0001672909

Canterbury Park Holding Corp

false

--12-31

Q3

2023

1

1

4

4

4

0

4

0

0

2

Finance lease assets are net of accumulated amortization of $120,631 and $106,586 as of June 30, 2023 and December 31, 2022, respectively.

00016729092023-01-012023-09-30

xbrli:shares

00016729092023-11-10

thunderdome:item

iso4217:USD

00016729092023-09-30

00016729092022-12-31

0001672909us-gaap:RelatedPartyMember2023-09-30

0001672909us-gaap:RelatedPartyMember2022-12-31

0001672909us-gaap:CasinoMember2023-07-012023-09-30

0001672909us-gaap:CasinoMember2022-07-012022-09-30

0001672909us-gaap:CasinoMember2023-01-012023-09-30

0001672909us-gaap:CasinoMember2022-01-012022-09-30

0001672909cphc:ParimutuelMember2023-07-012023-09-30

0001672909cphc:ParimutuelMember2022-07-012022-09-30

0001672909cphc:ParimutuelMember2023-01-012023-09-30

0001672909cphc:ParimutuelMember2022-01-012022-09-30

0001672909us-gaap:FoodAndBeverageMember2023-07-012023-09-30

0001672909us-gaap:FoodAndBeverageMember2022-07-012022-09-30

0001672909us-gaap:FoodAndBeverageMember2023-01-012023-09-30

0001672909us-gaap:FoodAndBeverageMember2022-01-012022-09-30

0001672909us-gaap:ProductAndServiceOtherMember2023-07-012023-09-30

0001672909us-gaap:ProductAndServiceOtherMember2022-07-012022-09-30

0001672909us-gaap:ProductAndServiceOtherMember2023-01-012023-09-30

0001672909us-gaap:ProductAndServiceOtherMember2022-01-012022-09-30

00016729092023-07-012023-09-30

00016729092022-07-012022-09-30

00016729092022-01-012022-09-30

0001672909cphc:OtherParimutuelExpensesMember2023-07-012023-09-30

0001672909cphc:OtherParimutuelExpensesMember2022-07-012022-09-30

0001672909cphc:OtherParimutuelExpensesMember2023-01-012023-09-30

0001672909cphc:OtherParimutuelExpensesMember2022-01-012022-09-30

0001672909us-gaap:PublicUtilitiesMember2023-07-012023-09-30

0001672909us-gaap:PublicUtilitiesMember2022-07-012022-09-30

0001672909us-gaap:PublicUtilitiesMember2023-01-012023-09-30

0001672909us-gaap:PublicUtilitiesMember2022-01-012022-09-30

iso4217:USDxbrli:shares

0001672909us-gaap:CommonStockMember2023-06-30

0001672909us-gaap:AdditionalPaidInCapitalMember2023-06-30

0001672909us-gaap:RetainedEarningsMember2023-06-30

00016729092023-06-30

0001672909us-gaap:CommonStockMember2023-07-012023-09-30

0001672909us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-30

0001672909us-gaap:RetainedEarningsMember2023-07-012023-09-30

0001672909us-gaap:CommonStockMember2023-09-30

0001672909us-gaap:AdditionalPaidInCapitalMember2023-09-30

0001672909us-gaap:RetainedEarningsMember2023-09-30

0001672909us-gaap:CommonStockMember2022-12-31

0001672909us-gaap:AdditionalPaidInCapitalMember2022-12-31

0001672909us-gaap:RetainedEarningsMember2022-12-31

0001672909us-gaap:CommonStockMember2023-01-012023-09-30

0001672909us-gaap:AdditionalPaidInCapitalMember2023-01-012023-09-30

0001672909us-gaap:RetainedEarningsMember2023-01-012023-09-30

0001672909us-gaap:CommonStockMember2022-06-30

0001672909us-gaap:AdditionalPaidInCapitalMember2022-06-30

0001672909us-gaap:RetainedEarningsMember2022-06-30

00016729092022-06-30

0001672909us-gaap:CommonStockMember2022-07-012022-09-30

0001672909us-gaap:AdditionalPaidInCapitalMember2022-07-012022-09-30

0001672909us-gaap:RetainedEarningsMember2022-07-012022-09-30

0001672909us-gaap:CommonStockMember2022-09-30

0001672909us-gaap:AdditionalPaidInCapitalMember2022-09-30

0001672909us-gaap:RetainedEarningsMember2022-09-30

00016729092022-09-30

0001672909us-gaap:CommonStockMember2021-12-31

0001672909us-gaap:AdditionalPaidInCapitalMember2021-12-31

0001672909us-gaap:RetainedEarningsMember2021-12-31

00016729092021-12-31

0001672909us-gaap:CommonStockMember2022-01-012022-09-30

0001672909us-gaap:AdditionalPaidInCapitalMember2022-01-012022-09-30

0001672909us-gaap:RetainedEarningsMember2022-01-012022-09-30

00016729092021-10-012021-12-31

utr:Y

0001672909cphc:NonemployeeBoardMemberStockOptionAndRestrictedStockMembersrt:DirectorMember2023-01-012023-09-30

xbrli:pure

0001672909cphc:NonemployeeBoardMemberStockOptionAndRestrictedStockMember2023-01-012023-09-30

0001672909us-gaap:RestrictedStockMember2023-03-31

0001672909cphc:EmployeeDeferredStockAwardMembersrt:MinimumMember2023-01-012023-09-30

0001672909cphc:EmployeeDeferredStockAwardMembersrt:MaximumMember2023-01-012023-09-30

0001672909cphc:EmployeeDeferredStockAwardMember2023-01-012023-09-30

0001672909cphc:EmployeeDeferredStockAwardMember2022-01-012022-09-30

0001672909cphc:EmployeeDeferredStockAwardMember2022-12-31

0001672909cphc:EmployeeDeferredStockAwardMember2023-09-30

0001672909cphc:CPHCLongTermIncentivePlanLtiPlanMember2023-09-30

0001672909cphc:EmployeeDeferredStockAwardMembercphc:CPHCLongTermIncentivePlanLtiPlanMember2023-01-012023-09-30

0001672909cphc:EmployeeDeferredStockAwardMembercphc:CPHCLongTermIncentivePlanLtiPlanMember2022-01-012022-09-30

0001672909us-gaap:RevolvingCreditFacilityMember2023-09-30

0001672909us-gaap:LetterOfCreditMember2023-09-30

0001672909us-gaap:OperatingSegmentsMembercphc:HorseRacingMember2023-01-012023-09-30

0001672909us-gaap:OperatingSegmentsMembercphc:CardCasinoMember2023-01-012023-09-30

0001672909us-gaap:OperatingSegmentsMembercphc:FoodAndBeverageSegmentMember2023-01-012023-09-30

0001672909us-gaap:OperatingSegmentsMembercphc:DevelopmentMember2023-01-012023-09-30

0001672909us-gaap:OperatingSegmentsMember2023-01-012023-09-30

0001672909us-gaap:IntersegmentEliminationMembercphc:HorseRacingMember2023-01-012023-09-30

0001672909us-gaap:IntersegmentEliminationMembercphc:CardCasinoMember2023-01-012023-09-30

0001672909us-gaap:IntersegmentEliminationMembercphc:FoodAndBeverageSegmentMember2023-01-012023-09-30

0001672909us-gaap:IntersegmentEliminationMembercphc:DevelopmentMember2023-01-012023-09-30

