Filed pursuant to Rule 424(b)(5)

Registration Statement No. 333-282522

PROSPECTUS

$93,512,230

American Depositary Shares representing

Ordinary Shares

We are party to a sales agreement, or the Sales Agreement, with TD Securities (USA) LLC, or TD Cowen, dated October 8, 2021, relating to the sale of our American Depositary Shares, or ADSs, offered by this prospectus. In accordance with the terms of the Sales Agreement, we may offer and sell up to $150,000,0000 of ADSs through TD Cowen, acting as our agent. As of October 18, 2024, we had offered and sold 5,491,836 ADSs for aggregate gross proceeds to us of approximately $56,487,770 pursuant to the Sales Agreement and therefore $93,512,230 of ADSs remained available for issuance pursuant to the Sales Agreement, which may be offered and sold from time to time through TD Cowen under this prospectus. Each ADS represents one ordinary share, nominal value £0.008 per ordinary share. The ADSs may be evidenced by American Depositary Receipts, or ADRs.

Our ADSs are listed on the Nasdaq Global Select Market, or Nasdaq, under the symbol “CMPS.” On October 17, 2024, the closing price of our American Depositary Shares on Nasdaq was $6.27 per ADS.

Sales of our ADSs, if any, under this prospectus may be made in sales deemed to be an “at the market offering” as defined in Rule 415(a)(4) promulgated under the Securities Act of 1933, as amended, or the Securities Act. TD Cowen is not required to sell any specific number or dollar amount of securities, but will act as a sales agent using commercially reasonable efforts consistent with its normal trading and sales practices, on mutually agreed terms between TD Cowen and us. There is no arrangement for funds to be received in any escrow, trust or similar arrangement.

TD Cowen will be entitled to compensation at a commission rate of up to 3.0% of the gross sales price per ADS sold under the Sales Agreement. See “Plan of Distribution” beginning on page S-16 for additional information regarding the compensation to be paid to TD Cowen. In connection with the sale of the ADSs on our behalf, TD Cowen will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of TD Cowen will be deemed to be underwriting commissions or discounts. We have also agreed to provide indemnification and contribution to TD Cowen with respect to certain liabilities, including liabilities under the Securities Act or the Securities Exchange Act of 1934, as amended, or the Exchange Act.

We are a “smaller reporting company” under the federal securities laws and, as such, we have elected to comply with certain reduced public company reporting requirements for this prospectus and for future filings. See the section titled “Prospectus Summary—Implications of Being a Smaller Reporting Company.”

Investing in our ADSs involves risks. You should review carefully the risks and uncertainties described in the section titled “Risk Factors” on page S-6 of this prospectus, as well as in the documents incorporated or deemed to be incorporated by reference into this prospectus, concerning factors you should consider before buying our ADSs. Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

TD Cowen

The date of this prospectus is October 18, 2024.

TABLE OF CONTENTS

PROSPECTUS

ABOUT THIS PROSPECTUS

This prospectus is part of a shelf registration statement that we filed with the SEC. By using a shelf registration statement, we may offer our ADSs having an aggregate offering price of up to $93,512,230 from time to time under this prospectus at prices and on terms to be determined by market conditions at the time of offering.

This prospectus relates to the offering of our ADSs. Before buying any of the ADSs that we are offering, we urge you to carefully read this prospectus together with the information incorporated by reference herein, as well as the additional information described under the headings “Where You Can Find More Information” and “Incorporation of Certain Information by Reference” and any free writing prospectus that we may authorize for use in connection with this offering. These documents contain important information that you should consider when making your investment decision. If any statement in one of these documents is inconsistent with a statement in another document having a later date (for example, a document incorporated by reference into this prospectus) the statement in the document having the later date modifies or supersedes the earlier statement.

You should rely only on the information contained in or incorporated by reference in this prospectus and any free writing prospectus filed by us with the SEC. We have not, and TD Cowen has not, authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus does not constitute an offer to sell or the solicitation of an offer to buy any securities other than the securities described in this prospectus or an offer to sell or the solicitation of an offer to buy such securities. We are not, and TD Cowen is not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus, any documents incorporated by reference, and in any free writing prospectus that we have authorized for use in connection with this offering, is accurate only as of the date of those respective documents. Our business, financial condition, results of operations and prospects may have changed since those dates. You should read this prospectus, any documents incorporated by reference, and any free writing prospectus that we have authorized for use in connection with this offering, in their entirety before making an investment decision.

Unless otherwise stated, all references in this prospectus refer to the “Company,” “Compass,” “Compass Pathways,” “we,” “us,” and “our,” except where the context requires otherwise, refer to Compass Pathways plc and its consolidated subsidiaries.

We own various trademark registrations and applications, and unregistered trademarks, including COMPASS and COMPASS PATHWAYS and our corporate logo. All other trade names, trademarks and service marks of other companies appearing in this prospectus are the property of their respective holders. Solely for convenience, the trademarks and trade names in this prospectus may be referred to without the ®, ™ or RTM symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend to use or display other companies’ trademarks and trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

This prospectus contains or incorporates by reference industry, market and competitive position data that are based on general and industry publications, surveys and studies conducted by third parties, some of which may not be publicly available, and our own internal estimates and research. Third-party publications, surveys and studies generally state that they have obtained information from sources believed to be reliable, but do not guarantee the accuracy and completeness of such information. These data involve a number of assumptions and limitations and contain projections and estimates of the future performance of the industries in which we operate that are subject to a high degree of uncertainty. We caution you not to give undue weight to such projections, assumptions and estimates.

