As filed

with the Securities and Exchange Commission on March 7, 2025

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Cryoport, Inc.

(Exact name of registrant as

specified in its charter)

Nevada

(State or other jurisdiction

of

incorporation or organization) |

88-0313393

(I.R.S. Employer

Identification No.) |

112 Westwood Place, Suite 350

Brentwood, TN 37027

(Address of principal executive offices, including

zip code)

Stock Option Agreements

(Full

title of the plan)

Robert Stefanovich

Cryoport, Inc.

Chief Financial Officer

112 Westwood Place, Suite 350

Brentwood, TN 37027

(949) 470-2300

(Name, address and telephone

number, including area code, of agent for service)

With a copy to:

Kevin Zen

Snell & Wilmer L.L.P.

600 Anton Boulevard., Suite 1400

Costa Mesa, CA 92626

(714) 427-7000

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging

growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting

company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer

¨ | | Accelerated

filer x |

| Non-accelerated filer ¨ | | Smaller

reporting company ¨ |

| | | Emerging

growth company ¨ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

EXPLANATORY

NOTE

This registration statement is being filed by

Cryoport, Inc., a Nevada corporation (the “Company”), for the purpose of registering the reoffer and resale of an aggregate

of up to 489,958 shares of the Company’s common stock, $0.001 par value per share (the “Shares”), issued or issuable

upon exercise of stock options previously granted to the Company’s President and Chief Executive Officer and the Company’s

Chief Financial Officer (each, a “Selling Stockholder”) pursuant to certain stock option agreements outside of the Company’s

2002 Stock Incentive Plan, 2009 Stock Incentive Plan, 2011 Stock Incentive Plan, 2015 Omnibus Equity Incentive Plan, and 2018 Omnibus

Equity Incentive Plan (collectively, the “Plans”), entered into between the respective Selling Stockholder and the Company.

This registration statement contains two parts.

The first part contains a “reoffer” prospectus prepared in accordance with General Instruction C of Form S-8 and in

accordance with the requirements of Part I of Form S-3. The reoffer prospectus may be used for the reoffer and resale on a

continuous or delayed basis of the Shares, which may be deemed to be “restricted securities” and/or “control securities”

within the meaning of the Securities Act of 1933, as amended (the “Securities Act”), and the rules and regulations promulgated

thereunder, by the Selling Stockholders. The

second part contains information required to be set forth in the registration statement pursuant

to Part II of Form S-8.

PART I

Information Required in the Section 10(a) Prospectus

Item

1. Plan Information.*

Item

2. Registrant Information and Employee Plan Annual Information.*

| * | The documents containing the information specified in Part I of Form S-8 will be delivered

to the participants in the employee benefit plans covered by this registration statement prepared by Cryoport, Inc.,

a Nevada corporation (the “Company”), in accordance with Form S-8 and Rule 428(b)(1) under

the Securities Act of 1933, as amended (the “Securities Act”), as applicable. Such documents

are not required to be, and are not, filed with the Securities and Exchange Commission (the “SEC”),

either as part of this registration statement or as prospectuses or prospectus supplements pursuant to

Rule 424 under the Securities Act. These documents and the documents incorporated by reference into

this registration statement pursuant to Item 3 of Part II of this registration statement, taken together,

constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act and

are available to participants without charge upon written or oral request to: |

Cryoport, Inc.

112 Westwood Place, Suite 350

Brentwood, TN 37027

Attn: Secretary

(949) 470-2300

CRYOPORT, INC.

REOFFER

PROSPECTUS

489,958

SHARES OF COMMON STOCK

This

reoffer prospectus relates to an aggregate of up to 489,958 shares of common stock, $0.001 par value per share (the “Shares”),

of Cryoport, Inc., a Nevada corporation (the “Company”), that may be reoffered or resold from time to time by Jerrell

W. Shelton, the Company’s President and Chief Executive Officer, and Robert S. Stefanovich, the Company’s Chief Financial

Officer (collectively, the “Selling Stockholders”). The Shares were issued, or are issuable, upon exercise of stock options

previously granted to the Selling Stockholders pursuant to certain stock option agreements outside of the Company’s 2002 Stock

Incentive Plan, 2009 Stock Incentive Plan, 2011 Stock Incentive Plan, 2015 Omnibus Equity Incentive Plan, and 2018 Omnibus Equity Incentive

Plan (collectively, the “Plans”), entered into between the respective Selling Stockholder and the Company.

The Selling Stockholders may sell the Shares covered

by this reoffer prospectus from time to time through various means, including directly or indirectly to purchasers, in one or more transactions

on The Nasdaq Capital Market or any other stock exchange or stock market on which the Shares are traded at the time of sale, in

privately negotiated transactions, or through a combination of these methods. These sales may be at fixed prices, which may change, at

market prices available at the time of sale, at prices based on the available market price at the time of sale, or at negotiated prices.

If the Shares are sold through underwriters, broker-dealers or agents, these parties may be compensated for their services in the form

of discounts or commissions, which may be deemed to be “underwriting commissions.” If required, the names of any underwriter(s),

applicable commissions or discounts, and any other required information with respect to any particular sales will be disclosed in an

accompanying prospectus supplement.

Our common stock is listed on The Nasdaq Capital

Market under the symbol “CYRX.” On March 6, 2025, the last reported sale price of our common stock on The Nasdaq Capital

Market was $6.66 per share.

We will not receive any of the proceeds from the

sale of the Shares by the Selling Stockholders. While we will pay the expenses of registering the Shares, the Selling Stockholders will

bear all sales commissions and similar expenses.

Investing in our securities involves a high

degree of risk. You should carefully review the risks and uncertainties referenced under the heading “Risk Factors” contained

in this reoffer prospectus beginning on page 7, and under similar headings in the other documents that are incorporated by reference

into this reoffer prospectus.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus.

Any representation to the contrary is a criminal offense.

