false000181659000018165902025-02-272025-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): FEBRUARY 27, 2025

COMPASS PATHWAYS PLC

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | |

| | |

| England and Wales | 001-39522 | Not applicable |

| (State or other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

33 Broadwick Street

London W1F 0DQ

United Kingdom

(Address of Principal Executive Offices; Zip Code)

+1 (716) 676-6461

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| American Depositary Shares, each representing one ordinary share, nominal value £0.008 per share | | CMPS | | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02 | Results of Operation and Financial Condition |

On February 27, 2025, COMPASS Pathways plc (the “Company”) issued a press release announcing the Company's financial results for the fourth quarter and year ended December 31, 2024. A copy of this press release is furnished herewith as Exhibit 99.1.

The information in Item 2.02 of this Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

The following exhibits are filed herewith:

| | | | | | | | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| | | | |

| 104 | | Cover page interactive data file (embedded within Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | COMPASS PATHWAYS PLC |

| | | |

| Date: February 27, 2025 | | | | By: | | /s/ Teri Loxam |

| | | | | | Teri Loxam |

| | | | | | Chief Financial Officer |

| | | | | | |

Compass Pathways Announces Fourth Quarter and Full-Year 2024

Financial Results and Business Highlights

Highlights:

•Phase 3 COMP005 trial in participants with treatment resistant depression (TRD) 6-week top-line data on track for second quarter 2025

•Phase 3 COMP006 in TRD is on track for 26-week data in second half of 2026

•Cash position of $165.1 million at December 31, 2024; additional $150 million gross cash proceeds raised in January 2025

•Conference call on February 27 at 8:00 am ET (1:00 pm UK)

LONDON & NEW YORK - February 27, 2025

Compass Pathways plc (Nasdaq: CMPS), a biotechnology company dedicated to accelerating patient access to evidence-based innovation in mental health, today reported its financial results for the fourth quarter and full year 2024 and provided an update on recent progress across its business.

“We are excited that the first data readout from our pivotal phase 3 COMP360 program in treatment resistant depression continues on track with top-line 6-week data expected next quarter,” said Kabir Nath, Chief Executive Officer. “Building on last year’s promising phase 2a data in PTSD and the resources now available from the January financing, we are advancing plans to develop a late-stage clinical program for PTSD with the goal of getting COMP360 to patients as quickly as possible. The need for a new approach to treatment remains significant in TRD and PTSD and we believe COMP360 represents a novel treatment option in these mental health conditions.”

Business Highlights

The pivotal phase 3 clinical program of COMP360 psilocybin treatment in TRD is the largest randomized, controlled, double-blind psilocybin treatment clinical program ever conducted. Top-line 6-week (primary endpoint) COMP005 data is on track for the second quarter 2025 and 26-week COMP005 data is expected once all participants in the COMP006 trial have completed part A of the COMP006 trial. The COMP006 26-week data is expected in the second half of 2026. In addition, design of late-stage clinical program in patients with post-traumatic stress disorder (PTSD) is underway.

Leadership Update

•Steve Levine, M.D., appointed to role of Chief Patient Officer

Financial Highlights

•Net loss for the year ended December 31, 2024, was $155.1 million, or $2.30 loss per share (including non-cash share-based compensation expense of $19.5 million), compared with $118.5 million, or $2.32 loss per share, during the same period in 2023 (including non-cash-share-based compensation expense of $17.3 million).

•Net loss for the three months ended December 31, 2024, was $43.3 million, or $0.63 loss per share (including non-cash share-based compensation expense of $4.5 million), compared with $32.5 million, or $0.53 loss per share, during the same period in 2023 (including non-cash-share-based compensation expense of $4.2 million).

•Research and development expenses were $119.0 million for the year ended December 31, 2024, compared with $87.5 million during the same period in 2023. The increase was primarily attributable to development expenses associated with advancing our late-stage COMP360 phase 3 clinical trials and increased personnel expenses due to increased R&D headcount, as well as one-time costs associated with the strategic reorganization announced in the fourth quarter.

•Research and development expenses were $32.1 million for the three months ended December 31, 2024, compared with $27.1 million during the same period in 2023. The increase was primarily attributable to development expenses associated with advancing our late-stage COMP360 phase 3 clinical trials. and increased personnel expenses due to increased R&D headcount, as well as one-time costs associated with the strategic reorganization.

•General and administrative expenses were $59.2 million for the year ended December 31, 2024, compared with $49.4 million during the same period in 2023. The increase was primarily attributable to increased personnel expenses due to increased headcount supporting our corporate functions, as well as one-time costs associated with the strategic reorganization and increased legal and professional fees due to consulting, legal advice and patent applications.

•General and administrative expenses were $16.3 million for the three months ended December 31, 2024, compared with $11.3 million during the same period in 2023. The increase was primarily attributable to increased personnel expenses due to increased headcount supporting our corporate functions, as well as one-time costs associated with the strategic reorganization and increased legal and professional fees due to consulting, legal advice and patent applications.