No action is being taken in any jurisdiction outside the United States to permit a public offering of the securities or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus applicable to that jurisdiction.

PROSPECTUS SUMMARY

This summary highlights certain information about us, this offering and selected information contained elsewhere in this prospectus and in the documents incorporated by reference herein. This summary does not contain all of the information that you should consider before making an investment. You should read this entire prospectus carefully, especially the risks of investing in our ADSs discussed under “Risk Factors” beginning on page S-6 of this prospectus, along with our consolidated financial statements and notes to those consolidated financial statements and the other information incorporated by reference in this prospectus and any related free writing prospectus, before making an investment decision. Overview

We are a biotechnology company dedicated to accelerating patient access to evidence-based innovation in mental health. We are motivated by the need to find better ways to help and empower people suffering with mental health challenges who are not helped by existing treatments, and are pioneering the development of a new model of psilocybin treatment, in which our investigational COMP360 psilocybin is administered in conjunction with psychological support, which we refer to as COMP360 psilocybin treatment. COMP360 is our proprietary psilocybin formulation that includes our pharmaceutical-grade polymorphic crystalline psilocybin, optimized for stability and purity.

We believe that our investigational COMP360 psilocybin treatment could offer a new approach to treatment of serious mental health conditions, including treatment-resistant depression, or TRD, a subset of major depressive disorder, or MDD, post-traumatic stress disorder, or PTSD, and anorexia nervosa.

Our initial focus is on TRD, comprising patients who are inadequately served by the current treatment paradigm. In 2018, we received Breakthrough Therapy designation from the FDA for COMP360 for the treatment of TRD. In November 2021, we announced positive top-line results from our Phase 2b clinical trial evaluating COMP360 in conjunction with psychological support for the treatment of TRD. On November 3, 2022, The New England Journal of Medicine, the world’s leading peer-reviewed medical journal, published the positive results from our Phase 2b trial.

At the beginning of 2023, we commenced our Phase 3 program evaluating our COMP360 psilocybin treatment in TRD. The Phase 3 program is composed of two pivotal trials, each with a long-term follow-up component. The pivotal program design is as follows:

•Pivotal trial 1 (COMP005) (n=255): a single dose (25mg) monotherapy compared with placebo. This trial is designed to replicate the treatment response seen in our Phase 2b trial (n=233). We expect to report top-line data in the fourth quarter of 2024 or potentially early 2025.

•Pivotal trial 2 (COMP006) (n= 568): a fixed repeat dose monotherapy using three dose arms: 25mg, 10mg and 1mg. This trial is designed to investigate whether a second dose can increase treatment responders and whether a second dose can improve responses observed in our Phase 2b trial and to explore the potential for a meaningful treatment response from repeat administration of COMP360 10mg. We expect to report top-line data by mid-2025.

•The primary endpoint in both pivotal trials is the change from baseline in MADRS (Montgomery-Åsberg Depression Rating Scale) total score at week 6.

Beyond TRD, in May 2024, we announced top-line data from our open label Phase 2 study to assess the safety and tolerability of COMP360 psilocybin treatment, administered with psychological support, in people with PTSD, as a result of trauma experienced as adults. In addition, we are conducting a Phase 2 trial in anorexia nervosa.

The need for innovation in mental health care is significant, given that the current treatment paradigm is ineffective for millions of people. Our vision is a world of mental wellbeing – a world in which mental health isn’t simply the absence of mental illness, but the ability to flourish.

Company Information

We were originally incorporated as a private limited company under the laws of England and Wales in June 2020 under the name COMPASS Rx Limited to become a holding company for COMPASS Pathfinder Holdings Limited. COMPASS Rx Limited was subsequently re-registered as a public limited company in August 2020 and renamed Compass Pathways plc. COMPASS Pathfinder Holdings Limited was originally incorporated under the laws of England and Wales in June 2017. Our registered office is located at 33 Broadwick Street, London W1F 0DQ, United Kingdom, and our telephone number is +1 (716) 676-6461. Our website address is www.compasspathways.com. We do not incorporate the information on or accessible through our website into this prospectus, and you should not consider any information on, or that can be accessed through, our website as part of this prospectus.

Implications of Being a Smaller Reporting Company

We are a “smaller reporting company” as defined in the Exchange Act. As a result, we may take advantage of certain of the scaled disclosures available to smaller reporting companies. As a smaller reporting company with annual revenues of less than $100.0 million and a non-accelerated filer, we are also not required to provide an attestation report on internal control over financial reporting issued by our independent registered public accounting firm. We will remain a smaller reporting company until the fiscal year following the determination that the market value of our shares held by non-affiliates is more than $250 million measured on the last business day of our second fiscal quarter, or our annual revenues are less than $100 million during the most recently completed fiscal year and the market value of our shares held by non-affiliates is more than $700 million measured on the last business day of our second fiscal quarter.

