False000027816600002781662025-01-302025-01-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 30, 2025

CAVCO INDUSTRIES INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 000-08822 | | 56-2405642 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | | | | | | | |

| 3636 North Central Avenue, Suite 1200 |

| Phoenix | Arizona | 85012 | |

| (Address of principal executive offices, including zip code) |

Registrant's telephone number, including area code: (602) 256-6263

Not applicable

(Former name or former address, if changed from last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, par value $0.01 | CVCO | The Nasdaq Stock Market LLC |

| | (Nasdaq Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

On January 30, 2025, Cavco Industries, Inc., a Delaware corporation (the "Company"), announced financial results for its fiscal third quarter ended December 28, 2024. A copy of the Company’s press release announcing these financial results is attached as Exhibit 99.1 hereto and incorporated in this Item 2.02 by reference.

Item 9.01. Financial Statements and Exhibits

| | | | | |

| Exhibit Number | Description |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| CAVCO INDUSTRIES, INC. |

| By: | /s/ Allison K. Aden |

| Allison K. Aden |

| Executive Vice President, Chief Financial Officer & Treasurer |

| |

| Date: | January 30, 2025 |

| | | | | | | | |

| For additional information, contact: |

Mark Fusler Corporate Controller and Investor Relations investor_relations@cavco.com |

| News Release | Phone: 602-256-6263 On the Internet: www.cavcoindustries.com |

FOR IMMEDIATE RELEASE

CAVCO INDUSTRIES REPORTS FISCAL 2025 THIRD QUARTER RESULTS

PHOENIX, January 30, 2025 (GLOBE NEWSWIRE) – Cavco Industries, Inc. (Nasdaq: CVCO) ("we," "our," the "Company" or "Cavco") today announced financial results for the third fiscal quarter ended December 28, 2024.

Quarterly Highlights

•Net revenue was $522 million, up $75 million or 16.8% compared to $447 million in the third quarter of the prior year, primarily on home sales volume growth.

•Home sales volume is up 21.6% and capacity utilization is up to approximately 75% from approximately 60% in the third quarter of the prior year.

•Factory-built housing Gross profit as a percentage of Net revenue was 23.6%, compared to 22.4% in the prior year period.

•Financial services Gross profit as a percentage of Net revenue was 55.5%, compared to Gross profit of 36.8% in the prior year period.

•Income before income taxes was $69.3 million, up $25.4 million, or 57.9% compared to $43.9 million in the prior year period.

•The effective tax rate was 18.6% with the difference from the statutory rate driven primarily by higher than expected production of Energy Star homes year to date.

•Net income per diluted share attributable to Cavco common stockholders was $6.90, up 62%, compared to $4.27 in the prior year quarter on higher Factory-built housing volume and stronger Financial services results.

•Backlogs totaled $224 million at the end of the quarter representing 6-8 weeks of production.

•Stock repurchases were approximately $42 million in the quarter.

Commenting on the quarter, President and Chief Executive Officer Bill Boor said, "Our pre-tax profit improved significantly on increased home shipments and a strong recovery in Financial services. The outstanding EPS performance was further boosted by positive tax items and our continuing use of buybacks to manage the balance sheet.”

He continued, "While the third quarter is typically strong for our insurance operation, pricing and underwriting improvements implemented earlier in the year came to fruition and led to one of the strongest Financial services quarters in several years. In Factory-built housing, we executed our plan to utilize backlogs to ramp up production in anticipation of continued market improvement. Across the board, we are very well set-up going into the new calendar year.”

Financial Results

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | |

| ($ in thousands, except revenue per home sold) | December 28,

2024 | | December 30,

2023 | | Change |

| Net revenue | | | | | | | |

| Factory-built housing | $ | 500,860 | | | $ | 426,939 | | | $ | 73,921 | | | 17.3 | % |

| Financial services | 21,180 | | | 19,830 | | | 1,350 | | | 6.8 | % |

| $ | 522,040 | | | $ | 446,769 | | | $ | 75,271 | | | 16.8 | % |

| | | | | | | |

| Factory-built modules sold | 8,378 | | | 6,806 | | | 1,572 | | | 23.1 | % |

| | | | | | | |

| Factory-built homes sold (consisting of one or more modules) | 5,059 | | | 4,160 | | | 899 | | | 21.6 | % |