The date of this reoffer prospectus in March 7,

2025

TABLE

OF CONTENTS

ABOUT THIS REOFFER PROSPECTUS

This reoffer prospectus contains important information

you should know before investing, including important information about the Company and the securities being offered. You should carefully

read this reoffer prospectus, as well as the additional information contained in the documents described under “Where You Can Find

More Information; Incorporation by Reference” in this reoffer prospectus, and in particular, the periodic and current reports we

file with the Securities and Exchange Commission (the “SEC”).

You

should rely only on the information contained in this reoffer prospectus or incorporated herein by reference or

in any prospectus supplement. Neither we nor the Selling Stockholders have authorized any other person to provide you with different

information. If anyone provides you with different or inconsistent information, you should not rely on it. Neither we nor the Selling

Stockholders take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give

you. Neither we nor the Selling Stockholders are making an offer to sell the Shares, or soliciting an offer to buy the Shares, in any

jurisdiction where the offer or sale is not permitted.

You should assume that the information appearing

in this reoffer prospectus and any prospectus supplement is accurate only as of the date on its respective cover and that any information

incorporated by reference is accurate only as of the date of the document incorporated by reference, unless we indicate otherwise. Our

business, financial condition, results of operations and prospects may have changed since those dates. This reoffer prospectus incorporates

by reference, and any prospectus supplement may contain and incorporate by reference, market data and industry statistics and forecasts

that are based on independent industry publications and other publicly available information. Although we believe these sources are reliable,

we do not guarantee the accuracy or completeness of this information and we have not independently verified this information. In addition,

the market and industry data and forecasts that may be included or incorporated by reference in this reoffer prospectus and any

prospectus supplement may involve estimates, assumptions and other risks and uncertainties and are subject to change based on various

factors, including those discussed under the heading “Risk Factors” contained in this reoffer prospectus and any applicable

prospectus supplement, as well as under similar headings in any documents that are incorporated by reference into this reoffer prospectus

and any applicable prospectus supplement. Accordingly, investors should not place undue reliance on this information.

When we refer to “Cryoport,” “we,”

“our,” “us” and the “Company” in this reoffer prospectus, we mean Cryoport, Inc. and its

consolidated subsidiaries, unless otherwise specified.

This reoffer prospectus contains references

to our trademarks and to trademarks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this

reoffer prospectus, including logos, artwork and other visual displays, may appear without the ® or TM

symbols, but such references are not intended to indicate, in any way, that their respective owners will not assert, to the fullest extent

under applicable law, their rights thereto. We do not intend our use or display of other companies’ trade names or trademarks to

imply a relationship with, or endorsement or sponsorship of us by, any other companies.

WHERE YOU CAN FIND MORE INFORMATION; INCORPORATION

BY REFERENCE

Available Information

We file annual, quarterly and current reports,

proxy statements and other information with the SEC. The SEC maintains a website that contains reports, proxy and information statements

and other information about issuers, such as us, who file electronically with the SEC. The address of that website is http://www.sec.gov.

Our website address is https://www.cryoportinc.com.

The information on our website, however, is not, and should not be deemed to be, a part of this reoffer prospectus.

This reoffer prospectus and any prospectus supplement

are part of a registration statement that we filed with the SEC and do not contain all of the information in the registration statement.

The full registration statement may be obtained from the SEC or us, as provided below. You may obtain a copy of the registration statement

through the SEC’s website, as provided above.

Incorporation by Reference

The SEC’s rules allow us to “incorporate

by reference” information into this reoffer prospectus, which means that we can disclose important information to you by referring

you to another document filed separately with the SEC. The information incorporated by reference is deemed to be part of this reoffer

prospectus, and subsequent information that we file with the SEC will automatically update and supersede that information. Any statement

contained in this reoffer prospectus or a previously filed document incorporated by reference will be deemed to be modified or superseded

for purposes of this reoffer prospectus to the extent that a statement contained in this reoffer prospectus or a subsequently filed document

incorporated by reference modifies or replaces that statement.

This reoffer prospectus incorporates by reference

the documents set forth below that have previously been filed with the SEC:

All documents filed by us pursuant to Section 13(a),

13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (other than Current Reports

on Form 8-K furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits furnished on such form that relate to such items),

subsequent to the filing of this reoffer prospectus and prior to the termination of this offering, shall be deemed to be incorporated

by reference into this reoffer prospectus and to be a part hereof from the date of filing such documents, except as to specific sections

of such documents as set forth therein.

We will provide without charge to each person,

including any beneficial owner, to whom this reoffer prospectus is delivered, upon written or oral request, a copy of any or all documents

that are incorporated by reference into this reoffer prospectus, but not delivered with this reoffer prospectus, other than exhibits

to such documents unless such exhibits are specifically incorporated by reference into the documents that this reoffer prospectus incorporates.

You should direct any requests for such documents to:

Cryoport, Inc.

112 Westwood Place, Suite 350

Brentwood, TN 37027

Attn: Chief Financial Officer

(949) 470-2300

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This reoffer prospectus, including the documents

that we incorporate by reference, contains forward-looking statements. All statements other than statements of historical facts contained

in this reoffer prospectus, including any statements regarding our future results of operations and financial position, business strategy

and plans and objectives of management for future operations are forward-looking statements. These statements involve known and unknown

risks, uncertainties, and other important factors that may cause our actual results, performance or achievements to be materially different

from any future results, performance, or achievements expressed or implied by the forward-looking statements.