THE OFFERING

| | | | | |

| ADSs Offered By Us | Ordinary shares represented by ADSs having an aggregate offering price of up to $93,512,230. |

| |

| Plan of Distribution | “At the market offerings" that may be made from time to time through our sales agent, TD Securities (USA) LLC. See “Plan of Distribution” on page S-16. |

| |

| The ADSs | Each ADS represents one ordinary share, nominal value £0.008 per share. The offered ADSs may be evidenced by American Depositary Receipts, or ADRs. |

| |

| Use of Proceeds | We intend to use the net proceeds from this offering primarily for general corporate purposes, which may include working capital and capital expenditures, expenses related to research, clinical development and commercial efforts, general and administrative expenses, repayment of indebtedness and potential acquisitions of, or investments in, companies, products or assets that complement our business (although we have no current commitments or agreements with respect to any acquisitions as of the date of this prospectus). See “Use of Proceeds” on page S-13 for additional information. |

| |

| Risk Factors | Investing in our ADSs involves significant risks. You should read the section titled “Risk Factors” beginning on page S-6 of this prospectus and other information included or incorporated by reference into this prospectus for a discussion of the factors you should carefully consider before deciding to purchase our ADSs. |

| |

Nasdaq symbol | “CMPS” |

| |

| Depositary | Citibank, N.A. |

The total number of our ordinary shares (including ordinary shares represented by one ADS) to be outstanding after this offering is based on 68,387,469 of our ordinary shares outstanding as of June 30, 2024, and excludes:

•12,418,922 ordinary shares issuable upon exercise of warrants outstanding as of June 30, 2024, with a weighted-average exercise price of $9.92 per share;

•8,427,170 ordinary shares issuable upon the exercise of options for ordinary shares outstanding as of June 30, 2024, with a weighted-average exercise price of $11.98 per share;

•677,924 ordinary shares issuable upon the vesting of unvested restricted share units outstanding as of June 30, 2024;

•686,050 ordinary shares that were available for future issuance under our 2020 Share Option and Incentive Plan, or 2020 Option Plan as of June 30, 2024; and

•636,245 ordinary shares that were available for future issuance under our Employee Share Purchase Plan, or ESPP as of June 30, 2024.

Unless otherwise stated, all information contained in this prospectus assumes no issuance or exercise of options after June 30, 2024 and reflects an assumed public offering price of $5.89, which was the last reported sale price of our ADSs on Nasdaq on October 3, 2024.

RISK FACTORS

Investing in our American Depositary Shares, or ADSs, involves a high degree of risk. You should carefully consider the risks and uncertainties described below and the other information contained in this prospectus and documents incorporated by reference herein before making an investment decision. The risks and uncertainties described below and incorporated by reference are not the only ones we face. Additional risks and uncertainties not presently known to us may also adversely affect our business. Our business, financial condition and/or results of operations could be materially and adversely affected if any of these risks occur, and as a result the trading price of our ADSs could decline and you could lose all or part of your investment.

This prospectus also contains forward-looking statements that involve risks and uncertainties. See “Special Note Regarding Forward-Looking Statements.” Our actual results could differ materially and adversely from those anticipated in these forward-looking statements as a result of certain factors.

Risks Related to this Offering

The market price of our ADSs has been and will likely continue to be volatile and you could lose all or part of your investment.

The market price of our ADSs has been and may continue to be highly volatile and could be subject to large fluctuations in response to the risk factors discussed in this section, and others beyond our control, including the following:

•positive or negative results of testing and clinical trials by us, strategic partners or competitors;

•positive or negative developments in the regulatory approval process for psychedelic-based compounds developed by us, strategic partners or competitors;

•timing of completion of our Phase 3 clinical program for TRD and the time period during which results of our Phase 3 trials will become available;

•delays in entering into strategic relationships with respect to development or commercialization of our investigational COMP360 psilocybin treatment or any future therapeutic candidates;

•entry into strategic relationships on terms that are not deemed to be favorable to us;

•technological innovations or commercial therapeutic introductions by competitors;

•changes in government regulations and healthcare payment systems;

•developments concerning proprietary rights, including patent and litigation matters;

•public concern relating to the commercial value or safety of our COMP360 psilocybin treatment or any future therapeutic candidates;

•negative publicity or public perception of the use of psilocybin as a treatment for mental health conditions;

•financing or other corporate transactions;

•publication of research reports or comments by securities or industry analysts;

•the trading volume of our ADSs on Nasdaq, including the sale of ADSs held by holders from our private placement or the exercise of the PIPE Warrants;

•sales of our ADSs by us (including through our sales agreement), members of our senior management and directors or our significant shareholders or the anticipation that such sales may occur in the future;

•general market conditions in the pharmaceutical industry or in the economy as a whole;

•general economic, political, geopolitical and market conditions, including the fluctuations in inflation in the U.S., UK and Europe, and overall market volatility in the U.S. or the UK as a result of, among other

factors, macroeconomic conditions and the war between Russia and Ukraine, the Israel-Hamas war and conflict in the Middle East, or similar events; and

•other events and factors, many of which are beyond our control.

In recent years, the stock markets, and particularly the stock of pharmaceutical and biotechnology companies, at times have experienced price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of affected companies. In addition, if the market for pharmaceutical and biotechnology stocks or the broader stock market experiences a loss of investor confidence, the trading price of our ADSs could decline for reasons unrelated to our business, financial condition or results of operations. Since our ADSs were sold in our IPO at a price of $17.00 per ADS, our ADS price has fluctuated significantly, ranging from an intraday low of $5.01 to an intraday high of $61.69 for the period beginning September 18, 2020, our first day of trading on Nasdaq, through October 17, 2024. If the market price of our ADSs does not exceed the price at which you acquired them, you may not realize any return on your investment in us and may lose some or all of your investment.

We have broad discretion in the use of the net proceeds from the offering and may not use them effectively.

Our board of directors and management will have broad discretion in the application of the net proceeds from the offering and could spend the proceeds in ways that do not improve our results of operations or enhance the value of our ADSs. The failure by our board of directors and management to apply these funds effectively could result in financial losses that could have a material adverse effect on our business, cause the price of our ADSs to decline and delay the development of our investigational COMP360 psilocybin treatment or any future therapeutic candidates. Pending their use, we may invest the net proceeds from the offering in a manner that does not produce income or that loses value.

