0001842952FALSE00018429522025-01-102025-01-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 10, 2025

Context Therapeutics Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-40654 | 86-3738787 |

| (State of other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

2001 Market Street, Suite 3915, Unit #15

Philadelphia, Pennsylvania 19103

(Address of principal executive offices including zip code)

(267) 225-7416

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | | | | | | | |

Title of each class | | Trading

Symbol | | Name of exchange

on which registered |

| Common Stock | | CNTX | | The Nasdaq Stock Market |

$0.001 par value per share | | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 10, 2025, Richard Berman gave notice of his resignation from the Board of Directors (the “Board”) of Context Therapeutics Inc. (the "Company"), effective as of January 12, 2025. Mr. Berman’s resignation was not due to any disagreement with the Company on any matter relating to its operations, policies or practices. The Company thanks Mr. Berman for his service and valuable contributions.

In connection with Mr. Berman’s resignation, effective as of January 13, 2025, upon the recommendation of the Nominating and Corporate Governance Committee ("Nominating Committee") of the Board, the Board appointed Andy Pasternak as a member and Chairperson of the Board, with an initial term expiring at the Company’s 2027 annual meeting of stockholders. Additionally, effective as of January 13, 2025, the Board appointed Mr. Pasternak to the Audit Committee and Compensation Committee, and appointed Dr. Karen L. Smith as the Chairperson of the Compensation Committee.

Mr. Pasternak currently serves as an advisory partner at Bain & Company, Inc. (“Bain”), a global consulting firm. Prior to Bain, Mr. Pasternak served as Executive Vice President, Chief Strategy Officer at Horizon Therapeutics plc (“Horizon”), a biotechnology company focused on serious, rare autoimmune and inflammatory diseases. Prior to joining Horizon in 2019, Mr. Pasternak was a senior partner at Bain, where he served as Head of the Healthcare Practice in the Americas. Earlier in his career, Mr. Pasternak was an analyst in the Investment Banking division of Chemical Securities, Inc. (now part of J.P. Morgan). Mr. Pasternak is a member of the Board of Directors of Endo, Inc., a specialty pharmaceutical company. Mr. Pasternak also is an Adjunct Lecturer in the Healthcare Program at the Kellogg School of Management (“HCAK”), where he teaches a course about the biopharmaceutical industry, and serves on the advisory board of the HCAK program. Mr. Pasternak received his B.A. in economics from Northwestern University and an MBA from the University of Chicago.

Pursuant to the Company’s non-employee director compensation program, Mr. Pasternak was granted on the date of his appointment options to purchase 20,685 shares of the Company’s common stock, which vest and become exercisable on the earlier of (i) June 13, 2025 or (ii) the date of the Company’s 2025 annual meeting of stockholders. Mr. Pasternak will also receive cash compensation for his service on the Board, and each committee of the Board, in accordance with the Company’s non-employee director compensation program, as such program may be amended from time to time, which currently consists of a $55,000 annual cash retainer, payable quarterly, for service as the Chairperson of the Board.

There is no arrangement or understanding between Mr. Pasternak and any other person pursuant to which he was appointed as a director. Mr. Pasternak is not a party to any transaction that would require disclosure under Item 404(a) of Regulation S-K. The Board has determined that Mr. Pasternak is an independent director in accordance with the listing requirements of The Nasdaq Stock Market LLC.

Item 7.01. Regulation FD Disclosure.

On January 13, 2025, the Company issued a press release announcing the appointment of Mr. Pasternak to the Board. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Item 7.01, and Exhibit 99.1 attached hereto, are being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Dated: January 13, 2025 | Context Therapeutics Inc. |

| | |

| By: | /s/ Martin A. Lehr |

| | Name: Martin A. Lehr |

| | Title: Chief Executive Officer |

Context Therapeutics Appoints Andy Pasternak as Chairman of the Board of Directors

Mr. Pasternak brings decades of global pharmaceutical leadership experience

Transition further highlights transformation of the Board to lead Context into next phase of growth

PHILADELPHIA, PA— January 13, 2025—Context Therapeutics Inc. (“Context” or the “Company”) (Nasdaq: CNTX), a biopharmaceutical company advancing T cell engagers for solid tumors, today announced the appointment of Andy Pasternak as Chairman of its Board of Directors, succeeding Richard Berman, who stepped down from the Board effective January 12, 2025.

“I am honored to become the next Chairman of the Board of Directors of Context, where I expect to leverage my experience advising and building fully integrated global biopharmaceutical companies to help Context continue to deliver on the promise of T cell engagers for solid tumors,” said Andy Pasternak. “T cell engagers is a quickly evolving field with tremendous potential, and I am excited to work with the Board and management team to keep Context at the forefront of this modality and help improve patients’ lives.”

