Fourth quarter 2014 net income per share of

$0.31 compared with $0.10 last year

Full year net income per share of $0.60

compared with $0.03 last year

Citi Trends, Inc. (NASDAQ: CTRN) today reported results for the

fourth quarter and fiscal year ended January 31, 2015.

Financial Highlights – 13-week fourth

quarter ended January 31, 2015

Total sales in the 13 weeks ended January 31, 2015 increased

15.2% to $181.1 million compared with $157.2 million in the 13

weeks ended February 1, 2014. Comparable store sales increased

13.9% in the fourth quarter.

The Company had net income of $4.7 million, or $0.31 per diluted

share, in the fourth quarter of 2014 compared with $1.5 million, or

$0.10 per diluted share, in last year’s fourth quarter.

Financial Highlights – 52-week fiscal

year ended January 31, 2015

Total sales in the 52 weeks ended January 31, 2015 increased

7.8% to $670.8 million compared with $622.2 million in the 52 weeks

ended February 1, 2014. Comparable store sales increased 7.5% for

the full year.

The Company had net income of $9.0 million, or $0.60 per diluted

share, in fiscal 2014 compared with $0.5 million, or $0.03 per

diluted share, in fiscal 2013.

The Company opened eight stores, relocated or expanded six

others, and closed two stores in fiscal 2014.

Investor Conference Call and

Webcast

Citi Trends will host a conference call today at 9:00 a.m. ET.

The number to call for the live interactive teleconference is

(212) 231-2937. A replay of the conference call will be

available until March 20, 2015, by dialing (402) 977-9140 and

entering the passcode, 21761232.

The live broadcast of Citi Trends’ conference call will be

available online at the Company’s website, www.cititrends.com, as

well as www.cititrends.com/http/ircititrendscom, beginning today at

9:00 a.m. ET. The online replay will follow shortly after the call

and will be available for replay for one year.

During the conference call, the Company may discuss and answer

questions concerning business, financial developments and trends

that have occurred after year-end. The Company’s responses to

questions, as well as other matters discussed during the conference

call, may contain or constitute information that has not been

disclosed previously.

About Citi Trends

Citi Trends, Inc. is a value-priced retailer of urban fashion

apparel and accessories for the entire family. The Company operates

513 stores located in 29 states. Citi Trends’ website address is

www.cititrends.com. CTRN-G

Forward-Looking

Statements

All statements other than historical facts contained in this

news release, including statements regarding our future financial

results and position, business policy and plans and objectives of

management for future operations, are forward-looking statements

that are subject to material risks and uncertainties. The words

“believe,” “may,” “could,” “plans,” “estimate,” “continue,”

“anticipate,” “intend,” “expect” and similar expressions, as they

relate to Citi Trends, are intended to identify forward-looking

statements. Any statements with respect to earnings guidance are

forward-looking statements. Investors are cautioned that any such

forward-looking statements are subject to the finalization of the

Company’s year-end financial and accounting procedures, are not

guarantees of future performance or results and are inherently

subject to risks and uncertainties, some of which cannot be

predicted or quantified. Actual results or developments may differ

materially from those included in the forward-looking statements as

a result of various factors which are discussed in Citi Trends,

Inc. filings with the Securities and Exchange Commission. These

risks and uncertainties include, but are not limited to,

uncertainties relating to economic conditions, growth risks,

consumer spending patterns, competition within the industry,

competition in our markets and the ability to anticipate and

respond to fashion trends. Any forward-looking statements by the

Company, with respect to earnings guidance or otherwise, are

intended to speak only as of the date such statements are made.

Except as required by applicable law, including the securities laws

of the United States and the rules and regulations of the

Securities and Exchange Commission, Citi Trends does not undertake

to publicly update any forward-looking statements in this news

release or with respect to matters described herein, whether as a

result of any new information, future events or otherwise.

CITI TRENDS, INC. CONDENSED CONSOLIDATED

STATEMENTS OF INCOME (unaudited) (in thousands, except per

share data) Thirteen Weeks

Ended Thirteen Weeks Ended January 31, 2015

February 1, 2014 (unaudited) (unaudited) Net sales $ 181,143

$ 157,193 Cost of sales (exclusive of depreciation shown

separately below) (113,567 ) (99,567 ) Selling, general and

administrative expenses (57,515 ) (50,170 ) Depreciation (4,871 )

(5,258 ) Asset impairment - (305 ) Income from

operations 5,190 1,893 Interest income 52 68 Interest expense

(48 ) (49 ) Income before income taxes 5,194 1,912

Income tax expense (521 ) (447 ) Net income $ 4,673

$ 1,465 Basic net income per common share $

0.31 $ 0.10 Diluted net income per common share $

0.31 $ 0.10 Weighted average shares

used to compute basic net income per share 14,989

14,825 Weighted average shares used to compute

diluted net income per share 15,128 14,882

Fifty-Two Weeks Ended

Fifty-Two Weeks Ended January 31, 2015 February 1,

2014 (unaudited) (unaudited) Net sales $ 670,840 $ 622,204

Cost of sales (exclusive of depreciation shown separately

below) (418,416 ) (394,445 ) Selling, general and administrative

expenses (221,041 ) (206,146 ) Depreciation (20,177 ) (21,974 )

Asset impairment (83 ) (1,542 ) Gain on sale of former distribution

center - 1,526 Income (loss) from

operations 11,123 (377 ) Interest income 187 281 Interest expense

(200 ) (194 ) Income (loss) before income taxes

11,110 (290 ) Income tax (expense) benefit (2,144 )

754 Net income $ 8,966 $ 464 Basic net

income per common share $ 0.60 $ 0.03 Diluted net

income per common share $ 0.60 $ 0.03

Weighted average shares used to compute basic net income per share

14,961 14,798 Weighted average shares

used to compute diluted net income per share 15,020

14,813

CITI TRENDS, INC. CONDENSED CONSOLIDATED BALANCE

SHEETS (unaudited) (in thousands) January 31,

2015 February 1, 2014 (unaudited) (unaudited) Assets:

Cash and cash equivalents $ 74,514 $ 58,928 Short-term investment

securities 15,850 6,004 Inventory 131,057 126,501 Other current

assets 19,936 16,326 Property and equipment, net 47,603 56,154

Long-term investment securities 22,447 19,777 Other noncurrent

assets 6,966 7,618 Total assets $ 318,373 $ 291,308

Liabilities and Stockholders’ Equity:

Accounts payable $ 72,245 $ 60,037 Accrued liabilities 29,172

24,199 Other current liabilities 585 515 Noncurrent liabilities

5,749 7,686 Total liabilities 107,751 92,437

Total stockholders’ equity

210,622 198,871

Total liabilities and stockholders’

equity

$ 318,373 $ 291,308

Citi Trends, Inc.Bruce Smith, 912-443-2075Chief Financial

OfficerorEd Anderson, 912-443-3705Chairman & Chief Executive

Officer

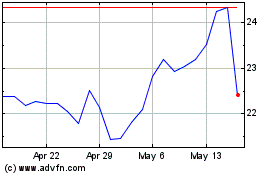

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jun 2024 to Jul 2024

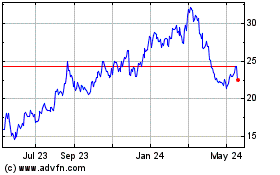

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jul 2023 to Jul 2024