0001672909us-gaap:IntersegmentEliminationMember2023-01-012023-09-30

0001672909cphc:HorseRacingMember2023-01-012023-09-30

0001672909cphc:CardCasinoMember2023-01-012023-09-30

0001672909cphc:FoodAndBeverageSegmentMember2023-01-012023-09-30

0001672909cphc:DevelopmentMember2023-01-012023-09-30

0001672909us-gaap:OperatingSegmentsMembercphc:HorseRacingMember2023-09-30

0001672909us-gaap:OperatingSegmentsMembercphc:CardCasinoMember2023-09-30

0001672909us-gaap:OperatingSegmentsMembercphc:FoodAndBeverageSegmentMember2023-09-30

0001672909us-gaap:OperatingSegmentsMembercphc:DevelopmentMember2023-09-30

0001672909us-gaap:OperatingSegmentsMember2023-09-30

0001672909us-gaap:OperatingSegmentsMembercphc:HorseRacingMember2022-01-012022-12-31

0001672909us-gaap:OperatingSegmentsMembercphc:CardCasinoMember2022-01-012022-12-31

0001672909us-gaap:OperatingSegmentsMembercphc:FoodAndBeverageSegmentMember2022-01-012022-12-31

0001672909us-gaap:OperatingSegmentsMembercphc:DevelopmentMember2022-01-012022-12-31

0001672909us-gaap:OperatingSegmentsMember2022-01-012022-12-31

0001672909us-gaap:IntersegmentEliminationMembercphc:HorseRacingMember2022-01-012022-12-31

0001672909us-gaap:IntersegmentEliminationMembercphc:CardCasinoMember2022-01-012022-12-31

0001672909us-gaap:IntersegmentEliminationMembercphc:FoodAndBeverageSegmentMember2022-01-012022-12-31

0001672909us-gaap:IntersegmentEliminationMembercphc:DevelopmentMember2022-01-012022-12-31

0001672909us-gaap:IntersegmentEliminationMember2022-01-012022-12-31

0001672909us-gaap:OperatingSegmentsMembercphc:HorseRacingMember2022-12-31

0001672909us-gaap:OperatingSegmentsMembercphc:CardCasinoMember2022-12-31

0001672909us-gaap:OperatingSegmentsMembercphc:FoodAndBeverageSegmentMember2022-12-31

0001672909us-gaap:OperatingSegmentsMembercphc:DevelopmentMember2022-12-31

0001672909us-gaap:OperatingSegmentsMember2022-12-31

0001672909srt:ReportableLegalEntitiesMember2023-01-012023-09-30

0001672909srt:ReportableLegalEntitiesMember2022-01-012022-09-30

0001672909us-gaap:IntersegmentEliminationMember2022-01-012022-09-30

0001672909srt:ReportableLegalEntitiesMember2023-09-30

0001672909srt:ReportableLegalEntitiesMember2022-12-31

0001672909us-gaap:IntersegmentEliminationMember2023-09-30

0001672909us-gaap:IntersegmentEliminationMember2022-12-31

0001672909cphc:IndemnityAgreementMember2021-12-21

0001672909cphc:IndemnityAgreementMember2022-10-27

0001672909cphc:CooperativeMarketingAgreementCMA1Member2022-12-31

0001672909us-gaap:ProductAndServiceOtherMembercphc:CooperativeMarketingAgreementCMA1Member2022-07-012022-09-30

0001672909us-gaap:ProductAndServiceOtherMembercphc:CooperativeMarketingAgreementCMA1Member2022-01-012022-09-30

0001672909cphc:CooperativeMarketingAgreementCMA1Member2022-07-012022-09-30

0001672909cphc:CooperativeMarketingAgreementCMA1Member2022-01-012022-09-30

utr:acre

0001672909cphc:DoranCanterburyIJointVentureMember2018-09-27

0001672909cphc:DoranCanterburyIJointVentureMember2023-07-012023-09-30

0001672909cphc:DoranCanterburyIJointVentureMember2023-01-012023-09-30

0001672909cphc:DoranCanterburyIJointVentureMember2022-07-012022-09-30

0001672909cphc:DoranCanterburyIJointVentureMember2022-01-012022-09-30

0001672909cphc:DoranCanterburyIJointVentureMember2023-09-30

0001672909cphc:DoranCanterburyIJointVentureMember2022-12-31

0001672909cphc:DoranCanterburyIiMember2020-09-30

0001672909cphc:DoranCanterburyIiLlcMembercphc:DoranCanterburyIiMember2020-09-30

0001672909cphc:DoranCanterburyIiMember2023-07-012023-09-30

0001672909cphc:DoranCanterburyIiMember2023-01-012023-09-30

0001672909cphc:DoranCanterburyIiMember2022-07-012022-09-30

0001672909cphc:DoranCanterburyIiMember2022-01-012022-09-30

0001672909cphc:CanterburyDBSVMember2020-06-16

0001672909cphc:CanterburyDBSVMember2020-07-01

0001672909cphc:CanterburyDBSVMember2023-07-012023-09-30

0001672909cphc:CanterburyDBSVMember2023-01-012023-09-30

0001672909cphc:CanterburyDBSVMember2022-07-012022-09-30

0001672909cphc:CanterburyDBSVMember2022-01-012022-09-30

00016729092023-01-012023-03-31

00016729092023-04-012023-06-30

00016729092022-01-252022-01-25

00016729092022-01-25

0001672909us-gaap:StateAndLocalJurisdictionMember2023-09-30

0001672909us-gaap:StateAndLocalJurisdictionMember2022-12-31

0001672909cphc:LandBuildingsAndEquipmentNetMember2023-09-30

0001672909cphc:LandBuildingsAndEquipmentNetMember2022-12-31

0001672909cphc:DoranCanterburyIAndIiJointVenturesMember2023-09-30

0001672909cphc:DoranCanterburyIAndIiJointVenturesMember2022-12-31

0001672909cphc:DoranCanterburyIAndIiJointVenturesMemberus-gaap:PrimeRateMember2023-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE QUARTERLY PERIOD ENDED SEPTEMBER 30, 2023. |

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM _____ TO _____. |

Commission File Number: 001-37858

| CANTERBURY PARK HOLDING CORPORATION |

| (Exact Name of Registrant as Specified in Its Charter) |

| | Minnesota | | 47-5349765 | |

| | (State or Other Jurisdiction of Incorporation or | | (I.R.S. Employer | |

| | Organization) | | Identification No.) | |

| | 1100 Canterbury Road | |

| | Shakopee, MN 55379 | |

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (952) 445-7223

Securities registered pursuant Section 12(b) of the Act:

| Title of Each Class | Trading Symbol | Name of each exchange on which registered |

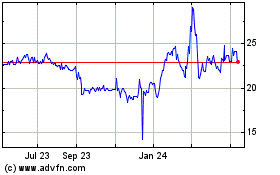

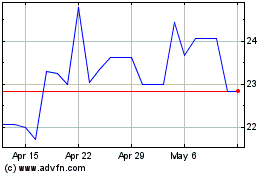

| Common Stock Common stock, $.01 par value | CPHC | Nasdaq |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | Large accelerated filer | ☐ | | Accelerated filer | ☐ | | |

| | Non-accelerated filer | ☒ | | Smaller reporting company | ☒ | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2).

The Company had 4,944,642 shares of common stock, $.01 par value, outstanding as of November 10, 2023.