•Cash and cash equivalents were $165.1 million as of December 31, 2024, compared with $220.2 million as of December 31, 2023.

•Debt was $30.2 million as of December 31, 2024, compared with $28.8 million as of December 31, 2023.

•Additional $140.4 million net cash raised to date in the first quarter of 2025.

Financial Guidance

Full year 2025 net cash used in operating activities is expected to be in the range of $120 million to $145 million. The cash position at February 27, 2025 is expected to be sufficient to fund operating

expenses and capital expenditure requirements at least through the planned 26-week data read-out from the COMP006 study, which is expected in the second half of 2026.

Conference call

The management team will host a conference call at 8:00 am ET (1:00 pm UK) on February 27, 2025. A live webcast of the call will be available on the Compass Pathways website at Fourth Quarter 2024 Financial Results. The webcast will also be on the Investors section of the Compass Pathways website for 30 days.

Please register in advance here to access the call and obtain a local or toll-free phone number and personal pin.

About Compass Pathways

Compass Pathways plc (Nasdaq: CMPS) is a biotechnology company dedicated to accelerating patient access to evidence-based innovation in mental health. We are motivated by the need to find better ways to help and empower people with serious mental health conditions who are not helped by existing treatments. We are pioneering a new paradigm for treating mental health conditions focused on rapid and durable responses through the development of our investigational COMP360 psilocybin treatment, potentially a first in class treatment. COMP360 has Breakthrough Therapy designation from the US Food and Drug Administration (FDA) and has received Innovative Licensing and Access Pathway (ILAP) designation in the UK for treatment-resistant depression (TRD).

Compass is headquartered in London, UK, with offices in New York and San Francisco in the US. Our vision is a world of mental wellbeing.

Forward-looking statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. In some cases, forward-looking statements can be identified by terminology such as “may”, “might”, “will”, “could”, “would”, “should”, “expect”, “intend”, “plan”, “objective”, “anticipate”, “believe”, “contemplate”, “estimate”, “predict”, “potential”, “continue” and “ongoing,” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. Forward-looking statements include express or implied statements relating to, among other things, statements regarding our expectations regarding the our financial guidance; our business strategy and goals, our expectations and projections about the company’s future cash needs and financial results; our plans and expectations regarding our phase 3 trials in TRD, including our expectations regarding the time periods during which the results of the two Phase 3 trials will become available; the potential for the pivotal phase 3 program in TRD, any future trials in PTSD, or other trials to support regulatory filings and approvals; our expectations regarding the safety or efficacy of our investigational COMP360 psilocybin treatment, including as a treatment for treatment of TRD, PTSD, and anorexia nervosa; our ability to obtain regulatory approval and adequate coverage and reimbursement; and our ability to transition from a clinical-stage to a commercial-stage organization and effectively launch a commercial product, if regulatory approval is obtained. The forward-looking statements in this press release are neither promises nor guarantees, and you should not place undue reliance on these forward-looking statements because they involve known and unknown risks, uncertainties, and other factors, many of which are beyond Compass’s control and which could cause actual results, levels of activity, performance or achievements to differ materially from those expressed or implied by these forward-looking statements.

These risks, uncertainties, and other factors include, among others: uncertainties associated with risks related to clinical development which is a lengthy and expensive process with uncertain

outcomes, and therefore our clinical trials may be delayed or terminated and may be more costly than expected; the results of early-stage clinical trials of our investigational COMP360 psilocybin treatment may not be predictive of the results of later stage clinical trials; our need for substantial additional funding to achieve our business goals and if we are unable to obtain this funding when needed and on acceptable terms, we could be forced to delay, limit or terminate our clinical trials; our efforts to obtain marketing approval from the applicable regulatory authorities in any jurisdiction for our investigational COMP360 psilocybin treatment may be unsuccessful; our efforts to commercialize and obtain coverage and reimbursement for our investigational COMP360 psilocybin treatment, if approved, may be unsuccessful; the risk that our strategic collaborations will not continue or will not be successful; and our ability to retain key personnel; and those risks and uncertainties described under the heading “Risk Factors” in Compass’s most recent annual report on Form 10-K or quarterly report on Form 10-Q, the prospectus supplement related to the proposed public offering we plan to file and in other reports we have filed with the U.S. Securities and Exchange Commission (“SEC”), which are available on the SEC’s website at www.sec.gov. Except as required by law, Compass disclaims any intention or responsibility for updating or revising any forward-looking statements contained in this press release in the event of new information, future developments or otherwise. These forward-looking statements are based on Compass’s current expectations and speak only as of the date hereof.

