Context Therapeutics Reports Third Quarter 2024 Operating and Financial Results

November 06 2024 - 3:06PM

Context Therapeutics Inc. (“Context” or the “Company”) (Nasdaq:

CNTX), a biopharmaceutical company advancing T cell engagers for

solid tumors, today announced its financial results for the third

quarter ended September 30, 2024, and reported on recent and

upcoming business highlights.

“Context executed on its strategy to build a pipeline of T cell

engaging bispecific antibodies through its acquisitions of CT-95, a

Mesothelin x CD3 bispecific antibody, and CT-202, a Nectin-4 x CD3

bispecific antibody,” said Martin Lehr, CEO of Context. “We

continue to activate additional sites for our Phase 1 trial for

CTIM-76, a Claudin 6 x CD3 bispecific antibody, and expect to dose

our first patient by the end of this year. We also expect to

advance CT-95 into the clinic soon and expect to enroll our first

patient in our CT-95 Phase 1 study in the first quarter of

2025.”

Mr. Lehr continued, “Additionally, the expansion of our Board of

Directors is exemplary of the transformation Context has made this

year. Dr. Karen Smith and Dr. Luke Walker each bring a diversified

skillset and we are excited to leverage their wealth of operational

experience as we navigate the next stages of growth.”

Third Quarter 2024 and Recent Corporate

Highlights

Pipeline Updates

- In September 2024, announced an exclusive worldwide license

agreement with BioAtla, Inc. to develop and commercialize CT-202, a

Nectin-4 x CD3 bispecific antibody. Context expects to file an

Investigational New Drug (“IND”) application for CT-202 in

mid-2026.

- In July 2024, completed the acquisition of CT-95, a potentially

first-in-class Mesothelin x CD3 bispecific antibody that has

received IND clearance from the U.S. Food and Drug Administration.

The Company believes that CT-95 is on track for dosing the first

patient in the Phase 1 trial in the first quarter of 2025.

Corporate Updates

- In November 2024, the Company will participate in the

Guggenheim Global Healthcare Conference, the UBS Global Healthcare

Conference, and the Stifel 2024 Healthcare Conference. A live

webcast of each presentation will be available on the News and

Events section of the Company’s website

at https://ir.contexttherapeutics.com/.

- In November 2024, Context will present a poster titled

“Determination of First In Human Dose of the T Cell-redirecting

Bispecific Antibody CTIM-76 Targeting Claudin 6” at the

Society for Immunotherapy of Cancer’s (SITC) 39th Annual

Meeting.

- In September 2024, announced the appointments of Dr. Karen

Smith and Dr. Luke Walker to Context’s Board of Directors.

- In August 2024, announced the appointments of Dr. Claudio

Dansky Ullmann as Chief Medical Officer and Ms. Karen Andreas as

VP, Clinical Operations.

Third Quarter 2024 Financial

Results

- Cash and cash equivalents were $84.8 million at September 30,

2024, compared to $14.4 million at December 31, 2023.

- Research and development (“R&D”) expenses were $16.8

million for the third quarter of 2024, as compared to $4.5 million

for the same period in 2023. The increase in R&D expenses was

primarily driven by higher in-process research and development

charges of $14.75 million related to the acquisitions of CT-95 and

CT-202 in the third quarter 2024. This increase was partially

offset by lower CTIM-76 expense of $2.8 million, which was mainly

the result of lower contract manufacturing costs and preclinical

costs.

- General and administrative expenses were $1.9 million for the

third quarter 2024, as compared to $1.7 million for the same period

in 2023. The increase was primarily driven by an increase in

professional fees for legal services incurred.

- Other income, net was $1.2 million for the third quarter 2024,

as compared to $0.3 million for the same period in 2023, primarily

due to higher interest income earned on cash and cash equivalent

balances.

- Context reported a net loss of $17.5 million for the third

quarter of 2024, as compared to $5.9 million for the same period in

2023.

2024 Cash GuidanceThe Company expects that its

cash and cash equivalents will be sufficient to fund the estimated

duration of the dose escalation portions of its CTIM-76 and CT-95

Phase 1 trials, the estimated expenses through IND filing for

CT-202, as well as its operations into 2027.

About Context Therapeutics®Context Therapeutics

Inc. (Nasdaq: CNTX) is a biopharmaceutical company advancing T

cell engaging (“TCE”) bispecific antibodies for solid tumors.

Context is building an innovative portfolio of TCE bispecific

therapeutics, including CTIM-76, a Claudin 6 x CD3 bispecific

antibody, CT-95, a Mesothelin x CD3 bispecific antibody, and

CT-202, a Nectin-4 x CD3 bispecific antibody. Context is

headquartered in Philadelphia. For more information, please

visit www.contexttherapeutics.com or follow the Company

on X (formerly Twitter) and LinkedIn.

