Compass Pathways plc (Nasdaq: CMPS), a biotechnology company

dedicated to accelerating patient access to evidence-based

innovation in mental health, today announced the pricing of an

underwritten offering of 24,014,728 American Depositary Shares

(“ADSs”) and in lieu of ADS, to certain institutional investors,

pre-funded warrants to purchase up to 11,044,720 ADSs. Each ADS and

pre-funded warrant shall be accompanied by a warrant (“ADS

Warrant”) to purchase one ADS, which has an exercise price of

$5.796 per ADS, representing a 40% premium to the last sale price

and will be exercisable following a specified data milestone. The

offering price is $4.275 per ADS and accompanying ADS Warrant, and

$4.2649 per pre-funded warrant and accompanying ADS Warrant. All of

the securities are to be sold by Compass. The offering is expected

to close on or about January 13, 2025, subject to satisfaction of

customary closing conditions.

The offering was led by Deep Track Capital and included

participation from high quality new and existing investors.

The gross proceeds to Compass from the offering, before

deducting the underwriting discounts and commissions and other

estimated offering expenses, are expected to be approximately $150

million, and up to approximately $353 million if the ADS Warrants

are fully exercised for cash.

Compass intends to use the net proceeds from this offering,

together with its existing cash and cash equivalents to fund its

ongoing COMP005 and COMP006 Phase 3 trials in treatment-resistant

depression with data expected in the second quarter of 2025 and

second half of 2026, respectively. Net proceeds will also be used

to accelerate a late-stage development program in PTSD, and for

working capital and general corporate purposes.

TD Cowen, Cantor, Stifel and RBC Capital Markets are joint book

running managers for the offering.

The securities are being offered by Compass Pathways pursuant to

a Registration Statement on Form S-3 (File no. 333-282522)

previously filed on October 7, 2024 and declared effective by the

SEC on October 17, 2024, and Compass Pathways will also file a

final prospectus supplement and accompanying prospectus relating to

and describing the terms of the offering with the SEC. These

documents can be accessed for free through the SEC’s website at

www.sec.gov.

When available, copies of the prospectus supplement and the

accompanying prospectus relating to this offering may also be

obtained from: TD Securities (USA) LLC, 1 Vanderbilt Avenue, New

York, New York 10017, by telephone at (855) 495-9846 or by email at

TD.ECM_Prospectus@tdsecurities.com; Cantor Fitzgerald & Co.,

Attention: Capital Markets, 110 East 59th Street, 6th Floor, New

York, New York, 10022, or by email at prospectus@cantor.com;

Stifel, Nicolaus & Company, Incorporated, Attention: Syndicate,

One Montgomery Street, Suite 3700, San Francisco, California 94104,

by telephone at (415) 364-2720 or by email at

syndprospectus@stifel.com; or RBC Capital Markets, LLC, Attention:

Equity Syndicate Department, 200 Vesey Street, 8th Floor, New York,

New York 10281; by phone at (877) 822-4089 or by email at

equityprospectus@rbccm.com.

This press release does not constitute an offer to sell or a

solicitation of an offer to buy, nor will there be any sale of

these securities in any state or other jurisdiction in which such

offer, solicitation, or sale would be unlawful before registration

or qualification under the securities laws of that state or

jurisdiction.

About Compass Pathways

Compass Pathways plc (Nasdaq: CMPS) is a biotechnology company

dedicated to accelerating patient access to evidence-based

innovation in mental health. Our focus is on improving the lives of

those who are living with mental health challenges and who are not

helped by existing standards of care. We are pioneering the

development of a new model of psilocybin treatment, in which our

proprietary formulation of synthetic psilocybin, COMP360, is

administered in conjunction with psychological support. COMP360 has

Breakthrough Therapy designation from the US Food and Drug

Administration (FDA) and has received Innovative Licensing and

Access Pathway (ILAP) designation in the UK for treatment-resistant

depression (TRD).

Compass is headquartered in London, UK, with offices in New York

and San Francisco in the US. Our vision is a world of mental

wellbeing.

Forward-looking statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, as amended. In some cases, forward-looking statements can be

identified by terminology such as “may”, “might”, “will”, “could”,

“would”, “should”, “expect”, “intend”, “plan”, “objective”,

“anticipate”, “believe”, “contemplate”, “estimate”, “predict”,

“potential”, “continue” and “ongoing,” or the negative of these

terms or other comparable terminology, although not all

forward-looking statements contain these words. Forward-looking

statements include express or implied statements relating to, among

other things, statements regarding the completion of the offering

on the anticipated terms or at all, the size and terms of the

offering, the timing of the closing of the offering, the

anticipated proceeds to be received in the offering (including,

without limitation, the proceeds, if any, from the exercise of the

warrants) and the expected use of such proceeds. The

forward-looking statements in this press release are neither

promises nor guarantees, and you should not place undue reliance on

these forward-looking statements because they involve known and

unknown risks, uncertainties, and other factors, many of which are

beyond Compass’s control and which could cause actual results,

levels of activity, performance or achievements to differ

materially from those expressed or implied by these forward-looking

statements.

These risks, uncertainties, and other factors include, among

others: uncertainties associated with our ability to complete this

offering on the anticipated terms or at all, including the

satisfaction of customary closing conditions; general economic and

market conditions and we may not receive any additional funds upon

the exercise of the ADS warrants; as well as risks and

uncertainties inherent in our business including risks related to

clinical development which is a lengthy and expensive process with

uncertain outcomes, and therefore our clinical trials may be

delayed or terminated and may be more costly than expected; we will

require substantial additional funding to achieve our business

goals and if we are unable to obtain this funding when needed and

on acceptable terms, we could be forced to delay, limit or

terminate our clinical trials; and those risks and uncertainties

described under the heading “Risk Factors” in Compass’s most recent

annual report on Form 10-K or quarterly report on Form 10-Q, the

prospectus supplement related to the proposed public offering we

plan to file and in other reports we have filed with the U.S.

Securities and Exchange Commission (“SEC”), which are available on

the SEC’s website at www.sec.gov. Except as required by law,

Compass disclaims any intention or responsibility for updating or

revising any forward-looking statements contained in this press

release in the event of new information, future developments or

otherwise. These forward-looking statements are based on Compass’s

current expectations and speak only as of the date hereof.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250110715215/en/

Enquiries Media: media@compasspathways.com, Investors:

Stephen Schultz, stephen.schultz@compasspathways.com, +1 401 290

7324

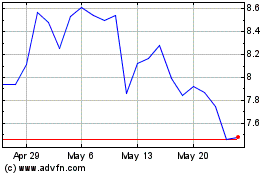

COMPASS Pathways (NASDAQ:CMPS)

Historical Stock Chart

From Jan 2025 to Feb 2025

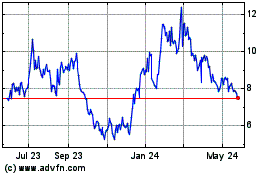

COMPASS Pathways (NASDAQ:CMPS)

Historical Stock Chart

From Feb 2024 to Feb 2025