false

0001279704

0001279704

2025-03-13

2025-03-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 13, 2025

Cellectar Biosciences, Inc.

(Exact name of Registrant as Specified in its

Charter)

| Delaware | |

1-36598 | |

04-3321804 |

(State or other jurisdiction

of incorporation) | |

(Commission

File Number) | |

(IRS Employer

Identification No.) |

100

Campus Drive, Florham Park, NJ, 07932

(Address of principal executive offices) (Zip

Code)

Registrant’s telephone number, including

area code: (608) 441-8120

N/A

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, par value $0.00001 per share |

|

CLRB |

|

The Nasdaq Capital

Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

| Item 2.02. |

Results of Operations and Financial Condition. |

On March 13, 2025, we issued

a press release announcing our financial results for the year ended December 31, 2024 and provided a corporate update. A copy of the press

release is furnished as Exhibit 99.1 and is incorporated by reference herein.

| Item 9.01. |

Financial Statements and Exhibits |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CELLECTAR BIOSCIENCES, INC. |

| |

|

|

| Date:

March 13, 2025 |

By: |

/s/ Chad J. Kolean |

| |

Name: |

Chad J. Kolean |

| |

Title: |

Chief Financial Officer |

Exhibit 99.1

Cellectar Biosciences

Reports Financial Results for Year Ended 2024 and Provides a Corporate Update

Achieves alignment

with U.S. Food and Drug Administration (FDA) on regulatory path for potential accelerated approval of iopofosine I 131 as a treatment

for Waldenström macroglobulinemia (WM)

Evaluating timing

for Phase 1 solid tumor studies; Auger-emitting radioconjugate prepared for Phase 1b; plans to submit an IND for alpha-emitting radioconjugate;

Company to host

webcast and conference call at 8:30 AM ET today

FLORHAM PARK, N.J., March 13, 2025

(GLOBE NEWSWIRE) -- Cellectar Biosciences, Inc. (NASDAQ: CLRB), a late-stage clinical biopharmaceutical company focused on the discovery,

development, and commercialization of drugs for the treatment of cancer, today announced financial results for the year ended December

31, 2024, and provided a corporate update.

“In 2024

the company showcased the efficacy and safety of iopofosine I 131 for the treatment of relapsed/refractory Waldenström macroglobulinemia.

We recently completed a productive meeting with the FDA that established a clear regulatory pathway for the accelerated approval of this

promising drug. Based upon this regulatory clarity, the quality of the CLOVER-WaM data, and a robust global market opportunity, we continue

to evaluate inbound inquiries regarding a range of collaborations for iopofosine I 131, which we view as an attractive, non-dilutive

funding approach.” said James Caruso, president and CEO of Cellectar. “In addition, the company received clearance for an

IND for our Auger-emitting radioconjugate and will be submitting an IND application for our alpha-emitting radioconjugate. By the middle

of 2025 we will be prepared to advance into phase 1 clinical studies for both compounds, in triple negative breast cancer and pancreatic

cancer indications, respectively.”

2024 and Recent Corporate Highlights

| · | Finalized

confirmatory study design and regulatory pathway for potential FDA accelerated approval of

iopofosine I 131, the Company’s targeted radiotherapeutic candidate for the treatment

of relapsed/refractory WM. |

| o | The

study will be a randomized, controlled trial of iopofosine I 131 versus a comparator arm,

with 100 patients per arm. |

| | | |

| o | Two-stage

approval process includes conditional accelerated approval based on a major response rate

(MRR) endpoint with full approval based upon achieving a progression-free survival endpoint. |

| | | |

| o | Company

expects to complete full patient enrollment within 24 months of the first patient admitted

to the study. |

| | | |

| o | Total

study cost is expected to be between $40M-$45M, with approximately $30M to full enrollment. |

| · | Presented

data from the Phase 2 CLOVER-WaM study in an oral session at the 66th American

Society of Hematology Annual Meeting and Exposition (ASH 2024) in December. The oral presentation

highlighted that treatment with iopofosine I 131 in patients suffering from relapsed/refractory

WM demonstrated: |

| o | overall

Response Rate (ORR) was 83.6%; |

| o | major

Response Rate (MRR) was 58.2%, which exceeded the FDA agreed-upon primary endpoint of 20%