If you purchase our ADSs in the offering, you will experience substantial and immediate dilution.

If you purchase ADSs in this offering, you will experience immediate dilution in an amount equal to the difference between the purchase price per ADS and our then-net tangible book value per ADS. Assuming that an aggregate of $93,512,230 of ADSs are sold at an assumed public offering price of $5.89 per ADS, which was the last reported sale price of our ADSs on Nasdaq on October 3, 2024, and after deducting commissions and estimated offering expenses payable by us, you would experience immediate dilution of $2.14 per ADS, representing the difference between the assumed public offering price and our as adjusted net tangible book value as of June 30, 2024. For a further description of the dilution that you will experience immediately after the offering, see the section of this prospectus titled “Dilution.”

Future sales or issuances of our ADSs in the public markets, or the perception of such sales, could depress the trading price of our ADSs.

The sale of a substantial number of shares of our ADSs or other equity-related securities in the public markets, or the perception that such sales could occur, could depress the market price of our ADSs and impair our ability to raise capital through the sale of additional equity securities. We may sell large quantities of our ADSs at any time pursuant to this prospectus or in one or more separate offerings. We cannot predict the effect that future sales of ADSs or other equity-related securities would have on the market price of our ADSs.

The actual number of ADSs we will issue under the Sales Agreement, at any one time or in total, is uncertain.

Subject to certain limitations in the Sales Agreement entered into by us with TD Cowen and compliance with applicable law, we have the discretion to deliver a placement notice to TD Cowen at any time throughout the term of the Sales Agreement. The number of ADSs that are sold by TD Cowen after delivering a placement notice will fluctuate based on the market price of our ADSs during the sales period and limits we set with TD Cowen. Because the price per ADS sold will fluctuate based on the market price of our ADSs during the sales period, it is not possible at this stage to predict the number of ADSs that will be ultimately issued or the resulting gross proceeds.

The ADSs offered hereby will be sold in “at the market offerings,” and investors who buy shares at different times will likely pay different prices.

Investors who purchase ADSs in this offering at different times will likely pay different prices, and so may experience different outcomes in their investment results. We will have discretion, subject to market demand, to vary the timing, prices, and numbers of ADSs sold, and there is no minimum or maximum sales price. Investors may

experience a decline in the value of their shares as a result of share sales made at prices lower than the prices they paid.

Holders of our ADSs are not treated as holders of our ordinary shares.

By participating in this offering you will become a holder of ADSs with underlying ordinary shares in a company incorporated under English law. Holders of ADSs are not treated as holders of our ordinary shares, unless they withdraw the ordinary shares underlying their ADSs in accordance with the deposit agreement among us, Citibank, N.A., or the depositary, and all holders and beneficial owners of ADSs issued thereunder, or the deposit agreement, and applicable laws and regulations. The depositary is the holder of the ordinary shares underlying our ADSs. Holders of ADSs therefore do not have any rights as holders of our ordinary shares, other than the rights that they have pursuant to the deposit agreement.

Holders of our ADSs will not have the same voting rights as the holders of our ordinary shares, and may not receive voting materials or any other documents that would need to be provided to our shareholders pursuant to English corporate law, including the UK Companies Act 2006, or Companies Act 2006, in time to be able to exercise their right to vote.

Except as described in the deposit agreement, holders of the ADSs will not be able to exercise voting rights attaching to the ordinary shares represented by the ADSs. The deposit agreement provides that, upon receipt of notice of any meeting of holders of our ordinary shares, the depositary will fix a record date for the determination of ADS holders who shall be entitled to give instructions for the exercise of voting rights. Upon our request, the depositary shall distribute to the holders as of the record date (i) the notice of the meeting or solicitation of consent or proxy sent by us and (ii) a statement as to the manner in which instructions may be given by the holders. We cannot guarantee that ADS holders will receive the voting materials in time to ensure that they can instruct the depositary to vote the ordinary shares underlying their ADSs.

Otherwise, ADS holders will not be able to exercise their right to vote, unless they withdraw the ordinary shares underlying the ADSs they hold. However, ADS holders may not know about the meeting far enough in advance to withdraw those ordinary shares. In addition, the depositary and its agents are not responsible for failing to carry out voting instructions or for the manner of carrying out voting instructions. As a result, ADS holders may not be able to exercise their right to vote, and there may be nothing they can do if the ordinary shares underlying their ADSs are not voted as they requested or if their shares cannot be voted.

Fluctuations in the exchange rate between the U.S. dollar and the pound sterling may increase the risk of holding our ADSs.

Our ADSs trade on Nasdaq in U.S. dollars. Fluctuations in the exchange rate between the U.S. dollar and the pound sterling may result in temporary differences between the value of our ADSs and the value of our ordinary shares, which may result in heavy trading by investors seeking to exploit such differences.

In addition, as a result of fluctuations in the exchange rate between the U.S. dollar and the pound sterling, the U.S. dollar equivalent of the proceeds that a holder of ADSs would receive upon the sale in the UK of any ordinary shares withdrawn from the depositary and the U.S. dollar equivalent of any cash dividends paid in pounds on our ordinary shares represented by ADSs could also decline.

Holders of ADSs may not be able to participate in equity offerings we may conduct from time to time.