| | | | | | | |

| Net factory-built housing revenue per home sold | $ | 99,004 | | | $ | 102,630 | | | $ | (3,626) | | | (3.5) | % |

| | | | | | | |

| | Nine Months Ended | | | | |

| ($ in thousands, except revenue per home sold) | December 28,

2024 | | December 30,

2023 | | Change |

| Net revenue | | | | | | | |

| Factory-built housing | $ | 1,445,251 | | | $ | 1,318,114 | | | $ | 127,137 | | | 9.6 | % |

| Financial services | 61,849 | | | 56,560 | | | 5,289 | | | 9.4 | % |

| $ | 1,507,100 | | | $ | 1,374,674 | | | $ | 132,426 | | | 9.6 | % |

| | | | | | | |

| Factory-built modules sold | 24,168 | | | 21,124 | | | 3,044 | | | 14.4 | % |

| | | | | | | |

| Factory-built homes sold (consisting of one or more modules) | 14,693 | | | 12,990 | | | 1,703 | | | 13.1 | % |

| | | | | | | |

| Net factory-built housing revenue per home sold | $ | 98,363 | | | $ | 101,471 | | | $ | (3,108) | | | (3.1) | % |

•In the factory-built housing segment, the increase in Net revenue in both periods was due to higher home sales volume, partially offset by a decrease in Net revenue per home sold primarily caused by a lower proportion of homes sold through our Company-owned stores.

•Financial services segment Net revenue increased in both periods from higher insurance premiums.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | |

| ($ in thousands) | December 28,

2024 | | December 30,

2023 | | Change |

| Gross profit | | | | | | | |

| Factory-built housing | $ | 118,193 | | | $ | 95,756 | | | $ | 22,437 | | | 23.4 | % |

| Financial services | 11,757 | | | 7,295 | | | 4,462 | | | 61.2 | % |

| $ | 129,950 | | | $ | 103,051 | | | $ | 26,899 | | | 26.1 | % |

| | | | | | | |

| Gross profit as % of Net revenue | | | | | | | |

| Consolidated | 24.9 | % | | 23.1 | % | | N/A | | 1.8 | % |

| Factory-built housing | 23.6 | % | | 22.4 | % | | N/A | | 1.2 | % |

| Financial services | 55.5 | % | | 36.8 | % | | N/A | | 18.7 | % |

| | | | | | | |

| Selling, general and administrative expenses | | | | | | | |

| Factory-built housing | $ | 60,409 | | | $ | 57,854 | | | $ | 2,555 | | | 4.4 | % |

| Financial services | 5,571 | | | 5,458 | | | 113 | | | 2.1 | % |

| $ | 65,980 | | | $ | 63,312 | | | $ | 2,668 | | | 4.2 | % |

| | | | | | | |

| Income from operations | | | | | | | |

| Factory-built housing | $ | 57,784 | | | $ | 37,902 | | | $ | 19,882 | | | 52.5 | % |

| Financial services | 6,186 | | | 1,837 | | | 4,349 | | | 236.7 | % |

| $ | 63,970 | | | $ | 39,739 | | | $ | 24,231 | | | 61.0 | % |

| | | | | | | |

| | Nine Months Ended | | | | |

| ($ in thousands) | December 28,

2024 | | December 30,

2023 | | Change |

| Gross profit | | | | | | | |

| Factory-built housing | $ | 333,223 | | | $ | 309,631 | | | $ | 23,592 | | | 7.6 | % |

| Financial services | 16,251 | | | 18,256 | | | (2,005) | | | (11.0) | % |

| $ | 349,474 | | | $ | 327,887 | | | $ | 21,587 | | | 6.6 | % |

| | | | | | | |

| Gross profit as % of Net revenue | | | | | | | |

| Consolidated | 23.2 | % | | 23.9 | % | | N/A | | (0.7) | % |

| Factory-built housing | 23.1 | % | | 23.5 | % | | N/A | | (0.4) | % |

| Financial services | 26.3 | % | | 32.3 | % | | N/A | | (6.0) | % |

| | | | | | | |

| Selling, general and administrative expenses | | | | | | | |

| Factory-built housing | $ | 181,569 | | | $ | 170,330 | | | $ | 11,239 | | | 6.6 | % |

