Cuentas, Inc. (Nasdaq: CUEN & CUENW), the leading developer of

a fully integrated telecommunications and financial ecosystem for

the unbanked and underbanked Hispanic market, announced today the

publication of the company’s Q3 FY 2023 financial report on SEC

Form 10Q.

Revenue increase, pending acquisition

and improved operations performance

Management is pleased to present a report that

highlights the company's ongoing transition, strategically

capitalizing on its extensive experience in the telecommunications

sector. The aim is to broaden its scope by offering a diverse range

of services that cater to the comprehensive basic needs of today's

consumers, spanning from housing solutions to secure communications

and innovative financial services.

The results speak volumes about Cuentas

progress, with sales surging to an impressive $1 million, marking

an extraordinary quarter-over-quarter increase of 861%, and an

increase of $0.896 million for the period ending September

2023.

The revenue increase originates from its joint

ventures and its wholesale telecommunications increase in volume in

preparation for its Cuentas Mobile products, which will include

international features via Cuentas FinTech proprietary intellectual

property core platform.

Expenses and losses reflect a corresponding

reduction due to a decrease in sales, marketing and administrative

expenses. These robust financial indicators underscore the success

of its expansion strategy and its commitment to delivering value

across various sectors.

Central to Cuentas’ transition is a strategic

acquisition currently underway. As noted in the Q3 FY 2023 report

on SEC Form 10Q for the period ending September 30, 2023, under

subsequent events, on October 19th of this year, Cuentas entered

into a binding agreement to acquire the majority interest in WHEN

Group (OTC Pink: WHEN), a telecom and cybersecurity company with

proprietary technologies developed to protect individuals and

enterprises. Management believes the Company’s solutions address a

broad segment of the fast-growing, multi-billion-dollar

cybersecurity market, projected to total $215 billion in 2024,

according to Gartner.

This acquisition will enable Cuentas to provide

a suite of solutions that utilize advanced pattern recognition and

artificial intelligence (AI) to create a security screening

environment that can detect and defend against a range of threats

and attacks on telecom, banking, and other communication

infrastructure.

The Q3 FY 2023 report on SEC Form 10Q also

discloses details regarding recent real estate investments. The

initial investment of $2.1 million is expected to increase due to

short-term property appreciation. As part of the company’s

plan to diversify into multifamily property management, Cuentas

owns 6% of the Lakewood Village project, recently completed in

Lakewood, Florida. Future resident services will include Cuentas

Mobile, Cuentas Fintech, Cuentas Casa and secure financial services

applications.

Operating Expense and Loss Reductions

The Company has reduced its operating expenses

in an effort to improve cash use and reduce net operating results

compared to the same period in 2022. Management continues to take

measures to migrate the business to mobile-based applications. By

targeting consumer services, it expects to generate a steady

revenue source based on subscription services from Cuentas Mobile

and by adding the future cybersecurity applications from the WHEN

portfolio of products, increase gross margins from the projected

average revenues per user.

Cuentas has engaged an external investment

banking firm with the intent of providing new financing. The

expected funds will be used for market expansion, to support future

acquisitions, and to increase the stockholders' equity

requirements.

Financial Results for the Third Quarter Ended

September 30, 2023

Net Loss: The net loss for the quarter ended

September 30, 2023, was $4.3 million. This net loss was $4.8

million lower than the $9.1 million recorded during the quarter

ended September 30, 2022.

Operating Expenses were $3.512 million, compared

to $9.320 million for the nine months in the previous fiscal year

quarter. This represents a decrease of $5.808 million. Selling,

general, and administrative expenses totaled $3.499 million during

the nine months ended September 30, 2023, a net decrease of $4.463

million, or 56%, compared to $7.962 million during the nine months

ended September 30, 2022. A decrease in the amount of $0.471

million in officers' compensation, a decrease in the amount of

$1.258 million in Share-based compensation, and shares issued for

services. A decrease in the amount of $0.580 million in maintenance

and support services, an additional $0.448 million decrease in

Directors’ and officers’ insurance and a decrease in selling and

marketing expenses of $1.028 million since the Company

significantly reduced its selling and marketing campaigns in 2023.

The company had a partial offset increase of approximately $0.299

million from its settlement expenses.

Cash Position: For the nine months ended

September 30, 2023, the Company deployed $3.2 million of cash for

operations and $2.2 million for investing activities, while raising

$6.0 million from financing activities. As of September 30, 2023,

cash and cash equivalents were $1.1 million.

Management encourages investors to review the

full Q3 FY 2023 report on SEC Form 10Q for all pertinent

information, including additional information not addressed in this

press release.

FOR IMMEDIATE RELEASE

About Cuentas

Cuentas, Inc. (Nasdaq: CUEN & CUENW) is

creating an alternative financial ecosystem for the growing global

population who do not have access to traditional financial

alternatives. The Company’s proprietary technologies help to

integrate FinTech (Financial Technology), e-finance and e-commerce

services into solutions that deliver next generation digital

financial services to the unbanked, under-banked and underserved

populations nationally in the USA. The Cuentas Platform integrates

Cuentas Mobile, the Company’s Telecommunications solution, with its

core financial services offerings to help entire communities enter

the modern financial marketplace. Cuentas has launched its General

Purpose Reloadable (GPR) Card, which includes a digital wallet,

discounts for purchases at major physical and online retailers,

rewards, and the ability to purchase digital content. In Q1 of 2023

Cuentas launched Cuentas Casa, an alternative housing development

initiative that secured a 10-year supply agreement for a patented,

sustainable building system that will provide the bridge between

its technology solutions and the affordable housing market. Cuentas

has made investments to date in affordable housing projects for

over 450 apartments. LINK: https://cuentas.com

AND https://cuentasmobile.com

Forward-Looking Statements

This news release contains "forward-looking

statements," as that term is defined in section 27a of the United

States Securities Act of 1933, as amended, and section 21e of the

United States Securities Exchange Act of 1934, as amended. These

forward-looking statements involve substantial uncertainties and

risks and are based upon our current expectations, estimates and

projections and reflect our beliefs and assumptions based upon

information available to us at the date of this release. We caution

readers that forward-looking statements are predictions based on

our current expectations about future events. These forward-looking

statements are not guarantees of future performance and are subject

to risks, uncertainties and assumptions that are difficult to

predict. Our actual results, performance or achievements could

differ materially from those expressed or implied by the

forward-looking statements as a result of a number of factors,

including, but not limited to, Nasdaq and shareholder approval of

the proposed transaction, our ability to manage our research and

development programs that are based on novel technologies, our

ability to successfully integrate WHEN operations and product

offerings, the sufficiency of working capital to realize our

business plans and our ability to raise additional capital, market

acceptance, the going concern qualification in our financial

statements, our ability to retain key employees, our competitors

developing better or cheaper alternatives to our products, risks

relating to legal proceedings against us and the risks and

uncertainties discussed under the heading "RISK FACTORS" in Item 1A

of our Annual Report on Form 10-K for the fiscal year ended

December 31, 2022, and in our other filings with the Securities and

Exchange Commission. We undertake no obligation to revise or update

any forward-looking statement for any reason.

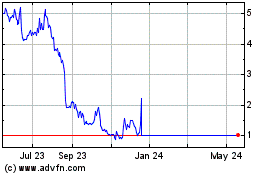

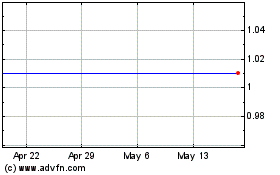

Cuentas (NASDAQ:CUEN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Cuentas (NASDAQ:CUEN)

Historical Stock Chart

From Nov 2023 to Nov 2024