Certain shareholders and holders of ADSs, including those in the United States, may, even in the case where preferential subscription rights have not been cancelled or limited, not be entitled to exercise such rights, unless the offering is registered or the ordinary shares are qualified for sale under the relevant regulatory framework. As a result, there is the risk that investors may suffer dilution of their holdings should they not be permitted to participate in preference right equity or other offerings that we may conduct in the future.

Holders of ADSs may be subject to limitations on the transfer of their ADSs and the withdrawal of the underlying ordinary shares.

ADSs are transferable on the books of the depositary. However, the depositary may close its books at any time or from time to time when it deems expedient in connection with the performance of its duties. The depositary may refuse to deliver, transfer or register transfers of ADSs generally when our books or the books of the depositary are

closed, or at any time if we or the depositary think it is advisable to do so because of any requirement of law, government or governmental body, or under any provision of the deposit agreement, or for any other reason, subject to the right of ADS holders to cancel their ADSs and withdraw the underlying ordinary shares. Temporary delays in the cancellation of your ADSs and withdrawal of the underlying ordinary shares may arise because the depositary has closed its transfer books or we have closed our transfer books, the transfer of ordinary shares is blocked to permit voting at a shareholders meeting or we are paying a dividend on our ordinary shares. In addition, ADS holders may not be able to cancel their ADSs and withdraw the underlying ordinary shares when they owe money for fees, taxes and similar charges and when it is necessary to prohibit withdrawals in order to comply with any laws or governmental regulations that apply to ADSs or to the withdrawal of ordinary shares or other deposited securities.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the information incorporated by reference herein contain statements that are not historical facts and are considered forward-looking statements within the meaning of the Private Securities Litigation Reform Act, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Act of 1934, as amended, that involve substantial risks and uncertainties. All statements other than statements of historical fact, including statements regarding our strategy, future operations, future financial position, future revenues, projected costs, prospects, plans and objectives of management, are forward looking statements. In some cases, you can identify forward-looking statements by the words “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “objective,” “anticipate,” “believe,” “contemplate,” “estimate,” “predict,” “potential,” “continue” and “ongoing,” or the negative of these terms, or other comparable terminology intended to identify statements about the future, although not all forward-looking statements contain these identifying words. Forward-looking statements include, but are not limited to, statements about:

•the timing, progress and results of our Phase 3 clinical program for treatment-resistant depression, or TRD, and our other clinical trials of investigational COMP360 psilocybin treatment, including statements regarding the timing of initiation and completion of trials or studies and related preparatory work, our expectations regarding results of discussions with the Food and Drug Administration, or FDA, regarding our trial design and protocols, and our expectations regarding the periods during which the results of our clinical trials will become available;

•our estimates regarding our expenses, capital requirements, the sufficiency of our cash resources and our expected cash runway;

•our ability to raise additional capital or secure other financing to fund our operations;

•the potential for the remaining warrants issued in our private placement financing in August 2023 (which are referred to in this prospectus as the PIPE Warrants) to be exercised in full for cash, and any expected proceeds from the exercise of the PIPE Warrants;

•our reliance on the success of our investigational COMP360 psilocybin treatment;

•the timing, scope or likelihood of regulatory filings and approvals;

•our expectations regarding the size of the eligible patient populations for COMP360 psilocybin treatment, if approved for commercial use;

•our ability to identify third-party clinical sites to conduct our trials and our ability to identify and train appropriately qualified therapists to administer COMP360 psilocybin treatment in our clinical trials;

•our ability to implement our business model and our strategic plans for our business and our investigational COMP360 psilocybin treatment;

•our ability to identify new indications for COMP360 beyond our current primary focus on TRD, post-traumatic stress disorder, or PTSD and anorexia nervosa;

•our commercialization, marketing and manufacturing capabilities and strategy;

•the pricing, coverage and reimbursement of our investigational COMP360 psilocybin treatment, if approved;

•the scalability and commercial viability of our manufacturing methods and processes;

•the rate and degree of market acceptance and clinical utility of our investigational COMP360 psilocybin treatment, in particular, and psilocybin-based treatments, in general;

•our ability to establish or maintain collaborations or strategic relationships or obtain additional funding;

•our expectations regarding potential benefits of our investigational COMP360 psilocybin treatment and our treatment approach generally;

•our expectations around feedback from and discussions with regulators, regulatory development paths and with respect to Controlled Substances Act designation;

•the scope of protection we and any current or future licensors or collaboration partners are able to establish and maintain for intellectual property rights covering COMP360;

•our ability to operate our business without infringing, misappropriating, or otherwise violating the intellectual property rights and proprietary technology of third parties;

•our ability to successfully establish and maintain research collaborations and Centers of Excellence and our ability to achieve our goals with respect to the Center for Mental Health Research and Innovation;

•our ability to identify, develop or acquire digital technologies to enhance the administration of our investigational COMP360 psilocybin treatment;

•our ability to leverage our technology and drug development candidates to advance new psychedelic compounds in other areas of unmet mental health need;

•regulatory developments in the United States, or U.S., under the laws and regulations of England and Wales, and other jurisdictions;

•developments and projections relating to our competitors and our industry;

•the effectiveness of our internal control over financial reporting;

•our ability to attract and retain qualified employees and key personnel;

•our ability to meet milestones to draw down additional amounts in accordance with the terms of our Loan and Security Agreement, or the Loan Agreement, with Hercules Capital, Inc., and our ability to comply with the operating and financial covenants, including the minimum cash covenant, in our Loan Agreement;