Canterbury Park Holding Corporation

INDEX

PART 1 – FINANCIAL INFORMATION

CANTERBURY PARK HOLDING CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

| |

|

(Unaudited) |

|

|

|

|

|

| |

|

September 30, |

|

|

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

| ASSETS |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| CURRENT ASSETS |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

25,727,477 |

|

|

$ |

12,989,087 |

|

| Restricted cash |

|

|

2,348,076 |

|

|

|

3,116,916 |

|

| Short-term investments |

|

|

4,500,000 |

|

|

|

5,000,000 |

|

| Accounts receivable, net of allowance of $19,250 for both periods |

|

|

1,619,887 |

|

|

|

618,365 |

|

| Employee retention credit receivable |

|

|

— |

|

|

|

6,103,236 |

|

| Inventory |

|

|

284,443 |

|

|

|

262,073 |

|

| Prepaid expenses |

|

|

499,149 |

|

|

|

557,520 |

|

| Income taxes receivable and prepaid income taxes |

|

|

2,426,364 |

|

|

|

2,052,364 |

|

| Total current assets |

|

|

37,405,396 |

|

|

|

30,699,561 |

|

| |

|

|

|

|

|

|

|

|

| LONG-TERM ASSETS |

|

|

|

|

|

|

|

|

| Deposits |

|

|

— |

|

|

|

27,000 |

|

| Other prepaid expenses |

|

|

8,414 |

|

|

|

41,774 |

|

| TIF receivable |

|

|

13,801,141 |

|

|

|

13,294,337 |

|

| Related party receivable |

|

|

2,938,307 |

|

|

|

2,555,320 |

|

| Operating lease right-of-use asset |

|

|

53,026 |

|

|

|

— |

|

| Equity investment |

|

|

6,789,772 |

|

|

|

6,863,517 |

|

| Land held for development |

|

|

1,229,475 |

|

|

|

2,303,010 |

|

| Land, buildings, and equipment, net |

|

|

39,012,223 |

|

|

|

36,491,660 |

|

| Total long-term assets |

|

|

63,832,358 |

|

|

|

61,576,618 |

|

| TOTAL ASSETS |

|

$ |

101,237,754 |

|

|

$ |

92,276,179 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

3,512,863 |

|

|

$ |

3,368,683 |

|

| Casino accruals |

|

|

2,687,596 |

|

|

|

2,684,444 |

|

| Accrued wages and payroll taxes |

|

|

2,396,327 |

|

|

|

1,814,879 |

|

| Cash dividend payable |

|

|

345,369 |

|

|

|

341,602 |

|

| Accrued property taxes |

|

|

532,891 |

|

|

|

795,646 |

|

| Deferred revenue |

|

|

366,999 |

|

|

|

413,442 |

|

| Payable to horsepersons |

|

|

225,798 |

|

|

|

993,529 |

|

| Current portion of operating lease obligations |

|

|

25,352 |

|

|

|

— |

|

| Current portion of finance lease obligations |

|

|

1,570 |

|

|

|

18,973 |

|

| Total current liabilities |

|

|

10,094,765 |

|

|

|

10,431,198 |

|

| |

|

|

|

|

|

|

|

|

| LONG-TERM LIABILITIES |

|

|

|

|

|

|

|

|

| Deferred income taxes |

|

|

8,250,015 |

|

|

|

7,474,015 |

|

| Investee losses in excess of equity investment |

|

|

2,550,187 |

|

|

|

3,185,923 |

|

| Operating lease obligations, net of current portion |

|

|

27,674 |

|

|

|

— |

|

| Finance lease obligations, net of current portion |

|

|

8,184 |

|

|

|

— |

|

| Total long-term liabilities |

|

|

10,836,060 |

|

|

|

10,659,938 |

|

| TOTAL LIABILITIES |

|

|

20,930,825 |

|

|

|

21,091,136 |

|

| |

|

|

|

|

|

|

|

|

| STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Common stock, $.01 par value, 10,000,000 shares authorized, 4,944,642 and 4,888,975 respectively, shares issued and outstanding |

|

|

49,446 |

|

|

|

48,890 |

|

| Additional paid-in capital |

|

|

26,879,814 |

|

|

|

25,914,644 |

|

| Retained earnings |

|

|

53,377,669 |

|

|

|

45,221,509 |

|

| Total stockholders’ equity |

|

|

80,306,929 |

|

|

|

71,185,043 |

|

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY |

|

$ |

101,237,754 |

|

|

$ |

92,276,179 |

|

See notes to condensed consolidated financial statements.

CANTERBURY PARK HOLDING CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| |

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| OPERATING REVENUES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Casino |

|

$ |

10,224,216 |

|

|

$ |

10,039,527 |

|

|

$ |

30,322,149 |

|

|

$ |

30,394,387 |

|

| Pari-mutuel |

|

|

3,405,010 |

|

|

|

4,730,827 |

|

|

|

7,009,710 |

|

|

|

9,599,070 |

|

| Food and beverage |

|

|

3,310,759 |

|

|

|

3,913,320 |

|

|

|

6,808,242 |

|

|

|

7,150,715 |

|

| Other |

|

|

2,328,564 |

|

|

|

3,608,729 |

|

|

|

4,769,694 |

|

|

|

6,560,477 |

|

| Total Net Revenues |

|

|

19,268,549 |

|

|

|

22,292,403 |

|

|

|

48,909,795 |

|

|

|

53,704,649 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING EXPENSES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Purse expense |

|

|

2,594,270 |

|

|

|

2,979,947 |

|

|

|

6,034,508 |

|

|

|

6,931,243 |

|

| Minnesota Breeders’ Fund |

|

|

308,038 |

|

|

|

323,156 |

|

|

|

822,797 |

|

|

|

874,464 |

|

| Other pari-mutuel expenses |

|

|

210,212 |

|

|

|

212,102 |

|

|

|

691,519 |

|

|

|

740,282 |

|

| Salaries and benefits |

|

|

7,245,775 |

|

|

|

6,860,590 |

|

|

|

19,922,853 |

|

|

|

18,881,258 |

|

| Cost of food and beverage and other sales |

|

|

1,161,665 |

|

|

|

1,365,748 |

|

|

|

2,567,561 |

|

|

|

2,771,338 |

|

| Depreciation and amortization |

|

|

831,379 |

|

|

|

747,267 |

|

|

|

2,308,272 |

|

|

|

2,234,790 |

|

| Utilities |

|

|

568,022 |

|

|

|

654,000 |

|

|

|

1,366,742 |

|

|

|

1,425,074 |

|

| Advertising and marketing |

|

|

887,197 |

|

|

|

1,567,163 |

|

|

|

1,817,180 |

|

|

|

2,739,638 |

|

| Professional and contracted services |

|

|

2,284,181 |

|

|

|

1,571,128 |

|

|

|

4,857,229 |

|

|

|

3,781,005 |

|

| Gain on disposal of assets |

|

|

(19,265 |

) |

|

|

- |

|

|

|

(19,265 |

) |

|

|

- |

|

| Other operating expenses |

|

|

1,390,339 |

|

|

|

1,602,933 |

|

|

|

4,117,388 |

|

|

|

3,800,281 |

|

| Total Operating Expenses |

|

|

17,461,813 |

|

|

|

17,884,034 |

|

|

|

44,486,784 |

|

|

|

44,179,373 |

|

| Gain on sale of land |

|

|

- |

|

|

|

- |

|

|

|

6,489,976 |

|

|

|

12,151 |

|

| INCOME FROM OPERATIONS |

|

|

1,806,736 |

|

|

|

4,408,369 |

|

|

|

10,912,987 |

|

|

|

9,537,427 |

|

| OTHER INCOME (LOSS) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) gain from equity investment |