| Financial services | 16,259 | | | 16,168 | | | 91 | | | 0.6 | % |

| $ | 197,828 | | | $ | 186,498 | | | $ | 11,330 | | | 6.1 | % |

| | | | | | | |

| Income from operations | | | | | | | |

| Factory-built housing | $ | 151,654 | | | $ | 139,301 | | | $ | 12,353 | | | 8.9 | % |

| Financial services | (8) | | | 2,088 | | | (2,096) | | | (100.4) | % |

| $ | 151,646 | | | $ | 141,389 | | | $ | 10,257 | | | 7.3 | % |

•In the factory-built housing segment, Gross profit as a percent of Net revenue for the three months increased due to lower input costs per unit and efficiencies gained on increased production, partially offset by lower average selling price. Gross profit as a percent of Net revenue for the nine months decreased due to lower average selling price, partially offset by lower input costs per unit.

•In the financial services segment, Gross profit and Income from operations for the three months increased due to higher insurance premiums and lower claim losses. Gross profit and Income from operations for the nine months decreased due to higher storm and fire activity, partially offset by higher insurance premiums.

•Selling, general and administrative expenses increased for both periods as a result of increases in variable compensation driven by higher incentive compensation and increases in expense from acquired retail locations, partially offset by lower legal expenses.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | |

| ($ in thousands, except per share amounts) | December 28,

2024 | | December 30,

2023 | | Change |

| Interest Income | $ | 5,353 | | | $ | 5,234 | | | $ | 119 | | | 2.3 | % |

| | | | | | | |

| Net income attributable to Cavco common stockholders | $ | 56,462 | | | $ | 35,987 | | | $ | 20,475 | | | 56.9 | % |

| Diluted net income per share | $ | 6.90 | | | $ | 4.27 | | | $ | 2.63 | | | 61.6 | % |

| | | | | | | |

| | Nine Months Ended | | | | |

| ($ in thousands, except per share amounts) | December 28,

2024 | | December 30,

2023 | | Change |

| Interest Income | $ | 16,556 | | | $ | 15,664 | | | $ | 892 | | | 5.7 | % |

| | | | | | | |

| Net income attributable to Cavco common stockholders | $ | 134,706 | | | $ | 123,883 | | | $ | 10,823 | | | 8.7 | % |

| Diluted net income per share | $ | 16.25 | | | $ | 14.34 | | | $ | 1.91 | | | 13.3 | % |

Items ancillary to our core operations had the following impact on the results of operations:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| ($ in millions) | December 28,

2024 | | December 30,

2023 | | December 28,

2024 | | December 30,

2023 |

| Net revenue |

| Unrealized (losses) gains recognized during the period on securities held in the financial services segment | $ | (2.4) | | | $ | 0.4 | | | $ | (1.9) | | | $ | 0.4 | |

| Selling, general and administrative expenses | | |

| Legal and other expense related to the SEC inquiry, including indemnified costs of a former officer | — | | | (2.0) | | | — | | | (3.0) | |

| Other income, net |

| Unrealized (losses) gains on corporate equity securities | (0.2) | | | 2.0 | | | (0.1) | | | 0.3 | |

Conference Call Details

Cavco's management will hold a conference call to review these results tomorrow, January 31, 2025, at 1:00 p.m. (Eastern Time). Interested parties can access a live webcast of the conference call on the Internet at https://investor.cavco.com or via telephone. To participate by phone, please register at

https://edge.media-server.com/mmc/p/9ye53925 to receive the dial in number and your PIN. An archive of the webcast and presentation will be available for 60 days at https://investor.cavco.com.