•the effect of global financial and economic conditions and geopolitical events, including heightened and fluctuating interest rates and inflation, foreign exchange fluctuations, particularly the Pound Sterling to U.S. Dollar, the risk of economic slowdown or recession in the U.S., instability in the banking system, overall market volatility in the U.S. or the United Kingdom, or UK, including as a result of, among other factors, the ongoing war between Russia and Ukraine, the Israel-Hamas war and escalating conflict in the Middle East, the upcoming presidential election in the U.S., or similar events, on our business;

•the effect of public health crises, pandemics or epidemics such as the COVID-19 pandemic, and any future mitigation efforts, and current or future economic effects, on any of the foregoing or other aspects of our business or operations;

•whether we are classified as a controlled foreign corporation, or CFC, or a passive foreign investment company, or PFIC, under the Internal Revenue Code of 1986, as amended, for current and future periods;

•the future trading price of the ADSs and impact of securities analysts’ reports on these prices;

•the anticipated use of proceeds from this offering, if any; and

•other risks and uncertainties, including those listed under the caption “Risk Factors” in this prospectus as well as those risk factors that are incorporated by reference in this prospectus.

We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. We have included important factors in the cautionary statements included in this prospectus, the documents incorporated by reference herein, and any free writing prospectus, particularly in the section titled “Risk Factors,” that we believe may cause our actual results or events to differ materially from those expressed or implied by our forward-looking statements. Moreover, we operate in a competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this prospectus. As a result of these factors, we cannot assure you that the forward-looking statements in this prospectus will prove to be accurate. Furthermore, if our forward-looking

statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this prospectus, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

You should read this prospectus, the documents incorporated by reference herein and therein, any free writing prospectus, as well as the documents that we have filed as exhibits to the registration statement of which this prospectus forms a part, completely and with the understanding that our actual future results, performance or achievements may be materially different from what we expect. Except as required by law, we assume no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future.

USE OF PROCEEDS

We may issue and sell our ADSs having aggregate sales proceeds of up to $93,512,230 from time to time. Because there is no minimum offering amount required as a condition to close this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time. There can be no assurance that we will sell any shares under or fully utilize the Sales Agreement with TD Cowen as a source of financing.

We currently intend to use the net proceeds from this offering primarily for general corporate purposes, which may include working capital and capital expenditures, expenses related to research, clinical development and commercial efforts, general and administrative expenses, repayment of indebtedness, and potential acquisitions of, or investments in, companies, products or assets that complement our business (although we have no current commitments or agreements with respect to any acquisitions as of the date of this prospectus).

This expected use of net proceeds from this offering represents our intentions based upon our current plans and business conditions, which could change in the future as our plans and business conditions evolve. We cannot predict with certainty all of the particular uses for the net proceeds to be received upon the completion of this offering or the amounts that we will actually spend on the uses set forth above. Predicting the cost necessary to develop product candidates and commercialize approved products can be difficult and the amounts and timing of our actual expenditures may vary significantly depending on numerous factors, including the progress of our development, the status of and results from clinical trials, any collaborations that we may enter into with third parties for our therapeutic candidate and any unforeseen cash needs. Our management will retain broad discretion over the allocation of the net proceeds from this offering.

Pending our use of proceeds from this offering, we plan to invest these net proceeds in investment-grade, interest-bearing securities such as money market funds, certificates of deposit, or direct or guaranteed obligations of the U.S. or U.K. government, hold as cash or apply them to the reduction of indebtedness.

DILUTION

If you invest in our ADSs in this offering, your ownership interest will be diluted to the extent of the difference between the price per ADS you pay in this offering and the as adjusted net tangible book value per ADS immediately after this offering. As of June 30, 2024, our net tangible book value was $225.8 million, or $3.30 per ordinary share (equivalent to $3.30 per ADS). Our net tangible book value per ADS represents total tangible assets (excluding fixed asset investments) less total liabilities, divided by the aggregate number of ordinary shares outstanding on June 30, 2024.

After giving effect to the assumed sale of ADSs in this offering in the aggregate amount of $93,512,230 at the assumed public offering price of $5.89 per ADS, which was the last reported sale price of our ADSs on Nasdaq on October 3, 2024, and after deducting estimated offering commissions and offering expenses payable by us, our as adjusted net tangible book value as of June 30, 2024 would have been approximately $3.75 per ordinary share, or approximately $3.75 per ADS. This represents an immediate increase in as adjusted net tangible book value of $0.45 per ADS to our existing shareholders and an immediate dilution of $2.14 per ADS to investors participating in this offering. The following table illustrates this dilution to new investors purchasing ADSs in this offering:

| | | | | | | | | | | | | | | | | | | | | | | |

| Assumed public offering price per ADS | | | $ | 5.89 | |

Historical net tangible book value per ADS as of June 30, 2024 | $ | 3.30 | | | |

Increase in net tangible book value per ADS attributable to new investors purchasing ADSs in this offering | | 0.45 | | | |

| As adjusted net tangible book value per ADS after this offering | | |

| 3.75 | |

| Dilution per ADS to new investors purchasing ADSs in this offering | | | $ | 2.14 | |

The table above assumes for illustrative purposes that all of our ADSs in the aggregate amount of $93,512,230 are sold during the term of the sale agreement at a price of $5.89 per ADS, the last reported sale price of our ADSs on Nasdaq on October 3, 2024. The ADSs subject to the sale agreement are being sold from time to time at various prices. An increase of $1.00 per ADS in the price at which the ADSs are sold from the assumed offering price of $5.89 per ADS shown in the table above, assuming all of our ADSs in the aggregate amount of $93,512,230 are sold at that price, would increase our adjusted net tangible book value per ADS after the offering to $3.86 per ADS and would increase the dilution in net tangible book value per ADS to new investors in this offering to $3.03 per ADS, after deducting commissions and estimated offering expenses payable by us. A decrease of $1.00 per ADS in the price at which the ADSs are sold from the assumed offering price of $5.89 per ADS shown in the table above, assuming all of our ADSs in the aggregate amount of $93,512,230 are sold at that price, would decrease our adjusted net tangible book value per ADS after the offering to $3.61 per ADS and would decrease the dilution in net tangible book value per ADS to new investors in this offering to $1.28 per ADS, after deducting commissions and estimated aggregate offering expenses payable by us. This information is supplied for illustrative purposes only and may differ based on the actual offering price and the actual number of ADSs sold.