In some cases, you can identify forward-looking

statements by terms such as “may,” “should,” “expects,” “might,” “plans,”

“anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,”

“believes,” “estimates,” “predicts,” “potential,” “seek,” “would”

or “continue,” or the negative of these terms or other similar expressions. Forward-looking statements include, but are not

necessarily limited to, those relating to:

| · | our

expectations about future business plans, new products or services, regulatory approvals,

strategies, development timelines, prospective financial performance and opportunities, including

potential acquisitions; |

| · | expectations

about future benefits of our acquisitions and our ability to successfully integrate those

businesses and our plans related thereto; |

| · | liquidity

and capital resources; |

| · | plans

relating to our cost reduction and capital realignment measures and expectations about resulting

annual cost savings and financial impact; |

| · | assumptions

relating to the impairment of assets; |

| · | plans

relating to any repurchases of our common stock and/or convertible notes; |

| · | projected

trends in the market in which we operate; |

| · | our

expectations relating to current supply chain impacts; |

| · | inflationary

pressures and the effect of foreign currency fluctuations; |

| · | anticipated

regulatory filings or approvals with respect to the products of our clients; |

| · | expectations

about securing and managing strategic relationships with global couriers or large clinical

research organizations; |

| · | our

future capital needs and ability to raise capital on favorable terms or at all; |

| · | results

of our research and development efforts; and |

| · | approval

of our patent applications. |

We have based these forward-looking statements

largely on our current expectations and projections about future events and financial trends that we believe may affect our business,

financial condition and results of operations. Although we believe that the expectations reflected in the forward-looking statements

are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in

the forward-looking statements will be achieved or occur. Because forward-looking statements are inherently subject to risks and uncertainties,

some of which cannot be predicted or are beyond our control, you should not rely on these forward-looking statements as predictions of

future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results

could differ materially from those projected in the forward-looking statements. Some of the key factors that could cause actual results

to differ from our expectations include, but are not limited to, risks and uncertainties associated with the effect of changing economic

and geopolitical conditions, supply chain constraints, inflationary pressures, and the effects of foreign currency fluctuations, trends

in the products markets, variations in the Company’s cash flow, market acceptance risks, and technical development risks. Other

factors that might cause such a difference include, but are not limited to, those discussed under the heading “Risk Factors”

in this reoffer prospectus and in our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q,

as well as in our subsequent filings with the SEC, which are incorporated by reference into this reoffer prospectus.

Any forward-looking statements speak only as of

the date on which they are made. Except as required by applicable law, including the securities laws of the United States and the rules and

regulations of the SEC, we undertake no obligation to update or revise any forward-looking statements to reflect new information or future

events or developments. New factors emerge from time to time, and it is not possible for our management to predict all of such factors

or to assess the effect of each factor on our business. You are advised to consult any further disclosures we make on related subjects

in the reports we file with the SEC.

PROSPECTUS SUMMARY

This summary is not complete and does not

contain all the information you should consider in making your investment decision. This summary is qualified in its entirety by the

more detailed information included in this reoffer prospectus, including the documents incorporated by reference herein. You should read

the entire reoffer prospectus carefully before making an investment in our securities. You should carefully consider, among other things,

our consolidated financial statements and the related notes and the sections titled “Risk Factors,” “Business”

and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the documents incorporated

by reference in this reoffer prospectus.

Company Overview

We are a global leader in integrated temperature-controlled

supply chain solutions for the life sciences industry, with a strong focus on supporting the Cell and Gene Therapy market (CGT). Our

broad array of products and services are designed to mitigate risks and ensure the safe and reliable storage and delivery of critical

therapies and other high value biologic materials. We support the entire continuum from biomaterial collection to final delivery, ‘Enabling

the Future of MedicineTM’.

Our integrated supply chain platform leverages

advanced temperature-controlled packaging, systems, and informatics to deliver essential solutions for companies in the CGT ecosystem,

including:

| · | Cryopreservation

services |

We have a market leading role in supporting

the CGT market and other markets in the life sciences industry that require comprehensive, technology-centric supply chain solutions

for high-value products and materials.

| · | As

of December 31, 2024, we supported 701 clinical trials and 19 commercial cell and gene

therapies. |

| · | Our

integrated solutions help ensure the integrity of cellular material throughout the supply

chain from the time biological materials are extracted from the patient for the cell and

gene manufacturing process to the delivery of the therapies to the point of care. |

| · | These

solutions include BioLogistics, BioServices, and Cryopreservation services, all of which

are critical for the development and delivery of these lifesaving therapies. |

| · | Our

newly introduced Cryopreservation services (IntegriCell®) provide enhanced

cryopreservation and characterization services to maintain the quality of cellular therapy

starting materials. |

| · | Our

informatics, led by the Cryoportal® Logistics Management Platform, provides

visibility of real-time monitoring and tracking and Chain-of-Compliance®.

It also provides the process control and information that ensures quality and regulatory

compliance. The Cryoportal® Logistics Management Platform has integration

capabilities with clients, partners and vendors through Application Program Interfaces (API). |

| · | MVE

Biological Solutions, the global leader for cryogenic systems used in the life sciences for

storage and transportation, is known for its reliability, safety, high-quality manufacturing,

and innovation. This inhouse manufacturing capability protects Cryoport Systems by ensuring

the reliable supply of essential purpose-built cryogenic equipment and technology that enables

us to quickly scale our services capabilities as the CGT market grows and expands worldwide. |

We have a global presence through our directly

operated global supply chain centers, logistics centers and depots, biostorage/bioservices, and cryoprocessing centers. We have partner

networks in the Americas, EMEA (Europe, the Middle East, and Africa) and APAC (Asia-Pacific) regions. In addition, our MVE Biological

Solutions business unit operates three cryogenic systems manufacturing centers, including two in the U.S. and one in China.

Our principal executive offices are located

at 112 Westwood Place, Suite 350, Brentwood, TN 37027. The telephone number of our principal executive offices is (949) 470-2300,

and our main corporate website is https://www.cryoportinc.com. The information on our website is not, and should not be deemed

to be, a part of this reoffer prospectus.

The Offering

This reoffer

prospectus relates to an aggregate of up to 489,958 Shares that may be reoffered or resold from time to time by the Selling Stockholders.

