0001290900FALSE00012909002025-02-132025-02-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): February 10, 2025

Commercial Vehicle Group, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-34365 | | 41-1990662 |

| (State or other jurisdiction | | (Commission | | (I.R.S. Employer |

| of incorporation) | | File Number) | | Identification No.) |

| | | | | | | | |

| | |

7800 Walton Parkway, New Albany, Ohio | | 43054 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: 614-289-5360

Not Applicable

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | CVGI | The NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | |

| Emerging growth company | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ¨

|

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Effective February 13, 2025, Commercial Vehicle Group, Inc., (the “Company”) appointed Scott Reed (60-years old) to the position of Chief Operating Officer of the Company. In connection with Mr. Reed joining the Company, the Compensation Committee (the “Compensation Committee”) of the Board of Directors of the Company approved, on February 10, 2025, the compensation package referenced below for Mr. Reed.

Before joining CVG, Mr. Reed served as President of Arrow Tru-Line Inc. (from November 2022 to October 2024), the largest manufacturer and supplier of structural hardware components to the North American residential and commercial overhead garage door market. He also held operations leadership roles at Peterson Spring (from October 2019 to November 2022), and prior to that at Unique Fabricating, Inc., GT Technologies and Lear Corporation.

Mr. Reed holds a bachelor’s degree in business administration from Cleary University.

There are no family relationships between Mr. Reed and any of the directors and executive officers of the Company, nor are there transactions in which Mr. Reed has an interest requiring disclosure under Item 404(a) of Regulation S-K.

In connection with Mr. Reed’s appointment as Chief Operating Officer, the Company entered into an offer letter (the “Offer Letter”) with Mr. Reed and the Compensation Committee of the Board approved compensation for Mr. Reed consisting of (i) a base salary of $435,000 per year, (ii) a discretionary annual bonus targeted at 70% of his base salary, and (iii) as a material inducement to Mr. Reed joining the Company, the grant of the following inducement equity awards (collectively, the Inducement Awards), granted outside the Company’s stockholder-approved 2020 equity incentive plan: (x) 58,331 shares of time-vesting restricted stock, which will vest ratably on March 31, 2026, 2027 and 2028; and (y) 87,497 performance shares, that will vest and be paid in cash if performance metrics are met, aligning the interests of Mr. Reed with the interests of the Company’s shareholders.

The foregoing descriptions of the terms of the Offer Letter are not complete and are qualified in their entirety by reference to the full text of the Offer Letter which are attached hereto as Exhibits 10.1and incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

On February 13, 2025, the Company issued a press release announcing the appointment of Scott Reed as Chief Operating Officer of the Company. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

Exhibit No. | | Description |

| | Offer Letter between the Company and Mr. Reed dated February 10, 2025. |

| | Press release of the Company dated February 13, 2025 announcing the appointment of Scott Reed as Chief Operating Officer of the Company. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | COMMERCIAL VEHICLE GROUP, INC. |

| | | |

| February 13, 2025 | | | | By: | | /s/ Aneezal H. Mohamed |

| | | | Name: | | Aneezal H. Mohamed |

| | | | Title: | | Chief Legal Officer |

Exhibit 10.1

February 13, 2025

Scott Reed

Via Email: scott.a.reed2016@gmail.com

Dear Scott:

On behalf of CVG, I am pleased to confirm the following terms of your employment. This offer is consistent with our discussions and supersedes any previous offers of employment, whether verbal or written:

Job Title: Chief Operating Officer.

Location: This is a remote position (IN), reporting to our headquarters in New Albany, OH.

Start Date: Thursday, February 13, 2025, or a mutually agreeable alternative date.

Reports To: James Ray – President and Chief Executive Officer.

Salary: $435,000 annualized. This is a salaried exempt position as defined by the Fair Labor Standards Act.

Annual Incentive Plan: You will be eligible for a discretionary annual incentive award targeted at 70% of your base salary.

Annual payouts may range from 0%-200% depending on performance versus plan. For the 2025 plan year, you will be eligible for 11 months of bonus; payouts for the 2025 plan year would be made in 2026 contingent on payouts to all other similarly situated executives.