The foregoing table and discussion is based on 68,387,469 ordinary shares outstanding as June 30, 2024, excluding:

•12,418,922 ordinary shares issuable upon exercise of warrants outstanding as of June 30, 2024, with a weighted-average exercise price of $9.92 per share;

•8,427,170 ordinary shares issuable upon the exercise of options for ordinary shares outstanding as of June 30, 2024, with a weighted-average exercise price of $11.98 per share;

•677,924 ordinary shares issuable upon the vesting of unvested restricted share units outstanding as of June 30, 2024;

•686,050 ordinary shares that were available for future issuance under our 2020 Option Plan as of June 30, 2024; and

•636,245 ordinary shares that were available for future issuance under our ESPP as of June 30, 2024.

To the extent that options or restricted share units are issued under our 2020 Option Plan or shares are issued under our ESPP, or we issue additional ordinary shares or ADSs in the future, there will be further dilution to investors participating in this offering.

In addition, we may choose to raise additional capital due to market conditions or strategic considerations, even if we believe we have sufficient funds for our current or future operating plans. To the extent that additional capital is raised through the sale of equity or convertible debt securities, the issuance of these securities could result in further dilution to our shareholders.

PLAN OF DISTRIBUTION

We have previously entered into a Sales Agreement with TD Cowen, under which we may issue and sell from time to time up to $150,000,000 of our ADSs, each representing one ordinary share, through TD Cowen as our sales agent. As of October 18, 2024, we had offered and sold 5,491,836 ADSs for aggregate gross proceeds to us of approximately $56,487,770 pursuant to the Sales Agreement and therefore $93,512,230 of ADSs remained available for issuance pursuant to the Sales Agreement which may be offered and sold from time to time through TD Cowen under this prospectus. Sales of our ADSs, if any, will be made at market prices by any method that is deemed to be an “at the market offering” as defined in Rule 415(a)(4) under the Securities Act, including block trades.

TD Cowen will offer our ADSs subject to the terms and conditions of the Sales Agreement on a daily basis or as otherwise agreed upon by us and TD Cowen. We will designate the maximum amount of ADSs to be sold through TD Cowen on a daily basis or otherwise determine such maximum amount together with TD Cowen. Subject to the terms and conditions of the Sales Agreement, TD Cowen will use its commercially reasonable efforts to sell on our behalf all of the ADSs requested to be sold by us. We may instruct TD Cowen not to sell ADSs if the sales cannot be effected at or above the price designated by us in any such instruction. TD Cowen or we may suspend the offering of our ADSs being made through TD Cowen under the Sales Agreement upon proper notice to the other party. TD Cowen and we each have the right, by giving written notice as specified in the Sales Agreement, to terminate the Sales Agreement in each party’s sole discretion at any time.

The aggregate compensation payable to TD Cowen as sales agent is up to 3.0% of the gross sales price of the ADSs sold through it pursuant to the Sales Agreement. We have also agreed to reimburse TD Cowen up to $75,000 of TD Cowen’s actual outside legal expenses incurred by TD Cowen in connection with this offering. We estimate that the total expenses of the offering payable by us, excluding commissions payable to TD Cowen under the Sales Agreement, will be approximately $0.7 million.

The remaining sales proceeds, after deducting any expenses payable by us and any transaction fees imposed by any governmental, regulatory, or self-regulatory organization in connection with the sales, will equal our net proceeds for the sale of such ADSs.

TD Cowen will provide written confirmation to us following the close of trading on Nasdaq on each day in which ADSs are sold through it as sales agent under the Sales Agreement. Each confirmation will include the number of ADSs sold through it as sales agent on that day, the volume weighted average price of the ADSs sold, the percentage of the daily trading volume and the net proceeds to us.

We will report at least quarterly the number of ADSs sold through TD Cowen under the Sales Agreement, the net proceeds to us and the compensation paid by us to TD Cowen in connection with the sales of ADSs.

Settlement for sales of ADSs will occur, unless the parties agree otherwise, on the first business day that is also a trading day following the date on which any sales were made in return for payment of the net proceeds to us. There is no arrangement for funds to be received in an escrow, trust or similar arrangement.

In connection with the sales of our ADSs on our behalf, TD Cowen will be deemed to be an “underwriter” within the meaning of the Securities Act, and the compensation paid to TD Cowen will be deemed to be underwriting commissions or discounts. We have agreed in the Sales Agreement to provide indemnification and contribution to TD Cowen against certain liabilities, including liabilities under the Securities Act. As sales agent, TD Cowen will not engage in any transactions that stabilizes our ADSs.

Our ADSs are listed on Nasdaq and trade under the symbol “CMPS.” The depositary of our ADSs is Citibank, N.A.