About Cavco

Cavco Industries, Inc., headquartered in Phoenix, Arizona, designs and produces factory-built housing products primarily distributed through a network of independent and Company-owned retailers. We are one of the largest producers of manufactured and modular homes in the United States, based on reported wholesale shipments. Our products are marketed under a variety of brand names including Cavco, Fleetwood, Palm Harbor, Nationwide, Fairmont, Friendship, Chariot Eagle, Destiny, Commodore, Colony, Pennwest, R-Anell, Manorwood, MidCountry and Solitaire. We are also a leading producer of park model RVs, vacation cabins and factory-built commercial structures. Cavco's finance subsidiary, CountryPlace Mortgage, is an approved Fannie Mae and Freddie Mac seller/servicer and a Ginnie Mae mortgage-backed securities issuer that offers conforming mortgages, non-conforming mortgages and home-only loans to purchasers of factory-built homes. Our insurance subsidiary, Standard Casualty, provides property and casualty insurance to owners of manufactured homes.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that are not historical facts. These forward-looking statements reflect Cavco's current expectations and projections with respect to our expected future business and financial performance, including, among other things: (i) expected financial performance and operating results, such as revenue and gross margin percentage; (ii) our liquidity and financial resources; (iii) our outlook with respect to the Company and the manufactured housing business in general; (iv) the expected effect of certain risks and uncertainties on our business; and (iv) the strength of Cavco's business model. These statements may be preceded by, followed by, or include the words "aim," "anticipate," "believe," "estimate," "expect," "forecast," "future," "goal," "intend," "likely," "outlook," "plan," "potential," "project," "seek," "target," "can," "could," "may," "should," "would," "will," the negatives thereof and other words and terms of similar meaning. A number of factors could cause actual results or outcomes to differ materially from those indicated by these forward-looking statements. These factors include, among other factors, Cavco's ability to manage: (i) customer demand and the availability of financing for our products; (ii) labor shortages and the pricing, availability, or transportation of raw materials; (iii) the impact of local or national emergencies; (iv) excessive health and safety incidents or warranty and construction claims; (v) increases in cancellations of home sales; (vi) information technology failures or cyber incidents; (vii) our ability to maintain the security of personally identifiable information of our customers, (viii) comply with the numerous laws and regulations applicable to our business, including state, federal, and foreign laws relating manufactured housing, privacy, the internet, and accounting matters; (ix) successfully defend against litigation, government inquiries, and investigations, and (x) other risks and uncertainties indicated from time to time in documents filed or to be filed with the Securities and Exchange Commission (the "SEC") by Cavco. The forward-looking statements herein represent the judgment of Cavco as of the date of this release and Cavco disclaims any intent or obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments, or otherwise. This press release should be read in conjunction with the information included in the Company's other press releases, reports, and other filings with the SEC. Readers are specifically referred to the Risk Factors described in Item 1A of the Company's Annual Report on Form 10-K for the year ended March 30, 2024 as may be updated from time to time in future filings on Form 10-Q and other reports filed by the Company pursuant to the Securities Exchange Act of 1934, which identify important risks that could cause actual results to differ from those contained in the forward-looking statements. Understanding the information contained in these filings is important in order to fully understand Cavco's reported financial results and our business outlook for future periods.

CAVCO INDUSTRIES, INC.

CONSOLIDATED BALANCE SHEETS

(Dollars in thousands, except per share amounts) | | | | | | | | | | | |

| December 28,

2024 | | March 30,

2024 |

| ASSETS | (Unaudited) | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 362,863 | | | $ | 352,687 | |

| Restricted cash, current | 15,178 | | | 15,481 | |

| Accounts receivable, net | 91,840 | | | 77,123 | |

| Short-term investments | 16,062 | | | 18,270 | |

| Current portion of consumer loans receivable, net | 33,242 | | | 20,713 | |

| Current portion of commercial loans receivable, net | 34,892 | | | 40,787 | |

| Current portion of commercial loans receivable from affiliates, net | 1,358 | | | 2,529 | |

| Inventories | 243,299 | | | 241,339 | |

| | | |

| Prepaid expenses and other current assets | 79,253 | | | 82,870 | |

| | | |

| Total current assets | 877,987 | | | 851,799 | |

| Restricted cash | 585 | | | 585 | |

| Investments | 18,287 | | | 17,316 | |

| Consumer loans receivable, net | 20,394 | | | 23,354 | |

| Commercial loans receivable, net | 51,305 | | | 45,660 | |

| Commercial loans receivable from affiliates, net | 6,798 | | | 2,065 | |

| Property, plant and equipment, net | 226,126 | | | 224,199 | |

| Goodwill | 121,969 | | | 121,934 | |

| Other intangibles, net | 27,068 | | | 28,221 | |

| Operating lease right-of-use assets | 35,248 | | | 39,027 | |

| Total assets | $ | 1,385,767 | | | $ | 1,354,160 | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

| Current liabilities | | | |

| Accounts payable | $ | 26,088 | | | $ | 33,531 | |

| Accrued expenses and other current liabilities | 259,134 | | | 239,736 | |

| Total current liabilities | 285,222 | | | 273,267 | |

| Operating lease liabilities | 31,472 | | | 35,148 | |

| Other liabilities | 7,206 | | | 7,759 | |

| Deferred income taxes | 4,642 | | | 4,575 | |

| | | |

| Stockholders' equity | | | |

| Preferred stock, $0.01 par value; 1,000,000 shares authorized; No shares issued or outstanding | — | | | — | |