The Shares were issued, or are issuable, upon exercise of stock options previously granted to the Selling Stockholders pursuant

to certain stock option agreements outside of the Plans entered into between the respective Selling Stockholder and us. The Selling Stockholders

may from time to time sell, transfer or otherwise dispose of any or all of the Shares covered by this reoffer prospectus through underwriters

or dealers, directly to purchasers (or a single purchaser), or through broker-dealers or agents. We will not receive any proceeds from

the sale of the Shares by the Selling Stockholders. The Selling Stockholders will bear all sales commissions and similar expenses in

connection with this offering. We will bear all expenses of registration incurred in connection with this offering, as well as any other

expenses incurred by us in connection with the registration and offering that are not borne by the Selling Stockholders. For more information,

see the sections titled “Use of Proceeds,” “Selling Stockholders,” and “Plan of Distribution” in

this reoffer prospectus.

RISK FACTORS

Investing in our common stock involves a high

degree of risk. Before making an investment decision, you should carefully consider the risk factors incorporated by reference to our

most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K,

and all other information contained or incorporated by reference into this reoffer prospectus, as updated by our subsequent filings under

the Exchange Act. There may be other unknown or unpredictable economic, business, competitive, regulatory or other factors that could

have material adverse effects on our future results. Past financial performance may not be a reliable indicator of future performance,

and historical trends should not be used to anticipate results or trends in future periods. If any of these risks actually occurs, our

business, financial condition, results of operations or cash flow could be seriously harmed. This could cause the trading price of our

common stock to decline, resulting in a loss of all or part of your investment. Please also carefully read the section titled “Special

Note Regarding Forward-Looking Statements” in this reoffer prospectus.

USE OF PROCEEDS

The Shares offered by the Selling Stockholders

pursuant to this reoffer prospectus will be sold by the Selling Stockholders for their respective accounts. We will not receive any proceeds

from the sale of the Shares offered through this reoffer prospectus by the Selling Stockholders.

SELLING STOCKHOLDERS

This

reoffer prospectus relates to the possible resale by the Selling Stockholders from time to time of up to an aggregate of 489,958 Shares

that have been or will be issued to the Selling Stockholders pursuant to certain stock option agreements outside of the Plans

entered into between the respective Selling Stockholder and us.

The following table sets forth, as of February 28,

2025 (the “Determination Date”): (i) the name of each Selling Stockholder; (ii) the number of shares and percentage

of our common stock beneficially owned by each Selling Stockholder; (iii) the number of Shares that may be offered under this reoffer

prospectus by each Selling Stockholder; and (iv) the number and percentage of our common stock beneficially owned by each Selling

Stockholder assuming all of the Shares offered under this reoffer prospectus are sold. There is no assurance as to whether the Selling

Stockholders will in fact sell any or all of their Shares offered under this reoffer prospectus. Beneficial ownership is determined in

accordance with Section 13(d) of the Exchange Act and Rule 13d-3 thereunder.

Unless otherwise indicated, the Selling Stockholders

have sole voting and sole investment control with respect to all shares of common stock beneficially owned. Furthermore, unless otherwise

indicated, the business address of each Selling Stockholder is c/o Cryoport, Inc., 112 Westwood Place, Suite 350, Brentwood,

Tennessee 37027.

| |

|

Common Stock Beneficially Owned

Before this Offering |

|

Maximum

Number of

Shares

to be Sold

Pursuant

to this

Reoffer |

|

|

Common Stock Beneficially Owned

Upon Completion of this Offering |

| Name of Selling Stockholder |

|

Number |

|

Percentage(1) |

|

|

Prospectus |

|

|

Number |

|

Percentage(1)(2) |

|

| Jerrell W. Shelton(3) |

|

3,231,128 |

|

|

6.2% |

|

|

|

482,392 |

|

|

2,748,736 |

|

|

5.2% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Robert S. Stefanovich(4) |

|

846,856 |

|

|

1.7% |

|

|

|

7,566 |

|

|

839,290 |

|

|

1.7% |

|

| |

(1) |

Based on 49,910,391 shares of our common stock outstanding as of the Determination Date. |

| |

(2) |

Assumes that all of the Shares offered under this reoffer prospectus are sold and that no Selling Stockholder will acquire additional shares of our common stock before the completion of this offering. |

| |

(3) |

Consists of (i) 687,176 shares of common stock held by Mr. Shelton; (ii) 25,521 shares of common stock issuable to Mr. Shelton upon vesting of restricted stock rights (“RSRs”) held by Mr. Shelton that vest within 60 days of the Determination Date; and (iii) 2,518,431 shares of common stock issuable to Mr. Shelton upon exercise of stock options held by Mr. Shelton that are exercisable within 60 days of the Determination Date (including 219,892 Shares that are offered under this reoffer prospectus). Mr. Shelton serves as the Chair of our board of directors and as our President and Chief Executive Officer. |

| |

(4) |

Consists of (i) 162,849 shares of common stock held by Mr. Stefanovich; (ii) 165,000 shares held by the Jerrell W. Shelton 2021 GST Exempt Trust, over which Mr. Stefanovich has sole voting and dispositive power; (iii) 9,332 shares of common stock issuable to Mr. Stefanovich upon vesting of RSRs held by Mr. Stefanovich that vest within 60 days of the Determination Date; and (iv) 509,675 shares of common stock issuable to Mr. Stefanovich upon exercise of stock options held by Mr. Stefanovich that are exercisable within 60 days of the Determination Date (including 7,566 Shares that are offered under this reoffer prospectus). Mr. Stefanovich serves as our Senior Vice President, Chief Administrative Officer and Chief Financial Officer. |

PLAN OF DISTRIBUTION

The Selling Stockholders may sell the Shares covered

by this reoffer prospectus from time to time in one or more offerings. Registration of the Shares covered by this reoffer prospectus

does not mean, however, that those securities will necessarily be offered or sold.