|

|

(674,341 |

) |

|

|

(500,143 |

) |

|

|

561,991 |

|

|

|

(1,274,058 |

) |

| Interest income, net |

|

|

536,904 |

|

|

|

222,671 |

|

|

|

1,433,353 |

|

|

|

620,811 |

|

| Net Other (Loss) Income |

|

|

(137,437 |

) |

|

|

(277,472 |

) |

|

|

1,995,344 |

|

|

|

(653,247 |

) |

| INCOME BEFORE INCOME TAXES |

|

|

1,669,299 |

|

|

|

4,130,897 |

|

|

|

12,908,331 |

|

|

|

8,884,180 |

|

| INCOME TAX EXPENSE |

|

|

(533,000 |

) |

|

|

(1,209,777 |

) |

|

|

(3,709,000 |

) |

|

|

(2,434,078 |

) |

| NET INCOME |

|

$ |

1,136,299 |

|

|

$ |

2,921,120 |

|

|

$ |

9,199,331 |

|

|

$ |

6,450,102 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per share |

|

$ |

0.23 |

|

|

$ |

0.60 |

|

|

$ |

1.87 |

|

|

$ |

1.33 |

|

| Diluted earnings per share |

|

$ |

0.23 |

|

|

$ |

0.60 |

|

|

$ |

1.86 |

|

|

$ |

1.32 |

|

| Weighted average basic shares outstanding |

|

|

4,933,961 |

|

|

|

4,872,674 |

|

|

|

4,913,560 |

|

|

|

4,845,743 |

|

| Weighted average diluted shares |

|

|

4,950,524 |

|

|

|

4,901,189 |

|

|

|

4,941,100 |

|

|

|

4,879,803 |

|

| Cash dividends declared per share |

|

$ |

0.07 |

|

|

$ |

0.07 |

|

|

$ |

0.21 |

|

|

$ |

0.28 |

|

See notes to condensed consolidated financial statements.

CANTERBURY PARK HOLDING CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(Unaudited)

For the three months ended September 30, 2023

| |

|

Number of |

|

|

Common |

|

|

Additional |

|

|

Retained |

|

|

|

|

|

| |

|

Shares |

|

|

Stock |

|

|

Paid-in Capital |

|

|

Earnings |

|

|

Total |

|

| Balance at June 30, 2023 |

|

|

4,933,844 |

|

|

$ |

49,338 |

|

|

$ |

26,538,005 |

|

|

$ |

52,586,742 |

|

|

$ |

79,174,085 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

132,436 |

|

|

|

— |

|

|

|

132,436 |

|

| Dividend declared |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(345,372 |

) |

|

|

(345,372 |

) |

| 401(k) stock match |

|

|

10,798 |

|

|

|

108 |

|

|

|

209,373 |

|

|

|

— |

|

|

|

209,481 |

|

| Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,136,299 |

|

|

|

1,136,299 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at September 30, 2023 |

|

|

4,944,642 |

|

|

$ |

49,446 |

|

|

$ |

26,879,814 |

|

|

$ |

53,377,669 |

|

|

$ |

80,306,929 |

|

For the nine months ended September 30, 2023

| |

|

Number of |

|

|

Common |

|

|

Additional |

|

|

Retained |

|

|

|

|

|

| |

|

Shares |

|

|

Stock |

|

|

Paid-in Capital |

|

|

Earnings |

|

|

Total |

|

| Balance at December 31, 2022 |

|

|

4,888,975 |

|

|

$ |

48,890 |

|

|

$ |

25,914,644 |

|

|

$ |

45,221,509 |

|

|

$ |

71,185,043 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

398,269 |

|

|

|

— |

|

|

|

398,269 |

|

| Dividend declared |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,043,171 |

) |

|

|

(1,043,171 |

) |

| 401(K) stock match |

|

|

28,597 |

|

|

|

286 |

|

|

|

644,287 |

|

|

|

— |

|

|

|

644,573 |

|

| Issuance of deferred stock awards |

|

|

22,197 |

|

|

|

221 |

|

|

|

(171,970 |

) |

|

|

— |

|

|

|

(171,749 |

) |

| Shares issued under Employee Stock Purchase Plan |

|

|

4,873 |

|

|

|

49 |

|

|

|

94,584 |

|

|

|

— |

|

|

|

94,633 |

|

| Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

9,199,331 |

|

|

|

9,199,331 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at September 30, 2023 |

|

|

4,944,642 |

|

|

$ |

49,446 |

|

|

$ |

26,879,814 |

|

|

$ |

53,377,669 |

|

|

$ |

80,306,929 |

|

For the three months ended September 30, 2022

| |

|

Number of |

|

|

Common |

|

|

Additional |

|

|

Retained |

|

|

|

|

|

| |

|

Shares |

|

|

Stock |

|

|

Paid-in Capital |

|

|

Earnings |

|

|

Total |

|

| Balance at June 30, 2022 |

|

|

4,872,593 |

|

|

$ |

48,726 |

|

|

$ |

25,273,814 |

|

|

$ |

41,920,229 |

|

|

$ |

67,242,769 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

110,290 |

|

|

|

— |

|

|

|

110,290 |

|

| Dividend declared |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(341,082 |

) |

|

|

(341,082 |

) |

| 401(k) stock match |

|

|

7,438 |

|

|

|

74 |

|

|

|

165,198 |

|

|

|

— |

|

|

|

165,272 |

|

| Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,921,120 |

|

|

|

2,921,120 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at September 30, 2022 |

|

|

4,880,031 |

|

|

$ |

48,800 |

|

|

$ |

25,549,302 |

|

|

$ |

44,500,267 |

|

|

$ |

70,098,369 |

|

For the nine months ended September 30, 2022

| |

|

Number of |

|

|

Common |

|

|

Additional |

|

|

Retained |

|

|

|

|

|

| |

|

Shares |

|

|

Stock |

|

|

Paid-in Capital |

|

|

Earnings |

|

|

Total |

|

| Balance at December 31, 2021 |

|

|

4,812,085 |

|

|

$ |

48,121 |

|

|

$ |

24,894,571 |

|

|

$ |

39,410,534 |

|

|

$ |

64,353,226 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

325,152 |

|

|

|

— |

|

|

|

325,152 |

|

| Dividend distribution |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,360,369 |

) |

|

|

(1,360,369 |

) |

| 401(K) stock match |

|

|

21,191 |

|

|

|

212 |

|

|

|

470,100 |

|

|

|

— |

|

|

|

470,312 |

|

| Issuance of deferred stock awards |

|

|

41,816 |

|

|

|

418 |

|

|

|

(213,026 |

) |

|

|

— |

|

|

|

(212,608 |

) |

| Shares issued under Employee Stock Purchase Plan |

|

|

4,939 |

|

|

|

49 |

|

|

|

72,505 |

|

|

|

— |

|

|

|

72,554 |

|

| Net Income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

6,450,102 |

|

|

|

6,450,102 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at September 30, 2022 |

|

|

4,880,031 |

|

|

$ |

48,800 |

|

|

$ |

25,549,302 |

|

|

$ |

44,500,267 |

|

|

$ |

70,098,369 |

|

See notes to condensed consolidated financial statements.