TD Cowen and/or its affiliates have provided, and may in the future provide, various investment banking and other financial services for us for which services they have received and, may in the future receive, customary fees.

LEGAL MATTERS

The validity of our ADSs and our ordinary shares and certain other matters of U.S. federal law and English law will be passed upon for us by Goodwin Procter LLP, Boston, Massachusetts and Goodwin Procter (UK) LLP, London, United Kingdom, respectively. TD Securities (USA) LLC is being represented in connection with this offering by Paul Hastings LLP, New York, New York with respect to U.S. federal law and Paul Hastings (Europe) LLP, London, United Kingdom with respect to certain matters of English law.

EXPERTS

The financial statements incorporated in this prospectus by reference to the Annual Report on Form 10-K for the year ended December 31, 2023 have been so incorporated in reliance on the report of PricewaterhouseCoopers LLP, an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

The registered business address of PricewaterhouseCoopers LLP is 1 Embankment Place, London, WC2N 6RH, United Kingdom.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains an Internet website (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers, like us, that file electronically with the SEC. We maintain a corporate website at www.compasspathways.com. Information contained in, or that can be accessed through, our website is not a part of, and shall not be incorporated by reference into, this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

This prospectus is part of the Registration Statement on Form S-3 we filed with the SEC under the Securities Act. We have also filed related registration statements on Form F-6 (File No. 333-248514 and File No. 333-279431). This prospectus does not contain all of the information set forth in the Registration Statement and the exhibits to the Registration Statement. For further information with respect to us and the securities we are offering under this prospectus, we refer you to the Registration Statement and the exhibits and schedules filed as a part of the Registration Statement. You should rely only on the information contained in this prospectus or incorporated by reference. We have not authorized anyone else to provide you with different information. We are not making an offer of these securities in any state where the offer is not permitted. You should not assume that the information in this prospectus is accurate as of any date other than the date on the front page of this prospectus, regardless of the time of delivery of this prospectus or any sale of the securities offered by this prospectus.

We will send the depositary a copy of all notices of shareholders meetings and other reports, communications and information that are made generally available to shareholders. The depositary has agreed to mail to all holders of ADSs a notice containing the information (or a summary of the information) contained in any notice of a meeting of our shareholders received by the depositary and will make available to all holders of ADSs such notices and all such other reports and communications received by the depositary.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

We have elected to incorporate the following documents into this prospectus, together with all exhibits filed therewith or incorporated therein by reference, to the extent not otherwise amended or superseded by the contents of this prospectus:

•Our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on February 29, 2024; •Our Quarterly Reports on Form 10-Q for the period ended March 31, 2024, filed with the SEC on May 8, 2024 and for the period ended June 30, 2024 filed with the SEC on August 1, 2024; •Our Definitive Proxy Statement on Schedule 14A filed with the SEC on April 8, 2024 (solely to the extent specifically incorporated by reference into the Annual Report on Form 10-K for the year ended December 31, 2023); •Our Current Reports on Form 8-K filed on March 28, 2024, May 8, 2024, May 9, 2024 and August 1, 2024 (except that, with respect to the foregoing Current Reports, any portions thereof which are furnished and not filed shall not be deemed incorporated by reference); and •The description of our ordinary shares and ADSs contained in our registration statement on Form 8-A, as filed with the SEC under Section 12(b) of the Exchange Act on September 15, 2020, including any amendment or report filed for the purpose of updating such description (File No. 001-39522). The information incorporated by reference is an important part of this prospectus. In addition, all documents we file with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, except as to any portion of any report or documents that is not deemed filed under such provisions, on or after the date of this prospectus until the earlier of the date on which all of the securities registered hereunder have been sold or all offerings under this prospectus are terminated, shall be deemed incorporated by reference in this prospectus. Any report on Form 8-K that we furnish to the SEC on or after the date of this prospectus (or portions thereof) is incorporated by reference in this prospectus only to the extent that the report expressly states that we incorporate it (or such portions) by reference in this prospectus and that it is not subsequently superseded.

Any statement contained in a document incorporated by reference herein shall be deemed to be modified or superseded for all purposes to the extent that a statement contained in this prospectus or in any other subsequently filed document which is also incorporated or deemed to be incorporated by reference, modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus. You may request a copy of these filings (other than an exhibit to a filing unless that exhibit is specifically incorporated by reference into that filing) at no cost by writing to us at the following address: Compass Pathways plc, Attention: Investor Relations, 3rd Floor, 1 Ashley Road, Altrincham, Cheshire, United Kingdom, WA14 2DT. In addition, copies of the documents incorporated herein by reference may be accessed, free of charge, on the SEC’s website at www.sec.gov, or on our website at www.compasspathways.com. Information contained on our website is not incorporated by reference into this prospectus, and you should not consider any information on, or that can be accessed from, our website as part of this prospectus.

$93,512,230

American Depositary Shares Representing

Ordinary Shares

PROSPECTUS

TD Cowen

October 18, 2024

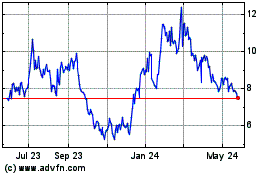

COMPASS Pathways (NASDAQ:CMPS)

Historical Stock Chart

From Sep 2024 to Oct 2024

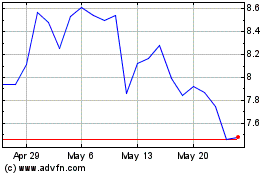

COMPASS Pathways (NASDAQ:CMPS)

Historical Stock Chart

From Oct 2023 to Oct 2024