We will pay all fees and expenses incurred in

connection with the registration of the Shares, and the Selling Stockholders will pay any brokerage or underwriting commissions or discounts

or other expenses relating to the sale of the Shares. We will not receive any of the proceeds from the sale of the Shares offered by

this reoffer prospectus.

The Selling Stockholders may sell the securities

separately or together:

| · | through

one or more underwriters or dealers in a public offering and sale by them; |

| · | directly

to investors; or |

The Selling Stockholders may sell the securities

from time to time:

| · | in

one or more transactions at a fixed price or prices, which may be changed from time to time; |

| · | at

market prices prevailing at the times of sale; |

| · | at

prices related to such prevailing market prices; or |

If required at the time of the offering of the

Shares, a prospectus supplement will be distributed which will describe the method of distribution of the securities and the terms of

the offering.

If underwriters are used in the sale of any securities,

the securities will be acquired by the underwriters for their own account and may be resold from time to time in one or more transactions

described above. The securities may be either offered to the public through underwriting syndicates represented by managing underwriters,

or directly by underwriters. Generally, the underwriters’ obligations to purchase the securities will be subject to conditions

precedent and the underwriters will be obligated to purchase all of the securities if they purchase any of the securities. The prospectus

supplement will name any underwriter used in the offering.

The Selling Stockholders may sell the securities

offered through this reoffer prospectus directly. In this case, no underwriters or agents would be involved. Such securities may also

be sold through agents designated from time to time. The prospectus supplement will name any agent involved in the offer or sale of the

offered securities and will describe any commissions payable to the agent. Unless otherwise indicated in the prospectus supplement, any

agent will agree to use its reasonable best efforts to solicit purchases for the period of its appointment.

The Selling Stockholders may sell the securities

directly to institutional investors or others who may be deemed to be underwriters within the meaning of the Securities Act of 1933,

as amended (the “Securities Act”), with respect to any sale of those securities. The terms of any such sales will be described

in the prospectus supplement.

The Selling Stockholders may authorize underwriters,

dealers or agents to solicit offers by certain purchasers to purchase the securities from them at the public offering price set forth

in the prospectus supplement pursuant to delayed delivery contracts providing for payment and delivery on a specified date in the future.

The contracts will be subject only to those conditions set forth in the prospectus supplement, and the prospectus supplement will set

forth any commissions to be paid for solicitation of these contracts.

Underwriters, dealers and agents may be entitled

to indemnification by the Selling Stockholders against certain civil liabilities, including liabilities under the Securities Act, or

to contribution with respect to payments made by the underwriters, dealers or agents, under agreements between the Selling Stockholders

and the underwriters, dealers and agents.

The Selling Stockholders and any broker-dealer

participating in the distribution of the Shares may be deemed to be “underwriters” within the meaning of the Securities Act,

and any profits realized by the Selling Stockholders, and commissions paid, or any discounts or concessions allowed to any broker-dealer

may be deemed to be underwriting commissions or discounts under the Securities Act. In addition, any Shares covered by this reoffer prospectus

which qualify for sale pursuant to Rule 144 under the Securities Act may be sold under Rule 144 rather than pursuant to this

reoffer prospectus.

Any discounts or concessions allowed or re-allowed

or paid to dealers may be changed from time to time.

The Selling Stockholders and any other person

participating in the sale of the Shares will be subject to the Exchange Act. The Exchange Act rules include, without

limitation, Regulation M, which may limit the timing of purchases and sales of any of the Shares by the Selling Stockholders and

any other person. In addition, Regulation M may restrict the ability of any person engaged in the distribution of the Shares

to engage in market-making activities with respect to the particular securities being distributed. This may affect the marketability

of the Shares and the ability of any person or entity to engage in market-making activities with respect to the Shares.

We have notified the Selling Stockholders of the

need to deliver a copy of this Reoffer Prospectus in connection with any sale of the shares of common stock.

LEGAL MATTERS

The validity of the Shares offered hereby has

been passed upon for us by Snell & Wilmer L.L.P., Las Vegas, Nevada.

EXPERTS

The consolidated financial statements of Cryoport, Inc.

and its subsidiaries for the year ended December 31, 2022, appearing in Cryoport, Inc.’s Annual Report (Form 10-K)

for the year ended December 31, 2024, have been audited by Ernst & Young LLP, independent registered public accounting

firm, as set forth in their report thereon, included therein, and incorporated herein by reference. Such consolidated financial statements

are incorporated herein by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

The consolidated financial statements of Cryoport, Inc.

and its subsidiaries as of December 31, 2024 and 2023, and for the years ended December 31, 2024 and 2023, incorporated by reference

in this prospectus by reference to Cryoport, Inc.’s annual report on Form 10-K for the year ended December 31, 2024, and the effectiveness

of Cryoport, Inc.’s internal control over financial reporting, have been audited by Deloitte & Touche LLP, an independent registered

public accounting firm, as stated in their reports. Such financial statements are incorporated by reference in reliance upon the reports

of such firm given their authority as experts in accounting and auditing.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item

3. Incorporation of Documents by Reference.

The following documents filed by the Company with

the SEC are incorporated by reference into this registration statement and are deemed to be a part hereof from the date of filing:

All documents filed by the Company pursuant to

Section 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (other than Current Reports on Form 8-K

furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits furnished on such form that relate to such items), subsequent to

the filing of this registration statement and prior to the filing of a post-effective amendment which indicates that all securities offered

hereby have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference into

this registration statement and to be a part hereof from the date of filing such documents, except as to specific sections of such documents

as set forth therein. Any statement contained in this registration statement or a previously filed document incorporated by reference

will be deemed to be modified or superseded for purposes of this registration statement to the extent that a statement contained in this

registration statement or a subsequently filed document incorporated by reference modifies or replaces that statement.

Item

4. Description of Securities.

Not applicable.

Item

5. Interests of Named Experts and Counsel.

Not applicable.