Inducement Award: As a material inducement to you accepting employment with the Company, the Company will grant to the Executive the following one-time equity awards (The stock price used to determine the number of CVGI shares issues is the 20-day average CVGI share price from January 3 – February 3, 2025):

(1)58,331 shares of time-vested restricted stock (“Inducement Restricted Stock”) valued at $127,600, outside of the Company’s 2020 Equity Incentive Plan, as amended (the “2020 EIP”) as an “inducement grant” (within the meaning of NASDAQ Listing Rule 5635(c)) having substantially the same terms, definitions and provisions of the 2020 EIP. The Inducement Restricted Stock will vest ratably on March 31, 2026, 2027 and 2028 subject to other terms and conditions set forth in an award agreement to be entered into by the Company and the Executive; and

(2)87,497 performance shares (“Inducement PSs”) valued at $191,400, outside of the 2020 EIP as an “inducement grant” (within the meaning of NASDAQ Listing Rule 5635(c)) having substantially the same terms, definitions and provisions of the 2020 EIP. The Inducement PSs will be tied to performance metrics and subject to other terms and conditions set forth in an award agreement to be entered into by the Company and the Executive. If the performance metrics are met as provided for in the award agreement, the Executive will receive fully vested performance cash.

Long Term Incentive: Starting in 2026, you will be eligible to receive equity and other long-term incentive awards under any applicable plan adopted by the Company during your employment term for which executives are generally eligible. The level of participation in any such plan shall be determined at the sole discretion of the Compensation Committee from time to time.

7800 Walton Parkway New Albany, OH 43054 614.289.5360

Awards under the plan may be issued in restricted stock or cash or performance shares or cash or a combination thereof under terms and conditions that are no less favorable than those awards granted to executives of the Company.

The target award and award design are determined annually by the Compensation Committee and may include a restricted share component which vests ratably over a three-year period and a three-year cliff vested cash and stock based performance component. Currently, the performance component has two measures; (1) relative total shareholder return versus a published peer group, with payouts ranging from 0% to 200% based on performance relative to the peer group and (2) a component based on our return on invested capital (ROIC) metric that will be tracked on an annual basis for payout consideration and banked for a three-year cliff payout as set forth in the grant documents.

Target awards are subject to annual review and approval by the Compensation Committee but will be no less than 80% of your base salary each calendar year.

Annual Review: Performance reviews take place annually, generally in the first quarter. Executive compensation is reviewed annually, and market adjustments are made as warranted by the executive benchmark data; any such merit increases and adjustments are subject to review and approval by the Compensation Committee.

Vacation: Four (4) weeks of vacation per calendar year, accrued at a rate of 13.33 hours per month, pro-rated for 2025 based on your start date. Vacation is earned and must be used within each calendar year.

Personal Days: Three paid (3) personal days per calendar year paid in accordance with company policy.

Holidays: Ten, paid in accordance with our annual observation calendar.

Benefits: Medical, Dental, and Vision insurance is available for you and your eligible dependents. Coverage is effective the first day of the month following your date of hire. A pre-tax premium contribution will apply based on the type of coverage you select. CVG also offers supplemental critical care, accident, and hospital indemnity insurance. These benefits can be purchased at group rates at your expense. In some instances, evidence of insurability is required for supplemental coverage.

Group life insurance coverage equal to three (3) times your base salary is provided at no cost to you and with no medical exam required. This coverage is effective on the first day of the month following your date of hire. CVG also offers a supplemental life insurance benefit that can be purchased at group rates at your expense. In some instances, evidence of insurability is required for supplemental coverage.

Short term disability (STD) coverage applies after 180 days of employment and provides disability pay at 100% of your base salary for the first two weeks of an eligible disability and up to an additional 24 weeks at 60% of base salary. Long term disability (LTD) coverage takes effect following the exhaustion of your STD coverage

Conditional Employment: Employment is contingent upon successfully passing a drug screen, background check, and signing a Non-compete/Confidentiality Agreement.

Eligibility: This offer and continued employment are contingent upon your eligibility to work in the United States under the provisions of the Immigration Reform and Control Act of 1986 and providing the necessary documents to establish identity and employment eligibility to satisfactorily complete U.S. Citizenship and Immigration Services’ Form I-9.

7800 Walton Parkway New Albany, OH 43054 614.289.5360

401(k) Savings Plan: All employees over the age of eighteen are automatically enrolled in the CVG 401(k) Plan on the first day of the month following 30 days of service unless they opt out. The Company matches 100% of the first 3% of employee contributions and 50% of the next 2% of employee contributions. All matching dollars vest immediately under the Plan.

Early Termination: Your employment relationship will be “at will,” meaning Commercial Vehicle Group reserves the right to terminate your employment for any reason whatsoever, and in accordance with the terms of the CIC agreement.

