false

0001175151

0001175151

2025-02-25

2025-02-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

February 25, 2025

CYTOSORBENTS CORPORATION

(Exact name of registrant as specified in

its charter)

| Delaware |

|

001-36792 |

|

98-0373793 |

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

305

College Road East

Princeton, New Jersey |

08540 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including

area code: (732) 329-8885

Not Applicable

|

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which

registered |

| Common Stock, $0.001 par value |

CTSO |

The Nasdaq Stock Market LLC (Nasdaq Capital Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 | Regulation FD Disclosure. |

On February 25, 2025, CytoSorbents Corporation (the “Company”)

issued a press release announcing the expiration of the Series A Right Warrants issued pursuant to its previously announced rights offering,

and received aggregate gross proceeds of $1.6 million from the exercise of 1,417,208 Series A Right Warrants at $1.13 per Series A Right

Warrant. A copy of the press release is furnished herewith as Exhibit 99.1.*

(d) Exhibits

* The information in Item 7.01 of this Form 8-K

shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under

the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such a filing.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: February 25, 2025 |

CYTOSORBENTS CORPORATION |

| |

|

|

| |

By: |

/s/

Dr. Phillip P. Chan |

| |

Name: |

Dr. Phillip P. Chan |

| |

Title: |

Chief Executive Officer |

EXHIBIT 99.1

CytoSorbents

Further Strengthens Balance Sheet with Exercise of Previously Announced Series A Right Warrants

1,417,208 Series A Right Warrants Exercised

at $1.13 Per Share, Providing $1.6 Million in Aggregate Gross Proceeds

PRINCETON, NJ,

February 25, 2025 — CytoSorbents Corporation (NASDAQ: CTSO), a leader in the treatment of life-threatening conditions in the intensive

care unit and cardiac surgery using blood purification, announced today the Company received aggregate gross proceeds of $1.6 million

from the exercise of 1,417,208 Series A Right Warrants at $1.13 per warrant upon their expiration at 5:00 PM EST on February 24, 2025.

The Series A Right Warrants were exercised by shareholders, including members of the Company’s management and Board of Directors,

who received them as part of the Company’s previously closed Rights Offering (the “Rights Offering”).

The Company has now raised a total of $7.85 million

of aggregate gross proceeds, inclusive of the original $6.25 million raised on January 10, 2025, through the exercise of subscription

rights and the exercise of Series A Right Warrants. As previously disclosed, the proceeds from the January 10, 2025 Rights Offering also

satisfied a debt covenant allowing for $5.0 million of restricted cash on our balance to become unrestricted and available for use. As

a result, the Company’s balance sheet has been strengthened with an increase of net liquidity available to the Company of approximately

$12.3 million, net of related offering fees.

“We are pleased with the success of our Rights Offering which has served

to strengthen our balance sheet and provide the liquidity to drive innovation and execution in our core international business with CytoSorb®

while we pursue potential U.S. and Canadian approval and launch of DrugSorb™-ATR in 2025. We thank our shareholders for their continued

support,” commented Dr. Phillip Chan, Chief Executive Officer of CytoSorbents. “Additionally, we are pleased with the progress

of our DrugSorb-ATR marketing applications with both the U.S. FDA and Health Canada, where we continue to be in interactive review and

expect regulatory decisions from both agencies in 2025.”

The exercise price was determined to be $1.13

per share, based on 90% of the 5-day volume weighted average price of our common stock over the last 5-trading days prior to the expiration

date of the Series A Right Warrants, rounded down to the nearest whole cent but (x) not lower than $1.00 and (y) not higher than $2.00,

as specified in the prospectus for the Rights Offering. The 5-day volume weighted average price for our stock was determined to be $1.2589

per share inclusive of the last 5 trading days of February 14 – 21, 2025. Holders of the Series A Right Warrants were required

to provide the maximum exercise price of $2.00 per Series A Right Warrant to exercise their warrants. Those holders will soon receive

the shares purchased along with a refund of $0.87 per Series A Right Warrant exercised.

The maximum number of shares of the Company’s common stock available

for issuance in the Rights Offering was 12,500,000 shares, including the shares of common stock comprising the Units and pursuant to the

exercise of the Right Warrants comprising the Units. Given the number of subscription rights and Series A Right Warrants exercised, approximately

4.8 million shares of common stock remain available for the exercise of Series B Right Warrants, as discussed below.

The Series B Right Warrants

The Series B Right Warrants are exercisable commencing

on their date of issuance at an exercise price equal to 90% of the 5-day volume weighted average price of our common stock over the last

5-trading days prior to the expiration date of the Series B Right Warrants on April 10, 2025, rounded down to the nearest whole cent

but (x) not lower than $2.00 and (y) not higher than $4.00.

Exercise of the Right Warrants require additional

investment separate from the exercise of subscription rights in the Rights Offering. Approximately 4.8 million shares of common stock

remain reserved for exercise of the Series B Right Warrants, after which any remaining unexercised Series B Right Warrants will immediately

expire worthless. Instructions to exercise the Series B Right Warrants will be fulfilled in the order they are received. Holders of the

Series B Right Warrants are required to provide the maximum price of the Right Warrant of $4.00 to exercise their warrant and will be

refunded the difference based on the final Series B Right Warrant exercise price.

About Moody Capital Solutions, Inc.