CANTERBURY PARK HOLDING CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| |

|

Nine Months Ended September 30, |

|

| |

|

2023 |

|

|

2022 |

|

| Operating Activities: |

|

|

|

|

|

|

|

|

| Net income |

|

$ |

9,199,331 |

|

|

$ |

6,450,102 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

| Depreciation |

|

|

2,308,272 |

|

|

|

2,234,790 |

|

| Stock-based compensation expense |

|

|

398,269 |

|

|

|

325,152 |

|

| Stock-based employee match contribution |

|

|

644,573 |

|

|

|

470,312 |

|

| Gain on disposal of assets |

|

|

(19,265 |

) |

|

|

— |

|

| Gain on sale of land |

|

|

(6,489,976 |

) |

|

|

(12,151 |

) |

| Deferred income taxes |

|

|

776,000 |

|

|

|

13,900 |

|

| (Gain) loss from equity investment |

|

|

(561,991 |

) |

|

|

1,274,058 |

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

| Accounts receivable |

|

|

(1,001,522 |

) |

|

|

(1,499,353 |

) |

| Employee retention credit |

|

|

6,103,236 |

|

|

|

211,232 |

|

| Increase in TIF receivable |

|

|

(502,644 |

) |

|

|

(501,306 |

) |

| Inventory, prepaid expenses and deposits |

|

|

96,360 |

|

|

|

78,221 |

|

| Income taxes receivable/payable and prepaid income taxes |

|

|

(374,000 |

) |

|

|

(1,286,931 |

) |

| Operating lease right-of-use asset |

|

|

24,524 |

|

|

|

22,786 |

|

| Operating lease liabilities |

|

|

(24,524 |

) |

|

|

(22,786 |

) |

| Accounts payable |

|

|

116,379 |

|

|

|

1,595,149 |

|

| Deferred revenue |

|

|

(46,443 |

) |

|

|

(160,872 |

) |

| Casino accruals |

|

|

3,152 |

|

|

|

(560,636 |

) |

| Accrued wages and payroll taxes |

|

|

581,448 |

|

|

|

482,430 |

|

| Accrued property taxes |

|

|

(262,755 |

) |

|

|

197,175 |

|

| Payable to horsepersons |

|

|

(767,731 |

) |

|

|

557,568 |

|

| Net cash provided by operating activities |

|

|

10,200,693 |

|

|

|

9,868,841 |

|

| |

|

|

|

|

|

|

|

|

| Investing Activities: |

|

|

|

|

|

|

|

|

| Additions to land, buildings, and equipment |

|

|

(5,577,116 |

) |

|

|

(2,663,322 |

) |

| Proceeds from disposal of assets |

|

|

22,500 |

|

|

|

— |

|

| Proceeds from sale of land |

|

|

8,336,359 |

|

|

|

1,159,640 |

|

| Additions for TIF eligible improvements |

|

|

(4,160 |

) |

|

|

(31,697 |

) |

| Equity investment contributions |

|

|

— |

|

|

|

(397,807 |

) |

| Increase in related party receivable |

|

|

(382,987 |

) |

|

|

(145,041 |

) |

| Proceeds from sale of short term investments |

|

|

500,000 |

|

|

|

— |

|

| Net cash provided by (used in) investing activities |

|

|

2,894,596 |

|

|

|

(2,078,227 |

) |

| |

|

|

|

|

|

|

|

|

| Financing Activities: |

|

|

|

|

|

|

|

|

| Proceeds from issuance of common stock |

|

|

94,633 |

|

|

|

72,554 |

|

| Cash dividend paid to shareholders |

|

|

(1,039,404 |

) |

|

|

(1,019,288 |

) |

| Payments for taxes related to net share settlement of equity awards |

|

|

(171,749 |

) |

|

|

(212,608 |

) |

| Principal payments on finance lease |

|

|

(9,219 |

) |

|

|

(20,170 |

) |

| Net cash used in financing activities |

|

|

(1,125,739 |

) |

|

|

(1,179,512 |

) |

| |

|

|

|

|

|

|

|

|

| Net increase in cash, cash equivalents, and restricted cash |

|

|

11,969,550 |

|

|

|

6,611,102 |

|

| |

|

|

|

|

|

|

|

|

| Cash, cash equivalents, and restricted cash at beginning of period |

|

|

16,106,003 |

|

|

|

15,598,753 |

|

| |

|

|

|

|

|

|

|

|

| Cash, cash equivalents, and restricted cash at end of period |

|

$ |

28,075,553 |

|

|

$ |

22,209,855 |

|

CANTERBURY PARK HOLDING CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (continued)

(Unaudited)

| Schedule of non-cash investing and financing activities |

|

|

|

|

|

|

|

|

| Additions to land, buildings, and equipment funded through accounts payable |

|

$ |

28,000 |

|

|

$ |

53,000 |

|

| Dividend declared but not yet paid |

|

|

345,000 |

|

|

|

341,000 |

|

| Change in investee losses in excess of equity investments |

|

|

(636,000 |

) |

|

|

1,466,000 |

|

| ROU assets obtained in exchange for operating lease obligations |

|

|

77,550 |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

| Supplemental disclosure of cash flow information: |

|

|

|

|

|

|

|

|

| Income taxes paid, net of refunds |

|

$ |

3,257,000 |

|

|

$ |

3,707,000 |

|

| Interest paid |

|

|

— |

|

|

|

1,000 |

|

See notes to condensed consolidated financial statements.

CANTERBURY PARK HOLDING CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

1. OVERVIEW AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Business – Canterbury Park Holding Corporation’s (the “Company,” “we,” “our,” or “us”) Racetrack operations are conducted at facilities located in Shakopee, Minnesota, approximately 25 miles southwest of downtown Minneapolis. In May 1994, the Company commenced year-round horse racing simulcast operations and hosted the first annual live race meet during the summer of 1995. The Company’s live racing operations are a seasonal business, as it typically hosts live race meets each year from May until September. The Company earns additional pari-mutuel revenue by televising its live racing to out-of-state racetracks around the country. Canterbury Park’s Casino typically operates 24 hours a day, seven days a week and is limited by Minnesota State law to conducting card play on a maximum of 80 tables. The Casino currently offers a variety of poker and table games. The Company’s three largest sources of revenues are from Casino operations, pari-mutuel operations, and food and beverage sales. The Company also derives revenues from related services and activities, such as admissions, advertising signage, publication sales, and from other entertainment events and activities held at the Racetrack. Additionally, the Company is developing underutilized land surrounding the Racetrack in a project known as Canterbury Commons™, with approximately 140 acres originally designated as underutilized. The Company has obtained and is pursuing several mixed-use development opportunities for this land, directly and through joint ventures.

Basis of Presentation and Preparation – The accompanying condensed consolidated financial statements include the accounts of the Company (Canterbury Park Holding Corporation and its direct and indirect subsidiaries Canterbury Park Entertainment, LLC; Canterbury Park Concessions, Inc.; and Canterbury Development, LLC). Intercompany accounts and transactions have been eliminated. The preparation of these condensed consolidated financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the amounts reported in these condensed consolidated financial statements and accompanying notes. Actual results could differ materially from those estimates.

These condensed consolidated financial statements and accompanying notes should be read in conjunction with the Company’s annual consolidated financial statements and the notes thereto for the fiscal year ended December 31, 2022, included in its Annual Report on Form 10-K (the “2022 Form 10-K”).

The condensed consolidated balance sheets and the related condensed consolidated statements of operations, stockholders’ equity, and the cash flows for the periods ended September 30, 2023 and 2022 have been prepared by Company management. In the opinion of management, all adjustments (which include only normal recurring adjustments, except where noted) necessary to present fairly the financial position, results of operations, statement of stockholders’ equity, and cash flows at September 30, 2023 and 2022 and for the periods then ended have been made.

Summary of Significant Accounting Policies – A detailed description of our significant accounting policies can be found in our most recent Annual Report on the 2022 Form 10-K. There were no material changes in significant accounting policies during the three and nine months ended September 30, 2023.