Andy Pasternak is a biopharmaceutical executive and expert with over 25 years of experience, and currently serves as an Advisory Partner at Bain & Company, a leading global consulting firm. Most recently, Mr. Pasternak served as Executive Vice President, Chief Strategy Officer at Horizon Therapeutics, a biotechnology company focused on serious, rare autoimmune diseases; in this role, he was responsible for corporate strategy, M&A / business development, commercial development, and portfolio management, and he played a central role in the $28 billion acquisition of Horizon by Amgen, Inc. in 2023. Prior to joining Horizon in 2019, Mr. Pasternak was a senior partner at Bain & Company, where he served as Head of the Healthcare Practice in the Americas. Mr. Pasternak currently serves on the Board of Directors of Endo, Inc., a specialty pharmaceutical company. Mr. Pasternak is also an adjunct lecturer at the Kellogg School of Management at Northwestern University and member of the advisory board of the Healthcare at Kellogg Program.

“On behalf of the Board, I would like to thank Richard Berman for his support of Context as he steps down so we can welcome Andy’s extensive pharmaceutical expertise to help lead the Company in this next exciting phase. We greatly appreciate Richard’s contributions over the last four years, and we wish him the best,” said Martin Lehr, CEO of Context.

About Context Therapeutics®

Context Therapeutics Inc. (Nasdaq: CNTX) is a biopharmaceutical company advancing T cell engaging (“TCE”) bispecific antibodies for solid tumors. Context is building an innovative portfolio of TCE bispecific therapeutics, including CTIM-76, a Claudin 6 x CD3 bispecific

antibody, CT-95, a Mesothelin x CD3 bispecific antibody, and CT-202, a Nectin-4 x CD3 bispecific antibody. Context is headquartered in Philadelphia. For more information, please visit www.contexttherapeutics.com or follow the Company on X (formerly Twitter) and LinkedIn.

Forward-looking Statements

This press release contains “forward-looking statements” that involve substantial risks and uncertainties for purposes of the safe harbor provided by the Private Securities Litigation Reform Act of 1995. Any statements, other than statements of historical fact, included in this press release regarding strategy, future operations, prospects, plans and objectives of management, including words such as “may,” “will,” “expect,” “anticipate,” “look forward,” “plan,” “intend,” and similar expressions (as well as other words or expressions referencing future events, conditions, or circumstances) are forward-looking statements. These include, without limitation, statements regarding (i) our expectation that Mr. Pasternak’s experience and expertise can assist and support the Company and its product candidates, (ii) our expectations regarding the field of T cell engagers, (iii) the potential benefits, characteristics, safety and side effect profile of our product candidates, and (iv) the likelihood data will support future development of our product candidates. Forward-looking statements in this release involve substantial risks and uncertainties that could cause actual results to differ materially from those expressed or implied by the forward-looking statements, and we therefore cannot assure you that our plans, intentions, expectations, or strategies will be attained or achieved. Other factors that may cause actual results to differ from those expressed or implied in the forward-looking statements in this press release are discussed in our filings with the U.S. Securities and Exchange Commission, including the section titled “Risk Factors” contained therein. Except as otherwise required by law, we disclaim any intention or obligation to update or revise any forward-looking statements, which speak only as of the date they were made, whether as a result of new information, future events, or circumstances or otherwise.

Investor Relations Contact:

Jennifer Minai-Azary

Context Therapeutics

IR@contexttherapeutics.com

v3.24.4

Cover

|

Jan. 10, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 10, 2025

|

| Entity Registrant Name |

Context Therapeutics Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40654

|

| Entity Tax Identification Number |

86-3738787

|

| Entity Address, Address Line One |

2001 Market Street,

|

| Entity Address, Address Line Two |

Suite 3915

|

| Entity Address, Address Line Three |

Unit #15

|

| Entity Address, City or Town |

Philadelphia

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

19103

|

| City Area Code |

(267)

|

| Local Phone Number |

225-7416

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

CNTX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001842952

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

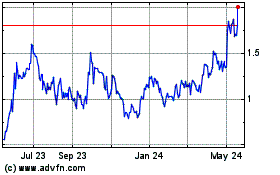

Context Therapeutics (NASDAQ:CNTX)

Historical Stock Chart

From Dec 2024 to Jan 2025

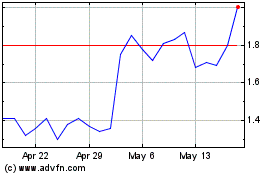

Context Therapeutics (NASDAQ:CNTX)

Historical Stock Chart

From Jan 2024 to Jan 2025