Item

6. Indemnification of Directors and Officers.

Under the Nevada Revised Statutes and the Company’s

Amended and Restated Articles of Incorporation, as amended, the Company’s directors will have no personal liability to the Company

or its stockholders for monetary damages incurred as the result of the breach or alleged breach by a director of their fiduciary duty.

This provision does not apply to the directors’ (i) acts or omissions that involve intentional misconduct, fraud or a knowing

violation of law, or (ii) approval of an unlawful dividend, distribution, stock repurchase or redemption. Section 78.138 of

the Nevada Revised Statutes provides that, unless the corporation’s articles of incorporation provide otherwise, a director or

officer will not be individually liable to the corporation or its stockholders or creditors for damages resulting from an act or failure

to act in his or her capacity as a director or officer unless (a) the presumption that a director or officer acted in good faith,

on an informed basis and with a view to the interest of the corporation is rebutted; and (b) it is proven that (i) the director’s

or officer’s acts or omissions constituted a breach of their fiduciary duties as a director or officer, and (ii) such breach

involved intentional misconduct, fraud, or a knowing violation of the law.

Under the Company’s Amended and Restated

Bylaws, persons who are made a party to, threatened to be made a party to, or otherwise involved in any action, suit or proceeding, whether

civil, criminal, administrative or investigative, or a proceeding, by reason of the fact that he or she (or a person for whom he or she

is a representative) is or was a director or an officer of the Company or is or was serving at the request of the Company in any position

or capacity for any other corporation, partnership, joint venture, trust, employee benefit plan or other enterprise, or an indemnitee,

whether the basis of such proceeding is alleged action in an official capacity or in any other capacity, shall be indemnified and held

harmless by the Company to the fullest extent permitted by Nevada law, as the same exists or may be amended (but, in the case of any

such amendment, only to the extent that such amendment permits the Company to provide broader indemnification rights than such law permitted

the Company to provide prior to such amendment), against all expense, liability and loss incurred (including attorneys’ fees, judgments,

fines, ERISA excise taxes or penalties and amounts paid in settlement) or suffered by such indemnitees in connection therewith. However,

subject to certain exceptions with respect to proceedings to enforce rights to indemnification, the Company shall indemnify any such

indemnitee in connection with a proceeding (or part thereof) initiated by such indemnitee only if such proceeding (or part thereof) was

authorized by the Company’s board of directors.

Insofar as indemnification for liabilities arising

under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing

provisions, or otherwise, the registrant has been advised that in the opinion of the SEC such indemnification is against public policy

as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities

(other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant

in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection

with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling

precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as

expressed in the Securities Act and will be governed by the final adjudication of such issue.

Item

7. Exemption From Registration Claimed.

All

Shares registered hereunder for reoffer or resale have been or will be issued to Jerrell W. Shelton, the Company’s President and

Chief Executive Officer, and Robert S. Stefanovich, the Company’s Chief Financial Officer (collectively, the “Selling Stockholders”),

as applicable, in reliance upon an exemption from the registration requirements of the Securities Act by virtue of Section 4(a)(2) thereof.

Each of the Selling Stockholders is an executive officer of the Company and an “accredited investor” as defined in Rule 501(a) under

the Securities Act.

Item

8. Exhibits.

Exhibit

Number |

|

Description |

|

Page or Method of Filing |

| 4.5 |

|

Amendment

to Certificate of Designation of Class B Preferred Stock |

|

Incorporated

by reference to Exhibit 3.6 to the Company’s Amendment No. 1 to Registration Statement on Form S-1 filed with

the SEC on April 17, 2015 |

| |

|

|

|

|

| 4.6 |

|

Certificate

of Change filed with the Nevada Secretary of State on May 12, 2015 |

|

Incorporated

by reference to Exhibit 3.7 to the Company’s Annual Report on Form 10-K filed with the SEC on May 19, 2015 |

| |

|

|

|

|

| 4.7 |

|

Amendment

to Certificate of Designation of Class A Preferred Stock |

|

Incorporated

by reference to Exhibit 3.8 to the Company’s Amendment No. 4 to Registration Statement on Form S-1 filed with

the SEC on June 22, 2015 |

| |

|

|

|

|

| 4.8 |

|

Amendment

to Certificate of Designation of Class B Preferred Stock |

|

Incorporated

by reference to Exhibit 3.9 to the Company’s Amendment No. 4 to Registration Statement on Form S-1 filed with

the SEC on June 22, 2015 |

| |

|

|

|

|

| 4.9 |

|

Amendment

to Certificate of Designation of Class A Preferred Stock |

|

Incorporated

by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K filed with the SEC on September 4, 2015 |

| |

|

|

|

|

| 4.10 |

|

Amendment

to Certificate of Designation of Class B Preferred Stock |

|

Incorporated

by reference to Exhibit 3.2 to the Company’s Current Report on Form 8-K filed with the SEC on September 4, 2015 |

| |

|

|

|

|

| 4.11 |

|

Certificate

of Amendment filed with the Nevada Secretary of State on November 23, 2015 |

|

Incorporated

by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K filed with the SEC on December 1, 2015 |

| |

|

|

|

|

| 4.12 |

|

Certificate

of Amendment filed with the Nevada Secretary of State on May 30, 2018 |

|

Incorporated

by reference to Exhibit 3.12 of the Company’s Annual Report on Form 10-K filed with the SEC on March 13, 2019 |

| |

|

|

|

|

| 4.13 |

|

Certificate

of Designation of 4.0% Series C Convertible Preferred Stock of Cryoport, Inc. |

|

Incorporated

by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K filed with the SEC on October 1, 2020 |