MRR; |

| o | durable

efficacy in previously treated WM patients, with no current standard of care therapy; |

| o | well

tolerated with a manageable toxicity profile across broad biologic and clinical subgroups. |

| · | An

article published in the journal eBioMedicine, volume 111, 2025, 105496, ISSN 2352-3964 from

a SPORE Grant-supported, investigator-led study utilizing iopofosine I 131 (also known as

CLR 131) in combination with external beam radiation, reported the best overall response

from 11 evaluable patients included seven participants with a complete response (63.6%),

one with a partial response (9%), one with stable disease (9%), and two with disease progression

(18%), further supporting iopofosine I 131’s therapeutic benefit in solid tumors. |

| · | Continued

development of CLR 121225 and CLR 121125, the Company’s pre-clinical radioconjugate

assets, to support Phase 1 solid tumor studies: |

| o | The

company is prepared to initiate a Phase 1b/2a dose-finding study with CLR 121125 in triple-negative

breast cancer. CLR 121125 is the company’s lead Auger-emitting (iodine-125) Phospholipid

Radioconjugate™ (PRC) that provides the greatest precision in targeted radiotherapy

as emissions only travel a few nanometers. |

| o | The

company plans to file an IND application in the first half of 2025 for CLR 121225. CLR 121225

is Cellectar’ s lead alpha-emitting (actinium-225) PRC, which has demonstrated activity

in multiple solid tumor animal models, including pancreatic and colorectal cancer. |

2024 Financial Highlights

| · | Cash

and Cash Equivalents: As of December 31, 2024, the company had cash and cash equivalents

of $23.3 million, compared to $9.6 million as of December 31, 2023. In 2024, Cellectar executed

multiple financial transactions, including investors’ exercise of warrants in January

2024 that generated $44.1 million, and an inducement financing in July 2024, which included

the exercise of existing warrants and the purchase of new warrants for an additional $19.4

million. The company believes its cash balance as of December 31, 2024, is adequate

to fund its basic budgeted operations into the fourth quarter of 2025. |

| · | Research

and Development Expenses: R&D expenses for the year ended December 31,

2024, were approximately $26.1 million, compared to approximately $27.3 million for the year

ended December 31, 2023. The decrease was primarily a result of the timing of expenditures

for our WM Phase 2 study to support final patient visits, partially offset by the extensive

analytic work necessary to prepare for a planned regulatory submission, product sourcing,

manufacturing, and logistics infrastructure costs to support multi sourcing for each aspect

of iopofosine I 131 production. |

| · | General

and Administrative Expenses: G&A expenses for the year ended December 31,

2024, were approximately $25.6 million, compared to approximately $11.7 million for the same

period in 2023. The increase was primarily driven by costs associated with the development

of infrastructure necessary to support potential commercialization, including the related

marketing and personnel costs. |

| · | Other

income and expense: Other income and expense, net, was approximately $7.3 million of

income in 2024, as compared to approximately $3.9 million of expense in the prior year. These

amounts are almost exclusively non-cash and driven by the issuance and valuation of equity

securities in conjunction with financing activities. The only cash impact was interest income,

which for 2024 improved to approximately $1.2 million from $0.4 million in the prior year.

|

| · | Net

Loss: Net loss for the full year ending December 31, 2024, was $44.6 million or

$1.22 per basic share and $1.40 per diluted share, compared with $42.8 million or $3.50 per

basic and diluted share during 2023. |

Conference Call & Webcast Details

Cellectar management

will host a conference call and webcast today, March 13, 2024, at 8:30 AM Eastern Time to discuss these results and answer questions.

Stockholders and other interested parties may participate in the conference call by dialing 1-800-717-1738. A live webcast of the conference

call can be accessed in the “Events & Presentations” section of Cellectar’s website at www.cellectar.com.

A recording of the webcast will be available and archived on the Company’s website for approximately 90 days.

About Cellectar Biosciences, Inc.

Cellectar Biosciences is a late-stage

clinical biopharmaceutical company focused on the discovery and development of proprietary drugs for the treatment of cancer, independently

and through research and development collaborations. The company’s core objective is to leverage its proprietary Phospholipid Drug

Conjugate™ (PDC) delivery platform to develop the next-generation of cancer cell-targeting treatments, delivering improved efficacy

and better safety as a result of fewer off-target effects.

