partly absorbed by the tax loss carried forwards from the year

ended 31 December 2022, thus less income tax expense was provided in 6M2023.

Net income

We recorded net income of approximately $0.5 million

in 6M2024, compared to approximately $0.4 million in 6M2023. Such increase was attributable to the increase in revenue and gross profit

margin, partially offset by the increase in general and administrative expense in 6M2024.

Basic and diluted EPS

Basic and diluted EPS remained stable at approximately

$0.03 per ordinary share for 6M2024 and 6M2023, respectively.

Liquidity and Capital Resources

We financed our operations primarily through cash

flows from operations and loans from banks, if necessary. As of June 30, 2024, we had cash and cash equivalents of $221,047 and outstanding

bank loans of $448,718. The bank loans bore interest ranging from 5.47% to 6.11%. As of June 30, 2024, our current assets were approximately

$1.4 million, and our current liabilities were approximately $0.9 million. As of December 31, 2023, our current assets were approximately

$1.4 million, and our current liabilities were approximately $1.2 million. Our current ratio improved from approximately 1.2 for the year

ended December 31, 2023 to 1.6 in 6M2024.

Cash Flow

The following summarizes the key components of

our cash flows for 6M2024 and 6M2023:

Operating Activities

For 6M2024 and 6M2023, our net cash used in

or provided by operating activities were primarily derived from cash inflow from our net income adjusted for (i) net non-cash expenses

comprising depreciation, non-cash lease expense, and provision for expected credit losses, and (ii) net change in operating assets and

liabilities, including accounts receivable, prepaid expenses and other current assets, due from related parties, accounts payable, accrued

expenses and other liabilities, advance from customers, due to a related party, income tax payable and lease liabilities.

Net cash used in operating activities was $30,520

for 6M2024 compared to net cash provided by operating activities of $203,081 for 6M2023, representing a decrease of $233,601. Such decrease

was primarily due to unfavorable net change in operating assets and liabilities, partially offset by the increase in net income.

Investing activities

Net cash used in investing activities for 6M2024

and 6M2023 were $2,255 and $1,114, respectively, which represent cash payment for purchase of property and equipment.

Financing activities

For 6M2024, net cash used in financing activities

was approximately $0.2 million, mainly consisted of repayments on bank loans of approximately $0.8 million and deferred offering cost

of approximately $0.7 million, which were offset by proceeds from bank loans of approximately $0.7 million and proceeds from issuance

of ordinary shares of approximately $0.5 million. For 6M2023, net cash used in financing activities was approximately $0.3 million, mainly

consisted of repayments on bank loans of approximately $1.3 million, which were offset by proceeds from bank loans of approximately $1.0

million.

For more information, please contact:

Click Holdings Limited

Unit 709, 7/F., Ocean Centre

5 Canton Road

Tsim Sha Tsui, Kowloon

Hong Kong

Email: admin@clickholdings.com.hk

Phone: +852 2691 8200

Exhibit 99.3

Click Holdings Limited

Reports Strong Growth in the First Half of 2024 Financial Results

Hong Kong, November 22, 2024 (GLOBE NEWSWIRE)

-- Click Holdings Limited (“Click Holdings” or “we” or “us”, NASDAQ: CLIK) and its subsidiaries (collectively,

the “Company”), a human resources solutions provider based in Hong Kong, announced its unaudited financial results for the

six months ended June 30, 2024.

In the first half of 2024, total revenue increased

by approximately 14.3%

We achieved steady growth over the past six months

and continued to consolidate its market position in the human resources solutions sector. In the first half of 2024, the Company achieved

total revenue of approximately $3.2 million.

In the first half of 2024, net income increased

by approximately 25.0%

We have realized an improvement in our gross profit margin within

our business. During the first half of 2024, the Company reported a net income of approximately $0.5 million, marking a notable increase

of approximately 25.0% compared to that of approximately $0.4 million for the same period in 2023.

Updates on principal sectors

Professional solution services: This sector

contributed approximately 31.7% of the Company’s total revenue, amounting to approximately $1.0 million. The services provided by

us include (i) the secondment of senior executives such as chief financial officers and company secretaries to perform compliance, financial

reporting and financial management functions for customers; (ii) the provision of accounting and audit professionals to perform audit

work under the instruction of Certified Public Accountant firms; and (iii) the provision of corporate finance experts to assist in drafting

of documents including circulars, announcements and others for Hong Kong listed companies and listing documents for private companies

planning to go public.

Nursing solution services: This sector

generated approximately $0.7 million in revenue, representing approximately 21.3% of the Company’s total revenue. We provide human

resources solutions to social service organizations and nursing homes by matching both temporary and permanent vacancies with candidates

in our extensive talent pool.

Logistics and other solution services:

This sector brought in approximately $1.5 million in revenue, representing approximately 47.0% of the Company’s total revenue. We

provide human resources solutions by matching workers such as packaging staff and movers from our talent pool with both temporary and

permanent vacancies offered by our customers. The strong growth in revenue from this sector of approximately 72.6% reflected the rapid

expansion of this sector during the six months ended June 30, 2024 in particular the additional demand for placement of works from a major

customer starting in April 2024.

Outlook

Amid a challenging but promising market environment

in Hong Kong, we will continue to focus on enhancing service quality and fulfillment capabilities to meet the ever-changing

needs of our customers. Furthermore, we will actively pursue fresh business prospects to extend its market presence. Moving forward, our

management holds a positive outlook on the long-term potential of the Company.

About Click Holdings Limited

We are a human resources solutions provider, specializing

in offering comprehensive human resources solutions in three principal sectors, namely (i) professional solution services, (ii) nursing

solution services, and (iii) logistics and other solution services. We are primarily focused on talent sourcing and the provision of temporary

and permanent personnel to customers. Our primary market is in Hong Kong and our diverse clientele includes accounting and professional

firms, Hong Kong listed companies, nursing homes, individual patients, logistics companies and warehouses.

For more information on the Company and its filings, which are available

for review at www.sec.gov.

Safe Harbor Statement

Certain statements in this announcement are forward-looking

statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on the Company’s current

expectations and projections about future events that the Company believes may affect its financial condition, results of operations,

business strategy and financial needs. Investors can identify these forward-looking statements by words or phrases such as “may,”

“will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,”

“believe,” “is/are likely to,” “potential,” “continue” or other similar expressions. The

Company undertakes no obligation to update or revise publicly any forward-looking statements to reflect subsequent occurring events or

circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed

in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company

cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors

that may affect its future results in the Company’s registration statement and other filings with the SEC, which are available for

review at www.sec.gov.

For enquiry, please contact:

Click Holdings Limited

Unit 709, 7/F., Ocean Centre

5 Canton Road

Tsim Sha Tsui, Kowloon

Hong Kong

Email: admin@clickholdings.com.hk

Phone: +852 2691 8200

Click (NASDAQ:CLIK)

Historical Stock Chart

From Feb 2025 to Mar 2025

Click (NASDAQ:CLIK)

Historical Stock Chart

From Mar 2024 to Mar 2025