For

nearly 40 years, Moody Capital Solutions Inc. has operated as an investment bank, focusing on private placements, mergers &

acquisitions, corporate advisory, divestitures, spin-outs and best-efforts underwritings. The investment bankers at Moody Capital

pride themselves on their ability to bring together the necessary resources to solve most of the complex capital and treasury issues

facing companies in a thoughtful and focused manner. Moody Capital Solutions, Inc. is a member of FINRA/SIPC.

About CytoSorbents Corporation (NASDAQ:

CTSO)

CytoSorbents Corporation is a leader

in the treatment of life-threatening conditions in the intensive care unit and cardiac surgery through blood purification. CytoSorbents’

proprietary blood purification technologies are based on biocompatible, highly porous polymer beads that can actively remove toxic substances

from blood and other bodily fluids by pore capture and surface adsorption. Cartridges filled with these beads can be used with standard

blood pumps already in the hospital (e.g. dialysis, ECMO, heart-lung machines). CytoSorbents’ technologies are used in a number

of broad applications. Specifically, two important applications are 1) the removal of blood thinners during and after cardiothoracic

surgery to reduce the risk of severe bleeding and 2) the removal of inflammatory agents in common critical illnesses such as sepsis,

burn injury, trauma, lung injury, liver failure, cytokine release syndrome, and pancreatitis that can lead to massive inflammation, organ

failure and patient death. In these diseases, the risk of death can be extremely high, and there are few, if any, effective treatments.

CytoSorbents’ lead product, CytoSorb®,

is approved in the European Union and distributed in 76 countries worldwide, with more than a quarter million devices used

cumulatively to date. CytoSorb was originally launched in the European Union under CE mark as the first cytokine adsorber.

Additional CE mark extensions were granted for bilirubin and myoglobin removal in clinical conditions such as liver disease and

trauma, respectively, and for ticagrelor and rivaroxaban removal in cardiothoracic surgery procedures.

CytoSorb has also received FDA Emergency Use Authorization in the United States for use in adult critically

ill COVID-19 patients with impending or confirmed respiratory failure, to reduce pro-inflammatory cytokine levels. CytoSorb is not yet

approved in the United States.

In the U.S. and Canada, CytoSorbents is developing

the DrugSorb™-ATR antithrombotic removal system, an investigational device based on an equivalent polymer technology to

CytoSorb, to reduce the severity of perioperative bleeding in high-risk surgery due to blood thinning drugs. It has received two FDA

Breakthrough Device Designations: one for the removal of ticagrelor and another for the removal of the direct

oral anticoagulants (DOAC) apixaban and rivaroxaban in a cardiopulmonary bypass circuit during urgent cardiothoracic procedures.

In September 2024, the Company submitted a De Novo medical device application to the U.S. FDA requesting

marketing approval to reduce the severity of perioperative bleeding in CABG patients on the antithrombotic drug ticagrelor, which was

accepted for substantive review in October 2024. In November 2024, the Company received its Medical Device Single Audit Program

(MDSAP) certification and submitted its Medical Device License (MDL) application to Health Canada. DrugSorb-ATR is not yet granted

or approved in the United States and Canada, respectively.

The Company has numerous marketed products and

products under development based upon this unique blood purification technology protected by many issued U.S. and international

patents and registered trademarks, and multiple patent applications pending, including ECOS-300CY®, CytoSorb-XL™, HemoDefend-RBC™,

HemoDefend-BGA™, VetResQ®, K+ontrol™, DrugSorb™, ContrastSorb, and others. For more information, please visit the

Company’s website at https://ir.cytosorbents.com/ or follow us on Facebook and X.

Forward-Looking Statements

This press

release includes forward-looking statements intended to qualify for the safe harbor from liability established by the Private Securities

Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements about our plans, objectives,

future targets and outlooks for our business, representations and contentions, and the outcome of our regulatory submissions, the anticipated

benefits of the Rights Offering, and are not historical facts and typically are identified by use of terms such as “may,”

“should,” “could,” “expect,” “plan,” “anticipate,” “believe,”

“estimate,” “predict,” “potential,” “continue” and similar words, although some forward-looking

statements are expressed differently. You should be aware that the forward-looking statements in this press release represent management’s

current judgment and expectations, but our actual results, events and performance could differ materially from those in the forward-looking

statements. Factors which could cause or contribute to such differences include, but are not limited to, the risks discussed in our Annual

Report on Form 10-K, filed with the SEC on March 14, 2024, as updated by the risks reported in our Quarterly Reports on Form 10-Q, and

in the press releases and other communications to shareholders issued by us from time to time which attempt to advise interested parties

of the risks and factors which may affect our business. We caution you not to place undue reliance upon any such forward-looking statements.

We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future

events, or otherwise, other than as required under the Federal securities laws.

Please Click to Follow Us on Facebook and X

U.S. Company

Contact:

Peter J. Mariani

Chief Financial Officer

pmariani@cytosorbents.com

Investor Relations Contact:

Aman Patel, CFA

Investor Relations, ICR Healthcare

(443) 450-4191

ir@cytosorbents.com

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

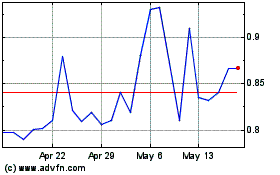

CytoSorbents (NASDAQ:CTSO)

Historical Stock Chart

From Jan 2025 to Feb 2025

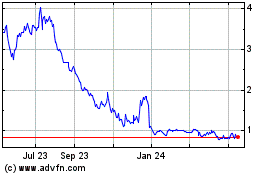

CytoSorbents (NASDAQ:CTSO)

Historical Stock Chart

From Feb 2024 to Feb 2025