Common stock, $0.01 par value; 40,000,000 shares authorized; Issued 9,422,969 and 9,389,953 shares, respectively; Outstanding 8,066,549 and 8,320,718, respectively | 94 | | | 94 | |

Treasury stock, at cost; 1,356,420 and 1,069,235 shares, respectively | (391,128) | | | (274,693) | |

| Additional paid-in capital | 286,573 | | | 281,216 | |

| Retained earnings | 1,161,833 | | | 1,027,127 | |

| Accumulated other comprehensive loss | (147) | | | (333) | |

| Total stockholders' equity | 1,057,225 | | | 1,033,411 | |

| Total liabilities and stockholders' equity | $ | 1,385,767 | | | $ | 1,354,160 | |

CAVCO INDUSTRIES, INC.

CONSOLIDATED STATEMENTS OF INCOME

(Dollars in thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | December 28,

2024 | | December 30,

2023 | | December 28,

2024 | | December 30,

2023 |

| Net revenue | $ | 522,040 | | | $ | 446,769 | | | $ | 1,507,100 | | | $ | 1,374,674 | |

| Cost of sales | 392,090 | | | 343,718 | | | 1,157,626 | | | 1,046,787 | |

| Gross profit | 129,950 | | | 103,051 | | | 349,474 | | | 327,887 | |

| Selling, general and administrative expenses | 65,980 | | | 63,312 | | | 197,828 | | | 186,498 | |

| Income from operations | 63,970 | | | 39,739 | | | 151,646 | | | 141,389 | |

| Interest income | 5,353 | | | 5,234 | | | 16,556 | | | 15,664 | |

| Interest expense | (155) | | | (842) | | | (370) | | | (1,365) | |

| Other income, net | 168 | | | (224) | | | 315 | | | 557 | |

| Income before income taxes | 69,336 | | | 43,907 | | | 168,147 | | | 156,245 | |

| Income tax expense | (12,874) | | | (7,920) | | | (33,441) | | | (32,274) | |

| Net income | 56,462 | | | 35,987 | | | 134,706 | | | 123,971 | |

| Less: net income attributable to redeemable noncontrolling interest | — | | | — | | | — | | | 88 | |

| Net income attributable to Cavco common stockholders | $ | 56,462 | | | $ | 35,987 | | | $ | 134,706 | | | $ | 123,883 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net income per share attributable to Cavco common stockholders | | | | | | | |

| Basic | $ | 6.97 | | | $ | 4.31 | | | $ | 16.42 | | | $ | 14.47 | |

| Diluted | $ | 6.90 | | | $ | 4.27 | | | $ | 16.25 | | | $ | 14.34 | |

| Weighted average shares outstanding | | | | | | | |

| Basic | 8,096,538 | | | 8,358,389 | | | 8,203,448 | | | 8,561,209 | |

| Diluted | 8,186,814 | | | 8,432,471 | | | 8,291,647 | | | 8,640,288 | |

CAVCO INDUSTRIES, INC.

OTHER OPERATING DATA

(Dollars in thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| December 28,

2024 | | December 30,

2023 | | December 28,

2024 | | December 30,

2023 |

| Capital expenditures | $ | 5,434 | | | $ | 4,767 | | | $ | 15,253 | | | $ | 13,237 | |

| Depreciation | $ | 4,407 | | | $ | 4,228 | | | $ | 13,151 | | | $ | 12,677 | |

| Amortization of other intangibles | $ | 377 | | | $ | 392 | | | $ | 1,154 | | | $ | 1,177 | |

###

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

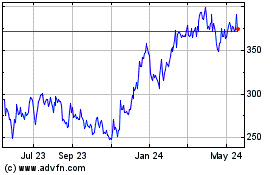

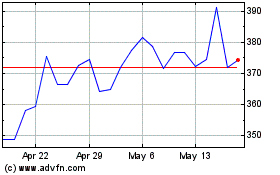

Cavco Industries (NASDAQ:CVCO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Cavco Industries (NASDAQ:CVCO)

Historical Stock Chart

From Jan 2024 to Jan 2025