| |

|

|

|

|

| 5.1 |

|

Opinion of Snell &

Wilmer L.L.P. |

|

Filed herewith |

| |

|

|

|

|

| 23.1 |

|

Consent of Ernst &

Young LLP, Independent Registered Public Accounting Firm |

|

Filed herewith |

| |

|

|

|

|

| 23.2 |

|

Consent of Deloitte &

Touche LLP, Independent Registered Public Accounting Firm |

|

Filed herewith |

| |

|

|

|

|

| 23.3 |

|

Consent of Snell &

Wilmer L.L.P. |

|

Included as part of

Exhibit 5.1 |

| |

|

|

|

|

| 24.1 |

|

Power of Attorney |

|

Included on the signature page hereto |

| |

|

|

|

|

| 99.1 |

|

Form of Stock Option Agreement (granted outside of the Plans) |

|

Incorporated by reference to Exhibit 10.17 of the Company’s Annual Report on Form 10-K filed with the SEC on March 7, 2025 |

| |

|

|

|

|

| 107 |

|

Filing Fee Table |

|

Filed herewith |

Item

9. Undertakings.

| (a) | The undersigned registrant hereby undertakes: |

| (1) | To file, during any period in which offers or sales are being made,

a post-effective amendment to this registration statement: |

| (i) | To include any prospectus required by Section 10(a)(3) of

the Securities Act; |

| (ii) | To reflect in the prospectus any facts or events arising after the

effective date of the registration statement (or the most recent post-effective amendment

thereof) which, individually or in the aggregate, represent a fundamental change in the information

set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease

in volume of securities offered (if the total dollar value of securities offered would not

exceed that which was registered) and any deviation from the low or high end of the estimated

maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant

to Rule 424(b) if, in the aggregate, the changes in volume and price represent

no more than 20% change in the maximum aggregate offering price set forth in the “Calculation

of Filing Fee Tables” or “Calculation of Registration Fee” table, as applicable,

in the effective registration statement; |

| (iii) | To include any material information with respect to the plan of

distribution not previously disclosed in the registration statement or any material change

to such information in the registration statement; |

provided,

however, that paragraphs (a)(1)(i) and (a)(1)(ii) above do not apply if the registration statement is on Form S-8,

and the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished

to the SEC by the registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference

in the registration statement.

| (2) | That, for the purpose of determining any liability under the Securities

Act, each such post-effective amendment shall be deemed to be a new registration statement

relating to the securities offered therein, and the offering of such securities at that time

shall be deemed to be the initial bona fide offering thereof. |

| (3) | To remove from registration by means of a post-effective amendment any

of the securities being registered which remain unsold at the termination of the offering. |

| (b) | The undersigned registrant hereby undertakes that, for purposes of

determining any liability under the Securities Act, each filing of the registrant’s

annual report pursuant to Section 13(a) or Section 15(d) of the Exchange

Act (and, where applicable, each filing of an employee benefit plan’s annual report

pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference

in the registration statement shall be deemed to be a new registration statement relating

to the securities offered therein, and the offering of such securities at that time shall

be deemed to be the initial bona fide offering thereof. |

| (c) | Insofar as indemnification for liabilities arising under the Securities

Act may be permitted to directors, officers and controlling persons of the registrant pursuant

to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion

of the SEC such indemnification is against public policy as expressed in the Securities Act

and is, therefore, unenforceable. In the event that a claim for indemnification against such

liabilities (other than the payment by the registrant of expenses incurred or paid by a director,

officer or controlling person of the registrant in the successful defense of any action,

suit or proceeding) is asserted by such director, officer or controlling person in connection

with the securities being registered, the registrant will, unless in the opinion of its counsel

the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction

the question whether such indemnification by it is against public policy as expressed in

the Securities Act and will be governed by the final adjudication of such issue. |

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8

and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City

of Brentwood, State of Tennessee, on March 7, 2025.

|

CRYOPORT, INC. |

| |

|

|

By: |

/s/

Robert S. Stefanovich |

|

Name: |

Robert S. Stefanovich |

|

Title: |

Chief Financial

Officer |

POWER OF ATTORNEY

Each person whose signature appears below hereby

constitutes and appoints Jerrell W. Shelton and Robert S. Stefanovich, and each of them, his or her true and lawful attorneys-in-fact

and agents, with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all

capacities, to sign any and all amendments (including post-effective amendments) to this registration statement, and to file the same,

with any and all exhibits thereto, and other documents in connection therewith, with the SEC, and hereby grants to such attorneys-in-fact

and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done

in connection therewith, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming

all that said attorneys-in-fact and agents, or any of them, or their or his substitute or substitutes, may lawfully do or cause to be

done by virtue hereof.

Pursuant to the requirements of the Securities

Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

| Signature |

Title |

Date |

| |

|

|

| /s/ Jerrell W. Shelton |

President, Chief Executive

Officer and Director |

March 7, 2025 |

| Jerrell W. Shelton |

(Principal Executive Officer) |

|

| |

|

|

| /s/ Robert S. Stefanovich |

Chief Financial Officer |

March 7, 2025 |

| Robert S. Stefanovich |

(Principal Financial and Accounting Officer) |

|

| |

|

|

| /s/ Daniel M. Hancock |

Director |

March 7, 2025 |

| Daniel M. Hancock |

|

|

| |

|

|

| /s/ Robert Hariri, M.D., Ph.D. |

Director |

March 7, 2025 |

| Robert Hariri, M.D., Ph.D. |

|

|

| |

|

|

| /s/ Ramkumar Mandalam, Ph.D. |

Director |

March 7, 2025 |

| Ramkumar Mandalam, Ph.D. |

|

|

| |

|

|

| /s/ Ram Jagannath |

Director |

March 7, 2025 |

| Ram Jagannath |

|

|

| |

|

|

| /s/ Linda Baddour |

Director |

March 7, 2025 |

| Linda Baddour |

|

|

EXHIBIT 5.1

[Snell & Wilmer L.L.P. Letterhead]

March 7, 2025

Cryoport, Inc.