The company’s product pipeline

includes its lead assets: iopofosine I 131, a PDC designed to provide targeted delivery of iodine-131 (radioisotope); CLR 121225, an

actinium-225 based program being targeted to several solid tumors with significant unmet need, such as pancreatic cancer; and CLR 121125,

an iodine-125 Auger-emitting program targeted in solid tumors, such as triple negative breast, lung and colorectal, as well as proprietary

preclinical PDC chemotherapeutic programs and multiple partnered PDC assets.

In addition, iopofosine I 131 has been

studied in Phase 2b trials for relapsed or refractory multiple myeloma (MM) and central nervous system (CNS) lymphoma, and the CLOVER-2

Phase 1b study, targeting pediatric patients with high-grade gliomas, for which Cellectar is eligible to receive a Pediatric Review Voucher

from the FDA upon approval. The FDA has also granted iopofosine I 131 six Orphan Drug, four Rare Pediatric Drug, and two Fast Track Designations

for various cancer indications.

For more information,

please visit www.cellectar.com or join the conversation by liking and following us on the company’s social media channels:

X, LinkedIn, and Facebook.

Forward Looking Statements Disclaimer

This

news release contains forward-looking statements. You can identify these statements by our use of words such as "may," "expect,"

"believe," "anticipate," "intend," "could," "estimate," "continue," "plans,"

or their negatives or cognates. These statements are only estimates and predictions and are subject to known and unknown risks and uncertainties

that may cause actual future experience and results to differ materially from the statements made. These statements are based on our

current beliefs and expectations as to such future outcomes. Drug discovery and development involve a high degree of risk. Factors that

might cause such a material difference include, among others, uncertainties related to the ability to raise additional capital, uncertainties

related to the disruptions at our sole source supplier of iopofosine, the ability to attract and retain partners for our technologies,

the identification of lead compounds, the successful preclinical development thereof, patient enrollment and the completion of clinical

studies, the FDA review process and other government regulation, our ability to maintain orphan drug designation in the United States

for iopofosine, the volatile market for priority review vouchers, our pharmaceutical collaborators' ability to successfully develop and

commercialize drug candidates, competition from other pharmaceutical companies, product pricing and third-party reimbursement. A complete

description of risks and uncertainties related to our business is contained in our periodic reports filed with the Securities and Exchange

Commission including our Form 10-K for the year ended December 31, 2024. These forward-looking statements are made only as of the date

hereof, and we disclaim any obligation to update any such forward-looking statements.

INVESTORS:

Anne Marie Fields

Precision AQ

212-362-1200

annemarie.fields@precisionaq.com

+++

TABLES FOLLOW +++

CELLECTAR BIOSCIENCES, INC.

CONSOLIDATED

BALANCE SHEETS

| | |

December 31, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| ASSETS | |

| | | |

| | |

| CURRENT ASSETS: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 23,288,607 | | |

$ | 9,564,988 | |

| Prepaid expenses and other current assets | |

| 961,665 | | |

| 888,225 | |

| Total current assets | |

| 24,250,272 | | |

| 10,453,213 | |

| Property, plant & equipment, net | |

| 757,121 | | |

| 1,090,304 | |

| Operating lease right-of-use asset | |

| 436,874 | | |

| 502,283 | |

| Other long-term assets | |

| 29,780 | | |

| 29,780 | |

| TOTAL ASSETS | |

$ | 25,474,047 | | |

$ | 12,075,580 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ (DEFICIT) EQUITY | |

| | | |

| | |

| CURRENT LIABILITIES: | |

| | | |

| | |

| Accounts payable and accrued liabilities | |

$ | 7,585,340 | | |

$ | 9,178,645 | |

| Warrant liability | |

| 1,718,000 | | |

| 16,120,898 | |

| Lease liability, current | |

| 84,417 | | |

| 58,979 | |

| Total current liabilities | |

| 9,387,757 | | |

| 25,358,522 | |

| Lease liability, net of current portion | |

| 409,586 | | |

| 494,003 | |

| TOTAL LIABILITIES | |

| 9,797,343 | | |

| 25,852,525 | |

| COMMITMENTS AND CONTINGENCIES (Note 10) | |

| | | |

| | |

| MEZZANINE EQUITY: | |

| | | |

| | |

| Series D convertible preferred stock, 111.11 shares authorized; 111.11 shares issued and outstanding as of December 31, 2024 and 2023 | |