Restricted Cash – Restricted cash represents refundable deposits and amounts due to horsemen for purses, stakes and awards, and amounts accumulated in card game progressive jackpot pools, the player pool and poker promotional fund to be used to repay card players in the form of promotions, giveaways, prizes, or by other means.

Accounts Receivable - We evaluate our allowance for credit losses and estimate collectability of current and non-current accounts receivable based on historical bad debt experience, our assessment of the financial condition of individual companies with which we do business, current market conditions, and reasonable and supportable forecasts of future economic conditions. In times of economic turmoil, our estimates and judgments with respect to the collectability of our receivables are subject to greater uncertainty than in more stable periods. The Company does not have accounts receivable with original maturities greater than one year. The allowance for credit losses and activity as of September 30, 2023 and December 31, 2022 was not material.

Employee Retention Credit ("ERC") – The Company qualified for federal government assistance through ERC provisions of the CARES Act passed in 2020, for the 2020 second, third, and fourth quarters, as well as the 2021 first and second quarters. The purpose of the ERC is to encourage employers to keep employees on the payroll, even if they are not working during the covered period because of the coronavirus outbreak. We recognize amounts to be refundable as tax credits if there is a reasonable assurance of compliance with grant conditions and receipt of credits. During the first nine months of 2023, the Company received the payments in full and as of September 30, 2023 and December 31, 2022, the Company's expected one-time refunds totaling $0 and $6,103,236, respectively, are included on the Condensed Consolidated Balance Sheets as an employee retention credit receivable. The Company recorded $6,103,236 on the Consolidated Statements of Operations as a credit to salaries and benefits expense in the 2021 fourth quarter.

Deferred Revenue – Deferred revenue includes advance sales related to racing, events and corporate partnerships. Revenue from these advance billings is recognized when the related event occurs or services have been performed.

Payable to Horsepersons - The Minnesota Pari-mutuel Horse Racing Act requires the Company to segregate a portion of funds (recorded as purse expense in the statements of operations) received from Casino operations and wagering on simulcast and live horse races, for future payment as purses for live horse races or other uses of the horsepersons’ association. Pursuant to an agreement with the Minnesota Horsemen’s Benevolent and Protective Association (“MHBPA”), the Company transferred into a trust account or paid directly to the MHBPA, $6,174,000 and $5,877,000 for the nine months ended September 30, 2023 and 2022, respectively, related to thoroughbred races. Minnesota Statutes provide that amounts transferred into the trust account are the property of the trust and not of the Company, and therefore these amounts are not recorded on the Company’s Condensed Consolidated Balance Sheet.

Revenue Recognition – The Company’s primary revenues with customers consist of Casino operations, pari-mutuel wagering on simulcast and live horse races, and food and beverage transactions. We determine revenue recognition through the following steps:

| | ● | Identification of the contract, or contracts, with a customer |

| | ● | Identification of the performance obligations in the contract |

| | ● | Determination of the transaction price |

| | ● | Allocation of the transaction price to the performance obligation in the contract |

| | ● | Recognition of revenue when, or as, we satisfy a performance obligation |

The transaction price for a Casino contract is a set percentage of wagers and is recognized at the time that the wagering process is complete. The transaction price for pari-mutuel wagering is the commission received on a wager, exclusive of any track fees and is recognized upon occurrence of the live race that is presented for wagering and after that live race is made official by the respective state’s racing regulatory body. The transaction price for food and beverage contracts is the net amount collected from the customer for these goods. Food and beverage services have been determined to be separate, stand-alone performance obligations and the transaction price is recorded as revenue as the good is transferred to the customer when delivery is made.

Contracts for Casino operations and pari-mutuel wagering involve two performance obligations for those customers earning points under the Company’s loyalty program and a single performance obligation for customers who do not participate in the program. The Company applies a practical expedient by accounting for its gaming contracts on a portfolio basis as these wagers have similar characteristics and the Company reasonably expects the effects on the financial statements of applying the revenue recognition guidance to the portfolio would not differ materially from what would result if the guidance were applied on an individual wagering contract. For purposes of allocating the transaction price in a wagering contract between the wagering performance obligation and the obligation associated with the loyalty points earned, the Company allocates an amount to the loyalty point contract liability based on the stand-alone redemption value of the points earned, which is determined by the value of a point that can be redeemed for a cash voucher, food and beverage voucher, racing admission, valet parking, or racing forms. Based on past experience, the majority of customers redeem their points for cash vouchers. Therefore, there are no further performance obligations by the Company.

We have two general types of liabilities related to contracts with customers: (1) our MVP Loyalty Program and (2) outstanding chip liability. These are included in the line item Casino accruals on the consolidated balance sheet. We defer the full retail value of these complimentary reward items until the future revenue transaction occurs.

The Company offers certain promotional allowances at no charge to patrons who participate in its player rewards program.

We evaluate our on-track revenue, export revenue (as described below), and import revenue (as described below) contracts to determine whether we are acting as the principal or as the agent when providing services, to determine if we should report revenue on a gross or net basis. An entity acts as a principal if it controls a specified service before that service is transferred to a customer.

For on-track revenue and “import revenue,” that is revenue we generate for racing held elsewhere that our patrons wager on, we are entitled to retain a commission for providing a wagering service to our customers. For these arrangements, we are the principal because we control the wagering service; therefore, any charges, including simulcast fees, we incur for delivering the wagering service are presented as operating expenses.

For “export revenue,” when the wagering occurs outside our premises, our customer is the third-party wagering site such as a racetrack, Off Track Betting (“OTB”), or advance deposit wagering (“ADW”) provider. Therefore, the revenue we recognize for export revenue is the simulcast host fee we earn for exporting our racing signal to the third-party wagering site.

2. STOCK-BASED COMPENSATION

Long Term Incentive Plan and Award of Deferred Stock

The Long Term Incentive Plan (the “LTI Plan”) authorizes the grant of Long Term Incentive Awards that provide an opportunity to Named Executive Officers (“NEOs”) and other Senior Executives to receive a payment in cash or shares of the Company’s common stock to the extent of achievement at the end of a period greater than one year (the “Performance Period”) as compared to Performance Goals established at the beginning of the Performance Period. Beginning in 2020, and as a result of the COVID-19 pandemic, the Company temporarily suspended the granting of performance awards under its LTI Plan, and instead granted deferred stock awards designed to retain NEOs and other senior executives in lieu of LTI Plan awards from 2020 through 2023. In February 2022, the Compensation Committee made determinations regarding the achievement of 2021 performance goals and payouts under the 2019-2021 LTI Plan, which completed the performance period and awards under the 2019-2021 LTI Plan, and the last outstanding awards under the LTI Plan. Accordingly, there are no awards outstanding under the LTI Plan.

Board of Directors Stock Options, Deferred Stock Awards, and Restricted Stock Grants

The Company’s Stock Plan currently authorizes annual grants of restricted stock, deferred stock, stock options, or any combination of the three, to non-employee members of the Board of Directors at the time of the Company’s annual shareholders’ meeting as determined by the Board prior to each such meeting. Deferred stock awards represent the right to receive shares of the Company's common stock upon vesting. Options granted under the Plan generally expire 10 years after the grant date. Restricted stock and deferred stock grants to non-employee directors generally vest 100% one year after the date of the annual meeting at which they were granted, are subject to restrictions on resale for an additional year, and are subject to forfeiture if a board member terminates his or her board service prior to the shares vesting. The unvested deferred stock awards outstanding as of September 30, 2023 to our non-employee directors consists of only the grant of deferred stock on June 1, 2023 of 7,818 shares with a weighted average fair value per share of $23.01. There were no unvested restricted stock or stock options outstanding to any non-employee director at September 30, 2023.