112 Westwood Place, Suite 350

Brentwood, TN 37027

Ladies and Gentlemen:

We have examined the Registration Statement on

Form S-8 (the “Registration Statement”) of Cryoport, Inc., a Nevada corporation (the “Company”), to

be filed with the Securities and Exchange Commission (the “Commission”) on or about the date hereof, in connection with the

registration under the Securities Act of 1933, as amended (the “Securities Act”), of the proposed resale from time to time

by the selling stockholders named in the prospectus (the “Prospectus”) made part of the Registration Statement (the “Selling

Stockholders”) of up to 489,958 shares of the Company’s common stock, $0.001 par value per share, consisting of (i) 262,500

shares of common stock (the “Selling Stockholder Shares”) and (ii) up to 227,458 shares of common stock (the “Selling

Stockholder Option Shares”) issuable upon exercise of stock options previously granted to the Selling Stockholders pursuant to certain

stock option agreements entered into between the respective Selling Stockholder and the Company (the “Stock Option Agreements”).

We have examined the originals, or photostatic

or certified copies, of such records of the Company and certificates of officers of the Company and of public officials and such other

documents as we have deemed relevant and necessary as the basis for the opinions set forth below. In our examination, we have assumed

the genuineness of all signatures, the legal capacity and competency of all natural persons, the authenticity of all documents submitted

to us as originals and the conformity to original documents of all documents submitted to us as copies. We are opining herein as to the

Nevada Revised Statutes, and we express no opinion with respect to any other laws.

Based upon the foregoing examination and in reliance

thereon, and subject to the assumptions stated and in reliance on statements of fact contained in the documents that we have examined,

we are of the opinion that:

| 1. | The Selling Stockholder Shares have been duly authorized and are validly issued, fully paid and non-assessable. |

| 2. | The Selling Stockholder Option Shares have been duly authorized and, when issued in accordance with the terms of the respective Stock

Option Agreement against payment therefor, will be validly issued, fully paid and non-assessable. |

We consent to the filing of this opinion as an

exhibit to the Registration Statement. We also consent to the reference to our firm under the heading “Legal Matters” in the

Registration Statement, the Prospectus, any prospectus supplement and in any amendment or supplement thereto. In giving such consent,

we do not thereby admit that we are within the category of persons whose consent is required under Section 7 of the Securities Act

or the Rules and Regulations of the Commission.

| |

Very truly yours, |

| |

|

| |

/s/ Snell & Wilmer L.L.P. |

EXHIBIT 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

We consent to the reference to our firm under the caption “Experts”

in the Registration Statement (Form S-8) pertaining to the Stock Option Agreements of Cryoport, Inc. and to the incorporation

by reference therein of our report dated February 28, 2023 (except the Revenue Disaggregation section of Note 3 and Note 20, Segment

Reporting, as to which the date is March 7, 2025), with respect to the consolidated financial statements for the year ended December 31,

2022 of Cryoport, Inc. included in its Annual Report (Form 10-K) for the year ended December 31, 2024, filed with the Securities

and Exchange Commission.

| /s/ Ernst & Young LLP |

| |

| Irvine, California |

| March 7, 2025 |

EXHIBIT 23.2

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

We consent to the incorporation by reference in this Registration Statement

on Form S-8 of our reports dated March 7, 2025, relating to the financial statements of Cryoport, Inc. and the effectiveness

of Cryoport, Inc.’s internal control over financial reporting, appearing in the Annual Report on Form 10-K of Cryoport, Inc.

for the year ended December 31, 2024. We also consent to the reference to us under the heading “Experts” in such Registration

Statement.

| /s/ Deloitte & Touche LLP |

| |

| Nashville, Tennessee |

| March 7, 2025 |

EXHIBIT 107

CALCULATION OF FILING FEE TABLE

Form S-8

(Form Type)

Cryoport, Inc.

(Exact Name of Registrant as Specified in its Charter)

| Table 1—Newly Registered Securities |

Security

Type |

Security

Class

Title |

Fee

Calculation

Rule |

Amount

Registered(1) |

Proposed

Maximum

Offering

Price Per

Unit |

Maximum

Aggregate

Offering

Price |

Fee Rate |

Amount of

Registration

Fee |

| Equity |

Common Stock, $0.001 par value per share |

Other(2) |

262,500 |

$4.88 |

$1,281,000 |

0.00015310 |

$196.12 |

| Equity |

Common Stock, $0.001 par value per share |

Other(3) |

227,458(4) |

$7.80(4) |

$1,774,172 |

0.00015310 |

$271.63 |

| Total Offering Amounts |

|

$3,055,172 |

|

$467.75 |

| Total Fee Offsets |

|

|

|

$0 |

| Net Fee Due |

|

|

|

$467.75 |

| |

(1) |

Pursuant to Rule 416(a) promulgated under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement shall also cover any additional shares of the registrant’s common stock, $0.001 par value per share (“Common Stock”), as may be issuable as a result of stock splits, stock dividends or similar transactions. |

| |

(2) |

Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(h) and Rule 457(c) under the Securities Act based upon the average of the high and low prices of the Common Stock as reported on The Nasdaq Capital Market on March 4, 2025. |

| |

(3) |

Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(h) under the Securities Act based upon the exercise price of outstanding stock options. |

| |

(4) |

Represents shares of Common Stock underlying certain outstanding stock options exercisable at a price of $7.80 per share. |

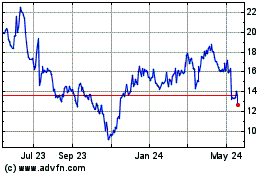

CryoPort (NASDAQ:CYRX)

Historical Stock Chart

From Feb 2025 to Mar 2025

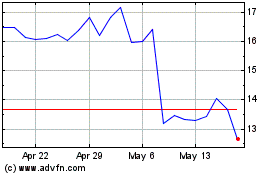

CryoPort (NASDAQ:CYRX)

Historical Stock Chart

From Mar 2024 to Mar 2025