If you have any questions, please feel free to contact me directly. If not, please sign this letter and return it as soon as possible. This will indicate your acceptance of our offer. We look forward to welcoming you to CVG.

Sincerely,

Kristin Mathers

CHRO

Date: February 10, 2025

Accepted and acknowledged by: /s/ Scott Reed Scott Reed

Date: February 10, 2025

7800 Walton Parkway New Albany, OH 43054 614.289.5360

CVG Appoints Scott Reed as Chief Operating Officer

NEW ALBANY, Ohio, Feb. 13, 2025 (GLOBE NEWSWIRE) -- Commercial Vehicle Group (the “Company” or “CVG”) (NASDAQ: CVGI), a diversified industrial products and services company, is pleased to announce the appointment of Scott Reed as Chief Operating Officer, effective February 13, 2025. Mr. Reed comes to CVG with more than 30 years of diverse business and leadership experience in industrial and manufacturing organizations.

In his new role, Mr. Reed will oversee the global manufacturing and supply chain operations of the company, driving operational excellence and strengthening cross-functional alignment across planning and execution, ensuring that our operational processes are aligned with our strategic goals. He will report to James Ray, President and CEO of CVG, and serve on the executive leadership team.

“We are thrilled to welcome Scott to our executive leadership team,” said Mr. Ray. “His extensive background in operations and strategic leadership aligns perfectly with our mission to optimize our business operations and enhance our value proposition. We believe Scott’s vision and expertise will accelerate our growth and help us to deliver outstanding results.”

Before joining CVG, Mr. Reed served as President of Arrow Tru-Line Inc., the largest manufacturer and supplier of structural hardware components to the North American residential and commercial overhead garage door market. He also held operations leadership roles at Peterson Spring, Unique Fabricating, Inc., GT Technologies, Inc. and Lear Corporation. He is recognized for his ability to deliver year-over-year success in achieving operational, profit, and business growth objectives, as well as building, motivating, and leading culturally diverse worldwide operating teams.

“I am excited to join CVG and look forward to working with the team to drive continued operational excellence across our global operations footprint,” said Mr. Reed. “I am confident that together we will continue to strengthen the company’s position in the market and achieve success.”

Mr. Reed holds a bachelor’s degree in business administration from Cleary University.

As a material inducement to Mr. Reed joining the Company, the Compensation Committee of the Board of Directors approved the grant of the following inducement equity awards (collectively, the Inducement Awards), granted outside the Company’s stockholder-approved 2020 equity incentive plan: (i) 58,331 shares of time-vesting restricted stock, which will vest ratably on March 31, 2026, 2027 and 2028; and (ii) 87,497 performance shares, that will vest and be paid in cash if performance metrics are met, aligning the interests of Mr. Reed with the interests of the Company’s shareholders.

In addition to welcoming Mr. Reed, the Company is announcing the departure of Don Fishel, President, Trim Systems and Components, after 14 years with CVG. “We are grateful for Don’s leadership and contributions during his time at CVG,” said Mr. Ray. “He played an integral role in CVG’s growth and success, and we wish him well in his future endeavors. We are confident that

the leadership team will continue to drive our company forward as we execute our vision and strategy."

We expect to conduct a search for a new permanent leader for our Trim Systems and Components business. In the interim, Andy Cheung will oversee the Trim Systems and Components business, in addition to his current CFO responsibilities.

About CVG

At CVG, we deliver real solutions to complex design, engineering and manufacturing problems while creating positive change for our customers, industries, and communities we serve. Information about CVG and its products is available at www.cvgrp.com.

Investor Relations Contact:

Ross Collins or Stephen Poe

Alpha IR Group

CVGI@alpha-ir.com

Media Contact:

Patrick Woolford

Director, Communications

Patrick.Woolford@cvgrp.com

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

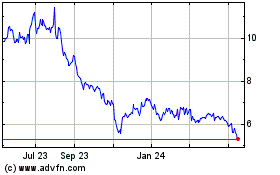

Commercial Vehicle (NASDAQ:CVGI)

Historical Stock Chart

From Feb 2025 to Mar 2025

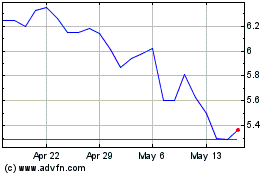

Commercial Vehicle (NASDAQ:CVGI)

Historical Stock Chart

From Mar 2024 to Mar 2025