Employee Deferred Stock Awards

The Company's Stock Plan permits its Compensation Committee to grant stock-based awards, including deferred stock awards, to key employees and non-employee directors. The Company has made deferred stock grants to key employees that vest over one to four years. Deferred stock awards represent the right to receive shares of the Company's common stock upon vesting.

During the nine months ended September 30, 2023, the Company granted employees deferred stock awards totaling 19,020 shares of common stock, with a vesting term of approximately four years and a fair value of $25.52 per share. During the nine months ended September 30, 2022, the Company granted employees deferred stock awards totaling 18,600 shares of common stock, with a vesting term of approximately four years and a fair value of $21.62 per share.

Employee deferred stock transactions during the nine months ended September 30, 2023 are summarized as follows:

| | | | | | | Weighted | |

| | | | | | | Average | |

| | | Deferred | | | Fair Value | |

| | | Stock | | | Per Share | |

| Non-Vested Balance, December 31, 2022 | | | 41,200 | | | $ | 16.62 | |

| Granted | | | 19,020 | | | | 25.52 | |

| Vested | | | (20,050 | ) | | | 14.33 | |

| Forfeited | | | (1,950 | ) | | | 19.07 | |

| Non-Vested Balance, September 30, 2023 | | | 38,220 | | | $ | 22.13 | |

There were no stock options outstanding to any employee or other person at September 30, 2023. Stock-based compensation expense related to the LTI Plan, deferred stock awards, and restricted stock awards is included on the Condensed Consolidated Statements of Operations and totaled approximately $398,000 and $325,000 for the nine months ended September 30, 2023 and 2022. At September 30, 2023, there was approximately $744,000 of total unrecognized stock-based compensation expense related to unvested employee and board of director deferred stock awards that is expected to be recognized over a period of approximately 3.5 years.

3. NET INCOME PER SHARE COMPUTATIONS

The following is a reconciliation of the numerator and denominator of the earnings per common share computations for the three and nine months ended September 30, 2023 and 2022:

| |

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Net income (numerator) amounts used for basic and diluted per share computations: |

|

$ |

1,136,299 |

|

|

$ |

2,921,120 |

|

|

$ |

9,199,331 |

|

|

$ |

6,450,102 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares (denominator) of common stock outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

4,933,961 |

|

|

|

4,872,674 |

|

|

|

4,913,560 |

|

|

|

4,845,743 |

|

| Plus dilutive effect of deferred stock awards |

|

|

16,563 |

|

|

|

28,515 |

|

|

|

27,540 |

|

|

|

34,060 |

|

| Diluted |

|

|

4,950,524 |

|

|

|

4,901,189 |

|

|

|

4,941,100 |

|

|

|

4,879,803 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.23 |

|

|

$ |

0.60 |

|

|

$ |

1.87 |

|

|

$ |

1.33 |

|

| Diluted |

|

|

0.23 |

|

|

|

0.60 |

|

|

|

1.86 |

|

|

|

1.32 |

|

4. GENERAL CREDIT AGREEMENT

The Company has a general credit and security agreement with a financial institution, which provides a revolving credit line up to $10,000,000 and allows for letters of credit in the aggregate amount of up to $2,000,000 to be issued under the credit agreement. The line of credit is collateralized by all receivables, inventory, equipment, and general intangibles of the Company. The line of credit also includes collateral in the form of a Mortgage, Security Agreement, Fixture Financing Statement and Assignment of Leases and Rents. The maturity date of the revolving line of credit is January 31, 2024. The outstanding balance on the line of credit was $0 at both September 30, 2023 and December 31, 2022.

5. OPERATING SEGMENTS

The Company has four reportable operating segments: horse racing, Casino, food and beverage, and development. The horse racing segment primarily represents simulcast and live horse racing operations. The Casino segment represents operations of Canterbury Park’s Casino. The food and beverage segment represents food and beverage operations provided during simulcast and live racing, in the Casino, and during special events. The development segment represents our real estate development operations. The Company’s reportable operating segments are strategic business units that offer different products and services. They are managed separately because the segments differ in the nature of the products and services provided as well as process to produce those products and services. The Minnesota Racing Commission regulates the horse racing and Casino segments.

Depreciation, interest, and income taxes are allocated to the segments, but no allocation is made to the food and beverage segment for shared facilities. However, the food and beverage segment pays approximately 25% of gross revenues earned on live racing and special event days to the horse racing segment for use of the facilities. Starting in 2020, the food and beverage segment has not paid a commission related to live racing to the horse racing segment subsequent to the Company's first temporary shutdown of operations starting March 16, 2020.

The following tables represent a disaggregation of revenues from contracts with customers along with the Company’s operating segments (in 000’s):

| | | Nine Months Ended September 30, 2023 | |

| | | Horse Racing | | | Casino | | | Food and Beverage | | | Development | | | Total | |

| Net revenues from external customers | | $ | 11,186 | | | $ | 30,322 | | | $ | 7,402 | | | $ | — | | | $ | 48,910 | |

| Intersegment revenues | | | 194 | | | | — | | | | 893 | | | | — | | | | 1,087 | |

| Net interest income | | | 754 | | | | — | | | | — | | | | 679 | | | | 1,433 | |

| Depreciation | | | 1,954 | | | | 225 | | | | 129 | | | | — | | | | 2,308 | |

| Segment income (loss) before income taxes | | | (820 | ) | | | 6,940 | | | | 2,137 | | | | 7,576 | | | | 15,833 | |

| Segment tax expense (benefit) | | | (1,076 | ) | | | 1,994 | | | | 614 | | | | 2,177 | | | | 3,709 | |

| | | September 30, 2023 | |

| Segment Assets | | $ | 88,641 | | | $ | 2,199 | | | $ | 33,344 | | | $ | 33,084 | | | $ | 157,268 | |

| | | Nine Months Ended September 30, 2022 | |

| | | Horse Racing | | | Casino | | | Food and Beverage | | | Development | | | Total | |

| Net revenues from external customers | | $ | 15,406 | | | $ | 30,395 | | | $ | 7,904 | | | $ | — | | | $ | 53,705 | |

| Intersegment revenues | | | 150 | | | | — | | | | 785 | | | | — | | | | 935 | |

| Net interest income | | | 24 | | | | — | | | | — | | | | 597 | | | | 621 | |

| Depreciation | | | 1,860 | | | | 226 | | | | 149 | | | | — | | | | 2,235 | |

| Segment income (loss) before income taxes | | | 1,241 | | | | 8,474 | | | | 2,383 | | | | (846 | ) | | | 11,252 | |

| Segment tax expense (benefit) | | | (309 | ) | | | 2,322 | | | | 653 | | | | (232 | ) | | | 2,434 | |

| | | December 31, 2022 | |

| Segment Assets | | $ | 71,338 | | | $ | 2,425 | | | $ | 30,341 | | | $ | 26,475 | | | $ | 130,579 | |