Forward-looking StatementsThis press release

contains “forward-looking statements” that involve substantial

risks and uncertainties for purposes of the safe harbor provided by

the Private Securities Litigation Reform Act of 1995. Any

statements, other than statements of historical fact, included in

this press release regarding strategy, future operations,

prospects, plans and objectives of management, including words such

as “may,” “will,” “expect,” “anticipate,” “look forward,” “plan,”

“intend,” and similar expressions (as well as other words or

expressions referencing future events, conditions, or

circumstances) are forward-looking statements. These include,

without limitation, statements regarding (i) our expectation to

dose the first patient in the Phase 1 clinical trial for CTIM-76 by

the end of 2024, (ii) our expectation to dose the first patient in

the Phase 1 clinical trial for CT-95 in the first quarter of 2025,

(iii) our expectation to file an IND for CT-202 in mid-2026, (iv)

having sufficient cash and cash equivalents to fund the estimated

duration of the dose escalation portions of our CTIM-76 and CT-95

Phase 1 trials, the estimated expenses through IND filing for

CT-202, as well as our operations into 2027, (v) the ability of the

Company and its employees to participate in and present at

conferences, (vi) the potential benefits, characteristics, safety

and side effect profile of our product candidates, (vii) the

likelihood data will support future development of our product

candidates, and (viii) the ability of the Company to build its

portfolio. Forward-looking statements in this release involve

substantial risks and uncertainties that could cause actual results

to differ materially from those expressed or implied by the

forward-looking statements, and we therefore cannot assure you that

our plans, intentions, expectations, or strategies will be attained

or achieved. Other factors that may cause actual results to differ

from those expressed or implied in the forward-looking statements

in this press release are discussed in our filings with

the U.S. Securities and Exchange Commission, including the

section titled “Risk Factors” contained therein. Except as

otherwise required by law, we disclaim any intention or obligation

to update or revise any forward-looking statements, which speak

only as of the date they were made, whether as a result of new

information, future events, or circumstances or otherwise.

|

Context Therapeutics Inc. |

|

|

|

|

Condensed Statements of Operations |

|

|

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses |

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

16,825,198 |

|

|

$ |

4,485,223 |

|

|

$ |

20,182,960 |

|

|

$ |

12,480,836 |

|

|

General and administrative |

|

|

1,876,230 |

|

|

|

1,695,272 |

|

|

|

5,430,518 |

|

|

|

5,658,575 |

|

|

Loss from operations |

|

|

(18,701,428 |

) |

|

|

(6,180,495 |

) |

|

|

(25,613,478 |

) |

|

|

(18,139,411 |

) |

|

Other (expense) income, net |

|

|

1,241,535 |

|

|

|

305,809 |

|

|

|

2,231,282 |

|

|

|

945,086 |

|

|

Net loss |

|

$ |

(17,459,893 |

) |

|

$ |

(5,874,686 |

) |

|

$ |

(23,382,196 |

) |

|

$ |

(17,194,325 |

) |

|

|

|

|

|

|

|

|

|

|

|

Net loss per common share, basic and diluted |

|

$ |

(0.22 |

) |

|

$ |

(0.37 |

) |

|

$ |

(0.46 |

) |

|

$ |

(1.08 |

) |

|

Weighted average shares outstanding, basic and diluted |

|

|

80,481,053 |

|

|

|

15,966,053 |

|

|

|

50,578,115 |

|

|

|

15,966,053 |

|

|

|

|

|

|

|

|

|

|

|

|

Context Therapeutics Inc. |

|

|

|

|

Condensed Balance Sheets Data |

|

|

|

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

December 31, |

|

|

|

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

84,801,556 |

|

|

$ |

14,449,827 |

|

|

|

|

|

|

Other assets |

|

|

1,528,293 |

|

|

|

1,612,908 |

|

|

|

|

|

|

Total assets |

|

$ |

86,329,849 |

|

|

$ |

16,062,735 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities |

|

$ |

2,472,232 |

|

|

$ |

4,191,715 |

|

|

|

|

|

|

Total stockholders' equity |

|

|

83,857,617 |

|

|

|

11,871,020 |

|

|

|

|

|

|

Total liabilities and stockholders' equity |

|

$ |

86,329,849 |

|

|

$ |

16,062,735 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investor Relations Contact:Jennifer

Minai-AzaryContext TherapeuticsIR@contexttherapeutics.com

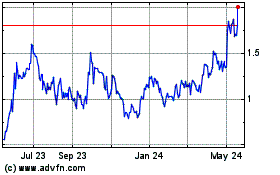

Context Therapeutics (NASDAQ:CNTX)

Historical Stock Chart

From Dec 2024 to Jan 2025

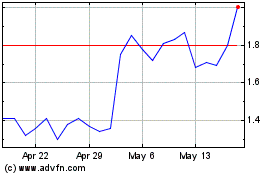

Context Therapeutics (NASDAQ:CNTX)

Historical Stock Chart

From Jan 2024 to Jan 2025