Enquiries

Media: Media, media@compasspathways.com

Investors: Stephen Schultz, stephen.schultz@compasspathways.com, +1 401 290 7324

COMPASS PATHWAYS PLC

Consolidated Balance Sheets

(in thousands, except share and per share amounts)

(expressed in U.S. Dollars, unless otherwise stated)

| | | | | | | | | | | |

| December 31, |

| 2024 | | 2023 |

| ASSETS | | | |

| CURRENT ASSETS: | | | |

| Cash and cash equivalents | $ | 165,081 | | | $ | 220,198 | |

| Restricted cash | 389 | | | 440 | |

| Prepaid expenses and other current assets | 35,821 | | | 40,658 | |

| Total current assets | 201,291 | | | 261,296 | |

| NON-CURRENT ASSETS: | | | |

| Operating lease right-of-use assets | 2,006 | | | 4,306 | |

| Deferred tax assets | 3,774 | | | 3,336 | |

Long-term prepaid expenses and other assets | 6,595 | | | 7,049 | |

| Total assets | $ | 213,666 | | | $ | 275,987 | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | |

| CURRENT LIABILITIES: | | | |

| Accounts payable | $ | 12,283 | | | $ | 5,892 | |

| Accrued expenses and other liabilities | 14,495 | | | 11,301 | |

Debt, current portion | 5,513 | | | — | |

| Operating lease liabilities - current | 1,725 | | | 2,411 | |

| Total current liabilities | 34,016 | | | 19,604 | |

| NON-CURRENT LIABILITIES | | | |

Debt, non-current portion | 24,652 | | | 28,757 | |

| Operating lease liabilities - non-current | 303 | | | 1,882 | |

| Total liabilities | 58,971 | | | 50,243 | |

| SHAREHOLDERS' EQUITY: | | | |

| Ordinary shares, £0.008 par value; 68,552,215 and 61,943,471 shares authorized, issued and outstanding at December 31, 2024 and 2023, respectively | 702 | | | 635 | |

| Additional paid-in capital | 704,919 | | | 621,645 | |

Accumulated other comprehensive loss | (16,194) | | | (16,926) | |

| Accumulated deficit | (534,732) | | | (379,610) | |

| Total shareholders' equity | 154,695 | | | 225,744 | |

| Total liabilities and shareholders' equity | $ | 213,666 | | | $ | 275,987 | |

COMPASS PATHWAYS PLC

Consolidated Statements of Operations and Comprehensive Loss

(in thousands, except share and per share amounts)

(expressed in U.S. Dollars, unless otherwise stated)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| OPERATING EXPENSES: | | | | | | | |

| Research and development | $ | 32,141 | | | $ | 27,139 | | | $ | 119,039 | | | $ | 87,518 | |

| General and administrative | 16,273 | | | 11,266 | | | 59,166 | | | 49,401 | |

| Total operating expenses | 48,414 | | | 38,405 | | | 178,205 | | | 136,919 | |

| LOSS FROM OPERATIONS: | (48,414) | | | (38,405) | | | (178,205) | | | (136,919) | |

| OTHER INCOME (EXPENSE), NET: | | | | | | | |

Benefit from R&D tax credit | 10,203 | | | 3,354 | | | 21,097 | | | 12,875 | |

Interest income | 1,623 | | | 2,266 | | | 8,268 | | | 4,623 | |

Foreign exchange (losses) gains | (4,926) | | | 1,622 | | | (1,032) | | | 3,686 | |

Interest expense | (1,132) | | | (1,124) | | | (4,479) | | | (2,204) | |

Other income | 337 | | | 149 | | | 823 | | | 255 | |

Total other income, net | 6,105 | | | 6,267 | | | 24,677 | | | 19,235 | |

| Loss before income taxes | (42,309) | | | (32,138) | | | (153,528) | | | (117,684) | |

| Income tax expense | (1,023) | | | (394) | | | (1,594) | | | (780) | |

| Net loss | (43,332) | | | (32,532) | | | (155,122) | | | (118,464) | |

| | | | | | | |

| Net loss per share attributable to ordinary shareholders—basic and diluted | $ | (0.63) | | | $ | (0.53) | | | $ | (2.30) | | | $ | (2.32) | |

| Weighted average ordinary shares outstanding—basic and diluted | 68,466,005 | | 61,961,674 | | 67,482,902 | | 51,028,024 |

| | | | | | | |

| Net loss | (43,332) | | | (32,532) | | | (155,122) | | | (118,464) | |

Other comprehensive income (loss): | | | | | | | |

| Foreign exchange translation adjustment | 348 | | | 540 | | | 732 | | | (59) | |

| Comprehensive loss | (42,984) | | | (31,992) | | | (154,390) | | | (118,523) | |

| | | | | | | |

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

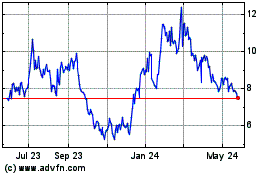

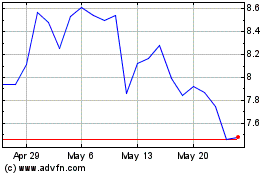

COMPASS Pathways (NASDAQ:CMPS)

Historical Stock Chart

From Feb 2025 to Mar 2025

COMPASS Pathways (NASDAQ:CMPS)

Historical Stock Chart

From Mar 2024 to Mar 2025