The following are reconciliations of reportable segment revenues, income before income taxes, and assets, to the Company’s consolidated totals (in 000’s):

| | | Nine Months Ended September 30, | |

| | | 2023 | | | 2022 | |

| Revenues | | | | | | | | |

| Total net revenue for reportable segments | | $ | 49,997 | | | $ | 54,640 | |

| Elimination of intersegment revenues | | | (1,087 | ) | | | (935 | ) |

| Total consolidated net revenues | | $ | 48,910 | | | $ | 53,705 | |

| Income before income taxes | | | | | | | | |

| Total segment income (loss) before income taxes | | $ | 15,833 | | | $ | 11,252 | |

| Elimination of intersegment (income) loss before income taxes | | | (2,925 | ) | | | (2,368 | ) |

| Total consolidated income before income taxes | | $ | 12,908 | | | $ | 8,884 | |

| | | September 30, | | | December 31, | |

| | | 2023 | | | 2022 | |

| Assets | | | | | | | | |

| Total assets for reportable segments | | $ | 157,268 | | | $ | 130,579 | |

| Elimination of intercompany balances | | | (56,030 | ) | | | (38,303 | ) |

| Total consolidated assets | | $ | 101,238 | | | $ | 92,276 | |

6. COMMITMENTS AND CONTINGENCIES

Effective on December 21, 2021, the Company entered into a Contribution and Indemnity Agreement ("Indemnity Agreement") with affiliates of Doran Companies ("Doran") in connection with the debt refinancing on the Doran Canterbury I, LLC joint venture. Under the Indemnity Agreement, the Company is obligated to indemnify Doran for loan payment amounts up to $5,000,000 only if the lender demands the loan guarantee by Doran. Effective on October 27, 2022, the Indemnity Agreement was amended to increase the maximum indemnification by an additional $700,000.

The Company is periodically involved in various claims and legal actions arising in the normal course of business. Management believes that the resolution of any pending claims and legal actions at September 30, 2023 and as of the date of this report, will not have a material impact on the Company’s consolidated financial positions or results of operations.

In August 2018, the Company entered into a Contract for Private Redevelopment with the City of Shakopee in connection with a Tax Increment Financing District (“TIF District”). On January 25, 2022, the Company received the fully executed First Amendment to the Contract for Redevelopment among the Master Developer, the City and the Authority, which is effective as of September 7, 2021. Under this contract, the Company is obligated to construct certain infrastructure improvements within the TIF District, and will be reimbursed for the cost of TIF eligible improvements by the City of Shakopee by future tax increment revenue generated from the developed property, up to specified maximum amounts. The total amount of funding that Canterbury will be paid as reimbursement under the TIF program for these improvements is not guaranteed and will depend on future tax revenues generated from the developed property.

7. COOPERATIVE MARKETING AGREEMENT

On March 4, 2012, the Company entered into a Cooperative Marketing Agreement (the "CMA") with the Shakopee Mdewakanton Sioux Community ("SMSC"). The primary purpose of the CMA was to increase purses paid during live horse racing at Canterbury Park’s Racetrack in order to strengthen Minnesota’s thoroughbred and quarter horse industry. Under the CMA, as amended, this was achieved through “Purse Enhancement Payments to Horsemen” paid directly to the MHBPA. These payments had no direct impact on the Company’s consolidated financial statements or operations.

Under the CMA, as amended, SMSC also agreed to make “Marketing Payments” to the Company relating to joint marketing efforts for the mutual benefit of the Company and SMSC, including signage, joint promotions, player benefits, and events.

As noted above and affirmed in the Fifth Amendment, SMSC was obligated to make an annual purse enhancement of $7,380,000 and an annual marketing payment of $1,620,000 for 2022.

The amounts earned from the marketing payments were recorded as a component of other revenue and the related expenses were recorded as a component of advertising and marketing expense and depreciation in the Company’s condensed consolidated statements of operations. For the three and nine months ended September 30, 2022, the Company recorded $977,000 and $1,764,000 in other revenue, incurred $916,000 and $1,603,000 in advertising and marketing expense, and incurred $61,000 and $161,000 in depreciation related to the SMSC marketing funds. The excess of amounts received over revenue is reflected as deferred revenue on the Company’s consolidated balance sheets.

Under the CMA, the Company agreed for the term of the CMA that it would not promote or lobby the Minnesota legislature for expanded gambling authority and will support the SMSC’s lobbying efforts against expanding gambling authority.

The CMA expired by its terms on December 31, 2022. Accordingly, for the three and nine months ended September 30, 2023, there were no purse enhancement payments or marketing payments under the CMA.

8. REAL ESTATE DEVELOPMENT

Equity Investments

Doran Canterbury I, LLC

On April 2, 2018, the Company’s subsidiary Canterbury Development LLC, entered into an Operating Agreement (“Operating Agreement”) with an affiliate of Doran Companies (“Doran”), a national commercial and residential real estate developer, as the two members of a Minnesota limited liability company named Doran Canterbury I, LLC (“Doran Canterbury I”). Doran Canterbury I was formed as part of a joint venture between Doran and Canterbury Development LLC to construct an upscale apartment complex on land adjacent to the Company’s Racetrack (the “Project”).

On September 27, 2018, Canterbury Development LLC contributed approximately 13 acres of land as its equity contribution in the Doran Canterbury I joint venture and became a 27.4% equity member. On December 20, 2018, financing for Doran Canterbury I was secured. Doran Canterbury I has completed developing Phase I of the Project, which includes 321 units, a heated parking ramp, and a clubhouse. As the Company is able to assert significant influence, but not control, over Doran Canterbury I’s operational and financial policies, the Company accounts for the joint venture as an equity method investment. For the three and nine months ended September 30, 2023, the Company recorded a loss of $650,000 and income of $636,000, respectively, on equity method investment related to this joint venture. The increased income for the first nine months of 2023 related to this joint venture is due to the receipt of insurance proceeds related to an outstanding claim. For the three and nine months ended September 30, 2022, the Company recorded $455,000 and $1,466,000, respectively, in loss on equity method investments related to this joint venture. In accordance with U.S. GAAP, since we are committed to provide future member loans to Doran Canterbury I to cover the costs of construction or operating deficiencies, we also present as a liability in the accompanying Condensed Consolidated Balance Sheets the net balance recorded for our share of Doran Canterbury I's losses in excess of the amount funded into Doran Canterbury I, which was $2,550,000 and $3,186,000 at September 30, 2023 and December 31, 2022, respectively. See Note 10 of Notes to Financial Statements for a summary of member loans to Doran Canterbury I.

Doran Canterbury II, LLC

In connection with the execution of the Amended Doran Canterbury I Agreement, on August 18, 2018, Canterbury Development LLC entered into an Operating Agreement with Doran Shakopee, LLC as the two members of a Minnesota limited liability company entitled Doran Canterbury II, LLC (“Doran Canterbury II”). The Operating Agreement was amended and restated by the members effective July 30, 2020. Under the Doran Canterbury II Operating Agreement, Doran Canterbury II will pursue development of Phase II of the Project. Phase II will include an additional 300 apartment units. Canterbury Development’s equity contribution to Doran Canterbury II for Phase II was approximately 10 acres of land, which were contributed to Doran Canterbury II on September 30, 2020. In connection with its contribution, Canterbury Development became a 27.4% equity member in Doran Canterbury II with Doran owning the remaining 72.6%. As the Company is able to assert significant influence, but not control, over Doran Canterbury II’s operational and financial policies, the Company accounts for the joint venture as an equity method investment. As of September 30, 2023, the proportionate share of Doran Canterbury II's earnings was immaterial. During the three and nine months ended September 30, the Company did not make any contributions as an equity investment contribution in Doran Canterbury II. During the three and nine months ended September 30, 2022, the Company contributed approximately $0 and $398,000, respectively, as an equity investment contribution in Doran Canterbury II. Under the Operating Agreement, we are required to provide future member loans to Doran Canterbury II to cover the costs of construction or operating deficiencies. See Note 10 of Notes to Financial Statements for a summary of member loans to Doran Canterbury II.

Canterbury DBSV Development, LLC