| 1,382,023 | | |

| 1,382,023 | |

| STOCKHOLDERS’ (DEFICIT) EQUITY: | |

| | | |

| | |

| Series E-2 preferred stock, 1,225.00 shares authorized; 35.60 and 319.76 shares issued and outstanding as of December 31, 2024 and 2023, respectively | |

| 520,778 | | |

| 4,677,632 | |

| Common stock, $0.00001 par value; 170,000,000 shares authorized; 46,079,875 and 20,744,110 shares issued and outstanding as of December 31, 2024 and 2023, respectively | |

| 461 | | |

| 207 | |

| Additional paid-in capital | |

| 261,115,905 | | |

| 182,924,210 | |

| Accumulated deficit | |

| (247,342,463 | ) | |

| (202,761,017 | ) |

| Total stockholders’ (deficit) equity | |

| 14,294,681 | | |

| (15,158,968 | ) |

| TOTAL LIABILITIES AND STOCKHOLDERS’ (DEFICIT) EQUITY | |

$ | 25,474,047 | | |

$ | 12,075,580 | |

CELLECTAR BIOSCIENCES, INC.

CONSOLIDATED

STATEMENTS OF OPERATIONS

| | |

Year Ended December 31, | |

| | |

2024 | | |

2023 | |

| OPERATING EXPENSES: | |

| | | |

| | |

| Research and development | |

$ | 26,136,246 | | |

$ | 27,266,276 | |

| General and administrative | |

| 25,641,452 | | |

| 11,694,367 | |

| Total operating expenses | |

| 51,777,698 | | |

| 38,960,643 | |

| | |

| | | |

| | |

| LOSS FROM OPERATIONS | |

| (51,777,698 | ) | |

| (38,960,643 | ) |

| | |

| | | |

| | |

| OTHER INCOME (EXPENSE): | |

| | | |

| | |

| Warrant issuance expense | |

| (7,743,284 | ) | |

| (470,000 | ) |

| Gain (loss) on valuation of warrants | |

| 13,794,683 | | |

| (3,787,114 | ) |

| Interest income | |

| 1,210,853 | | |

| 387,147 | |

| Total other income (expense), net | |

| 7,262,252 | | |

| (3,869,967 | ) |

| LOSS BEFORE INCOME TAXES | |

| (44,515,446 | ) | |

| (42,830,610 | ) |

| | |

| | | |

| | |

| INCOME TAX PROVISION (BENEFIT) | |

| 66,000 | | |

| (60,000 | ) |

| | |

| | | |

| | |

| NET LOSS | |

$ | (44,581,446 | ) | |

$ | (42,770,610 | ) |

| NET LOSS PER SHARE — BASIC | |

$ | (1.22 | ) | |

$ | (3.50 | ) |

| NET LOSS PER SHARE — DILUTED | |

$ | (1.40 | ) | |

$ | (3.50 | ) |

| WEIGHTED-AVERAGE COMMON SHARES OUTSTANDING — BASIC | |

| 36,622,474 | | |

| 12,221,571 | |

| WEIGHTED-AVERAGE COMMON SHARES OUTSTANDING — DILUTED | |

| 37,143,769 | | |

| 12,221,571 | |

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

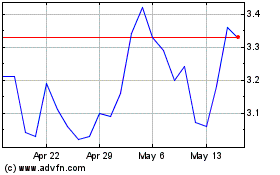

Cellectar Biosciences (NASDAQ:CLRB)

Historical Stock Chart

From Feb 2025 to Mar 2025

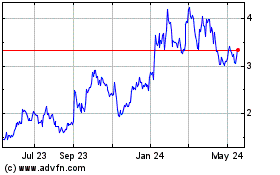

Cellectar Biosciences (NASDAQ:CLRB)

Historical Stock Chart

From Mar 2024 to Mar 2025